Technical & Derivatives Report

November 16, 2015

Sensex (25611) / Nifty (7762)

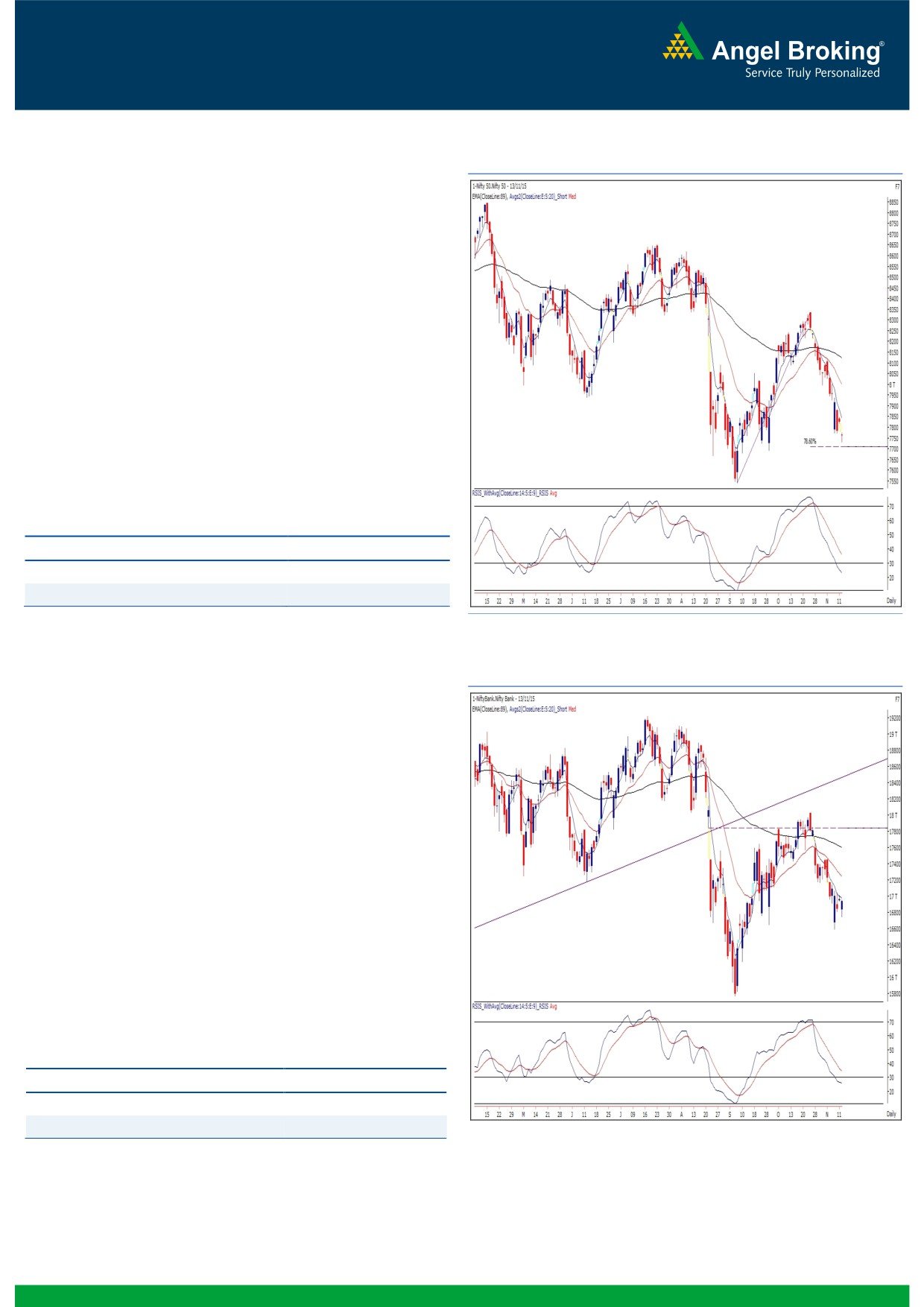

Exhibit 1: Nifty Daily Chart

The first half of the forthcoming week would be very important

for the market. If the Nifty manages to hold the support of

7691, then we may witness an immediate bounce back

towards 7850 - 7930 levels. Further, if we meticulously

observe the weekly chart, an ‘Inverted Hammer’ pattern is

clearly visible. The ongoing pessimism may get arrested once

the Nifty surpasses the high (7937.75) of the pattern on a

closing basis. In this scenario, an immediate up move towards

8100 on the Nifty cannot be ruled out. This pattern needs a

confirmation and thus, traders are advised not to pre-empt

any move, but rather wait for developments to happen around

the mentioned key level. On the flipside, a sustainable move

below 7691 may lead to an extension of this down move and

the Nifty could test its recent low of 7539.50. Meanwhile, a

stock specific approach should be continued to be followed

with a proper exit strategy.

