Technical & Derivatives Report

December 21, 2016

Sensex (26308) / Nifty (8082)

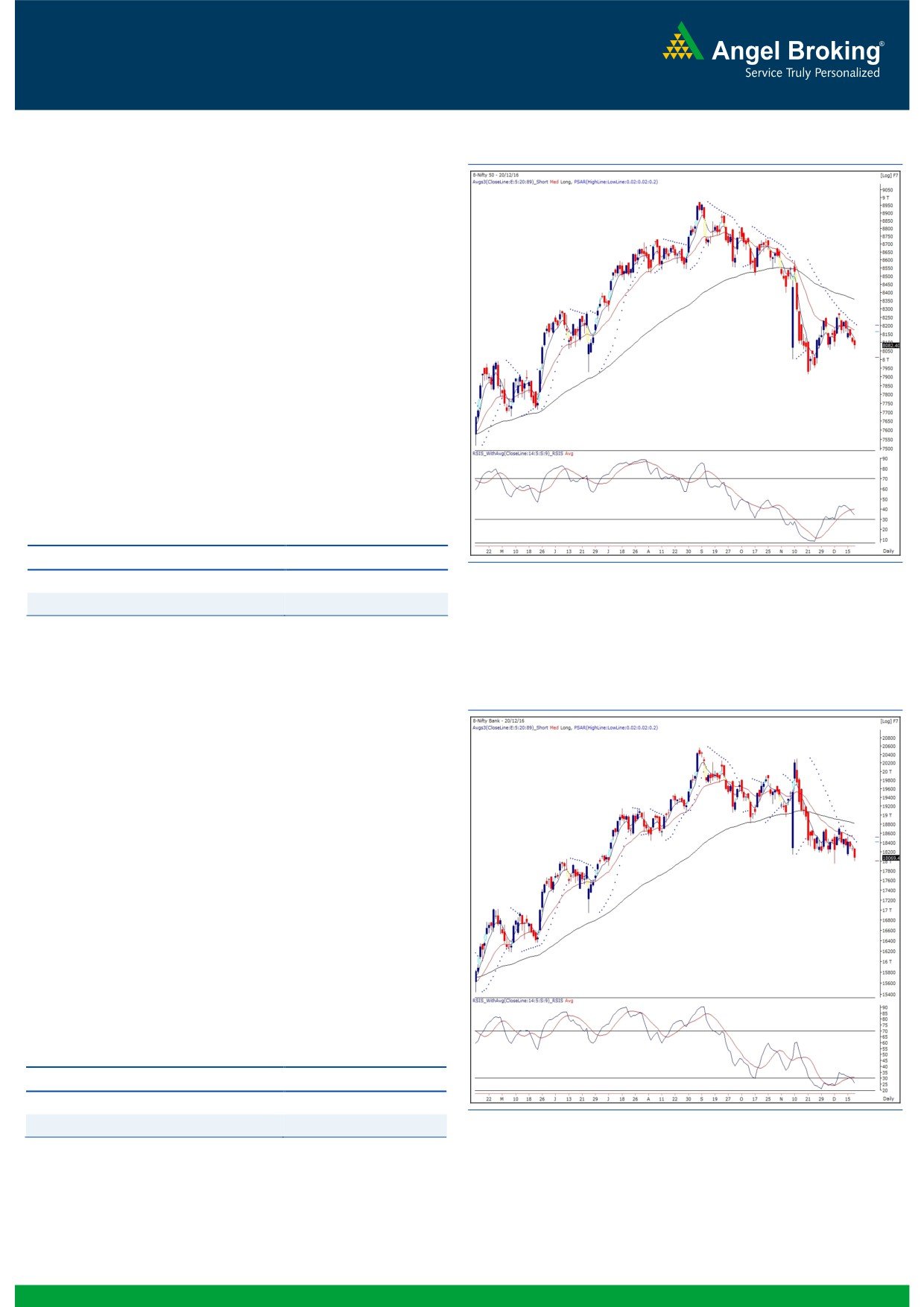

Exhibit 1: Nifty Daily Chart

It was yet another day of consolidation with a slightly negative

bias for our markets. The Nifty started on a flat note and then saw

some selling pressure at the midst of the day to sneak below the

8100 mark. However, a modest recovery during the penultimate

hour trimmed some of their losses.

