Technical & Derivatives Report

November 17, 2016

Sensex (26299) / Nifty (8112)

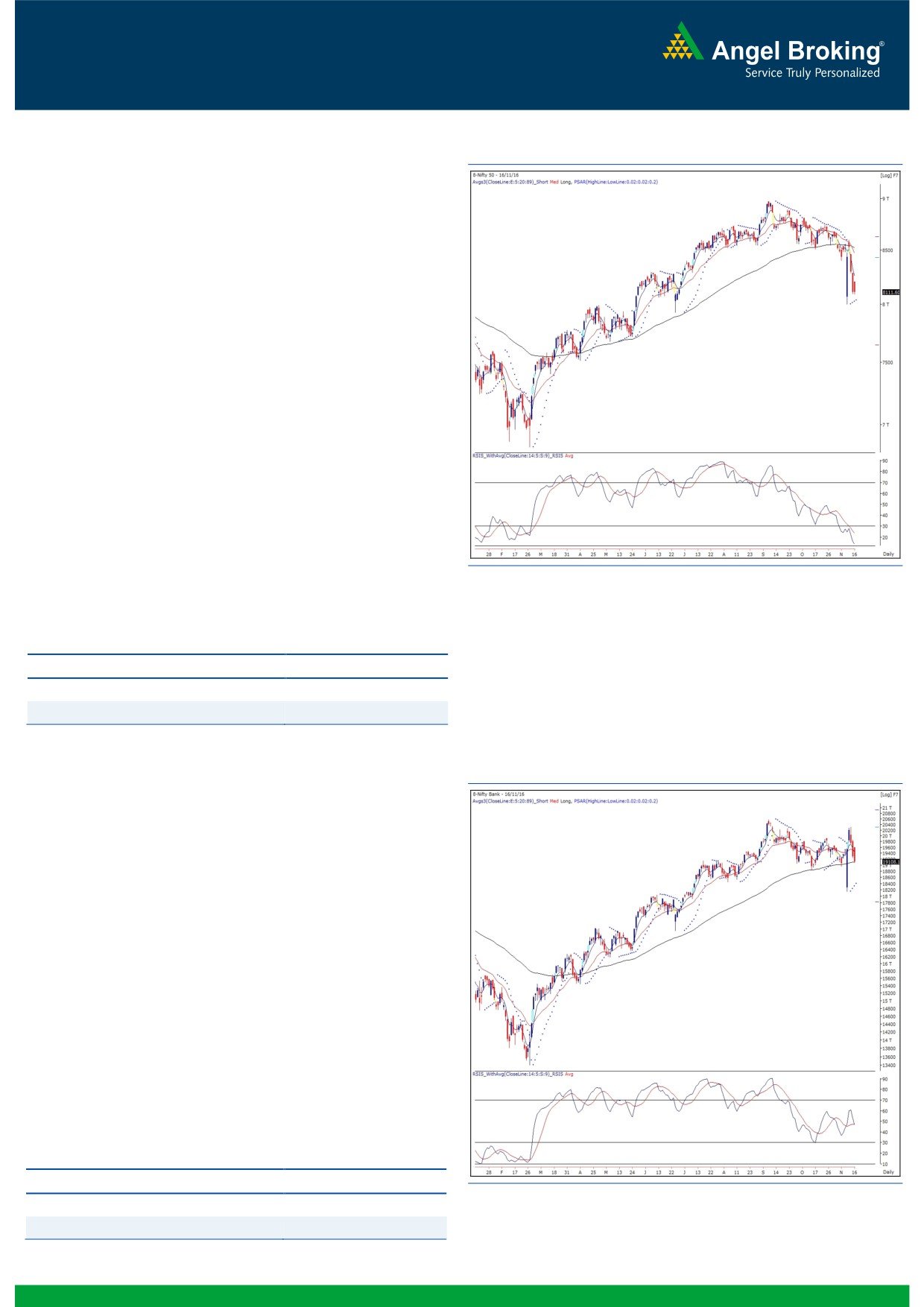

Exhibit 1: Nifty Daily Chart

Yesterday’s session opened with a decent upside gap as indicated

by the SGX Nifty. However, this lead was very short lived as we

witnessed a sharp decline in initial trades to pare down all

opening gains. Subsequently, the index consolidated for some

time with an attempt to recover from morning lows; but, once

again, a tail-end selling pressure in the broader market led to a

flat close tad above the 8100 mark.

