Technical & Derivatives Report

September 23, 2016

Sensex (28773) / Nifty (8867)

Exhibit 1: Nifty Daily Chart

Yesterday, our markets opened with a decent upside gap owing

to extremely positive cues across the globe. However, due to lack

of follow up buying, the Nifty consolidated in a thin range

throughout the day to end the session almost around its opening

point.

Now, as discussed in our earlier, we do not want to get carried

away by this move as the pattern formed on weekly chart (during

the previous week) is not so encouraging. We would stick to our

cautious stance and would use this bounce to go short on the

market. The immediate resistance levels are seen at 8880 - 8910.

On the downside, 8750 - 8700 would be the immediate support

zone.

Key Levels

Support 1 - 8750

Resistance 1 - 8880

Support 2 - 8700

Resistance 2 - 8910

Exhibit 2: Nifty Bank Daily Chart

Nifty Bank Outlook - (20110)

In line with the benchmark indices, the Nifty Bank index too

opened with upside gap and rallied higher during the initial hour

of the trade. The index then traded with higher volatility and

ended the session with gains of 1.42 percent over its previous

session's close.

Since last few session's, we have been maintaining our cautious

stance on the index and yesterday was one of the move that we

had unlooked - for. On daily charts, the 'Parabolic SAR' is in 'Sell'

mode and thus there is a probability that the yesterday's upmove

may be just a retracement pullback. Hence, we still continue to

advise traders to stay cautious and wait for further development

on the charts. The intraday support for the index are placed

around 20000 and 19900 whereas resistances are seen around

20265 and 20450.

