Technical & Derivatives Report

March 22, 2016

Sensex (25285) / Nifty (7704)

Exhibit 1: Nifty Daily Chart

A late surge on Friday to conquer the 7600 mark set the stage

for an ideal gap up opening on Monday. Markets did not

surprise us also as we saw yesterday's opening on a cheerful

note supported by favorable global cues. In fact, the bulls

managed to take the momentum forward to post decent gains

to end the session on a high note.

The Nifty has reached yet another landmark of 7700 within no

time. As of now, we do not see any weakness on charts and

thus, we reiterate our view that traders shouldn't pre-empt any

reversal until we see any definite signal. One can adopt a

cautious approach if Nifty reaches 7750 - 7780 zone by

booking timely profits or trailing stop losses; but, shorting is

strictly avoided in such kind of strong optimism. On the

downside, 7600 would now be seen as a strong support.

Meanwhile, individual stocks are giving good moves and thus,

traders should focus on such potential trades.

Key Levels

Support 1 - 7630

Resistance 1 - 7750

Support 2 - 7600

Resistance 2 -

7780

Exhibit 2: Nifty Bank Daily Chart

Nifty Bank Outlook - (15926)

Yesterday, the Nifty Bank index opened with the upside gap of

around half a percent and started moving higher from initial

trades. The banking index continued to make ‘Higher Highs’

throughout the session and eventually ended with gains of

1.73 percent over its previous close.

Yesterday, the Nifty Bank index opened above its crucial

resistance of ‘Horizontal Trend line’ (15735) on weekly chart,

which coincides with the ‘89DEMA’ and 50% retracement level

and formed a ‘Long Bullish’ candle on daily chart. The

ongoing momentum in banking counters may continue for few

more sessions and thus, we may see an extension in rally

towards 16240 and 16400 levels. Traders are advised to

remain with the trend until any reversal patterns get formed in

charts. Going forward, intraday support for the index is placed

around 15735 and 15555.

