Technical & Derivatives Report

October 19, 2015

Sensex (27215) / Nifty (8238)

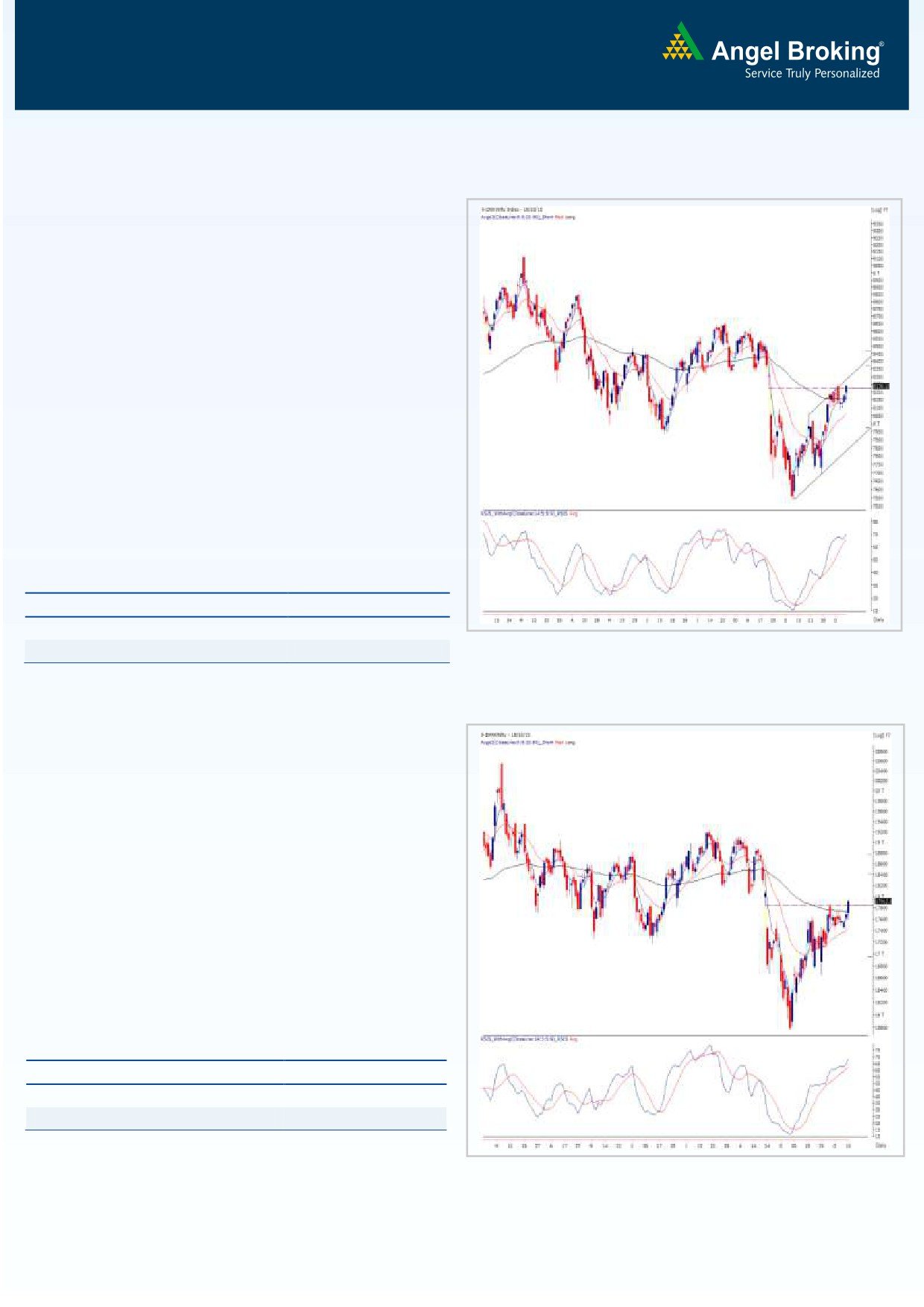

Exhibit 1: Nifty Daily Chart

For most part of the concluded week, the Nifty was largely

confined within the range of 8250 - 8050. A strong surge in the

penultimate hour of Friday's session surprised most of the

participants and the Nifty resultantly managed to close the week a

tad below the 8250 mark, which is the highest point in the last

two months.

