Technical & Derivatives Report

April 21, 2016

Sensex (25844) / Nifty (7915)

Exhibit 1: Nifty Daily Chart

Yesterday, we saw Nifty opening with an upside gap owing to

positive global cues on Tuesday. However, the index corrected

immediately post the opening tick and registered almost an

‘Open High’, which remained a strong hurdle for the day. Due to

minor dip during the day, the Nifty ended the session almost at

the same level where it closed on Monday.

With reference to our previous report, we witnessed a hint of

profit booking after entering mentioned resistance zone of 7930 -

7972. We maintain our wait n watch approach at this juncture

and would advise traders to lighten up existing longs until Nifty

doesn’t indicate a breakout beyond the 8000 mark. In case of a

continued profit booking, we may see Nifty correcting back to

7842 - 7775 levels. Traders are advised to keep focusing on

individual stocks which have a strong chart structure.

Key Levels

Support 1 - 7842

Resistance 1 - 7930

Support 2 - 7775

Resistance 2 - 7972

Exhibit 2: Nifty Bank Daily Chart

Nifty Bank Outlook - (16350)

Yesterday, The Nifty Bank index traded in a narrow range and

eventually ended the session with gains of 0.78% over its previous

close.

The banking index has ended the session marginally positive led

by some private sector banks. However, the index is hovering

near its resistance zone of

16500-16550, which is

127%

reciprocal retracement level of the previous corrective move from

16283 to 15440. The mentioned resistance level coincides with

the ‘Super Trend’ resistance and ’89 EMA’ on weekly chart.

Hence, although the index may move marginally higher from

current levels, the cluster of resistances suggests that traders

should not create fresh long positions in the index. In fact, at

higher levels, it would be a prudent strategy to book profits on

long positions. Unless any reversal signs seen, stock specific

positive action may continue, which traders should concentrate on

with proper risk management strategy. The intraday support for

the index is placed in range of

16150 -

16080 whereas

resistances are seen around 16450 and 16510.

