Technical & Derivatives Report

March 16, 2016

Sensex (24551) / Nifty (7461)

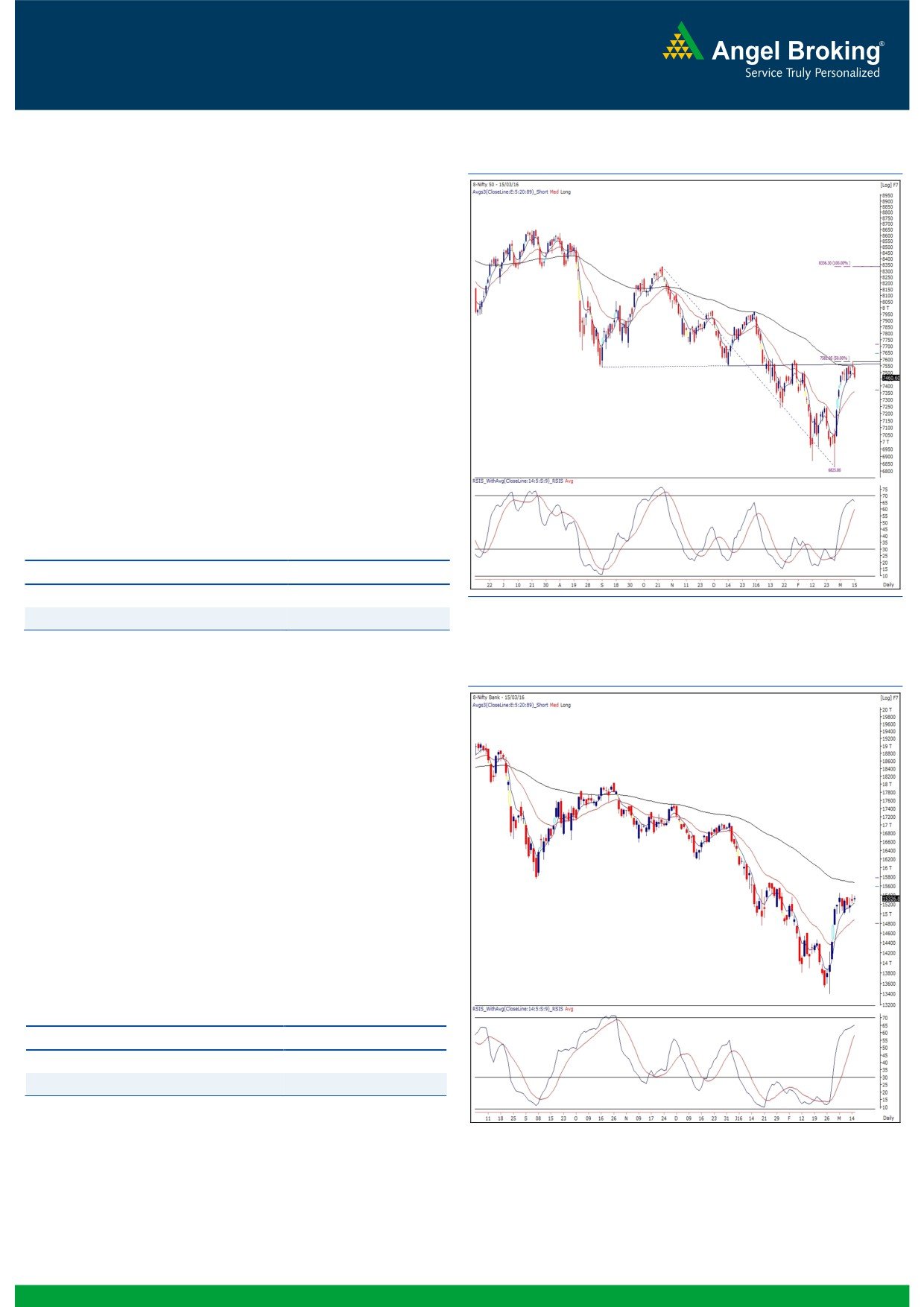

Exhibit 1: Nifty Daily Chart

Yesterday, the Nifty opened on a flat note and started

correcting from initial trades. Nifty continued to make ‘Lower

Lows’ throughout the session and eventually ended the session

with the loss of 1.04 percent over its previous close.

