Technical & Derivatives Report

December 22, 2015

Sensex (25736) / Nifty (7834)

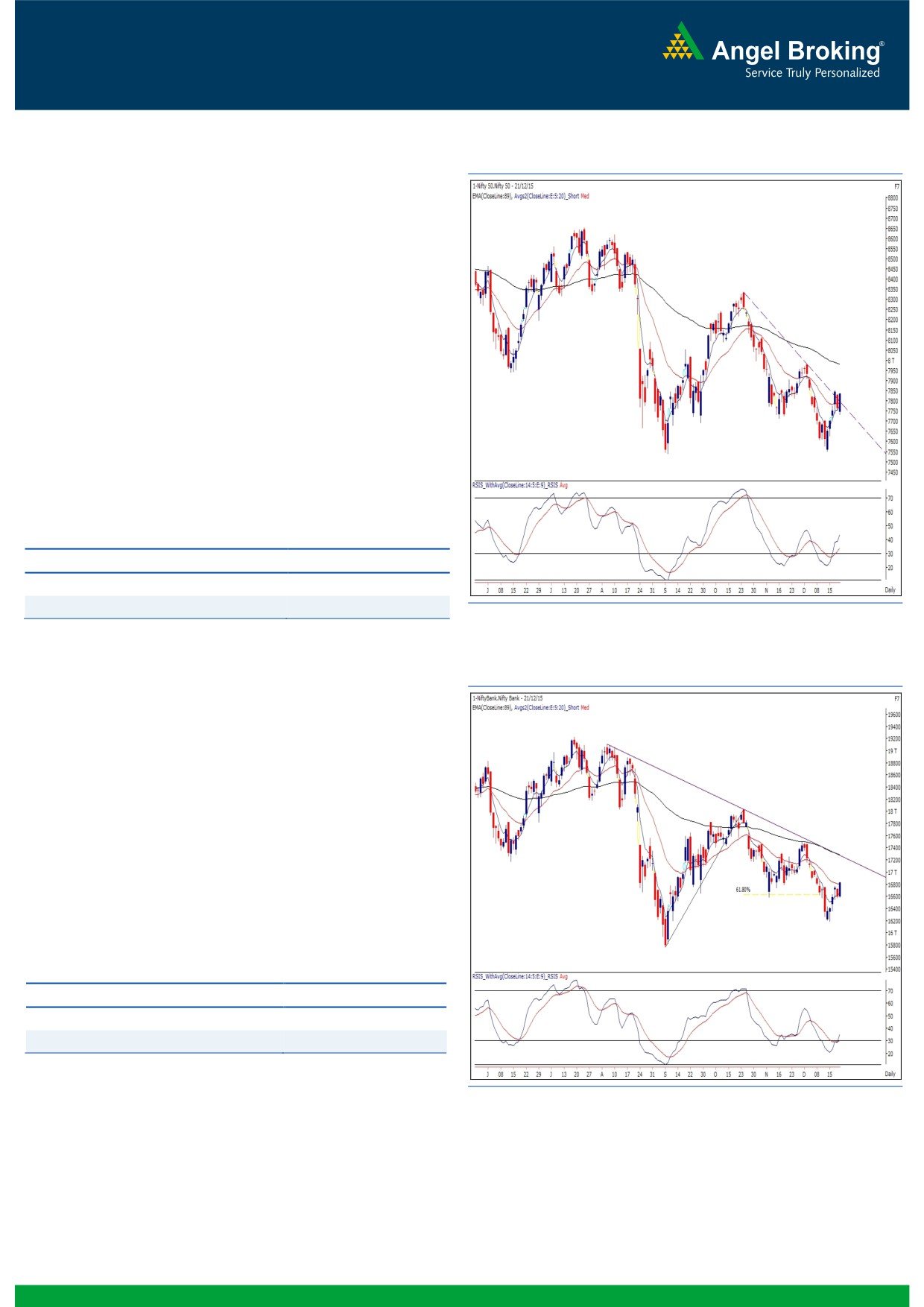

Exhibit 1: Nifty Daily Chart

Trading for the week began on a soft note despite extremely

negative cues from US bourses. The index managed to recover

steadily in the initial hour and kept on ascending throughout the

remaining part of the day. As a result, the Nifty eventually ended

the session with nearly a percent gains.