Key Levels

Support 1 - 20000

Resistance 1 - 20265

Support 2 - 19900

Resistance 2 - 20450

1

Technical & Derivatives Report

September 23, 2016

Comments

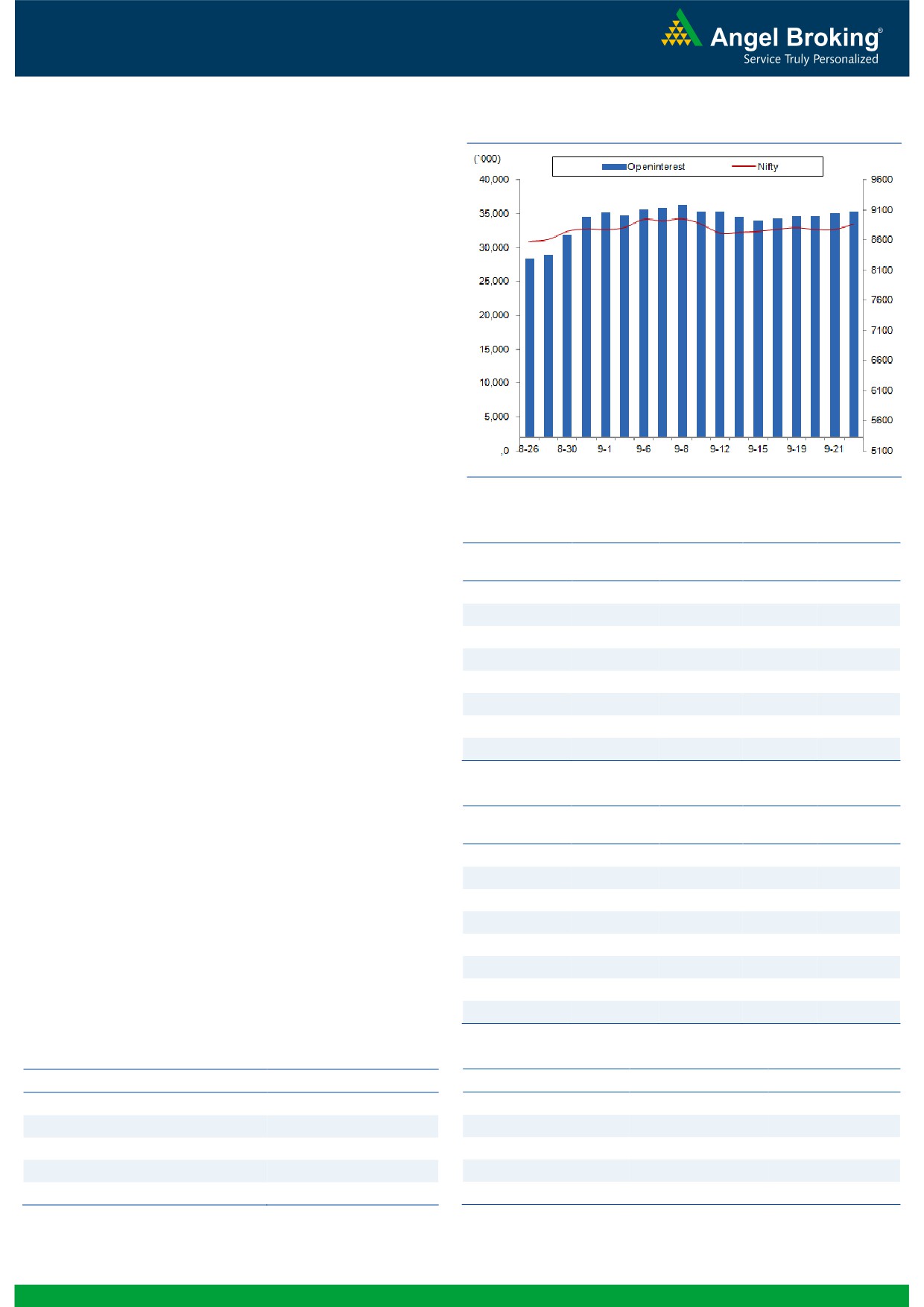

Nifty Vs OI

The Nifty futures open interest has increased by 0.50%

BankNifty futures open interest has increased by 0.84%

as market closed at 8867.45 levels.

The Nifty September future closed with a premium of

17.00 points against a premium of 29.80 points in

previous session. The October series closed at a

premium of 56.30 points.

The Implied Volatility of at the money options has

decreased from 15.64% to 11.17%. At the same time,

the PCR-OI of Nifty has increased from 1.12 to 1.16.

The total OI of the market is Rs. 3,29,493/- cr. and the

stock futures OI is Rs. 88,471/- cr.

Few of the liquid counters where we have seen high cost

of carry are JPASSOCIAT, SOUTHBANK, JINDALSTEL,

CENTURYTEX and ADANIPOWER.

Views

Yesterday, FIIs were net buyer in cash segment; they

OI Gainers

bought equities worth Rs. 337 crores. While, they were

OI

PRICE

net sellers worth Rs. 299 crores in index future with

SCRIP

OI

PRICE

CHG. (%)

CHG. (%)

marginal change in OI, indicating blend of long

AJANTPHARM

524800

22.62

2050.10

4.31

unwinding and some short formation in last trading

FEDERALBNK

34408000

18.31

73.50

3.09

session.

