Technical & Derivatives Report

October 16, 2015

Sensex (27010) / Nifty (8180)

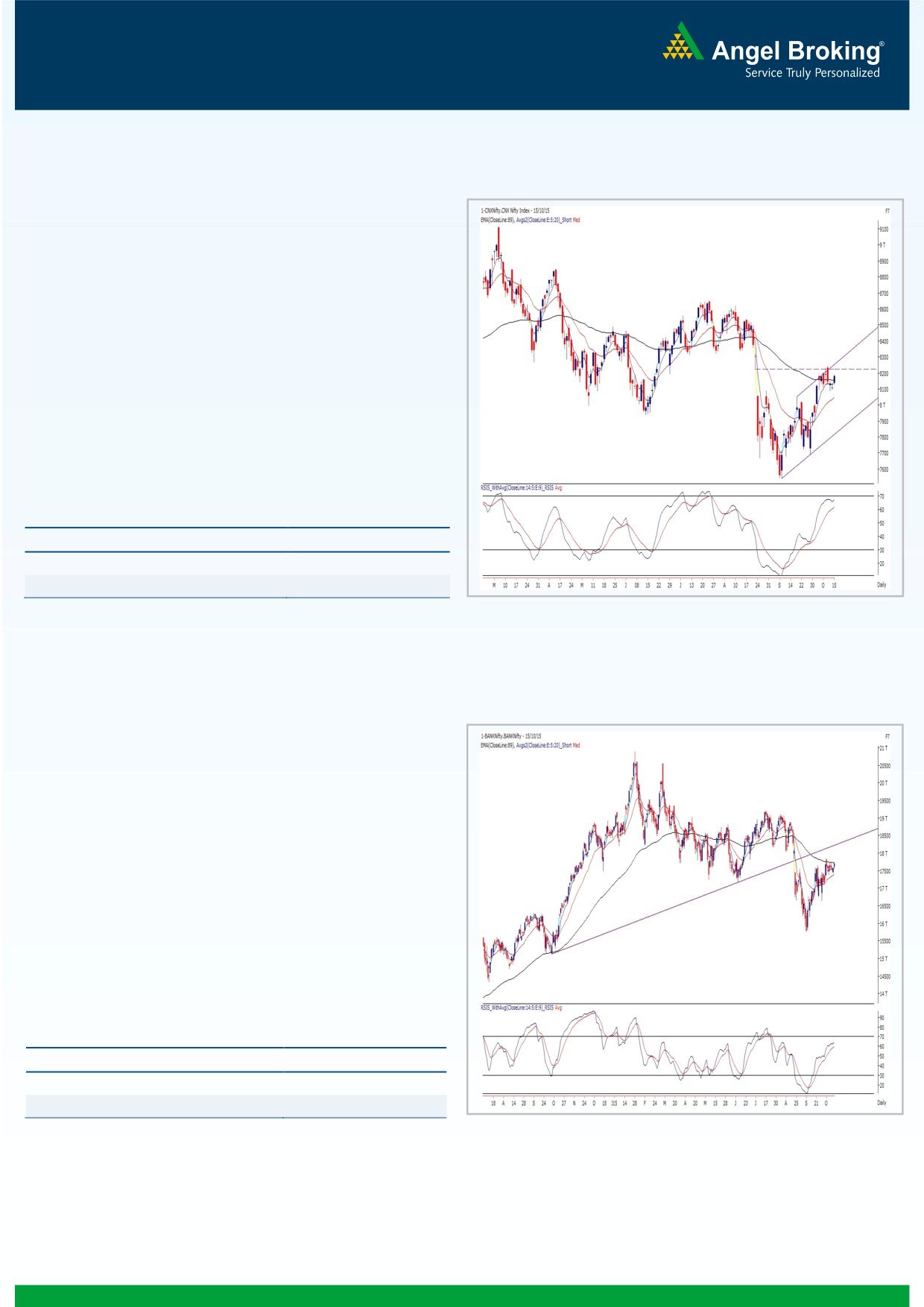

Exhibit 1: Nifty Daily Chart

Despite unfavorable cues from overnight correction in US

bourses, the Asian markets managed to trade with a positive bias

and thus, our benchmark index too kick started the session with

half a percent upside gap. This early morning lead extended a bit

in the remaining part of the day to end with decent gains.

