Technical & Derivatives Report

August 18, 2016

Sensex (28005) / Nifty (8643)

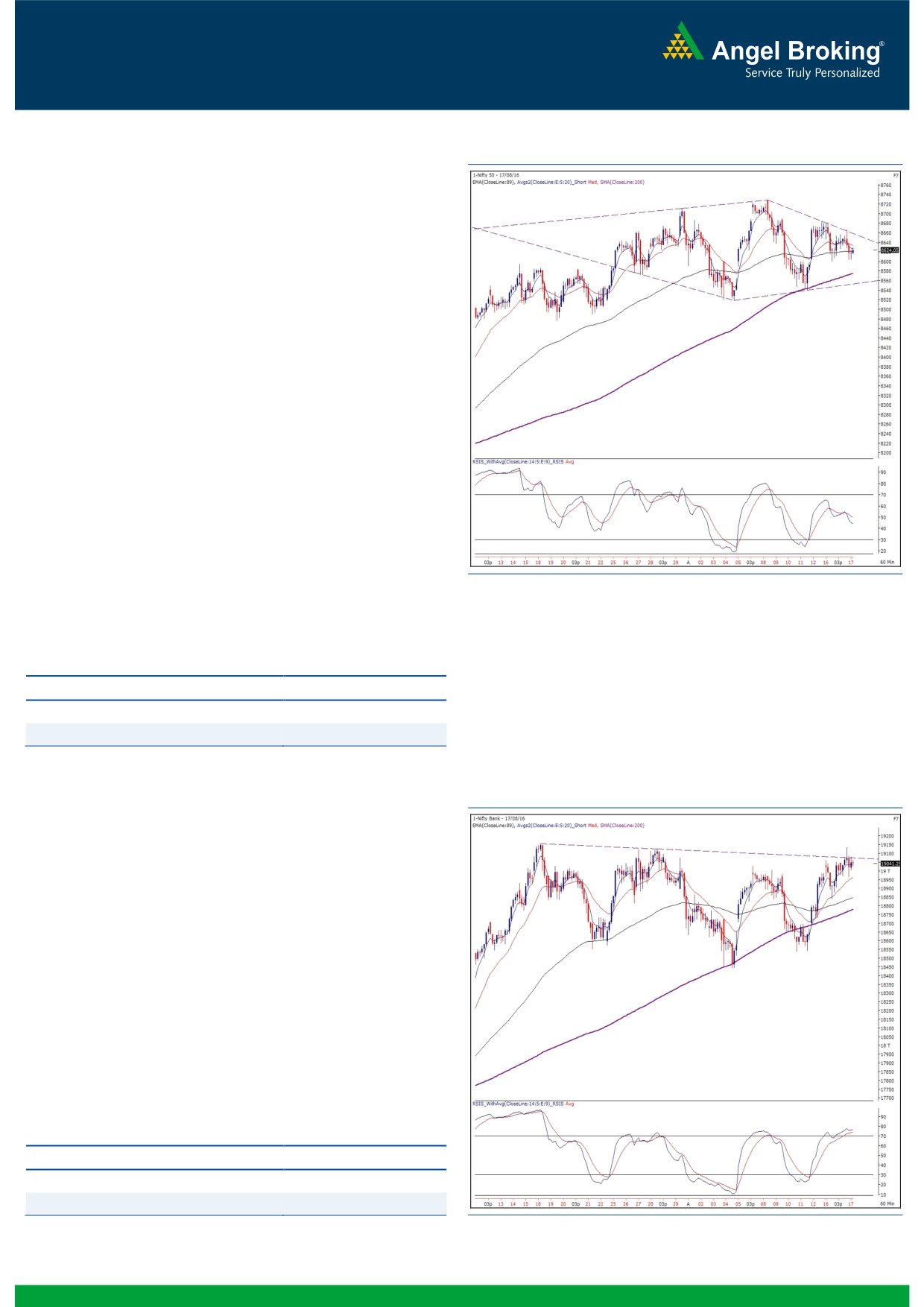

Exhibit 1: Nifty Hourly Chart

Yesterday’s session opened on a flat note citing mixed cues from

the global peers. Post the consolidation in the first half, the Nifty

made a valiant attempt to surpass the higher end (8670 - 8660)

of the ‘Diamond’ pattern formed on the hourly chart. However,

once again, we witnessed a decent correction from the mentioned

resistance zone on the back of strong selling pressure. Eventually,

the Nifty managed to close well above the 8600 mark by

shedding 0.21% from its previous close.