Key Levels

Support 1 - 7691

Resistance 1 - 7850

Support 2 - 7539

Resistance 2 - 7930

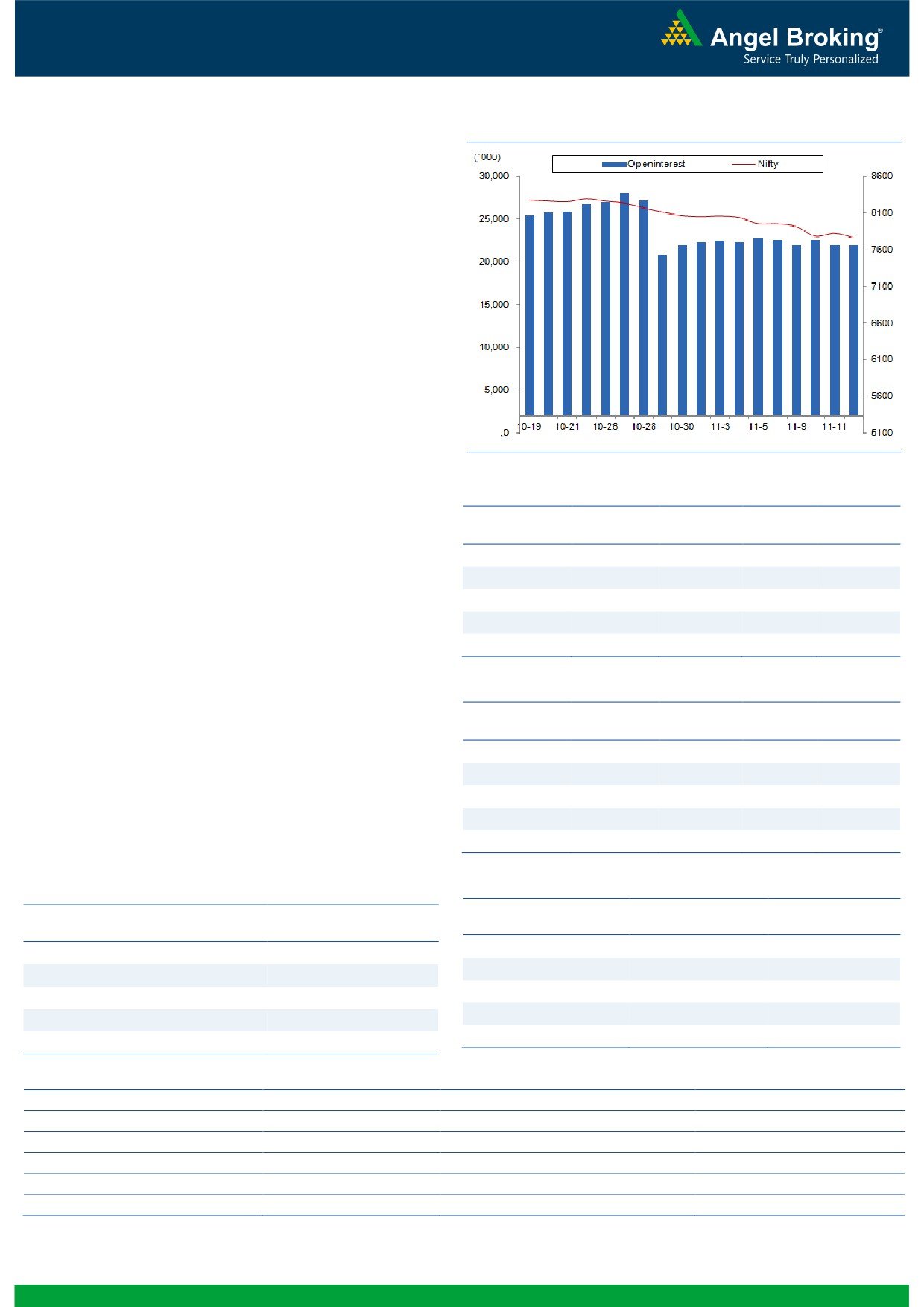

Exhibit 2: Bank Nifty Daily Chart

Bank Nifty Outlook - (16933)

Last week, the Nifty Bank Index ended with losses of 0.90 per

cent as compared to its previous week's close. On weekly

charts, the index has formed a small body candle near the 89

weekly EMA. The support also coincides with the

61.8%

retracement level of the previous up-leg from 15762 to

18029. Hence, it will be prudent to watch last week's low of

16587 which is a crucial support level. The index could show

pullback moves as the correction has halted near the above

mentioned crucial support. However, there are no major

reversal signals at this juncture. Hence, any pullback could just

be a dead cat bounce unless we see any strength in broader

market. The resistance on pullbacks will be seen around

17170 and hence we expect the index to trade in the range of

16587

-

17170 in near term. Any breakout from the

mentioned range could lead to a directional momentum in the

direction of the breakout.

