Technical & Derivatives Report

December 15, 2016

Sensex (26603) / Nifty (8182)

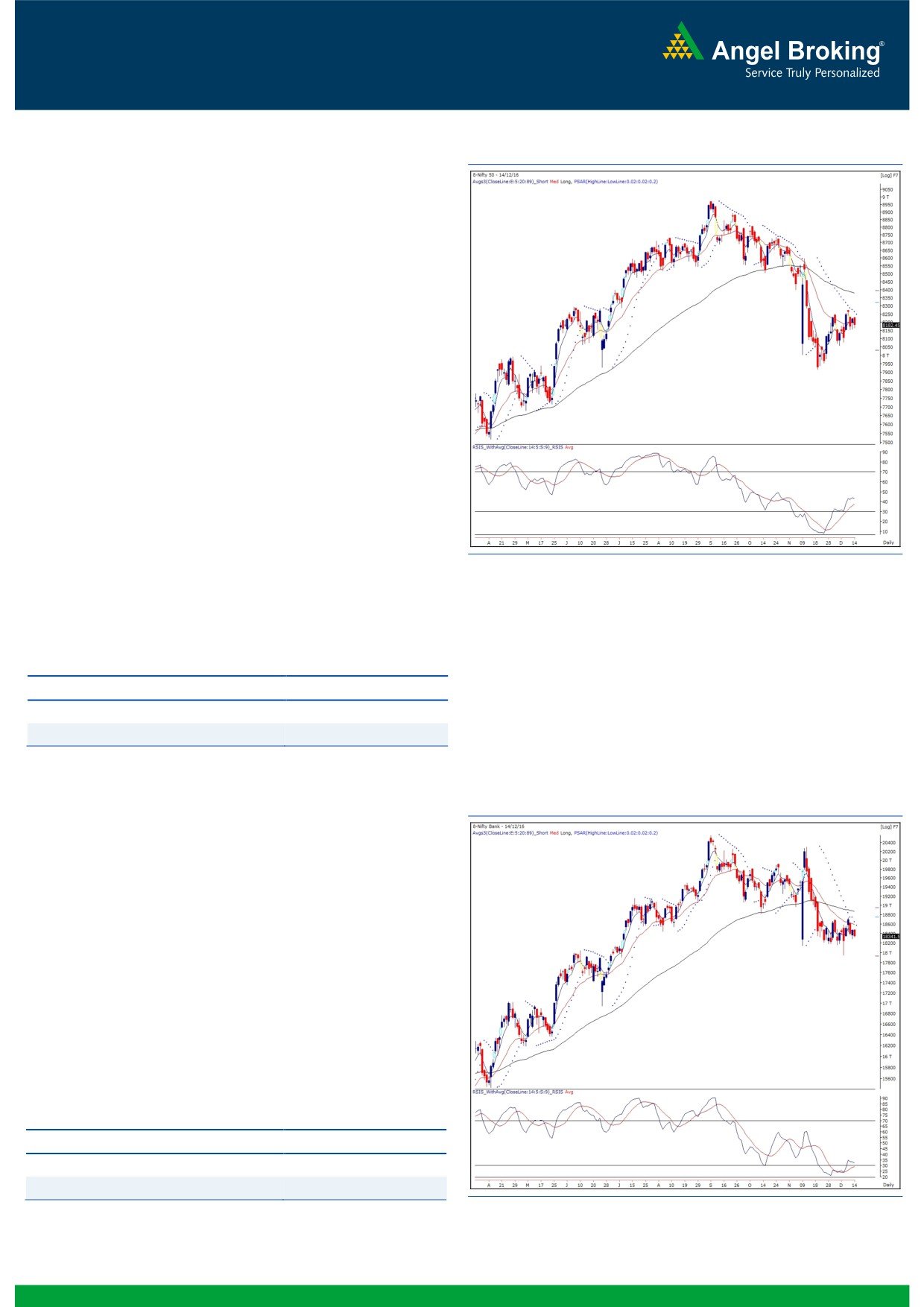

Exhibit 1: Nifty Daily Chart

Yesterday, the benchmark index opened on a flat note as

indicated by the SGX Nifty. Subsequently, we witnessed a

complete tug-of-war between market participants throughout the

session. However, due to tail end weakness, the Nifty eventually

closed with nearly half a percent cut.

