Technical & Derivatives Report

June 21, 2016

Sensex (26867) / Nifty (8239)

Exhibit 1: Nifty Daily Chart

The opening session of the week started on a pessimistic note

after the announcement of RBI Governor Raghuram Rajan's exit at

the end of his term. However, this was just a temporary reaction

to the announcement as the index shrugged off this negative

development and immediately joined its global peers. As a result,

we witnessed a smart recovery followed by a strong buying to end

the session to close convincingly above the 8200 mark.

Yesterday's vertical rally from early morning lows was a perfect

example of a famous quote 'Trend is your friend'. Our strategy of

using dips as a buying opportunity has been working well for us

and as expected, Nifty retested the 8250 mark. We continue with

our positive stance on the market and expect the index to move

towards 8290 - 8336 levels. On the flipside, 8210 - 8150 would

be seen as immediate support levels. Considering the

unfavourable risk to reward ratio in the index, traders are advised

to focus on stock specific moves.

Key Levels

Support 1 - 8210

Resistance 1 - 8290

Support 2 - 8150

Resistance 2 - 8336

Exhibit 2: Nifty Bank Daily Chart

Nifty Bank Outlook - (17719)

In yesterday's session, the Nifty Bank index opened gap down by

270 points; but recovered immediately to end the session

marginally in the positive territory.

On announcement of RBI Governor Dr. Raghuram Rajan's

decision to not continue his post after his term ends in September,

the Nifty Bank index opened with a gap down opening. However,

as the Dow Theory states that 'Price Discounts Everything'; the

index factored in the news in opening ticks and then recovered

the early losses before ending the session on a marginal positive

note. As we had also mentioned yesterday, the index is trading in

a broader range of 17350-18050 and only a breakout of the

range will lead to directional move in the index. Till then, traders

are advised to focus on stock specific trades with proper risk

management. The near term supports for the index are placed

around 17588 and 17350; whereas, resistances are seen around

17935 and 18050.

