Technical & Derivatives Report

July 19, 2016

Sensex (27747) / Nifty (8509)

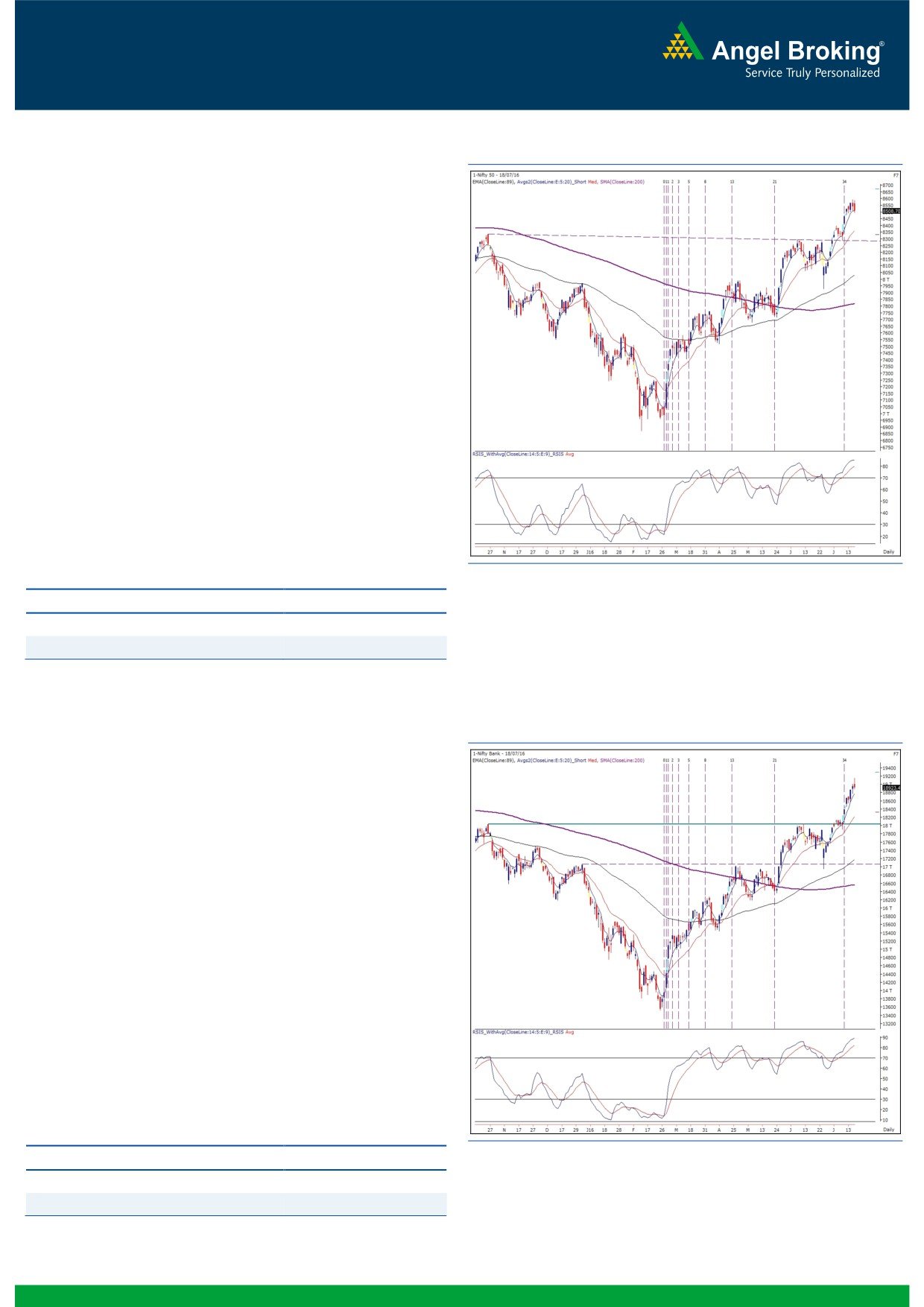

Exhibit 1: Nifty Daily Chart

The opening session of the week began with a mildly positive bias

owing to mixed global cues. Subsequently, the index maintained

its positivity throughout the first half and at one point of time, the

Nifty was at a kissing distance from the 8600 mark. However, a

strong bout of selling in the latter half dragged the index lowers to

close tad above the support level of 8500.

