Technical & Derivatives Report

October 19, 2016

Sensex (28051) / Nifty (8678)

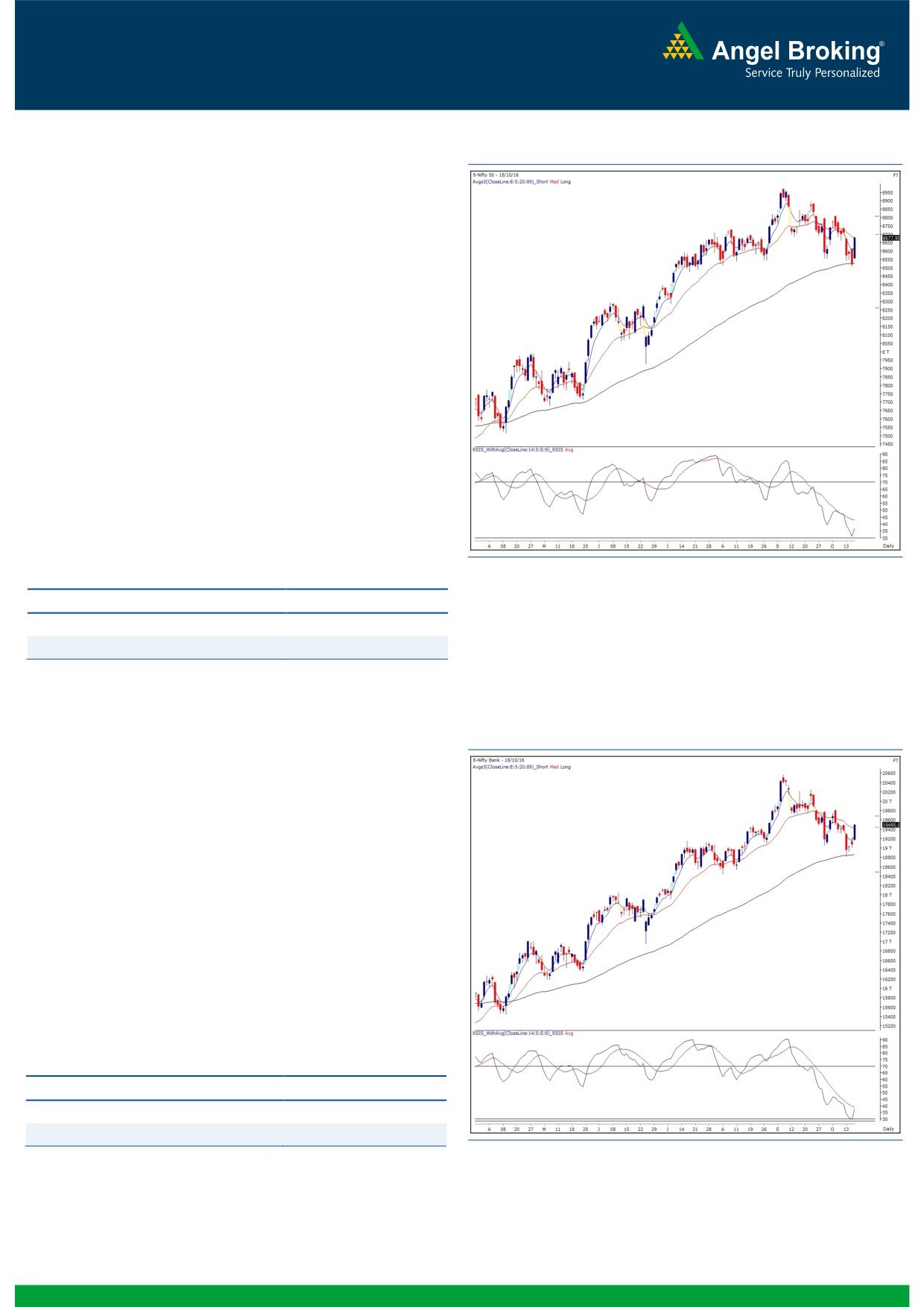

Exhibit 1: Nifty Daily Chart

Yesterday, the Nifty opened on a positive note as indicated by

SGX Nifty in opening trades. The Bulls were active from the initial

trades and kept the ball in their court throughout the session. By

closing, the index posted gains of 1.85 percent over its previous

session's close.

