Technical & Derivatives Report

May 23, 2016

Sensex (25302) / Nifty (7750)

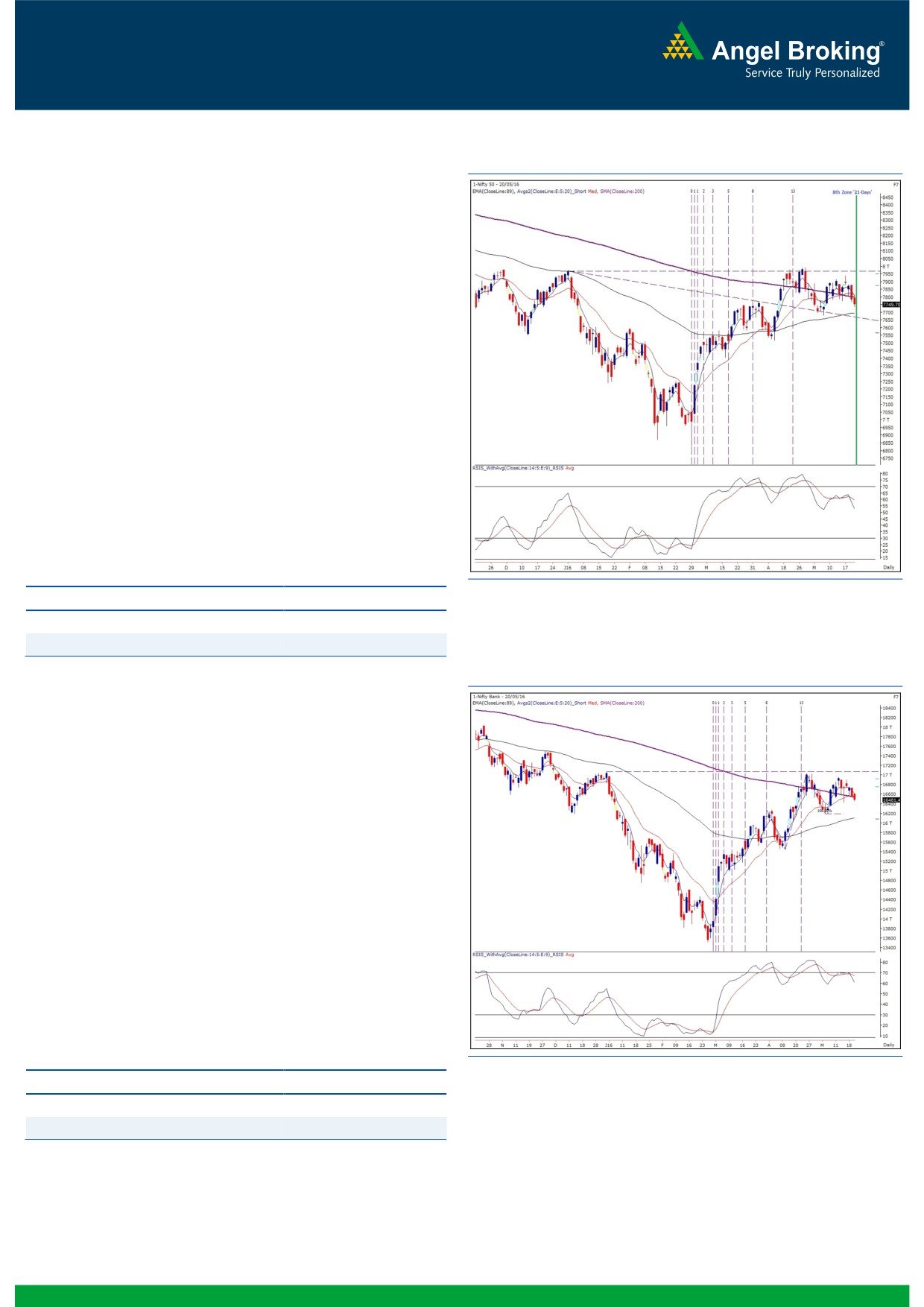

Exhibit 1: Nifty Daily Chart

The indecisiveness continued on Dalal Street in the week gone by;

however, it must be noted that the last two sessions of the week

were completely dominated by the bears.

