October 15, 2015

Sensex (26780) / Nifty (8108)

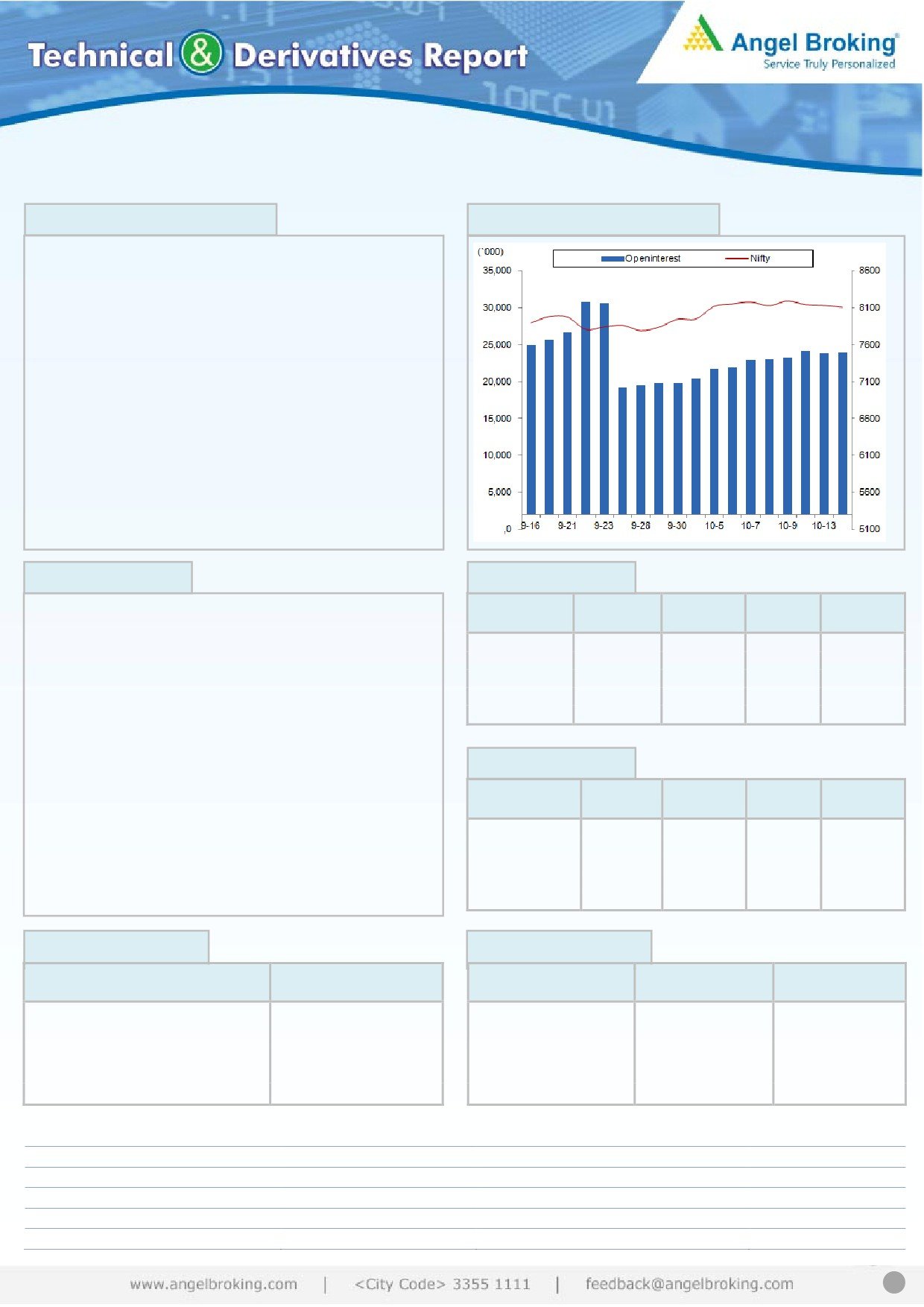

Exhibit 1: Nifty Daily Chart

Yesterday too, our benchmark index opened slightly lower

despite negative cues from other Asian bourses. The soft

opening was mainly led by another IT giant, TCS, as the company

posted lower-than-expected 2QFY2016 numbers post the market

hours on Tuesday.

