Technical & Derivatives Report

May 19, 2016

Sensex (25705) / Nifty (7870)

Exhibit 1: Nifty Daily Chart

Tuesday’s gap up opening was followed by a weak beginning on

Wednesday owing to extremely negative cues from the global

peers. Subsequently, the index extended its losses in the first half.

However, a v-shaped recovery in the latter half pulled the index

higher to close with nominal losses of 0.26%.

Yesterday’s price action was a mirror image of what we had

experienced on Tuesday. The index first traded with a pessimistic

mood and then pared down all losses to fill yesterday’s downside

gap. Last two days movement clearly indicates that the market is

lacking direction and probably waiting for a trigger to come out

of this congestion zone. Despite this volatility, we maintain our

positive stance on the market and expect the index to steadily

move towards the higher end of 7940 - 7980. On the flipside,

7840 - 7810 are likely to act as immediate support levels.

Key Levels

Support 1 - 7840

Resistance 1 - 7940

Support 2 - 7810

Resistance 2 - 7980

Exhibit 2: Nifty Bank Daily Chart

Nifty Bank Outlook - (16729)

In line with benchmark indices, the Nifty Bank index too opened

with a loss of around 90 points and started moving lower from

the first tick. However, post the correction in initial hour, the

banking index rebounded piercingly and filled the entire gap.

Eventually, the Nifty Bank index ended the session with a

marginal loss of 0.20 percent over its previous close.

From last few trading sessions, the Nifty Bank index has been

moving in a narrow range and not giving any directional move

on either side. Currently, the banking index is hovering around

the lower end of the ‘Rising Channel’ on daily chart. Going

forward, a strong support for the index is placed at 16500 -

16430 levels; whereas, the major resistance continues to be in

the range of 17020 - 17050. A move beyond this range would

dictate the near term direction. Till then, traders should continue

to focus on stock specific strategies with proper risk management.

Key Levels

Support 1 - 16500

Resistance 1 - 16950

Support 2 - 16430

Resistance 2 - 17050

1

Technical & Derivatives Report

May 19, 2016

Comments

Nifty Vs OI

The Nifty futures open interest has increased by 0.97%

BankNifty futures open interest has increased by 2.57%

as market closed at 7870.15 levels.

The Nifty May future closed at a premium of 9.15 points

against a premium of 16.85 points. The June series

closed at a premium of 19.25 points.

The Implied Volatility of at the money options has

increased from 15.16% to 15.25%.

The total OI of the market is Rs. 2,39,190/- cr. and the

stock futures OI is Rs. 62,977/- cr.

Few of the liquid counters where we have seen high cost

of carry are UNITECH, JPASSOCIAT, SOUTHBANK, IDBI

and NCC.

Views

Yesterday, the FIIs were net seller in both equity cash and

OI Gainers

index future segment. They sold equities worth Rs. 251

OI

PRICE

crores. While, they were seller in Index future to the tune

SCRIP

OI

PRICE

CHG. (%)

CHG. (%)

of Rs.

1282 with significant rise in OI, indicating

CASTROLIND

5388900

34.92

384.90

-2.99

formation of short positions.