Going forward, considering a strong weekly close, if the Nifty

manages to sustain above 8250 for an hour in today’s session

then we may witness an extension of this up move towards 8350 -

8400 levels. On the lower side, 8050 has become a major

support for the Nifty. Only a move below this support may apply

brakes on the ongoing optimism. We expect individual stocks to

perform well in the coming week as well, and we therefore

recommend traders to follow a stock specific strategy with proper

exits in place.

Key Levels

Support 1 - 8190

Resistance 1 - 8250

Support 2 - 8140

Resistance 2 - 8315

Bank Nifty Outlook - (17913)

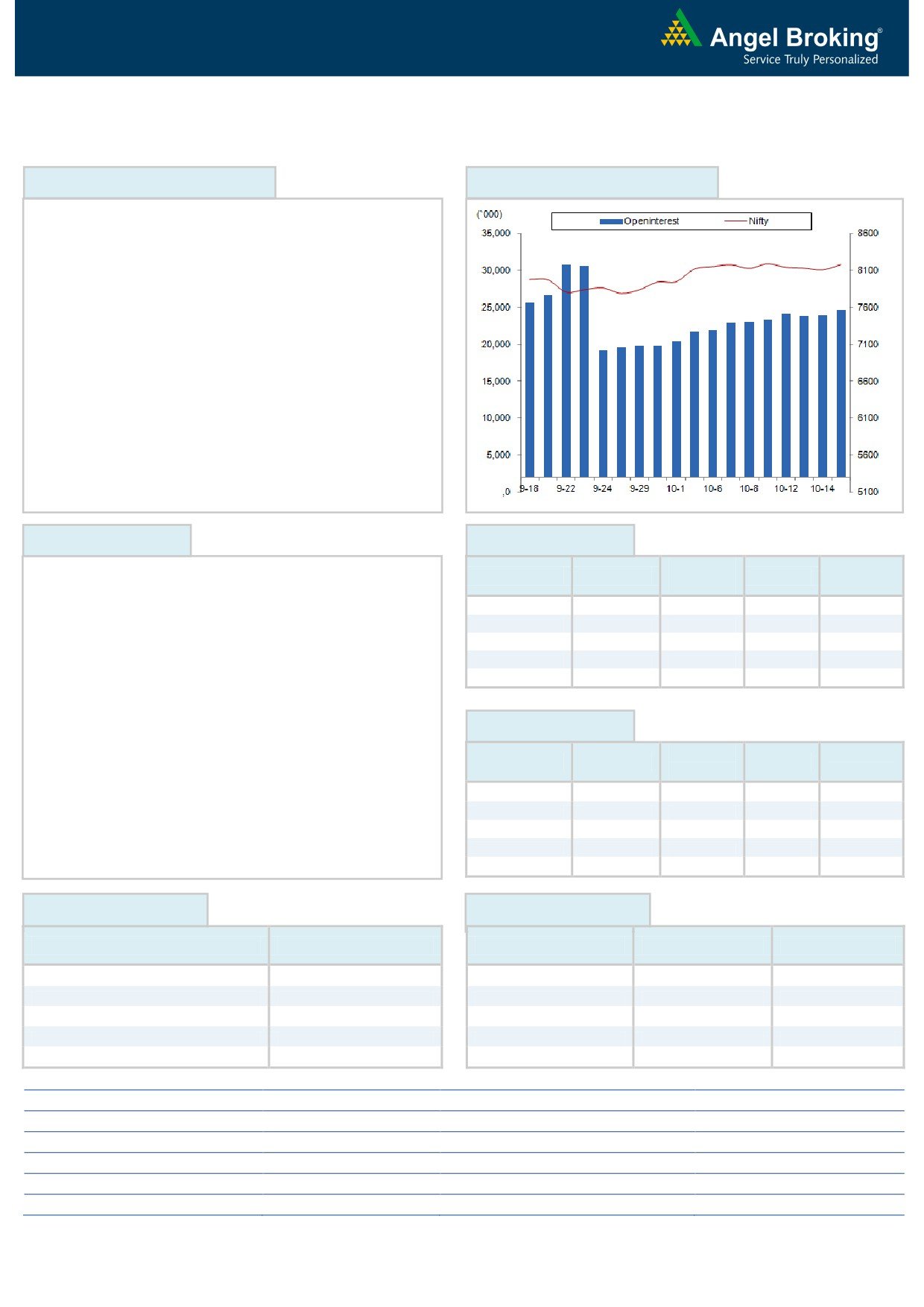

Exhibit 2: Bank Nifty Daily Chart

The Bank Nifty opened with a marginal upside gap on Friday and

started falling in the initial hour of the trading. But, the fall

arrested around the previous day’s low and then remained in the

sideways direction throughout the remaining part of first half of

the session. However, the banking index rallied sharply in the

latter half of the session and as a result, the Bank Nifty ended

with gains of 1.28 percent. With Friday’s price action, the Bank

Nifty finally broke the silence and posted a decisive close above

its major hurdle of

17842

-

17900 levels. The positive

momentum in banking counters may continue for upcoming days

too. Going forward, the immediate resistance for the index is

placed at 18100 and 18230 levels. On the flipside, 17800 and

17650 levels will now act as support in coming trading session.