Since last couple of days, we have been closely observing the

chart structure in the hourly time frame. As mentioned in the

earlier report, the ‘Diamond’ pattern is clearly visible and within

this the ‘Super Trend’ indicator placed around 8600 is providing

a decent support. Thus, going forward, traders with a day

perspective should keep an eye on two key levels. Firstly 8600,

which would be a crucial support and a breach of this would

result into further weakness towards 8560 - 8540 levels. On the

upside 8670, which is the higher end of the ‘Diamond Pattern’,

will now act as an immediate hurdle. A decisive breakout beyond

this level would result into an extension of the up move towards

8728. At present, the Nifty is undergoing a consolidation phase

and thus, traders are advised to stay light on positions.

Key Levels

Support 1 - 8600

Resistance 1 - 8670

Support 2 - 8560

Resistance 2 - 8728

Nifty Bank Outlook - (19041)

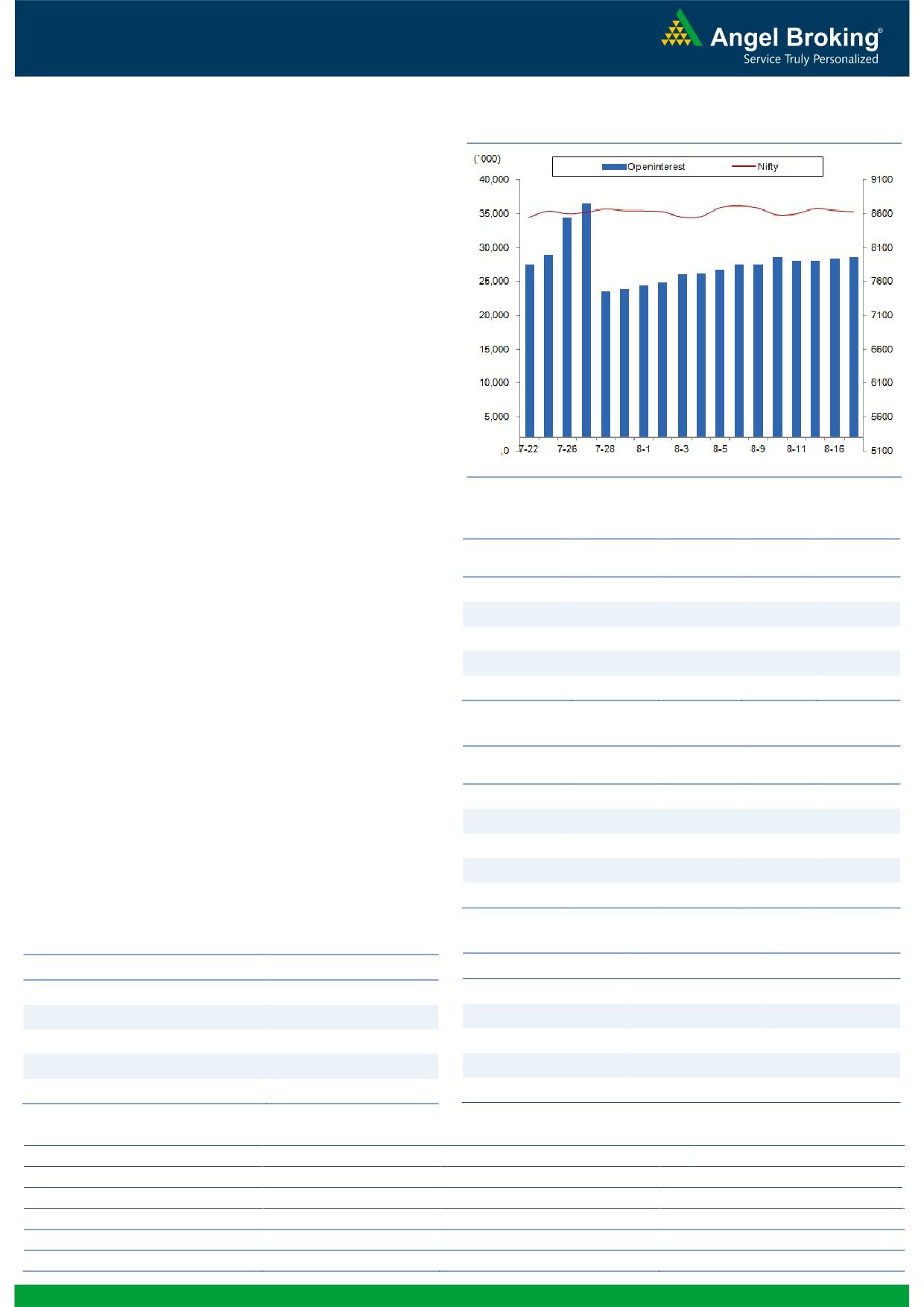

Exhibit 2: Nifty Bank Hourly Chart

In yesterday's trading session, the Nifty Bank index tested the

higher end of last one month's trading range and ended the

session with marginal gains of 0.20 percent.

As we have highlighted earlier, the Nifty Bank index since last one

month have been trading in a narrow range. The index is

currently trading near the higher end of the range and thus, the

bulls have a herculean task in near term to cross the resistance

for continuation of upmove. If the index manages to surpass

19158, then we could see continuation of the upmove till 19320-

19485 (resistance on monthly charts). Till then, the index could

continue to oscillate range bound. The intraday support for the

index is placed around 18960 and 18880 whereas resistances

are seen around 19158 and 19229.

