Technical & Derivatives Report

July 21, 2016

Sensex (27916) / Nifty (8566)

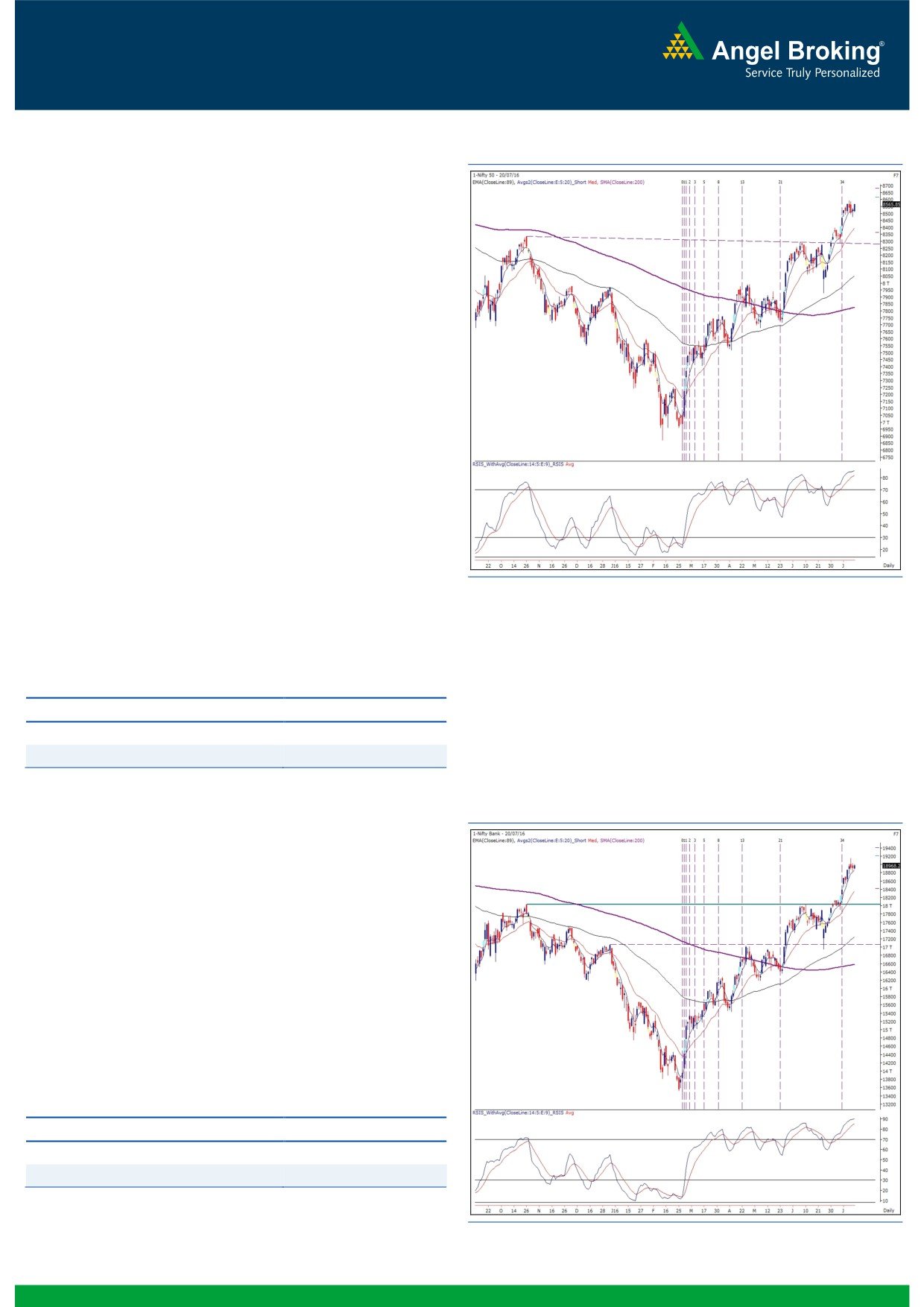

Exhibit 1: Nifty Daily Chart

Yesterday too our markets opened on a flat note owing to mixed

global cues. However, despite negative start from IT

conglomerates (on the back of weak set of 1QFY2017 numbers

from ‘Wipro’), our markets managed to gain momentum in the

upward direction and then traded with a strong positive bias to

end the session with nearly half a percent gains.