IBREALEST

30681000

27.58

93.00

4.49

In Index Options front, FIIs were net seller worth Rs. 112

STAR

1058000

8.85

1140.80

-2.03

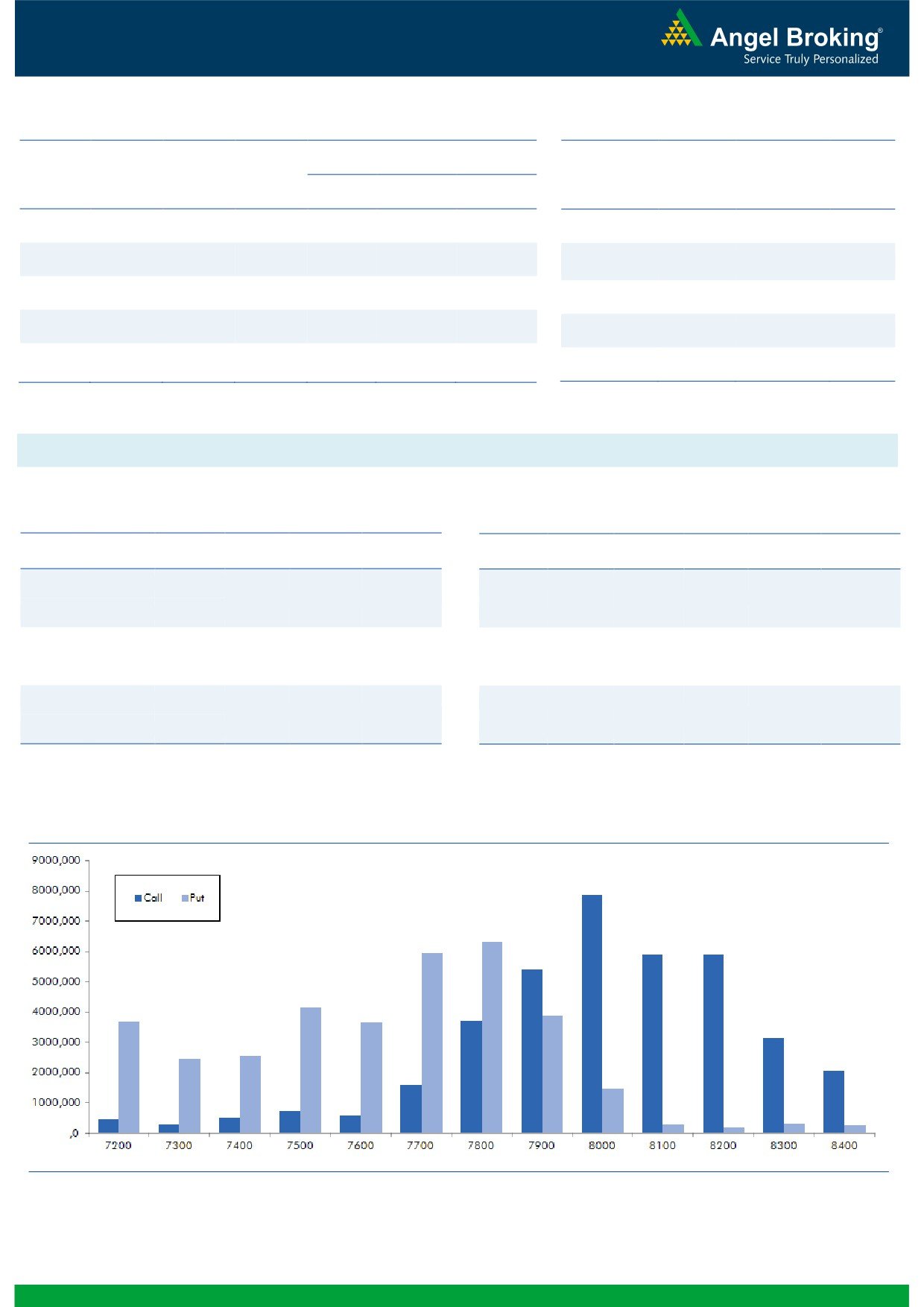

crores with rise in OI. In call options, we witnessed OI

addition in 7800 and 7850 strikes; while, unwinding was

MCLEODRUSS

2270400

8.52

190.30

-0.10

seen in 8300, 8100 and 7900 strikes. Whereas, in put

HDIL

24904000

7.19

91.55

4.09

options,

7700 strike added huge fresh positions;

followed by unwinding in

7900 and

7600 strikes.

OI Losers

Maximum OI in current series is seen at 8000 call and

OI

PRICE

SCRIP

OI

PRICE

7800 put.

CHG. (%)

CHG. (%)

Yesterday’s sell figure in index future doesn’t bode well

VOLTAS

6203600

-11.56

331.60

-1.34

for bulls. But, we need to wait for a follow-up activity

HCLTECH

11248400

-6.36

742.40

1.32

from FIIs as that seems missing in past few sessions.

CANBK

11714000

-5.49

185.35

2.52

Traders are advised to remain light and wait for further

ABIRLANUVO

1160000

-5.19

1017.40

5.23

development on derivative data front before initiating

SYNDIBANK

12072000

-5.18

68.80

3.85

any fresh positions in index future.