The market has been experiencing decent selling pressure at

higher levels since last few days. Due to yesterday’s corrective

move the Nifty almost rested the recent swing low of 8056.85.

However, the hope is still alive for bulls as the Nifty managed to

gain some lost ground in the latter half. Since the important level

(8056.85) is still unbroken, we would maintain our optimistic

stance on the market and interpret this as a buying opportunity.

On the flipside, 8133 - 8179 would be seen as immediate

hurdles. Since, there is no major action seen in key indices,

traders are advised to continue with their stock centric approach.

Key Levels

Support 1 - 8056

Resistance 1 - 8133

Support 2 - 8000

Resistance 2 - 8179

Nifty Bank Outlook - (18069)

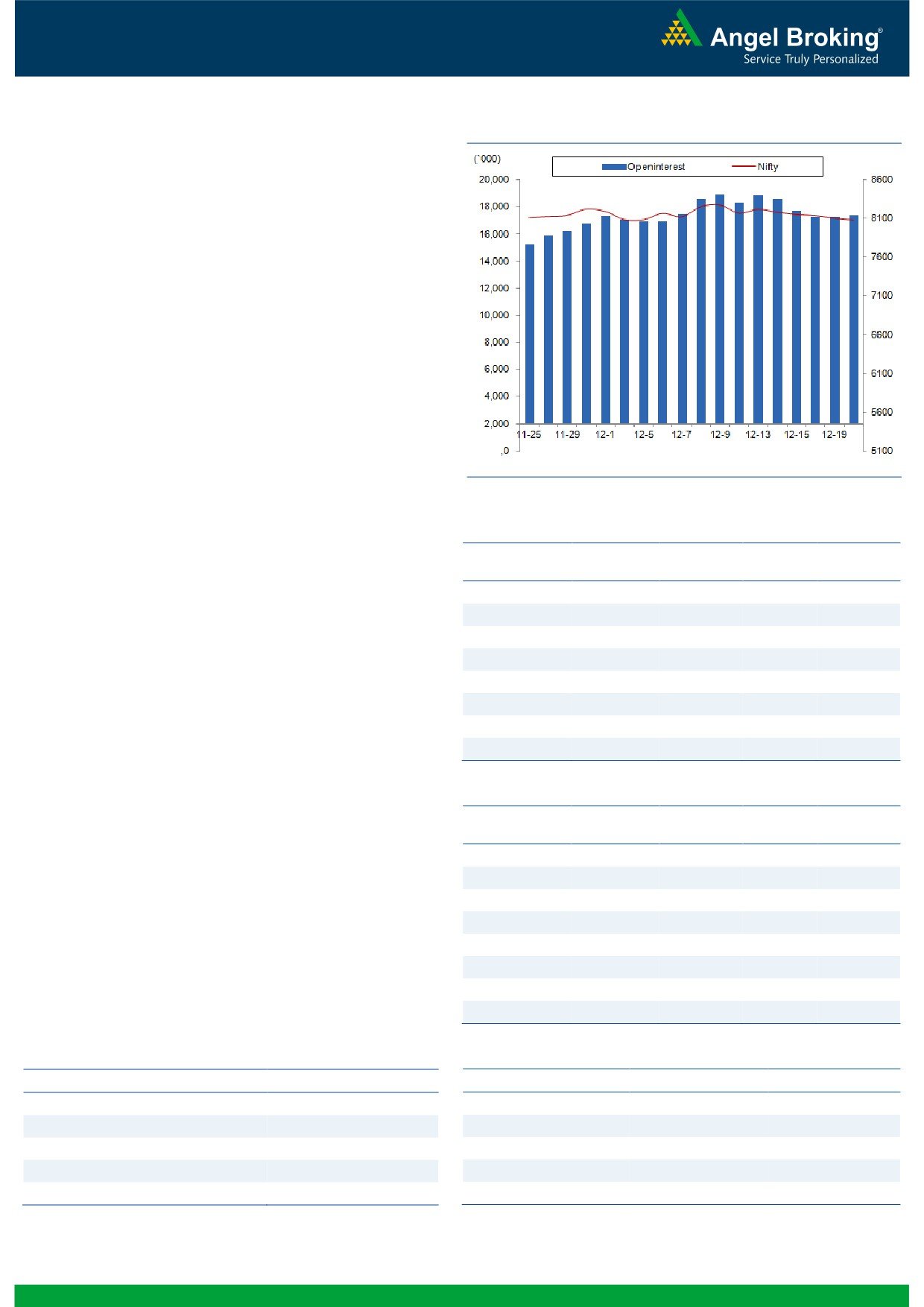

Exhibit 2: Nifty Bank Daily Chart

Post opening on a flat note, the Nifty Bank index corrected

yesterday and ended the session with a loss of 1.03 percent.

Amongst the individual stocks, the PSU Bank corrected sharply as

the Nifty PSU Bank index corrected by 2.53 percent yesterday.

The Nifty Bank index has closed tad above its crucial support of

'200 SMA' on daily charts, which is considered as a long term

support. The index has not closed below the mentioned average

since 25th May, 2016. It would hence be prudent to watch the

move in next few days as only a closing below the average would

favor the bears in near term. Thus, we continue with our last few

day's of advice to stay light on the index and focus more on stock

specific moves. The intraday support for the Nifty Bank index is

placed in range of 18000-17951 whereas resistance is seen in

range of 18200-18251.