Key Levels

Support 1 - 17588

Resistance 1 - 17935

Support 2 - 17350

Resistance 2 - 18050

1

Technical & Derivatives Report

June 21, 2016

Comments

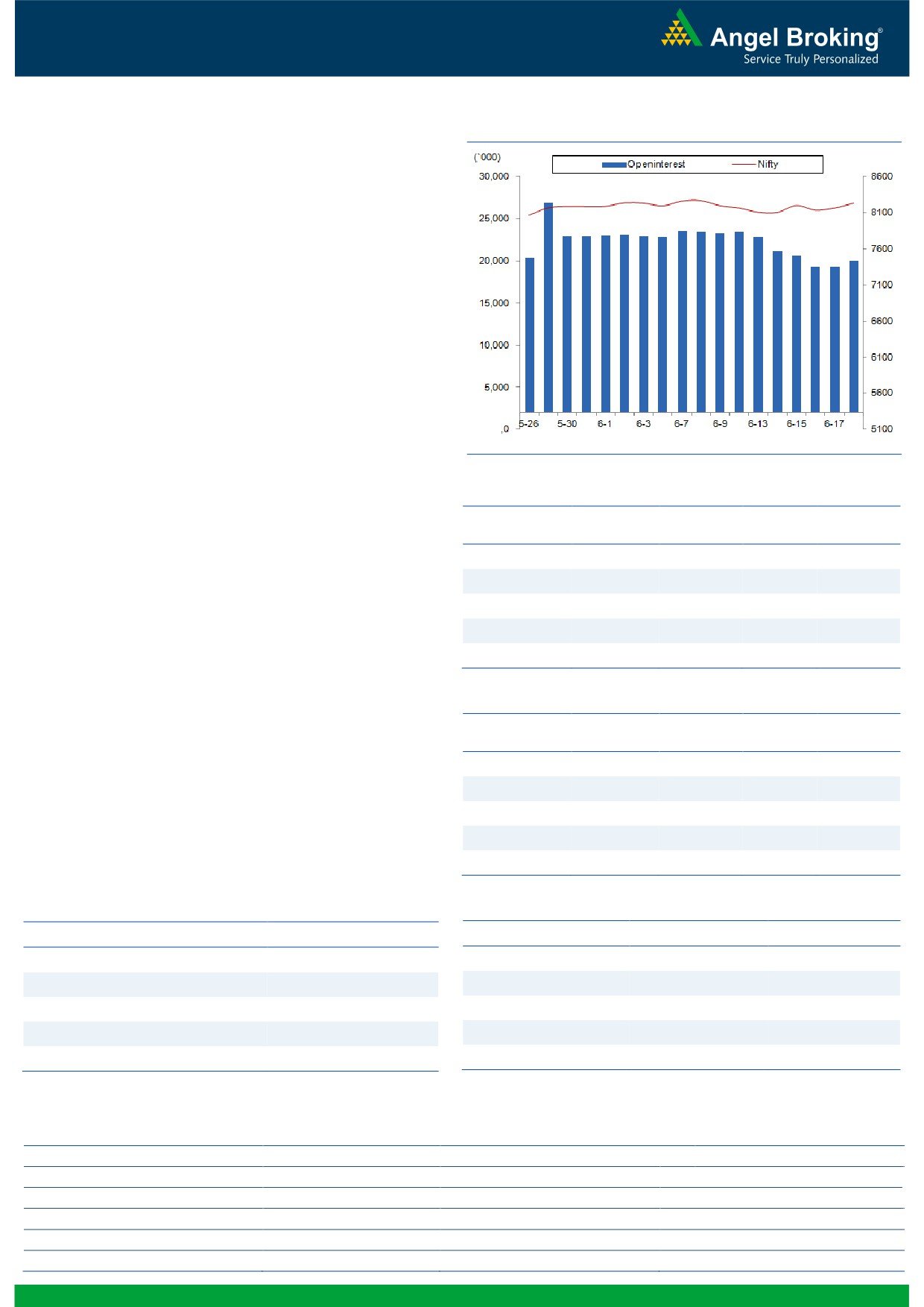

Nifty Vs OI

The Nifty futures open interest has increased by 3.78%

BankNifty futures open interest has increased by 21.42%

as market closed at 8238.50 levels.

The Nifty June future closed with a premium of 13.40

points against a premium of 4.20 points in previous

session. The July series closed at a premium of 41.95

points.

The Implied Volatility of at the money options has

increased from 16.44% to 17.40%.

The total OI of the market is Rs. 2,51,061/- cr. and the

stock futures OI is Rs. 68,481/- cr.

Few of the liquid counters where we have seen high cost

of

carry are UNITECH, MOTHERSUMI, IGL,

APOLLOTYRE and JPASSOCIAT.

Views

OI Gainers

Yesterday, despite the sharp recovery from lower levels,

OI

PRICE

FIIs were net sellers in both equity cash and index future

SCRIP

OI

PRICE

CHG. (%)

CHG. (%)

segment. They sold equities worth Rs. 537 crores. While

UPL

9042600

11.54

571.90

0.62

in Index Futures, they were net seller to the tuned of

BEML

1747500

7.87

872.50

3.93

Rs. 1336 crores with rise in open interest, indicating short

TORNTPHARM

202000

7.45

1347.00

-0.30

build-up in last trading session.

On Index Options front, FIIs sold worth Rs. 1055 crores

HAVELLS

5812000

7.11

363.10

1.28

with marginal change in open interest. In call options,

ABIRLANUVO

1335750

6.52

1038.75

-0.12

8400 strike added good amount of fresh positions;

whereas, unwinding was seen in 8200 and 8000 strikes.

OI Losers

While in put options, we witnessed huge OI build-up in

OI

PRICE

SCRIP

OI

PRICE

8100 and 8200 strikes with rise in IV’s. We believe its

CHG. (%)

CHG. (%)

buying which took place in these puts. Maximum OI in

JETAIRWAYS

5067000

-14.12

587.00

6.31

June series is visible in 8300 call and 8000 put options.

AMARAJABAT

685800

-9.93

862.05

-0.39

For the first time in June series, FIIs has formed good

IBREALEST

31258000

-8.82

97.60

-1.31

amount of short positions in index future, which doesn’t

BANKINDIA

20943000

-8.43

97.10

3.13

bode well for Bulls. However, we would like to wait for

HINDZINC

4118400

-6.13

177.00

2.49

follow up selling before initiating fresh shorts in index.