Yesterday's sharp upmove was a bit surprising to us as the index

posted a sharp upmove and formed a large bullish candle.

However, due to the reasons mentioned in our earlier reports, we

still believe that there is higher probability of the current upmove

being just a pullback rally which would retrace the recent fall and

then resume the corrective move. Hence, we continue to advise

traders not to participate aggressively in the pullback rally and

look for reversal signs at higher levels on the intraday charts.

Untill the index crosses the recent swing high of 8746, the 'Lower

Top Lower Bottom' structure will remain intact on hourly chart.

The intraday supports for the Nifty index are placed around 8615

and 8575 whereas resistances are seen around 8705 and 8746.

Key Levels

Support 1 - 8615

Resistance 1 - 8705

Support 2 - 8575

Resistance 2 - 8746

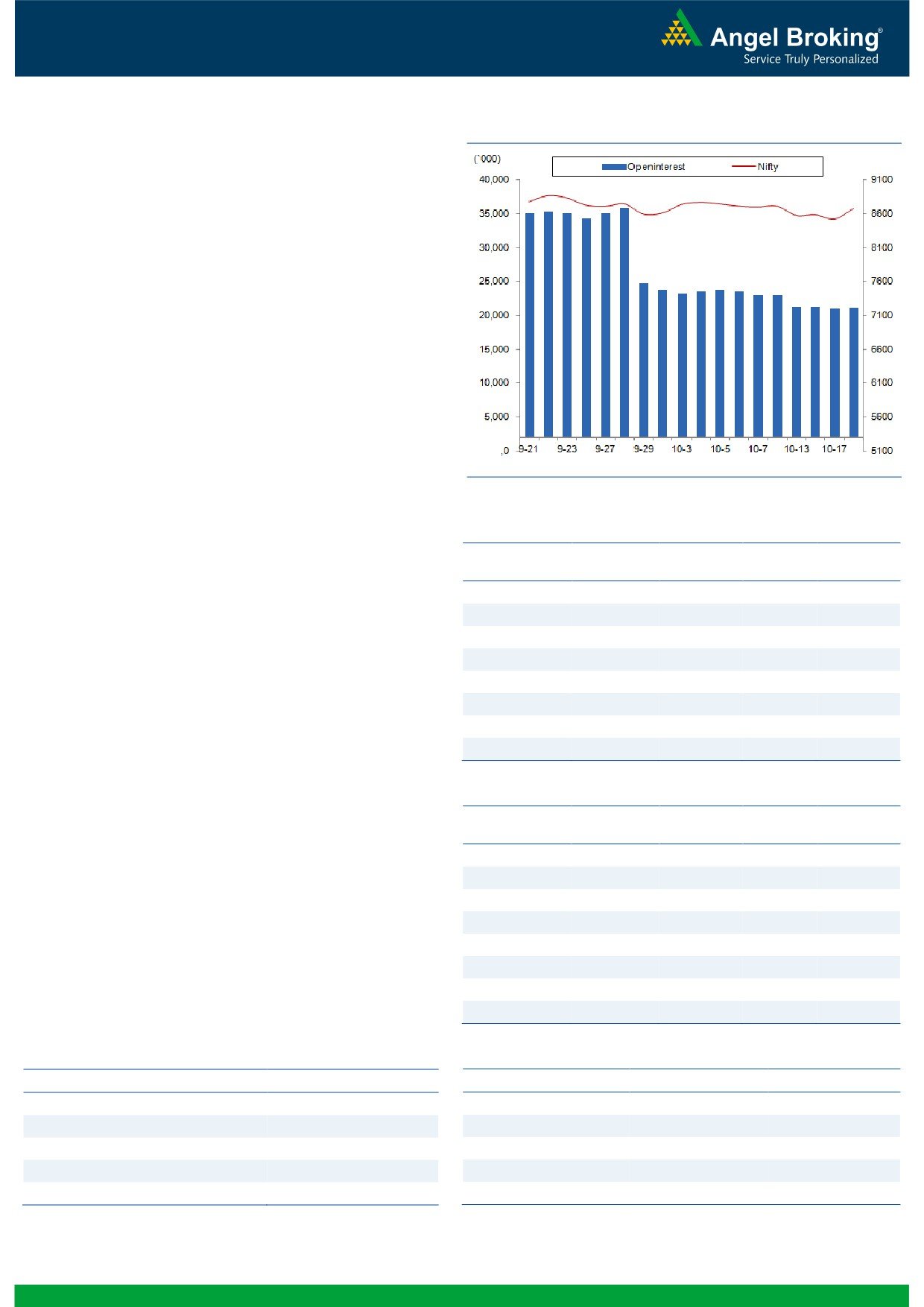

Exhibit 2: Nifty Bank Daily Chart

Nifty Bank Outlook - (19495)

The Nifty Bank index opened on a positive note and rallied higher

throughout the session to end the day with gains of 2.23 percent

over its previous session's close.

Although we have been mentioning about the probability of a

pullback rally in the index due to the cluster of supports in range

of 18795-18841, the velocity of upmove seen yesterday was

certainly not expected by us. On daily charts, the lower top lower

bottom structure is still intact and untill the same is violated, we

advise traders to wait on sidelines for further price development.

The intraday support for the Nifty Bank index are placed around

19355 and 19240 whereas resistances are seen around 19615

and 19775.