After four days of lethargic movement, finally bulls had something

to cheer for. The Nifty maintained its optimism throughout the

session; but, the Nifty couldn't move beyond the 8200 mark.

Going forward, we continue to expect the Nifty to remain within a

small range of 8250 to 8050 whilst the 8250 mark is likely to act

as a major hurdle for the bulls. It’s advisable to stay light on

positions and focus more on stock specific moves.

Key Levels

Support 1 - 8130

Resistance 1 - 8225

Support 2 - 8090

Resistance 2 - 8250

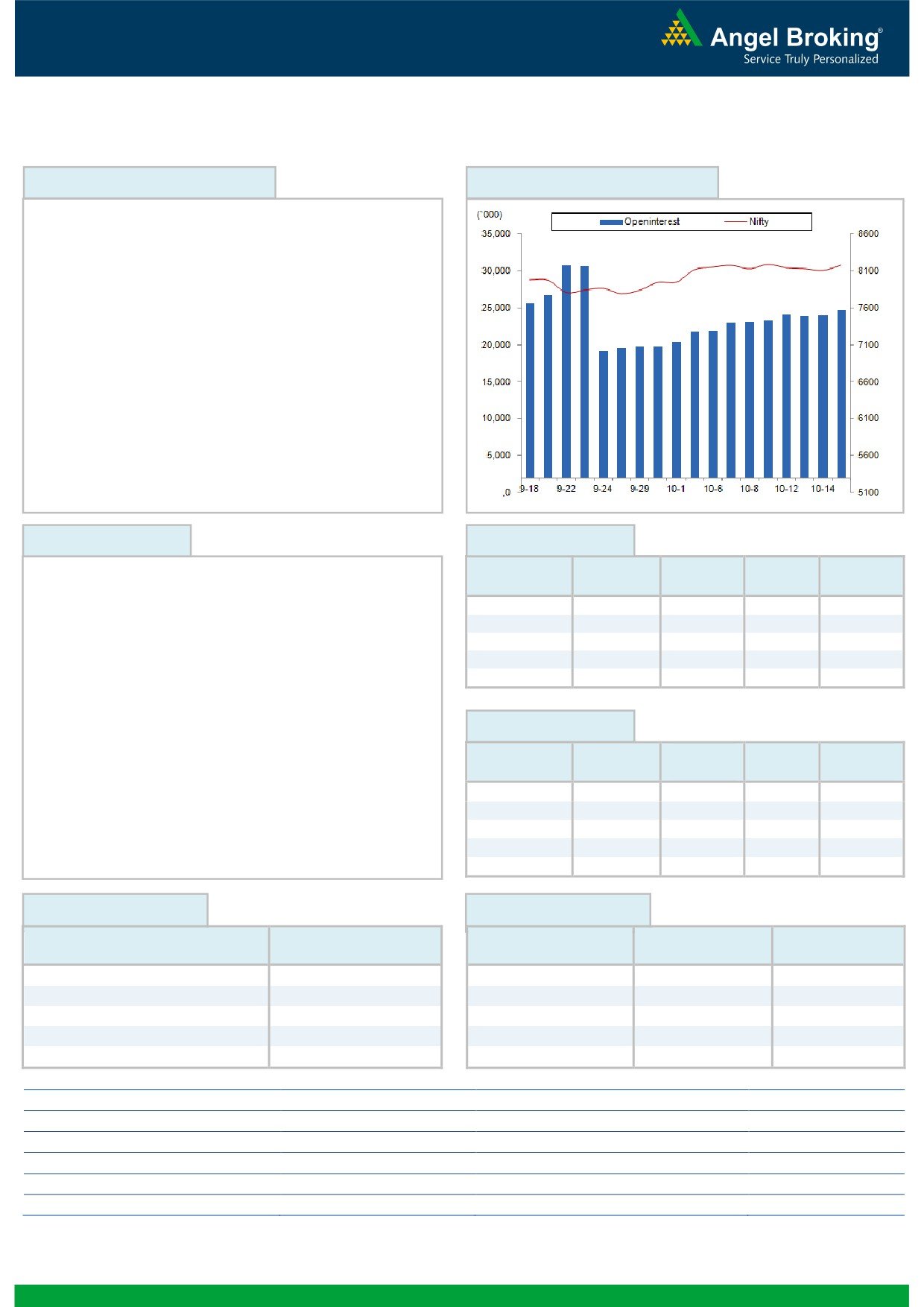

Bank Nifty Outlook - (17686)

Exhibit 2: Bank Nifty Daily

Yesterday, in-line with the broader indices, the Bank Nifty too

opened with an upside gap of around 50 points and rallied

higher in the first half of the session. However, we witnessed some

corrective action in the latter half of the session and as a result,

the Bank Nifty ended with gains of 0.81 percent. Currently, the

banking index is hovering around the ’89 EMA’ in the daily chart;

while, the gap area in the weekly chart and the

61.80%

retracement levels of the fall from 19229.05 to 15762.20 would

be a major hurdle for the Bulls. At this juncture, traders are

advised to be vigilant towards the stock specific moves rather than

taking undue risk in the index. Going forward, the immediate

resistance for the index is placed at 17842 and 17910 levels. On

the flipside, 17434 and 17350 levels will now act as support in

coming trading session.