We had indicated in our previous report that a close below

7515 can be a short term reversal trigger and yesterday’s

candle reaffirms the same as we are now witnessing formation

of ‘Evening Doji Star’ pattern on daily chart. Though, we are

observing formation of bearish candlestick pattern around

resistance zone, we are not expecting major correction in Nifty

as couple of gap area around 7400 and 7300 levels are

going to act as a strong support for the index. Thus, traders

are advised to trade on stock specific ideas in near term.

Going forward, immediate resistance for the Nifty is placed at

7515 - 7585 levels; whereas, intraday support levels are seen

at 7424 - 7380 levels.

Key Levels

Support 1 - 7424

Resistance 1 - 7515

Support 2 - 7380

Resistance 2 -

7585

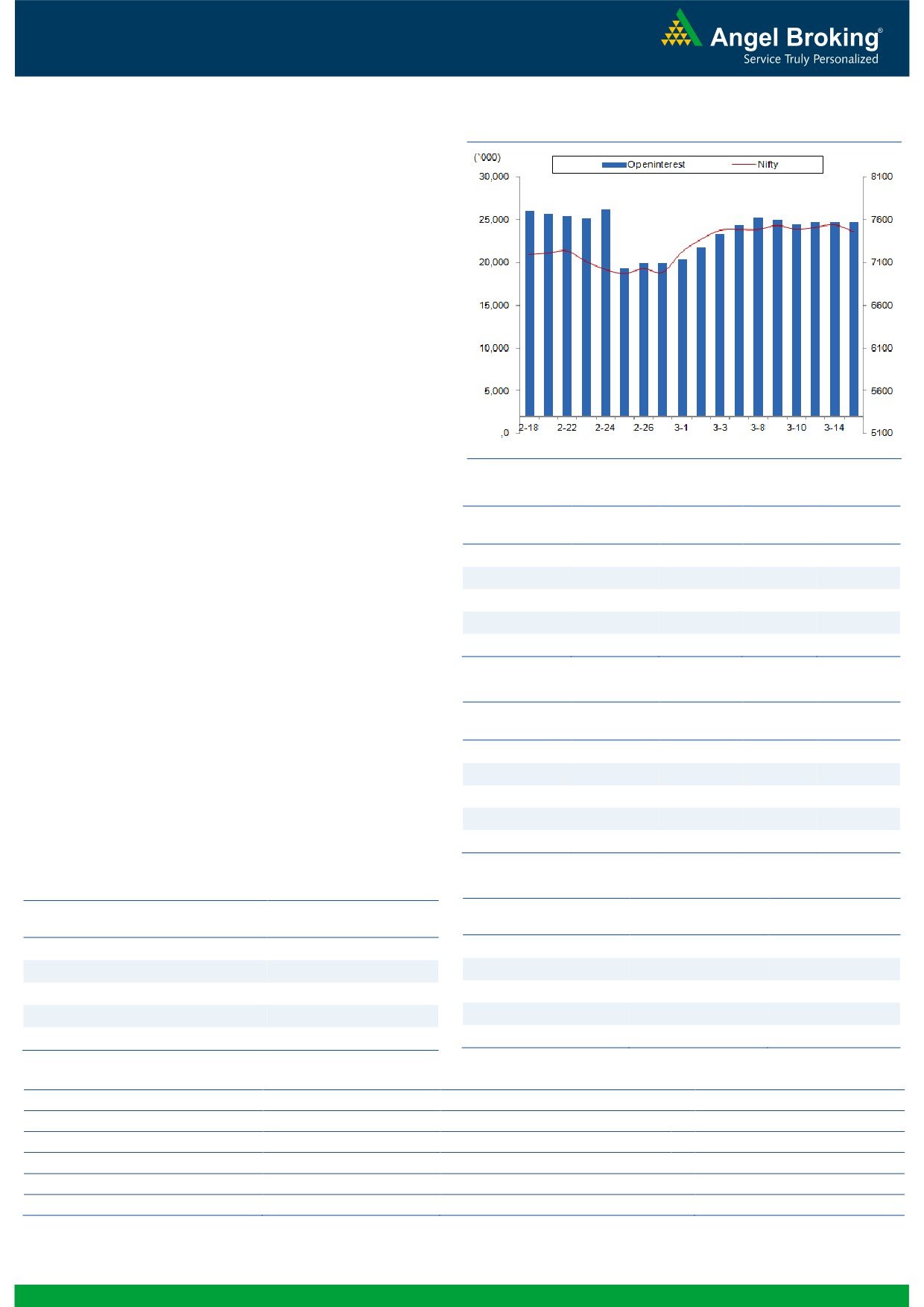

Exhibit 2: Nifty Bank Daily Chart

Nifty Bank Outlook - (15327)

In yesterday's trading session, the index traded in a narrow

range and ended the session with marginal gains of 0.32%.

The index continued its consolidation phase which has been

seen since last few trading sessions. Though, yesterday the

index outperformed the Nifty index which had shown

corrective action amidst negative breadth in broader market.

As of now, there is no directional movement in the Nifty Bank

index as the index has traded in range of 15000 - 15450

since last eight trading sessions. Only a move beyond this

range will lead to near term directional momentum. The

intraday support in the index are placed around 15140 and

15000 whereas resistances are seen around 15452 and

15700.