Key Levels

Support 1 - 19355

Resistance 1 - 19615

Support 2 - 19240

Resistance 2 - 19775

1

Technical & Derivatives Report

October 19, 2016

Comments

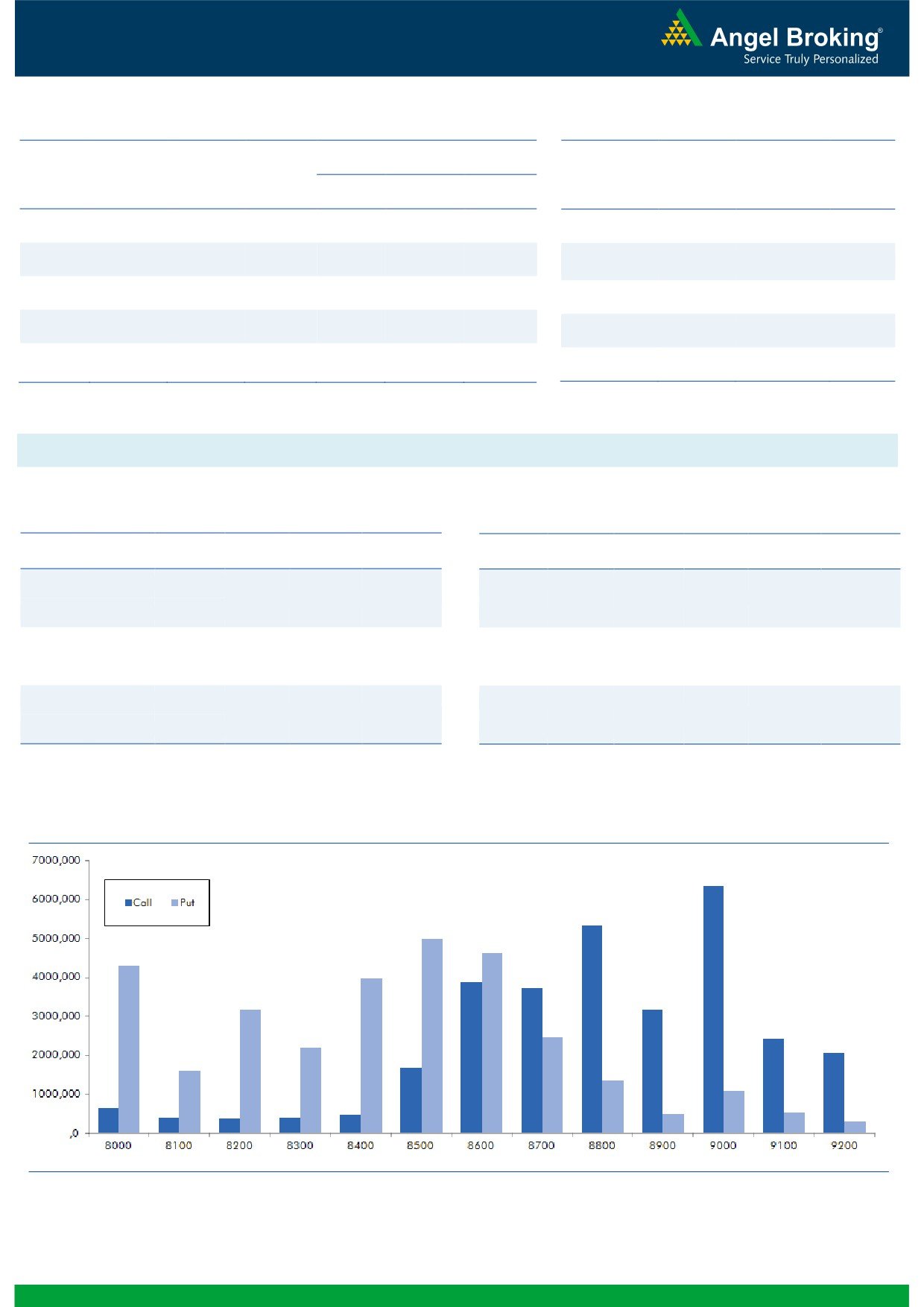

Nifty Vs OI

The Nifty futures open interest has increased by 0.40%

BankNifty futures open interest has decreased by 6.31%

as market closed at 8677.90 levels.

The Nifty October future closed with a premium of 1.95

against the premium of 3.50 points in last trading

session. The November series closed at a premium of

41.15 points.

The Implied Volatility of at the money options has

decreased from 14.78% to 12.87%. At the same time,

the PCR-OI of Nifty has increased from 0.87 to 0.96

levels.

The total OI of the market is Rs. 2,79,503/- cr. and the

stock futures OI is Rs. 80,460/- cr.

Few of the liquid counters where we have seen high cost

of carry are ANDHRABANK, IDFC, INFRATEL, PIDILITIND

and SINTEX.

Views

Yesterday, FIIs were net buyer in cash market segment to

OI Gainers

the tune of Rs. 345 crores. While, in index futures they

OI

PRICE

SCRIP

OI

PRICE

CHG. (%)

CHG. (%)

were net sellers of Rs. 730 crores with rise in open

IOC

31176000

97.19

321.95

0.34

interest, suggesting fresh short formation in last trading

HINDZINC

8361600

25.26

246.05

2.07

sessions.