Historical Volatility

Put-Call Ratio

SCRIP

HV

SCRIP

PCR-OI

PCR-VOL

TATACOMM

31.71

NIFTY

0.95

0.83

ABIRLANUVO

45.32

BANKNIFTY

0.93

0.75

HEXAWARE

38.35

RELIANCE

0.33

0.29

NMDC

40.35

SBIN

0.44

0.36

MCDOWELL-N

39.00

ICICIBANK

0.43

0.54

Strategy Date

Symbol

Strategy

Status

02-05-2016

NIFTY

Long Strangle

Active

09-05-2016

RELIANCE

Long Put

Loss Booked on May 17, 2016

16-05-2016

LT

Short Strangle

Active

2

Technical & Derivatives Report

May 19, 2016

FII Statistics for 18-May 2016

Turnover on 18-May 2016

Open Interest

No. of

Turnover

Change

Detail

Buy

Sell

Net

Instrument

Value

Contracts

( in Cr. )

(%)

Contracts

Change (%)

(in Cr.)

INDEX

INDEX

1616.64

2898.15

(1281.51)

273432

15731.20

9.68

327972

18357.21

19.82

FUTURES

FUTURES

INDEX

INDEX

30558.35

30670.23

(111.87)

1246645

72735.41

2.34

3882551

226425.24

13.27

OPTIONS

OPTIONS

STOCK

4750.02

4464.84

285.18

1050114

50479.13

(0.02)

STOCK

FUTURES

581160

28263.32

-3.72

FUTURES

STOCK

STOCK

3258.33

3358.74

(100.40)

89711

4332.27

7.17

OPTIONS

395235

19242.26

-0.27

OPTIONS

TOTAL

40183.35

41391.96

(1208.61)

2659902

143278.02

2.25

TOTAL

5186918

292288.03

10.77

Nifty Spot = 7870.15

Lot Size = 75

Bull-Call Spreads

Bear-Put Spreads

Action

Strike

Price

Risk

Reward

BEP

Action

Strike

Price

Risk

Reward

BEP

Buy

7900

60.55

Buy

7900

81.65

34.80

65.20

7934.80

40.20

59.80

7859.80

Sell

8000

25.75

Sell

7800

41.45

Buy

7900

60.55

Buy

7900

81.65

51.55

148.45

7951.55

61.15

138.85

7838.85

Sell

8100

9.00

Sell

7700

20.50

Buy

8000

25.75

Buy

7800

41.45

16.75

83.25

8016.75

20.95

79.05

7779.05

Sell

8100

9.00

Sell

7700

20.50

Note: Above mentioned Bullish or Bearish Spreads in Nifty (May Series) are given as an information and not as a recommendation.