Despite this price development, we still do not want to get carried

away by the momentum and hence, we would avoid going short

on the index at this juncture. Rather, if we combine last two day’s

candles on daily chart, we can observe a Japanese Candlestick

pattern which resembles a ‘Bullish Homing Pigeon’. As per the

requirement of this pattern, second red candle should be smaller

as compared to the previous one and importantly, its real body

should be located within the range of previous candle’s real body.

Going forward, 8080 - 8000 are seen as immediate support

levels; whereas on the other hand, a possibility of a bounce

towards 8220 - 8300 cannot be ruled out. Traders can use these

dips to create a contradictory buy call by placing a strict stop loss

below the 8000 mark.

Key Levels

Support 1 - 8080

Resistance 1 - 8220

Support 2 - 8000

Resistance 2 - 8300

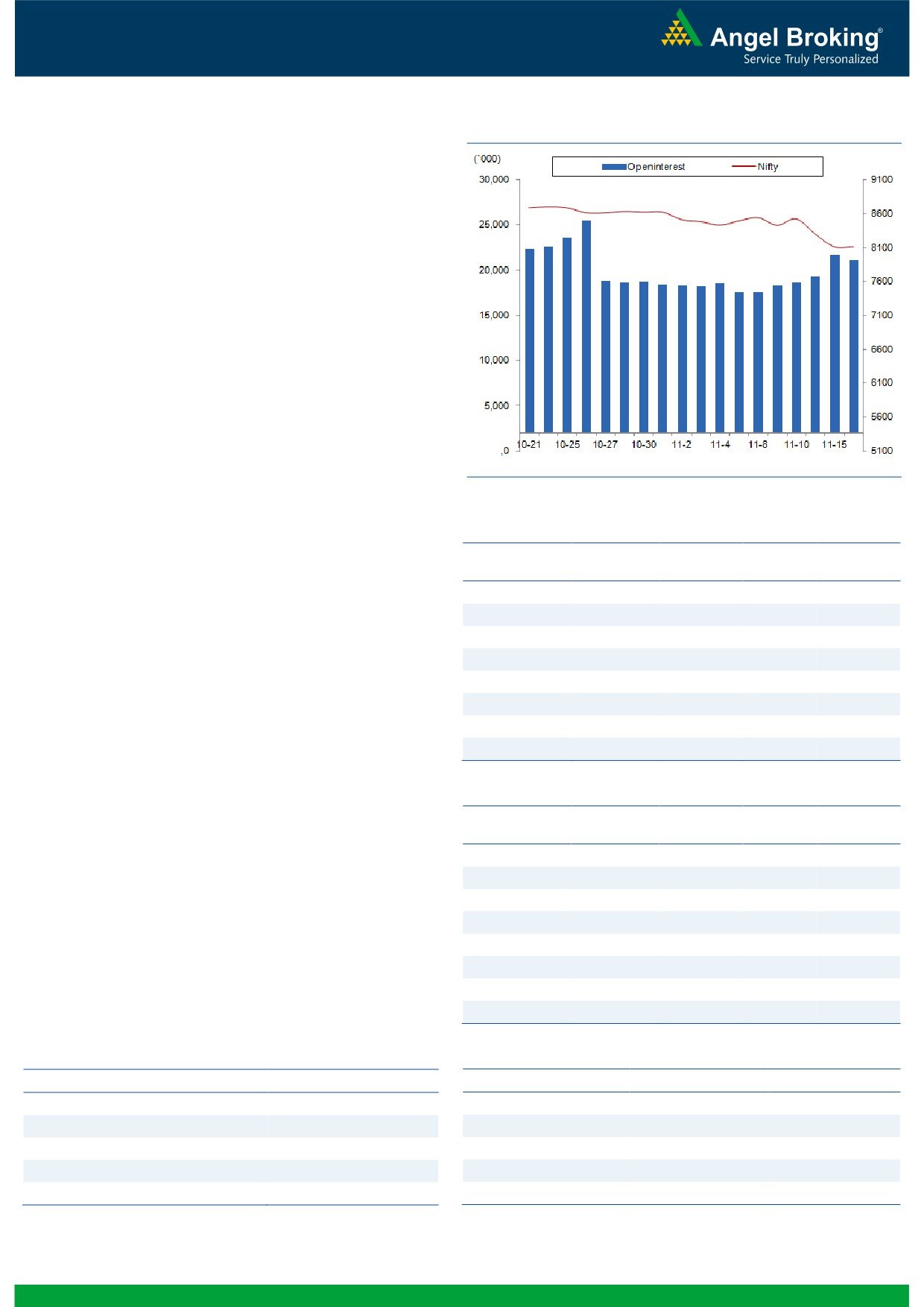

Exhibit 2: Nifty Bank Daily Chart

Nifty Bank Outlook - (19108)

Tracking SGX Nifty, the Nifty Bank index too opened on a positive

note yesterday along with the broader indices. However, the bulls

were unable to carry the positive momentum and the index

corrected throughout the session to end near the day's low with

loss of 0.94%.

Although since last three sessions the Nifty Bank index had been

correcting from their opening quotes, the broader chart does not

indicate signs of any catastrophic down move. If we observe the

recent trading history, the Nifty Bank index has not breached the

crucial '89 DEMA' on closing basis in last seven months. Also, the

61.80% retracement of the up move from 18144 to 20310 is

placed around

18972. Considering the multiple technical

supports, we are expecting a pullback in the banking index from

the support zone of 19000 -

18900. On the higher side,

immediate resistance is placed at 19340 and 19460.

