Technical & Derivatives Report

September 15, 2016

Sensex (28372) / Nifty (8727)

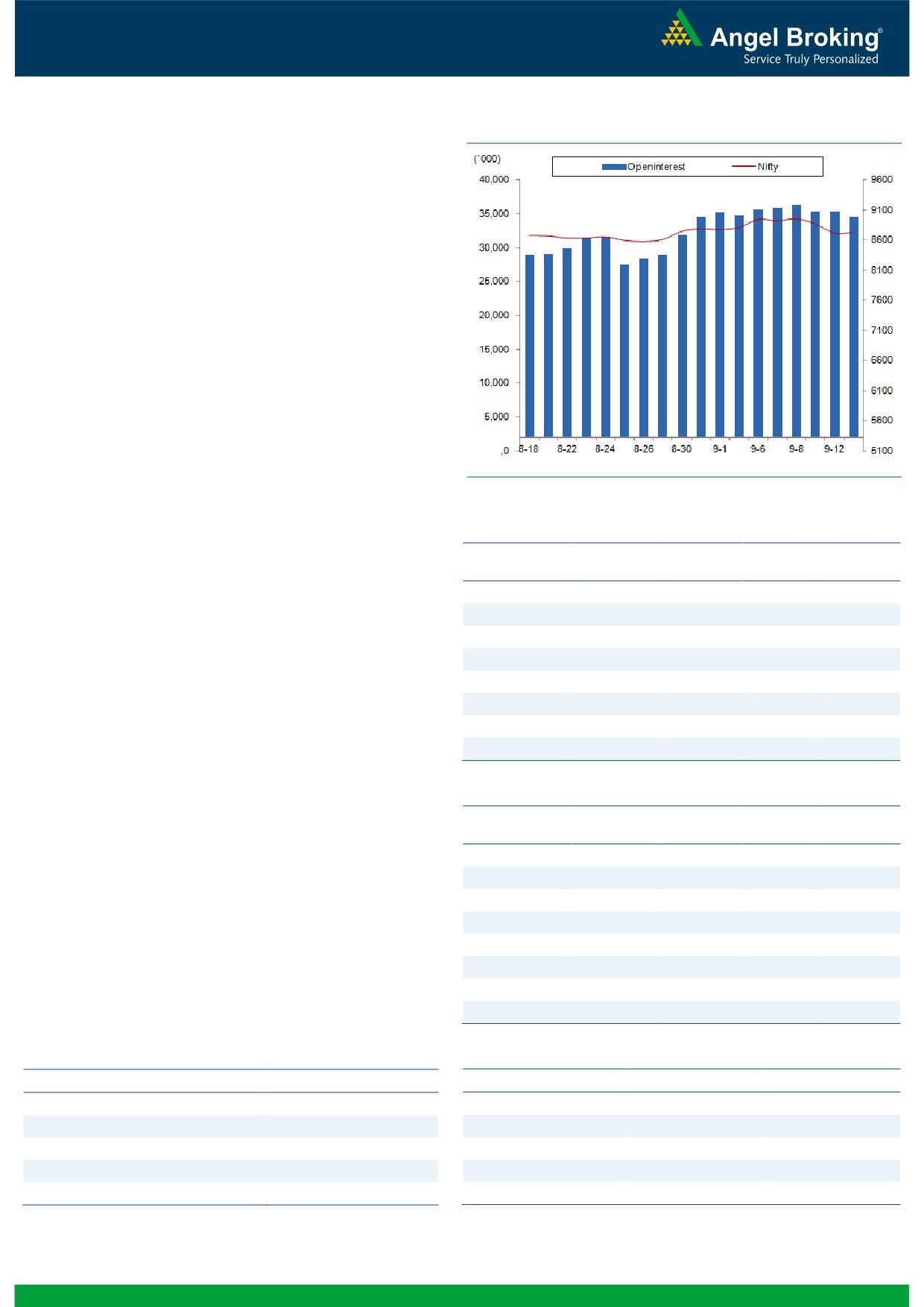

Exhibit 1: Nifty Daily Chart

Yesterday, our markets opened on a flat note mirroring mixed

cues from the global bourses. Subsequently, we saw a gentle

selling pressure in the initial hour to sneak below the 8700 mark

by a small margin. Due to modest recovery in the latter half, the

Nifty eventually ended the session with negligible gains.

Similar to Monday’s session, we witnessed a lethargic intraday

movement within a very narrow range throughout the day.