Key Levels

Support 1 - 17800

Resistance 1 - 18100

Support 2 - 17650

Resistance 2 - 18230

1

Technical & Derivatives Report

October 19, 2015

Comments

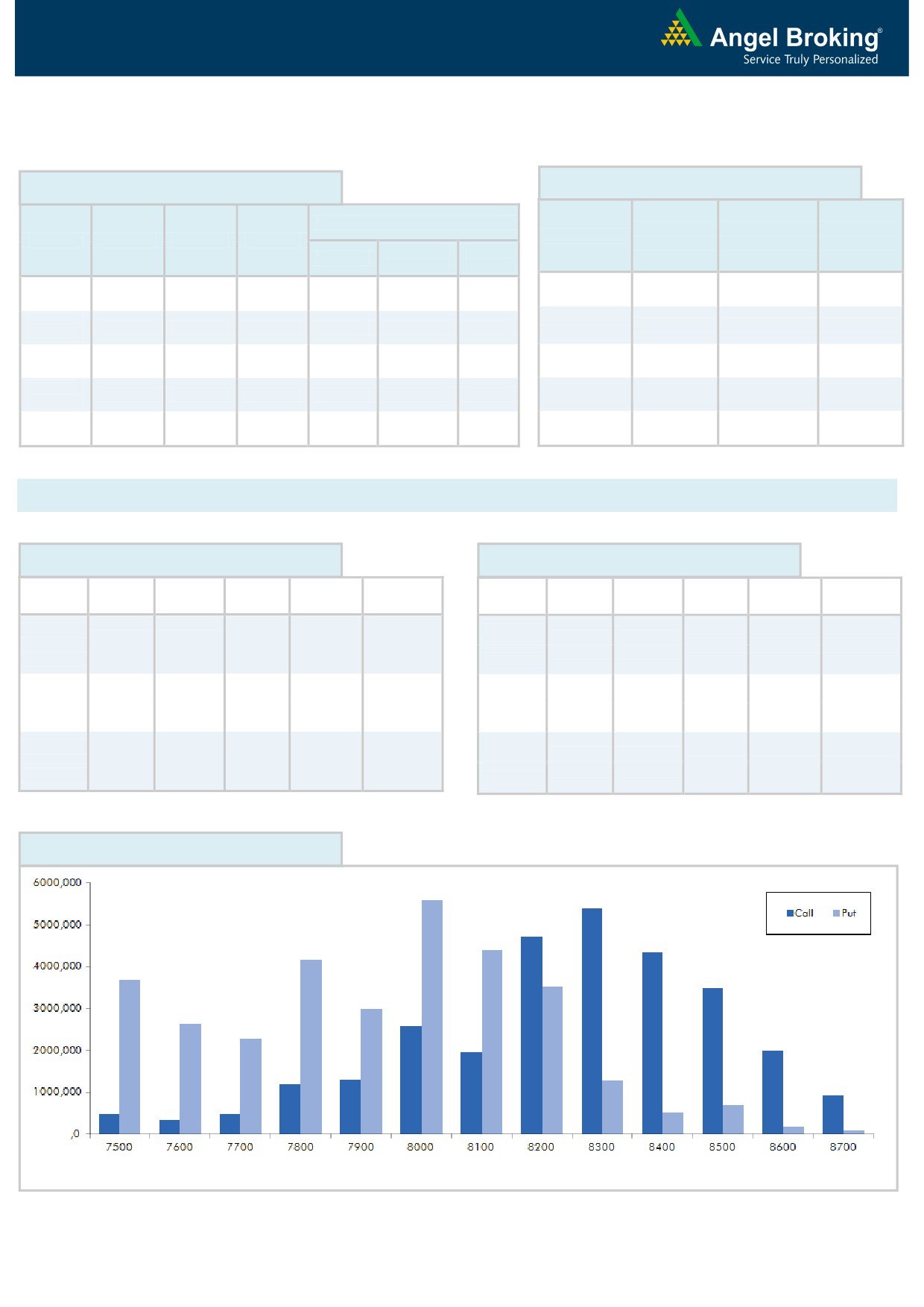

Nifty Vs OI

The Nifty futures open interest has increased by 3.25%

BankNifty futures open interest has increased by 3.16%

as market closed at 8238.15 levels.

The Nifty October future closed at a premium of 21.30

points against a premium of 7.50 points. The November

series closed at a premium of 59.95 points.

The Implied Volatility of at the money options has

decreased from 13.81% to 12.84%.

The total OI of the market is Rs. 2,31,143/- cr. and the

stock futures OI is Rs. 61,651/- cr.

Few of the liquid counters where we have seen high cost

of carry are AMTEKAUTO, UNITECH, IDFC, IOC and

AMBUJACEM.

Views

OI Gainers

OI

PRICE

FIIs bought in equity segment to the tune of Rs. 437

SCRIP

OI

PRICE

CHG. (%)

CHG. (%)

crores. While in Index Futures they sold of Rs. 831 crores

MINDTREE

675150

28.72

1425.75

1.67

with marginal change in OI, suggesting mix of long

IOC

9000800

13.42

407.75

0.73

unwinding and short formation in last trading session.

TV18BRDCST

19176000

12.35

32.90

-0.15

BEML

212000

12.17

1229.95

0.13

In Index Options front, they bought of Rs. 217 crores

NCC

5440000

12.03

81.85

0.55

with good amount of rise in OI. In call options, we saw

meaningful build-up in

8300-8400 call options,

OI Losers

followed by unwinding in 8100 & 8200 call options.

OI

PRICE

While in put options, good amount of OI addition was

SCRIP

OI

PRICE

CHG. (%)

CHG. (%)

seen in 8100-8300 strikes, some unwinding was also

ZEEL

8835800

-6.31

423.60

1.10

visible in 8000 put strike. Maximum OI is seen in 8300

MARUTI

2710500

-5.10

4452.35

1.56

call and 8000 put options. From last 2-3 trading

SYNDIBANK

7562000

-4.76

94.70

0.37

session, FIIs are forming fresh shorts, avoid going long.

