Technical & Derivatives Report

October 20, 2016

Sensex (27984) / Nifty (8659)

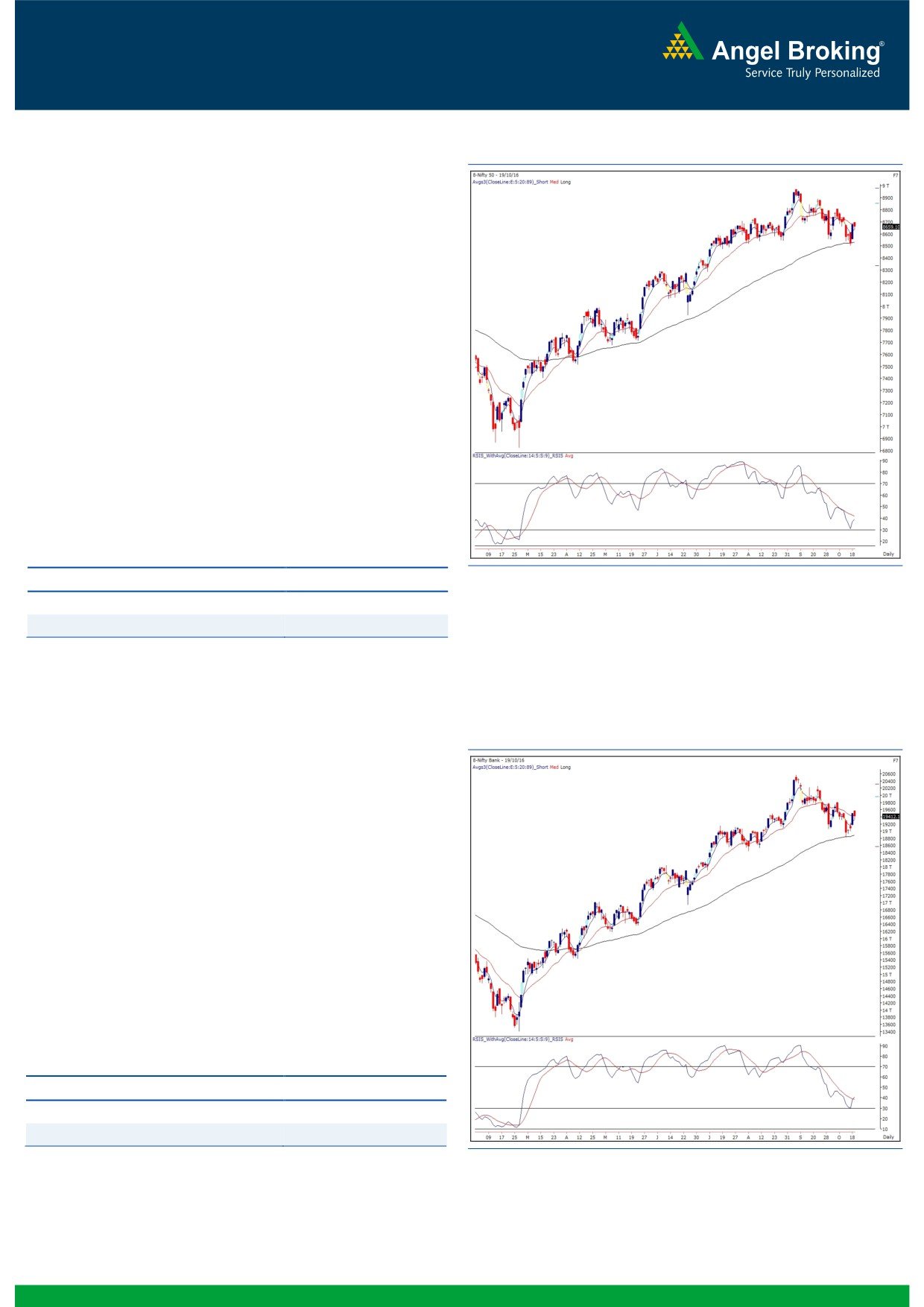

Exhibit 1: Nifty Daily Chart

Yesterday, the Nifty opened with a marginal gap up; however,

lack of follow up buying led to a rangebound trading session and

the index ended the day with a marginal loss of 0.22 percent.