Technically speaking, after a huge downside gap on the opening

day of the week, our benchmark index seems to be in a

consolidation mode around the ‘200-SMA’ on hourly chart. On

previous occasions in the recent past, this technical tool played a

sheet anchor role; but, now we are a bit skeptical on it. Going

ahead, considering the extreme oversold position of ‘RSI-

Smoothened’ on hourly chart, we may see a small bounce back

towards 8760 - 8780; but, we would advise traders not to

participate aggressively in it. We expect any attempt of a bounce

back towards mentioned levels to get sold into. The selling

pressure may get aggravated once the Nifty starts sustaining

below yesterday’s low of 8688.90. In this case, we may see the

index sliding towards the next support zone 8642 - 8612 levels.

The index may continue to trade in a range; but the bias would

be on the negative side.

Key Levels

Support 1 - 8642

Resistance 1 - 8760

Support 2 - 8612

Resistance 2 - 8780

Exhibit 2: Nifty Bank Daily Chart

Nifty Bank Outlook - (19909)

The Nifty Bank index pulled higher yesterday post opening and

ended the session with gains of 0.60 percent over its previous

session's close.

Yesterday's session witnessed more of stock specific action rather

than any significant movement in the index. As we had also

mentioned yesterday, the next couple of sessions will be crucial to

determine the short term trend of the index. Monday's gap area of

19861-20139 is a resistance zone now and the index needs to

cross the higher end of the gap to negate the bearish implication

of Monday's gap down opening. Untill then, traders are advised

to stay light on positions and remain cautious on further market

moves. The intraday support for the index is placed in range of

19735-19670 whereas resistance is seen in range of 19990-

20139.