Key Levels

Support 1 - 16150

Resistance 1 - 16450

Support 2 - 16080

Resistance 2 - 16510

1

Technical & Derivatives Report

April 21, 2016

Comments

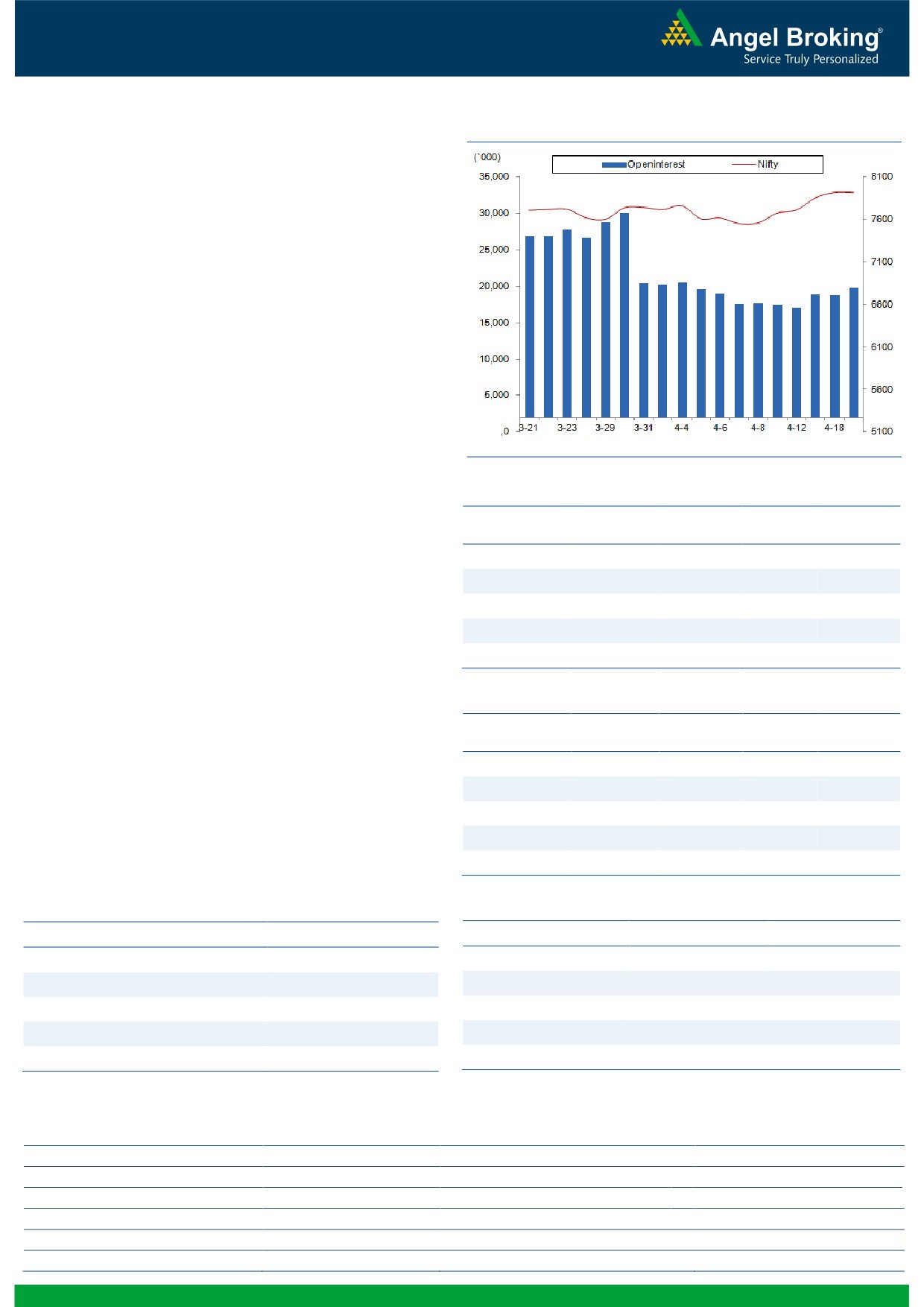

Nifty Vs OI

The Nifty futures open interest has increased by 5.59%

BankNifty futures open interest has increased by 9.70%

as market closed at 7914.75 levels.

The Nifty April future closed at a premium of 15.10

points against a premium of 5.60 points. The May series

closed at a premium of 55.15 points.

The Implied Volatility of at the money options has

decreased from 15.16% to 15.13%.

The total OI of the market is Rs. 2,30,491/- cr. and the

stock futures OI is Rs. 58,946/- cr.

Few of the liquid counters where we have seen high cost

of carry are JPASSOCIAT, NHPC, NMDC, APOLLOHOSP

and M&M.

Views

FIIs activity in cash market segment was subdued. While

OI Gainers

in Index Futures, they continue buying of Rs. 1328 crores

OI

PRICE

SCRIP

OI

PRICE

with good amount of rise in OI, suggesting fresh long

CHG. (%)

CHG. (%)

formation in last trading session.