Key Levels

Support 1 - 15140

Resistance 1 - 15452

Support 2 - 15000

Resistance 2 - 15700

1

Technical & Derivatives Report

March 16, 2016

Comments

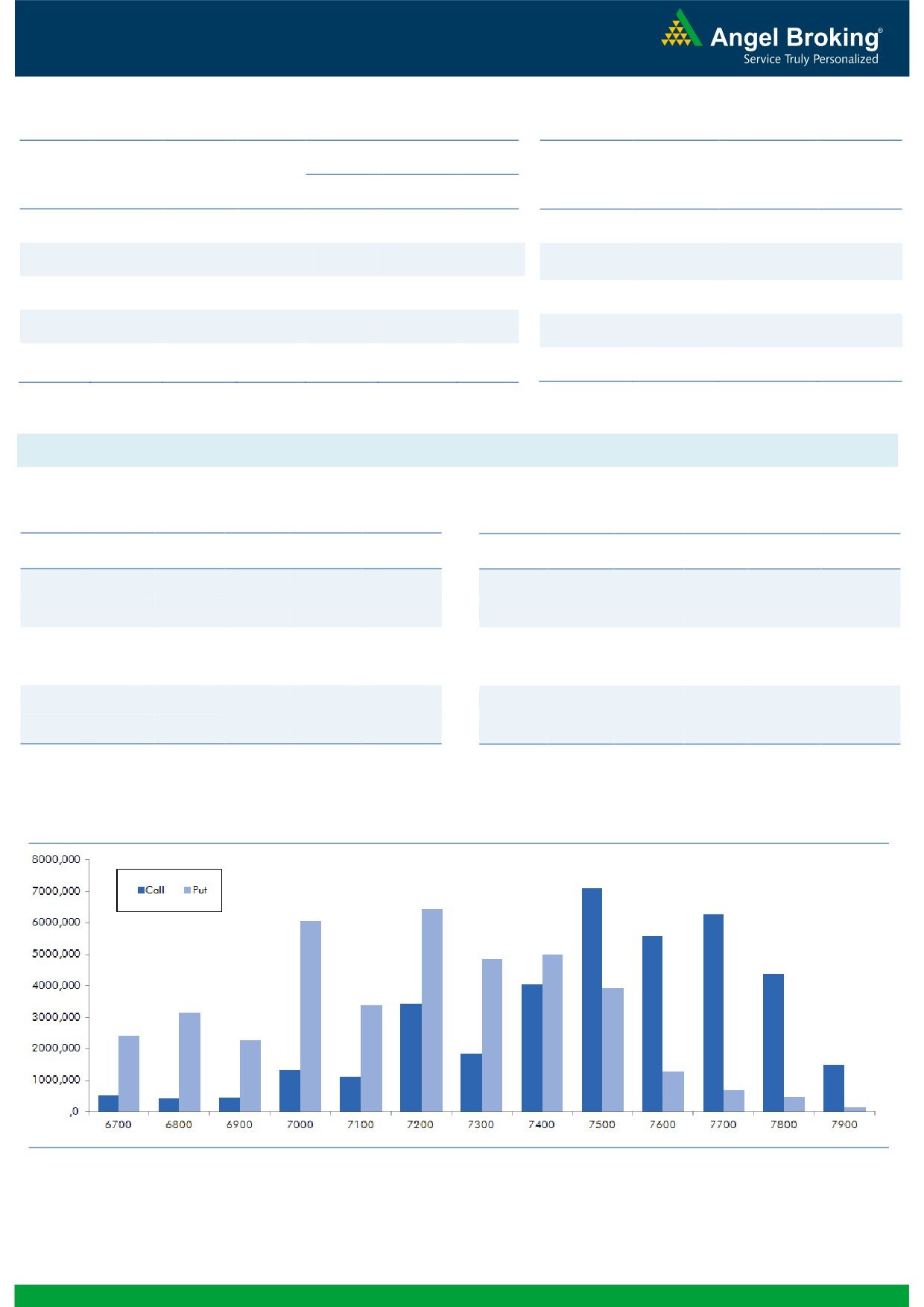

Nifty Vs OI

The Nifty futures open interest has increased by 0.03%

BankNifty futures open interest has decreased by 2.30%

as market closed at 7460.60 levels.

The Nifty March future closed at a premium of 24.80

points against a premium of 8.10 points. The April series

closed at a premium of 63.35 points.

The Implied Volatility of at the money options has

increased from 14.70% to 15.84%.

The total OI of the market is Rs. 2,28,077/- cr. and the

stock futures OI is Rs. 54,948/- cr.

Few of the liquid counters where we have seen high cost

of carry are JPASSOCIAT, JISLJALEQS, UNITECH,

GMRINFRA and IFCI.

Views

OI Gainers

FIIs activity in cash market segment remained subdued

OI

PRICE

SCRIP

OI

PRICE

yesterday. While in Index Futures, they were net buyers

CHG. (%)

CHG. (%)

ANDHRABANK

10512000

18.59

51.85

-0.67

of Rs. 554 crores with some fall in OI, suggesting short

CAIRN

11841000

9.40

146.25

-1.28

covering in last trading session.