Our markets completely outperformed its peers across the globe

as we witnessed a good traction throughout the session. After a

modest profit booking on Friday, the Nifty managed to regain the

7800 mark. As mentioned in our previous report, the Nifty has

now closed above 7800 and thus, has unfolded further up move

towards 7920 - 7970 levels. On the flipside, yesterday’s low of

7733.45 would now be seen an important support level. We

believe that the index may overall remain range bound in coming

sessions and thus, due to lack of trade set up in the index, it’s

advisable to focus on individual stocks. We continue to

recommend trading with a proper exit strategy and avoiding

undue risks.

Key Levels

Support 1 - 7760

Resistance 1 - 7920

Support 2 - 7733

Resistance 2 - 7970

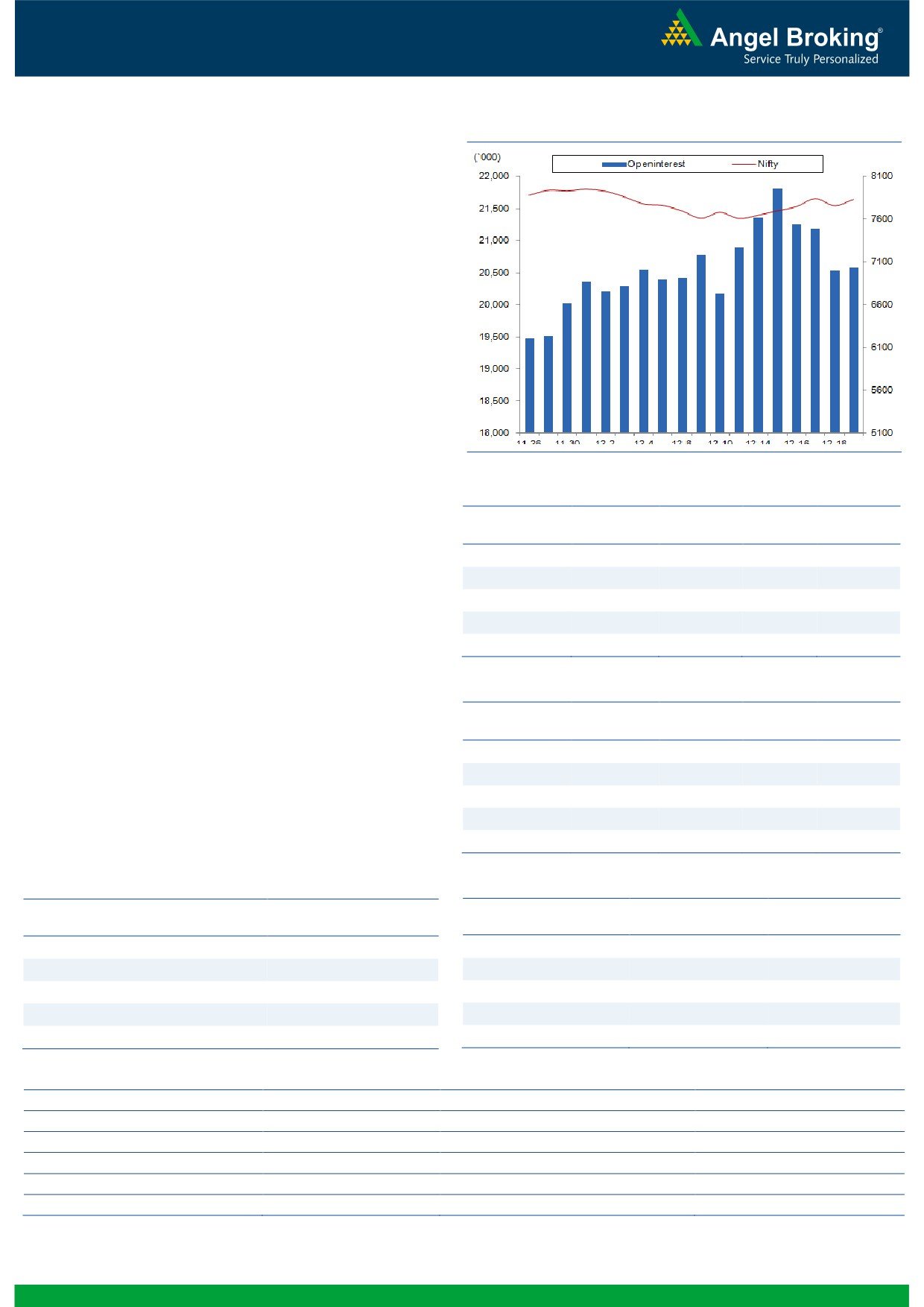

Exhibit 2: Bank Nifty Daily Chart

Bank Nifty Outlook - (16825)

Post flat opening, the Bank Nifty index moved up in first hour

of the day and crept higher till the end of session. The index

ended with a positive bias with gains of 1.39% over its

previous session's close. The lower time frame charts are

indicating that the index could continue its upmove further in

near term and hence it is advisable to trade with a positive

bias. The index could move higher upto its next resistance

zone of 17030-17080 (gap resistance zone). On the flipside,

on any corrections, the index is likely to find support near

16730 and 16565.