Key Levels

Support 1 - 18960

Resistance 1 - 19158

Support 2 - 18880

Resistance 2 - 19229

1

Technical & Derivatives Report

August 18, 2016

Comments

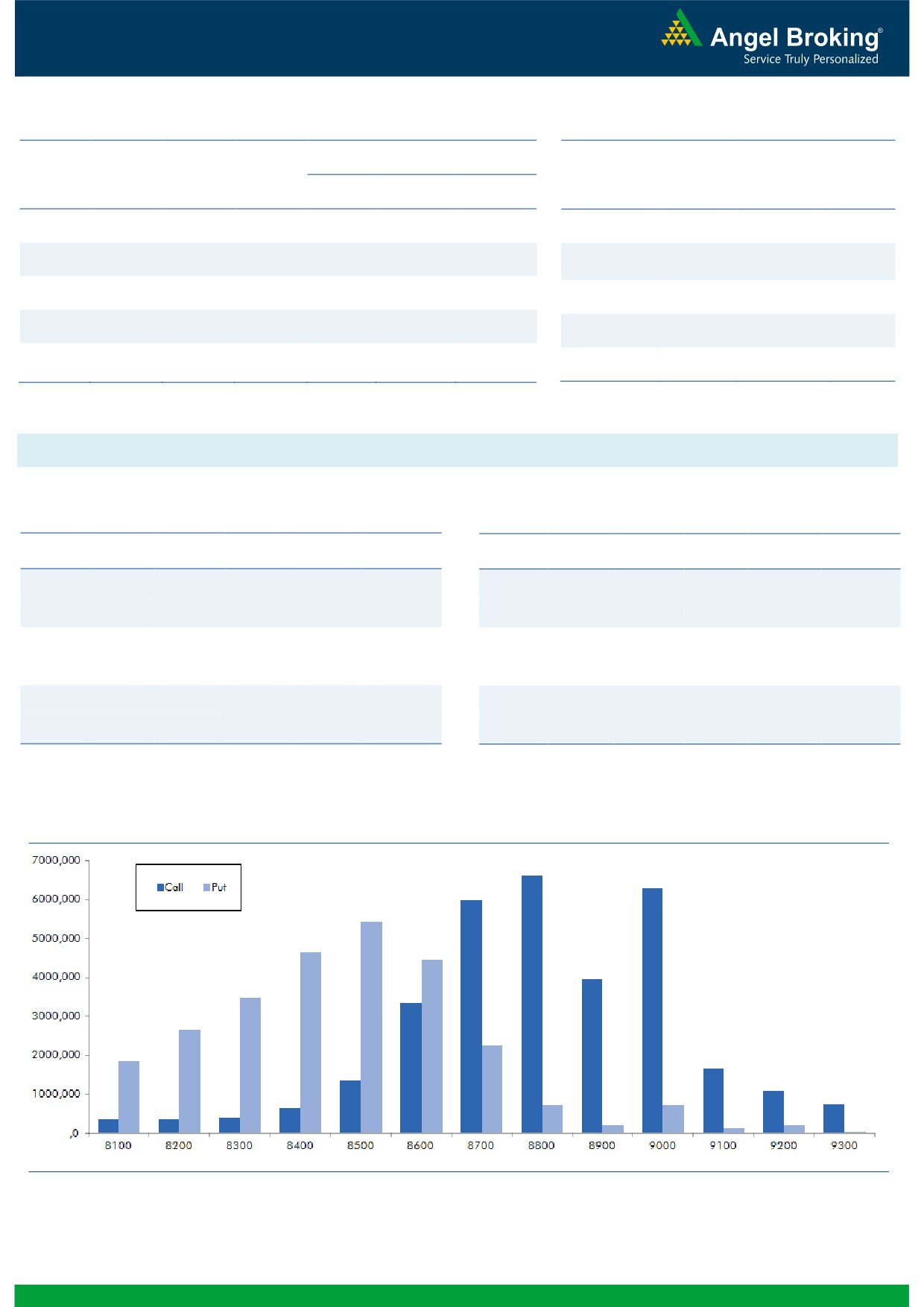

Nifty Vs OI

The Nifty futures open interest has increased by 0.34%

BankNifty futures open interest has increased by 7.95%

as market closed at 8624.05 levels.

The Nifty August future closed with a premium of 7.35

points against a premium of 17.35 points in previous

session. The September series closed at a premium of

56.10 points.

The Implied Volatility of at the money options has

increased from 13.35% to 13.55%.

The total OI of the market is Rs. 2,84,641/- cr. and the

stock futures OI is Rs. 79,043/- cr.

Few of the liquid counters where we have seen high cost

of carry are GMRINFRA, SOUTHBANK, TV18BRDCST,

EXIDEIND and KPIT.

Views

Yesterday, FIIs activity was negligible in equity cash

OI Gainers

segment. While, in Index Futures they were net sellers

OI

PRICE

worth Rs. 125 crores with marginal rise in OI, suggesting

SCRIP

OI

PRICE

CHG. (%)

CHG. (%)

short formation in last trading session.

