Technical & Derivatives Report

November 15, 2016

Sensex (26819) / Nifty (8296)

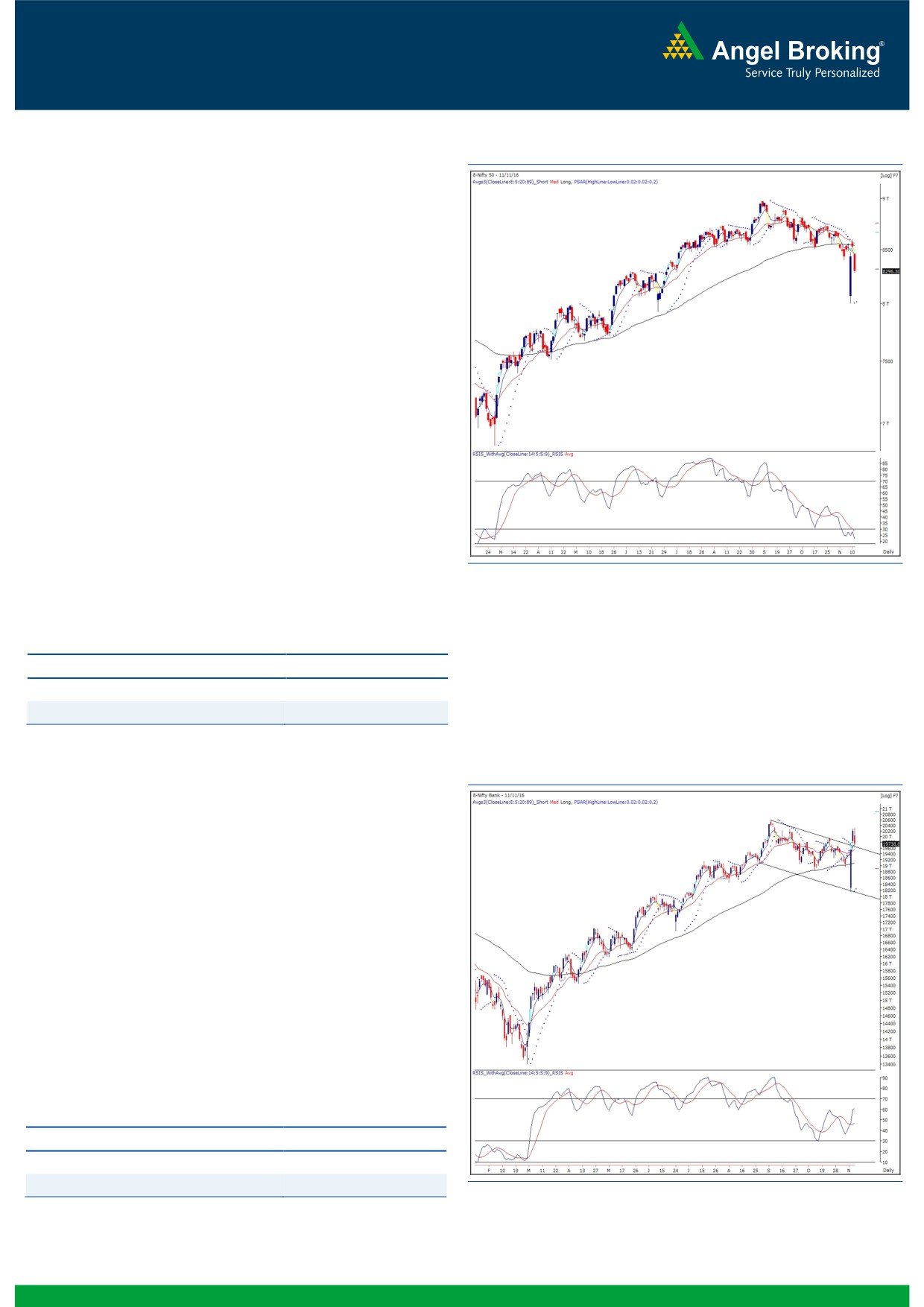

Exhibit 1: Nifty Daily Chart

The Nifty opened with the downside gap on Friday and continued

to move throughout the session to post a close with loss of 2.69

percent over its previous close.