AMARAJABAT

714600

-3.93

1000.25

0.31

GODREJIND

2635400

-3.34

359.20

0.27

Historical Volatility

Put-Call Ratio

SCRIP

HV

SCRIP

PCR-OI

PCR-VOL

CROMPGREAV

48.68

NIFTY

1.02

0.98

NMDC

45.85

BANKNIFTY

0.98

0.75

SRTRANSFIN

44.89

INFY

0.30

0.28

LT

34.60

TATAMOTORS

1.28

0.81

BIOCON

30.28

RELIANCE

0.94

0.73

Strategy Date

Symbol

Strategy

Status

September 28, 2015

NIFTY

Long Strangle

Profit booked on October 16, 2015

October 05, 2015

SBIN

Ratio Bear Put Spread

Active

October 12, 2015

LT

Long Put Ladder

Active

2

Technical & Derivatives Report

October 19, 2015

Turnover on 16-October 2015

FII Statistics for 16-October 2015

Open Interest

No. of

Turnover

Change

Instrument

Detail

Buy

Sell

Net

Contracts

( in Cr. )

(%)

Value

Change

Contracts

(in Cr.)

(%)

INDEX

INDEX

615813

16939.91

16.53

1122.81

1954.26

(831.44)

990835

24881.67

(0.23)

FUTURES

FUTURES

INDEX

INDEX

11422.64

11205.17

217.48

2332985

74049.18

4.71

6839723

158270.01

20.67

OPTIONS

OPTIONS

STOCK

STOCK

2518.07

2975.68

(457.60)

1804826

48744.39

0.09

861121

23554.52

4.99

FUTURES

FUTURES

STOCK

STOCK

2024.22

2046.58

(22.37)

129743

3539.59

(1.77)

528553

14033.34

5.14

OPTIONS

OPTIONS

TOTAL

17087.75

18181.68

(1093.94)