JUSTDIAL

5226400

52.85

467.20

-3.91

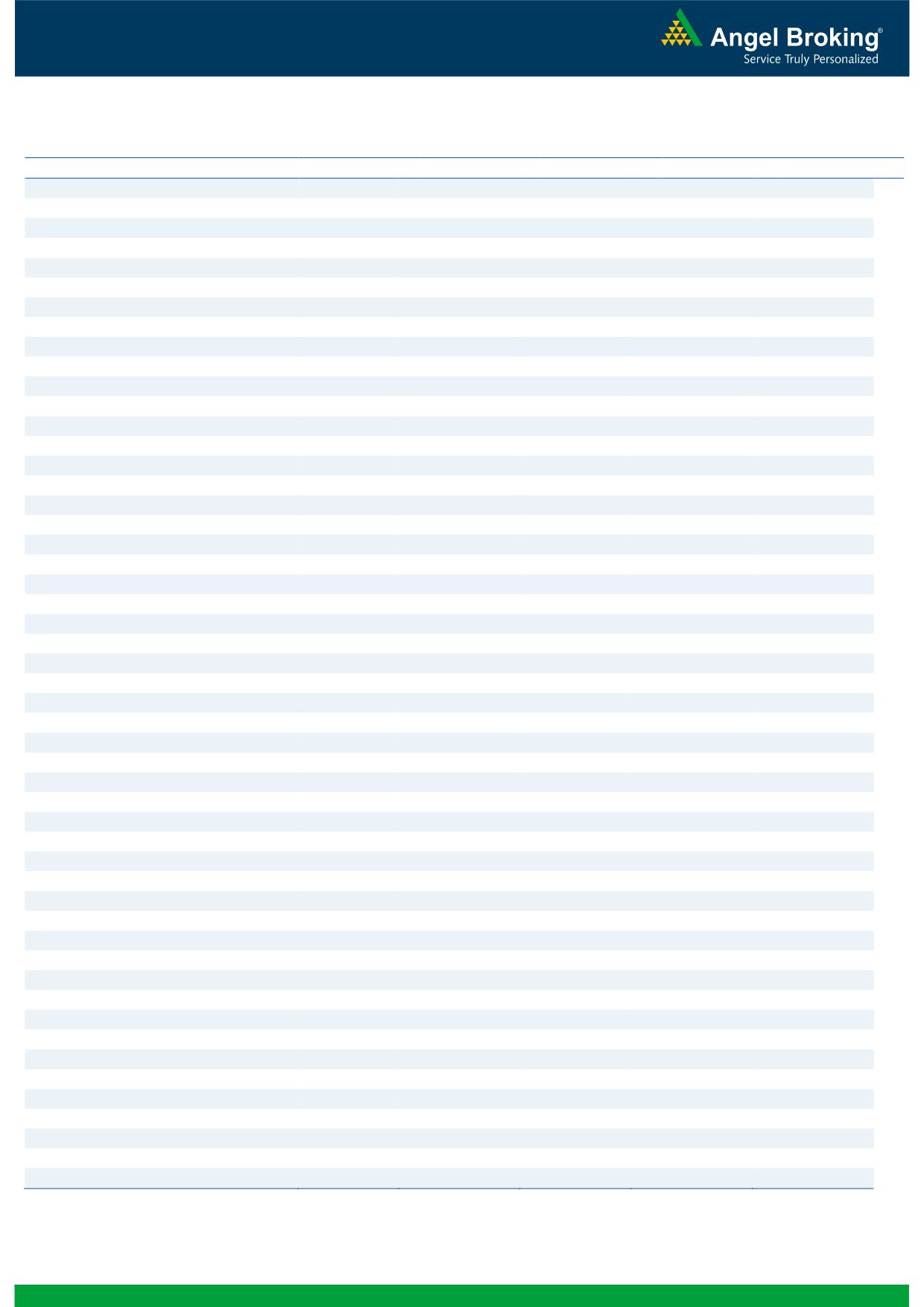

On Index Options front, FIIs bought worth Rs. 68 crores

STAR

1199000

41.56

1058.40

-4.79

with marginal change in OI. In call options, 8800 strike

ORIENTBANK

17508000

15.47

116.55

1.92

added fresh positions; followed by somew.build-upoinng.com

CUMMINSIND

744600

13.13

896.90

-0.46

8600 and 8700 strikes. While in put options, some

unwinding was seen in 8400 and 8600 strikes. Highest

PCJEWELLER

547500

12.65

429.80

1.74

OI in current series has shifted from 9000 to 8800 call

option; while it remains intact at 8500 put option.

OI Losers

Yet another day, when we saw marginal selling from FIIs

OI

PRICE

SCRIP

OI

PRICE

in index future. But, the quantum of shorts was too low

CHG. (%)

CHG. (%)

and their previous longs are still intact. Till the time, Nifty

WOCKPHARMA

3112800

-9.22

787.00

0.56

holds its support of 8500 - 8550 and we don’t see any

JISLJALEQS

40293000

-8.20

81.50

5.03

meaningful change in derivative data, we maintain our

ADANIPORTS

22542500

-7.95

267.40

-2.23

bullish stance on Nifty. Thus, traders are advised to

TVSMOTOR

5038000

-7.70

314.10

5.05

remain light on positions and trade with positive bias.