Technically speaking, the Nifty is now trading slightly above the

recent swing low of 7678.35, which almost coincides with the

daily ’89 EMA’ as well as the ‘Parabolic SAR’ indicator. Going

forward, traders would be meticulously tracking this support zone

as it could act as a trend deciding level in the near term. A

sustainable move below it may lead to further correction towards

the April month low of 7516.85. At the current juncture, if we look

at the ‘Fibonacci Time Series’ from the bottom of 6825.80, the

Nifty will be completing its 8th Time zone (21 days) and will enter

the 9th time zone of ‘34 Days’ on Monday. Generally, such points

are seen as ‘Potential Reversal Zones’ and hence, as long as the

Nifty manages to hold 7678.35, we would hope for this new

‘Time Zone’ to turn positive for our markets. On the upside, 7940

- 8000 levels are seen as major hurdles for the index.

Key Levels

Support 1 - 7720

Resistance 1 - 7800

Support 2 - 7678

Resistance 2 - 7845

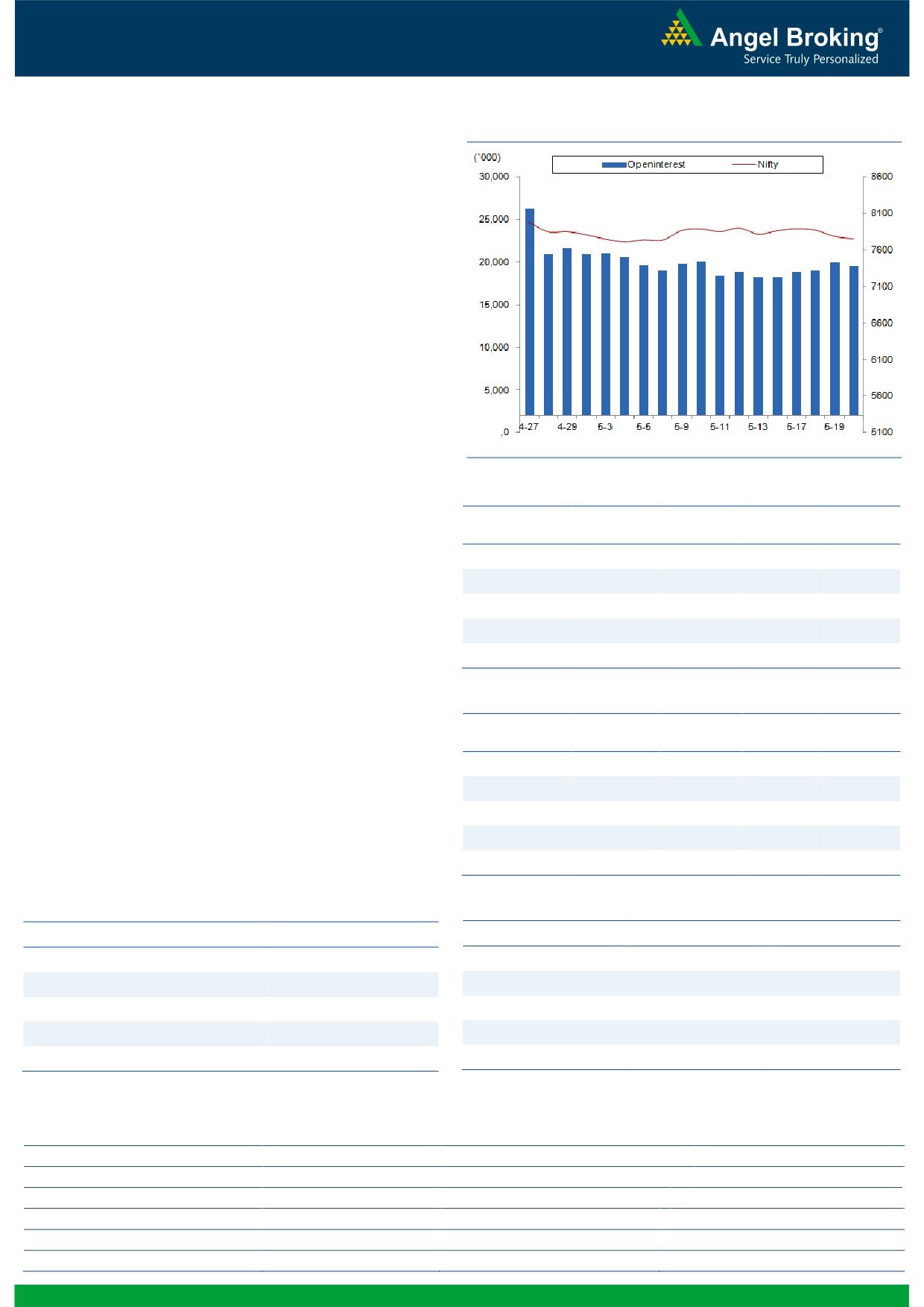

Exhibit 2: Nifty Bank Daily Chart

Nifty Bank Outlook - (16481)

The Nifty Bank index opened with marginal upside gap on Friday

and remained in a narrow range of 100 points in first half of the

sesison. However, we witnessed a selling pressure in concluding

hour and as a result, the banking index ended the session with a

loss of 0.51 percent over its previous close.

The banking index is currently trading above its previous swing

low of 16431.65 on hourly chat and thus, the uptrend is still

intact. On weekly chart, the Nifty Bank index traded within the

territory of previous week’s price action. Hence, the high (16962)

and low (16357) of previous week will be a trend deciding levels

for the index. Going forward, intraday support fot the index is

placed at 16431 and 16357 levels; while, resistance is seen at

16625 and 16780 levels. Traders are advised to remain light and

wait for further development on chart before initiating any

positional trade in the banking index.