During the recent corrective move, the Nifty index had an unfilled

gap in the range of 8704-8681. In yesterday's session, the bulls

were not able to carry forward its previous day's momentum

owing to the gap resistance, which also coincides with the 61.80

percent retracement level of the recent corrective move from 8807

to 8506. Till the 'Lower Top Lower Bottom' structure is intact on

the daily charts, there is a higher probability of the ongoing up

move of being a pullback rally within a corrective trend. Hence,

untill the index crosses the recent swing high of 8746, we

continue to advise traders to remain cautious and not to

participate aggressively in the pullback move. The intraday

supports for the Nifty index are placed around 8615 and 8575

whereas resistances are seen around 8710 and 8746.

Key Levels

Support 1 - 8615

Resistance 1 - 8710

Support 2 - 8575

Resistance 2 - 8746

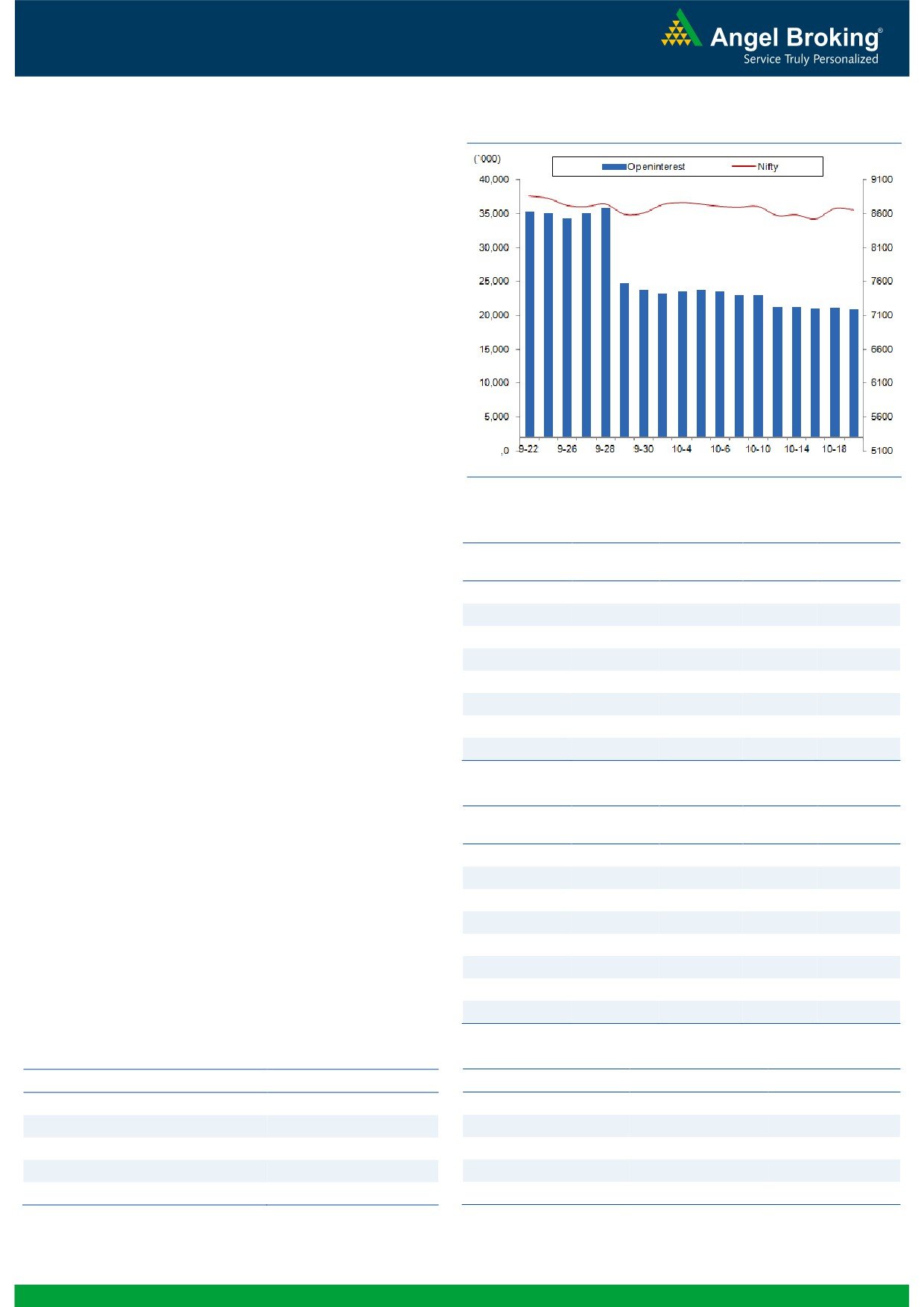

Exhibit 2: Nifty Bank Daily Chart

Nifty Bank Outlook - (19412)

Post a positive opening, the Nifty Bank index too corrected

marginally and traded in a narrow range throughout the session.

The banking index ended the session with a marginal loss of 0.43

percent over its previous session's close.

The broader chart structure still remains unchanged as the 'Lower

Top Lower Bottom' structure is still intact on the daily chart.

Hence, we continue to advise traders to wait on sidelines for

further price development and not to participate aggressively with

positive bias. The near term resistances for the index are seen

around 19617 and 19817 which are the 50% retracement and

the recent ‘lower top’ resistance levels respectively. The intraday

supports for the index are placed around 19310 and 19240.

