Technical & Derivatives Report

June 23, 2016

Sensex (26813) / Nifty (8204)

Exhibit 1: Nifty Hourly Chart

Yesterday’s session opened tad lower despite positive cues from

the Asian peers. The index maintained this pessimistic mood

throughout the session to conclude with a nominal cut of 0.20%

over it previous close.

The Nifty remained lethargic for the major part of the day.

However, a sharp cut in the penultimate hour caught most of the

intraday traders on a wrong foot. Fortunately, we witnessed a

smart recovery to reclaim the 8200 mark. If we meticulously

observe the hourly chart, the ‘Inverse Head and Shoulder’ formed

on Tuesday becomes clearly visible. Yesterday’s intraday dip

precisely tested the ‘Neckline’ level of 8160, which coincides with

’89 EMA’. Thus, this corrective move can be construed as a pull

back and going by this hypothesis; we maintain our positive

stance on the market and expect the index to move towards 8290

- 8336 levels. On the flipside, 8150 would be seen as immediate

support level. Traders should keep a note of a global event such

as ‘EU Referendum on Brexit’ and thus, it’s advisable to stay light

and avoid taking undue risks.

Key Levels

Support 1 - 8150

Resistance 1 - 8290

Support 2 - 8100

Resistance 2 - 8336

Exhibit 2: Nifty Bank Daily Chart

Nifty Bank Outlook - (17626)

Yesterday, the banking index too opened on a soft note and then

remained under pressure for the major part of the day. However,

a modest recovery towards the fag end led to a daily close

marginally in the positive territory.

Since last few trading sessions, the index is trading in a narrow

range and it seems that markets participants are waiting for the

development of Britain's EU referendum on 'Brexit', which is late in

the evening. Hence, we could see range bound trading sessions

with market participants waiting for the outcome, which may

dictate a near term direction for global markets. Technically, the

index has been trading in a range of 17350 - 18050 since last

few days and hence, unless it confirms a breakout from the

range, traders should focus on stock specific moves rather than

trading in the index. The near term support for the index is placed

around 17588 and 17350; whereas, resistances are seen around

17935 and 18050.