Key Levels

Support 1 - 17434

Resistance 1 - 17842

Support 2 - 17350

Resistance 2 - 17910

1

Technical & Derivatives Report

October 16, 2015

Comments

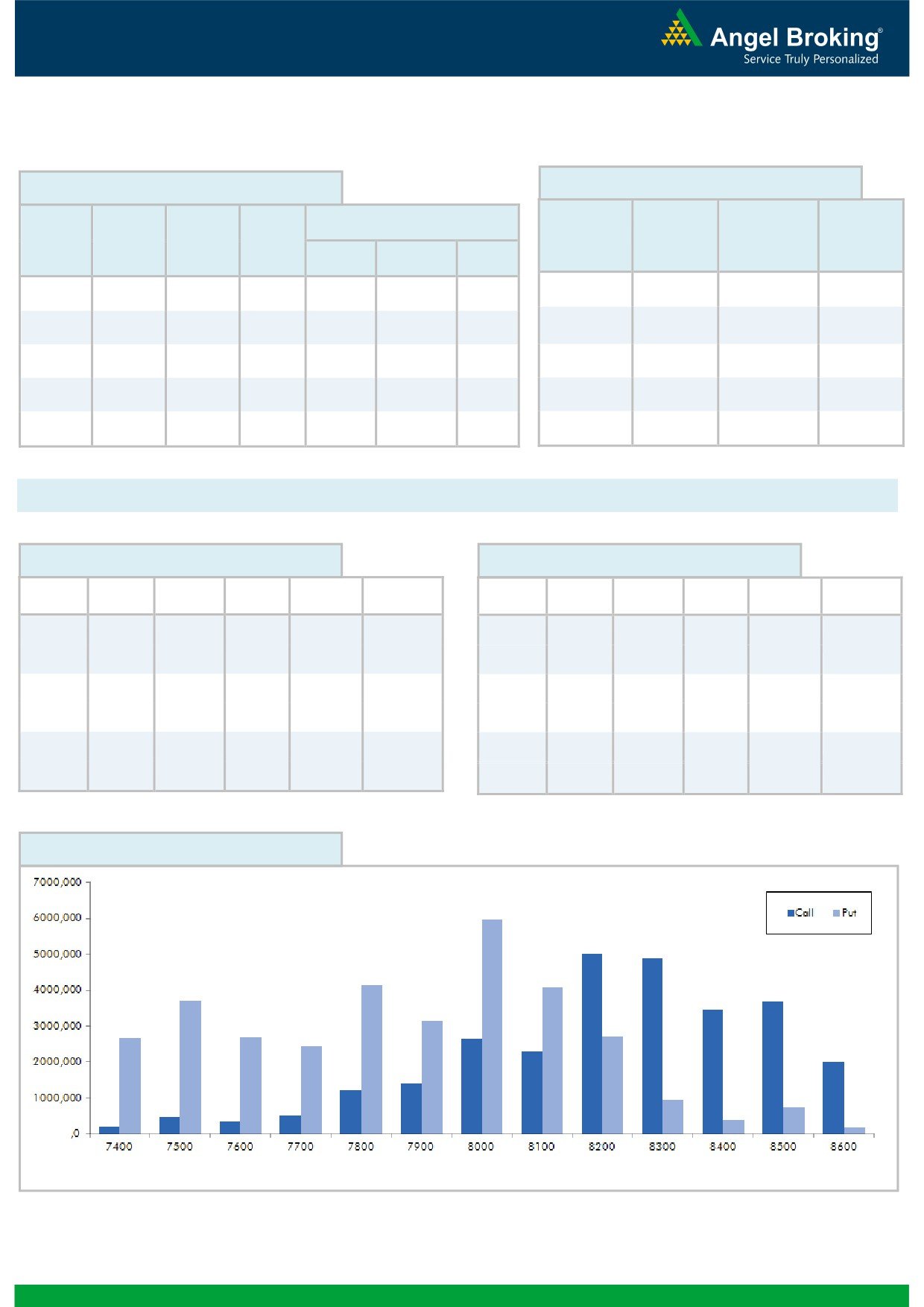

Nifty Vs OI

The Nifty futures open interest has increased by 3.24%

BankNifty futures open interest has increased by 5.82%

as market closed at 8179.50 levels.

The Nifty October future closed at a premium of 7.50

points against a premium of

13.50 points. The

November series closed at a premium of 48.35 points.

The Implied Volatility of at the money options has

decreased from 15.39% to 13.81%.

The total OI of the market is Rs. 2,25,420/- cr. and the

stock futures OI is Rs. 60,729/- cr.

Few of the liquid counters where we have seen high cost

of carry are AMTEKAUTO, GMRINFRA, JPASSOCIAT,

SOUTHBANK and ALBK.

Views

OI Gainers

OI

PRICE

Yesterday, FIIs were net buyers in equity segment to the

SCRIP

OI

PRICE

CHG. (%)

CHG. (%)

tune of Rs. 292 crores. While in Index Futures they sold

MINDTREE

524500

21.58

1402.35

-0.70

of Rs. 105 crores with rise in OI, suggesting mix of long

TV18BRDCST

17068000

14.09

32.95

-1.93

and short formation in last trading session.

PIDILITIND

749500

11.95

582.20

0.48

m

INDIACEM

26156000

9.96

84.55

3.81

In Index Options front, they bought of Rs. 749 crores

IRB

4238100

9.32

253.80

0.10

with marginal change in OI. In call options, we saw

some build-up in 8400 strike; meaningful unwinding

was also visible in 8100 call options. On the other hand

OI Losers

in put options, huge OI addition was seen in 8000 &

OI

PRICE

SCRIP

OI

PRICE

8100 strikes, followed by significant unwinding in 7900

CHG. (%)

CHG. (%)

put strike. Maximum OI is seen in 8200 call and 8000

SRF

928000

-5.41

1267.75

-0.34

KSCL

1126750

-4.41

475.65

-3.19

put options. We believe Nifty may trade in a narrow

TATAMTRDVR

15553400

-4.38

259.55

7.23

range of 7900-7950 on the lower side and 8200-8250

MCLEODRUSS

2566200

-3.87

175.95

2.21

on higher side.