HAVELLS

4398000

23.12

431.60

1.68

On Index Options front, FIIs bought of worth Rs. 3057ng.com

ARVIND

5866000

21.65

358.80

2.34

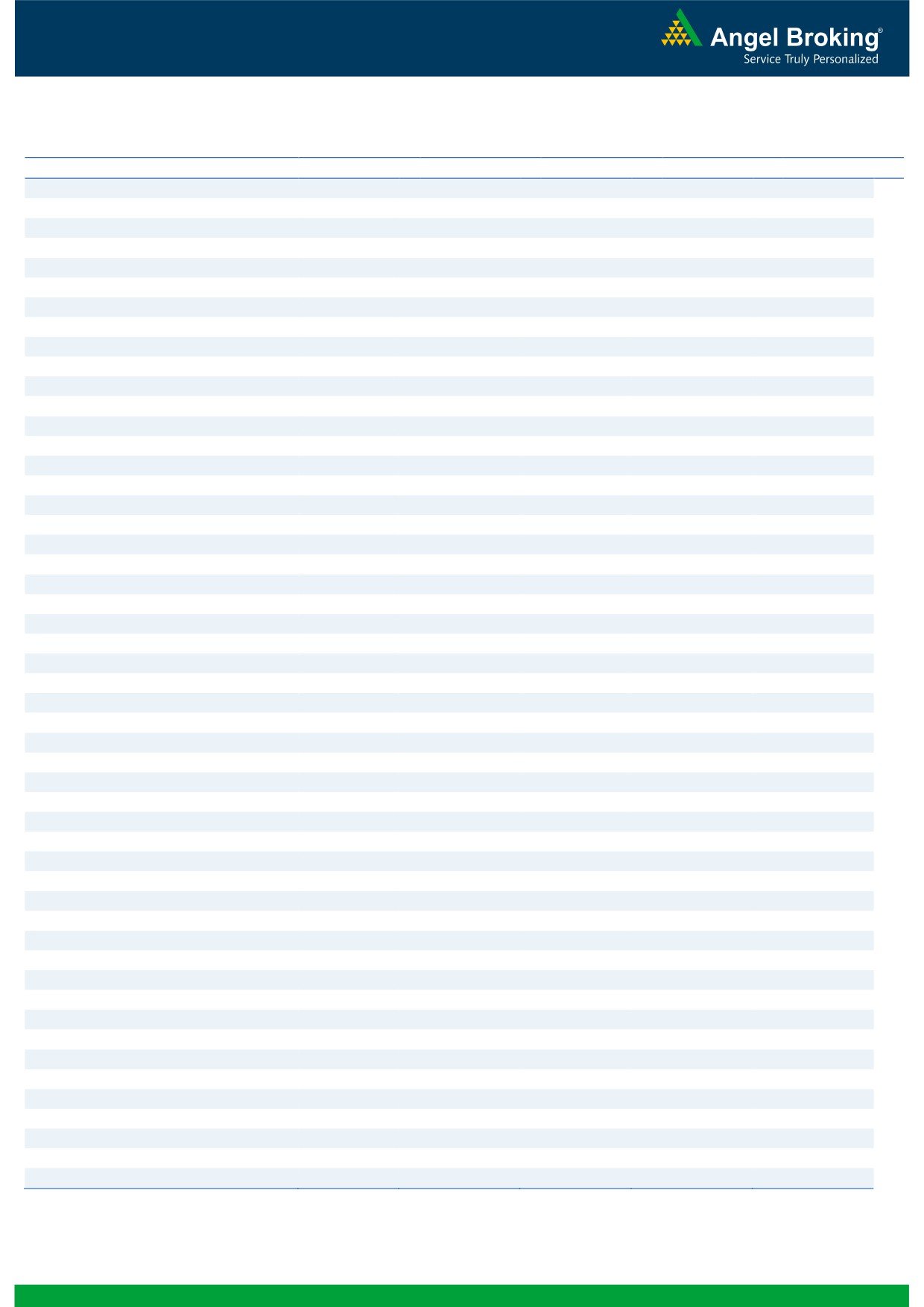

crores with marginal change in OI. In call options, we

TORNTPOWER

1686000

19.32

170.80

-0.15

hardly saw any strike price adding relevant open interest.

MINDTREE

3418400

18.56

478.30

-2.29

However, good amount of unwinding was visible in

MRF

49800

16.94

51826.65

3.75

8500-9000 call options, these is mostly covering of

shorts made earlier. While, in put options, 8600-8700

L&TFH

41805000

12.66

101.10

2.22

strikes added some positions. Maximum OI in October

series is placed at 9000 call and 8500 put options.

OI Losers

Despite, Nifty bounced more than 150 points, we saw

OI

PRICE

SCRIP

OI

PRICE

FIIs forming fresh short positions in Index Futures

CHG. (%)

CHG. (%)

DCBBANK

2367000

-6.90

127.35

0.79

yesterday and these short were formed in November

HDFC

11690500

-5.16

1355.50

3.72

series. Yesterday, we saw good amount of short covering

ORIENTBANK

14280000

-4.38

127.60

3.53

in call options by FIIs, creating uncertainty for Nifty

HINDPETRO

20913900

-4.11

439.70

0.46

closing below 8650-8700 levels. While, we witness good

amount of long formation in BankNifty call options

ALBK

16790000

-3.73

75.50

2.79

19600 and 19700. Thus, the above data indicates

TCS

4315750

-3.69

2396.95

1.65

market may show some strength in current series but the

SIEMENS

817500

-3.65

1234.30

2.06

trend remains negative for short term.