Key Levels

Support 1 - 19310

Resistance 1 - 19617

Support 2 - 19240

Resistance 2 - 19817

1

Technical & Derivatives Report

October 20, 2016

Comments

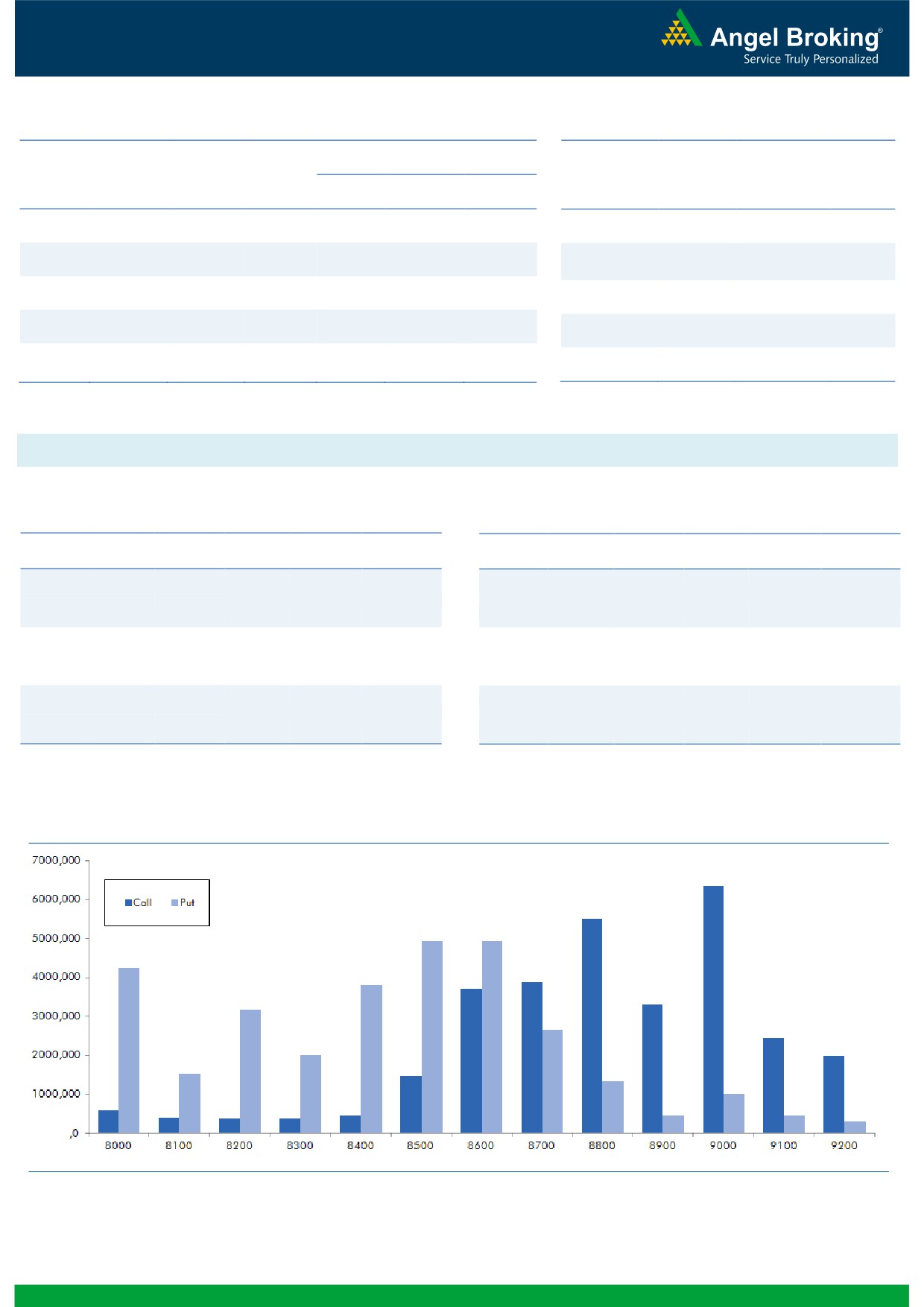

Nifty Vs OI

The Nifty futures open interest has decreased by 1.09%

BankNifty futures open interest has decreased by 2.23%

as market closed at 8659.10 levels.

The Nifty October future closed with a premium of 6.15

against the premium of 1.95 points in last trading

session. The November series closed at a premium of

46.20 points.

The Implied Volatility of at the money options has

decreased from 12.87% to 12.30%. At the same time,

the PCR-OI of Nifty has remained unchanged at 0.96

levels.

The total OI of the market is Rs. 2,85,374/- cr. and the

stock futures OI is Rs. 81,077/- cr.

Few of the liquid counters where we have seen high cost

of carry are GMRINFRA, IDEA, FEDERALBNK,

SYNDIBANK and JPASSOCIAT.

Views

OI Gainers

Yesterday, FIIs were net sellers in both cash market

OI

PRICE

SCRIP

OI

PRICE

segment and in index futures. They sold equities to the

CHG. (%)

CHG. (%)

tune of Rs. 283 crores. While, in index futures they were

IDFCBANK

22696000

22.07

77.55

1.04

net sellers of Rs. 112 crores with marginal change in

TORNTPHARM

352800

18.71

1623.15

-1.51

open interest, suggesting blend of long unwinding and

HINDZINC

9843200

17.72

249.05

1.22

www.angelbroking.com