Historical Volatility

Put-Call Ratio

SCRIP

HV

SCRIP

PCR-OI

PCR-VOL

GODREJIND

31.84

NIFTY

1.15

0.85

JETAIRWAYS

47.38

BANKNIFTY

1.09

0.92

BHARATFORG

30.47

SBIN

0.95

0.68

MRF

26.08

RELIANCE

0.57

0.38

SKSMICRO

28.70

SUNPHARMA

0.35

0.34

Strategy Date

Symbol

Strategy

Status

May 30, 2016

TCS

Ratio Bull Call Spread

Active

June 06, 2016

NIFTY

Long Call

Exited at Cost

June 13, 2016

ONGC

Ratio Bull Call Spread

Active

June 20, 2016

MARUTI

Long Call Ladder

Active

2

Technical & Derivatives Report

June 21, 2016

FII Statistics for 20-June 2016

Turnover on 20-June 2016

Open Interest

No. of

Turnover

Change

Detail

Buy

Sell

Net

Instrument

Value

Contracts

( in Cr. )

(%)

Contracts

Change (%)

(in Cr.)

INDEX

INDEX

2379.46

3715.41

(1335.96)

238860

14418.39

5.93

344926

20201.28

34.98

FUTURES

FUTURES

INDEX

INDEX

26458.97

27513.47

(1054.50)

1163478

71095.99

0.46

3626653

216706.81

38.53

OPTIONS

OPTIONS

STOCK

4946.32

4656.30

290.02

1089340

54654.31

0.01

STOCK

FUTURES

570772

29807.26

10.04

FUTURES

STOCK

STOCK

3293.28

3299.47

(6.18)

112859

5896.51

1.74

OPTIONS

358228

18889.17

19.64

OPTIONS

TOTAL

37078.03

39184.66

(2106.62)

2604537

146065.21

0.80

TOTAL

4900579

285604.52

33.29

Nifty Spot = 8238.50

Lot Size = 75

Bull-Call Spreads

Bear-Put Spreads

Action

Strike

Price

Risk

Reward

BEP

Action

Strike

Price

Risk

Reward

BEP

Buy

8300

70.45

Buy

8200

75.05

36.70

63.30

8336.70

27.50

72.50

8172.50

Sell

8400

33.75

Sell

8100

47.55

Buy

8300

70.45

Buy

8200

75.05

56.40

143.60

8356.40

44.85

155.15

8155.15

Sell

8500

14.05

Sell

8000

30.20

Buy

8400

33.75

Buy

8100

47.55

19.70

80.30

8419.70

17.35

82.65

8082.65

Sell

8500

14.05

Sell

8000

30.20

Note: Above mentioned Bullish or Bearish Spreads in Nifty (June Series) are given as an information and not as a recommendation.