Key Levels

Support 1 - 19000

Resistance 1 - 19340

Support 2 - 18900

Resistance 2 - 19460

1

Technical & Derivatives Report

November 17, 2016

Comments

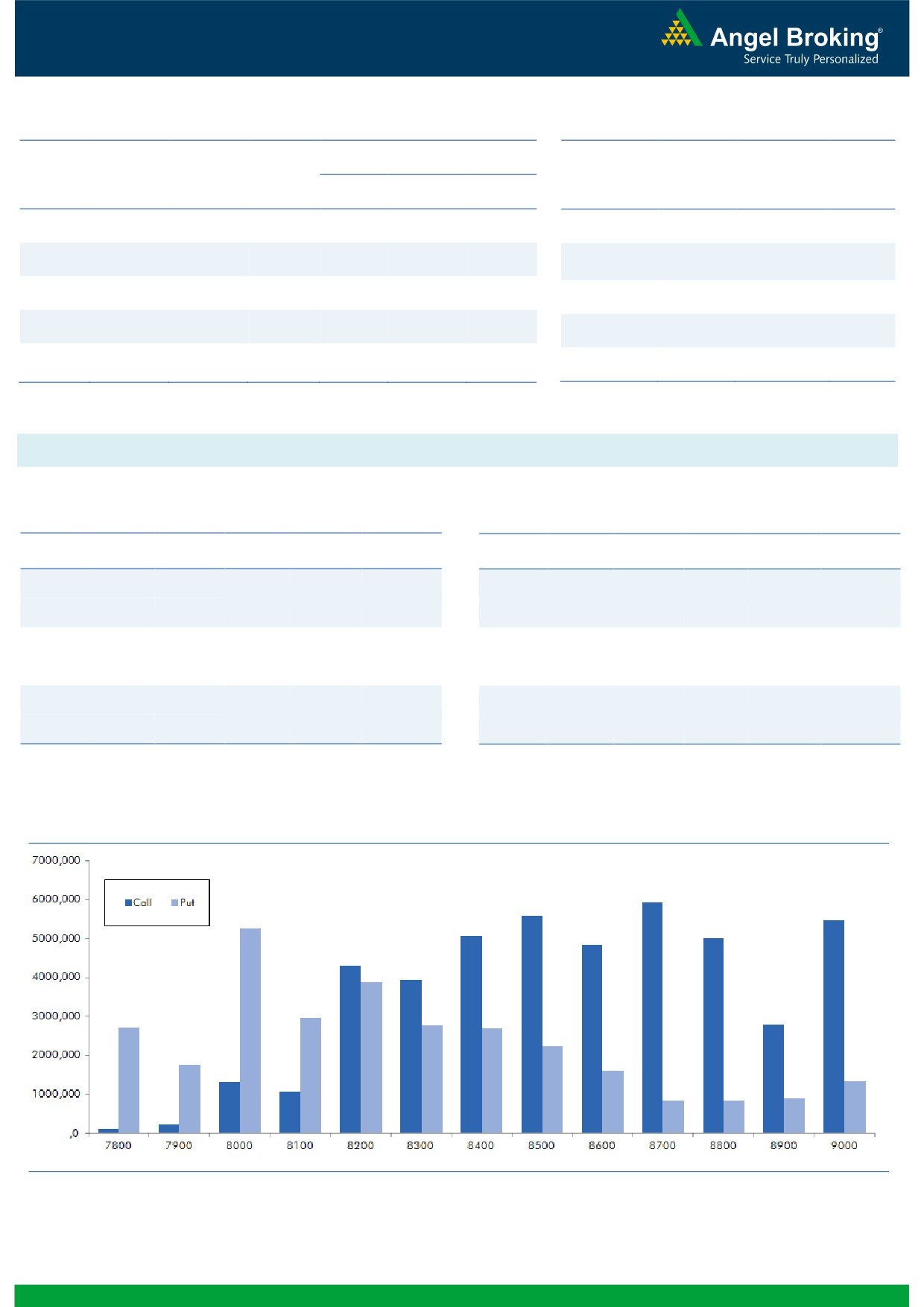

Nifty Vs OI

The Nifty futures open interest has decreased by 2.72%

BankNifty futures open interest has increased by 7.83%

as market closed at 8111.60 levels.

The Nifty November future closed with a premium of

6.95 against the premium of 31.10 points in last trading

session. The December series closed at a premium of

56.00 points.

The Implied Volatility of at the money options has

decreased from 25.45% to 22.54%. At the same time,

the PCR-OI of Nifty has increased from at 0.73 to 0.76

levels.

The total OI of the market is Rs. 2,89,347/- cr. and the

stock futures OI is Rs. 71,774/- cr.

Few of the liquid counters where we have seen high cost

of carry are JPASSOCIAT, BAJAJ-AUTO, JINDALSTEL,

SRTRANSFIN and FEDERALBNK.

Views

OI Gainers

FIIs continued their selling streak in cash segment in

OI

PRICE

SCRIP

OI

PRICE

CHG. (%)

CHG. (%)