Key Levels

Support 1 - 16700

Resistance 1 - 17000

Support 2 - 16587

Resistance 2 - 17170

1

Technical & Derivatives Report

November 16, 2015

Comments

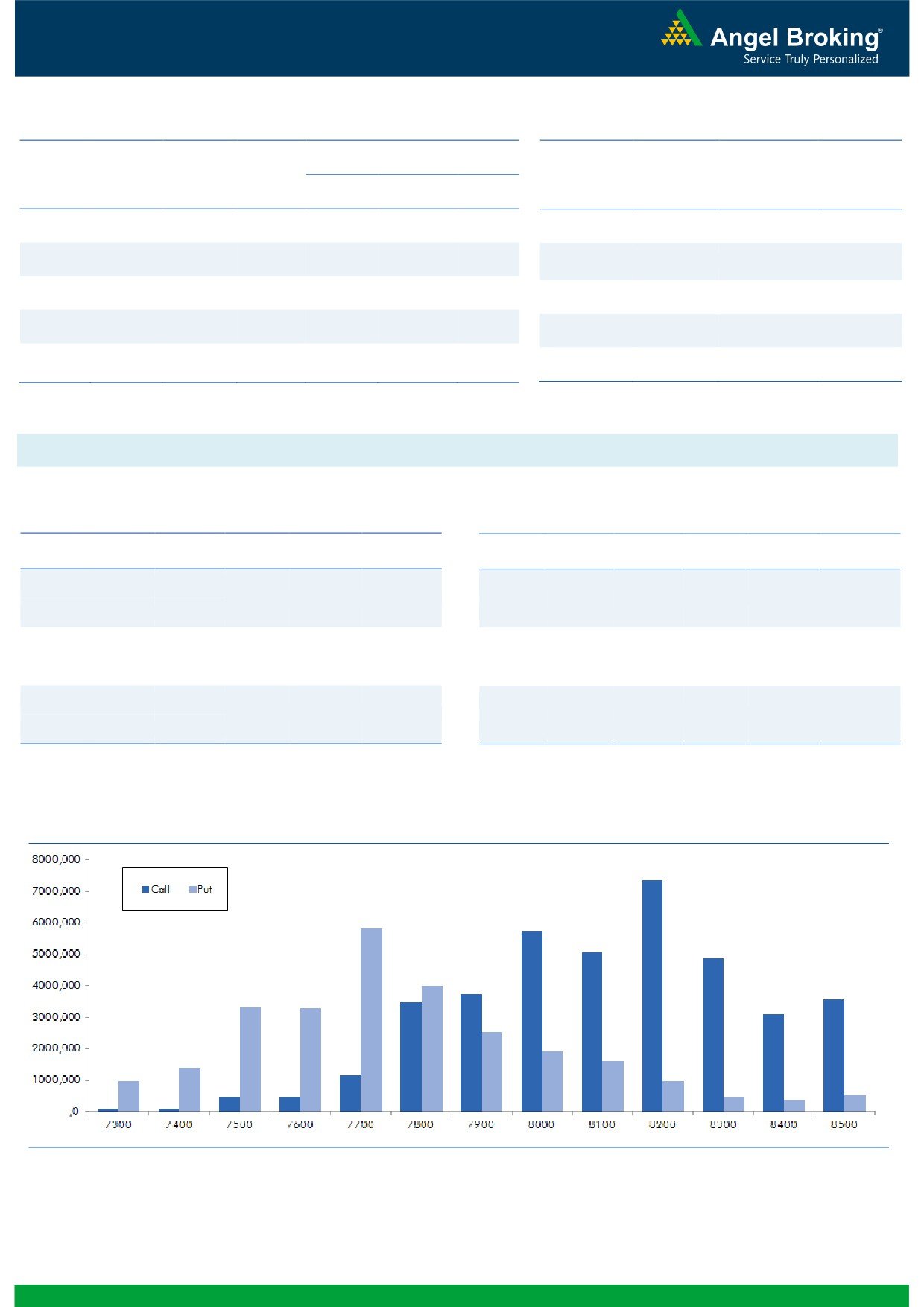

Nifty Vs OI

The Nifty futures open interest has decreased by 0.09%

BankNifty futures open interest has increased by 0.22%

as market closed at 7762.25 levels.

The Nifty November future closed at a premium of 12.05

points against a premium of 0.05 points. The December

series closed at a premium of 56.50 points.

The Implied Volatility of at the money options has

increased from 14.13% to 14.34%.

The total OI of the market is Rs. 2,29,546/- cr. and the

stock futures OI is Rs. 60,677/- cr.

Few of the liquid counters where we have seen high cost

of carry are JPASSOCIAT, PIDILITIND, UNITECH, NCC

and SUNTV.

OI Gainers

Views

OI

PRICE

SCRIP

OI

PRICE

CHG. (%)

CHG. (%)

FIIs were net sellers in both cash market segment and in

IBULHSGFIN

6943200

27.09

646.35

-10.15

Index Futures. They sold equities to the tune of Rs. 747

CESC

2432000

20.81

559.25

6.18

crores and Index Futures of Rs.

1250 crores with

TATAMTRDVR

15306900

15.90

290.60

4.44

marginal change in OI, which indicates blend of fresh

RCOM

65824000

12.37

66.15

-6.83

short formation and long unwinding.