TVSMOTOR

6612000

18.28

349.30

4.60

On Index Options front, FIIs bought to the tune of Rs.ng.com

DABUR

6195000

16.94

286.35

-1.46

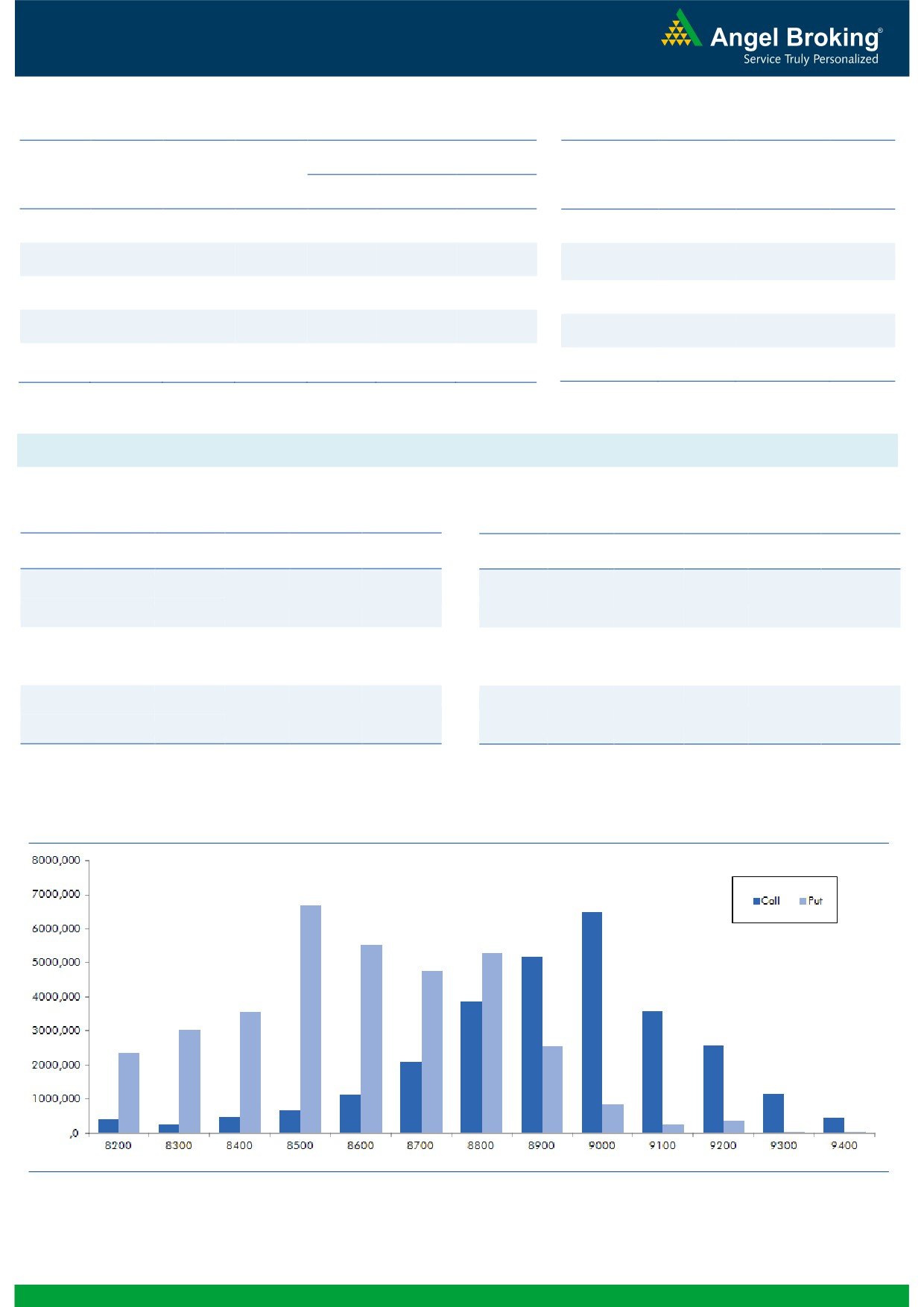

498 crores with rise in OI. In call options, we hardly saw

VOLTAS

4630000

16.33

381.05

0.32

any strike adding meaningful OI. Decent amount of

JSWENERGY

21840000

10.35

79.15

-0.50

unwinding was witness in 8800 call options. While in put

TECHM

8818700

9.10

456.30

-1.43

options, we witnessed some OI build-up in 8800-8900

BEL

2212200

8.45

1247.20

0.71

strikes; followed by decent amount of unwinding in 8600

and 8700 strikes. Highest OI in September series is

OI Losers

placed at 9000 call and 8500 put option.

OI

PRICE

Global market indicates we may start today’s session on

SCRIP

OI

PRICE

CHG. (%)

CHG. (%)

a flat note. Yesterday, Nifty bounced nearly 100 points

APOLLOHOSP

552000

-18.05

1341.95

2.28

but surprising no longs was visible. Thus, seeing the

JUBLFOOD

2526500

-8.58

978.75

3.00

derivatives data, we don’t see any signs of Index

TORNTPHARM

356000

-8.15

1652.40

2.06

sustaining at these higher levels.