CIPLA

6901000

-3.10

593.10

1.19

Historical Volatility

Put-Call Ratio

SCRIP

HV

SCRIP

PCR-OI

PCR-VOL

DIVISLAB

29.12

NIFTY

0.96

0.99

LICHSGFIN

44.34

BANKNIFTY

1.30

0.89

TECHM

32.63

INFY

0.50

0.55

HCLTECH

25.03

ICICIBANK

0.99

0.56

HDFC

32.61

RELIANCE

0.43

0.37

2

Technical & Derivatives Report

October 19, 2016

FII Statistics for 18, October 2016

Turnover on 18, October 2016

Open Interest

No. of

Turnover

Change

Detail

Buy

Sell

Net

Instrument

Value

Change

Contracts

( in Cr. )

(%)

Contracts

(in Cr.)

(%)

INDEX

INDEX

2237.11

2966.91

(729.80)

221591

14854.53

3.27

284849

19786.08

16.42

FUTURES

FUTURES

INDEX

INDEX

45216.86

42159.37

3057.48

1101643

73613.29

0.74

5030151

353136.50

27.65

OPTIONS

OPTIONS

STOCK

7668.41

6445.04

1223.37

882800

58457.74

0.62

STOCK

FUTURES

594681

43006.26

5.62

FUTURES

STOCK

STOCK

5049.19

5001.70

47.49

111232

7491.70

5.63

OPTIONS

398015

29011.73

-0.64

OPTIONS

TOTAL

60171.58

56573.03

3598.55

2317266

154417.27

1.15

TOTAL

6307696

444940.56

22.38

Nifty Spot = 8677.90

Lot Size = 75

Bull-Call Spreads

Bear-Put Spreads

Action

Strike

Price

Risk

Reward

BEP

Action

Strike

Price

Risk

Reward

BEP

Buy

8700

59.55

Buy

8700

77.80

34.30

65.70

8734.30

38.25

61.75

8661.75

Sell

8800

25.25

Sell

8600

39.55

Buy

8700

59.55

Buy

8700

77.80

49.45

150.55

8749.45

58.20

141.80

8641.80

Sell

8900

10.10

Sell

8500

19.60

Buy

8800

25.25

Buy

8600

39.55

15.15

84.85

8815.15

19.95

80.05

8580.05

Sell

8900

10.10

Sell

8500

19.60

Note: Above mentioned Bullish or Bearish Spreads in Nifty (October Series) are given as an information and not as a recommendation.