Key Levels

Support 1 - 16730

Resistance 1 - 17030

Support 2 - 16565

Resistance 2 - 17080

1

Technical & Derivatives Report

December 22, 2015

Comments

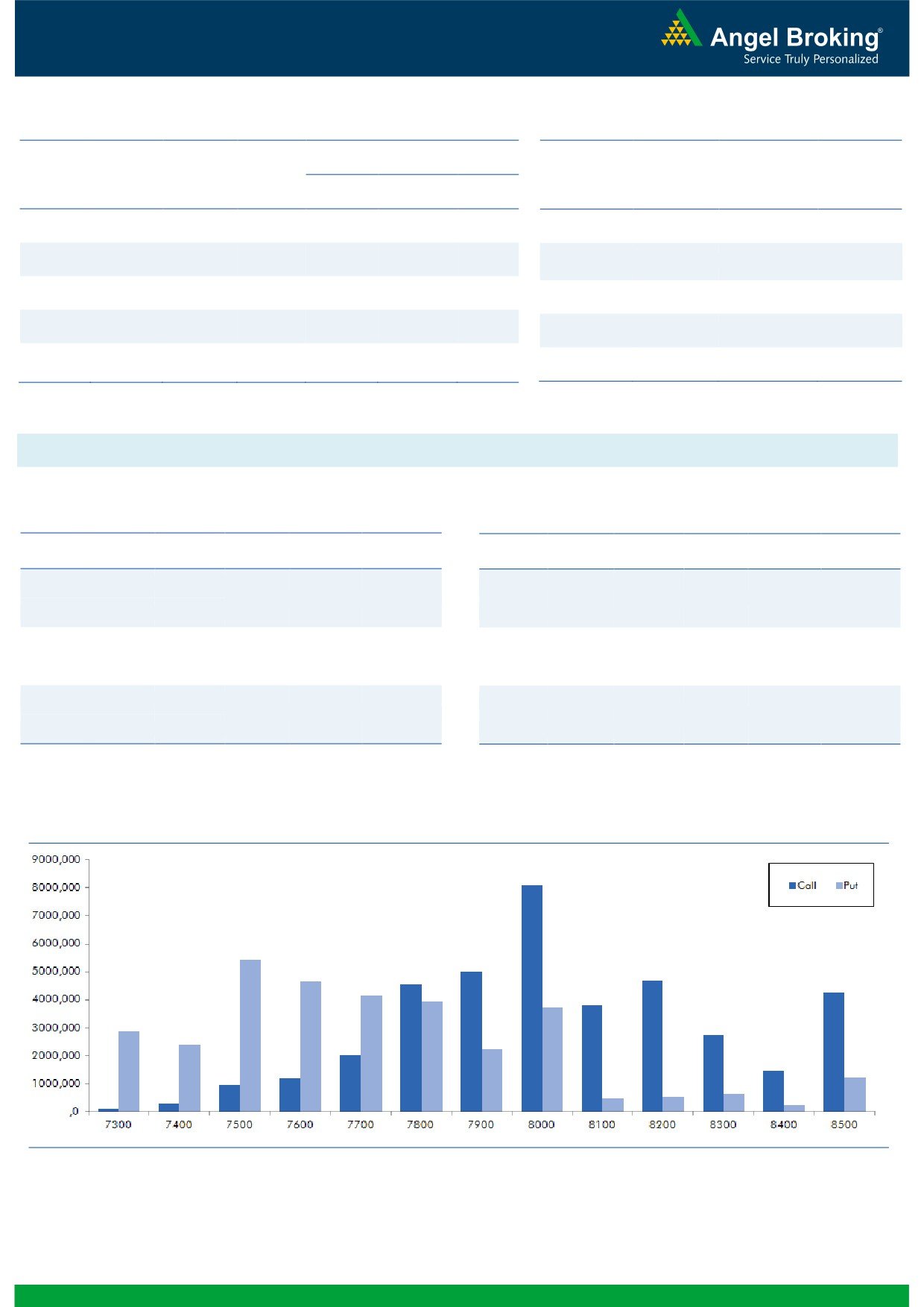

Nifty Vs OI

The Nifty futures open interest has increased by 0.25%

BankNifty futures open interest has decreased by 4.31%

as market closed at 7834.45 levels.

The Nifty December future closed at a premium of 7.00

points against a premium of 28.15 points. The January

series closed at a premium of 36.65 points.

The Implied Volatility of at the money options remained

unchanged at 12.57%.

The total OI of the market is Rs. 2,45,259/- cr. and the

stock futures OI is Rs. 67,480/- cr.

Few of the liquid counters where we have seen high cost

of carry are UNITECH, GMRINFRA, NCC, TV18BRDCST

and JINDALSTEL.

OI Gainers

Views

OI

PRICE

SCRIP

OI

PRICE

CHG. (%)

CHG. (%)

FIIs activity in equity segment was muted. While in Index

KSCL

3054000

53.26

353.30

-8.91

Futures, they were marginal buyers with decent fall in

MARICO

8574800

36.39

445.80

2.51

open interest, covering of shorts in last trading session.

TV18BRDCST

59585000

19.06

46.00

6.98

In Index Options front, FIIs bought of worth Rs. 735

NHPC

28971000

9.16

20.55

3.53

crores with good amount of rise in open interest. In call

HDIL

20778000

6.36

70.75

6.39

options we hardly saw any fresh OI buildup yesterday;

some profit booking was witness in 7800-8000 call

OI Losers

options. In put options, 7800 strike added decent build-

OI

PRICE

up with IV’s being unchanged. Maximum build-up in

SCRIP

OI

PRICE

CHG. (%)

CHG. (%)

current series in seen in 8000 call and 7500 put options.

IDBI

36632000

-6.55

91.25

2.70

Seeing the above data we believe one should avoid

SRTRANSFIN

3022800

-4.49

843.60

2.43

forming any shorts in Nifty at current levels, Nifty may

BEL

2182500

-4.23

1255.80

1.44

breach 8000-8050 levels.