Nifty Put-Call Analysis

3

Technical & Derivatives Report

May 19, 2016

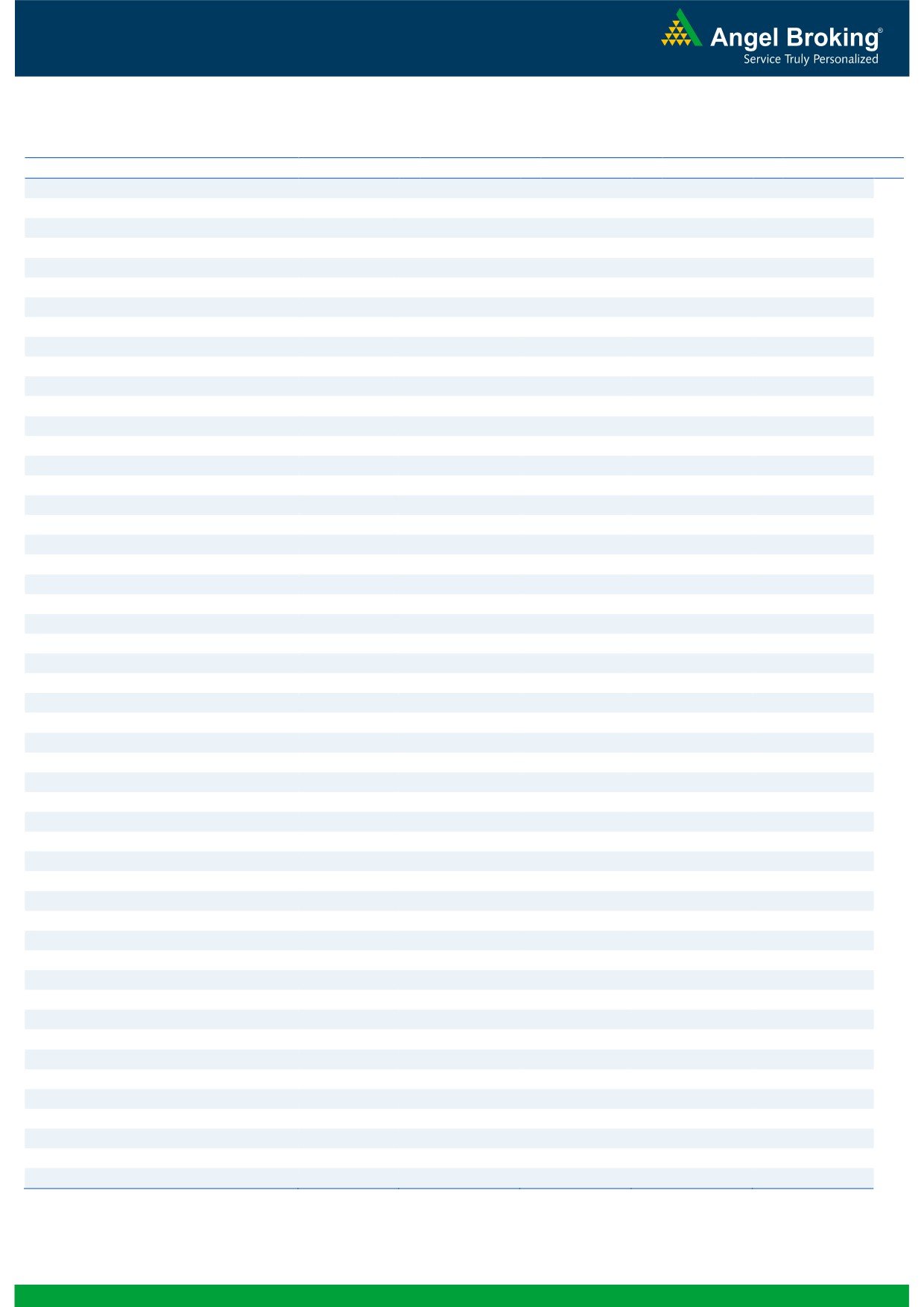

Daily Pivot Levels for Nifty Constituents

Scrips

S2

S1

PIVOT

R1

R2

ACC

1,421

1,428

1,435

1,442

1,449

ADANIPORTS

178

181

183

186

188

AMBUJACEM

213

215

216

218

219

ASIANPAINT

944

953

962

972

981

AUROPHARMA

763

773

779

789

795

AXISBANK

492

496

499

504

507

BAJAJ-AUTO

2,426

2,444

2,473

2,491

2,520

BANKBARODA

138

140

142

144

146

BHEL

117

118

119

121

122

BPCL

913

922

940

950

968

BHARTIARTL

345

348

350

353

356

INFRATEL

375

379

382

386

389

BOSCH

20,551

20,802

21,141

21,392

21,731

CIPLA

517

521

524

528

530

COALINDIA

279

282

283

286

288

DRREDDY

2,978

3,002

3,023

3,047

3,068

EICHERMOT

18,123

18,422

18,620

18,918

19,116

GAIL

373

378

383

388

393

GRASIM

4,238

4,252

4,263

4,277

4,289

HCLTECH

720

730

738

748

755

HDFCBANK

1,122

1,131

1,141

1,151

1,161

HDFC

1,188

1,198

1,206

1,216

1,224

HEROMOTOCO

2,829

2,854

2,884

2,909

2,940

HINDALCO

86

88

89

90

91

HINDUNILVR

816

821

828

832

839

ICICIBANK

220

223

225

229

231

IDEA

108

109

110

111

112

INDUSINDBK

1,059

1,071

1,078

1,091

1,098

INFY

1,191

1,201

1,207

1,217

1,223

ITC

322

327

331

336

340

KOTAKBANK

694

702

708

715

721

LT

1,265

1,287

1,300

1,322

1,335

LUPIN

1,585

1,611

1,629

1,655

1,673

M&M

1,302

1,314

1,324

1,336

1,347

MARUTI

3,752

3,834

3,886

3,968

4,020

NTPC

134

135

137

138

139

ONGC

207

211

213

217

219

POWERGRID

141

142

144

144

146

RELIANCE

961

966

969

974

977

SBIN

171

176

178

182

185

SUNPHARMA

787

791

795

799

803

TCS

2,508

2,529

2,548

2,569

2,587

TATAMTRDVR

264

266

268

271

273

TATAMOTORS

379

382

385

388

390

TATAPOWER

69

69

70

71

71

TATASTEEL

320

325

327

332

335

TECHM

477

481

484

487

490

ULTRACEMCO

3,176

3,200

3,234

3,258

3,292

WIPRO

533

536

538

542

544

YESBANK

956

963

970

978

985

ZEEL

428

432

438

442

448

4

Technical & Derivatives Report

May 19, 2016

Research Team Tel: 022 - 39357800

For Technical Queries

For Derivatives Queries

DISCLAIMER

Angel Broking Private Limited (hereinafter referred to as “Angel”) is a registered Member of National Stock Exchange of India Limited,

Bombay Stock Exchange Limited and MCX Stock Exchange Limited. It is also registered as a Depository Participant with CDSL and

Portfolio Manager with SEBI. It also has registration with AMFI as a Mutual Fund Distributor. Angel Broking Private Limited is a

registered entity with SEBI for Research Analyst in terms of SEBI (Research Analyst) Regulations, 2014 vide registration number

INH000000164. Angel or its associates has not been debarred/ suspended by SEBI or any other regulatory authority for accessing

/dealing in securities Market. Angel or its associates including its relatives/analyst do not hold any financial interest/beneficial