It was day of consolidation within a narrow range of merely 60

points in Nifty. Such choppy and directionless session was quite

evident ahead of the Fed policy. We have observed that traders

generally choose to stay on the sidelines and await the outcome

to form a directional view. Going forward, we would first observe

market’s reaction to this event in the initial trade. However,

keeping this event aside, we are still optimistic on the market as

the ‘Higher Top Higher Bottom’ formation on daily chart is still

intact. For the coming session, first key support is seen at 8154. In

case of breaking this level, we would see some weakness in the

market, which would drag the index towards 8100 - 8056 levels.

However, in case of a positive reaction, the Nifty is likely to move

towards our 8229 - 8275 levels. With a positional view, our

targets of 8320 - 8380 are still intact. Due to the global event,

we may see higher volatility in the market and thus, traders are

advised to keep a note of all the above mentioned points.

Key Levels

Support 1 - 8154

Resistance 1 - 8229

Support 2 - 8100

Resistance 2 - 8275

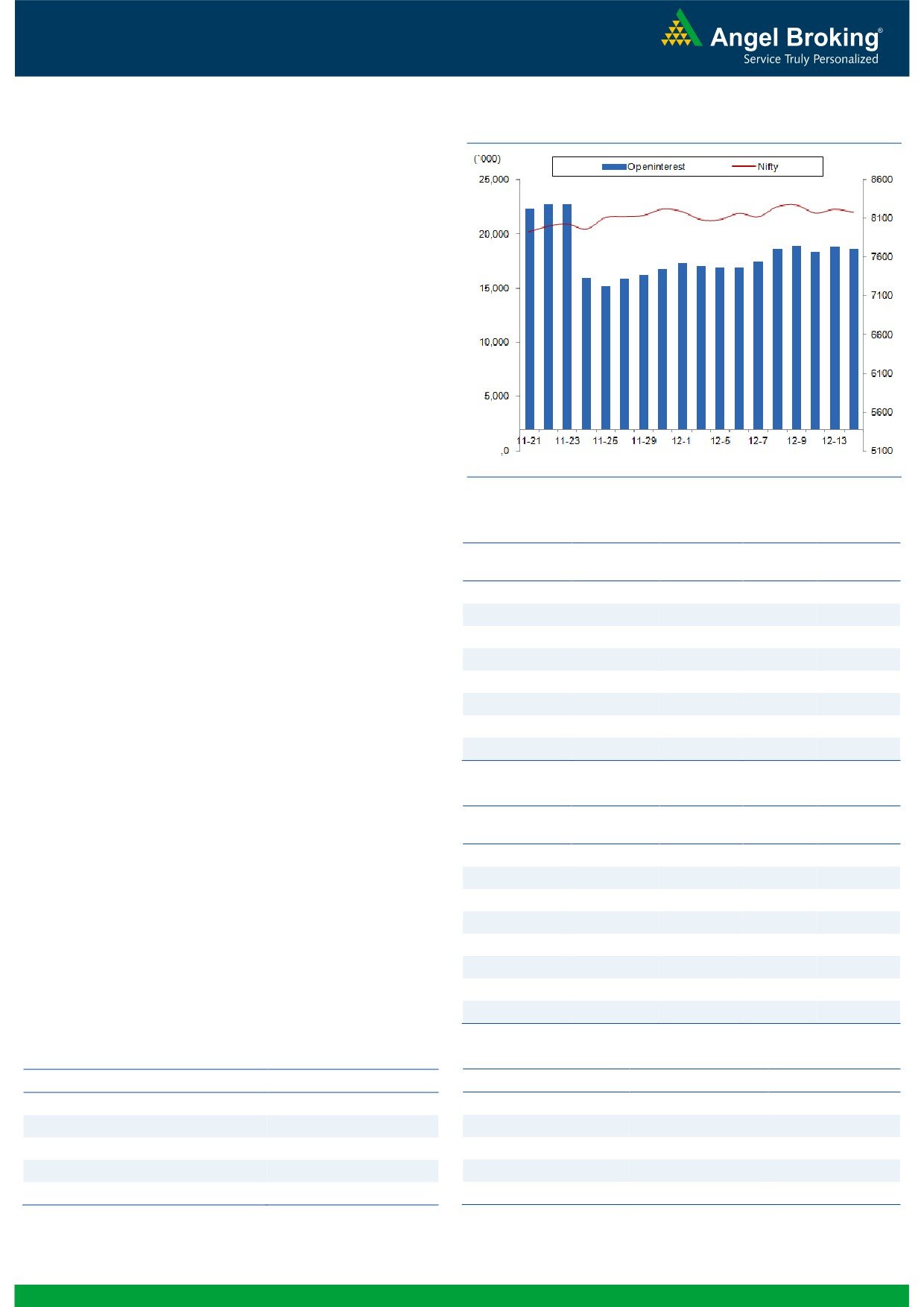

Nifty Bank Outlook - (18342)

Exhibit 2: Nifty Bank Daily Chart

The Nifty Bank index ended another session in a narrow range

yesterday and posted loss of 0.67 percent over its previous

session's close.

The Nifty Bank index continued its range bound move yesterday

and thus there is no sign of trended move yet. Although the

outcome of the FOMC could lead to higher volatility in line with

other global markets, it would be prudent to keep wait and watch

approach and let the index show definite signs of trended move.

Hence, we continue to advise traders to focus on stock specific

moves and trade with proper risk management. The intraday

supports for the Nifty Bank index are placed around 18250 and

18120 whereas resistances are seen around 18490 and 18725.