OIL

2744400

12.22

366.70

-3.97

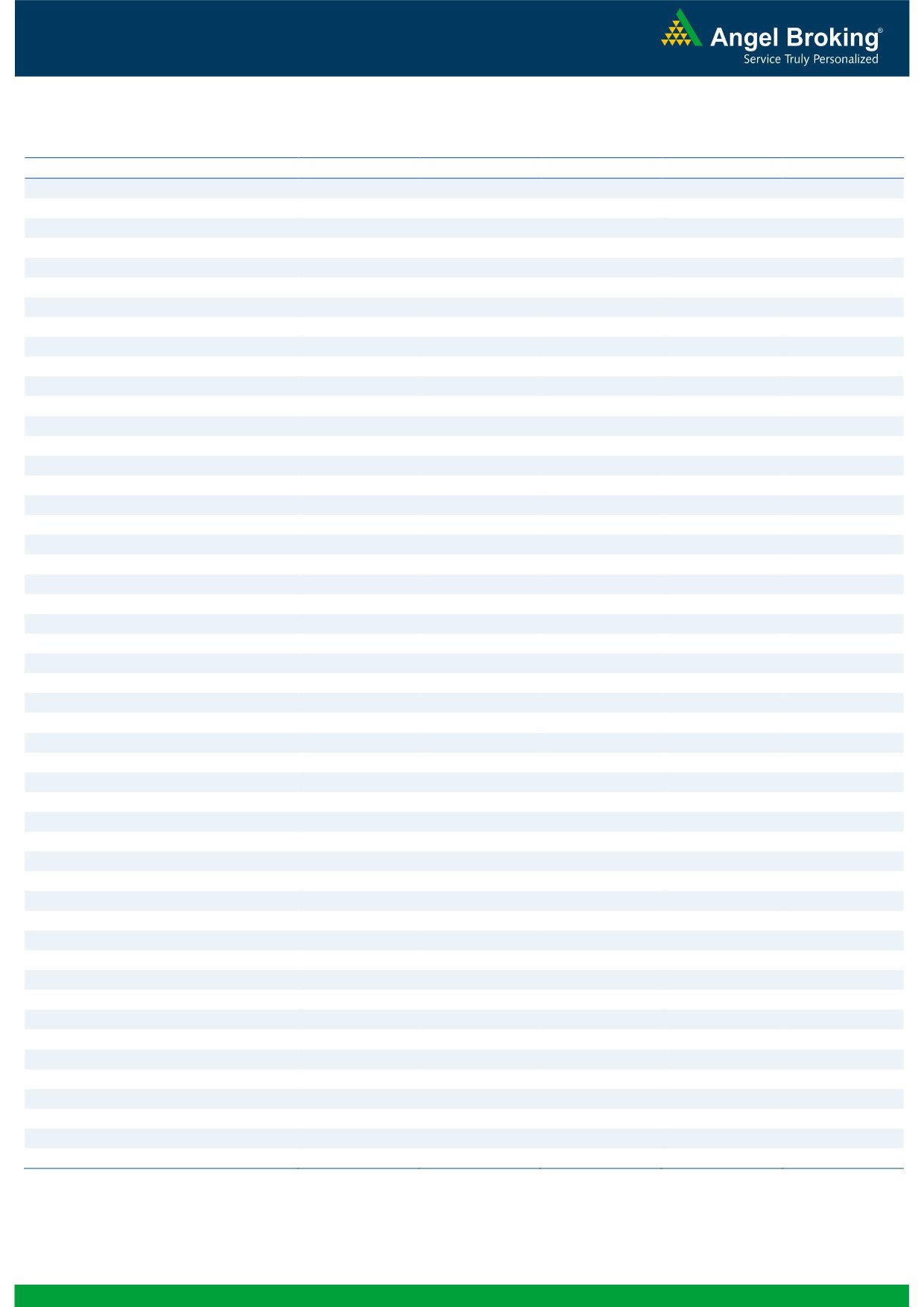

In Index Options front, they bought of worth Rs. 979

crores with decent rise in OI. If we see the overall Nifty

OI Losers

options data, both in call and put options we hardly saw

OI

PRICE

any meaningful OI addition. In call options, 8000 strike

SCRIP

OI

PRICE

CHG. (%)

CHG. (%)

was most active and added some OI. Maximum build-up

MARUTI

2369625

-15.40

4618.30

-2.41

is visible in 8200 call and 7700 put options. Seeing

DABUR

2866000

-9.13

267.40

-0.04

continuous selling in equities and Index Futures by bigger

COALINDIA

14354400

-6.58

337.60

2.69

hands, we believe market may still remain in pressure

HEROMOTOCO

1180000

-4.93

2619.95

-1.26

and one should avoid bottom fishing till we see any

AXISBANK

37781000

-4.46

485.80

1.07

meaningful changes in data.