Key Levels

Support 1 - 17588

Resistance 1 - 17935

Support 2 - 17350

Resistance 2 - 18050

1

Technical & Derivatives Report

June 23, 2016

Comments

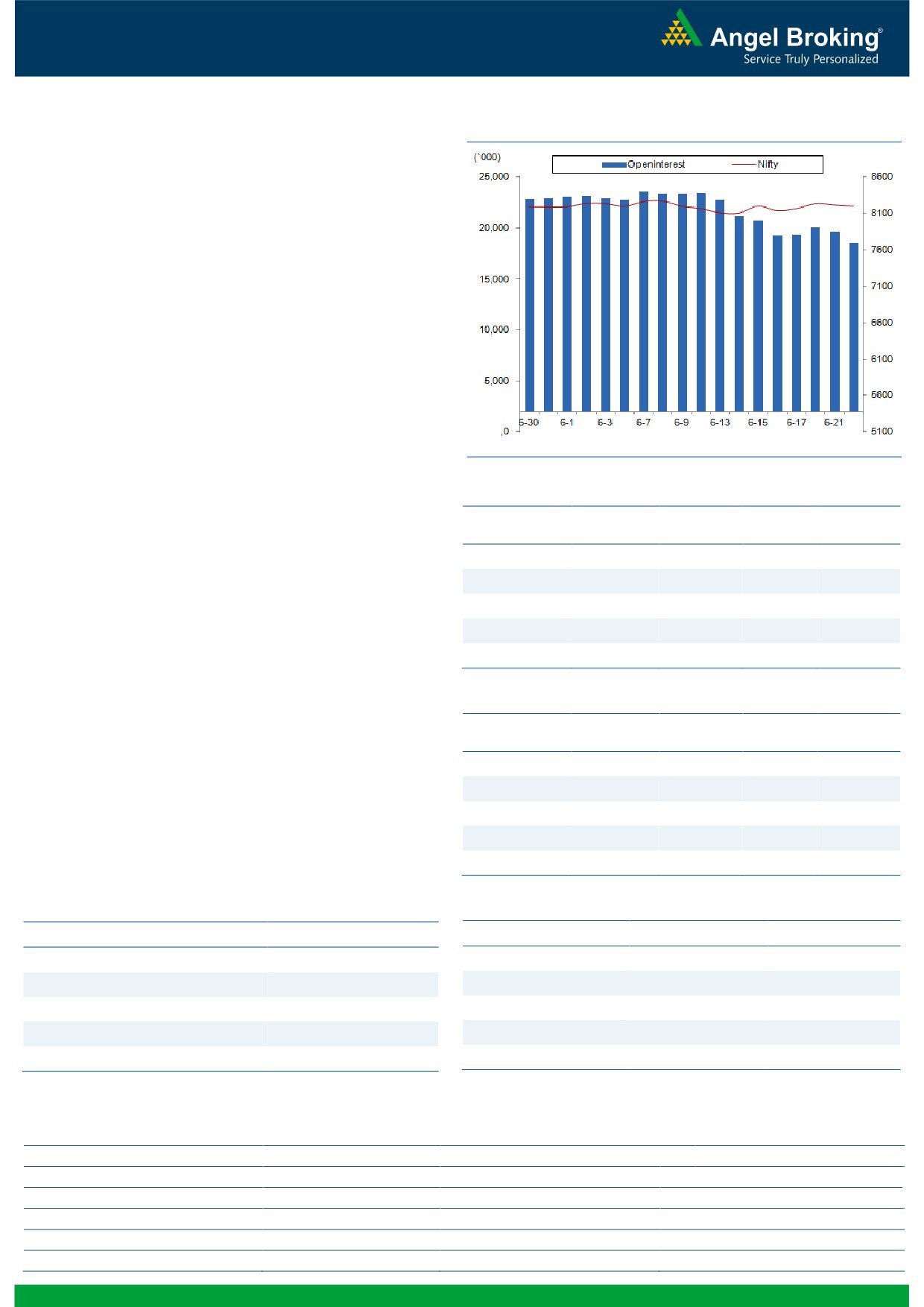

Nifty Vs OI

The Nifty futures open interest has decreased by 5.46%

BankNifty futures open interest has increased by 1.94%

as market closed at 8203.70 levels.

The Nifty June future closed with a premium of 1.35

points against a premium of 5.20 points in previous

session. The July series closed at a premium of 29.75

points.

The Implied Volatility of at the money options has

increased from 18.23% to 20.94%.

The total OI of the market is Rs. 2,58,237/- cr. and the

stock futures OI is Rs. 67,845/- cr.

Few of the liquid counters where we have seen high cost

of carry are JPASSOCIAT, UNITECH, GMRINFRA, IDFC

and AJANTPHARM.

Views

OI Gainers

Yesterday, FIIs were marginal sellers in cash market

OI

PRICE

segment. While in Index Futures, they sold worth Rs. 497

SCRIP

OI

PRICE

CHG. (%)

CHG. (%)

crores with fall in open interest, indicating continuation of

ARVIND

5766800

22.49

324.90

-0.95

long unwinding in last trading session.