The previous week has been full of events on domestic as well as

global front. Considering this price development, we are of the

opinion that the price-correction for a time being is done and the

market is now required to undergo some time-correction before

confirming the next direction. This time the range could be much

wider as 8460 - 8600 would seen as major hurdles and on the

downside, 8230 - 8130 would be considered as immediate

support levels. Going ahead, it would be a nightmare for traders

to trade within this broad range. Thus, one needs to be very

selective and it’s advisable to keep strict stop losses for existing

positions as individual stocks may continue to witness a strong

selling pressure. Technically speaking, the falling ‘RSI-

Smoothened’ oscillator which had indicated immediate correction

in the market is still not so encouraging. Thus, we believe traders

shouldn’t be participating aggressively on the long side, until we

get any reversal sign or an important resistance of 8600 remains

unbroken.

Key Levels

Support 1 - 8230

Resistance 1 - 8380

Support 2 - 8130

Resistance 2 - 8460

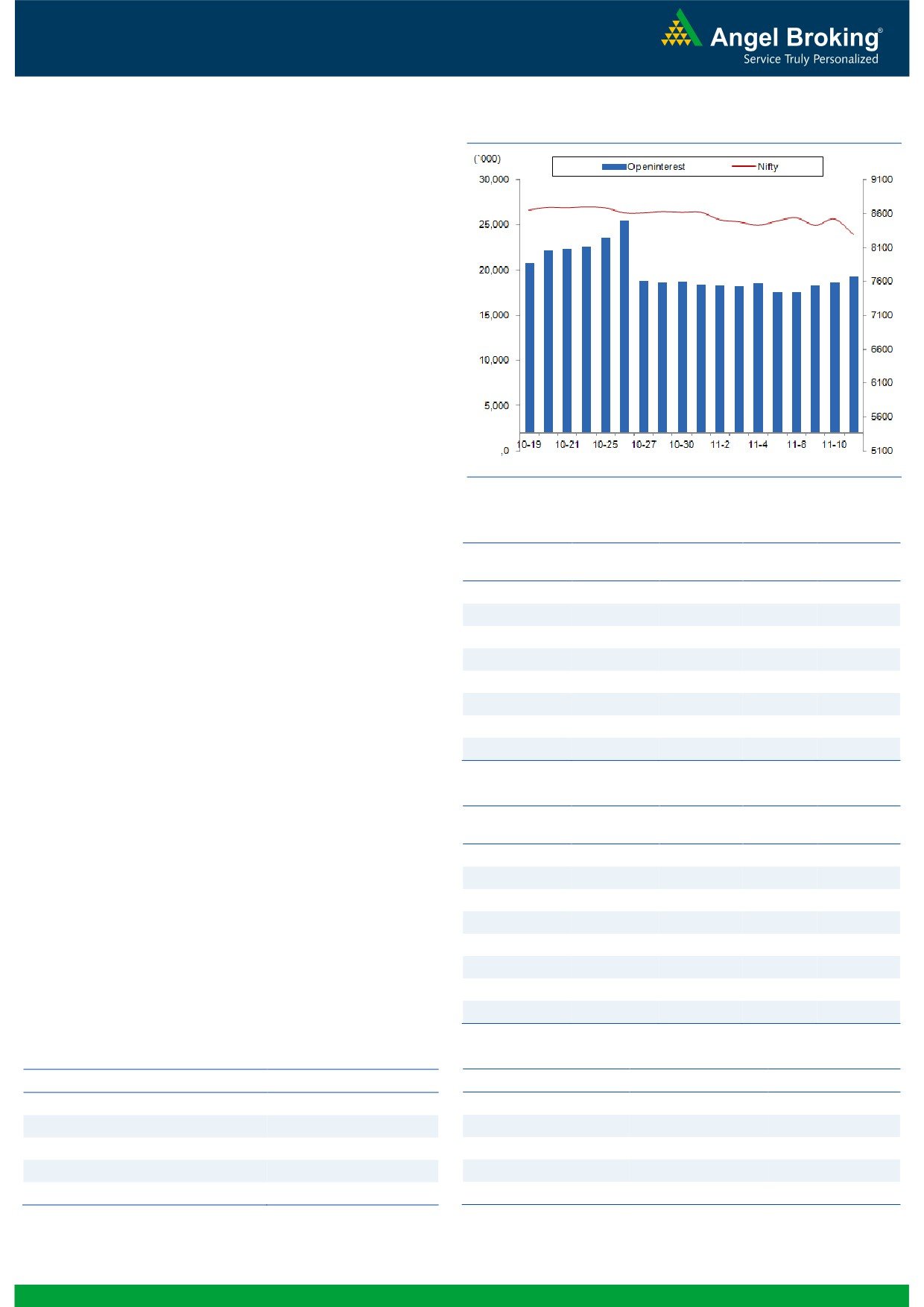

Exhibit 2: Nifty Bank Daily Chart

Nifty Bank Outlook - (19739)

The Nifty Bank index opened lower on Friday and corrected along

with the broader market. Though the Nifty index lost 1.63 %

during last week, the Nifty Bank index showed sheer

outperformance by gaining 3.57% during the week.

As we had highlighted in our Friday's report, the volatility in the

indices is expected to remain higher in near term. However, the

Nifty Bank index has given a breakout above the rising trendline

resistance during the week and thus, the broader outlook for the

index is now positive. It is although, difficult for intraday traders to

trade with the ongoing volatility, positional traders should use

dips as buying opportunities. The intraday supports for the Nifty

Bank index are placed around 19587 and 19480 whereas

resistances are seen around 19930 and 20200.