Put-Call Ratio

Historical Volatility

SCRIP

PCR-OI

PCR-VOL

SCRIP

HV

NIFTY

0.72

0.71

IBULHSGFIN

59.29

BANKNIFTY

0.76

0.72

OIL

39.47

LT

0.40

0.28

JINDALSTEL

70.51

DRREDDY

0.32

0.41

BRITANNIA

34.13

SBIN

0.48

0.47

CIPLA

30.61

Strategy Date

Symbol

Strategy

Status

November 02, 2015

RELIANCE

Short Strangle

Active

November 09, 2015

ITC

Short Strangle

Did not trigger.

2

Technical & Derivatives Report

November 16, 2015

FII Statistics for 13-November 2015

Turnover on 13-November 2015

Open Interest

No. of

Turnover

Change

Detail

Buy

Sell

Net

Instrument

Value

Change

Contracts

( in Cr. )

(%)

Contracts

(in Cr.)

(%)

INDEX

INDEX

1115.36

2365.03

(1249.67)

284579

16222.54

0.64

204938

11318.60

-24.30

FUTURES

FUTURES

INDEX

INDEX

16266.62

15287.30

979.32

1238111

71369.01

3.29

2148819

125696.62

-24.32

OPTIONS

OPTIONS

STOCK

3221.19

3564.54

(343.35)

959317

46554.07

(0.26)

STOCK

FUTURES

465055

23236.71

-4.14

FUTURES

STOCK

STOCK

2645.96

2530.68

115.29

74582

3630.32

8.87

OPTIONS

276953

14346.24

-6.22

OPTIONS

TOTAL

23249.13

23747.54

(498.41)

2556589

137775.95

1.79

TOTAL

3095765

174598.17

-20.85

Nifty Spot = 7762.25

Lot Size = 25

Bull-Call Spreads

Bear-Put Spreads

Action

Strike

Price

Risk

Reward

BEP

Action

Strike

Price

Risk

Reward

BEP

Buy

7800

70.70

Buy

7700

57.85

35.15

64.85

7835.15

25.80

74.20

7674.20

Sell

7900

35.55

Sell

7600

32.05

Buy

7800

70.70

Buy

7700

57.85

54.75

145.25

7854.75

40.25

159.75

7659.75

Sell

8000

15.95

Sell

7500

17.60

Buy

7900

35.55

Buy

7600

32.05

19.60

80.40

7919.60

14.45

85.55

7585.55

Sell

8000

15.95

Sell

7500

17.60

Note: Above mentioned Bullish or Bearish Spreads in Nifty (Nov. Series) are given as an information and not as a recommendation.