Nifty Put-Call Analysis

3

Technical & Derivatives Report

October 19, 2016

Daily Pivot Levels for Nifty Constituents

Scrips

S2

S1

PIVOT

R1

R2

ACC

1,581

1,598

1,608

1,626

1,636

ADANIPORTS

245

256

263

273

280

AMBUJACEM

241

246

249

254

257

ASIANPAINT

1,150

1,162

1,178

1,190

1,206

AUROPHARMA

802

819

828

845

854

AXISBANK

513

523

528

538

544

BAJAJ-AUTO

2,732

2,762

2,786

2,817

2,841

BANKBARODA

150

153

154

157

159

BHEL

131

133

135

138

140

BPCL

638

647

655

665

673

BHARTIARTL

293

300

304

311

315

INFRATEL

344

350

357

362

369

BOSCH

22,026

22,256

22,410

22,639

22,793

CIPLA

578

585

590

597

601

COALINDIA

310

311

313

314

316

DRREDDY

3,007

3,026

3,040

3,059

3,073

EICHERMOT

24,476

24,773

24,996

25,293

25,517

GAIL

422

426

430

434

438

GRASIM

967

973

978

984

989

HCLTECH

803

819

828

843

852

HDFCBANK

1,231

1,245

1,252

1,266

1,273

HDFC

1,289

1,322

1,340

1,373

1,391

HEROMOTOCO

3,353

3,381

3,408

3,437

3,464

HINDALCO

148

150

152

154

156

HINDUNILVR

846

851

854

859

862

ICICIBANK

255

263

267

275

279

IDEA

70

71

73

74

75

INDUSINDBK

1,197

1,204

1,212

1,218

1,226

INFY

1,022

1,031

1,036

1,044

1,049

ITC

238

242

244

248

251

KOTAKBANK

765

771

776

782

787

LT

1,436

1,462

1,477

1,503

1,518

LUPIN

1,435

1,458

1,473

1,496

1,511

M&M

1,311

1,322

1,329

1,340

1,346

MARUTI

5,552

5,589

5,617

5,655

5,683

NTPC

146

147

148

149

150

ONGC

271

274

277

280

284

POWERGRID

174

175

176

178

179

RELIANCE

1,055

1,068

1,075

1,089

1,096

SBIN

252

255

256

258

260

SUNPHARMA

732

738

741

747

751

TCS

2,329

2,365

2,390

2,426

2,451

TATAMTRDVR

355

359

362

367

370

TATAMOTORS

546

550

553

557

560

TATAPOWER

77

78

78

79

80

TATASTEEL

407

416

421

430

436

TECHM

396

410

421

435

446

ULTRACEMCO

3,957

3,990

4,020

4,053

4,083

WIPRO

469

476

480

487

491

YESBANK

1,239

1,265

1,281

1,307

1,323

ZEEL

489

502

511

523

532

4

Technical & Derivatives Report

October 19, 2016

Research Team Tel: 022 - 39357800

For Technical Queries

For Derivatives Queries

DISCLAIMER

Angel Broking Private Limited (hereinafter referred to as “Angel”) is a registered Member of National Stock Exchange of India Limited,

Bombay Stock Exchange Limited and Metropolitan Stock Exchange Limited. It is also registered as a Depository Participant with CDSL

and Portfolio Manager with SEBI. It also has registration with AMFI as a Mutual Fund Distributor. Angel Broking Private Limited is a

registered entity with SEBI for Research Analyst in terms of SEBI (Research Analyst) Regulations, 2014 vide registration number

INH000000164. Angel or its associates has not been debarred/ suspended by SEBI or any other regulatory authority for accessing

/dealing in securities Market. Angel or its associates/analyst has not received any compensation / managed or co-managed public

offering of securities of the company covered by Analyst during the past twelve months.

This document is solely for the personal information of the recipient, and must not be singularly used as the basis of any investment

decision. Nothing in this document should be construed as investment or financial advice. Each recipient of this document should

make such investigations as they deem necessary to arrive at an independent evaluation of an investment in the securities of the

companies referred to in this document (including the merits and risks involved), and should consult their own advisors to determine

the merits and risks of such an investment.

Reports based on technical and derivative analysis center on studying charts of a stock's price movement, outstanding positions and

trading volume, as opposed to focusing on a company's fundamentals and, as such, may not match with a report on a company's

fundamentals. Investors are advised to refer the Fundamental and Technical Research Reports available on our website to evaluate the

contrary view, if any.

The information in this document has been printed on the basis of publicly available information, internal data and other reliable

sources believed to be true, but we do not represent that it is accurate or complete and it should not be relied on as such, as this

document is for general guidance only. Angel Broking Pvt. Limited or any of its affiliates/ group companies shall not be in any way

responsible for any loss or damage that may arise to any person from any inadvertent error in the information contained in this report.

Angel Broking Pvt. Limited has not independently verified all the information contained within this document. Accordingly, we cannot

testify, nor make any representation or warranty, express or implied, to the accuracy, contents or data contained within this document.

While Angel Broking Pvt. Limited endeavors to update on a reasonable basis the information discussed in this material, there may be

regulatory, compliance, or other reasons that prevent us from doing so.

This document is being supplied to you solely for your information, and its contents, information or data may not be reproduced,

redistributed or passed on, directly or indirectly.

Neither Angel Broking Pvt. Limited, nor its directors, employees or affiliates shall be liable for any loss or damage that may arise from

or in connection with the use of this information.

5