Yesterday, for the first time in last four weeks, we saw some hint

of decent profit booking. Thus, going forward, momentum traders

should keep a close eye on intraday support level of 8493. In

case of a sustainable move below this level, we may see an

extension of yesterday’s profit booking towards 8443 - 8400.

However, traders should keep in mind that this would just be a

corrective leg of the higher degree uptrend and thus, shouldn’t be

participating aggressively on the short side. On the flipside, we

maintain our directionally positive stance on the market and

expect this Nifty to test 8606 - 8655 levels. Traders are advised to

adopt a stock specific approach and trade with strict stop losses.

Key Levels

Support 1 - 8443

Resistance 1 - 8606

Support 2 - 8400

Resistance 2 - 8655

Nifty Bank Outlook - (18923)

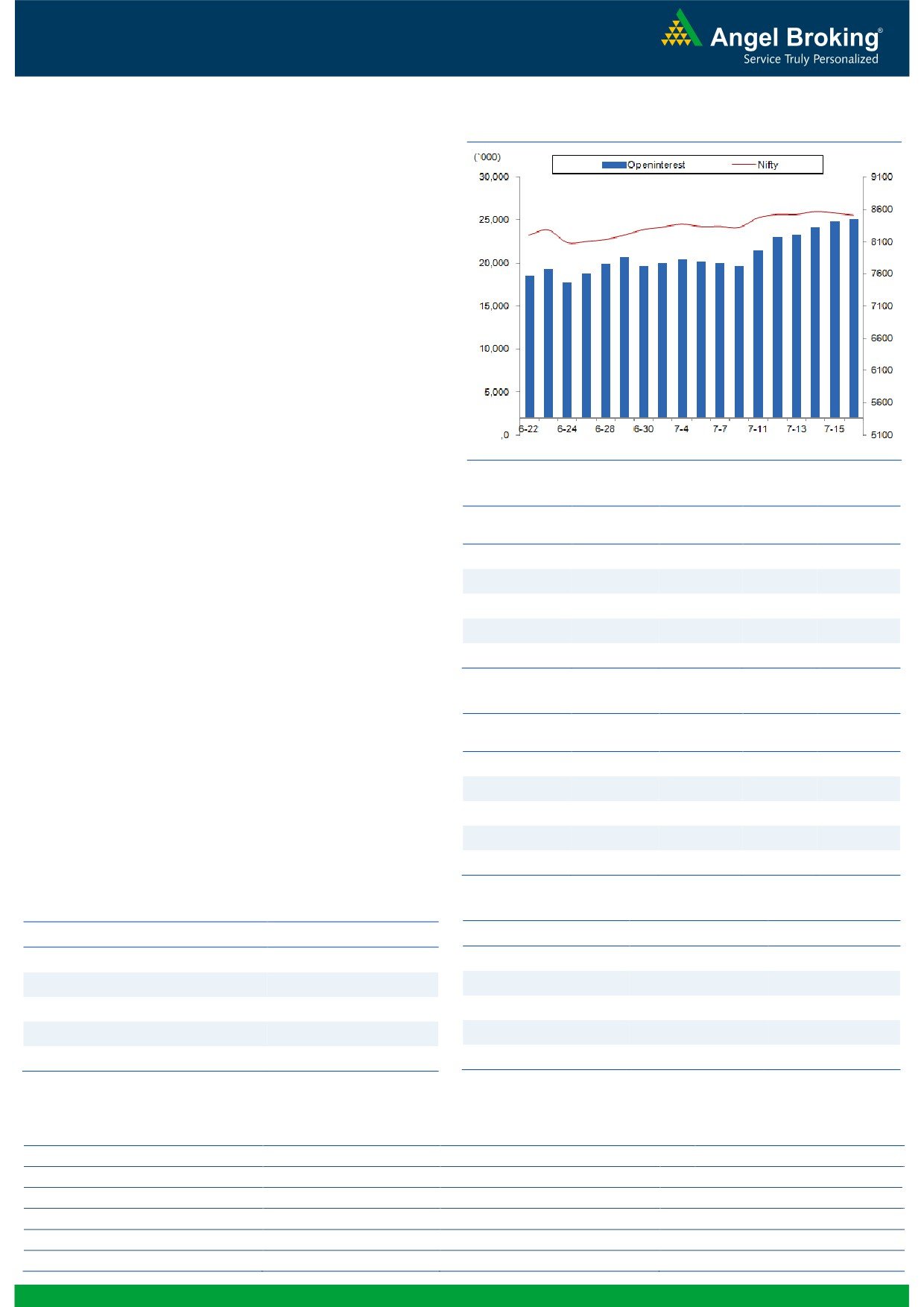

Exhibit 2: Nifty Bank Daily Chart

In yesterday's trading session, the Nifty Bank index rallied higher

post opening; however, corrective action in last couple of hours

eroded intraday gains and the index ended the session with

marginal losses of 0.16 percent over Friday's close.

In our yesterday's report, we had highlighted the resistance level

of 19229 (July 2015 high) and due to the overbought momentum

readings near the resistance, we were expecting a possible profit

booking around the resistance. The index approached near the

resistance area in initial couple of hours yesterday, which was

followed by a corrective move during the closing. Although, the

broader trend still remains up, corrective move within the uptrend

cannot be ruled out near the resistance. Hence, we continue to

advise traders to lighten up their positions around the resistance

and wait for dips to re-enter into long positions. The intraday

support for the index is placed around 18770 and 18710;

whereas, resistances are seen around 19150 and 19229.