Key Levels

Support 1 - 15735

Resistance 1 - 16240

Support 2 - 15555

Resistance 2 - 16400

1

Technical & Derivatives Report

March 22, 2016

Comments

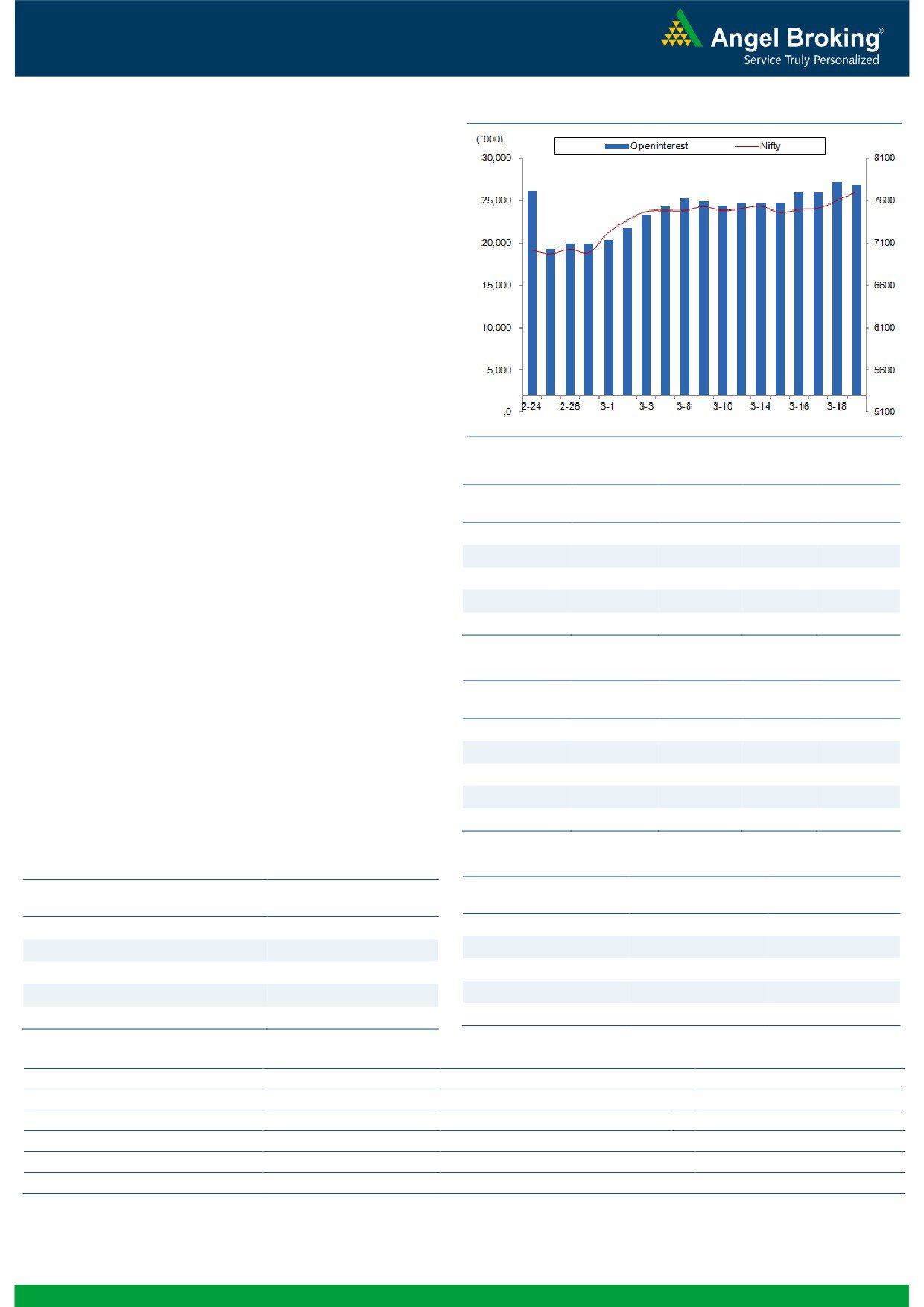

Nifty Vs OI

The Nifty futures open interest has decreased by 1.04%

BankNifty futures open interest has increased by 8.62%

as market closed at 7704.25 levels.

The Nifty March future closed at a premium of 9.10

points against a premium of 0.95 points. The April series

closed at a premium of 46.55 points.

The Implied Volatility of at the money options has

increased from 12.25% to 12.90%.

The total OI of the market is Rs. 2,48,767/- cr. and the

stock futures OI is Rs. 57;409/- cr.

Few of the liquid counters where we have seen high cost

of carry are JPASSOCIAT, UNITECH, GMRINFRA,

JINDALSTEL and RPOWER.

Views

FIIs continued to buy in both Cash market and Index

OI Gainers

Future segment. They bought equities worth Rs. 1396

OI

PRICE

SCRIP

OI

PRICE

CHG. (%)

CHG. (%)

crores. While in Index Futures, they were net buyers of

TVSMOTOR

3784000

23.90

306.25

6.36

Rs. 251 crores with decent fall in OI, suggesting short

BEML

547000

20.62

1074.10

5.18

covering in last trading session.