Key Levels

Support 1 - 19587

Resistance 1 - 19930

Support 2 - 19480

Resistance 2 - 20200

1

Technical & Derivatives Report

November 15, 2016

Comments

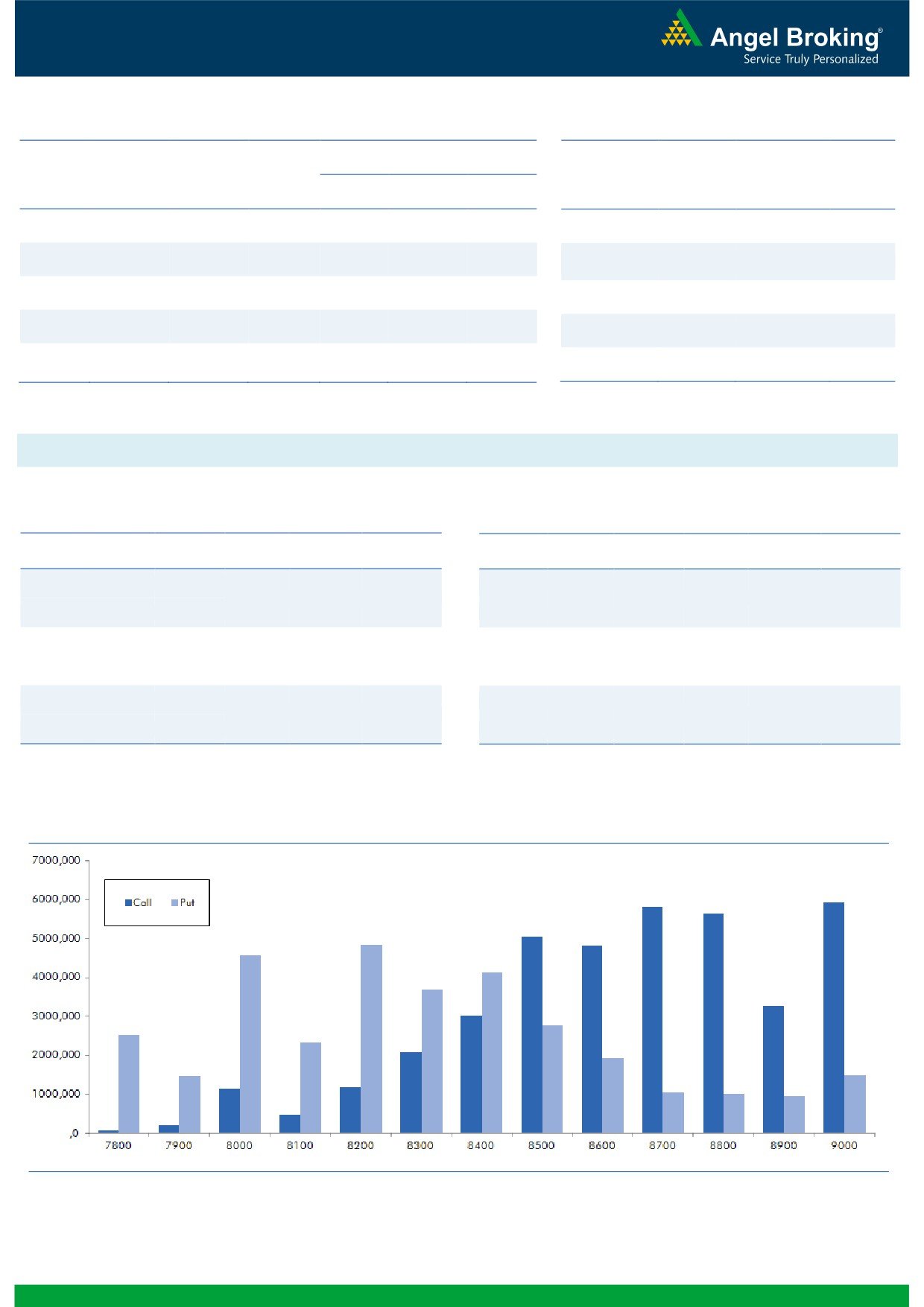

Nifty Vs OI

The Nifty futures open interest has increased by 3.57%

BankNifty futures open interest has increased by 0.80%

as market closed at 8296.30 levels.

The Nifty November future closed with a premium of

31.65 against the premium of 27.60 points in last

trading session. The December series closed at a

premium of 84.85 points.

The Implied Volatility of at the money options has

increased from 14.21% to 19.01%. At the same time, the

PCR-OI of Nifty has decreased from at 0.98 to 0.84

levels.

The total OI of the market is Rs. 2,73,545/- cr. and the

stock futures OI is Rs. 73,616/- cr.

Few of the liquid counters where we have seen high cost

of carry are BHEL, M&MFIN, BANKBARODA,

TORNTPOWER and FEDERALBNK.

Views

OI Gainers

On Friday, FIIs were net sellers in both in cash market

OI

PRICE

SCRIP

OI

PRICE

CHG. (%)

CHG. (%)

segment and in Index Futures. They sold equities of Rs.

ICIL

4230000

403.57

148.80

-7.00

1493 crores. While, in index futures, they were net sellers

ICICIBANK

56755000

13.65

277.65

-5.50

to the tune of Rs. 1020 crores with good amount of fall

CROMPGREAV

9456000

13.06

78.80

-4.14

in open interest, indicating long unwinding.aingFriday’sng.com

TVSMOTOR

6010000

12.04

359.80

-5.37

trading session.

PIDILITIND

2282000

11.97

662.20

-0.94

On Index Options front, FIIs sold significantly of worth Rs.

AMARAJABAT

648000

10.54

964.30

-4.73

2375 crores with rise in OI. In call options, 8400-8800

INDUSINDBK

3857400

10.46

1197.25

-1.82

strikes prices added huge positions and we believe these

ASIANPAINT

6367800

10.37

966.20

-4.82

are shorts positions formed by FIIs. On the other hand in

put options, we hardly saw any meaningful open interest

addition. While, good amount of unwinding was visible

OI Losers

in

8500 and

8600 put options. Maximum OI in

OI

PRICE

SCRIP

OI

PRICE

CHG. (%)

CHG. (%)

November series is placed at 9000 call and 8200 put

LICHSGFIN

9153100

-10.75

521.45

-5.53

options.