Yesterday’s price action was a replica of Tuesday’s session, in

fact; the price range was much narrower as the Nifty traded

within merely 43 points. Thus, the intraday movement was very

lethargic. Unlike Tuesday, the Nifty did not recover much and

eventually closed almost at the lowest of the day. The chart

structure remains unchanged and thus, we continue to expect

the Nifty to remain within a small range of 8250 to 8050 whilst

the 8250 mark is likely to act as a major hurdle for the bulls. It’s

advisable to stay light on positions and focus more on stock

specific moves.

Key Levels

Support 1 - 8095

Resistance 1 - 8142

Source: Falcon

Support 2 - 8050

Resistance 2 - 8250

Bank Nifty Outlook - (17555)

Exhibit 2: Bank Nifty Daily Chart

Yesterday, the Bank Nifty opened with a downside gap of nearly

100 points in-line with broader indices. The index then gave a

smart recovery from its initial lows within the first hour of the

trading. This was followed by a lackluster movement to

eventually end the session with the negligible loss.

Yesterday, the Bank Nifty took a support around the ’89 EMA’ in

the hourly chart and then consolidated above it. However, the

index once again failed to move above the resistance of the

neckline of the ‘Inverted Head & Shoulder’, which coincides with

the ’89 EMA’ in the daily chart. Since last few sessions, the

banking index is trading in a range of 17350 to 17850 and a

sustainable move beyond this zone will dictate the further move

in the index. Going forward, the intraday support for the Bank

Nifty is placed at 17400 - 17350 levels; whereas, 17650 and

Source: Falcon

17750 will now act as an intraday resistance zone for the index.

Key Levels

Support 1 - 17400

Resistance 1 - 17650

Support 2 - 17350

Resistance 2 - 17750

1

October 15, 2015

Comments

Nifty Vs OI

The Nifty futures open interest has increased by 0.43%

BankNifty futures open interest has increased by 0.75%

as market closed at 8107.90 levels.

The Nifty October future closed at a premium of 13.50

points against a premium of 7.10 points. The November

series closed at a premium of 53.50 points.

The Implied Volatility of at the money options has

decreased from 15.79% to 15.39%.

The total OI of the market is Rs. 2,22,436/- cr. and the

stock futures OI is Rs. 59,780/- cr.

Few of the liquid counters where we have seen high

cost of carry are GMRINFRA, JPASSOCIAT, UNITECH,

TATAPOWER and JISLJALEQS.

Views

OI Gainers

OI

PRICE

Yesterday, FIIs were net buyers in cash market segment

SCRIP

OI

PRICE

CHG. (%)

CHG. (%)

to the tune of Rs. 121 crores. While in Index Futures

ZEEL

9606400

33.21

387.30

-3.54

they were net sellers of Rs. 872 crores with fall in OI,

BEML

195000

17.82

1245.80

1.67

indicating unwinding of longs in last trading session.

TV18BRDCST

14960000

16.40

33.60

-3.45

HINDUNILVR

5217050

12.69

792.40

-2.05

In Index Options front, FIIs sold of Rs. 919 crores with

INDIACEM

23786000

9.77

81.45

3.23

fall in OI. We hardly saw any strikes adding reasonable

build-up in Nifty options yesterday. 7800 put option

added some build-up. While huge unwinding was

OI Losers

visible in 8100 put options. Maximum OI is seen in 8200

OI

PRICE

SCRIP

OI

PRICE

call and

8000 put options. FIIs were continuously

CHG. (%)

CHG. (%)

NCC

4480000

-20.23

80.95

-0.67

forming longs in Index Futures but we didn’t see buying

ACC

1015750

-14.67

1379.50

1.59

interest in heavy weight large cap counters. We would

ENGINERSIN

1217800

-7.38

208.80

2.43

suggest being light in Nifty and trading stock specific.