BANKINDIA

29016000

-6.62

112.00

0.27

Historical Volatility

Put-Call Ratio

SCRIP

HV

SCRIP

PCR-OI

PCR-VOL

TVSMOTOR

32.57

NIFTY

0.98

1.04

STAR

39.12

BANKNIFTY

1.22

0.99

NMDC

31.18

SBIN

0.90

0.71

COALINDIA

26.24

ICICIBANK

0.38

0.22

SAIL

40.97

INFY

0.31

0.50

Strategy Date

Symbol

Strategy

Status

01-08-2016

RELIANCE

Ratio Bear Put Spread

Active

08-08-2016

SBIN

Bull Call Spread

Active

2

Technical & Derivatives Report

August 18, 2016

FII Statistics for 17-August 2016

Turnover on 17-August 2016

Open Interest

No. of

Turnover

Change

Detail

Buy

Sell

Net

Instrument

Value

Contracts

( in Cr. )

(%)

Contracts

Change (%)

(in Cr.)

INDEX

INDEX

1777.43

1902.80

(125.37)

346838

22871.75

1.59

217784

14992.95

-2.81

FUTURES

FUTURES

INDEX

INDEX

45412.45

45344.84

67.61

1056844

69215.46

1.98

3909868

272612.31

12.62

OPTIONS

OPTIONS

STOCK

6131.05

5865.14

265.91

902864

58812.65

0.36

STOCK

FUTURES

547069

36912.24

-6.20

FUTURES

STOCK

STOCK

4189.81

4189.59

0.22

96761

6438.98

0.90

OPTIONS

375252

25592.84

-9.93

OPTIONS

TOTAL

57510.74

57302.36

208.37

2403307

157338.84

1.26

TOTAL

5049973

350110.34

7.64

Nifty Spot = 8624.05

Lot Size = 75

Bull-Call Spreads

Bear-Put Spreads

Action

Strike

Price

Risk

Reward

BEP

Action

Strike

Price

Risk

Reward

BEP

Buy

8700

41.15

Buy

8600

57.15

24.75

75.25

8724.75

29.35

70.65

8570.65

Sell

8800

16.40

Sell

8500

27.80

Buy

8700

41.15

Buy

8600

57.15

35.35

164.65

8735.35

44.10

155.90

8555.90

Sell

8900

5.80

Sell

8400

13.05

Buy

8800

16.40

Buy

8500

27.80

10.60

89.40

8810.60

14.75

85.25

8485.25

Sell

8900

5.80

Sell

8400

13.05

Note: Above mentioned Bullish or Bearish Spreads in Nifty (August Series) are given as an information and not as a recommendation.