Key Levels

Support 1 - 18770

Resistance 1 - 19150

Support 2 - 18710

Resistance 2 - 19229

1

Technical & Derivatives Report

July 19, 2016

Comments

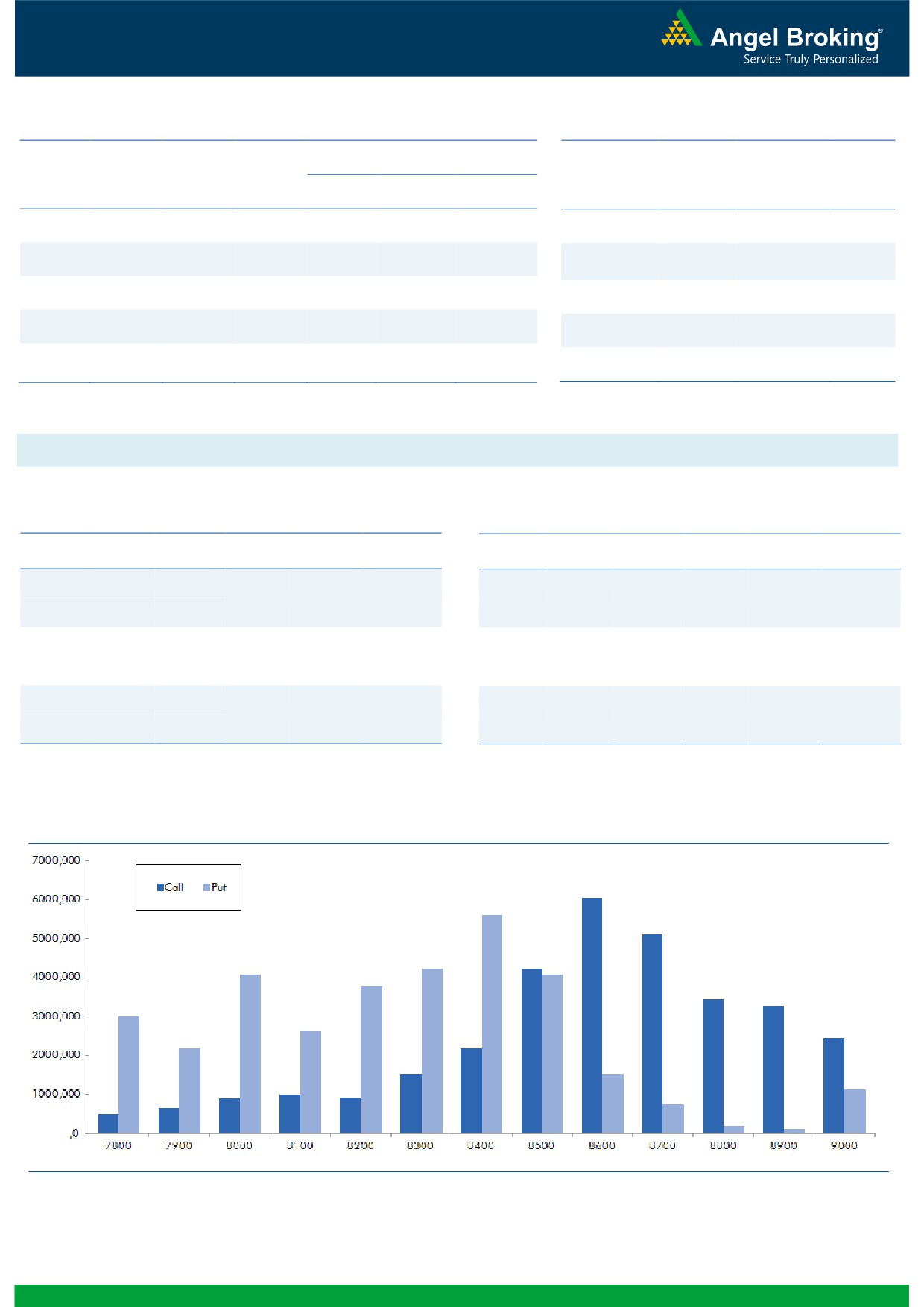

Nifty Vs OI

The Nifty futures open interest has increased by 0.96%

BankNifty futures open interest has increased by 0.31%

as market closed at 8508.70 levels.

The Nifty July future closed with a premium of 11.80

points against a premium of 13.45 points in previous

session. The August series closed at a premium of 48.15

points.

The Implied Volatility of at the money options has

increased from 13.61% to 14.40%.

The total OI of the market is Rs. 2,66,900/- cr. and the

stock futures OI is Rs. 70,489/- cr.

Few of the liquid counters where we have seen high cost

of carry are IFCI, RECLTD, SOUTHBANK, ALBK and

POWERGRID.

Views

OI Gainers

FIIs were net buyer in both cash market and Index

OI

PRICE

Futures segment. They bought equities to the tune of

SCRIP

OI

PRICE

CHG. (%)

CHG. (%)

Rs. 599 crores. While, they bought Index Futures worth

MINDTREE

2150400

58.87

607.30

-4.98

Rs. 807 crores with rise in open interest, indicating

ICIL

606000

17.44

868.70

-5.08

formation of long positions in last trading session.

WIPRO

6036000

13.33

551.70

-0.57

In Index Options segment, FIIs were net seller worth

Rs. 642 crores with rise in open interest. In call options,

OIL

1108400

7.77

362.30

-3.39

8500 - 8650 strikes were active and they also added

ONGC

37017500

7.75

219.60

-5.02

some fresh positions. On the other hand, we didn’t

witness any major build-up in put options. However,

OI Losers

8100 put strike have seen some amount of unwinding.

OI

PRICE

SCRIP

OI

PRICE

Highest OI in current series is placed at 8600 call and

CHG. (%)

CHG. (%)

8400 put options.

HINDZINC

5209600

-9.71

189.35

-3.64

Despite yesterday’s correction, FIIs continued their buying

UNIONBANK

18088000

-7.45

138.70

-1.00

streak in Index Futures. Looking at the derivatives data,

JINDALSTEL

46737000

-6.85

68.95

-5.22

we expect this upward momentum to continue. Thus,

UBL

1225000

-5.86

790.00

0.92

traders are suggested to trade with a positive bias, till we

CROMPGREAV

18792000

-5.49

70.85

0.78

see any traces of profit booking.