Key Levels

Support 1 - 16431

Resistance 1 - 16625

Support 2 - 16357

Resistance 2 - 16780

1

Technical & Derivatives Report

May 23, 2016

Comments

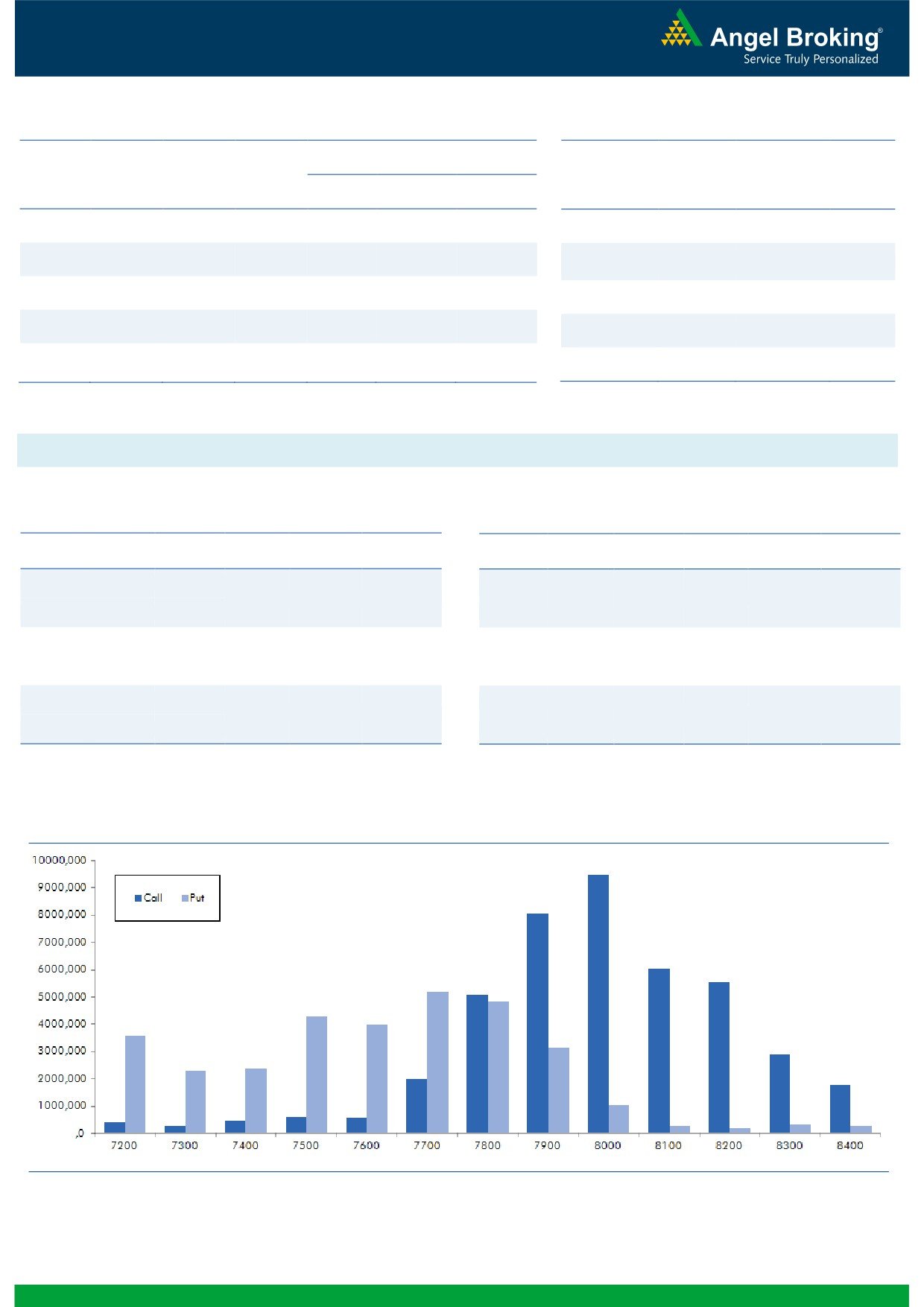

Nifty Vs OI

The Nifty futures open interest has decreased by 2.02%

BankNifty futures open interest has decreased by 2.42%

as market closed at 7749.70 levels.

The Nifty May future closed at a premium of 13.65

points against a premium of 1.70 points. The June series

closed at a premium of 18.25 points.

The Implied Volatility of at the money options has

decreased from 16.79% to 14.65%.

The total OI of the market is Rs. 2,46,929/- cr. and the

stock futures OI is Rs. 63,083/- cr.

Few of the liquid counters where we have seen high cost

of carry are UNITECH, ANDHRABANK, BOSCHLTD,

TATAPOWER and HEXAWARE.

Views

On Friday, the FIIs sold in equities worth Rs. 744 crores.

OI Gainers

While, they were marginal seller in index future with fall

OI

PRICE

in OI, indicating blend of long unwinding and short

SCRIP

OI

PRICE

CHG. (%)

CHG. (%)

covering.