Nifty Put-Call Analysis

3

Technical & Derivatives Report

August 18, 2016

Daily Pivot Levels for Nifty Constituents

Scrips

S2

S1

PIVOT

R1

R2

ACC

1,624

1,650

1,667

1,693

1,710

ADANIPORTS

259

263

270

274

281

AMBUJACEM

262

266

269

273

276

ASIANPAINT

1,097

1,105

1,116

1,125

1,136

AUROPHARMA

725

737

744

756

763

AXISBANK

578

584

591

597

604

BAJAJ-AUTO

2,856

2,898

2,925

2,967

2,994

BANKBARODA

148

150

151

153

154

BHEL

135

137

138

139

140

BPCL

575

581

590

596

605

BHARTIARTL

340

343

346

349

352

INFRATEL

342

345

349

353

357

BOSCH

23,647

23,811

23,990

24,154

24,333

CIPLA

537

543

554

560

570

COALINDIA

333

340

345

353

357

DRREDDY

2,964

2,985

3,002

3,022

3,040

EICHERMOT

22,065

22,207

22,353

22,495

22,641

GAIL

364

366

369

371

374

GRASIM

4,408

4,464

4,526

4,583

4,645

HCLTECH

770

777

789

796

808

HDFCBANK

1,221

1,228

1,233

1,240

1,244

HDFC

1,341

1,354

1,363

1,376

1,385

HEROMOTOCO

3,234

3,296

3,363

3,425

3,492

HINDALCO

153

154

156

157

158

HINDUNILVR

901

907

916

923

932

ICICIBANK

242

245

248

251

255

IDEA

91

92

94

95

96

INDUSINDBK

1,142

1,148

1,155

1,161

1,168

INFY

1,017

1,025

1,039

1,047

1,061

ITC

250

252

254

256

259

KOTAKBANK

756

761

766

771

777

LT

1,479

1,491

1,503

1,514

1,526

LUPIN

1,558

1,576

1,591

1,609

1,623

M&M

1,427

1,439

1,448

1,459

1,468

MARUTI

4,821

4,856

4,883

4,918

4,946

NTPC

159

160

161

162

163

ONGC

233

235

237

239

241

POWERGRID

171

173

176

178

180

RELIANCE

995

1,004

1,016

1,026

1,038

SBIN

241

244

247

249

252

SUNPHARMA

765

775

783

793

801

TCS

2,566

2,595

2,647

2,676

2,728

TATAMTRDVR

329

331

333

335

337

TATAMOTORS

502

506

510

514

519

TATAPOWER

75

76

77

79

80

TATASTEEL

375

384

388

397

401

TECHM

463

469

478

484

493

ULTRACEMCO

3,637

3,668

3,703

3,734

3,769

WIPRO

519

524

531

535

542

YESBANK

1,277

1,292

1,301

1,317

1,326

ZEEL

490

494

500

504

510

4

Technical & Derivatives Report

August 18, 2016

Research Team Tel: 022 - 39357800

For Technical Queries

For Derivatives Queries

DISCLAIMER

Angel Broking Private Limited (hereinafter referred to as “Angel”) is a registered Member of National Stock Exchange of India Limited,

Bombay Stock Exchange Limited and Metropolitan Stock Exchange Limited. It is also registered as a Depository Participant with CDSL

and Portfolio Manager with SEBI. It also has registration with AMFI as a Mutual Fund Distributor. Angel Broking Private Limited is a

registered entity with SEBI for Research Analyst in terms of SEBI (Research Analyst) Regulations, 2014 vide registration number