APOLLOHOSP

1068000

8.10

1353.15

-3.99

In Index Options front, FIIs bought of Rs. 873 crores with

TATAELXSI

347700

7.81

1946.10

-0.84

some rise in OI. We hardly saw any meaningful buildup

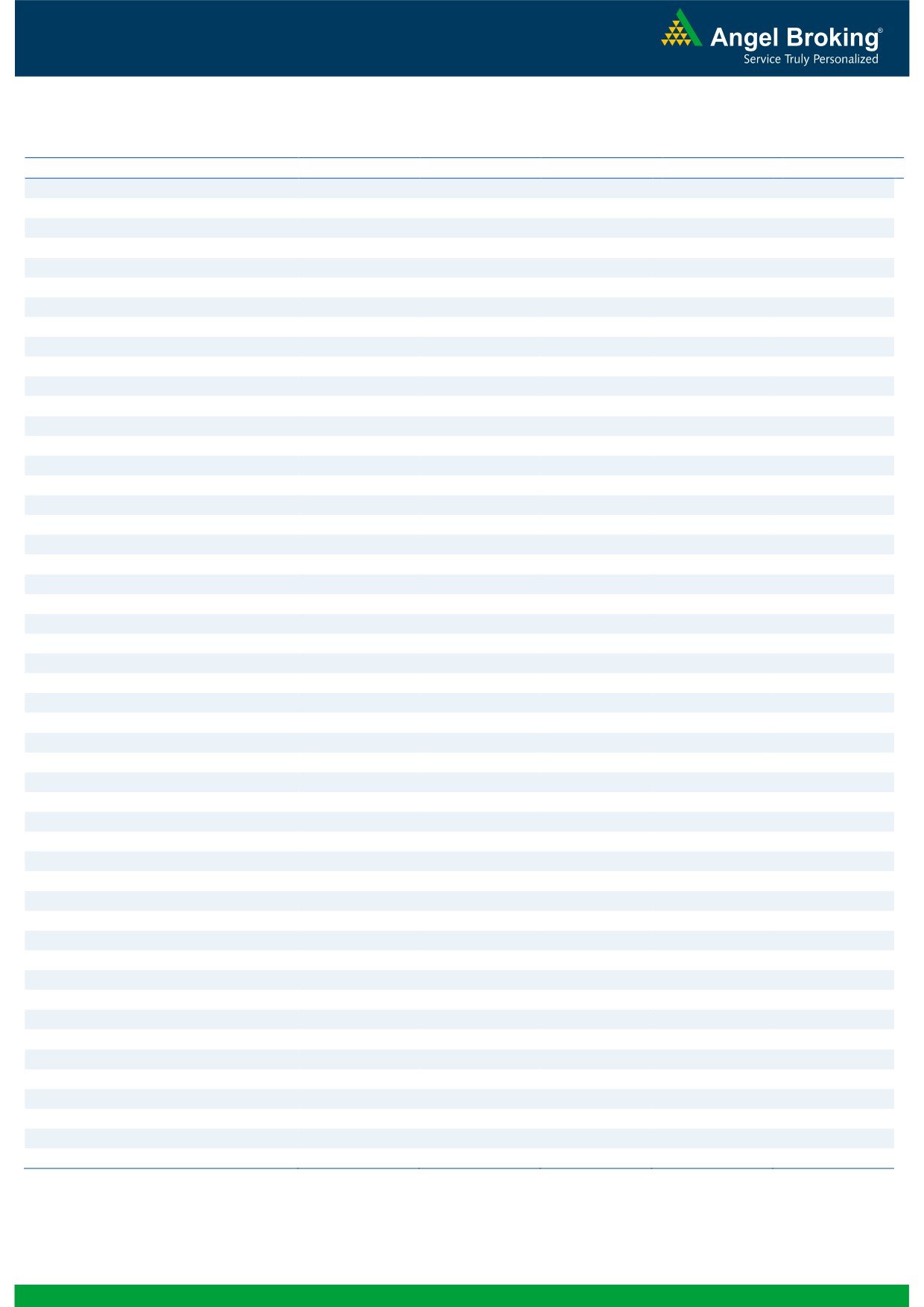

in both call and put options. 7500 and 7700 call optionsng.com

HEROMOTOCO

1136000

7.49

2788.60

-0.07

were comparatively active and they also added some

fresh OI. Maximum OI in current series is visible in 7500

OI Losers

call and 7200 put options. In this up move, we witnessed

OI

PRICE

SCRIP

OI

PRICE

good amount of buying, both in equity and Index Futures

CHG. (%)

CHG. (%)

CROMPGREAV

10026000

-61.34

43.90

-17.48

segment. Seeing the quantum of longs formed by bigger

ACC

1405875

-9.71

1247.20

0.48

hands, we believe Nifty may continue to show strength.

MCDOWELL-N

732250

-9.23

2475.65

2.24

Any dip in market can be a buying opportunity.

Large cap Stock Futures that added shorts in yesterday’s

NMDC

10800000

-6.78

94.40

-0.58

fall are CAIRN, LUPIN, ZEEL, BAJAJ-AUTO and IDEA.