CUMMINSIND

141600

19.80

852.30

1.06

In Index Options front, FIIs sold of worth Rs. 603 crores

TATAELXSI

462300

14.66

1957.85

1.61

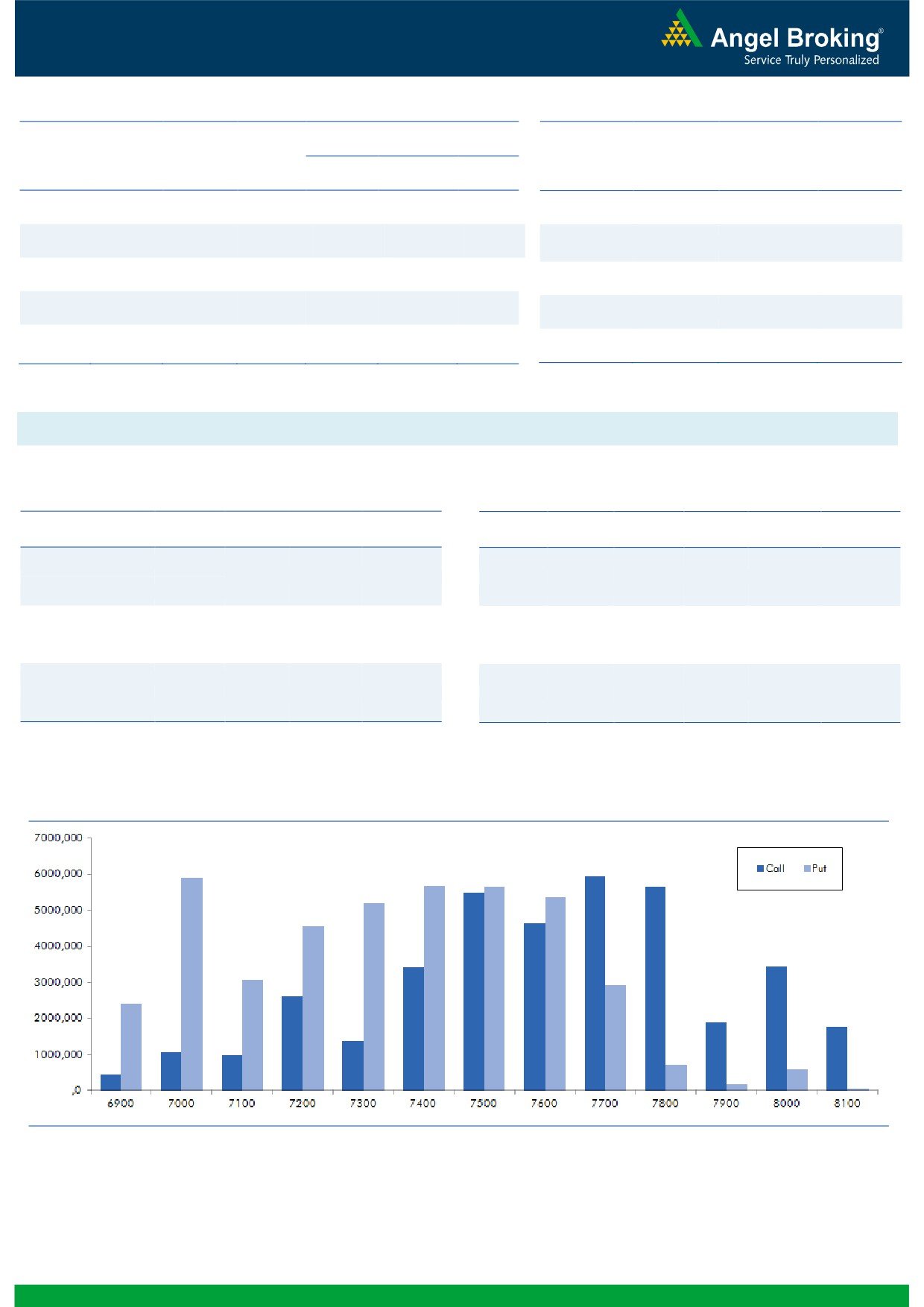

with marginal change in OI. In call options, 7800 strike

BAJFINANCE

215000

12.57

6676.70

0.75

price added some fresh build-up, followed by unwinding

in 7500-7700 call options. While in put options, 7600 -ng.com

and 7700 strikes added good amount of OI. Good

OI Losers

amount of unwinding was also witness in 7300 & 7400

OI

PRICE

SCRIP

OI

PRICE

CHG. (%)

CHG. (%)

put options. Maximum OI in current series is seen in

TORNTPHARM

348800

-8.11

1351.35

2.86

7700 call option; while, in put options due to good

BOSCHLTD

94325

-7.37

19286.15

2.40

amount of unwinding in 7400 strike yesterday, highest

CONCOR

1428400

-6.17

1204.80

4.42

build-up is now visible in 7000 strike price. Seeing

AXISBANK

39483000

-5.64

444.50

1.87

continuous addition of longs in banking space we believe

UNIONBANK

10416000

-5.42

131.20

2.18

this sector can be traded with appositive bias.