SYNDIBANK

8112000

-6.18

92.45

1.54

HDIL

13894000

-4.73

76.50

-0.52

Historical Volatility

Put-Call Ratio

SCRIP

HV

SCRIP

PCR-OI

PCR-VOL

TCS

30.14

NIFTY

1.00

0.98

ZEEL

36.26

BANKNIFTY

0.95

0.69

BHARATFORG

50.46

INFY

0.31

0.34

HINDUNILVR

25.25

SBIN

0.46

0.45

AUROPHARMA

41.29

TATAMOTORS

0.99

0.77

Strategy Date

Symbol

Strategy

Status

September 28, 2015

NIFTY

Long Strangle

Active

October 05, 2015

SBIN

Ratio Bear Put Spread

Active

October 12, 2015

LT

Long Put Ladder

Active

2

October 15, 2015

FII Statistics for 14-October 2015

Turnover on 14-October 2015

Open Interest

No. of

Turnover

Change

Detail

Buy

Sell

Net

Instrument

Contracts

( in Cr. )

(%)

Contracts

Value

Change

INDEX

INDEX

1885.01

2757.64

(872.64)

970490

23255.54

(2.36)

461001

12673.25

-17.18

FUTURES

FUTURES

INDEX

INDEX

6037.04

6956.90

(919.87)

2227933

70029.09

(1.42)

4242236

95191.63

-29.81

OPTIONS

OPTIONS

STOCK

STOCK

2179.16

2867.54

(688.38)

1801612

47455.38

0.31

FUTURES

744279

20180.27

3.30

FUTURES

STOCK

1693.16

1718.22

(25.05)

132504

3566.89

3.17

STOCK

502979

14088.3

4.94

OPTIONS

OPTIONS

TOTAL

11794.36

14300.31

(2505.95)

5132539

144306.90

(0.88)

TOTAL

5950495

142133.45

-22.70

Nifty Spot = 8107.90

Lot Size = 25

Bull-Call Spreads

Bear-Put Spreads

Action

Strike

Price

Risk

Reward

BEP

Action

Strike

Price

Risk

Reward

BEP

Buy

Buy

8200

60.80

8100

92.50

32.70

67.30

8232.70

32.60

67.40

8067.40

Sell

Sell

8300

28.10

8000

59.90

Buy

Buy

8200

60.80

8100

92.50

49.30

150.70

8249.30

54.50

145.50

8045.50

Sell

Sell

8400

11.50

7900

38.00

Buy

Buy

8300

28.10

8000

59.90

16.60

83.40

8316.60

21.90

78.10

7978.10

Sell

Sell

8400

11.50

7900

38.00

Note: Above mentioned Bullish or Bearish Spreads in Nifty (Oct. Series) are given as an information and not as a recommendation.