CEATLTD

1170400

-5.64

1080.35

0.67

Historical Volatility

Put-Call Ratio

SCRIP

HV

SCRIP

PCR-OI

PCR-VOL

LUPIN

51.24

NIFTY

0.95

0.96

DIVISLAB

39.57

BANKNIFTY

1.08

0.83

HDFC

35.46

SBIN

0.79

0.41

APOLLOHOSP

37.69

ICICIBANK

0.91

0.79

MARICO

34.48

RELIANCE

0.51

0.52

Strategy Date

Symbol

Strategy

Status

February 29, 2016

RELIANCE

Ratio Bull Call Spread

Active

March 05, 2016

BHEL

Long Call Ladder

Active

March 12, 2016

NIFTY

Ratio Bull Call Spread

Not Activated

2

Technical & Derivatives Report

March 16, 2016

FII Statistics for 15-March 2016

Turnover on 15-March 2016

Open Interest

No. of

Turnover

Change

Detail

Buy

Sell

Net

Instrument

Value

Change

Contracts

( in Cr. )

(%)

Contracts

(in Cr.)

(%)

INDEX

INDEX

1892.96

1339.28

553.68

308544

16937.29

(1.48)

252046

13273.56

-3.53

FUTURES

FUTURES

INDEX

INDEX

22716.74

21843.26

873.48

1391184

76774.47

0.95

2617014

144774.57

-3.78

OPTIONS

OPTIONS

STOCK

2838.58

3522.18

(683.60)

1036854

46603.35

(0.18)

STOCK

FUTURES

448808

20615.94

5.68

FUTURES

STOCK

STOCK

1611.78

1616.60

(4.82)

79887

3648.18

3.62

OPTIONS

239670

10834.68

-22.29

OPTIONS

TOTAL

29060.07

28321.32

738.75

2816469

143963.29

0.33

TOTAL

3557538

189498.75

-4.13

Nifty Spot = 7460.60

Lot Size = 75

Bull-Call Spreads

Bear-Put Spreads

Action

Strike

Price

Risk

Reward

BEP

Action

Strike

Price

Risk

Reward

BEP

Buy

7500

90.45

Buy

7400

65.00

41.50

58.50

7541.50

25.35

74.65

7374.65

Sell

7600

48.95

Sell

7300

39.65

Buy

7500

90.45

Buy

7400

65.00

67.00

133.00

7567.00

40.70

159.30

7359.30

Sell

7700

23.45

Sell

7200

24.30

Buy

7600

48.95

Buy

7300

39.65

25.50

74.50

7625.50

15.35

84.65

7284.65

Sell

7700

23.45

Sell

7200

24.30

Note: Above mentioned Bullish or Bearish Spreads in Nifty (March Series) are given as an information and not as a recommendation.