Key Levels

Support 1 - 18000

Resistance 1 - 18200

Support 2 - 17951

Resistance 2 - 18251

1

Technical & Derivatives Report

December 21, 2016

Comments

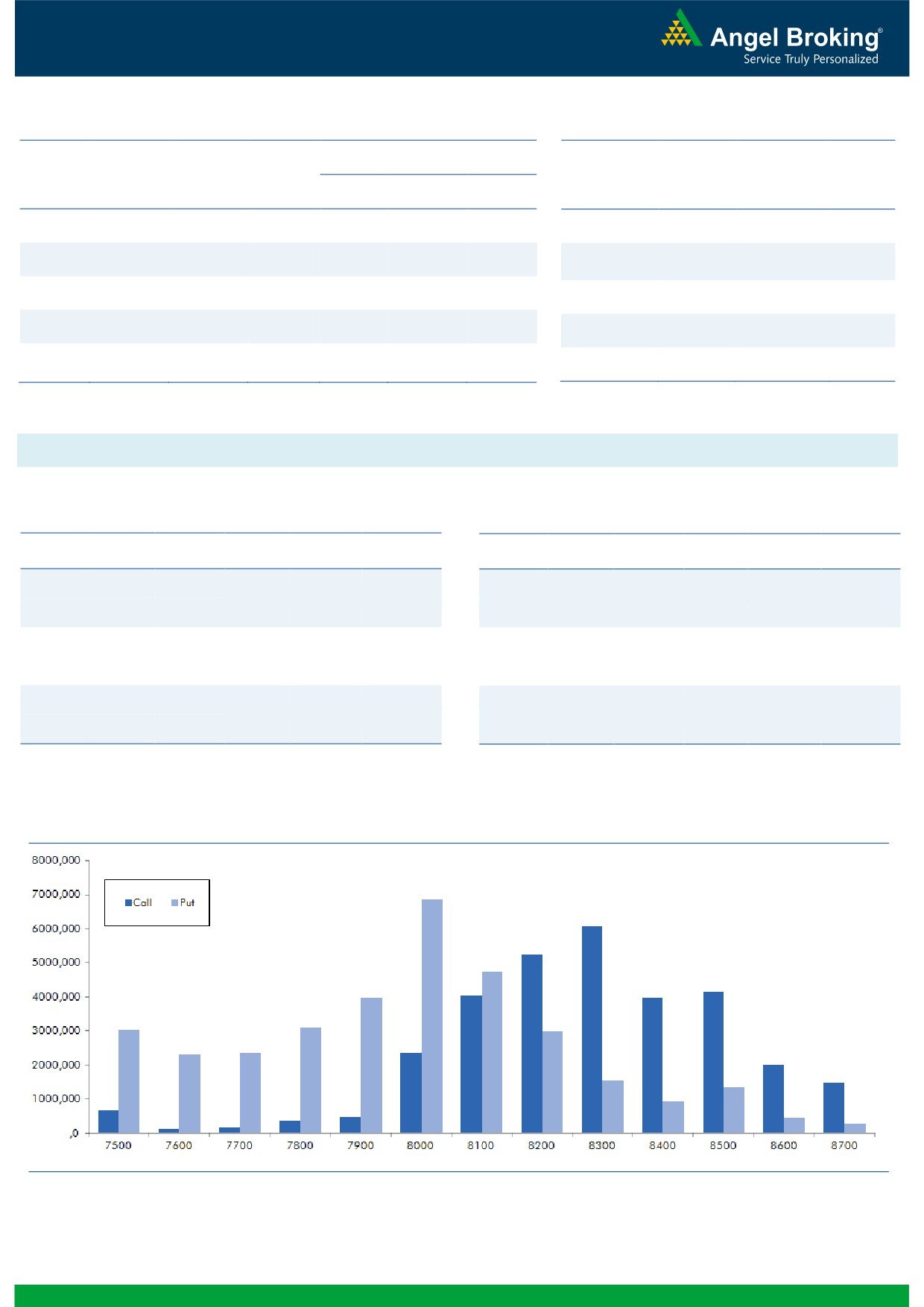

Nifty Vs OI

The Nifty futures open interest has increased by 0.85%

BankNifty futures open interest has increased by 14.30%

as market closed at 8082.40 levels.

The Nifty December future closed with a premium of

17.50 against the premium of 19.80 points in last

trading session. The January series closed at a premium

of 50.70 points.

The Implied Volatility of at the money options has

decreased from 12.48% to 10.67%. At the same time,

the PCR-OI of Nifty has decreased from 1.01 to 0.97

levels.

The total OI of the market is Rs. 2,66,158/- cr. and the

stock futures OI is Rs. 69,667/- cr.

Few of the liquid counters where we have seen high cost

of carry are GMRINFRA, ASHOKLEY, RECLTD,

SOUTHBANK and IDFC.

Views

OI Gainers

Yesterday, FIIs were net sellers in cash market segment to

OI

PRICE

SCRIP

OI

PRICE

the tune of Rs. 686 crores. While in index futures, they

CHG. (%)

CHG. (%)

were net buyers to worth Rs. 188 crores with marginal

BHARATFIN

12502000

15.77

582.70

-3.59

rise in open interest, suggesting formation of some long

AUROPHARMA

11092900

10.56

674.00

-3.71

positions in previous trading session.