HEXAWARE

3423000

-3.58

245.65

1.74

Historical Volatility

Put-Call Ratio

SCRIP

HV

SCRIP

PCR-OI

PCR-VOL

ZEEL

51.32

NIFTY

1.00

1.01

ADANIENT

84.78

BANKNIFTY

0.87

0.81

TATAMOTORS

67.57

INFY

0.31

0.27

TATAMTRDVR

64.32

TATAMOTORS

1.25

0.66

BPCL

37.98

RELIANCE

0.80

0.71

Strategy Date

Symbol

Strategy

Status

September 28, 2015

NIFTY

Long Strangle

Active

October 05, 2015

SBIN

Ratio Bear Put Spread

Active

October 12, 2015

LT

Long Put Ladder

Active

2

Technical & Derivatives Report

October 16, 2015

Turnover on 15-October 2015

FII Statistics for 15-October 2015

Open Interest

No. of

Turnover

Change

Instrument

Detail

Buy

Sell

Net

Contracts

( in Cr. )

(%)

Value

Change

Contracts

(in Cr.)

(%)

INDEX

INDEX

530283

14536.46

14.70

1932.34

2036.95

(104.61)

993104

24466.64

2.33

FUTURES

FUTURES

INDEX

INDEX

9194.98

8445.36

749.62

2228053

70901.53

0.01

5757666

131160.45

37.79

OPTIONS

OPTIONS

STOCK

STOCK

2515.54

2711.55

(196.01)

1803173

48274.55

0.09

840716

22435.30

11.17

FUTURES

FUTURES

STOCK

STOCK

1738.93

1745.07

(6.13)

132078

3567.41

(0.32)