It was a reasonably good trading session for our markets,

especially we saw encouraging moves across the broader market.

As mentioned in the earlier report, the Nifty halted its upward

rally after entering the intraday resistance zone of 8550 - 8580.

Going forward, purely with an intraday perspective, 8580 would

be the important level to watch out for. We may see an extension

of yesterday’s move only if Nifty manages to sustain above 8580.

In this scenario, the Nifty may move higher to test 8630 - 8655

levels. On the flipside, a failure to do so may result into loss of

momentum. On the downside, intraday support levels are seen at

8540 - 8512 levels. We reiterate that the index has slipped into a

consolidation mode after giving a stupendous rally in the recent

weeks and thus, it would be very difficult for traders to find clear

trade in the index. It’s advisable to use dips to initiate directional

long positions and meanwhile, trade with a stock centric

approach.

Key Levels

Support 1 - 8540

Resistance 1 - 8630

Support 2 - 8512

Resistance 2 - 8655

Nifty Bank Outlook - (18968)

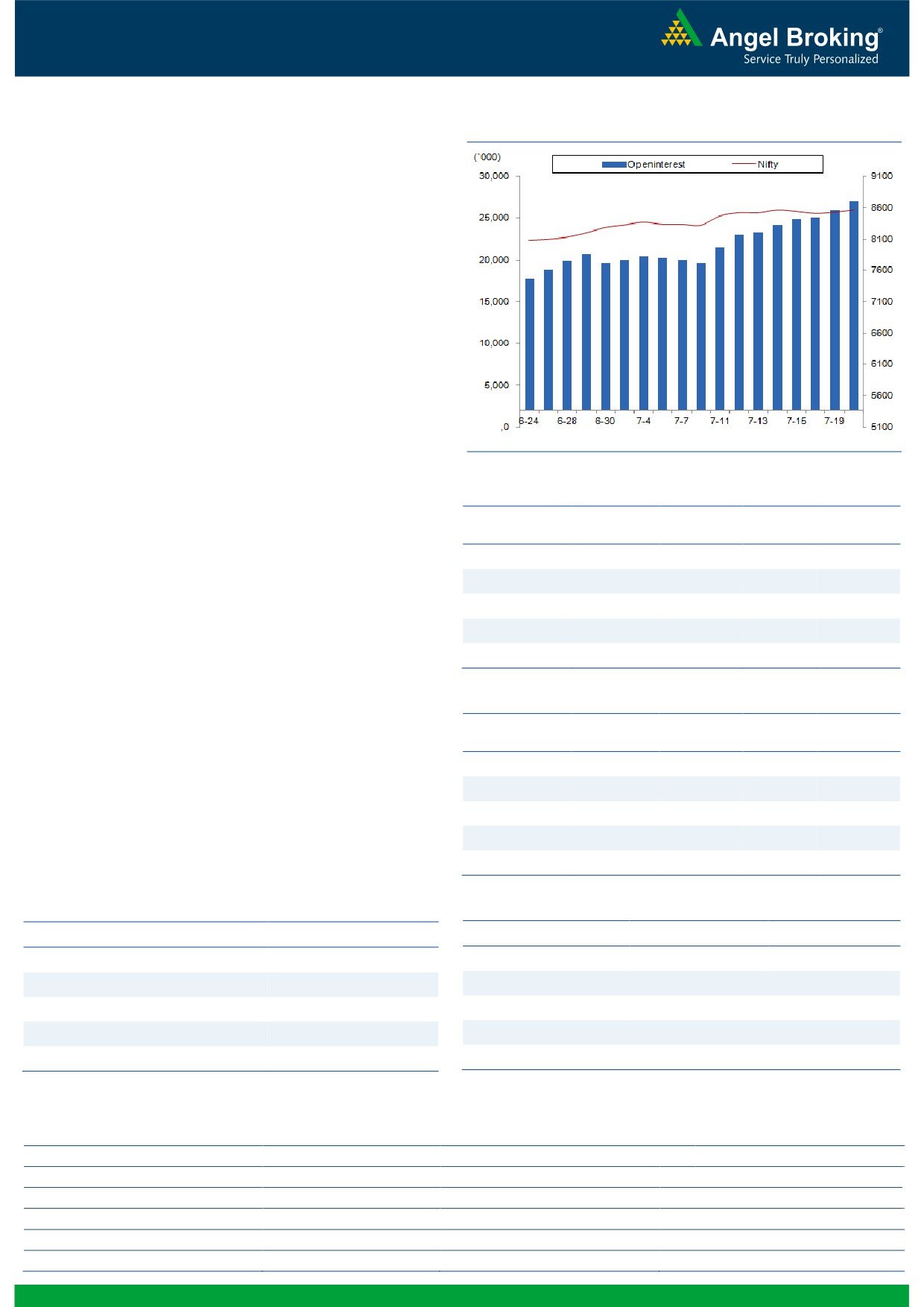

Exhibit 2: Nifty Bank Daily Chart

The Nifty Bank index continued its range bound movement and

ended yesterday's session with minor gains of 0.33 percent over

its previous session's close.

During the consolidation move in last four trading sessions, the

index has not given any reversal signs and thus the broader trend

continues to remain up. Traders should hence continue to trade

with positive bias and not create any contra trade in anticipation

of reversal. In fact, intraday corrections in recent past have

proved to be buying opportunities. The intraday support for the

index is placed around 18825 and 18772 whereas resistances

are seen around 19150 and 19229.