ICIL

484500

14.27

913.70

-0.44

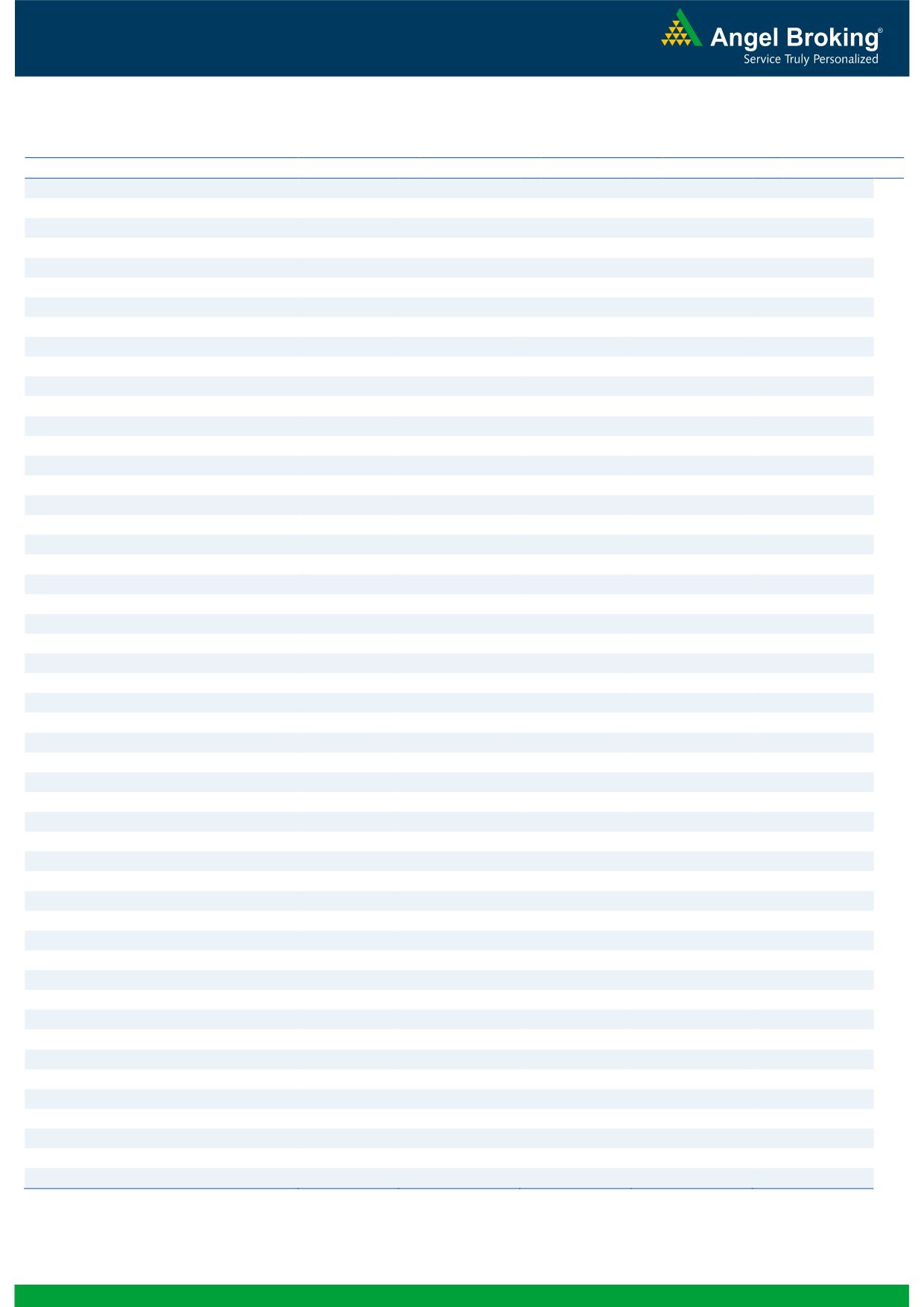

In Index Options front, FIIs were net seller worth Rs. 566

KTKBANK

14392000

13.50

120.45

7.31

crores with marginal rise in OI. In call options, 7800 -

HEXAWARE

6598000

12.86

209.40

-0.83

7850 strike were active and added fresh positions; while

ITC

29867200

12.74

330.75

1.57

unwinding was seen in 8200 and 8000 call options.

ADANIENT

14994000

9.94

69.05

-3.36

Whereas, in put options, some OI addition was seen in

7650 strike; followed by unwinding in 7700 strike.

Maximum OI in current series is seen at 8000 call and

OI Losers

7700 put options.

OI

PRICE

SCRIP

OI

PRICE

In last week, except a selling on Wednesday, we didn’t

CHG. (%)

CHG. (%)

HDIL

23622000

-12.80

93.75

1.74

witness any major activity in index future by FIIs. Their

activity remained subdued in index option segment too.

SUNTV

4816000

-7.21

375.80

0.95

Hence, it’s prudent to wait for noticeable data from FIIs

IBREALEST

24012000

-5.42

91.40

-1.72

to initiate any fresh positions in index. Rollover in Nifty

NMDC

8837000

-5.20

91.70

1.78

and BankNifty are 13.66% and 10.05% respectively.