Historical Volatility

Put-Call Ratio

SCRIP

HV

SCRIP

PCR-OI

PCR-VOL

MINDTREE

33.93

NIFTY

1.03

1.06

IDEA

50.39

BANKNIFTY

1.30

1.10

ONGC

40.57

INFY

0.46

0.43

BHARTIARTL

37.79

RELIANCE

0.41

0.43

ICIL

45.70

TCS

0.46

0.50

Strategy Date

Symbol

Strategy

Status

04-07-2016

RCOM

Ratio Bull Call Spread

Active

11-07-2016

BANKNIFTY

Bull Call Spread

Didn’t trigger

18-07-2016

TCS

Long Put

Active

2

Technical & Derivatives Report

July 19, 2016

FII Statistics for 18-July 2016

Turnover on 18-July 2016

Open Interest

No. of

Turnover

Change

Detail

Buy

Sell

Net

Instrument

Value

Contracts

( in Cr. )

(%)

Contracts

Change (%)

(in Cr.)

INDEX

INDEX

1870.90

1064.35

806.56

314506

20530.90

2.05

210192

14365.84

-10.34

FUTURES

FUTURES

INDEX

INDEX

28249.64

27607.84

641.80

995367

64206.11

4.18

3288205

223735.54

9.72

OPTIONS

OPTIONS

STOCK

4955.04

5347.75

(392.71)

837245

53153.39

0.16

STOCK

FUTURES

539128

35208.93

-18.00

FUTURES

STOCK

STOCK

5324.73

5340.57

(15.84)

103671

6720.70

4.45

OPTIONS

438700

28388.17

-31.60

OPTIONS

TOTAL

40400.31

39360.51

1039.80

2250789

144611.10

2.36

TOTAL

4476225

301698.49

-0.88

Nifty Spot = 8508.70

Lot Size = 75

Bull-Call Spreads

Bear-Put Spreads

Action

Strike

Price

Risk

Reward

BEP

Action

Strike

Price

Risk

Reward

BEP

Buy

8500

91.05

Buy

8500

71.85

46.35

53.65

8546.35

31.65

68.35

8468.35

Sell

8600

44.70

Sell

8400

40.20

Buy

8500

91.05

Buy

8500

71.85

71.90

128.10

8571.90

51.10

148.90

8448.90

Sell

8700

19.15

Sell

8300

20.75

Buy

8600

44.70

Buy

8400

40.20

25.55

74.45

8625.55

19.45

80.55

8380.55

Sell

8700

19.15

Sell

8300

20.75

Note: Above mentioned Bullish or Bearish Spreads in Nifty (July Series) are given as an information and not as a recommendation.