Key Levels

Support 1 - 18825

Resistance 1 - 19150

Support 2 - 18772

Resistance 2 - 19229

1

Technical & Derivatives Report

July 21, 2016

Comments

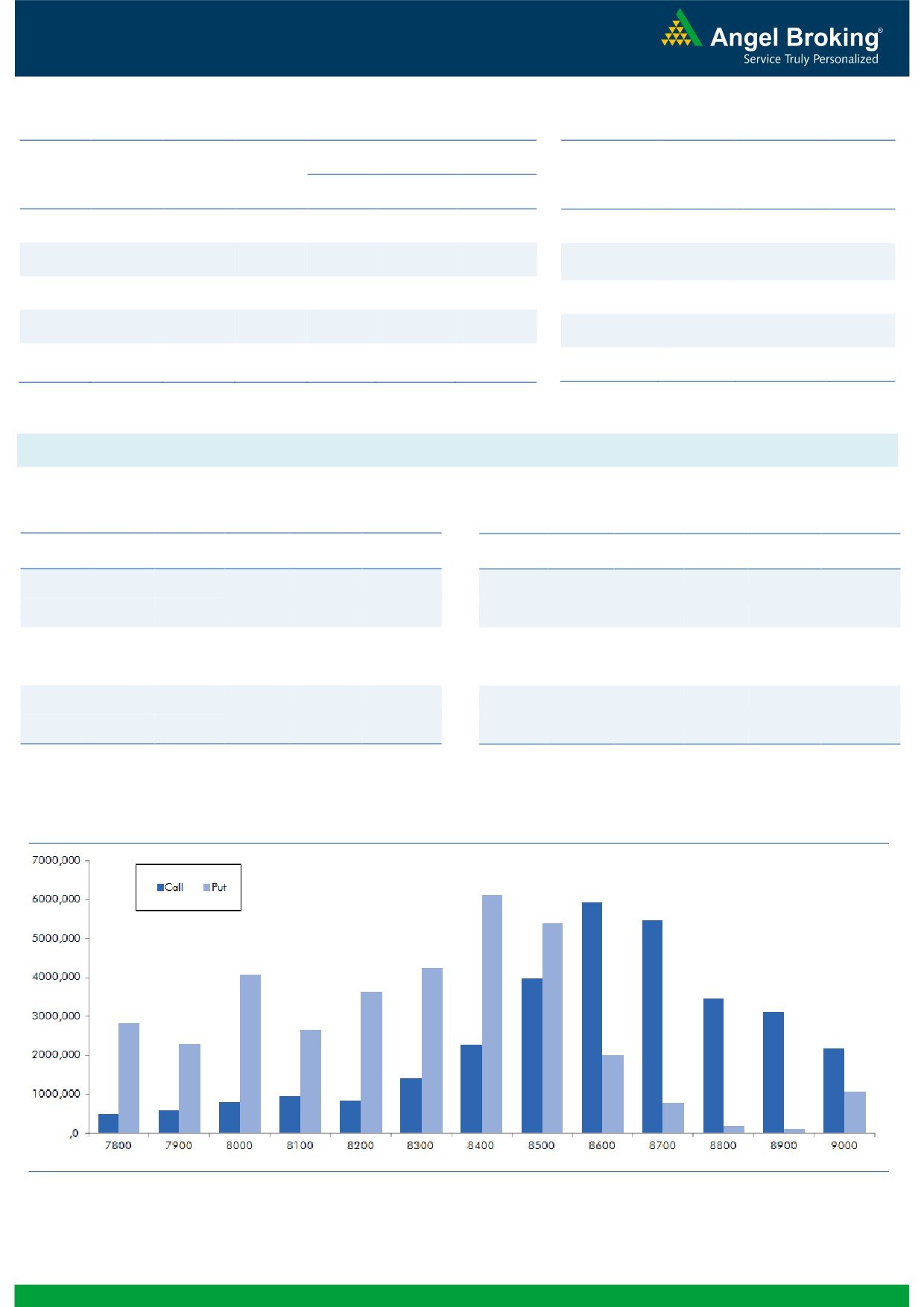

Nifty Vs OI

The Nifty futures open interest has increased by 3.80%

BankNifty futures open interest has increased by 0.81%

as market closed at 8565.85 levels.

The Nifty July future closed with a premium of 18.30

points against a premium of 11.90 points in previous

session. The August series closed at a premium of 55.70

points.

The Implied Volatility of at the money options has

increased from 12.30% to 13.80%.

The total OI of the market is Rs. 2,80,362/- cr. and the

stock futures OI is Rs. 73,347/- cr.

Few of the liquid counters where we have seen high cost

of carry are JPASSOCIAT, GMRINFRA, TATAPOWER,

UNITECH and NHPC.

Views

OI Gainers

OI

PRICE

Yesterday, FIIs were net buyer in both cash market and

SCRIP

OI

PRICE

CHG. (%)

CHG. (%)

Index Futures segment. They bought equities to the tune

GLENMARK

2525600

15.05

856.55

2.65

of Rs. 215 crores. While, they were marginal buyer in

SIEMENS

1243000

12.74

1349.90

3.18

Index Futures with rise in open interest, indicating blend

HAVELLS

5444000

12.48

367.80

2.08

of both long and short build-up in last trading session.