fresh short formation in last trading sessions.

PETRONET

6864000

14.34

384.80

-4.23

On Index Options front, FIIs bought of worth Rs. 133

RELCAPITAL

11787000

10.55

545.15

-1.39

crores with good amount of rise in OI. Yesterday, in both

TORNTPOWER

1863000

10.50

169.75

-0.61

call and put options of Nifty we hardly saw any

TECHM

9544700

10.18

426.20

-0.04

meaningful open interest additions. 8750 call and 8600

IDBI

43392000

9.49

73.10

3.84

put options were comparatively active and they also

added some fresh positions. Maximum OI in October

OI Losers

series is placed at 9000 call and 8500 put options.

OI

PRICE

SCRIP

OI

PRICE

Despite, Nifty bounced from its support zone 8500-8550

CHG. (%)

CHG. (%)

levels, we hardly saw any buying figure in Index Futures

CEATLTD

1451800

-15.24

1290.80

-3.32

by FIIs. In fact, they formed fresh short positions in

BHEL

44620000

-10.76

141.80

3.73

November series. Most of the heavy weight counters that

DCBBANK

2146500

-9.32

127.75

0.31

bounced were mainly due to short covering. We believe,

COLPAL

2152500

-7.85

940.05

1.99

Nifty may show some strength for current expiry, but the

PAGEIND

39150

-5.43

16162.45

-1.96

overall trend remains negative. Those traders who are

HDIL

31528000

-4.83

79.40

-1.00

long in index futures should avoid rolling their positions

BANKINDIA

33012000

-4.60

113.00

0.31

for next series.