yesterday's session too. They sold equities worth Rs. 1957

AMBUJACEM

16352500

23.02

203.00

-3.13

crores. While, in index futures, they were net buyer worth

SAIL

74052000

20.53

49.75

0.10

Rs. 94 crores with fall in open interest, indicating blend

PCJEWELLER

1006500

20.04

325.15

-8.49

of long and short unwinding in previous trading session.ing.com

CADILAHC

3265600

12.58

374.55

4.59

In Index options segment, FII were net sellers to the tune

APOLLOTYRE

9426000

11.14

184.80

-1.07

of Rs. 131 crores with rise in open interest. In call

TVSMOTOR

6402000

7.63

351.10

1.69

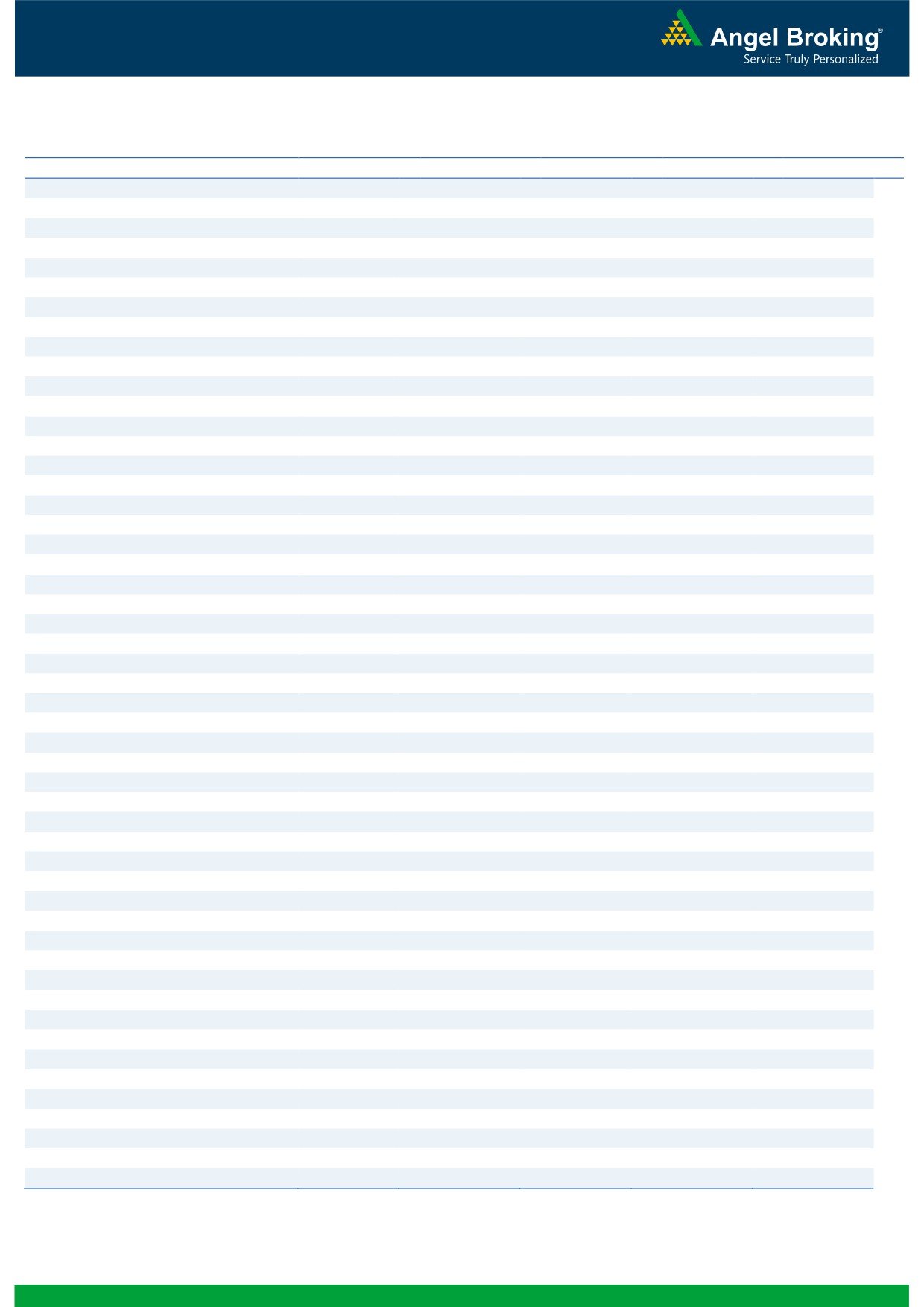

options, except some OI build-up in 8200 strike, we

JINDALSTEL

47484000

7.32

68.20

-3.94

witnessed decent unwinding in 8300-8700 strikes. On

INFRATEL

3522400

6.61

361.50

-1.19

the other hand, in put options, 8100 and 8000 strikes

added fresh positions; followed by unwinding in 8200

strike. Highest OI in current series is placed at 8700 call

OI Losers

and 8000 put.

OI

PRICE

SCRIP

OI

PRICE

CHG. (%)

CHG. (%)

FIIs are continuously liquidating their long positions in

BHARATFIN

6008000

-12.83

685.20

8.16

equity cash segment, which doesn't bode well for Bulls.

ULTRACEMCO

980400

-10.95

3365.80

0.07

While, some sign of relief was seen for Bulls as FIIs

PIDILITIND

1829000

-9.32

622.85

1.01

unwound some of their short positions in index futures.