UBL

951500

24.30

768.90

-2.23

UNIONBANK

10926000

20.48

127.60

-0.47

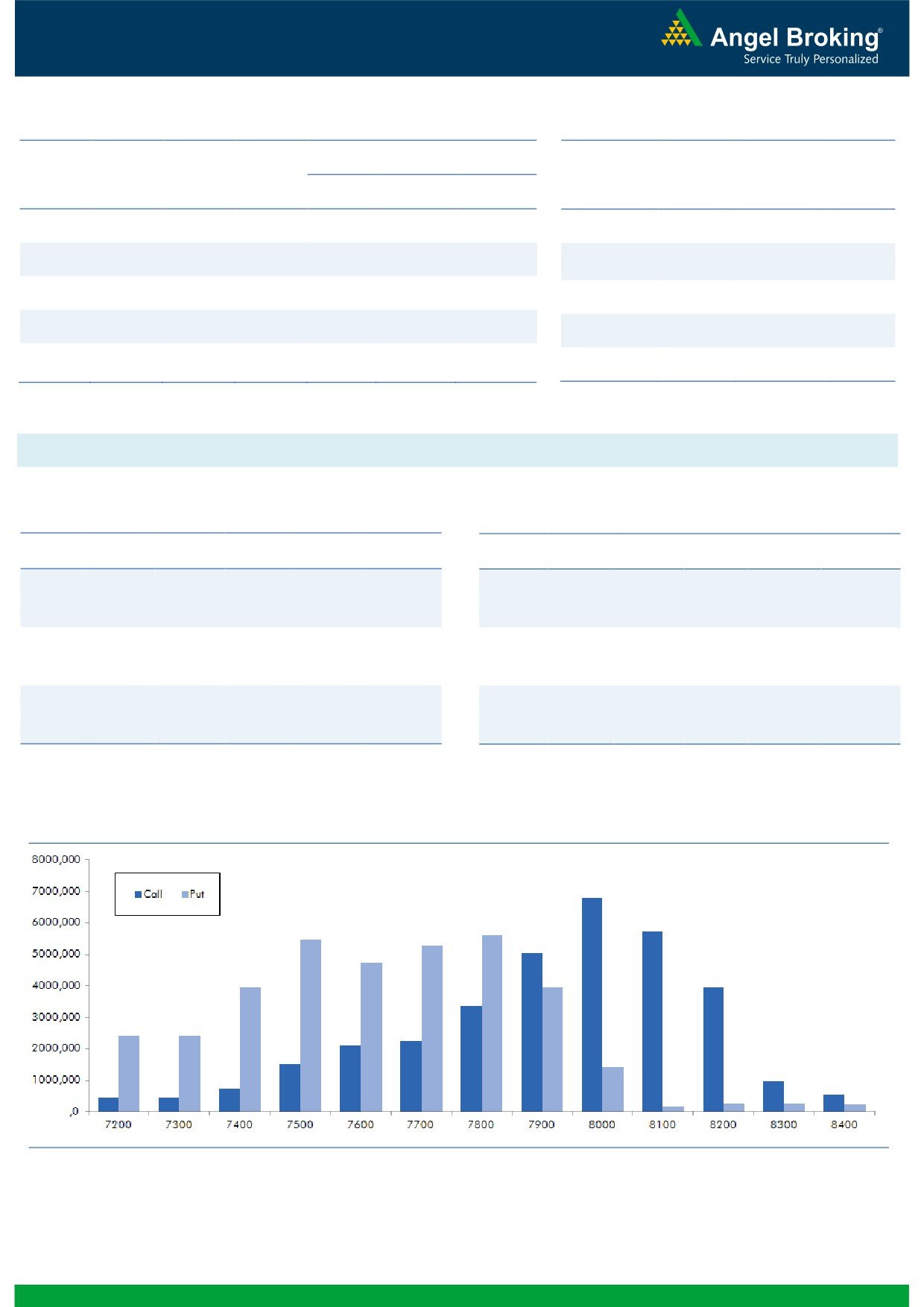

In Index Options front, FIIs were net sellers of Rs. 1152

crores with some rise in OI. In call options, 8100 strike

WIPRO

8776000

20.45

603.85

2.23

from past 2-3 trading sessions has been continuously

PETRONET

5409000

16.47

268.00

-1.54

adding fresh longs. Some unwinding was visible in 8000

IGL

1636800

13.50

573.45

0.92

call options, which may be covering by writers of this call

option. Whereas, 7900 put options added good amount

OI Losers

of OI, we believe FIIs are writing this strike expecting

OI

PRICE

SCRIP

OI

PRICE

expiry above these levels. Maximum OI in current series

CHG. (%)

CHG. (%)

is visible in 8000 call and of put options has shifted from

CONCOR

382800

-10.56

1381.60

3.82

7500 to 7800 strike. After continuous profit booking, we

NCC

8776000

-9.71

75.50

1.68

witnessed formation of fresh long positions in Index

MCLEODRUSS

2541000

-8.26

195.35

-1.11

Futures. We expect Nifty to test 8000 levels in current

PAGEIND

65000

-7.87

13555.00

5.89

series, trade accordingly.