TATASTEEL

20178000

-8.21

428.50

-2.29

FIIs continue to unwind their longs in a big way. They

OIL

921400

-7.98

406.90

-1.17

also bought good amount of put options along with sell

ONGC

18460000

-7.26

273.65

-0.92

positions in call options. Thus, looking at the overall data

BANKINDIA

23796000

-6.37

122.25

-1.85

we believe we may see further pain in Nifty. Hence, we

TATACHEM

6390000

-6.13

483.90

-4.37

suggest traders to avoid any aggressive long positions in

Index.

VOLTAS

3628000

-5.77

333.75

-4.75

NCC

21632000

-5.12

79.35

-2.40

Historical Volatility

Put-Call Ratio

SCRIP

HV

SCRIP

PCR-OI

PCR-VOL

MARICO

45.26

NIFTY

0.84

0.84

M&MFIN

65.32

BANKNIFTY

0.75

0.89

BATAINDIA

40.00

RELIANCE

0.44

0.55

DABUR

36.30

ICICIBANK

0.45

0.64

M&M

41.46

SBIN

0.56

0.69

2

Technical & Derivatives Report

November 15, 2016

FII Statistics for November 11, 2016

Turnover on November 11, 2016

Open Interest

No. of

Turnover

Change

Detail

Buy

Sell

Net

Instrument

Value

Change

Contracts

( in Cr. )

(%)

Contracts

(in Cr.)

(%)

INDEX

INDEX

3734.21

4754.46

(1020.25)

179842

11884.12

(7.16)

382205

26075.48

6.06

FUTURES

FUTURES

INDEX

INDEX

82925.89

85301.19

(2375.30)

1234065

79297.64

10.68

5293743

360567.07

-43.51

OPTIONS

OPTIONS

STOCK

9349.76

11057.43

(1707.67)

890838

55239.76

0.98

STOCK

FUTURES

704444

48457.53

-4.97

FUTURES

STOCK

STOCK

10031.43

10173.18

(141.75)

115040

7595.36

7.27

OPTIONS

587750

42453.84

0.32

OPTIONS

TOTAL

106041.28

111286.26

(5244.98)

2419785

154016.89

5.30

TOTAL

6968142

477553.92

-36.84

Nifty Spot = 8296.30

Lot Size = 75

Bull-Call Spreads

Bear-Put Spreads

Action

Strike

Price

Risk

Reward

BEP

Action

Strike

Price

Risk

Reward

BEP

Buy

8400

75.25

Buy

8300

98.30

33.85

66.15

8433.85

33.05

66.95

8266.95

Sell

8500

41.40

Sell

8200

65.25

Buy

8400

75.25

Buy

8300

98.30

54.30

145.70

8454.30

54.70

145.30

8245.30

Sell

8600

20.95

Sell

8100

43.60

Buy

8500

41.40

Buy

8200

65.25

20.45

79.55

8520.45

21.65

78.35

8178.35

Sell

8600

20.95

Sell

8100

43.60

Note: Above mentioned Bullish or Bearish Spreads in Nifty (November Series) are given as an information and not as a recommendation.