TCS

5336500

-8.67

2193.95

2.83

Since, the quantum of short covering is quite low; we

INFY

13173500

-6.82

941.40

1.47

would like to wait for follow up action before pre-

LICHSGFIN

9055200

-6.75

512.00

6.52

empting any reversal. At current juncture, 8000-7970

remains good support for index and traders are advised

IDBI

37888000

-6.50

71.00

1.07

to remain light on positions.

DCBBANK

2974500

-6.37

103.15

1.48

Historical Volatility

Put-Call Ratio

SCRIP

HV

SCRIP

PCR-OI

PCR-VOL

BAJFINANCE

75.72

NIFTY

0.76

0.82

SRF

53.06

BANKNIFTY

0.65

0.69

AMARAJABAT

62.62

SBIN

0.56

0.62

MCLEODRUSS

44.71

ICICIBANK

0.46

0.46

BHARATFIN

82.65

RELIANCE

0.45

0.37

2

Technical & Derivatives Report

November 17, 2016

FII Statistics for November 16, 2016

Turnover on November 16, 2016

Open Interest

No. of

Turnover

Change

Detail

Buy

Sell

Net

Instrument

Value

Change

Contracts

( in Cr. )

(%)

Contracts

(in Cr.)

(%)

INDEX

INDEX

2894.45

2800.18

94.27

195942

12610.66

(1.65)

312410

20691.63

-23.48

FUTURES

FUTURES

INDEX

INDEX

69086.72

69217.70

(130.99)

1287365

80495.99

2.38

5300688

364023.29

-5.78

OPTIONS

OPTIONS

STOCK

9217.76

8199.11

1018.65

894518

53681.10

(0.84)

STOCK

FUTURES

604099

39827.97

-18.39

FUTURES

STOCK

STOCK

7022.94

7091.87

(68.93)

125825

8068.78

0.32

OPTIONS

448172

31180.19

-18.18

OPTIONS

TOTAL

88221.87

87308.87

913.00

2503650

154856.52

0.79

TOTAL

6665369

455723.07

-8.91

Nifty Spot = 8111.60

Lot Size = 75

Bull-Call Spreads

Bear-Put Spreads

Action

Strike

Price

Risk

Reward

BEP

Action

Strike

Price

Risk

Reward

BEP

Buy

8200

66.60

Buy

8000

67.25

33.75

66.25

8233.75

23.40

76.60

7976.60

Sell

8300

32.85

Sell

7900

43.85

Buy

8200

66.60

Buy

8000

67.25

52.65

147.35

8252.65

39.20

160.80

7960.80

Sell

8400

13.95

Sell

7800

28.05

Buy

8300

32.85

Buy

7900

43.85

18.90

81.10

8318.90

15.80

84.20

7884.20

Sell

8400

13.95

Sell

7800

28.05

Note: Above mentioned Bullish or Bearish Spreads in Nifty (November Series) are given as an information and not as a recommendation.