UPL

8502000

-5.07

578.30

2.73

Historical Volatility

Put-Call Ratio

SCRIP

HV

SCRIP

PCR-OI

PCR-VOL

PIDILITIND

33.79

NIFTY

0.83

0.78

LUPIN

54.80

BANKNIFTY

0.82

0.73

KTKBANK

47.86

SBIN

0.39

0.30

TORNTPHARM

30.33

RELIANCE

0.36

0.46

JETAIRWAYS

42.96

ICICIBANK

0.42

0.57

Strategy Date

Symbol

Strategy

Status

02-05-2016

NIFTY

Long Strangle

Active

09-05-2016

RELIANCE

Long Put

Loss Booked on May 17, 2016

16-05-2016

LT

Short Strangle

Active

2

Technical & Derivatives Report

May 23, 2016

FII Statistics for 20-May 2016

Turnover on 20-May 2016

Open Interest

No. of

Turnover

Change

Detail

Buy

Sell

Net

Instrument

Value

Contracts

( in Cr. )

(%)

Contracts

Change (%)

(in Cr.)

INDEX

INDEX

1444.32

1489.24

(44.91)

264465

15027.18

(2.77)

281733

15610.08

-10.84

FUTURES

FUTURES

INDEX

INDEX

35348.55

35914.55

(566.00)

1289088

74047.54

1.70

4443375

256967.22

0.16

OPTIONS

OPTIONS

STOCK

5391.86

5251.94

139.93

1056343

49684.56

(0.58)

STOCK

FUTURES

608893

29193.87

-11.96

FUTURES

STOCK

STOCK

3580.04

3892.61

(312.57)

96224

4536.86

4.63

OPTIONS

408673

19952.62

-9.94

OPTIONS

TOTAL

45764.78

46548.34

(783.56)

2706120

143296.14

0.45

TOTAL

5742674

321723.80

-2.33

Nifty Spot = 7749.70

Lot Size = 75

Bull-Call Spreads

Bear-Put Spreads

Action

Strike

Price

Risk

Reward

BEP

Action

Strike

Price

Risk

Reward

BEP

Buy

7800

40.95

Buy

7700

33.60

26.80

73.20

7826.80

20.80

79.20

7679.20

Sell

7900

14.15

Sell

7600

12.80

Buy

7800

40.95

Buy

7700

33.60

36.30

163.70

7836.30

28.05

171.95

7671.95

Sell

8000

4.65

Sell

7500

5.55

Buy

7900

14.15

Buy

7600

12.80

9.50

90.50

7909.50

7.25

92.75

7592.75

Sell

8000

4.65

Sell

7500

5.55

Note: Above mentioned Bullish or Bearish Spreads in Nifty (May Series) are given as an information and not as a recommendation.