5258389

151214.83

1.98

TOTAL

8845210

212797.78

17.26

Nifty Spot = 8238.15

Lot Size = 25

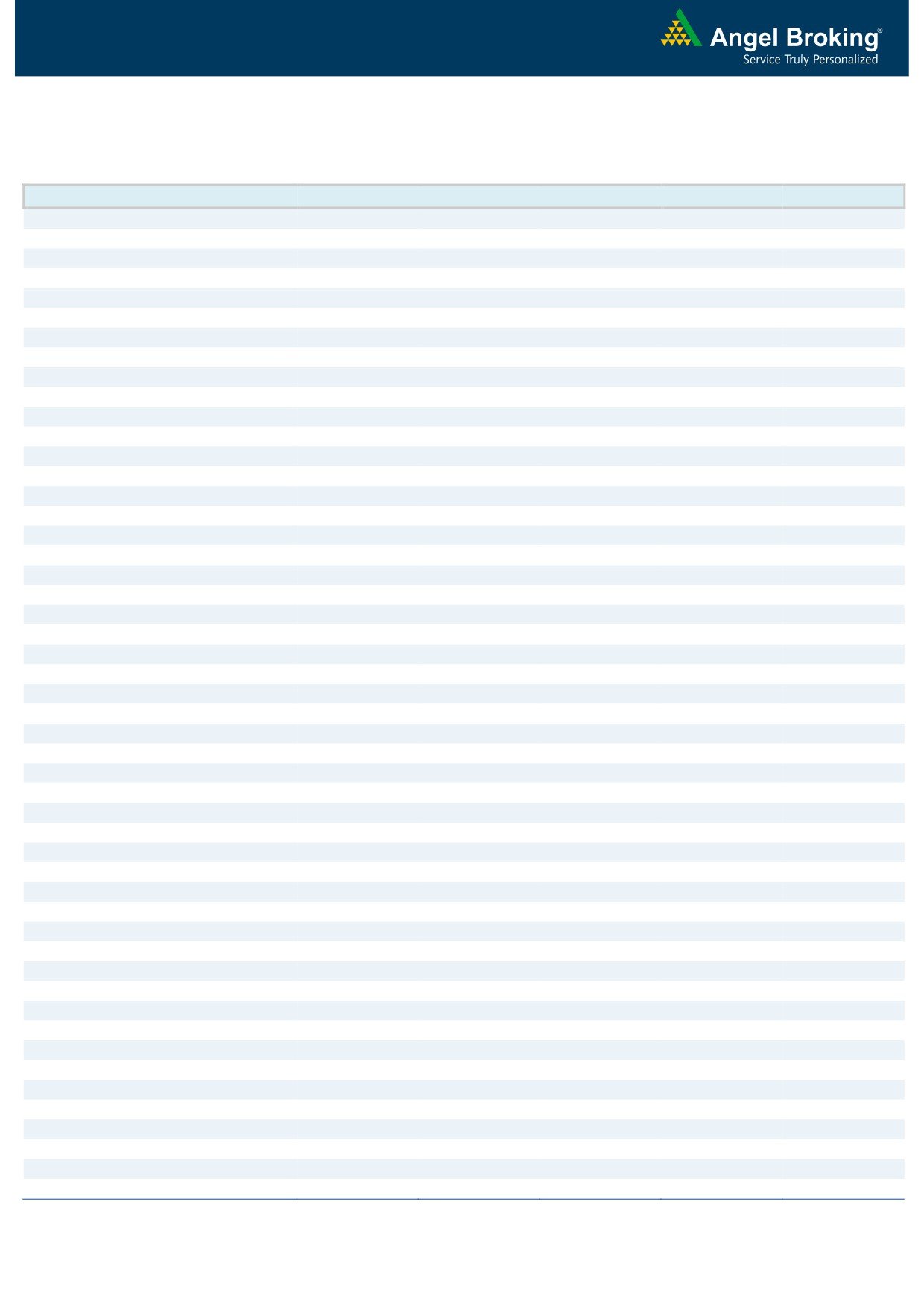

Bull-Call Spreads

Bear-Put Spreads

Action

Strike

Price

Risk

Reward

BEP

Action

Strike

Price

Risk

Reward

BEP

Buy

Buy

8300

61.45

8200

57.10

35.10

24.25

75.75

8175.75

Sell

Sell

8400

26.35

8100

32.85

Buy

Buy

8300

61.45

8200

57.10

52.05

147.95

8352.05

37.65

162.35

8162.35

Sell

Sell

8500

9.40

8000

19.45

Buy

Buy

8400

26.35

8100

32.85

16.95

83.05

8416.95

13.40

86.60

8086.60

Sell

Sell

8500

9.40

8000

19.45

Nifty Put-Call Analysis

3

Technical & Derivatives Report

October 19, 2015

Daily Pivot Levels for Nifty 50 Stocks

Scrips

S2

S1

PIVOT

R1

R2

ACC

1,394

1,352

1,373

1,386

1,407

AMBUJACEM

212

207

209

212

215

ASIANPAINT

883

858

870

878

890

AXISBANK

505

485

495

501

511

BAJAJ-AUTO

2,462

2,410

2,436

2,462

2,487

BANKBARODA

178

173

175

178

180

BHARTIARTL

350

336

343

348

354

BHEL

214

208

211

212

215

BOSCHLTD

21,068

20,756

20,912

21,096

21,251

BPCL

911

892

902

908

918

CAIRN

160

155

158

160

162

CIPLA

679

665

672

676

684

COALINDIA

339

331

335

339

343

DRREDDY

4,265

4,116

4,190

4,235

4,310

GAIL

325

319

322

324

327

GRASIM

3,649

3,593

3,621

3,643

3,671

HCLTECH

841

830

836

841

846

HDFC

1,312

1,271

1,292

1,304

1,324

HDFCBANK

1,100

1,079

1,090

1,096

1,106

HEROMOTOCO

2,584

2,546

2,565

2,578

2,596

HINDALCO

88

84

86

88

89

HINDUNILVR

785

777

781

786

790

ICICIBANK

284

288

294

IDEA

150

145

148

150

153

INDUSINDBK

963

944

953

960

969

INFY

1,095

1,084

1,089

1,095

1,101

ITC

349

341

345

347

351

KOTAKBANK

659

639

649

655

666

LT

1,605

1,532

1,569

1,589

1,625

LUPIN

2,055

2,000

2,028

2,063

2,090

M&M

1,289

1,257

1,273

1,284

1,300

MARUTI

4,450

4,351

4,401

4,431

4,480

NMDC

105

98

101

103

107

NTPC

127

124

125

127

128

ONGC

264

254

259

262

267

PNB

138

134

136

138

140

POWERGRID

135

132

134

135

136

RELIANCE

912

899

906

910

917