SRTRANSFIN

3493200

-7.43

1188.00

3.67

Yesterday, large cap counters like HDFC, ACC,

YESBANK

12920600

-7.20

1246.75

2.09

TATAMOTORS and EICHERMOT have seen decent long

RELCAPITAL

10869000

-6.85

576.00

3.48

formation. While, counters like TECHM, LUPIN,

ANDHRABANK

17330000

-6.43

61.20

3.03

AXISBANK and TCS added good amount of short

PFC

22176000

-5.88

123.25

1.73

positions.

Historical Volatility

Put-Call Ratio

SCRIP

HV

SCRIP

PCR-OI

PCR-VOL

AUROPHARMA

42.39

NIFTY

1.16

1.24

AJANTPHARM

29.85

BANKNIFTY

1.08

0.98

BAJFINANCE

45.48

RELIANCE

0.66

0.63

SRTRANSFIN

35.72

YESBANK

0.62

0.61

TVSMOTOR

43.19

SBIN

0.52

0.52

2

Technical & Derivatives Report

September 23, 2016

FII Statistics for 22, September 2016

Turnover on 22, September 2016

Open Interest

No. of

Turnover

Change

Detail

Buy

Sell

Net

Instrument

Value

Contracts

( in Cr. )

(%)

Contracts

Change (%)

(in Cr.)

INDEX

INDEX

3143.17

3442.40

(299.22)

475380

32350.12

(0.39)

271568

19644.51

38.75

FUTURES

FUTURES

INDEX

INDEX

51635.79

51137.90

497.89

1381217

94270.26

1.21

6945045

520148.54

97.45

OPTIONS

OPTIONS

STOCK

7817.62

7945.01

(127.39)

938951

63284.77

(0.22)

STOCK

FUTURES

648931

46832.40

39.39

FUTURES

STOCK

STOCK

6099.75

6265.94

(166.19)

122396

8618.16

(3.20)

OPTIONS

447790

32554.90

46.72

OPTIONS

TOTAL

68696.34

68791.25

(94.91)

2917944

198523.31

0.29

TOTAL

8313334

619180.34

85.73

Nifty Spot = 8867.45

Lot Size = 75

Bull-Call Spreads

Bear-Put Spreads

Action

Strike

Price

Risk

Reward

BEP

Action

Strike

Price

Risk

Reward

BEP

Buy

8900

47.05

Buy

8900

62.00

32.20

67.80

8932.20

35.40

64.60

8864.60

Sell

9000

14.85

Sell

8800

26.60

Buy

8900

47.05

Buy

8900

62.00

43.15

156.85

8943.15

50.70

149.30

8849.30

Sell

9100

3.90

Sell

8700

11.30

Buy

9000

14.85

Buy

8800

26.60

10.95

89.05

9010.95

15.30

84.70

8784.70

Sell

9100

3.90

Sell

8700

11.30

Note: Above mentioned Bullish or Bearish Spreads in Nifty (September Series) are given as an information and not as a recommendation.