Nifty Put-Call Analysis

3

Technical & Derivatives Report

May 23, 2016

Daily Pivot Levels for Nifty Constituents

Scrips

S2

S1

PIVOT

R1

R2

ACC

1,372

1,383

1,401

1,411

1,430

ADANIPORTS

166

172

176

182

186

AMBUJACEM

203

206

210

213

218

ASIANPAINT

944

950

957

962

969

AUROPHARMA

755

763

769

776

782

AXISBANK

484

487

491

495

499

BAJAJ-AUTO

2,413

2,433

2,447

2,467

2,482

BANKBARODA

132

133

136

138

140

BHEL

118

119

120

120

121

BPCL

899

910

929

939

958

BHARTIARTL

335

339

343

346

350

INFRATEL

368

373

380

385

392

BOSCH

20,770

20,910

21,080

21,220

21,390

CIPLA

494

500

508

515

522

COALINDIA

276

278

279

281

282

DRREDDY

3,011

3,022

3,034

3,045

3,057

EICHERMOT

18,027

18,154

18,252

18,379

18,477

GAIL

366

369

373

376

380

GRASIM

4,169

4,188

4,219

4,238

4,269

HCLTECH

724

730

735

741

746

HDFCBANK

1,126

1,134

1,141

1,148

1,156

HDFC

1,160

1,170

1,182

1,192

1,203

HEROMOTOCO

2,854

2,875

2,893

2,914

2,931

HINDALCO

85

86

87

88

89

HINDUNILVR

798

805

813

820

828

ICICIBANK

215

218

222

224

229

IDEA

105

107

109

111

113

INDUSINDBK

1,051

1,061

1,069

1,078

1,086

INFY

1,188

1,195

1,207

1,214

1,227

ITC

317

324

331

338

345

KOTAKBANK

694

698

704

708

715

LT

1,233

1,244

1,262

1,273

1,291

LUPIN

1,420

1,462

1,540

1,583

1,661

M&M

1,267

1,280

1,301

1,314

1,335

MARUTI

3,850

3,898

3,928

3,976

4,006

NTPC

134

136

137

138

139

ONGC

209

211

213

215

217

POWERGRID

143

144

145

145

146

RELIANCE

917

926

940

949

963

SBIN

168

170

172

174

176

SUNPHARMA

785

788

793

796

801

TCS

2,496

2,513

2,539

2,556

2,582

TATAMTRDVR

258

261

265

267

271

TATAMOTORS

378

381

387

390

396

TATAPOWER

68

69

69

70

71

TATASTEEL

318

320

324

326

330

TECHM

465

471

480

485

495

ULTRACEMCO

3,071

3,102

3,153

3,184

3,235

WIPRO

539

541

545

547

550

YESBANK

958

968

975

985

992

ZEEL

428

431

436

439

445

4

Technical & Derivatives Report

May 23, 2016

Research Team Tel: 022 - 39357800

For Technical Queries

For Derivatives Queries

DISCLAIMER

Angel Broking Private Limited (hereinafter referred to as “Angel”) is a registered Member of National Stock Exchange of India Limited,

Bombay Stock Exchange Limited and MCX Stock Exchange Limited. It is also registered as a Depository Participant with CDSL and

Portfolio Manager with SEBI. It also has registration with AMFI as a Mutual Fund Distributor. Angel Broking Private Limited is a

registered entity with SEBI for Research Analyst in terms of SEBI (Research Analyst) Regulations, 2014 vide registration number

INH000000164. Angel or its associates has not been debarred/ suspended by SEBI or any other regulatory authority for accessing

/dealing in securities Market. Angel or its associates including its relatives/analyst do not hold any financial interest/beneficial