BAJFINANCE

8553500

8.73

803.45

-2.54

www.angelbroking.com

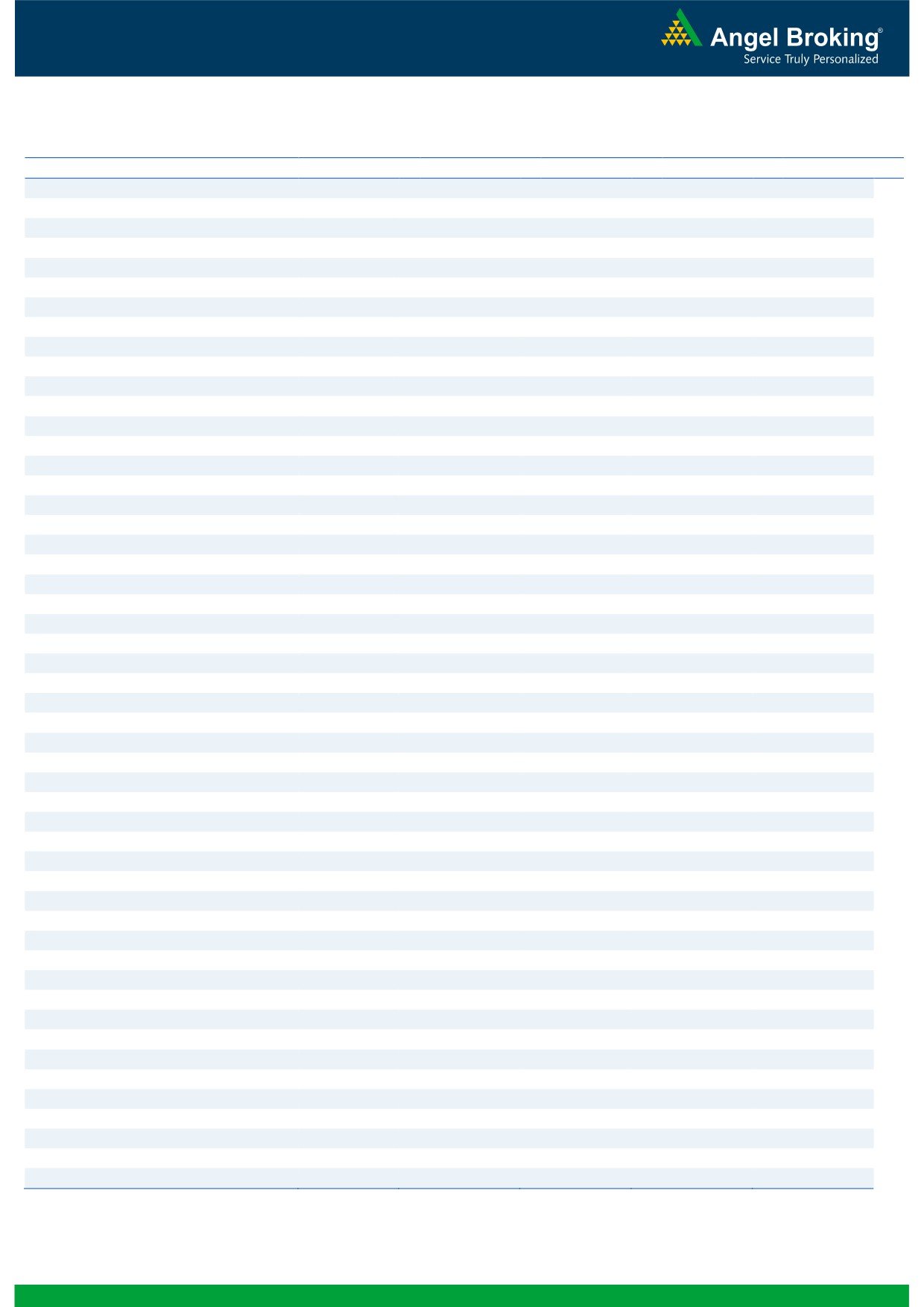

In Index options segment, FIIs bought of Rs. 276 crores

ALBK

16260000

8.11

63.00

-4.33

with marginal fall in open interest. In call options, 8100

M&MFIN

11395000

8.04

251.40

-3.42

and

8200 strikes added decent amount of fresh

IDEA

78604000

7.35

72.90

-4.08

positions; followed by unwinding in 8500 strike. While, in

CANBK

13668000

7.12

291.65

-2.25

put options, except 7900 strike, we hardly witnessed any

JUSTDIAL

4656800

6.55

352.75

-5.03

relevant build-up. However, reduction of positions was

seen in 8000 and 8200 strikes. Highest OI in current

OI Losers

series is placed at 8300 call and 8000 put option.

OI

PRICE

SCRIP

OI

PRICE

From last couple of sessions, we are witnessing some

CHG. (%)

CHG. (%)

long build in Index Futures from FIIs desk. However

SUNTV

7706000

-5.66

493.25

1.25

quantam is quite low. Also, the longs formed during

IGL

1636800

-5.46

898.40

-1.72

start of December series are still intact. But, the major

APOLLOTYRE

8646000

-5.07

195.15

-0.13

concern at current juncture is FII’s selling figure in Stock

KSCL

2649000

-4.85

398.95

-1.59

Future segment. Currently, Nifty is hovering around its

TATACHEM

4258500

-4.57

487.95

-0.16

strong support of 8050-8100 levels and thus we advise

PIDILITIND

1601000

-4.30

601.00

-0.25

traders to remain light on positions and focus more on

BEML

722700

-4.19

906.85

-1.16

stock specific moves.