Key Levels

Support 1 - 18250

Resistance 1 - 18490

Support 2 - 18120

Resistance 2 - 18725

1

Technical & Derivatives Report

December 15, 2016

Comments

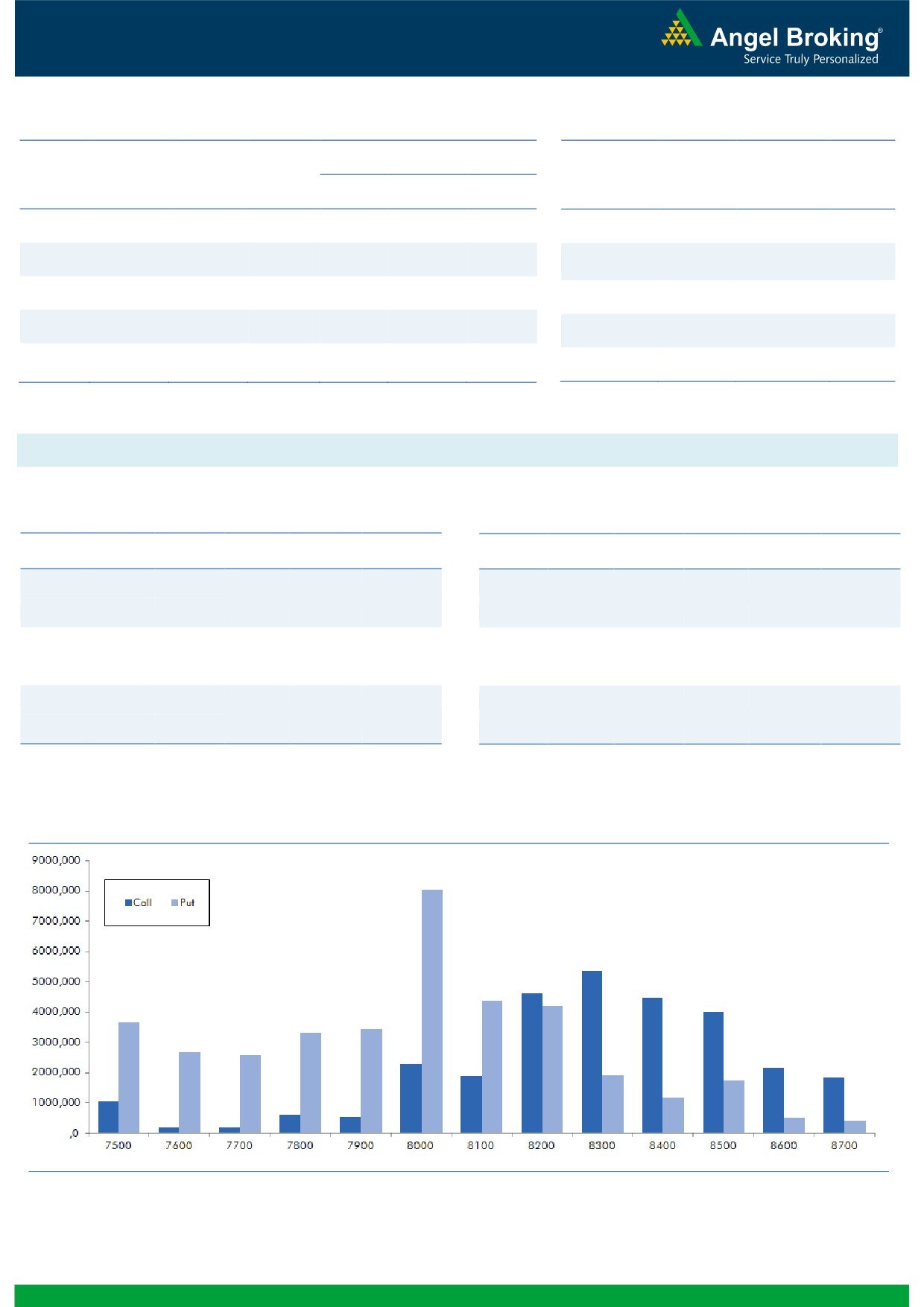

Nifty Vs OI

The Nifty futures open interest has decreased by 1.36%

BankNifty futures open interest has increased by 1.86%

as market closed at 8182.45 levels.

The Nifty December future closed with a premium of

15.20 against the premium of 5.65 points in last trading

session. The January series closed at a premium of

49.15 points.

The Implied Volatility of at the money options has

increased from 14.08% to 15.26%. At the same time, the

PCR-OI of Nifty has decreased from 1.09 to 1.08 levels.

The total OI of the market is Rs. 2,55,612/- cr. and the

stock futures OI is Rs. 68,927/- cr.

Few of the liquid counters where we have seen high cost

of carry are ADANIPOWER, SOUTHBANK, PTC,

HINDPETRO and FEDERALBNK.

OI Gainers

Views

OI

PRICE

SCRIP

OI

PRICE

CHG. (%)

CHG. (%)

Yesterday, FIIs were net seller in both cash market and

ONGC

28070000

25.19

305.55

-1.99

index futures segment. They sold equities worth Rs. 632

IBULHSGFIN

13163200

19.25

649.05

-3.31

crores. While in index futures, the overall activity from

KSCL

2667000

18.38

393.20

-8.63

FIIs desk was subdued.

www.angelbroking.com

ORIENTBANK

14292000

14.19

115.70

-3.34

In Index options segment, FIIs were net seller worth

GODREJIND

1617000

13.00

413.55

0.46

Rs. 2005 crores with marginal change in open interest.

