Technical & Derivatives Report

January 20, 2016

Sensex (24480) / Nifty (7435)

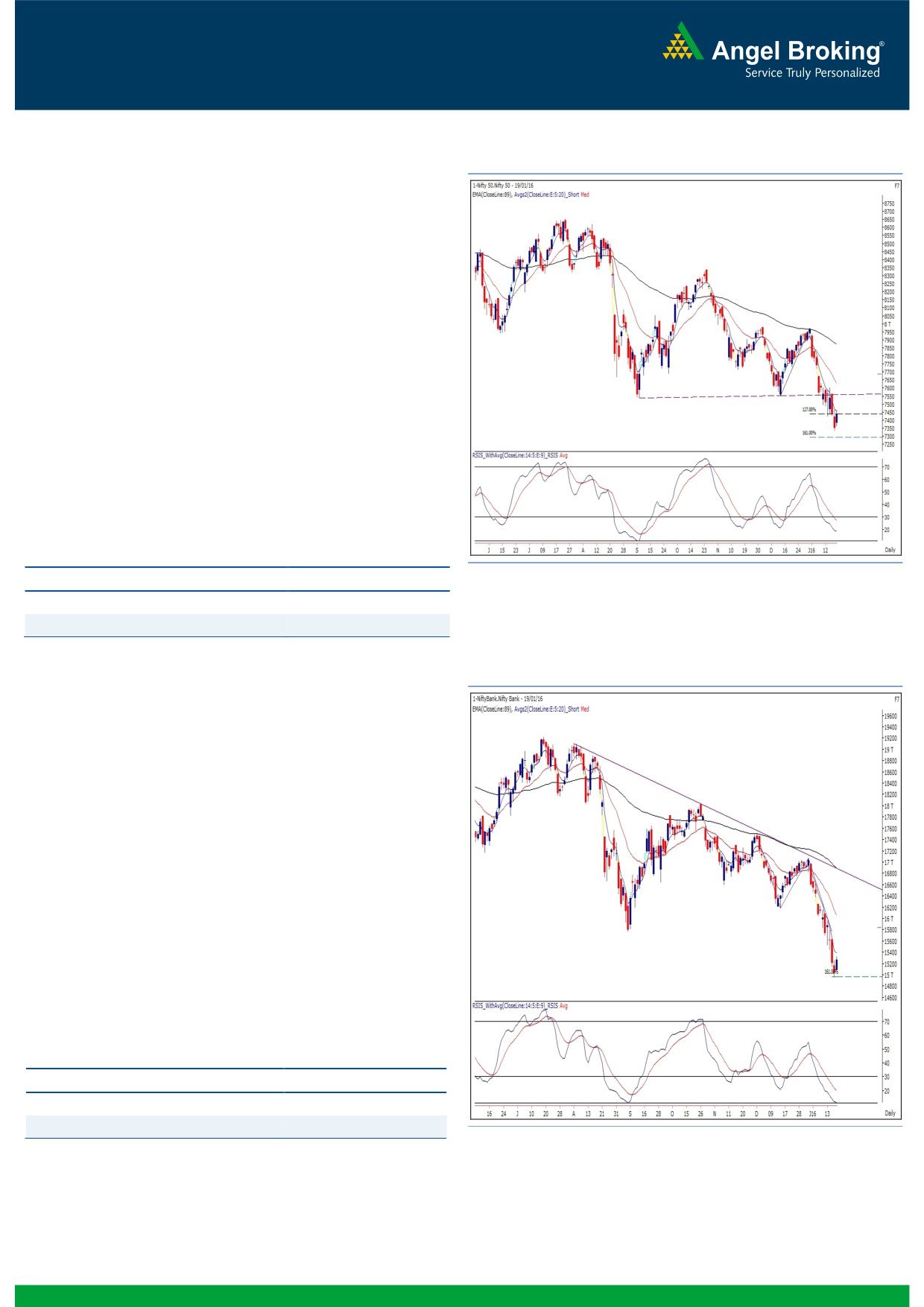

Exhibit 1: Nifty Daily Chart

Yesterday, our benchmark index opened with an upside gap

owing to positive cues from the Asian bourses. During the

remaining part of the day, the Nifty managed to give steady

up move to close with more than a percent gains. Yesterday,

we witnessed a relief rally across the globe, which certainly

had a rub-off effect on our market. We would have been more

convinced on this relief rally if the Nifty had tested 7320 -

7300 levels. Going forward, we would closely keep our eyes

on Monday’s high of 7463.65. If the Nifty manages to surpass

this level on a sustainable basis then we may witness a

continuation of this bounce towards 7520 - 7580 levels.