SBIN

255

245

250

253

259

VEDL

109

105

107

109

111

SUNPHARMA

889

876

883

887

894

TATAMOTORS

386

376

381

386

391

TATAPOWER

70

61

66

68

72

TATASTEEL

253

244

249

253

257

TCS

2,474

2,457

2,465

2,479

2,487

TECHM

546

539

542

547

550

ULTRACEMCO

2,955

2,871

2,913

2,944

2,986

WIPRO

577

558

568

575

584

YESBANK

773

744

759

767

781

ZEEL

423

409

416

421

429

4

Technical & Derivatives Report

October 19, 2015

Research Team Tel: 022 - 39357800

For Technical Queries

For Derivatives Queries

DISCLAIMER

Angel Broking Private Limited (hereinafter referred to as “Angel”) is a registered Member of National Stock Exchange of India Limited,

Bombay Stock Exchange Limited and MCX Stock Exchange Limited. It is also registered as a Depository Participant with CDSL and

Portfolio Manager with SEBI. It also has registration with AMFI as a Mutual Fund Distributor. Angel Broking Private Limited is a

registered entity with SEBI for Research Analyst in terms of SEBI (Research Analyst) Regulations, 2014 vide registration number

INH000000164. Angel or its associates has not been debarred/ suspended by SEBI or any other regulatory authority for accessing

/dealing in securities Market. Angel or its associates including its relatives/analyst do not hold any financial interest/beneficial

ownership of more than 1% in the company covered by Analyst. Angel or its associates/analyst has not received any compensation /

managed or co-managed public offering of securities of the company covered by Analyst during the past twelve months. Angel/analyst

has not served as an officer, director or employee of company covered by Analyst and has not been engaged in market making activity

of the company covered by Analyst.

This document is solely for the personal information of the recipient, and must not be singularly used as the basis of any investment

decision. Nothing in this document should be construed as investment or financial advice. Each recipient of this document should

make such investigations as they deem necessary to arrive at an independent evaluation of an investment in the securities of the