UPL

5481600

7.89

653.60

-3.98

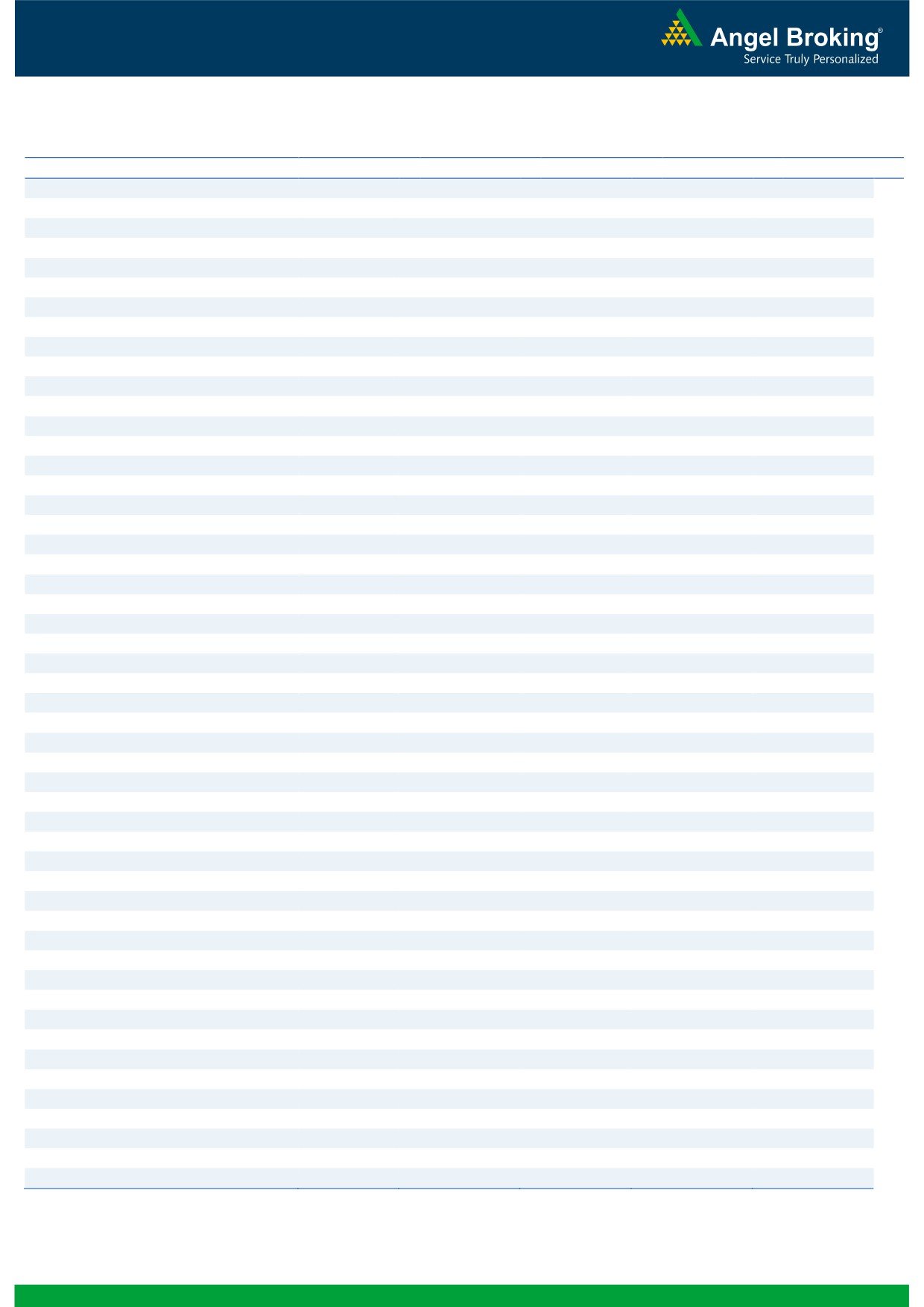

In call options, 8200-8300 strikes added some fresh

ARVIND

6376000

7.88

336.90

-2.91

positions. While, in put options, we witnessed build-up in

SOUTHBANK

40710000

7.87

21.35

-2.73

8100 and 7800 strikes. Highest OI in current series is

placed at 8300 call and 8000 put option.

Yesterday, FIIs have shorted both call and puts ahead of

OI Losers

the outcome of Fed meet. However, their long positions

OI

PRICE

SCRIP

OI

PRICE

CHG. (%)

CHG. (%)

in index futures formed in last week are still intact. Since,

AXISBANK

30700800

-9.18

467.10

3.07

strong support for the index is placed at 8100-8150,

ENGINERSIN

5894000

-8.43

306.45

-2.12

intraday dips should be used as buying opportunity.

MINDTREE

2726400

-7.39

502.25

1.52

Thus, traders are advised to trade with positive bias.