Historical Volatility

Put-Call Ratio

SCRIP

HV

SCRIP

PCR-OI

PCR-VOL

L&TFH

48.14

NIFTY

1.05

1.13

TVSMOTOR

43.43

BANKNIFTY

1.26

1.18

AMBUJACEM

40.18

SBIN

0.97

0.54

HINDUNILVR

33.45

LUPIN

0.42

0.59

ASHOKLEY

52.65

ICICIBANK

1.34

0.84

Strategy Date

Symbol

Strategy

Status

February 29, 2016

RELIANCE

Ratio Bull Call Spread

Active

March 07, 2016

BHEL

Long Call Ladder

Active

March 14, 2016

NIFTY

Ratio Bull Call Spread

Not Activated

March 21, 2016

BANKNIFTY

Long Call

Active

2

Technical & Derivatives Report

March 22, 2016

FII Statistics for 21-March 2016

Turnover on 21-March 2016

Open Interest

No. of

Turnover

Change

Detail

Buy

Sell

Net

Instrument

Value

Change

Contracts

( in Cr. )

(%)

Contracts

(in Cr.)

(%)

INDEX

INDEX

3454.34

3203.45

250.90

349349

19668.47

(3.19)

337546

18218.57

-4.11

FUTURES

FUTURES

INDEX

INDEX

30835.28

31438.44

(603.15)

1558990

88680.11

0.36

4487815

250377.77

1.75

OPTIONS

OPTIONS

STOCK

3418.19

3496.06

(77.88)

1047586

48429.10

0.82

STOCK

FUTURES

520613

24789.41

-3.48

FUTURES

STOCK

STOCK

2421.15

2472.16

(51.01)

92639

4322.95

3.60

OPTIONS

339063

16427.37

2.80

OPTIONS

TOTAL

40128.97

40610.11

(481.14)

3048564

161100.62

0.19

TOTAL

5685037

309813.12

1.00

Nifty Spot = 7704.25

Lot Size = 75

Bull-Call Spreads

Bear-Put Spreads

Action

Strike

Price

Risk

Reward

BEP

Action

Strike

Price

Risk

Reward

BEP

Buy

7700

68.85

Buy

7500

57.95

43.15

56.85

7743.15

30.45

69.55

7469.55

Sell

7800

25.70

Sell

7400

27.50

Buy

7700

68.85

Buy

7500

57.95

61.10

138.90

7761.10

44.40

155.60

7455.60

Sell

7900

7.75

Sell

7300

13.55

Buy

7800

25.70

Buy

7400

27.50

17.95

82.05

7817.95

13.95

86.05

7386.05

Sell

7900

7.75

Sell

7300

13.55

Note: Above mentioned Bullish or Bearish Spreads in Nifty (March Series) are given as an information and not as a recommendation.