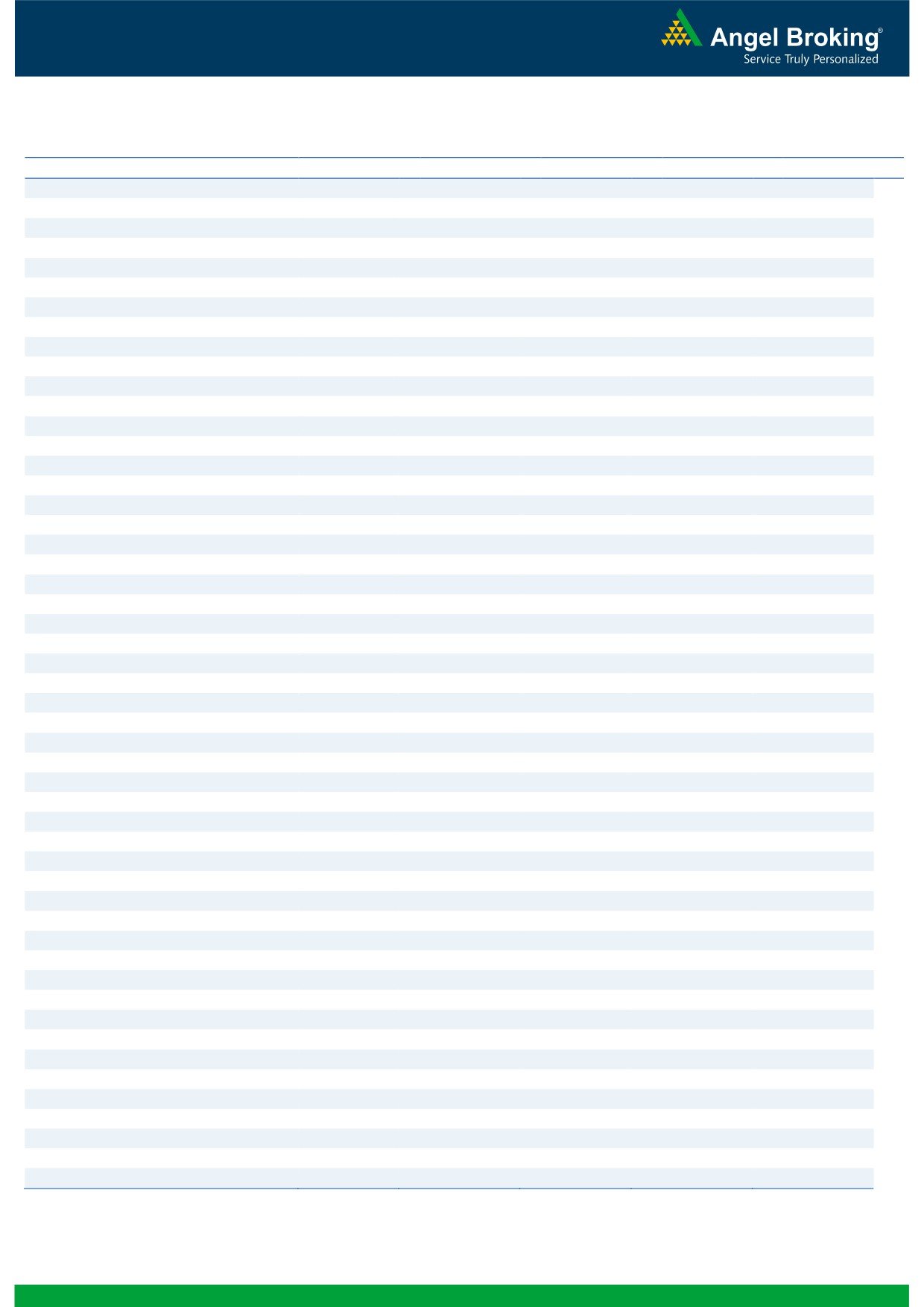

Nifty Put-Call Analysis

3

Technical & Derivatives Report

November 15, 2016

Daily Pivot Levels for Nifty Constituents

Scrips

S2

S1

PIVOT

R1

R2

ACC

1,356

1,378

1,414

1,436

1,471

ADANIPORTS

261

269

281

289

301

AMBUJACEM

212

216

223

226

233

ASIANPAINT

928

945

975

992

1,022

AUROPHARMA

750

761

778

789

806

AXISBANK

484

492

502

509

520

BAJAJ-AUTO

2,548

2,598

2,683

2,733

2,818

BANKBARODA

152

156

163

167

174

BHEL

130

133

138

141

146

BPCL

636

643

652

658

667

BHARTIARTL

293

297

303

307

312

INFRATEL

349

357

369

378

390

BOSCH

19,211

19,617

20,309

20,714

21,406

CIPLA

534

541

552

560

571

COALINDIA

315

320

326

330

336

DRREDDY

3,189

3,223

3,262

3,295

3,335

EICHERMOT

20,728

21,207

22,052

22,530

23,375

GAIL

418

428

438

448

458

GRASIM

872

885

905

918

937

HCLTECH

733

748

771

786

809

HDFCBANK

1,258

1,267

1,274

1,283

1,291

HDFC

1,233

1,251

1,281

1,299

1,329

HEROMOTOCO

2,857

2,916

3,023

3,082

3,189

HINDALCO

167

170

174

177

181

HINDUNILVR

788

795

805

812

822

ICICIBANK

262

269

282

289

301

IDEA

68

69

71

72

74

INDUSINDBK

1,162

1,177

1,203

1,218

1,244

INFY

902

912

928

938

955

ITC

236

240

244

248

252

KOTAKBANK

798

807

816

825

834

LT

1,372

1,380

1,395

1,403

1,418

LUPIN

1,425

1,442

1,469

1,486

1,514

M&M

1,178

1,209

1,263

1,294

1,348

MARUTI

4,987

5,061

5,177

5,250

5,367

NTPC

149

150

152

154

155

ONGC

265

269

274

278

283

POWERGRID

177

180

184

187

191

RELIANCE

982

992

1,005

1,014

1,027

SBIN

259

266

277

284

296

SUNPHARMA

664

676

692

704

720

TCS

2,051

2,076

2,111

2,137

2,172

TATAMTRDVR

320

324

332

337

344

TATAMOTORS

489

498

514

523

539

TATAPOWER

70

71

73

74

76

TATASTEEL

413

420

431

437

448

TECHM

420

425

432

437

444

ULTRACEMCO

3,492

3,563

3,682

3,753

3,872

WIPRO

430

436

440

446

450

YESBANK

1,161

1,188

1,237

1,264

1,313

ZEEL

466

474

488

496

509

4

Technical & Derivatives Report

November 15, 2016

Research Team Tel: 022 - 39357800

For Technical Queries

For Derivatives Queries

DISCLAIMER

Angel Broking Private Limited (hereinafter referred to as “Angel”) is a registered Member of National Stock Exchange of India Limited,

Bombay Stock Exchange Limited and Metropolitan Stock Exchange Limited. It is also registered as a Depository Participant with CDSL

and Portfolio Manager with SEBI. It also has registration with AMFI as a Mutual Fund Distributor. Angel Broking Private Limited is a

registered entity with SEBI for Research Analyst in terms of SEBI (Research Analyst) Regulations, 2014 vide registration number