Nifty Put-Call Analysis

3

Technical & Derivatives Report

September 23, 2016

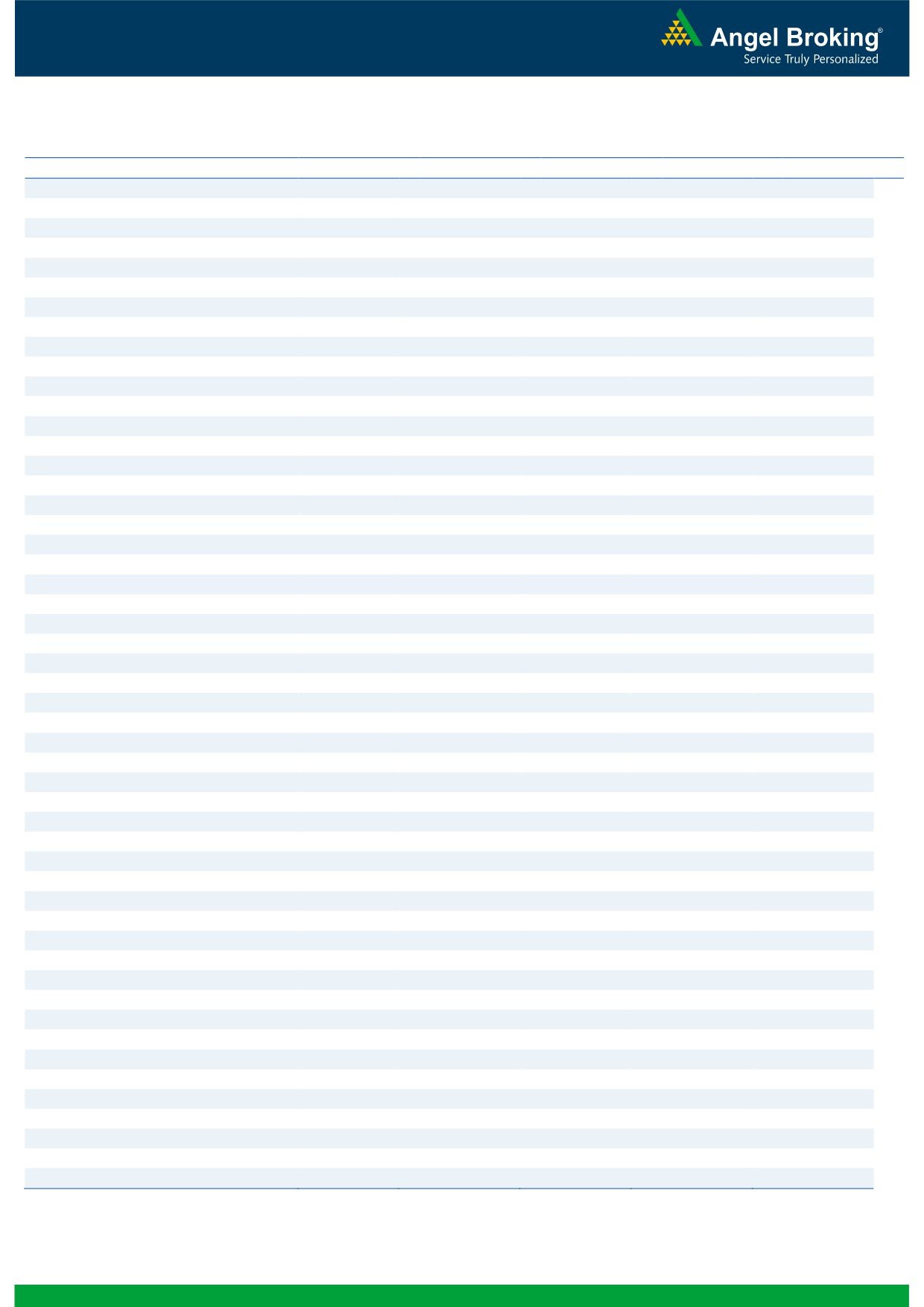

Daily Pivot Levels for Nifty Constituents

Scrips

S2

S1

PIVOT

R1

R2

ACC

1,628

1,647

1,659

1,678

1,690

ADANIPORTS

269

272

275

278

281

AMBUJACEM

261

263

266

268

271

ASIANPAINT

1,166

1,179

1,188

1,201

1,210

AUROPHARMA

794

826

843

874

891

AXISBANK

576

584

598

606

620

BAJAJ-AUTO

2,882

2,905

2,939

2,961

2,995

BANKBARODA

165

167

169

171

172

BHEL

145

146

147

148

149

BPCL

584

592

596

603

608

BHARTIARTL

321

324

326

329

331

INFRATEL

361

368

378

385

395

BOSCH

23,154

23,279

23,452

23,577

23,750

CIPLA

601

605

608

612

615

COALINDIA

322

325

329

332

336

DRREDDY

3,122

3,136

3,156

3,169

3,189

EICHERMOT

24,057

24,433

24,642

25,017

25,226

GAIL

385

388

391

393

396

GRASIM

4,856

4,892

4,916

4,951

4,975

HCLTECH

775

782

791

798

807

HDFCBANK

1,292

1,299

1,308

1,316

1,325

HDFC

1,394

1,404

1,412

1,421

1,429

HEROMOTOCO

3,463

3,501

3,539

3,577

3,615

HINDALCO

150

153

154

156

158

HINDUNILVR

896

903

910

918

925

ICICIBANK

270

273

275

278

281

IDEA

82

83

84

85

86

INDUSINDBK

1,187

1,203

1,215

1,231

1,243

INFY

1,048

1,054

1,057

1,063

1,066

ITC

252

254

255

257

259

KOTAKBANK

785

790

796

801

807

LT

1,467

1,483

1,494

1,510

1,521

LUPIN

1,490

1,510

1,535

1,554

1,579

M&M

1,400

1,407

1,415

1,421

1,429

MARUTI

5,530

5,563

5,599

5,632

5,668

NTPC

154

156

156

158

159

ONGC

256

258

260

261

263

POWERGRID

174

176

178

181

182

RELIANCE

1,071

1,080

1,088

1,097

1,105

SBIN

254

256

257

259

261

SUNPHARMA

781

784

786

789

792

TCS

2,335

2,357

2,392

2,414

2,449

TATAMTRDVR

349

352

355

358

361

TATAMOTORS

546

552

558

564

569

TATAPOWER

75

76

76

77

77

TATASTEEL

370

373

377

380

384

TECHM

445

450

458

463

471

ULTRACEMCO

3,934

3,957

3,983

4,006

4,032

WIPRO

477

479

482

485

488

YESBANK

1,217

1,232

1,245

1,260

1,274

ZEEL

517

521

528

533

539

4

Technical & Derivatives Report

September 23, 2016

Research Team Tel: 022 - 39357800

For Technical Queries

For Derivatives Queries

DISCLAIMER

Angel Broking Private Limited (hereinafter referred to as “Angel”) is a registered Member of National Stock Exchange of India Limited,

Bombay Stock Exchange Limited and Metropolitan Stock Exchange Limited. It is also registered as a Depository Participant with CDSL

and Portfolio Manager with SEBI. It also has registration with AMFI as a Mutual Fund Distributor. Angel Broking Private Limited is a

registered entity with SEBI for Research Analyst in terms of SEBI (Research Analyst) Regulations, 2014 vide registration number