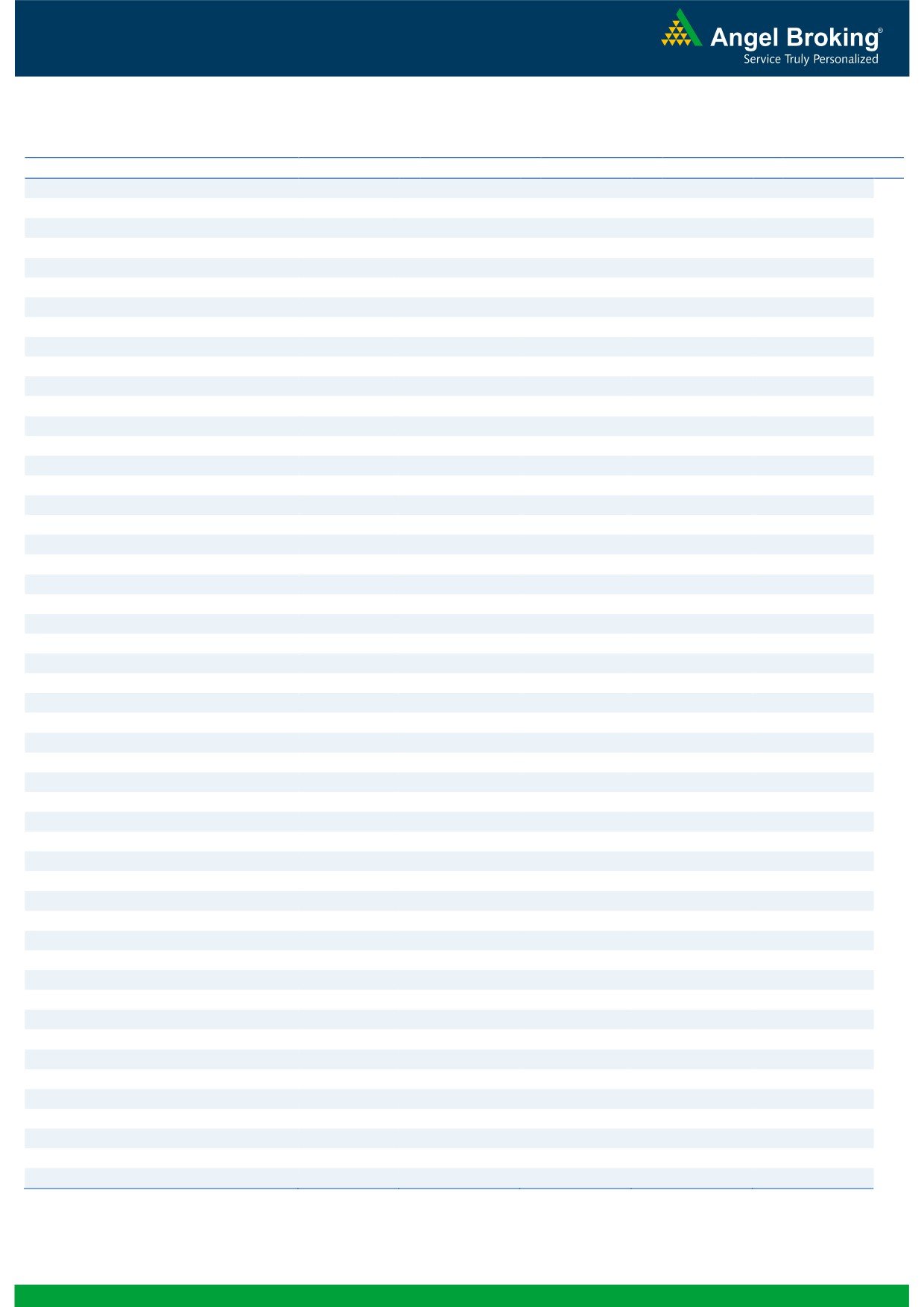

Nifty Put-Call Analysis

3

Technical & Derivatives Report

July 19, 2016

Daily Pivot Levels for Nifty Constituents

Scrips

S2

S1

PIVOT

R1

R2

ACC

1,573

1,584

1,602

1,613

1,630

ADANIPORTS

212

215

219

222

226

AMBUJACEM

257

258

261

262

264

ASIANPAINT

1,013

1,021

1,033

1,041

1,053

AUROPHARMA

736

743

754

761

773

AXISBANK

564

568

572

576

580

BAJAJ-AUTO

2,684

2,720

2,741

2,777

2,798

BANKBARODA

153

156

161

164

170

BHEL

135

137

141

144

147

BPCL

546

551

557

562

568

BHARTIARTL

349

356

368

375

387

INFRATEL

348

353

356

361

364

BOSCH

23,626

23,830

24,003

24,207

24,380

CIPLA

498

502

510

514

522

COALINDIA

316

319

322

324

327

DRREDDY

3,508

3,538

3,574

3,604

3,640

EICHERMOT

19,719

19,836

19,918

20,035

20,117

GAIL

377

381

390

395

404

GRASIM

4,729

4,764

4,806

4,840

4,883

HCLTECH

711

717

721

726

730

HDFCBANK

1,214

1,221

1,230

1,236

1,245

HDFC

1,309

1,327

1,357

1,376

1,405

HEROMOTOCO

3,207

3,228

3,262

3,283

3,317

HINDALCO

133

135

138

140

144

HINDUNILVR

890

906

926

942

963

ICICIBANK

257

260

266

269

274

IDEA

96

100

106

110

116

INDUSINDBK

1,117

1,124

1,134

1,141

1,152

INFY

1,044

1,063

1,074

1,093

1,104

ITC

246

248

249

250

251

KOTAKBANK

763

770

776

783

790

LT

1,542

1,558

1,581

1,597

1,620

LUPIN

1,643

1,654

1,672

1,683

1,701

M&M

1,453

1,461

1,471

1,479

1,490

MARUTI

4,352

4,403

4,484

4,535

4,616

NTPC

154

155

156

157

158

ONGC

210

214

222

226

233

POWERGRID

161

162

164

165

167

RELIANCE

979

992

1,016

1,029

1,053

SBIN

225

227

230

232

236

SUNPHARMA

766

771

776

782

786

TCS

2,406

2,420

2,444

2,458

2,483

TATAMTRDVR

307

311

317

321

326

TATAMOTORS

481

487

496

502

511

TATAPOWER

69

70

71

71

73

TATASTEEL

354

360

370

376

385

TECHM

500

503

507

510

513

ULTRACEMCO

3,445

3,472

3,510

3,537

3,575

WIPRO

541

547

550

556

559

YESBANK

1,162

1,168

1,176

1,183

1,191

ZEEL

450

456

465

471

480

4

Technical & Derivatives Report

July 19, 2016

Research Team Tel: 022 - 39357800

For Technical Queries

For Derivatives Queries

DISCLAIMER

Angel Broking Private Limited (hereinafter referred to as “Angel”) is a registered Member of National Stock Exchange of India Limited,

Bombay Stock Exchange Limited and MCX Stock Exchange Limited. It is also registered as a Depository Participant with CDSL and

Portfolio Manager with SEBI. It also has registration with AMFI as a Mutual Fund Distributor. Angel Broking Private Limited is a

registered entity with SEBI for Research Analyst in terms of SEBI (Research Analyst) Regulations, 2014 vide registration number

INH000000164. Angel or its associates has not been debarred/ suspended by SEBI or any other regulatory authority for accessing

/dealing in securities Market. Angel or its associates including its relatives/analyst do not hold any financial interest/beneficial