INH000000164. Angel or its associates has not been debarred/ suspended by SEBI or any other regulatory authority for accessing

/dealing in securities Market. Angel or its associates/analyst has not received any compensation / managed or co-managed public

offering of securities of the company covered by Analyst during the past twelve months.

This document is solely for the personal information of the recipient, and must not be singularly used as the basis of any investment

decision. Nothing in this document should be construed as investment or financial advice. Each recipient of this document should

make such investigations as they deem necessary to arrive at an independent evaluation of an investment in the securities of the

companies referred to in this document (including the merits and risks involved), and should consult their own advisors to determine

the merits and risks of such an investment.

Reports based on technical and derivative analysis center on studying charts of a stock's price movement, outstanding positions and

trading volume, as opposed to focusing on a company's fundamentals and, as such, may not match with a report on a company's

fundamentals. Investors are advised to refer the Fundamental and Technical Research Reports available on our website to evaluate the

contrary view, if any.

The information in this document has been printed on the basis of publicly available information, internal data and other reliable

sources believed to be true, but we do not represent that it is accurate or complete and it should not be relied on as such, as this

document is for general guidance only. Angel Broking Pvt. Limited or any of its affiliates/ group companies shall not be in any way

responsible for any loss or damage that may arise to any person from any inadvertent error in the information contained in this report.

Angel Broking Pvt. Limited has not independently verified all the information contained within this document. Accordingly, we cannot

testify, nor make any representation or warranty, express or implied, to the accuracy, contents or data contained within this document.

While Angel Broking Pvt. Limited endeavors to update on a reasonable basis the information discussed in this material, there may be

regulatory, compliance, or other reasons that prevent us from doing so.

This document is being supplied to you solely for your information, and its contents, information or data may not be reproduced,

redistributed or passed on, directly or indirectly.

Neither Angel Broking Pvt. Limited, nor its directors, employees or affiliates shall be liable for any loss or damage that may arise from

or in connection with the use of this information.

5