KTKBANK

16564250

-6.53

110.50

-1.95

TATAELXSI

1196500

-5.90

1458.65

-2.07

NTPC

14624000

-5.63

164.00

-0.43

OIL

1264800

-5.46

446.35

0.54

APOLLOTYRE

7857000

-5.42

197.75

0.43

Historical Volatility

Put-Call Ratio

SCRIP

HV

SCRIP

PCR-OI

PCR-VOL

KSCL

55.29

NIFTY

1.08

1.06

COALINDIA

33.37

BANKNIFTY

1.03

0.94

BEL

38.53

SBIN

0.62

0.58

HCLTECH

28.22

SUNPHARMA

0.51

0.52

UPL

47.11

INFY

0.65

0.60

2

Technical & Derivatives Report

December 15, 2016

FII Statistics for December 14, 2016

Turnover on December 14, 2016

Open Interest

No. of

Turnover

Change

Detail

Buy

Sell

Net

Instrument

Value

Change

Contracts

( in Cr. )

(%)

Contracts

(in Cr.)

(%)

INDEX

INDEX

1172.42

1252.19

(79.77)

214088

13546.23

0.33

169112

11127.12

1.58

FUTURES

FUTURES

INDEX

INDEX

25893.28

27898.35

(2005.07)

1064049

66356.09

0.77

2761016

186890.72

21.16

OPTIONS

OPTIONS

STOCK

5746.97

5634.80

112.17

896761

54697.98

1.28

STOCK

FUTURES

408543

26350.39

1.06

FUTURES

STOCK

STOCK

2585.75

2644.71

(58.96)

82161

5317.97

2.20

OPTIONS

251879

16509.85

2.75

OPTIONS

TOTAL

35398.42

37430.05

(2031.63)

2257059

139918.26

0.98

TOTAL

3590550

240878.08

16.17

Nifty Spot = 8182.45

Lot Size = 75

Bull-Call Spreads

Bear-Put Spreads

Action

Strike

Price

Risk

Reward

BEP

Action

Strike

Price

Risk

Reward

BEP

Buy

8200

97.65

Buy

8200

103.55

46.10

53.90

8246.10

34.85

65.15

8165.15

Sell

8300

51.55

Sell

8100

68.70

Buy

8200

97.65

Buy

8200

103.55

74.70

125.30

8274.70

57.30

142.70

8142.70

Sell

8400

22.95

Sell

8000

46.25

Buy

8300

51.55

Buy

8100

68.70

28.60

71.40

8328.60

22.45

77.55

8077.55

Sell

8400

22.95

Sell

8000

46.25

Note: Above mentioned Bullish or Bearish Spreads in Nifty (December Series) are given as an information and not as a recommendation.