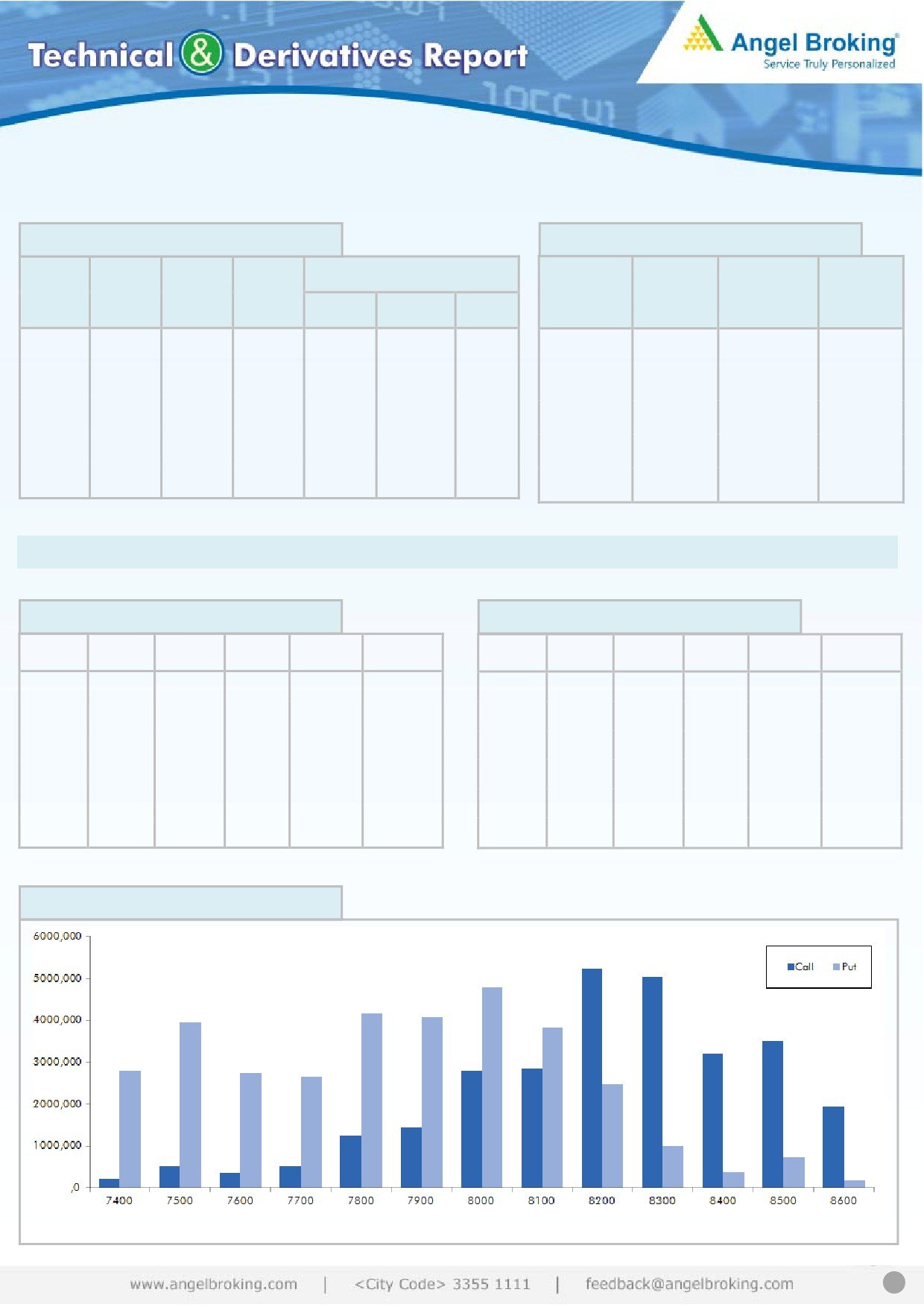

Nifty Put-Call Analysis

3

October 15, 2015

Daily Pivot Levels for Nifty 50 Stocks

Scrips

S2

S1

PIVOT

R1

R2

ACC

1,343

1,359

1,369

1,386

1,395

AMBUJACEM

208

209

210

211

212

ASIANPAINT

854

858

864

868

873

AXISBANK

485

490

493

499

502

BAJAJ-AUTO

2,402

2,420

2,450

2,468

2,497

BANKBARODA

171

172

174

176

178

BHARTIARTL

338

342

346

350

354

BHEL

201

203

206

208

212

BOSCHLTD

20,842

21,014

21,172

21,344

21,502

BPCL

854

858

865

869

875

CAIRN

153

156

161

164

170

CIPLA

653

666

673

686

693

COALINDIA

330

333

336

338

342

DRREDDY

4,132

4,165

4,212

4,245

4,292

GAIL

309

313

317

321

325

GRASIM

3,602

3,619

3,639

3,656

3,676

HCLTECH

819

826

833

840

846

HDFC

1,265

1,280

1,288

1,303

1,312

HDFCBANK

1,060

1,072

1,079

1,092

1,099

HEROMOTOCO

2,458

2,479

2,514

2,535

2,570

HINDALCO

83

86

88

91

94

HINDUNILVR

772

784

800

812

828

ICICIBANK

280

282

283

285

287

IDEA

148

149

152

153

155

INDUSINDBK

937

943

953

959

969

INFY

1,072

1,085

1,100

1,113

1,128

ITC

341

343

344

346

347

KOTAKBANK

644

648

655

660

667

LT

1,524

1,532

1,543

1,551

1,562

LUPIN

2,005

2,036

2,057

2,088

2,109

M&M

1,267

1,277

1,284

1,294

1,301

MARUTI

4,209

4,229

4,262

4,283

4,316

NMDC

96

97

99

100

102

NTPC

123

125

126

128

129

ONGC

247

251

257

261

267

PNB

133

134

136

137

139

POWERGRID

132

132

133

134

134

RELIANCE

890

896

901

907

912

SBIN

241

243

245

246

248

VEDL

103

105

109

111

115

SUNPHARMA

874

879

886

891

899

TATAMOTORS

345

349

355

358

364

TATAPOWER

69

69

70

70

71

TATASTEEL

239

244

248

253

258

TCS

2,436

2,460

2,504

2,528

2,572

TECHM

533

541

553

560

572

ULTRACEMCO

2,867

2,887

2,911

2,931

2,955

WIPRO

573

578

586

591

600

YESBANK

725

732

737

744

750

ZEEL

369

378

389

398

410

4

October 15, 2015

Research Team Tel: 022 - 39357800

For Technical Queries

For Derivatives Queries

DISCLAIMER

Angel Broking Private Limited (hereinafter referred to as “Angel”) is a registered Member of National Stock Exchange of India Limited,

Bombay Stock Exchange Limited and MCX Stock Exchange Limited. It is also registered as a Depository Participant with CDSL and

Portfolio Manager with SEBI. It also has registration with AMFI as a Mutual Fund Distributor. Angel Broking Private Limited is a

registered entity with SEBI for Research Analyst in terms of SEBI (Research Analyst) Regulations, 2014 vide registration number

INH000000164. Angel or its associates has not been debarred/ suspended by SEBI or any other regulatory authority for accessing

/dealing in securities Market. Angel or its associates including its relatives/analyst do not hold any financial interest/beneficial