ownership of more than 1% in the company covered by Analyst. Angel or its associates/analyst has not received any compensation /

managed or co-managed public offering of securities of the company covered by Analyst during the past twelve months. Angel/analyst

has not served as an officer, director or employee of company covered by Analyst and has not been engaged in market making activity

of the company covered by Analyst.

This document is solely for the personal information of the recipient, and must not be singularly used as the basis of any investment

decision. Nothing in this document should be construed as investment or financial advice. Each recipient of this document should

make such investigations as they deem necessary to arrive at an independent evaluation of an investment in the securities of the

companies referred to in this document (including the merits and risks involved), and should consult their own advisors to determine

the merits and risks of such an investment.

Reports based on technical and derivative analysis center on studying charts of a stock's price movement, outstanding positions and

trading volume, as opposed to focusing on a company's fundamentals and, as such, may not match with a report on a company's

fundamentals.

The information in this document has been printed on the basis of publicly available information, internal data and other reliable

sources believed to be true, but we do not represent that it is accurate or complete and it should not be relied on as such, as this

document is for general guidance only. Angel Broking Pvt. Limited or any of its affiliates/ group companies shall not be in any way

responsible for any loss or damage that may arise to any person from any inadvertent error in the information contained in this report.

Angel Broking Pvt. Limited has not independently verified all the information contained within this document. Accordingly, we cannot

testify, nor make any representation or warranty, express or implied, to the accuracy, contents or data contained within this document.

While Angel Broking Pvt. Limited endeavors to update on a reasonable basis the information discussed in this material, there may be

regulatory, compliance, or other reasons that prevent us from doing so.

This document is being supplied to you solely for your information, and its contents, information or data may not be reproduced,

redistributed or passed on, directly or indirectly.

Neither Angel Broking Pvt. Limited, nor its directors, employees or affiliates shall be liable for any loss or damage that may arise from

or in connection with the use of this information.

Note: Please refer to the important ‘Stock Holding Disclosure' report on the Angel website (Research Section). Also, please refer to the

latest update on respective stocks for the disclosure status in respect of those stocks. Angel Broking Pvt. Limited and its affiliates may

have investment positions in the stocks recommended in this report.

5