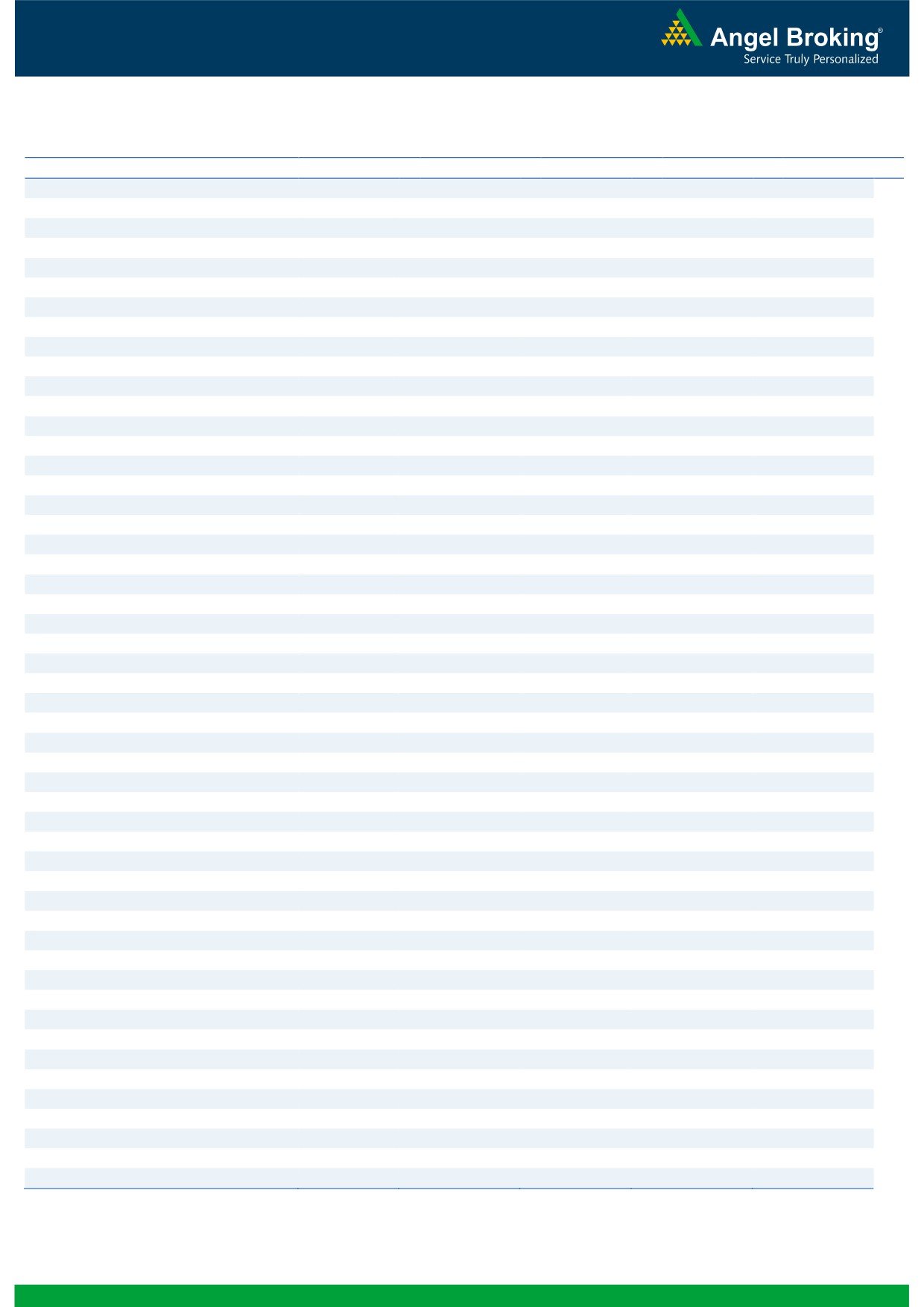

In Index Options segment, FIIs were net seller worth

WOCKPHARMA

3214200

11.91

1041.60

12.77

Rs. 199 crores with rise in open interest. In call options,

SUNTV

10156000

10.68

402.35

4.74

marginal OI addition was seen in 8700 strike; followed

by decent unwinding in 8500 strike. On the other hand,

OI Losers

in put options, good amount of build-up was seen in

OI

PRICE

SCRIP

OI

PRICE

8500, 8600 and 8550 strikes. Highest OI in current

CHG. (%)

CHG. (%)

series is placed at 8600 call and 8400 put options.

PNB

55769000

-8.45

129.70

-1.07

After the continuous buying in index futures, we saw a

IOC

10161000

-7.24

513.20

3.60

pause in buying momentum by FIIs in yesterday’s

ORIENTBANK

16428000

-6.20

115.95

-0.13

session. Though, our positional view remains positive on

PETRONET

4029000

-4.68

292.75

2.25

market; we may see a sideways movement in upcoming

NIITTECH

928000

-3.83

461.25

-0.59

sessions.