ownership of more than 1% in the company covered by Analyst. Angel or its associates/analyst has not received any compensation /

managed or co-managed public offering of securities of the company covered by Analyst during the past twelve months.

Angel/analyst has not served as an officer, director or employee of company covered by Analyst and has not been engaged in market

making activity of the company covered by Analyst.

This document is solely for the personal information of the recipient, and must not be singularly used as the basis of any investment

decision. Nothing in this document should be construed as investment or financial advice. Each recipient of this document should

make such investigations as they deem necessary to arrive at an independent evaluation of an investment in the securities of the

companies referred to in this document (including the merits and risks involved), and should consult their own advisors to determine

the merits and risks of such an investment.

Reports based on technical and derivative analysis center on studying charts of a stock's price movement, outstanding positions and

trading volume, as opposed to focusing on a company's fundamentals and, as such, may not match with a report on a company's

fundamentals.

The information in this document has been printed on the basis of publicly available information, internal data and other reliable

sources believed to be true, but we do not represent that it is accurate or complete and it should not be relied on as such, as this

document is for general guidance only. Angel Broking Pvt. Limited or any of its affiliates/ group companies shall not be in any way

responsible for any loss or damage that may arise to any person from any inadvertent error in the information contained in this

report. Angel Broking Pvt. Limited has not independently verified all the information contained within this document. Accordingly, we

cannot testify, nor make any representation or warranty, express or implied, to the accuracy, contents or data contained within this

document. While Angel Broking Pvt. Limited endeavors to update on a reasonable basis the information discussed in this material,

there may be regulatory, compliance, or other reasons that prevent us from doing so.

This document is being supplied to you solely for your information, and its contents, information or data may not be reproduced,

redistributed or passed on, directly or indirectly.

Neither Angel Broking Pvt. Limited, nor its directors, employees or affiliates shall be liable for any loss or damage that may arise from

or in connection with the use of this information.

Note: Please refer to the important ‘Stock Holding Disclosure' report on the Angel website (Research Section). Also, please

refer to the latest update on respective stocks for the disclosure status in respect of those stocks. Angel Broking Pvt. Limited

5