RELIANCE

20095000

-4.55

1087.70

0.54

Historical Volatility

Put-Call Ratio

SCRIP

HV

SCRIP

PCR-OI

PCR-VOL

HAVELLS

44.03

NIFTY

0.96

0.89

WIPRO

22.77

BANKNIFTY

1.28

1.01

ITC

24.39

INFY

0.50

0.63

BIOCON

38.61

ICICIBANK

0.91

0.82

STAR

33.38

RELIANCE

0.45

0.40

2

Technical & Derivatives Report

October 20, 2016

FII Statistics for 19, October 2016

Turnover on 19, October 2016

Open Interest

No. of

Turnover

Change

Detail

Buy

Sell

Net

Instrument

Value

Change

Contracts

( in Cr. )

(%)

Contracts

(in Cr.)

(%)

INDEX

INDEX

960.68

1072.33

(111.65)

222097

14878.51

0.23

183658

12802.39

-35.30

FUTURES

FUTURES

INDEX

INDEX

37598.26

37465.55

132.71

1129206

75279.14

2.50

4413458

318477.48

-9.81

OPTIONS

OPTIONS

STOCK

7218.10

7106.94

111.17

883200

58606.57

0.05

STOCK

FUTURES

577569

41925.20

-2.51

FUTURES

STOCK

STOCK

4611.45

4505.27

106.18

114484

7703.31

2.92

OPTIONS

368065

27016.27

-6.88

OPTIONS

TOTAL

50388.49

50150.08

238.41

2348987

156467.53

1.37

TOTAL

5542750

400221.34

-10.05

Nifty Spot = 8659.10

Lot Size = 75

Bull-Call Spreads

Bear-Put Spreads

Action

Strike

Price

Risk

Reward

BEP

Action

Strike

Price

Risk

Reward

BEP

Buy

8700

47.95

Buy

8700

81.10

30.55

69.45

8730.55

40.25

59.75

8659.75

Sell

8800

17.40

Sell

8600

40.85

Buy

8700

47.95

Buy

8700

81.10

41.75

158.25

8741.75

60.75

139.25

8639.25

Sell

8900

6.20

Sell

8500

20.35

Buy

8800

17.40

Buy

8600

40.85

11.20

88.80

8811.20

20.50

79.50

8579.50

Sell

8900

6.20

Sell

8500

20.35

Note: Above mentioned Bullish or Bearish Spreads in Nifty (October Series) are given as an information and not as a recommendation.