JETAIRWAYS

6393800

13.69

564.60

-2.42

On Index Options front, FIIs sold worth Rs. 390 crores

STAR

1172400

10.84

1066.85

-2.10

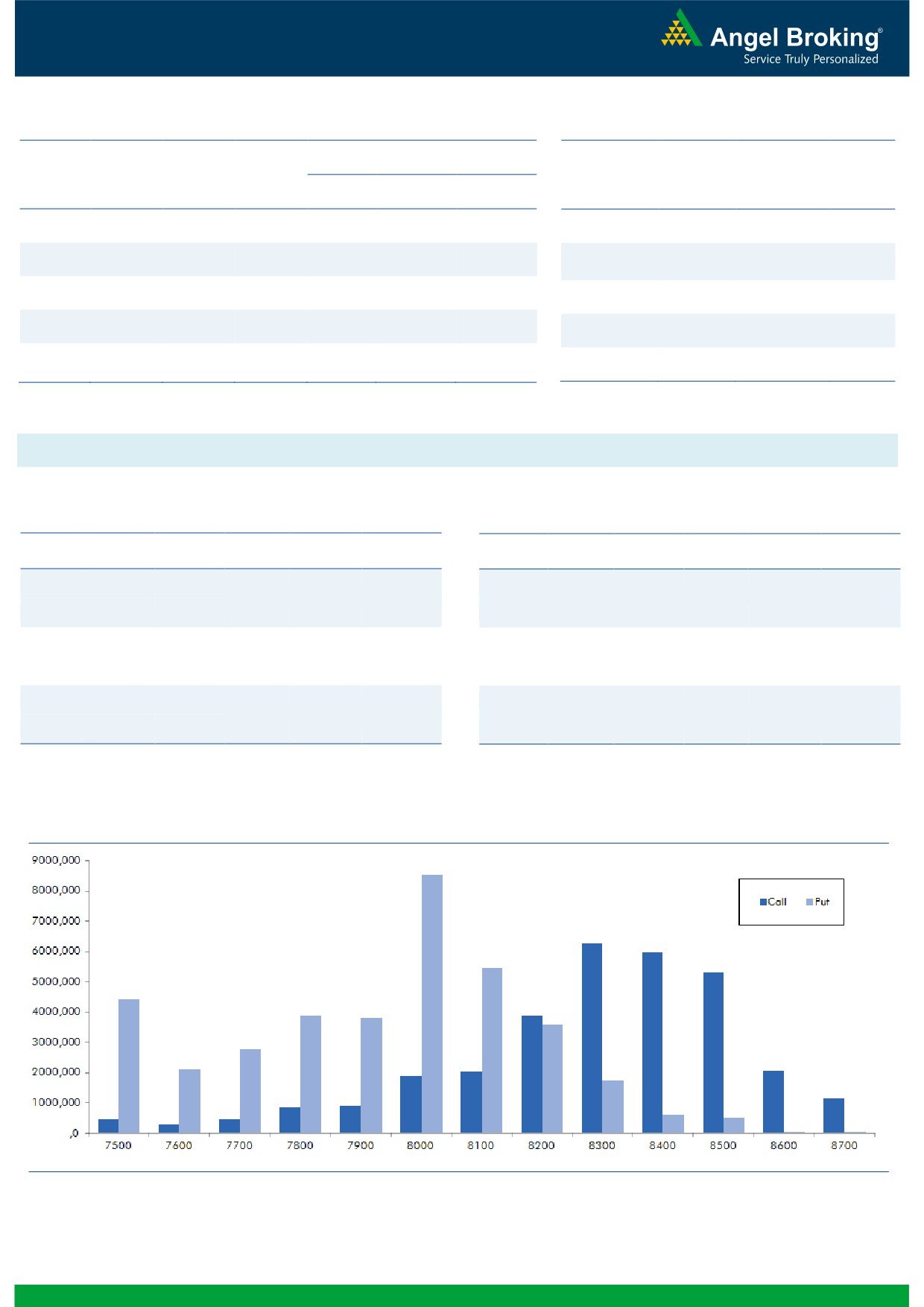

with rise in open interest. In Call option, 8250 strike was

quite active and added fresh positions. While in Put

INFRATEL

7300900

7.05

339.75

-2.50

option, OI addition was seen in 8000 strike; followed by

PETRONET

4848000

6.74

290.70

2.27

some unwinding in 8100 - 8200 strikes. Maximum OI

in June series remains intact in 8300 call and 8000 put

OI Losers

options.

OI

PRICE

SCRIP

OI

PRICE

FIIs are continuously unwinding their long positions in

CHG. (%)

CHG. (%)

Index and thus most of the longs are now out of the

IOB

7280000

-9.72

26.95

-0.92

system. However, except a fresh short build-up on

HDIL

23636000

-6.53

106.00

0.38

Monday, we didn’t witness any meaningful shorting

VOLTAS

4630400

-5.95

323.00

-0.25

taking place in June series from FIIs. We advise traders

LUPIN

5249700

-5.18

1464.85

0.98

to remain light on positions and avoid taking undue risk

NHPC

26028000

-5.02

24.65

-1.20

ahead of ‘EU Referendum on Brexit’.