Nifty Put-Call Analysis

3

Technical & Derivatives Report

March 16, 2016

Daily Pivot Levels for Nifty 50 Stocks

Scrips

S2

S1

PIVOT

R1

R2

ACC

1,225

1,233

1,239

1,246

1,252

ADANIPORTS

223

226

230

232

236

AMBUJACEM

201

203

205

207

208

ASIANPAINT

859

872

889

902

919

AXISBANK

413

416

419

422

425

BAJAJ-AUTO

2,232

2,255

2,292

2,315

2,351

BANKBARODA

139

141

143

145

146

BHARTIARTL

333

338

341

346

350

BHEL

104

105

106

107

108

BOSCHLTD

17,664

17,896

18,051

18,284

18,439

BPCL

798

804

812

819

826

CAIRN

144

147

150

152

155

CIPLA

512

518

529

535

546

COALINDIA

293

294

297

298

300

DRREDDY

3,034

3,084

3,158

3,208

3,282

GAIL

331

336

342

346

352

GRASIM

3,492

3,521

3,575

3,604

3,658

HCLTECH

800

806

816

822

833

HDFC

1,084

1,098

1,123

1,137

1,162

HDFCBANK

1,016

1,021

1,027

1,033

1,039

HEROMOTOCO

2,788

2,800

2,819

2,832

2,851

HINDALCO

82

83

85

85

87

HINDUNILVR

823

832

844

853

866

ICICIBANK

218

220

222

224

227

IDEA

97

98

100

101

103

INDUSINDBK

907

913

922

928

938

INFY

1,114

1,124

1,139

1,150

1,165

ITC

308

312

319

323

330

KOTAKBANK

627

633

638

644

649

LT

1,162

1,172

1,185

1,194

1,207

LUPIN

1,663

1,693

1,746

1,776

1,829

M&M

1,187

1,196

1,207

1,216

1,226

MARUTI

3,586

3,620

3,650

3,684

3,714

NTPC

125

126

127

128

129

ONGC

204

206

207

209

210

PNB

81

82

83

84

86

POWERGRID

137

138

139

140

141

RELIANCE

1,008

1,014

1,021

1,027

1,034

SBIN

180

183

184

187

189

VEDL

85

87

89

90

92

SUNPHARMA

828

835

848

856

869

TATAMOTORS

352

356

364

368

375

TATAPOWER

58

58

59

59

60

TATASTEEL

291

296

299

304

307

TCS

2,294

2,312

2,338

2,356

2,381

TECHM

449

454

465

471

481

ULTRACEMCO

2,971

2,980

2,994

3,004

3,018

WIPRO

520

527

535

541

549

YESBANK

788

800

808

820

828

ZEEL

373

380

391

398

409

4

Technical & Derivatives Report

March 16, 2016

Research Team Tel: 022 - 39357800

For Technical Queries

For Derivatives Queries

DISCLAIMER

Angel Broking Private Limited (hereinafter referred to as “Angel”) is a registered Member of National Stock Exchange of India Limited,

Bombay Stock Exchange Limited and MCX Stock Exchange Limited. It is also registered as a Depository Participant with CDSL and

Portfolio Manager with SEBI. It also has registration with AMFI as a Mutual Fund Distributor. Angel Broking Private Limited is a

registered entity with SEBI for Research Analyst in terms of SEBI (Research Analyst) Regulations, 2014 vide registration number

INH000000164. Angel or its associates has not been debarred/ suspended by SEBI or any other regulatory authority for accessing

/dealing in securities Market. Angel or its associates including its relatives/analyst do not hold any financial interest/beneficial