Historical Volatility

Put-Call Ratio

SCRIP

HV

SCRIP

PCR-OI

PCR-VOL

WOCKPHARMA

62.46

NIFTY

1.09

1.07

AUROPHARMA

37.56

BANKNIFTY

1.17

0.96

STAR

34.61

INFY

0.48

0.46

SIEMENS

25.22

RELIANCE

0.48

0.52

CADILAHC

38.15

SBIN

0.82

0.83

Strategy Date

Symbol

Strategy

Status

04-07-2016

RCOM

Ratio Bull Call Spread

Active

11-07-2016

BANKNIFTY

Bull Call Spread

Didn’t trigger

18-07-2016

TCS

Long Put

Active

2

Technical & Derivatives Report

July 21, 2016

FII Statistics for 20-July 2016

Turnover on 20-July 2016

Open Interest

No. of

Turnover

Change

Detail

Buy

Sell

Net

Instrument

Value

Contracts

( in Cr. )

(%)

Contracts

Change (%)

(in Cr.)

INDEX

INDEX

1301.38

1254.99

46.39

330448

21718.33

1.90

156755

10677.96

-35.29

FUTURES

FUTURES

INDEX

INDEX

22192.05

22390.71

(198.66)

1043231

67760.93

1.93

2928510

202451.92

-19.09

OPTIONS

OPTIONS

STOCK

4764.75

5639.28

(874.53)

855795

54903.91

1.12

STOCK

FUTURES

522317

34147.60

-3.95

FUTURES

STOCK

STOCK

3956.86

3956.86

(0.00)

108712

7090.80

1.49

OPTIONS

373399

24232.06

-8.81

OPTIONS

TOTAL

32215.04

33241.84

(1026.80)

2338186

151473.96

1.61

TOTAL

3980981

271509.53

-17.44

Nifty Spot = 8565.85

Lot Size = 75

Bull-Call Spreads

Bear-Put Spreads

Action

Strike

Price

Risk

Reward

BEP

Action

Strike

Price

Risk

Reward

BEP

Buy

8600

60.60

Buy

8600

76.35

36.40

63.60

8636.40

36.85

63.15

8563.15

Sell

8700

24.20

Sell

8500

39.50

Buy

8600

60.60

Buy

8600

76.35

53.05

146.95

8653.05

57.20

142.80

8542.80

Sell

8800

7.55

Sell

8400

19.15

Buy

8700

24.20

Buy

8500

39.50

16.65

83.35

8716.65

20.35

79.65

8479.65

Sell

8800

7.55

Sell

8400

19.15

Note: Above mentioned Bullish or Bearish Spreads in Nifty (July Series) are given as an information and not as a recommendation.