517048

13347.13

-5.26

OPTIONS

OPTIONS

TOTAL

15381.79

14938.92

442.87

5156408

147210.14

0.47

TOTAL

7645713

181479.34

27.68

Nifty Spot = 8179.50

Lot Size = 25

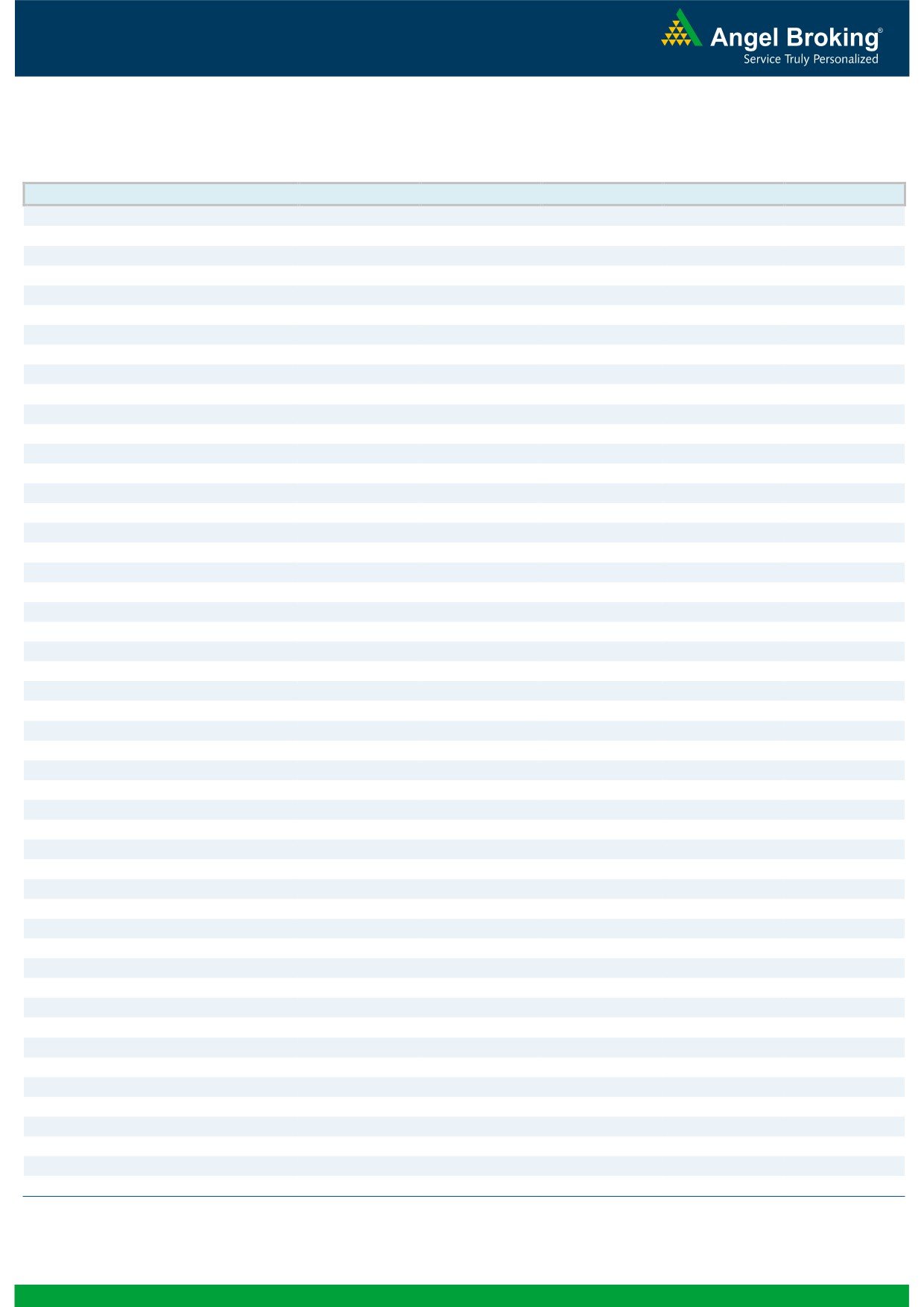

Bull-Call Spreads

Bear-Put Spreads

Action

Strike

Price

Risk

Reward

BEP

Action

Strike

Price

Risk

Reward

BEP

Buy

Buy

8200

82.85

8100

59.80

40.80

59.20

a

8240.80

g.com

24.20

75.80

8075.80

Sell

Sell

8300

42.05

8000

35.60

Buy

Buy

8200

82.85

8100

59.80

64.95

135.05

8264.95

37.95

162.05

8062.05

Sell

Sell

8400

17.90

7900

21.85

Buy

Buy

8300

42.05

8000

35.60

24.15

75.85

8324.15

13.75

86.25

7986.25

Sell

Sell

8400

17.90

7900

21.85

Nifty Put-Call Analysis

3

Technical & Derivatives Report

October 16, 2015

Daily Pivot Levels for Nifty 50 Stocks

Scrips

S2

S1

PIVOT

R1

R2

ACC

1,352

1,361

1,378

1,388

1,405

AMBUJACEM

208

209

210

211

212

ASIANPAINT

857

863

871

877

885

AXISBANK

492

496

499

502

505

BAJAJ-AUTO

2,431

2,441

2,450

2,460

2,470

BANKBARODA

172

176

178

182

184

BHARTIARTL

340

346

350

355

359

BHEL

203

207

210

214

217

BOSCHLTD

20,911

21,022

21,186

21,297

21,461

BPCL

854

874

886

905

918

CAIRN

157

158

160

161

163

CIPLA

660

666

675

680

689

COALINDIA

329

335

339

346

350

DRREDDY

4,158

4,183

4,211

4,236

4,264

GAIL

312

319

323

329

333

GRASIM

3,606

3,625

3,651

3,670

3,695

HCLTECH

823

829

834

840

845

HDFC

1,279

1,287

1,296

1,304

1,313

HDFCBANK

1,072

1,078

1,087

1,093

1,103

HEROMOTOCO

2,468

2,516

2,548

2,596

2,628

HINDALCO

83

86

89

91

94

HINDUNILVR

755

773

787

805

819

ICICIBANK

282

284

286

288

289

IDEA

150

151

152

153

154

INDUSINDBK

945

951

959

965

973

INFY

1,082

1,090

1,097

1,105

1,112

ITC

340

345

348

353

357

KOTAKBANK

645

649

657

661

668

LT

1,538

1,549

1,556

1,568

1,575

LUPIN

2,050

2,075

2,093

2,118

2,137

M&M

1,247

1,261

1,281

1,295

1,315

MARUTI

4,214

4,296

4,343

4,424

4,471

NMDC

98

99

100

101

102

NTPC

123

124

125

126

128

ONGC

252

256

258

263

265

PNB

135

136

137

138