Historical Volatility

Put-Call Ratio

SCRIP

HV

SCRIP

PCR-OI

PCR-VOL

HEXAWARE

31.25

NIFTY

1.11

0.93

PETRONET

30.14

BANKNIFTY

0.93

0.88

JSWENERGY

59.60

SBIN

0.93

0.80

GAIL

26.36

RELIANCE

0.51

0.48

DRREDDY

24.54

SUNPHARMA

0.34

0.24

Strategy Date

Symbol

Strategy

Status

May 30, 2016

TCS

Ratio Bull Call Spread

Active

June 06, 2016

NIFTY

Long Call

Exited at Cost

June 13, 2016

ONGC

Ratio Bull Call Spread

Active

June 20, 2016

MARUTI

Long Call Ladder

Active

2

Technical & Derivatives Report

June 23, 2016

FII Statistics for 22-June 2016

Turnover on 22-June 2016

Open Interest

No. of

Turnover

Change

Detail

Buy

Sell

Net

Instrument

Value

Contracts

( in Cr. )

(%)

Contracts

Change (%)

(in Cr.)

INDEX

INDEX

1404.99

1902.16

(497.17)

227898

13663.89

(3.35)

256909

15006.76

38.67

FUTURES

FUTURES

INDEX

INDEX

20335.48

20725.55

(390.07)

1214346

73843.75

3.19

3467061

201527.77

44.82

OPTIONS

OPTIONS

STOCK

4706.65

4358.87

347.78

1092629

54641.37

0.18

STOCK

FUTURES

513229

27018.99

2.10

FUTURES

STOCK

STOCK

3173.09

3139.58

33.51

119178

6230.18

2.45

OPTIONS

322284

17572.16

15.48

OPTIONS

TOTAL

29620.21

30126.16

(505.95)

2654051

148379.20

1.31

TOTAL

4559483

261125.69

36.25

Nifty Spot = 8203.70

Lot Size = 75

Bull-Call Spreads

Bear-Put Spreads

Action

Strike

Price

Risk

Reward

BEP

Action

Strike

Price

Risk

Reward

BEP

Buy

8200

102.85

Buy

8200

98.80

47.30

52.70

8247.30

35.65

64.35

8164.35

Sell

8300

55.55

Sell

8100

63.15

Buy

8200

102.85

Buy

8200

98.80

77.30

122.70

8277.30

58.95

141.05

8141.05

Sell

8400

25.55

Sell

8000

39.85

Buy

8300

55.55

Buy

8100

63.15

30.00

70.00

8330.00

23.30

76.70

8076.70

Sell

8400

25.55

Sell

8000

39.85

Note: Above mentioned Bullish or Bearish Spreads in Nifty (June Series) are given as an information and not as a recommendation.