Nifty Put-Call Analysis

3

Technical & Derivatives Report

July 21, 2016

Daily Pivot Levels for Nifty Constituents

Scrips

S2

S1

PIVOT

R1

R2

ACC

1,594

1,613

1,626

1,645

1,659

ADANIPORTS

217

219

221

223

225

AMBUJACEM

255

259

263

266

270

ASIANPAINT

1,012

1,020

1,028

1,037

1,045

AUROPHARMA

760

780

790

810

821

AXISBANK

549

553

561

565

573

BAJAJ-AUTO

2,726

2,753

2,773

2,799

2,820

BANKBARODA

156

157

158

159

160

BHEL

138

141

143

146

148

BPCL

563

569

576

582

589

BHARTIARTL

359

361

364

367

370

INFRATEL

348

352

356

360

364

BOSCH

24,041

24,470

24,730

25,159

25,419

CIPLA

500

509

514

523

528

COALINDIA

316

323

326

333

337

DRREDDY

3,552

3,614

3,652

3,714

3,752

EICHERMOT

19,564

19,707

19,798

19,941

20,032

GAIL

384

390

393

399

402

GRASIM

4,737

4,789

4,826

4,878

4,914

HCLTECH

711

721

726

736

742

HDFCBANK

1,214

1,223

1,231

1,240

1,248

HDFC

1,315

1,325

1,335

1,345

1,356

HEROMOTOCO

3,217

3,246

3,265

3,294

3,313

HINDALCO

132

134

137

139

142

HINDUNILVR

892

899

905

912

918

ICICIBANK

264

266

267

269

270

IDEA

104

104

106

107

108

INDUSINDBK

1,093

1,106

1,114

1,127

1,135

INFY

1,061

1,072

1,081

1,092

1,101

ITC

246

248

250

252

254

KOTAKBANK

775

778

781

785

788

LT

1,557

1,563

1,575

1,581

1,592

LUPIN

1,682

1,702

1,713

1,732

1,743

M&M

1,450

1,456

1,464

1,469

1,477

MARUTI

4,418

4,442

4,476

4,500

4,534

NTPC

154

156

157

158

159

ONGC

218

221

223

226

227

POWERGRID

165

167

168

170

171

RELIANCE

1,011

1,017

1,023

1,029

1,034

SBIN

227

229

231

233

235

SUNPHARMA

776

786

792

803

809

TCS

2,428

2,461

2,482

2,516

2,536

TATAMTRDVR

317

318

321

322

324

TATAMOTORS

486

490

496

500

506

TATAPOWER

70

71

72

74

75

TATASTEEL

363

366

369

372

376

TECHM

501

503

506

509

512

ULTRACEMCO

3,484

3,522

3,546

3,584

3,608

WIPRO

510

524

533

548

556

YESBANK

1,138

1,149

1,159

1,169

1,179

ZEEL

453

458

464

469

475

4

Technical & Derivatives Report

July 21, 2016

Research Team Tel: 022 - 39357800

For Technical Queries

For Derivatives Queries

DISCLAIMER

Angel Broking Private Limited (hereinafter referred to as “Angel”) is a registered Member of National Stock Exchange of India Limited,

Bombay Stock Exchange Limited and Metropolitan Stock Exchange Limited. It is also registered as a Depository Participant with CDSL

and Portfolio Manager with SEBI. It also has registration with AMFI as a Mutual Fund Distributor. Angel Broking Private Limited is a

registered entity with SEBI for Research Analyst in terms of SEBI (Research Analyst) Regulations, 2014 vide registration number