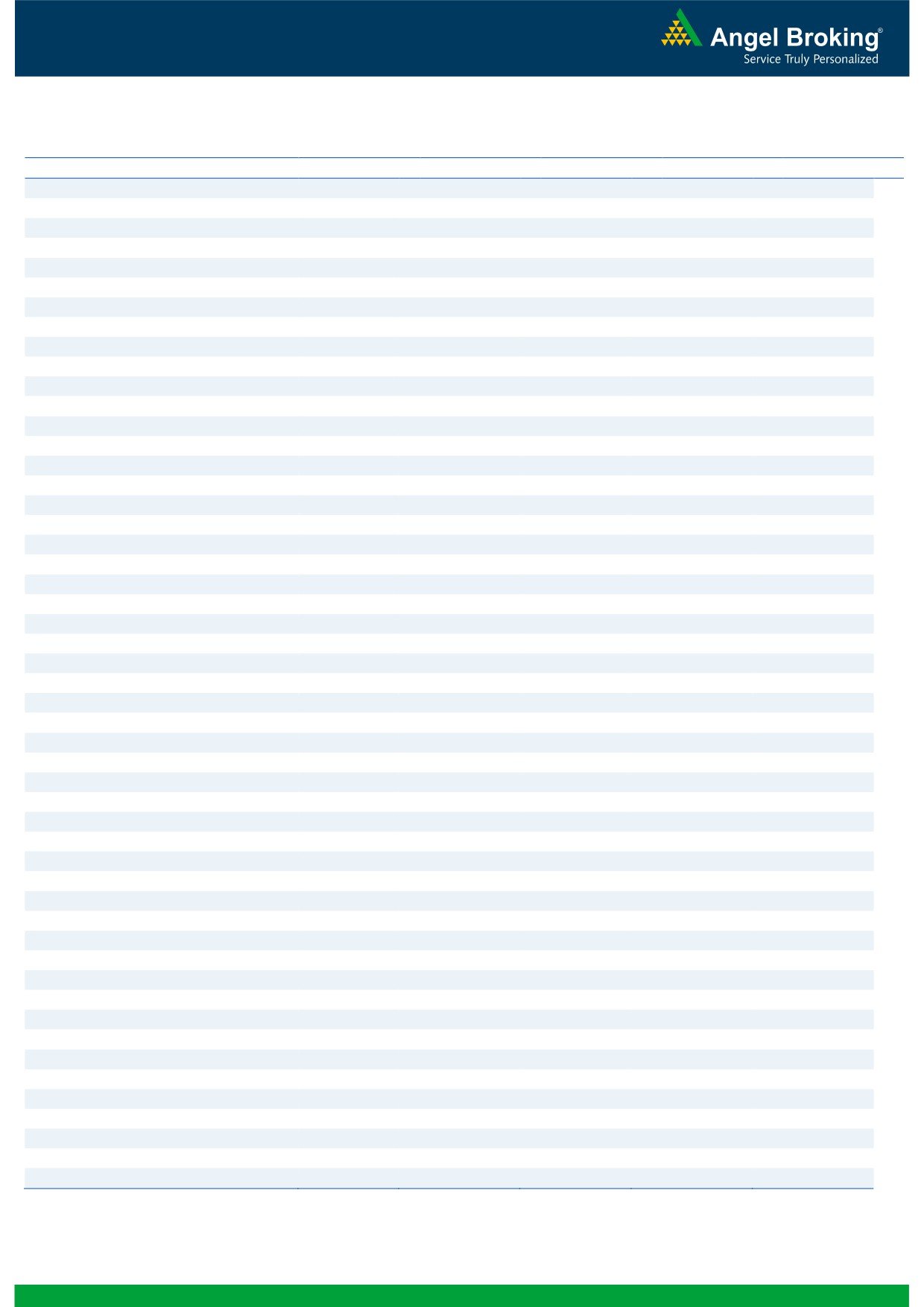

Nifty Put-Call Analysis

3

Technical & Derivatives Report

October 20, 2016

Daily Pivot Levels for Nifty Constituents

Scrips

S2

S1

PIVOT

R1

R2

ACC

1,594

1,602

1,615

1,623

1,635

ADANIPORTS

259

265

269

276

280

AMBUJACEM

247

249

251

254

256

ASIANPAINT

1,151

1,160

1,172

1,181

1,193

AUROPHARMA

816

822

831

837

846

AXISBANK

523

529

536

542

548

BAJAJ-AUTO

2,741

2,765

2,792

2,816

2,843

BANKBARODA

152

154

156

157

159

BHEL

137

139

141

144

146

BPCL

648

654

662

668

676

BHARTIARTL

301

304

307

310

312

INFRATEL

350

354

358

363

367

BOSCH

22,005

22,191

22,395

22,581

22,785

CIPLA

588

592

595

600

603

COALINDIA

310

311

313

314

316

DRREDDY

3,034

3,050

3,062

3,078

3,090

EICHERMOT

24,660

24,819

25,059

25,218

25,458

GAIL

422

429

437

444

452

GRASIM

974

978

984

989

994

HCLTECH

817

824

833

839

848

HDFCBANK

1,241

1,250

1,256

1,265

1,271

HDFC

1,323

1,332

1,346

1,356

1,369

HEROMOTOCO

3,314

3,338

3,378

3,402

3,442

HINDALCO

148

149

152

153

156

HINDUNILVR

837

841

849

853

861

ICICIBANK

258

262

267

270

275

IDEA

70

73

76

79

81

INDUSINDBK

1,195

1,203

1,210

1,218

1,225

INFY

1,031

1,037

1,041

1,046

1,051

ITC

234

237

241

244

248

KOTAKBANK

765

769

777

782

790

LT

1,464

1,478

1,489

1,503

1,514

LUPIN

1,474

1,493

1,506

1,525

1,538

M&M

1,300

1,314

1,326

1,340

1,353

MARUTI

5,560

5,582

5,615

5,637

5,670

NTPC

146

148

149

150

152

ONGC

274

277

278

281

282

POWERGRID

174

176

178

181

183

RELIANCE

1,075

1,081

1,088

1,094

1,101

SBIN

253

254

256

257

259

SUNPHARMA

740

745

752

757

764

TCS

2,352

2,374

2,392

2,413

2,432

TATAMTRDVR

354

358

360

364

367

TATAMOTORS

540

545

550

555

560

TATAPOWER

77

79

81

82

84

TATASTEEL

418

422

425

429

432

TECHM

409

417

427

435

444

ULTRACEMCO

3,984

4,008

4,029

4,053

4,074

WIPRO

479

487

492

500

505

YESBANK

1,261

1,276

1,292

1,308

1,324

ZEEL

498

503

510

515

522

4

Technical & Derivatives Report

October 20, 2016

Research Team Tel: 022 - 39357800

For Technical Queries

For Derivatives Queries

DISCLAIMER

Angel Broking Private Limited (hereinafter referred to as “Angel”) is a registered Member of National Stock Exchange of India Limited,

Bombay Stock Exchange Limited and Metropolitan Stock Exchange Limited. It is also registered as a Depository Participant with CDSL

and Portfolio Manager with SEBI. It also has registration with AMFI as a Mutual Fund Distributor. Angel Broking Private Limited is a

registered entity with SEBI for Research Analyst in terms of SEBI (Research Analyst) Regulations, 2014 vide registration number