ZEEL

9699300

-3.98

448.80

1.63

Historical Volatility

Put-Call Ratio

SCRIP

HV

SCRIP

PCR-OI

PCR-VOL

JUSTDIAL

43.05

NIFTY

0.97

0.78

ALBK

43.01

BANKNIFTY

0.81

0.83

GRANULES

46.64

SUNPHARMA

0.43

0.49

UBL

27.72

SBIN

0.55

0.48

AUROPHARMA

39.02

RELIANCE

1.02

0.75

2

Technical & Derivatives Report

December 21, 2016

FII Statistics for December 20, 2016

Turnover on December 20, 2016

Open Interest

No. of

Turnover

Change

Detail

Buy

Sell

Net

Instrument

Value

Change

Contracts

( in Cr. )

(%)

Contracts

(in Cr.)

(%)

INDEX

INDEX

1519.08

1331.12

187.96

173816

10956.94

1.00

204083

13422.95

74.89

FUTURES

FUTURES

INDEX

INDEX

34705.77

34981.37

(275.59)

1138343

70251.25

0.89

4203684

280475.98

73.59

OPTIONS

OPTIONS

STOCK

5732.04

6673.79

(941.75)

902650

53975.59

0.68

STOCK

FUTURES

463841

29639.28

30.80

FUTURES

STOCK

STOCK

3604.75

3678.31

(73.56)

90298

5696.14

3.17

OPTIONS

342717

23241.05

40.20

OPTIONS

TOTAL

45561.65

46664.60

(1102.94)

2305107

140879.92

0.90

TOTAL

5214325

346779.25

66.33

Nifty Spot = 8082.40

Lot Size = 75

Bull-Call Spreads

Bear-Put Spreads

Action

Strike

Price

Risk

Reward

BEP

Action

Strike

Price

Risk

Reward

BEP

Buy

8100

52.60

Buy

8100

55.85

34.80

65.20

8134.80

30.30

69.70

8069.70

Sell

8200

17.80

Sell

8000

25.55

Buy

8100

52.60

Buy

8100

55.85

46.55

153.45

8146.55

43.75

156.25

8056.25

Sell

8300

6.05

Sell

7900

12.10

Buy

8200

17.80

Buy

8000

25.55

11.75

88.25

8211.75

13.45

86.55

7986.55

Sell

8300

6.05

Sell

7900

12.10

Note: Above mentioned Bullish or Bearish Spreads in Nifty (December Series) are given as an information and not as a recommendation.