companies referred to in this document (including the merits and risks involved), and should consult their own advisors to determine

the merits and risks of such an investment.

Reports based on technical and derivative analysis center on studying charts of a stock's price movement, outstanding positions and

trading volume, as opposed to focusing on a company's fundamentals and, as such, may not match with a report on a company's

fundamentals.

The information in this document has been printed on the basis of publicly available information, internal data and other reliable

sources believed to be true, but we do not represent that it is accurate or complete and it should not be relied on as such, as this

document is for general guidance only. Angel Broking Pvt. Limited or any of its affiliates/ group companies shall not be in any way

responsible for any loss or damage that may arise to any person from any inadvertent error in the information contained in this report.

Angel Broking Pvt. Limited has not independently verified all the information contained within this document. Accordingly, we cannot

testify, nor make any representation or warranty, express or implied, to the accuracy, contents or data contained within this document.

While Angel Broking Pvt. Limited endeavors to update on a reasonable basis the information discussed in this material, there may be

regulatory, compliance, or other reasons that prevent us from doing so.

This document is being supplied to you solely for your information, and its contents, information or data may not be reproduced,

redistributed or passed on, directly or indirectly.

Neither Angel Broking Pvt. Limited, nor its directors, employees or affiliates shall be liable for any loss or damage that may arise from

or in connection with the use of this information.

Note: Please refer to the important ‘Stock Holding Disclosure' report on the Angel website (Research Section). Also, please refer to the

latest update on respective stocks for the disclosure status in respect of those stocks. Angel Broking Pvt. Limited and its affiliates may

5