Nifty Put-Call Analysis

3

Technical & Derivatives Report

March 22, 2016

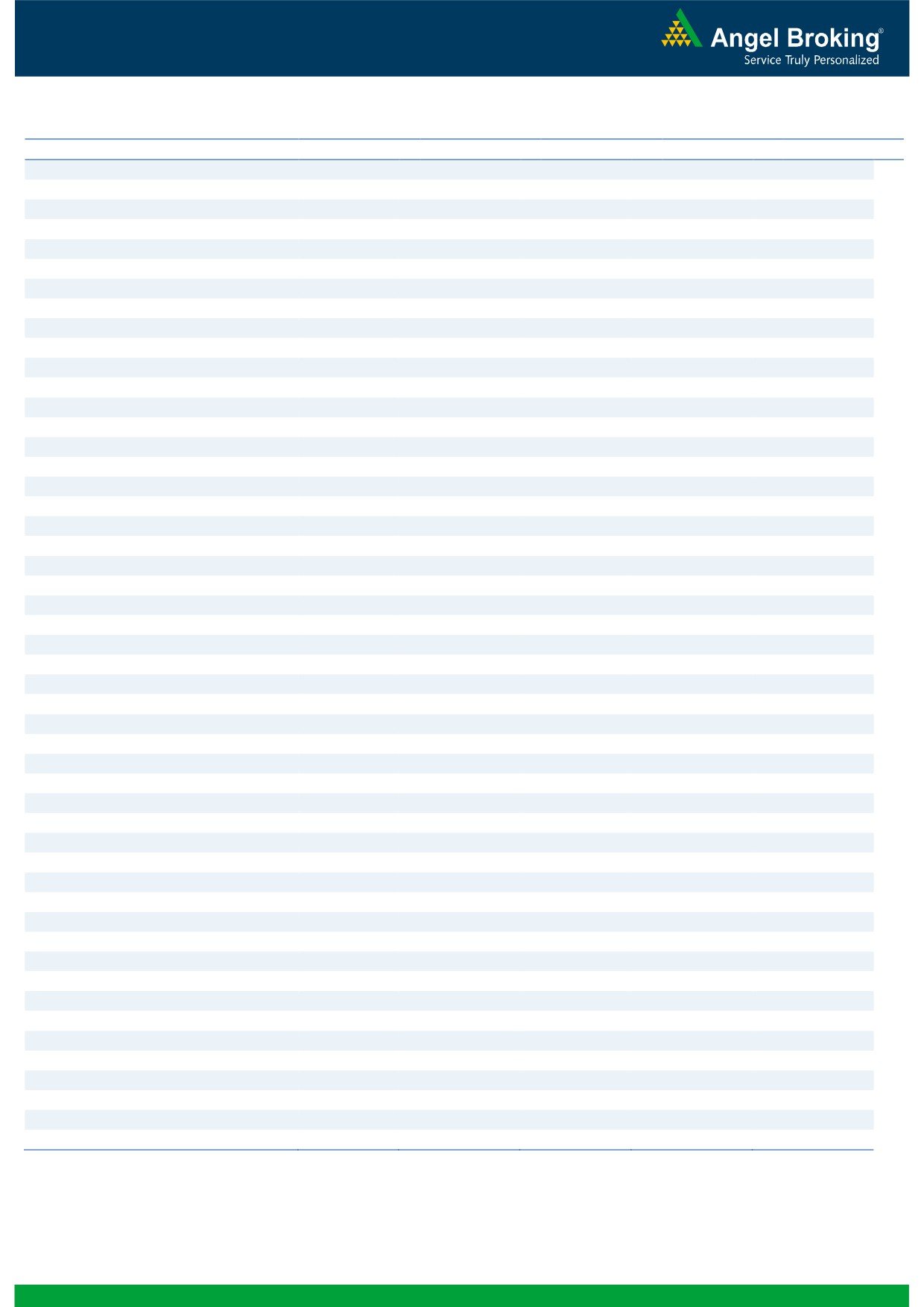

Daily Pivot Levels for Nifty 50 Stocks

Scrips

S2

S1

PIVOT

R1

R2

ACC

1,323

1,349

1,363

1,389

1,403

ADANIPORTS

234

239

242

247

250

AMBUJACEM

217

224

229

237

242

ASIANPAINT

840

850

862

872

885

AXISBANK

435

440

443

447

450

BAJAJ-AUTO

2,277

2,296

2,308

2,326

2,338

BANKBARODA

144

145

147

149

150

BHARTIARTL

339

346

351

358

362

BHEL

109

111

112

114

115

BOSCHLTD

18,442

18,897

19,188

19,642

19,934

BPCL

851

860

870

880

890

CAIRN

152

154

156

159

161

CIPLA

523

529

534

540

545

COALINDIA

293

295

297

298

300

DRREDDY

3,097

3,140

3,169

3,212

3,242

GAIL

356

360

364

368

372

GRASIM

3,598

3,666

3,708

3,776

3,818

HCLTECH

809

816

822

829

835

HDFC

1,117

1,134

1,145

1,162

1,173

HDFCBANK

1,027

1,036

1,042

1,051

1,057

HEROMOTOCO

2,754

2,777

2,800

2,823

2,846

HINDALCO

83

85

86

87

88

HINDUNILVR

834

857

870

893

906

ICICIBANK

230

232

234

236

238

IDEA

101

101

102

103

104

INDUSINDBK

917

925

931

938

944

INFY

1,172

1,184

1,191

1,203

1,210

ITC

321

326

331

336

341

KOTAKBANK

648

656

660

668

673

LT

1,180

1,204

1,218

1,242

1,257

LUPIN

1,465

1,500

1,536

1,571

1,607

M&M

1,211

1,219

1,225

1,233

1,239

MARUTI

3,577

3,623

3,651

3,697

3,725

NTPC

125

126

127

128

130

ONGC

211

214

216

218

220

PNB

84

85

86

88

89

POWERGRID

135

137

138

139

140

RELIANCE

1,015

1,026

1,034

1,045

1,053

SBIN

191

194

196

198

200

VEDL

91

93

94

95

96

SUNPHARMA

809

823

830

844

852

TATAMOTORS

362

368

372

378

382

TATAPOWER

58

59

59

60

60

TATASTEEL

298

301

303

306

309

TCS

2,405

2,426

2,440

2,461

2,475

TECHM

479

485

492

497

504

ULTRACEMCO

3,062

3,146

3,195

3,279

3,329

WIPRO

533

545

554

565

574

YESBANK

805

818

826

840

848

ZEEL

382

386

390

395

398

4

Technical & Derivatives Report

March 22, 2016

Research Team Tel: 022 - 39357800

For Technical Queries

For Derivatives Queries

DISCLAIMER

Angel Broking Private Limited (hereinafter referred to as “Angel”) is a registered Member of National Stock Exchange of India Limited,

Bombay Stock Exchange Limited and MCX Stock Exchange Limited. It is also registered as a Depository Participant with CDSL and

Portfolio Manager with SEBI. It also has registration with AMFI as a Mutual Fund Distributor. Angel Broking Private Limited is a

registered entity with SEBI for Research Analyst in terms of SEBI (Research Analyst) Regulations, 2014 vide registration number

INH000000164. Angel or its associates has not been debarred/ suspended by SEBI or any other regulatory authority for accessing

/dealing in securities Market. Angel or its associates including its relatives/analyst do not hold any financial interest/beneficial