INH000000164. Angel or its associates has not been debarred/ suspended by SEBI or any other regulatory authority for accessing

/dealing in securities Market. Angel or its associates/analyst has not received any compensation / managed or co-managed public

offering of securities of the company covered by Analyst during the past twelve months.

This document is solely for the personal information of the recipient, and must not be singularly used as the basis of any investment

decision. Nothing in this document should be construed as investment or financial advice. Each recipient of this document should

make such investigations as they deem necessary to arrive at an independent evaluation of an investment in the securities of the

companies referred to in this document (including the merits and risks involved), and should consult their own advisors to determine

the merits and risks of such an investment.

Reports based on technical and derivative analysis center on studying charts of a stock's price movement, outstanding positions and

trading volume, as opposed to focusing on a company's fundamentals and, as such, may not match with a report on a company's

fundamentals. Investors are advised to refer the Fundamental and Technical Research Reports available on our website to evaluate the

contrary view, if any.

The information in this document has been printed on the basis of publicly available information, internal data and other reliable

sources believed to be true, but we do not represent that it is accurate or complete and it should not be relied on as such, as this

document is for general guidance only. Angel Broking Pvt. Limited or any of its affiliates/ group companies shall not be in any way

responsible for any loss or damage that may arise to any person from any inadvertent error in the information contained in this report.

Angel Broking Pvt. Limited has not independently verified all the information contained within this document. Accordingly, we cannot

testify, nor make any representation or warranty, express or implied, to the accuracy, contents or data contained within this document.

While Angel Broking Pvt. Limited endeavors to update on a reasonable basis the information discussed in this material, there may be

regulatory, compliance, or other reasons that prevent us from doing so.

This document is being supplied to you solely for your information, and its contents, information or data may not be reproduced,

redistributed or passed on, directly or indirectly.

Neither Angel Broking Pvt. Limited, nor its directors, employees or affiliates shall be liable for any loss or damage that may arise from

or in connection with the use of this information.

5