INH000000164. Angel or its associates has not been debarred/ suspended by SEBI or any other regulatory authority for accessing

/dealing in securities Market. Angel or its associates/analyst has not received any compensation / managed or co-managed public

offering of securities of the company covered by Analyst during the past twelve months.

This document is solely for the personal information of the recipient, and must not be singularly used as the basis of any investment

decision. Nothing in this document should be construed as investment or financial advice. Each recipient of this document should

make such investigations as they deem necessary to arrive at an independent evaluation of an investment in the securities of the

companies referred to in this document (including the merits and risks involved), and should consult their own advisors to determine

the merits and risks of such an investment.

Reports based on technical and derivative analysis center on studying charts of a stock's price movement, outstanding positions and

trading volume, as opposed to focusing on a company's fundamentals and, as such, may not match with a report on a company's

fundamentals. Investors are advised to refer the Fundamental and Technical Research Reports available on our website to evaluate the

contrary view, if any.

The information in this document has been printed on the basis of publicly available information, internal data and other reliable

sources believed to be true, but we do not represent that it is accurate or complete and it should not be relied on as such, as this

document is for general guidance only. Angel Broking Pvt. Limited or any of its affiliates/ group companies shall not be in any way

responsible for any loss or damage that may arise to any person from any inadvertent error in the information contained in this report.

Angel Broking Pvt. Limited has not independently verified all the information contained within this document. Accordingly, we cannot

testify, nor make any representation or warranty, express or implied, to the accuracy, contents or data contained within this document.

While Angel Broking Pvt. Limited endeavors to update on a reasonable basis the information discussed in this material, there may be

regulatory, compliance, or other reasons that prevent us from doing so.

This document is being supplied to you solely for your information, and its contents, information or data may not be reproduced,

redistributed or passed on, directly or indirectly.

Neither Angel Broking Pvt. Limited, nor its directors, employees or affiliates shall be liable for any loss or damage that may arise from

or in connection with the use of this information.

5