ownership of more than 1% in the company covered by Analyst. Angel or its associates/analyst has not received any compensation /

managed or co-managed public offering of securities of the company covered by Analyst during the past twelve months. Angel/analyst

has not served as an officer, director or employee of company covered by Analyst and has not been engaged in market making activity

of the company covered by Analyst.

This document is solely for the personal information of the recipient, and must not be singularly used as the basis of any investment

decision. Nothing in this document should be construed as investment or financial advice. Each recipient of this document should

make such investigations as they deem necessary to arrive at an independent evaluation of an investment in the securities of the

companies referred to in this document (including the merits and risks involved), and should consult their own advisors to determine

Reports based on technical and derivative analysis center on studying charts of a stock's price movement, outstanding positions and

trading volume, as opposed to focusing on a company's fundamentals and, as such, may not match with a report on a company's

fundamentals.

The information in this document has been printed on the basis of publicly available information, internal data and other reliable

sources believed to be true, but we do not represent that it is accurate or complete and it should not be relied on as such, as this

document is for general guidance only. Angel Broking Pvt. Limited or any of its affiliates/ group companies shall not be in any way

responsible for any loss or damage that may arise to any person from any inadvertent error in the information contained in this report.

Angel Broking Pvt. Limited has not independently verified all the information contained within this document. Accordingly, we cannot

testify, nor make any representation or warranty, express or implied, to the accuracy, contents or data contained within this document.

While Angel Broking Pvt. Limited endeavors to update on a reasonable basis the information discussed in this material, there may be

regulatory, compliance, or other reasons that prevent us from doing so.

This document is being supplied to you solely for your information, and its contents, information or data may not be reproduced,

redistributed or passed on, directly or indirectly.

Neither Angel Broking Pvt. Limited, nor its directors, employees or affiliates shall be liable for any loss or damage that may arise from

or in connection with the use of this information.

Note: Please refer to the important ‘Stock Holding Disclosure' report on the Angel website (Research Section). Also, please refer to the

latest update on respective stocks for the disclosure status in respect of those stocks. Angel Broking Pvt. Limited and its affiliates may

have investment positions in the stocks recommended in this report.

5