139

POWERGRID

132

134

135

136

137

RELIANCE

894

899

905

910

916

SBIN

244

246

248

251

253

VEDL

104

107

109

112

114

SUNPHARMA

874

881

887

894

899

TATAMOTORS

345

363

373

392

402

TATAPOWER

69

70

70

71

72

TATASTEEL

244

250

254

259

263

TCS

2,440

2,454

2,479

2,493

2,517

TECHM

531

538

547

554

562

ULTRACEMCO

2,878

2,912

2,942

2,976

3,006

WIPRO

569

573

580

585

592

YESBANK

735

747

754

766

773

ZEEL

379

399

411

431

443

4

Technical & Derivatives Report

October 16, 2015

Research Team Tel: 022 - 39357800

For Technical Queries

For Derivatives Queries

DISCLAIMER

Angel Broking Private Limited (hereinafter referred to as “Angel”) is a registered Member of National Stock Exchange of India Limited,

Bombay Stock Exchange Limited and MCX Stock Exchange Limited. It is also registered as a Depository Participant with CDSL and

Portfolio Manager with SEBI. It also has registration with AMFI as a Mutual Fund Distributor. Angel Broking Private Limited is a

registered entity with SEBI for Research Analyst in terms of SEBI (Research Analyst) Regulations, 2014 vide registration number

INH000000164. Angel or its associates has not been debarred/ suspended by SEBI or any other regulatory authority for accessing

/dealing in securities Market. Angel or its associates including its relatives/analyst do not hold any financial interest/beneficial

ownership of more than 1% in the company covered by Analyst. Angel or its associates/analyst has not received any compensation /

managed or co-managed public offering of securities of the company covered by Analyst during the past twelve months. Angel/analyst

has not served as an officer, director or employee of company covered by Analyst and has not been engaged in market making activity

of the company covered by Analyst.

This document is solely for the personal information of the recipient, and must not be singularly used as the basis of any investment

decision. Nothing in this document should be construed as investment or financial advice. Each recipient of this document should