Nifty Put-Call Analysis

3

Technical & Derivatives Report

June 23, 2016

Daily Pivot Levels for Nifty Constituents

Scrips

S2

S1

PIVOT

R1

R2

ACC

1,552

1,561

1,568

1,578

1,585

ADANIPORTS

201

204

206

210

212

AMBUJACEM

238

240

242

245

246

ASIANPAINT

974

979

984

990

995

AUROPHARMA

702

712

723

732

744

AXISBANK

510

513

517

520

524

BAJAJ-AUTO

2,602

2,617

2,628

2,643

2,654

BANKBARODA

146

148

150

151

153

BHEL

121

122

122

123

124

BPCL

998

1,004

1,009

1,014

1,019

BHARTIARTL

357

360

364

366

370

INFRATEL

327

333

341

347

356

BOSCH

21,472

21,603

21,802

21,933

22,132

CIPLA

476

479

483

486

489

COALINDIA

310

314

316

320

322

DRREDDY

3,032

3,069

3,101

3,138

3,170

EICHERMOT

18,630

18,709

18,754

18,833

18,879

GAIL

366

371

378

382

389

GRASIM

4,234

4,256

4,290

4,311

4,346

HCLTECH

763

767

770

774

778

HDFCBANK

1,162

1,167

1,171

1,176

1,180

HDFC

1,218

1,228

1,235

1,245

1,252

HEROMOTOCO

3,004

3,039

3,059

3,094

3,114

HINDALCO

118

120

122

124

126

HINDUNILVR

851

855

861

866

872

ICICIBANK

233

236

239

242

246

IDEA

100

101

102

102

103

INDUSINDBK

1,080

1,085

1,091

1,097

1,103

INFY

1,176

1,188

1,200

1,212

1,224

ITC

349

352

355

358

362

KOTAKBANK

724

732

741

749

759

LT

1,469

1,480

1,492

1,503

1,514

LUPIN

1,437

1,450

1,458

1,471

1,479

M&M

1,331

1,345

1,363

1,377

1,395

MARUTI

4,097

4,124

4,152

4,180

4,208

NTPC

149

151

152

154

155

ONGC

215

216

218

220

221

POWERGRID

154

155

156

157

158

RELIANCE

972

976

981

985

990

SBIN

209

211

213

215

217

SUNPHARMA

728

734

738

744

748

TCS

2,613

2,640

2,659

2,686

2,705

TATAMTRDVR

306

310

316

321

327

TATAMOTORS

458

466

475

482

492

TATAPOWER

73

73

74

74

75

TATASTEEL

324

328

331

335

338

TECHM

524

528

535

540

547

ULTRACEMCO

3,257

3,284

3,327

3,354

3,397

WIPRO

558

560

562

565

567

YESBANK

1,061

1,070

1,076

1,085

1,091

ZEEL

442

445

449

452

456

4

Technical & Derivatives Report

June 23, 2016

Research Team Tel: 022 - 39357800

For Technical Queries

For Derivatives Queries

DISCLAIMER

Angel Broking Private Limited (hereinafter referred to as “Angel”) is a registered Member of National Stock Exchange of India Limited,

Bombay Stock Exchange Limited and MCX Stock Exchange Limited. It is also registered as a Depository Participant with CDSL and

Portfolio Manager with SEBI. It also has registration with AMFI as a Mutual Fund Distributor. Angel Broking Private Limited is a

registered entity with SEBI for Research Analyst in terms of SEBI (Research Analyst) Regulations, 2014 vide registration number

INH000000164. Angel or its associates has not been debarred/ suspended by SEBI or any other regulatory authority for accessing

/dealing in securities Market. Angel or its associates including its relatives/analyst do not hold any financial interest/beneficial

ownership of more than 1% in the company covered by Analyst. Angel or its associates/analyst has not received any compensation /

managed or co-managed public offering of securities of the company covered by Analyst during the past twelve months. Angel/analyst

has not served as an officer, director or employee of company covered by Analyst and has not been engaged in market making activity

of the company covered by Analyst.

This document is solely for the personal information of the recipient, and must not be singularly used as the basis of any investment

decision. Nothing in this document should be construed as investment or financial advice. Each recipient of this document should

make such investigations as they deem necessary to arrive at an independent evaluation of an investment in the securities of the

companies referred to in this document (including the merits and risks involved), and should consult their own advisors to determine

the merits and risks of such an investment.

Reports based on technical and derivative analysis center on studying charts of a stock's price movement, outstanding positions and

trading volume, as opposed to focusing on a company's fundamentals and, as such, may not match with a report on a company's

fundamentals.

The information in this document has been printed on the basis of publicly available information, internal data and other reliable

sources believed to be true, but we do not represent that it is accurate or complete and it should not be relied on as such, as this

document is for general guidance only. Angel Broking Pvt. Limited or any of its affiliates/ group companies shall not be in any way

responsible for any loss or damage that may arise to any person from any inadvertent error in the information contained in this report.

Angel Broking Pvt. Limited has not independently verified all the information contained within this document. Accordingly, we cannot

testify, nor make any representation or warranty, express or implied, to the accuracy, contents or data contained within this document.

While Angel Broking Pvt. Limited endeavors to update on a reasonable basis the information discussed in this material, there may be

regulatory, compliance, or other reasons that prevent us from doing so.

This document is being supplied to you solely for your information, and its contents, information or data may not be reproduced,

redistributed or passed on, directly or indirectly.

Neither Angel Broking Pvt. Limited, nor its directors, employees or affiliates shall be liable for any loss or damage that may arise from

or in connection with the use of this information.

Note: Please refer to the important ‘Stock Holding Disclosure' report on the Angel website (Research Section). Also, please refer to the

latest update on respective stocks for the disclosure status in respect of those stocks. Angel Broking Pvt. Limited and its affiliates may

have investment positions in the stocks recommended in this report.

5