HINDUNILVR

3641400

-4.20

854.60

-0.68

INDIACEM

31332000

-3.80

88.15

-1.01

Historical Volatility

Put-Call Ratio

SCRIP

HV

SCRIP

PCR-OI

PCR-VOL

KSCL

70.25

NIFTY

0.81

0.90

ADANIPOWER

69.37

BANKNIFTY

0.91

0.90

SUNPHARMA

40.97

SBIN

0.48

0.31

POWERGRID

27.21

RELIANCE

0.82

0.57

HDIL

57.79

LT

0.48

0.28

Strategy Date

Symbol

Strategy

Status

November 30, 2015

LT

Long Put

Profit Booked on Dec 11, 2015

December 07, 2015

BANKNIFTY

Raito Bear Put Spread

Active

December 14, 2015

HINDALCO

Long Call

Active

December 21, 2015

RELIANCE

Raito Bull Call Spread

Active

2

Technical & Derivatives Report

December 22, 2015

FII Statistics for 21-December 2015

Turnover on 21-December 2015

Open Interest

No. of

Turnover

Change

Detail

Buy

Sell

Net

Instrument

Value

Change

Contracts

( in Cr. )

(%)

Contracts

(in Cr.)

(%)

INDEX

INDEX

875.20

822.32

52.89

252625

14417.56

(1.52)

200846

11078.36

-21.47

FUTURES

FUTURES

INDEX

INDEX

13006.16

12270.99

735.16

1291957

75191.57

1.70

2341946

135379.37

-20.01

OPTIONS

OPTIONS

STOCK

2784.41

3178.78

(394.37)

1066591

52972.62

0.49

STOCK

FUTURES

395017

19685.09

-17.12

FUTURES

STOCK

STOCK

1581.64

1613.80

(32.17)