Nifty Put-Call Analysis

3

Technical & Derivatives Report

November 16, 2015

Daily Pivot Levels for Nifty 50 Stocks

Scrips

S2

S1

PIVOT

R1

R2

ACC

1,305

1,316

1,325

1,336

1,345

ADANIPORTS

259

263

266

270

273

AMBUJACEM

188

190

194

196

199

ASIANPAINT

785

793

800

808

816

AXISBANK

467

476

481

491

496

BAJAJ-AUTO

2,303

2,342

2,406

2,445

2,509

BANKBARODA

167

171

173

177

179

BHARTIARTL

321

327

332

338

343

BHEL

174

176

179

180

183

BOSCHLTD

18,509

18,748

19,003

19,242

19,498

BPCL

882

894

901

913

919

CAIRN

126

128

133

135

140

CIPLA

602

610

623

631

644

COALINDIA

324

331

336

343

349

DRREDDY

3,255

3,322

3,365

3,433

3,476

GAIL

277

280

282

284

286

GRASIM

3,529

3,576

3,603

3,650

3,677

HCLTECH

808

825

841

859

875

HDFC

1,149

1,164

1,173

1,187

1,196

HDFCBANK

1,035

1,044

1,049

1,058

1,063

HEROMOTOCO

2,586

2,601

2,625

2,640

2,664

HINDALCO

75

76

78

79

81

HINDUNILVR

789

793

796

800

803

ICICIBANK

257

260

261

264

265

IDEA

128

129

130

131

133

INDUSINDBK

874

883

889

899

905

INFY

1,083

1,092

1,099

1,108

1,115

ITC

324

327

330

333

337

KOTAKBANK

637

653

663

680

690

LT

1,311

1,321

1,340

1,350

1,369

LUPIN

1,742

1,760

1,778

1,796

1,814

M&M

1,234

1,243

1,251

1,260

1,268

MARUTI

4,518

4,569

4,653

4,704

4,788

NTPC

128

129

131

132

134

ONGC

225

227

230

232

236

PNB

130

134

136

139

141

POWERGRID

126

128

130

132

134

RELIANCE

905

919

929

943

953

SBIN

236

238

240

242

244

SUNPHARMA

84

86

88

90

92

TATAMOTORS

727

734

743

750

759

TATAPOWER

392

398

408

414

423

TATASTEEL

67

68

68

69

70

TCS

214

218

221

225

228

TECHM

2,356

2,377

2,407

2,428

2,459

ULTRACEMCO

514

517

521

524

529

VEDL

2,627

2,654

2,688

2,714

2,748

WIPRO

548

550

552

554

557

YESBANK

719

729

743

753

767

ZEEL

368

373

380

385

393

4

Technical & Derivatives Report

November 16, 2015

Research Team Tel: 022 - 39357800

For Technical Queries

For Derivatives Queries

DISCLAIMER

Angel Broking Private Limited (hereinafter referred to as “Angel”) is a registered Member of National Stock Exchange of India Limited,

Bombay Stock Exchange Limited and MCX Stock Exchange Limited. It is also registered as a Depository Participant with CDSL and

Portfolio Manager with SEBI. It also has registration with AMFI as a Mutual Fund Distributor. Angel Broking Private Limited is a

registered entity with SEBI for Research Analyst in terms of SEBI (Research Analyst) Regulations, 2014 vide registration number

INH000000164. Angel or its associates has not been debarred/ suspended by SEBI or any other regulatory authority for accessing

/dealing in securities Market. Angel or its associates including its relatives/analyst do not hold any financial interest/beneficial