make such investigations as they deem necessary to arrive at an independent evaluation of an investment in the securities of the

companies referred to in this document (including the merits and risks involved), and should consult their own advisors to determine

the merits and risks of such an investment.

Reports based on technical and derivative analysis center on studying charts of a stock's price movement, outstanding positions and

trading volume, as opposed to focusing on a company's fundamentals and, as such, may not match with a report on a company's

fundamentals.

The information in this document has been printed on the basis of publicly available information, internal data and other reliable

sources believed to be true, but we do not represent that it is accurate or complete and it should not be relied on as such, as this

document is for general guidance only. Angel Broking Pvt. Limited or any of its affiliates/ group companies shall not be in any way

responsible for any loss or damage that may arise to any person from any inadvertent error in the information contained in this report.

Angel Broking Pvt. Limited has not independently verified all the information contained within this document. Accordingly, we cannot

testify, nor make any representation or warranty, express or implied, to the accuracy, contents or data contained within this document.

While Angel Broking Pvt. Limited endeavors to update on a reasonable basis the information discussed in this material, there may be

regulatory, compliance, or other reasons that prevent us from doing so.

This document is being supplied to you solely for your information, and its contents, information or data may not be reproduced,

redistributed or passed on, directly or indirectly.

Neither Angel Broking Pvt. Limited, nor its directors, employees or affiliates shall be liable for any loss or damage that may arise from

or in connection with the use of this information.

Note: Please refer to the important ‘Stock Holding Disclosure' report on the Angel website (Research Section). Also, please refer to the

latest update on respective stocks for the disclosure status in respect of those stocks. Angel Broking Pvt. Limited and its affiliates may

5