86067

4213.97

3.09

OPTIONS

224420

11346.56

-18.58

OPTIONS

TOTAL

18247.41

17885.89

361.52

2697240

146795.72

0.95

TOTAL

3162229

177489.38

-19.70

Nifty Spot = 7834.45

Lot Size = 25

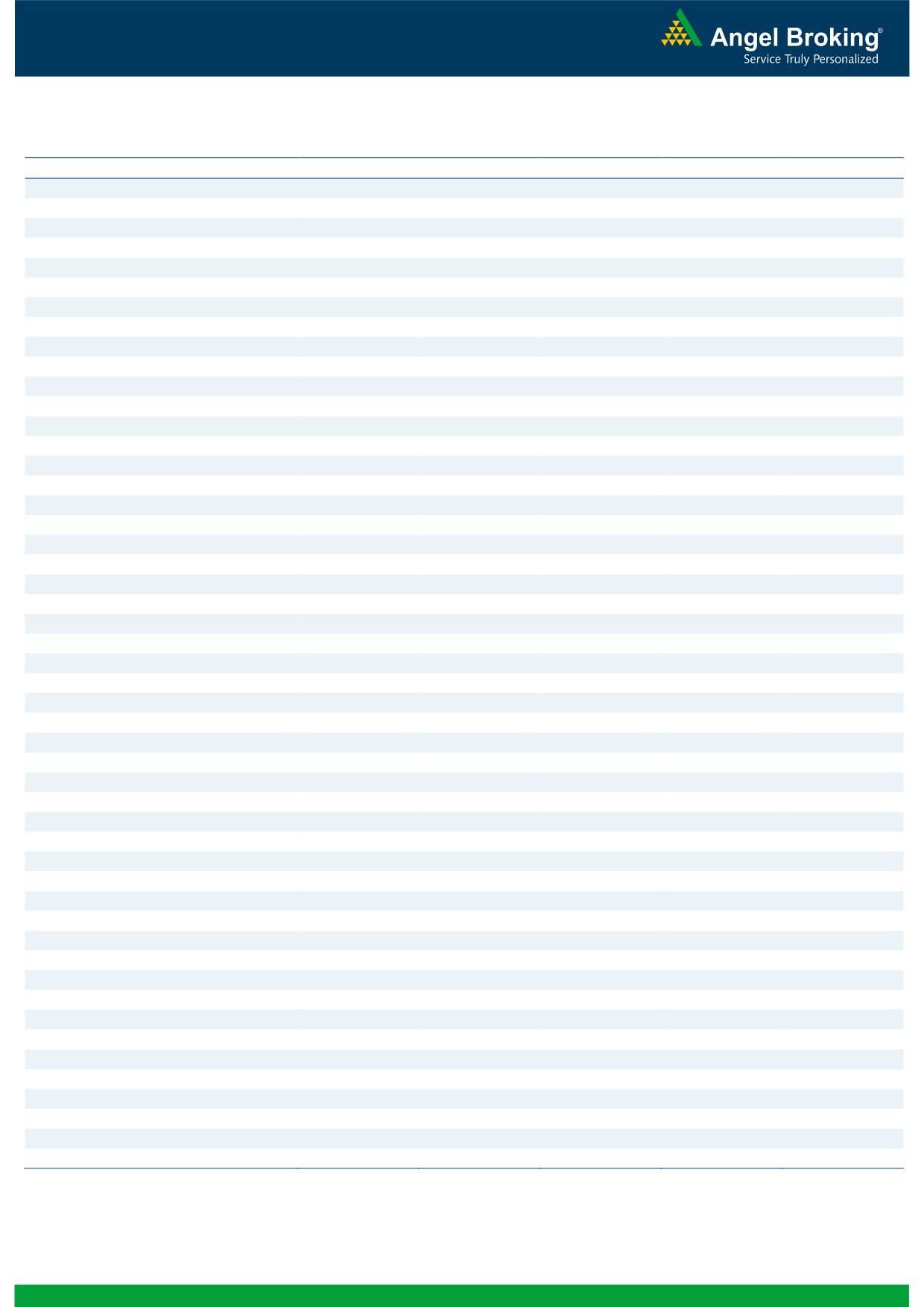

Bull-Call Spreads

Bear-Put Spreads

Action

Strike

Price

Risk

Reward

BEP

Action

Strike

Price

Risk

Reward

BEP

Buy

7900

37.75

Buy

7800

45.95

24.25

75.75

7924.25

25.35

74.65

7774.65

Sell

8000

13.50

Sell

7700

20.60

Buy

7900

37.75

Buy

7800

45.95

32.25

167.75

7932.25

36.15

163.85

7763.85

Sell

8100

5.50

Sell

7600

9.80

Buy

8000

13.50

Buy

7700

20.60

8.00

92.00

8008.00

10.80

89.20

7689.20

Sell

8100

5.50

Sell

7600

9.80

Note: Above mentioned Bullish or Bearish Spreads in Nifty (Dec. Series) are given as an information and not as a recommendation.