ownership of more than 1% in the company covered by Analyst. Angel or its associates/analyst has not received any compensation /

managed or co-managed public offering of securities of the company covered by Analyst during the past twelve months. Angel/analyst

has not served as an officer, director or employee of company covered by Analyst and has not been engaged in market making activity

of the company covered by Analyst.

This document is solely for the personal information of the recipient, and must not be singularly used as the basis of any investment

decision. Nothing in this document should be construed as investment or financial advice. Each recipient of this document should

make such investigations as they deem necessary to arrive at an independent evaluation of an investment in the securities of the

companies referred to in this document (including the merits and risks involved), and should consult their own advisors to determine

the merits and risks of such an investment.

Reports based on technical and derivative analysis center on studying charts of a stock's price movement, outstanding positions and

trading volume, as opposed to focusing on a company's fundamentals and, as such, may not match with a report on a company's

fundamentals.

The information in this document has been printed on the basis of publicly available information, internal data and other reliable

sources believed to be true, but we do not represent that it is accurate or complete and it should not be relied on as such, as this

document is for general guidance only. Angel Broking Pvt. Limited or any of its affiliates/ group companies shall not be in any way

responsible for any loss or damage that may arise to any person from any inadvertent error in the information contained in this report.

Angel Broking Pvt. Limited has not independently verified all the information contained within this document. Accordingly, we cannot

testify, nor make any representation or warranty, express or implied, to the accuracy, contents or data contained within this document.

While Angel Broking Pvt. Limited endeavors to update on a reasonable basis the information discussed in this material, there may be

regulatory, compliance, or other reasons that prevent us from doing so.

This document is being supplied to you solely for your information, and its contents, information or data may not be reproduced,

redistributed or passed on, directly or indirectly.

Neither Angel Broking Pvt. Limited, nor its directors, employees or affiliates shall be liable for any loss or damage that may arise from

or in connection with the use of this information.

Note: Please refer to the important ‘Stock Holding Disclosure' report on the Angel website (Research Section). Also, please refer to the

latest update on respective stocks for the disclosure status in respect of those stocks. Angel Broking Pvt. Limited and its affiliates may

have investment positions in the stocks recommended in this report.

5