ownership of more than 1% in the company covered by Analyst. Angel or its associates/analyst has not received any compensation /

managed or co-managed public offering of securities of the company covered by Analyst during the past twelve months. Angel/analyst

has not served as an officer, director or employee of company covered by Analyst and has not been engaged in market making activity

of the company covered by Analyst.

This document is solely for the personal information of the recipient, and must not be singularly used as the basis of any investment

decision. Nothing in this document should be construed as investment or financial advice. Each recipient of this document should

make such investigations as they deem necessary to arrive at an independent evaluation of an investment in the securities of the

companies referred to in this document (including the merits and risks involved), and should consult their own advisors to determine

the merits and risks of such an investment.

Reports based on technical and derivative analysis center on studying charts of a stock's price movement, outstanding positions and

trading volume, as opposed to focusing on a company's fundamentals and, as such, may not match with a report on a company's

fundamentals.

The information in this document has been printed on the basis of publicly available information, internal data and other reliable

sources believed to be true, but we do not represent that it is accurate or complete and it should not be relied on as such, as this

document is for general guidance only. Angel Broking Pvt. Limited or any of its affiliates/ group companies shall not be in any way

responsible for any loss or damage that may arise to any person from any inadvertent error in the information contained in this report.

Angel Broking Pvt. Limited has not independently verified all the information contained within this document. Accordingly, we cannot

testify, nor make any representation or warranty, express or implied, to the accuracy, contents or data contained within this document.

While Angel Broking Pvt. Limited endeavors to update on a reasonable basis the information discussed in this material, there may be

regulatory, compliance, or other reasons that prevent us from doing so.

This document is being supplied to you solely for your information, and its contents, information or data may not be reproduced,

redistributed or passed on, directly or indirectly.

Neither Angel Broking Pvt. Limited, nor its directors, employees or affiliates shall be liable for any loss or damage that may arise from

or in connection with the use of this information.

Note: Please refer to the important ‘Stock Holding Disclosure' report on the Angel website (Research Section). Also, please refer to the

latest update on respective stocks for the disclosure status in respect of those stocks. Angel Broking Pvt. Limited and its affiliates may

have investment positions in the stocks recommended in this report.

5