INH000000164. Angel or its associates has not been debarred/ suspended by SEBI or any other regulatory authority for accessing

/dealing in securities Market. Angel or its associates/analyst has not received any compensation / managed or co-managed public

offering of securities of the company covered by Analyst during the past twelve months.

This document is solely for the personal information of the recipient, and must not be singularly used as the basis of any investment

decision. Nothing in this document should be construed as investment or financial advice. Each recipient of this document should

make such investigations as they deem necessary to arrive at an independent evaluation of an investment in the securities of the

companies referred to in this document (including the merits and risks involved), and should consult their own advisors to determine

the merits and risks of such an investment.

Reports based on technical and derivative analysis center on studying charts of a stock's price movement, outstanding positions and

trading volume, as opposed to focusing on a company's fundamentals and, as such, may not match with a report on a company's

fundamentals. Investors are advised to refer the Fundamental and Technical Research Reports available on our website to evaluate the

contrary view, if any.

The information in this document has been printed on the basis of publicly available information, internal data and other reliable

sources believed to be true, but we do not represent that it is accurate or complete and it should not be relied on as such, as this

document is for general guidance only. Angel Broking Pvt. Limited or any of its affiliates/ group companies shall not be in any way

responsible for any loss or damage that may arise to any person from any inadvertent error in the information contained in this report.

Angel Broking Pvt. Limited has not independently verified all the information contained within this document. Accordingly, we cannot

testify, nor make any representation or warranty, express or implied, to the accuracy, contents or data contained within this document.

While Angel Broking Pvt. Limited endeavors to update on a reasonable basis the information discussed in this material, there may be

regulatory, compliance, or other reasons that prevent us from doing so.

This document is being supplied to you solely for your information, and its contents, information or data may not be reproduced,

redistributed or passed on, directly or indirectly.

Neither Angel Broking Pvt. Limited, nor its directors, employees or affiliates shall be liable for any loss or damage that may arise from

or in connection with the use of this information.

5