ownership of more than 1% in the company covered by Analyst. Angel or its associates/analyst has not received any compensation /

managed or co-managed public offering of securities of the company covered by Analyst during the past twelve months. Angel/analyst

has not served as an officer, director or employee of company covered by Analyst and has not been engaged in market making activity

of the company covered by Analyst.

This document is solely for the personal information of the recipient, and must not be singularly used as the basis of any investment

decision. Nothing in this document should be construed as investment or financial advice. Each recipient of this document should

make such investigations as they deem necessary to arrive at an independent evaluation of an investment in the securities of the

companies referred to in this document (including the merits and risks involved), and should consult their own advisors to determine

the merits and risks of such an investment.

Reports based on technical and derivative analysis center on studying charts of a stock's price movement, outstanding positions and

trading volume, as opposed to focusing on a company's fundamentals and, as such, may not match with a report on a company's

fundamentals.

The information in this document has been printed on the basis of publicly available information, internal data and other reliable

sources believed to be true, but we do not represent that it is accurate or complete and it should not be relied on as such, as this

document is for general guidance only. Angel Broking Pvt. Limited or any of its affiliates/ group companies shall not be in any way

responsible for any loss or damage that may arise to any person from any inadvertent error in the information contained in this report.

Angel Broking Pvt. Limited has not independently verified all the information contained within this document. Accordingly, we cannot

testify, nor make any representation or warranty, express or implied, to the accuracy, contents or data contained within this document.

While Angel Broking Pvt. Limited endeavors to update on a reasonable basis the information discussed in this material, there may be

regulatory, compliance, or other reasons that prevent us from doing so.

This document is being supplied to you solely for your information, and its contents, information or data may not be reproduced,

redistributed or passed on, directly or indirectly.

Neither Angel Broking Pvt. Limited, nor its directors, employees or affiliates shall be liable for any loss or damage that may arise from

or in connection with the use of this information.

Note: Please refer to the important ‘Stock Holding Disclosure' report on the Angel website (Research Section). Also, please refer to the

latest update on respective stocks for the disclosure status in respect of those stocks. Angel Broking Pvt. Limited and its affiliates may

have investment positions in the stocks recommended in this report.

5