However, a failure to sustain above this level may trim its

previous day’s gains. In case of the second scenario, it’s

advisable not to short the index for smaller moves as we are

seeing a strong support zone around 7340 - 7300. Hence, it

would be advisable to cover short positions at the mentioned

support zone and wait for further market developments.

Key Levels

Support 1 - 7340

Resistance 1 - 7464

Support 2 - 7300

Resistance 2 - 7520

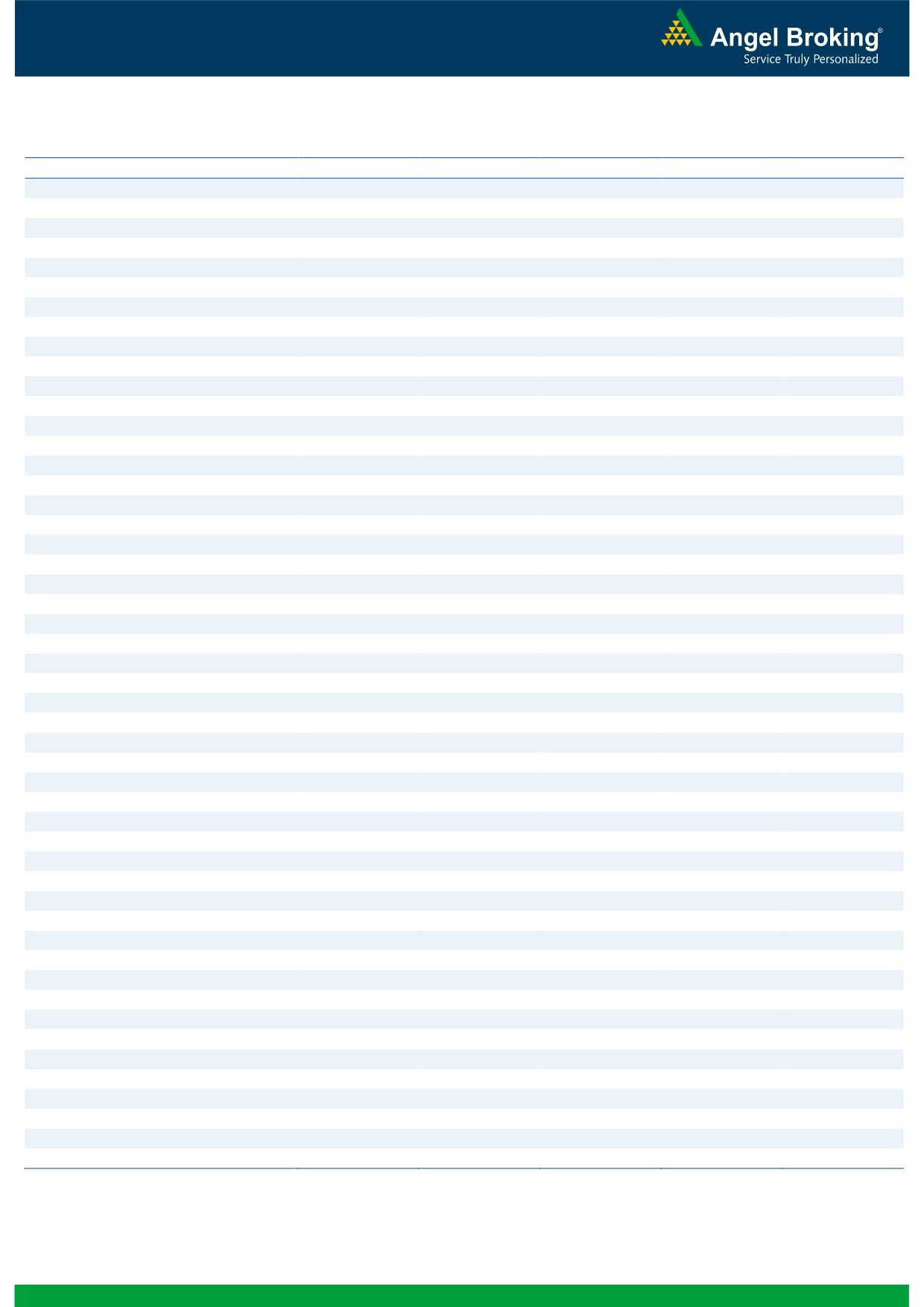

Exhibit 2: Bank Nifty Daily Chart

Bank Nifty Outlook - (15270)

The Nifty Bank index opened on a positive note and crept

higher throughout the session. Eventually, the banking index

ended the session with gains of 1.66 percent over its previous

close. After eleven trading sessions, the Nifty Bank index

managed to cross its previous day’s high, this shows some

relief for the Bulls. The index has moved higher from the

support zone in the weekly chart as we had mentioned in our

yesterday's report. The mentioned support also coincides with

a support of 161.80% retracement levels of the previous up

move in the daily chart. The 'RSI' indicator is in oversold zone

and is showing signs of pullback from the zone. Thus, the

index can give a pullback move in near term. The near term

support for the index are placed around 15086 and 14956

levels; whereas, resistances are seen around 15453 and

15650 levels.

Key Levels

Support 1 - 15086

Resistance 1 - 15453

Support 2 - 14956

Resistance 2 - 15650

1

Technical & Derivatives Report

January 20, 2016

Comments

Nifty Vs OI

The Nifty futures open interest has decreased by 1.25%

BankNifty futures open interest has decreased by 2.08%

as market closed at 7435.10.00 levels.