Nifty Put-Call Analysis

3

Technical & Derivatives Report

December 21, 2016

Daily Pivot Levels for Nifty Constituents

Scrips

S2

S1

PIVOT

R1

R2

ACC

1,262

1,278

1,289

1,305

1,316

ADANIPORTS

265

269

272

276

280

AMBUJACEM

199

202

204

207

209

ASIANPAINT

847

857

869

878

891

AUROPHARMA

654

663

679

688

704

AXISBANK

455

458

464

467

473

BAJAJ-AUTO

2,521

2,554

2,608

2,640

2,695

BANKBARODA

152

154

157

159

162

BHEL

120

120

121

122

123

BPCL

604

608

613

617

622

BHARTIARTL

295

299

303

307

310

INFRATEL

338

342

346

349

353

BOSCH

18,780

19,008

19,379

19,607

19,978

CIPLA

555

559

566

571

578

COALINDIA

287

289

291

292

294

DRREDDY

3,005

3,026

3,057

3,078

3,109

EICHERMOT

20,685

20,921

21,335

21,571

21,985

GAIL

420

425

429

434

437

GRASIM

814

821

827

835

841

HCLTECH

820

825

830

835

839

HDFCBANK

1,166

1,174

1,180

1,187

1,193

HDFC

1,212

1,224

1,240

1,252

1,268

HEROMOTOCO

3,002

3,031

3,073

3,102

3,144

HINDALCO

163

165

167

169

172

HINDUNILVR

790

796

804

810

819

ICICIBANK

246

249

253

255

259

IDEA

71

72

74

76

78

INDUSINDBK

1,054

1,063

1,076

1,085

1,098

INFY

993

1,003

1,011

1,020

1,029

ITC

226

228

229

231

233

KOTAKBANK

713

716

719

722

726

LT

1,337

1,346

1,354

1,363

1,371

LUPIN

1,419

1,434

1,461

1,476

1,503

M&M

1,162

1,170

1,178

1,186

1,194

MARUTI

5,034

5,071

5,109

5,146

5,185

NTPC

160

161

162

163

164

ONGC

196

198

200

202

204

POWERGRID

180

181

183

184

185

RELIANCE

1,050

1,054

1,057

1,062

1,065

SBIN

247

251

257

261

267

SUNPHARMA

613

621

629

637

645

TCS

2,266

2,303

2,324

2,361

2,382

TATAMTRDVR

296

297

298

300

301

TATAMOTORS

467

470

472

476

478

TATAPOWER

74

75

77

78

80

TATASTEEL

393

398

406

411

419

TECHM

470

473

477

480

484

ULTRACEMCO

3,074

3,110

3,140

3,176

3,205

WIPRO

458

462

466

470

474

YESBANK

1,118

1,133

1,158

1,173

1,198

ZEEL

436

442

446

452

456

4

Technical & Derivatives Report

December 21, 2016

Research Team Tel: 022 - 39357800

For Technical Queries

For Derivatives Queries

DISCLAIMER

Angel Broking Private Limited (hereinafter referred to as “Angel”) is a registered Member of National Stock Exchange of India Limited,

Bombay Stock Exchange Limited and Metropolitan Stock Exchange Limited. It is also registered as a Depository Participant with CDSL

and Portfolio Manager with SEBI. It also has registration with AMFI as a Mutual Fund Distributor. Angel Broking Private Limited is a

registered entity with SEBI for Research Analyst in terms of SEBI (Research Analyst) Regulations, 2014 vide registration number

INH000000164. Angel or its associates has not been debarred/ suspended by SEBI or any other regulatory authority for accessing

/dealing in securities Market. Angel or its associates/analyst has not received any compensation / managed or co-managed public

offering of securities of the company covered by Analyst during the past twelve months.

This document is solely for the personal information of the recipient, and must not be singularly used as the basis of any investment

decision. Nothing in this document should be construed as investment or financial advice. Each recipient of this document should

make such investigations as they deem necessary to arrive at an independent evaluation of an investment in the securities of the

companies referred to in this document (including the merits and risks involved), and should consult their own advisors to determine

the merits and risks of such an investment.

Reports based on technical and derivative analysis center on studying charts of a stock's price movement, outstanding positions and

trading volume, as opposed to focusing on a company's fundamentals and, as such, may not match with a report on a company's

fundamentals. Investors are advised to refer the Fundamental and Technical Research Reports available on our website to evaluate the

contrary view, if any.

The information in this document has been printed on the basis of publicly available information, internal data and other reliable

sources believed to be true, but we do not represent that it is accurate or complete and it should not be relied on as such, as this

document is for general guidance only. Angel Broking Pvt. Limited or any of its affiliates/ group companies shall not be in any way

responsible for any loss or damage that may arise to any person from any inadvertent error in the information contained in this report.

Angel Broking Pvt. Limited has not independently verified all the information contained within this document. Accordingly, we cannot

testify, nor make any representation or warranty, express or implied, to the accuracy, contents or data contained within this document.

While Angel Broking Pvt. Limited endeavors to update on a reasonable basis the information discussed in this material, there may be

regulatory, compliance, or other reasons that prevent us from doing so.

This document is being supplied to you solely for your information, and its contents, information or data may not be reproduced,

redistributed or passed on, directly or indirectly.

Neither Angel Broking Pvt. Limited, nor its directors, employees or affiliates shall be liable for any loss or damage that may arise from

or in connection with the use of this information.

5