Nifty Put-Call Analysis

3

Technical & Derivatives Report

December 15, 2016

Daily Pivot Levels for Nifty Constituents

Scrips

S2

S1

PIVOT

R1

R2

ACC

1,289

1,301

1,322

1,334

1,355

ADANIPORTS

279

281

285

287

291

AMBUJACEM

203

204

206

207

208

ASIANPAINT

900

907

915

922

930

AUROPHARMA

681

692

707

718

733

AXISBANK

448

458

464

473

479

BAJAJ-AUTO

2,612

2,630

2,650

2,668

2,688

BANKBARODA

156

157

159

160

162

BHEL

124

124

126

126

127

BPCL

609

615

624

630

639

BHARTIARTL

316

319

325

328

333

INFRATEL

351

354

358

361

365

BOSCH

19,823

20,094

20,572

20,844

21,321

CIPLA

555

562

571

577

586

COALINDIA

286

289

294

297

302

DRREDDY

3,124

3,136

3,152

3,163

3,179

EICHERMOT

21,159

21,480

22,032

22,353

22,905

GAIL

414

416

421

424

428

GRASIM

837

844

853

860

869

HCLTECH

786

803

814

831

842

HDFCBANK

1,164

1,170

1,179

1,185

1,194

HDFC

1,246

1,256

1,268

1,278

1,290

HEROMOTOCO

3,085

3,122

3,174

3,211

3,262

HINDALCO

173

175

176

178

180

HINDUNILVR

810

816

824

830

839

ICICIBANK

257

259

262

264

266

IDEA

75

76

77

78

79

INDUSINDBK

1,056

1,064

1,076

1,084

1,097

INFY

975

988

996

1,008

1,017

ITC

229

231

234

236

238

KOTAKBANK

720

724

728

732

736

LT

1,342

1,351

1,366

1,376

1,391

LUPIN

1,469

1,478

1,491

1,500

1,513

M&M

1,147

1,161

1,172

1,186

1,197

MARUTI

5,077

5,109

5,162

5,194

5,247

NTPC

161

162

164

166

168

ONGC

300

302

307

310

314

POWERGRID

179

180

183

184

187

RELIANCE

1,028

1,044

1,054

1,070

1,080

SBIN

260

261

264

265

268

SUNPHARMA

664

671

682

689

700

TCS

2,171

2,190

2,207

2,225

2,243

TATAMTRDVR

294

299

303

308

311

TATAMOTORS

456

464

471

479

485

TATAPOWER

77

78

78

79

80

TATASTEEL

411

414

420

424

430

TECHM

465

471

479

485

493

ULTRACEMCO

3,254

3,284

3,333

3,363

3,411

WIPRO

461

464

466

469

471

YESBANK

1,183

1,190

1,200

1,207

1,217

ZEEL

433

438

442

447

451

4

Technical & Derivatives Report

December 15, 2016

Research Team Tel: 022 - 39357800

For Technical Queries

For Derivatives Queries

DISCLAIMER

Angel Broking Private Limited (hereinafter referred to as “Angel”) is a registered Member of National Stock Exchange of India Limited,

Bombay Stock Exchange Limited and Metropolitan Stock Exchange Limited. It is also registered as a Depository Participant with CDSL

and Portfolio Manager with SEBI. It also has registration with AMFI as a Mutual Fund Distributor. Angel Broking Private Limited is a

registered entity with SEBI for Research Analyst in terms of SEBI (Research Analyst) Regulations, 2014 vide registration number

INH000000164. Angel or its associates has not been debarred/ suspended by SEBI or any other regulatory authority for accessing

/dealing in securities Market. Angel or its associates/analyst has not received any compensation / managed or co-managed public

offering of securities of the company covered by Analyst during the past twelve months.

This document is solely for the personal information of the recipient, and must not be singularly used as the basis of any investment

decision. Nothing in this document should be construed as investment or financial advice. Each recipient of this document should

make such investigations as they deem necessary to arrive at an independent evaluation of an investment in the securities of the

companies referred to in this document (including the merits and risks involved), and should consult their own advisors to determine

the merits and risks of such an investment.

Reports based on technical and derivative analysis center on studying charts of a stock's price movement, outstanding positions and

trading volume, as opposed to focusing on a company's fundamentals and, as such, may not match with a report on a company's

fundamentals. Investors are advised to refer the Fundamental and Technical Research Reports available on our website to evaluate the

contrary view, if any.

The information in this document has been printed on the basis of publicly available information, internal data and other reliable

sources believed to be true, but we do not represent that it is accurate or complete and it should not be relied on as such, as this

document is for general guidance only. Angel Broking Pvt. Limited or any of its affiliates/ group companies shall not be in any way

responsible for any loss or damage that may arise to any person from any inadvertent error in the information contained in this report.

Angel Broking Pvt. Limited has not independently verified all the information contained within this document. Accordingly, we cannot

testify, nor make any representation or warranty, express or implied, to the accuracy, contents or data contained within this document.

While Angel Broking Pvt. Limited endeavors to update on a reasonable basis the information discussed in this material, there may be

regulatory, compliance, or other reasons that prevent us from doing so.

This document is being supplied to you solely for your information, and its contents, information or data may not be reproduced,

redistributed or passed on, directly or indirectly.

Neither Angel Broking Pvt. Limited, nor its directors, employees or affiliates shall be liable for any loss or damage that may arise from

or in connection with the use of this information.

5