The Nifty January future closed at a premium of 3.00

points against a premium of 21.25 points. The February

series closed at a premium of 22.10 points.

The Implied Volatility of at the money options has

decreased from 18.43% to 15.94 %.

The total OI of the market is Rs. 2,51,471/- cr. and the

stock futures OI is Rs. 61,306/- cr.

Few of the liquid counters where we have seen high cost

of carry are JPASSOCIAT, UNITECH, NHPC, GMRINFRA

and HEXAWARE.

Views

OI Gainers

In equity segment, FIIs were net sellers to the tune of Rs.

OI

PRICE

858 crores. In Index Futures, they were net buyers of

SCRIP

OI

PRICE

CHG. (%)

CHG. (%)

worth Rs. 391 with marginal fall in OI, indicating blend

STAR

2188800

7.93

1053.85

3.43

of long build-up and short covering in last trading

M&M

3032000

7.87

1152.45

-1.51

session.

GODREJCP

152400

7.63

1212.30

0.10

In Index Options front, they bought of Rs. 794 crores with

NHPC

37287000

7.22

19.50

1.56

rise in open interest. In call options, we hardly saw any

BHARTIARTL

24520800

6.54

309.95

3.77

meaningful activity. 7500 call option was most active

added some OI. Whereas, in put options, 6900 strike

OI Losers

added decent build-up with fall in IV’s, which suggests

OI

PRICE

writing in this strike. While, some unwinding was witness

SCRIP

OI

PRICE

CHG. (%)

CHG. (%)

in 7300 strike price. Maximum build-up in current series

WOCKPHARMA

2974125

-12.10

1212.25

0.24

is visible in 7700 call and 7300 put options. At current

ENGINERSIN

2270400

-9.47

211.40

7.56

juncture, 7300 put option has highest OI and this is the

OIL

1020000

-8.31

342.90

1.20

immediate support for market. Thus, we advise traders

IRB

6203400

-8.00

223.20

4.79

not to go short in this market at current levels.