GODREJIND

1147900

-6.06

374.05

-0.77

Historical Volatility

Put-Call Ratio

SCRIP

HV

SCRIP

PCR-OI

PCR-VOL

TV18BRDCST

54.72

NIFTY

1.08

1.04

CESC

34.69

BANKNIFTY

1.02

0.94

VEDL

79.98

SBIN

0.35

0.27

TATACHEM

46.93

INFY

0.60

0.47

TATASTEEL

59.31

TCS

0.67

0.65

Strategy Date

Symbol

Strategy

Status

April 04, 2016

TCS

Ratio Bear Put Spread

Active

April 11, 2016

ITC

Short Strangle

Active

April 18, 2016

NIFTY

Long Call

Active

2

Technical & Derivatives Report

April 21, 2016

FII Statistics for 20-April 2016

Turnover on 20-April 2016

Open Interest

No. of

Turnover

Change

Detail

Buy

Sell

Net

Instrument

Value

Contracts

( in Cr. )

(%)

Contracts

Change (%)

(in Cr.)

INDEX

INDEX

3234.08

1906.02

1328.05

254055

14745.94

5.09

316042

17564.00

18.14

FUTURES

FUTURES

INDEX

INDEX

36219.37

37371.16

(1151.79)

1164158

68309.02

2.11

4113294

239293.19

33.87

OPTIONS

OPTIONS

STOCK

5112.36

5689.70

(577.33)

1006286

48698.24

0.07

STOCK

FUTURES

655237

33175.81

20.58

FUTURES

STOCK

STOCK

3694.74

3706.27

(11.53)

87151

4280.48

5.82

OPTIONS

418656

21734.72

7.05

OPTIONS

TOTAL

48260.55

48673.14

(412.60)

2511650

136033.69

1.69

TOTAL

5503229

311767.72

29.13

Nifty Spot = 7914.75

Lot Size = 75

Bull-Call Spreads

Bear-Put Spreads

Action

Strike

Price

Risk

Reward

BEP

Action

Strike

Price

Risk

Reward

BEP

Buy

7900

86.45

Buy

7900

56.30

48.10

51.90

7948.10

28.00

72.00

7872.00

Sell

8000

38.35

Sell

7800

28.30

Buy

7900

86.45

Buy

7900

56.30

73.50

126.50

7973.50

42.30

157.70

7857.70

Sell

8100

12.95

Sell

7700

14.00

Buy

8000

38.35

Buy

7800

28.30

25.40

74.60

8025.40

14.30

85.70

7785.70

Sell

8100

12.95

Sell

7700

14.00

Note: Above mentioned Bullish or Bearish Spreads in Nifty (April Series) are given as an information and not as a recommendation.