Nifty Put-Call Analysis

3

Technical & Derivatives Report

June 21, 2016

Daily Pivot Levels for Nifty Constituents

Scrips

S2

S1

PIVOT

R1

R2

ACC

1,525

1,548

1,561

1,583

1,597

ADANIPORTS

201

204

206

209

212

AMBUJACEM

231

237

240

245

248

ASIANPAINT

981

986

992

997

1,002

AUROPHARMA

711

725

733

747

755

AXISBANK

510

516

520

526

530

BAJAJ-AUTO

2,523

2,570

2,597

2,645

2,672

BANKBARODA

145

149

151

154

156

BHEL

119

121

123

126

127

BPCL

985

995

1,004

1,014

1,022

BHARTIARTL

349

357

361

369

374

INFRATEL

327

334

338

345

349

BOSCH

21,620

21,855

22,056

22,291

22,492

CIPLA

479

484

487

492

496

COALINDIA

308

310

312

314

315

DRREDDY

2,984

3,021

3,042

3,079

3,100

EICHERMOT

18,529

18,595

18,676

18,742

18,824

GAIL

379

382

387

390

395

GRASIM

4,214

4,267

4,304

4,357

4,394

HCLTECH

733

752

767

785

800

HDFCBANK

1,150

1,161

1,170

1,181

1,190

HDFC

1,195

1,211

1,223

1,239

1,251

HEROMOTOCO

2,963

3,004

3,048

3,089

3,133

HINDALCO

116

118

120

123

124

HINDUNILVR

866

873

877

884

889

ICICIBANK

231

235

237

240

243

IDEA

99

101

102

104

106

INDUSINDBK

1,077

1,090

1,102

1,115

1,126

INFY

1,168

1,188

1,200

1,220

1,232

ITC

352

355

358

361

364

KOTAKBANK

733

742

750

759

766

LT

1,443

1,475

1,492

1,525

1,542

LUPIN

1,431

1,446

1,461

1,477

1,491

M&M

1,321

1,336

1,345

1,360

1,369

MARUTI

4,035

4,084

4,115

4,163

4,194

NTPC

149

152

153

156

158

ONGC

208

211

213

216

218

POWERGRID

154

155

156

158

159

RELIANCE

959

975

984

999

1,008

SBIN

205

210

214

219

222

SUNPHARMA

728

734

740

746

752

TCS

2,564

2,611

2,640

2,688

2,716

TATAMTRDVR

307

314

318

324

328

TATAMOTORS

452

467

476

491

499

TATAPOWER

71

73

74

76

77

TATASTEEL

318

327

332

341

346

TECHM

525

535

542

551

559

ULTRACEMCO

3,234

3,302

3,338

3,406

3,443

WIPRO

540

548

554

562

567

YESBANK

1,046

1,061

1,070

1,084

1,094

ZEEL

443

446

450

453

456

4

Technical & Derivatives Report

June 21, 2016

Research Team Tel: 022 - 39357800

For Technical Queries

For Derivatives Queries

DISCLAIMER

Angel Broking Private Limited (hereinafter referred to as “Angel”) is a registered Member of National Stock Exchange of India Limited,

Bombay Stock Exchange Limited and MCX Stock Exchange Limited. It is also registered as a Depository Participant with CDSL and

Portfolio Manager with SEBI. It also has registration with AMFI as a Mutual Fund Distributor. Angel Broking Private Limited is a

registered entity with SEBI for Research Analyst in terms of SEBI (Research Analyst) Regulations, 2014 vide registration number

INH000000164. Angel or its associates has not been debarred/ suspended by SEBI or any other regulatory authority for accessing

/dealing in securities Market. Angel or its associates including its relatives/analyst do not hold any financial interest/beneficial

ownership of more than 1% in the company covered by Analyst. Angel or its associates/analyst has not received any compensation /

managed or co-managed public offering of securities of the company covered by Analyst during the past twelve months. Angel/analyst

has not served as an officer, director or employee of company covered by Analyst and has not been engaged in market making activity

of the company covered by Analyst.

This document is solely for the personal information of the recipient, and must not be singularly used as the basis of any investment

decision. Nothing in this document should be construed as investment or financial advice. Each recipient of this document should

make such investigations as they deem necessary to arrive at an independent evaluation of an investment in the securities of the

companies referred to in this document (including the merits and risks involved), and should consult their own advisors to determine

the merits and risks of such an investment.

Reports based on technical and derivative analysis center on studying charts of a stock's price movement, outstanding positions and

trading volume, as opposed to focusing on a company's fundamentals and, as such, may not match with a report on a company's

fundamentals.

The information in this document has been printed on the basis of publicly available information, internal data and other reliable

sources believed to be true, but we do not represent that it is accurate or complete and it should not be relied on as such, as this

document is for general guidance only. Angel Broking Pvt. Limited or any of its affiliates/ group companies shall not be in any way

responsible for any loss or damage that may arise to any person from any inadvertent error in the information contained in this report.

Angel Broking Pvt. Limited has not independently verified all the information contained within this document. Accordingly, we cannot

testify, nor make any representation or warranty, express or implied, to the accuracy, contents or data contained within this document.

While Angel Broking Pvt. Limited endeavors to update on a reasonable basis the information discussed in this material, there may be

regulatory, compliance, or other reasons that prevent us from doing so.

This document is being supplied to you solely for your information, and its contents, information or data may not be reproduced,

redistributed or passed on, directly or indirectly.

Neither Angel Broking Pvt. Limited, nor its directors, employees or affiliates shall be liable for any loss or damage that may arise from

or in connection with the use of this information.

Note: Please refer to the important ‘Stock Holding Disclosure' report on the Angel website (Research Section). Also, please refer to the

latest update on respective stocks for the disclosure status in respect of those stocks. Angel Broking Pvt. Limited and its affiliates may

have investment positions in the stocks recommended in this report.

5