ASIANPAINT

5516400

-6.95

846.90

-0.71

Historical Volatility

Put-Call Ratio

SCRIP

HV

SCRIP

PCR-OI

PCR-VOL

ADANIPORTS

47.58

NIFTY

0.81

0.73

APOLLOHOSP

34.50

BANKNIFTY

0.73

0.70

IBULHSGFIN

50.22

SBIN

0.33

0.33

AXISBANK

45.94

RELIANCE

0.47

0.45

BHARTIARTL

34.01

INFY

0.94

0.87

Strategy Date

Symbol

Strategy

Status

January 04, 2016

SBIN

Ratio Bear Put Spread

Loss booked on Jan 15, 2016

January 11, 2016

TCS

Short Strangle

Profit booked on Jan 18, 2016

January 18, 2016

HINDUNILVR

Short Strangle

Active

2

Technical & Derivatives Report

January 20, 2016

FII Statistics for 19-January 2015

Turnover on 19-January 2015

Open Interest

No. of

Turnover

Change

Detail

Buy

Sell

Net

Instrument

Value

Change

Contracts

( in Cr. )

(%)

Contracts

(in Cr.)

(%)

INDEX

INDEX

2316.31

1925.50

390.81

309777

16541.47

(0.86)

312062

16242.27

-13.39

FUTURES

FUTURES

INDEX

INDEX

33306.25

32512.46

793.79

1504074

82227.77

5.05

3824987

210998.19

-13.51

OPTIONS

OPTIONS

STOCK

4637.61

4394.54

243.06

1104396

49647.34

(0.26)

STOCK

FUTURES

578114

26640.28

-12.75

FUTURES

STOCK

STOCK

3338.03

3503.96

(165.93)

94675

4350.28

1.74

OPTIONS

414265

20437.78

-2.82

OPTIONS

TOTAL

43598.20

42336.47

1261.73

3012922

152766.87

2.32

TOTAL

5129428

274318.52

-12.71

Nifty Spot = 7435.10

Lot Size = 75

Bull-Call Spreads

Bear-Put Spreads

Action

Strike

Price

Risk

Reward

BEP

Action

Strike

Price

Risk

Reward

BEP

Buy

7500

45.10

Buy

7400

57.40

27.30

72.70

7527.30

26.75

73.25

7373.25

Sell

7600

17.80

Sell

7300

30.65

Buy

7500

45.10

Buy

7400

57.40

39.05

160.95

7539.05

41.10

158.90

7358.90

Sell

7700

6.05

Sell

7200

16.30

Buy

7600

17.80

Buy

7300

30.65

11.75

88.25

7611.75

14.35

85.65

7285.65

Sell

7700

6.05

Sell

7200

16.30

Note: Above mentioned Bullish or Bearish Spreads in Nifty (Jan. Series) are given as an information and not as a recommendation.