ownership of more than 1% in the company covered by Analyst. Angel or its associates/analyst has not received any compensation /

managed or co-managed public offering of securities of the company covered by Analyst during the past twelve months. Angel/analyst

has not served as an officer, director or employee of company covered by Analyst and has not been engaged in market making activity

of the company covered by Analyst.

This document is solely for the personal information of the recipient, and must not be singularly used as the basis of any investment

decision. Nothing in this document should be construed as investment or financial advice. Each recipient of this document should

make such investigations as they deem necessary to arrive at an independent evaluation of an investment in the securities of the

companies referred to in this document (including the merits and risks involved), and should consult their own advisors to determine

the merits and risks of such an investment.

Reports based on technical and derivative analysis center on studying charts of a stock's price movement, outstanding positions and

trading volume, as opposed to focusing on a company's fundamentals and, as such, may not match with a report on a company's

fundamentals.

The information in this document has been printed on the basis of publicly available information, internal data and other reliable

sources believed to be true, but we do not represent that it is accurate or complete and it should not be relied on as such, as this

document is for general guidance only. Angel Broking Pvt. Limited or any of its affiliates/ group companies shall not be in any way

responsible for any loss or damage that may arise to any person from any inadvertent error in the information contained in this report.

Angel Broking Pvt. Limited has not independently verified all the information contained within this document. Accordingly, we cannot

testify, nor make any representation or warranty, express or implied, to the accuracy, contents or data contained within this document.

While Angel Broking Pvt. Limited endeavors to update on a reasonable basis the information discussed in this material, there may be

regulatory, compliance, or other reasons that prevent us from doing so.

This document is being supplied to you solely for your information, and its contents, information or data may not be reproduced,

redistributed or passed on, directly or indirectly.

Neither Angel Broking Pvt. Limited, nor its directors, employees or affiliates shall be liable for any loss or damage that may arise from

or in connection with the use of this information.

Note: Please refer to the important ‘Stock Holding Disclosure' report on the Angel website (Research Section). Also, please refer to the

latest update on respective stocks for the disclosure status in respect of those stocks. Angel Broking Pvt. Limited and its affiliates may

have investment positions in the stocks recommended in this report.

5