INH000000164. Angel or its associates has not been debarred/ suspended by SEBI or any other regulatory authority for accessing

/dealing in securities Market. Angel or its associates/analyst has not received any compensation / managed or co-managed public

offering of securities of the company covered by Analyst during the past twelve months.

This document is solely for the personal information of the recipient, and must not be singularly used as the basis of any investment

decision. Nothing in this document should be construed as investment or financial advice. Each recipient of this document should

make such investigations as they deem necessary to arrive at an independent evaluation of an investment in the securities of the

companies referred to in this document (including the merits and risks involved), and should consult their own advisors to determine

the merits and risks of such an investment.

Reports based on technical and derivative analysis center on studying charts of a stock's price movement, outstanding positions and

trading volume, as opposed to focusing on a company's fundamentals and, as such, may not match with a report on a company's

fundamentals. Investors are advised to refer the Fundamental and Technical Research Reports available on our website to evaluate the

contrary view, if any.

The information in this document has been printed on the basis of publicly available information, internal data and other reliable

sources believed to be true, but we do not represent that it is accurate or complete and it should not be relied on as such, as this

document is for general guidance only. Angel Broking Pvt. Limited or any of its affiliates/ group companies shall not be in any way

responsible for any loss or damage that may arise to any person from any inadvertent error in the information contained in this report.

Angel Broking Pvt. Limited has not independently verified all the information contained within this document. Accordingly, we cannot

testify, nor make any representation or warranty, express or implied, to the accuracy, contents or data contained within this document.

While Angel Broking Pvt. Limited endeavors to update on a reasonable basis the information discussed in this material, there may be

regulatory, compliance, or other reasons that prevent us from doing so.

This document is being supplied to you solely for your information, and its contents, information or data may not be reproduced,

redistributed or passed on, directly or indirectly.

Neither Angel Broking Pvt. Limited, nor its directors, employees or affiliates shall be liable for any loss or damage that may arise from

or in connection with the use of this information.

5