Nifty Put-Call Analysis

3

Technical & Derivatives Report

January 20, 2016

Daily Pivot Levels for Nifty 50 Stocks

Scrips

S2

S1

PIVOT

R1

R2

ACC

1,211

1,223

1,235

1,247

1,258

ADANIPORTS

213

223

228

238

244

AMBUJACEM

187

189

191

193

195

ASIANPAINT

804

825

847

867

889

AXISBANK

368

381

388

401

408

BAJAJ-AUTO

2,207

2,237

2,264

2,293

2,321

BANKBARODA

121

123

126

128

131

BHARTIARTL

293

302

307

316

321

BHEL

133

139

142

148

151

BOSCHLTD

17,604

17,808

17,949

18,152

18,293

BPCL

870

883

895

907

919

CAIRN

103

109

112

118

121

CIPLA

576

587

594

605

612

COALINDIA

298

303

308

313

318

DRREDDY

2,797

2,856

2,901

2,960

3,005

GAIL

332

337

343

349

355

GRASIM

3,466

3,495

3,514

3,542

3,561

HCLTECH

766

802

836

872

906

HDFC

1,121

1,137

1,147

1,163

1,173

HDFCBANK

1,022

1,029

1,033

1,040

1,044

HEROMOTOCO

2,424

2,453

2,476

2,506

2,528

HINDALCO

69

71

72

73

75

HINDUNILVR

799

805

813

819

827

ICICIBANK

222

225

228

232

235

IDEA

108

112

115

120

122

INDUSINDBK

879

888

897

905

914

INFY

1,112

1,126

1,142

1,156

1,173

ITC

309

312

315

317

320

KOTAKBANK

657

663

669

675

682

LT

1,045

1,084

1,108

1,147

1,172

LUPIN

1,677

1,688

1,707

1,718

1,736

M&M

1,118

1,135

1,151

1,168

1,184

MARUTI

4,123

4,160

4,203

4,240

4,283

NTPC

132

134

136

137

140

ONGC

208

213

216

221

224

PNB

90

91

92

94

95

POWERGRID

132

134

137

139

142

RELIANCE

1,000

1,022

1,036

1,058

1,072

SBIN

178

180

184

187

190

VEDL

65

67

69

71

73

SUNPHARMA

775

785

791

800

806

TATAMOTORS

336

345

351

360

366

TATAPOWER

61

63

64

65

67

TATASTEEL

227

233

237

242

246

TCS

2,251

2,265

2,283

2,297

2,314

TECHM

503

508

515

519

526

ULTRACEMCO

2,597

2,618

2,637

2,657

2,676

WIPRO

530

536

544

550

558

YESBANK

646

664

675

693

704

ZEEL

383

389

394

400

405

4

Technical & Derivatives Report

January 20, 2016

Research Team Tel: 022 - 39357800

For Technical Queries

For Derivatives Queries

DISCLAIMER

Angel Broking Private Limited (hereinafter referred to as “Angel”) is a registered Member of National Stock Exchange of India Limited,

Bombay Stock Exchange Limited and MCX Stock Exchange Limited. It is also registered as a Depository Participant with CDSL and

Portfolio Manager with SEBI. It also has registration with AMFI as a Mutual Fund Distributor. Angel Broking Private Limited is a

registered entity with SEBI for Research Analyst in terms of SEBI (Research Analyst) Regulations, 2014 vide registration number

INH000000164. Angel or its associates has not been debarred/ suspended by SEBI or any other regulatory authority for accessing

/dealing in securities Market. Angel or its associates including its relatives/analyst do not hold any financial interest/beneficial

ownership of more than 1% in the company covered by Analyst. Angel or its associates/analyst has not received any compensation /

managed or co-managed public offering of securities of the company covered by Analyst during the past twelve months. Angel/analyst

has not served as an officer, director or employee of company covered by Analyst and has not been engaged in market making activity

of the company covered by Analyst.

This document is solely for the personal information of the recipient, and must not be singularly used as the basis of any investment

decision. Nothing in this document should be construed as investment or financial advice. Each recipient of this document should

make such investigations as they deem necessary to arrive at an independent evaluation of an investment in the securities of the

companies referred to in this document (including the merits and risks involved), and should consult their own advisors to determine

the merits and risks of such an investment.

Reports based on technical and derivative analysis center on studying charts of a stock's price movement, outstanding positions and

trading volume, as opposed to focusing on a company's fundamentals and, as such, may not match with a report on a company's

fundamentals.

The information in this document has been printed on the basis of publicly available information, internal data and other reliable

sources believed to be true, but we do not represent that it is accurate or complete and it should not be relied on as such, as this

document is for general guidance only. Angel Broking Pvt. Limited or any of its affiliates/ group companies shall not be in any way

responsible for any loss or damage that may arise to any person from any inadvertent error in the information contained in this report.

Angel Broking Pvt. Limited has not independently verified all the information contained within this document. Accordingly, we cannot

testify, nor make any representation or warranty, express or implied, to the accuracy, contents or data contained within this document.

While Angel Broking Pvt. Limited endeavors to update on a reasonable basis the information discussed in this material, there may be

regulatory, compliance, or other reasons that prevent us from doing so.

This document is being supplied to you solely for your information, and its contents, information or data may not be reproduced,

redistributed or passed on, directly or indirectly.

Neither Angel Broking Pvt. Limited, nor its directors, employees or affiliates shall be liable for any loss or damage that may arise from

or in connection with the use of this information.

Note: Please refer to the important ‘Stock Holding Disclosure' report on the Angel website (Research Section). Also, please refer to the

latest update on respective stocks for the disclosure status in respect of those stocks. Angel Broking Pvt. Limited and its affiliates may

have investment positions in the stocks recommended in this report.

5