Nifty Put-Call Analysis

3

Technical & Derivatives Report

April 21, 2016

Daily Pivot Levels for Nifty Constituents

Scrips

S2

S1

PIVOT

R1

R2

ACC

1,449

1,458

1,470

1,479

1,491

ADANIPORTS

229

231

234

236

239

AMBUJACEM

222

224

228

230

234

ASIANPAINT

870

878

883

891

895

AUROPHARMA

748

759

777

788

806

AXISBANK

438

449

455

465

471

BAJAJ-AUTO

2,479

2,506

2,539

2,566

2,599

BANKBARODA

144

148

151

155

158

BHEL

131

132

133

134

135

BPCL

940

947

958

966

977

BHARTIARTL

348

353

359

363

369

INFRATEL

375

381

389

395

403

BOSCH

19,687

19,837

20,068

20,219

20,450

CIPLA

514

521

526

532

537

COALINDIA

273

276

279

282

285

DRREDDY

3,082

3,095

3,113

3,126

3,143

EICHERMOT

20,118

20,314

20,447

20,644

20,776

GAIL

353

360

365

373

378

GRASIM

4,017

4,055

4,097

4,135

4,177

HCLTECH

819

830

846

857

873

HDFCBANK

1,077

1,088

1,094

1,104

1,110

HDFC

1,121

1,130

1,145

1,154

1,168

HEROMOTOCO

2,963

3,001

3,040

3,078

3,117

HINDALCO

97

99

101

103

105

HINDUNILVR

888

896

901

909

914

ICICIBANK

232

235

237

241

243

IDEA

113

115

118

120

123

INDUSINDBK

967

977

983

992

998

INFY

1,218

1,230

1,238

1,251

1,259

ITC

330

333

335

338

341

KOTAKBANK

675

681

686

693

698

LT

1,241

1,253

1,261

1,273

1,281

LUPIN

1,539

1,557

1,573

1,592

1,608

M&M

1,283

1,302

1,323

1,343

1,364

MARUTI

3,607

3,636

3,680

3,709

3,754

NTPC

138

140

141

142

143

ONGC

207

208

209

211

212

POWERGRID

143

145

148

150

152

RELIANCE

1,014

1,026

1,047

1,059

1,081

SBIN

182

185

187

189

191

SUNPHARMA

819

824

830

835

841

TCS

2,380

2,415

2,475

2,510

2,570

TATAMTRDVR

295

298

302

306

309

TATAMOTORS

395

400

405

409

415

TATAPOWER

69

70

71

72

73

TATASTEEL

330

344

351

365

373

TECHM

470

477

483

489

495

ULTRACEMCO

3,294

3,336

3,395

3,438

3,497

WIPRO

582

592

600

610

617

YESBANK

867

874

885

892

902

ZEEL

390

395

403

408

417

4

Technical & Derivatives Report

April 21, 2016

Research Team Tel: 022 - 39357800

For Technical Queries

For Derivatives Queries

DISCLAIMER

Angel Broking Private Limited (hereinafter referred to as “Angel”) is a registered Member of National Stock Exchange of India Limited,

Bombay Stock Exchange Limited and MCX Stock Exchange Limited. It is also registered as a Depository Participant with CDSL and

Portfolio Manager with SEBI. It also has registration with AMFI as a Mutual Fund Distributor. Angel Broking Private Limited is a

registered entity with SEBI for Research Analyst in terms of SEBI (Research Analyst) Regulations, 2014 vide registration number

INH000000164. Angel or its associates has not been debarred/ suspended by SEBI or any other regulatory authority for accessing

/dealing in securities Market. Angel or its associates including its relatives/analyst do not hold any financial interest/beneficial

ownership of more than 1% in the company covered by Analyst. Angel or its associates/analyst has not received any compensation /

managed or co-managed public offering of securities of the company covered by Analyst during the past twelve months. Angel/analyst

has not served as an officer, director or employee of company covered by Analyst and has not been engaged in market making activity

of the company covered by Analyst.

This document is solely for the personal information of the recipient, and must not be singularly used as the basis of any investment

decision. Nothing in this document should be construed as investment or financial advice. Each recipient of this document should

make such investigations as they deem necessary to arrive at an independent evaluation of an investment in the securities of the

companies referred to in this document (including the merits and risks involved), and should consult their own advisors to determine

the merits and risks of such an investment.

Reports based on technical and derivative analysis center on studying charts of a stock's price movement, outstanding positions and

trading volume, as opposed to focusing on a company's fundamentals and, as such, may not match with a report on a company's

fundamentals.

The information in this document has been printed on the basis of publicly available information, internal data and other reliable

sources believed to be true, but we do not represent that it is accurate or complete and it should not be relied on as such, as this

document is for general guidance only. Angel Broking Pvt. Limited or any of its affiliates/ group companies shall not be in any way

responsible for any loss or damage that may arise to any person from any inadvertent error in the information contained in this report.

Angel Broking Pvt. Limited has not independently verified all the information contained within this document. Accordingly, we cannot

testify, nor make any representation or warranty, express or implied, to the accuracy, contents or data contained within this document.

While Angel Broking Pvt. Limited endeavors to update on a reasonable basis the information discussed in this material, there may be

regulatory, compliance, or other reasons that prevent us from doing so.

This document is being supplied to you solely for your information, and its contents, information or data may not be reproduced,

redistributed or passed on, directly or indirectly.

Neither Angel Broking Pvt. Limited, nor its directors, employees or affiliates shall be liable for any loss or damage that may arise from

or in connection with the use of this information.

Note: Please refer to the important ‘Stock Holding Disclosure' report on the Angel website (Research Section). Also, please refer to the

latest update on respective stocks for the disclosure status in respect of those stocks. Angel Broking Pvt. Limited and its affiliates may

have investment positions in the stocks recommended in this report.

5