Nifty Put-Call Analysis

3

Technical & Derivatives Report

November 17, 2016

Daily Pivot Levels for Nifty Constituents

Scrips

S2

S1

PIVOT

R1

R2

ACC

1 273

1 306

1 341

1 373

1 408

ADANIPORTS

253

259

267

273

281

AMBUJACEM

194

198

206

210

217

ASIANPAINT

885

911

928

953

971

AUROPHARMA

664

689

723

748

782

AXISBANK

459

466

477

483

494

BAJAJ-AUTO

2 520

2 563

2 613

2 656

2 706

BANKBARODA

163

168

173

178

184

BHEL

128

130

133

135

139

BPCL

610

622

641

654

673

BHARTIARTL

300

305

308

313

316

INFRATEL

348

354

361

368

375

BOSCH

18 698

18 936

19 368

19 606

20 038

CIPLA

517

527

546

557

576

COALINDIA

305

309

313

317

321

DRREDDY

3 094

3 152

3 254

3 312

3 414

EICHERMOT

19 186

20 151

20 976

21 941

22 766

GAIL

412

420

433

441

454

GRASIM

779

798

817

836

855

HCLTECH

752

763

775

786

799

HDFCBANK

1 223

1 234

1 251

1 262

1 279

HDFC

1 204

1 230

1 248

1 273

1 291

HEROMOTOCO

2 816

2 863

2 939

2 986

3 062

HINDALCO

154

158

166

170

177

HINDUNILVR

791

800

807

816

822

ICICIBANK

256

261

270

275

284

IDEA

68

69

71

72

74

INDUSINDBK

1 055

1 075

1 096

1 116

1 136

INFY

914

927

942

956

970

ITC

222

226

233

237

244

KOTAKBANK

748

759

778

789

808

LT

1 334

1 355

1 372

1 392

1 409

LUPIN

1 353

1 380

1 418

1 444

1 482

M&M

1 186

1 212

1 245

1 271

1 304

MARUTI

4 859

4 925

4 967

5 033

5 075

NTPC

148

149

150

152

153

ONGC

263

267

276

281

290

POWERGRID

180

184

187

192

195

RELIANCE

972

979

988

995

1 004

SBIN

271

274

279

283

288

SUNPHARMA

639

653

674

688

709

TCS

2 108

2 149

2 179

2 220

2 250

TATAMTRDVR

276

284

295

303

314

TATAMOTORS

438

448

460

470

482

TATAPOWER

68

70

70

72

73

TATASTEEL

371

382

392

402

412

TECHM

427

435

442

450

457

ULTRACEMCO

3 269

3 320

3 393

3 444

3 517

WIPRO

435

440

447

453

460

YESBANK

1 106

1 144

1 172

1 209

1 237

ZEEL

450

462

472

485

495

4

Technical & Derivatives Report

November 17, 2016

Research Team Tel: 022 - 39357800

For Technical Queries

For Derivatives Queries

DISCLAIMER

Angel Broking Private Limited (hereinafter referred to as “Angel”) is a registered Member of National Stock Exchange of India Limited,

Bombay Stock Exchange Limited and Metropolitan Stock Exchange Limited. It is also registered as a Depository Participant with CDSL

and Portfolio Manager with SEBI. It also has registration with AMFI as a Mutual Fund Distributor. Angel Broking Private Limited is a

registered entity with SEBI for Research Analyst in terms of SEBI (Research Analyst) Regulations, 2014 vide registration number

INH000000164. Angel or its associates has not been debarred/ suspended by SEBI or any other regulatory authority for accessing

/dealing in securities Market. Angel or its associates/analyst has not received any compensation / managed or co-managed public

offering of securities of the company covered by Analyst during the past twelve months.

This document is solely for the personal information of the recipient, and must not be singularly used as the basis of any investment

decision. Nothing in this document should be construed as investment or financial advice. Each recipient of this document should

make such investigations as they deem necessary to arrive at an independent evaluation of an investment in the securities of the

companies referred to in this document (including the merits and risks involved), and should consult their own advisors to determine

the merits and risks of such an investment.

Reports based on technical and derivative analysis center on studying charts of a stock's price movement, outstanding positions and

trading volume, as opposed to focusing on a company's fundamentals and, as such, may not match with a report on a company's

fundamentals. Investors are advised to refer the Fundamental and Technical Research Reports available on our website to evaluate the

contrary view, if any.

The information in this document has been printed on the basis of publicly available information, internal data and other reliable

sources believed to be true, but we do not represent that it is accurate or complete and it should not be relied on as such, as this

document is for general guidance only. Angel Broking Pvt. Limited or any of its affiliates/ group companies shall not be in any way

responsible for any loss or damage that may arise to any person from any inadvertent error in the information contained in this report.

Angel Broking Pvt. Limited has not independently verified all the information contained within this document. Accordingly, we cannot

testify, nor make any representation or warranty, express or implied, to the accuracy, contents or data contained within this document.

While Angel Broking Pvt. Limited endeavors to update on a reasonable basis the information discussed in this material, there may be

regulatory, compliance, or other reasons that prevent us from doing so.

This document is being supplied to you solely for your information, and its contents, information or data may not be reproduced,

redistributed or passed on, directly or indirectly.

Neither Angel Broking Pvt. Limited, nor its directors, employees or affiliates shall be liable for any loss or damage that may arise from

or in connection with the use of this information.

5