Nifty Put-Call Analysis

3

Technical & Derivatives Report

December 22, 2015

Daily Pivot Levels for Nifty 50 Stocks

Scrips

S2

S1

PIVOT

R1

R2

ACC

1,337

1,345

1,351

1,359

1,365

ADANIPORTS

256

258

260

263

265

AMBUJACEM

196

199

200

203

205

ASIANPAINT

857

865

875

883

892

AXISBANK

428

435

439

446

450

BAJAJ-AUTO

2,456

2,473

2,490

2,507

2,524

BANKBARODA

156

158

159

161

162

BHARTIARTL

314

318

320

324

327

BHEL

165

166

167

168

170

BOSCHLTD

18,129

18,208

18,304

18,383

18,479

BPCL

882

890

900

908

918

CAIRN

126

130

132

137

139

CIPLA

636

640

645

649

654

COALINDIA

312

315

320

324

328

DRREDDY

2,934

2,972

3,001

3,038

3,067

GAIL

330

333

338

341

346

GRASIM

3,666

3,687

3,709

3,729

3,751

HCLTECH

837

846

852

861

867

HDFC

1,208

1,220

1,230

1,242

1,252

HDFCBANK

1,064

1,070

1,075

1,081

1,086

HEROMOTOCO

2,613

2,656

2,680

2,723

2,747

HINDALCO

80

80

81

82

83

HINDUNILVR

842

847

854

859

867

ICICIBANK

246

252

256

262

265

IDEA

131

135

137

140

142

INDUSINDBK

927

939

946

958

965

INFY

1,051

1,077

1,092

1,119

1,134

ITC

313

320

324

330

334

KOTAKBANK

695

701

704

710

713

LT

1,278

1,284

1,291

1,297

1,304

LUPIN

1,768

1,785

1,799

1,816

1,830

M&M

1,224

1,251

1,268

1,295

1,312

MARUTI

4,595

4,617

4,638

4,661

4,682

NTPC

134

135

136

138

139

ONGC

218

224

228

234

237

PNB

121

122

123

123

124

POWERGRID

134

137

138

141

143

RELIANCE

977

985

992

999

1,006

SBIN

225

228

229

232

234

VEDL

83

85

86

88

89

SUNPHARMA

722

738

747

764

773

TATAMOTORS

375

378

380

383

385

TATAPOWER

64

64

65

66

66

TATASTEEL

251

255

258

262

265

TCS

2,391

2,419

2,434

2,462

2,478

TECHM

510

516

520

526

530

ULTRACEMCO

2,765

2,785

2,803

2,823

2,842

WIPRO

544

550

555

561

565

YESBANK

711

715

721

725

730

ZEEL

410

413

416

420

422

4

Technical & Derivatives Report

December 22, 2015

Research Team Tel: 022 - 39357800

For Technical Queries

For Derivatives Queries

DISCLAIMER

Angel Broking Private Limited (hereinafter referred to as “Angel”) is a registered Member of National Stock Exchange of India Limited,

Bombay Stock Exchange Limited and MCX Stock Exchange Limited. It is also registered as a Depository Participant with CDSL and

Portfolio Manager with SEBI. It also has registration with AMFI as a Mutual Fund Distributor. Angel Broking Private Limited is a

registered entity with SEBI for Research Analyst in terms of SEBI (Research Analyst) Regulations, 2014 vide registration number

INH000000164. Angel or its associates has not been debarred/ suspended by SEBI or any other regulatory authority for accessing

/dealing in securities Market. Angel or its associates including its relatives/analyst do not hold any financial interest/beneficial

ownership of more than 1% in the company covered by Analyst. Angel or its associates/analyst has not received any compensation /

managed or co-managed public offering of securities of the company covered by Analyst during the past twelve months. Angel/analyst

has not served as an officer, director or employee of company covered by Analyst and has not been engaged in market making activity

of the company covered by Analyst.

This document is solely for the personal information of the recipient, and must not be singularly used as the basis of any investment

decision. Nothing in this document should be construed as investment or financial advice. Each recipient of this document should

make such investigations as they deem necessary to arrive at an independent evaluation of an investment in the securities of the

companies referred to in this document (including the merits and risks involved), and should consult their own advisors to determine

the merits and risks of such an investment.

Reports based on technical and derivative analysis center on studying charts of a stock's price movement, outstanding positions and

trading volume, as opposed to focusing on a company's fundamentals and, as such, may not match with a report on a company's

fundamentals.

The information in this document has been printed on the basis of publicly available information, internal data and other reliable

sources believed to be true, but we do not represent that it is accurate or complete and it should not be relied on as such, as this

document is for general guidance only. Angel Broking Pvt. Limited or any of its affiliates/ group companies shall not be in any way

responsible for any loss or damage that may arise to any person from any inadvertent error in the information contained in this report.

Angel Broking Pvt. Limited has not independently verified all the information contained within this document. Accordingly, we cannot

testify, nor make any representation or warranty, express or implied, to the accuracy, contents or data contained within this document.

While Angel Broking Pvt. Limited endeavors to update on a reasonable basis the information discussed in this material, there may be

regulatory, compliance, or other reasons that prevent us from doing so.

This document is being supplied to you solely for your information, and its contents, information or data may not be reproduced,

redistributed or passed on, directly or indirectly.

Neither Angel Broking Pvt. Limited, nor its directors, employees or affiliates shall be liable for any loss or damage that may arise from

or in connection with the use of this information.

Note: Please refer to the important ‘Stock Holding Disclosure' report on the Angel website (Research Section). Also, please refer to the

latest update on respective stocks for the disclosure status in respect of those stocks. Angel Broking Pvt. Limited and its affiliates may

have investment positions in the stocks recommended in this report.

5