Key Levels

Support 1 - 19735

Resistance 1 - 19990

Support 2 - 19670

Resistance 2 - 20139

1

Technical & Derivatives Report

September 15, 2016

Comments

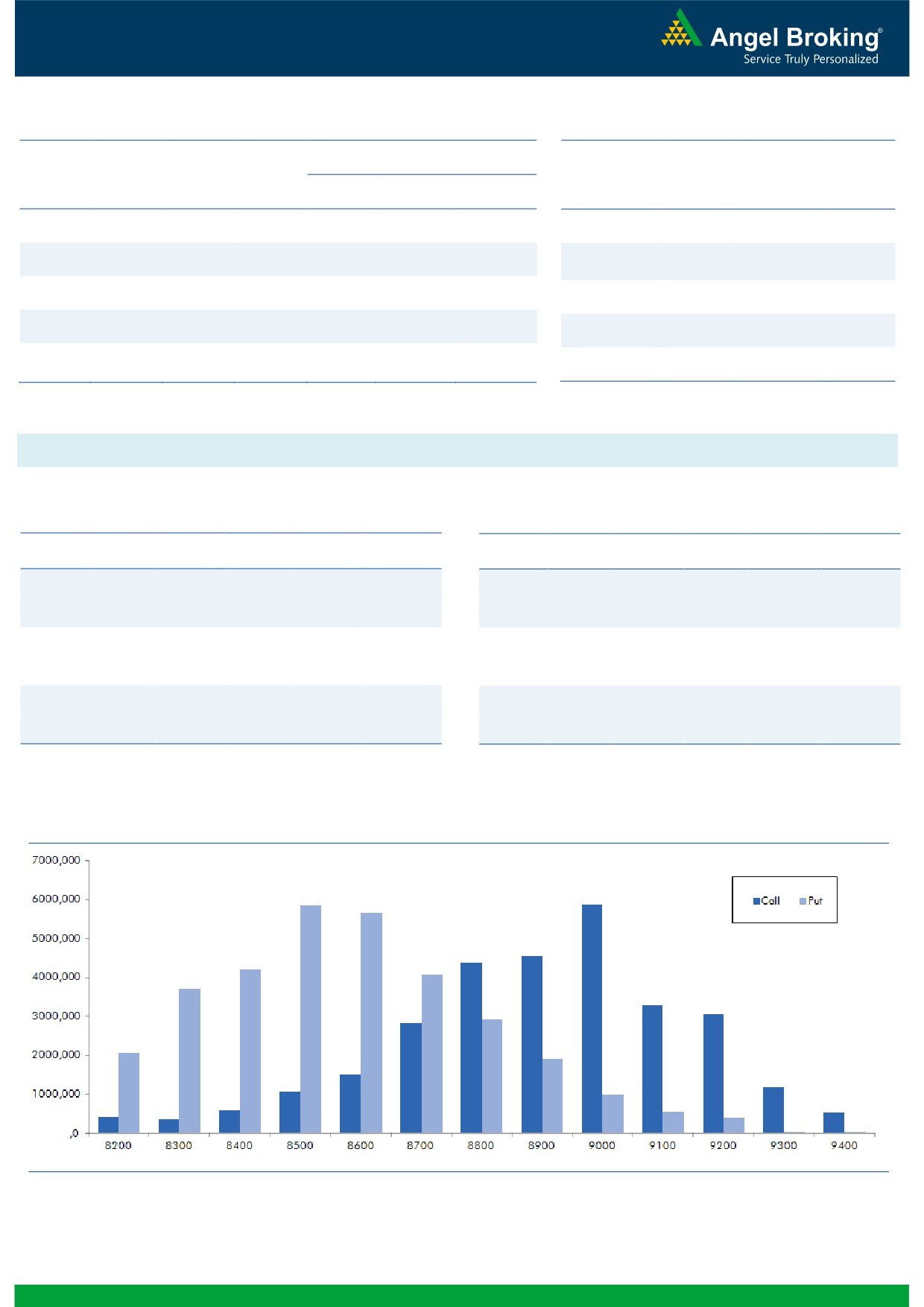

Nifty Vs OI

The Nifty futures open interest has decreased by 0.34%

BankNifty futures open interest has decreased by 0.75%

as market closed at 8726.60 levels.

The Nifty September future closed with a premium of

41.95 points against a premium of 26.35 points in

previous session. The October series closed at a

premium of 79.95 points.

The Implied Volatility of at the money options has

decreased from 14.32% to 13.93%. At the same time,

the PCR-OI of Nifty has decreased from 1.10 to 1.09.

The total OI of the market is Rs. 3,02,607/- cr. and the

stock futures OI is Rs. 84,017/- cr.

Few of the liquid counters where we have seen high cost

of carry are JPASSOCIAT, ADANIPOWER, IFCI,

GMRINFRA and HDFCBANK.

Views

FIIs continue selling in both cash market segment and

OI Gainers

Index Futures. They sold equities to the tune of Rs. 477

OI

PRICE

SCRIP

OI

PRICE

crores. While, they were net sellers in index future of Rs.

CHG. (%)

CHG. (%)

PCJEWELLER

769500

47.84

517.60

8.08

551 crores with some rise in OI, indicating blend of fresh

APOLLOTYRE

12594000

19.40

214.55

4.84

short formations and some long unwinding in last

trading session.

CASTROLIND

6594000

18.97

444.95

-4.31

www.angelbroking.com

On Index Options front, FIIs bought of Rs. 346 crores

UPL

6056400

12.86

700.00

7.81

with rise in OI. Yesterday, both in call and put options,

KSCL

3760500

11.97

354.90

4.86

we hardly saw any meaningful OI addition. 8800 call

TATAMOTORS

31096500

10.23

563.40

1.31

and 8300 & 8500 put options were comparatively active

BATAINDIA

3130600

9.93

525.00

-0.45

and added some build-up. Highest OI in September

TORNTPHARM

360400

9.34

1637.40

-1.28

series is placed at 9000 call and of put option has shifted

to 8500 strike.

OI Losers

We witness FIIs selling in both equity cash and Index

OI

PRICE

SCRIP

OI

PRICE

Futures from past few sessions. While, they also booked

CHG. (%)

CHG. (%)

losses in their puts that they sold earlier. Seeing the

YESBANK

13740300

-6.39

1256.60

3.85

above data, we believe Nifty may continue to remain

IOC

10122000

-6.33

567.15

2.40

under pressure. Thus, traders should square-off their

HDIL

31984000

-6.26

91.30

1.16

longs and look for shorting near 8750-8800 levels.

DLF

44810000

-5.93

145.00

-0.45

Large cap counters that added long positions yesterday

HINDZINC

5232000

-5.16

221.20

3.83

are TATAMOTORS, ULTRACEMCO, AMBUJACEM and

JISLJALEQS

42273000

-4.82

94.65

9.04

MARUTI. While, counters like HCLTECH, BOSCHLTD,

HINDPETRO

30034200

-4.30

401.20

0.26

KOTAKBANK and M&M added short positions.

DISHTV

32298000

-4.25

96.05

4.57

Historical Volatility

Put-Call Ratio

SCRIP

HV

SCRIP

PCR-OI

PCR-VOL

UPL

45.13

NIFTY

1.09

1.06

PCJEWELLER

51.87

BANKNIFTY

0.97

0.87

RELCAPITAL

60.66

RELIANCE

0.52

0.60

JISLJALEQS

69.36

YESBANK

0.49

0.46

CENTURYTEX

51.88

SBIN

0.59

0.45

2

Technical & Derivatives Report

September 15, 2016

FII Statistics for 14, September 2016

Turnover on 14, September 2016

Open Interest

No. of

Turnover

Change

Detail

Buy

Sell

Net

Instrument

Value

Contracts

( in Cr. )

(%)

Contracts

Change (%)

(in Cr.)

INDEX

INDEX

1542.22

2093.39

(551.17)

464154

31120.17

1.07

191684

13556.97

-32.90

FUTURES

FUTURES

INDEX

INDEX

40272.33

39926.13

346.20

1239232

83356.85

2.27

3739179

275757.43

-6.50

OPTIONS

OPTIONS

STOCK

6208.24

6977.26

(769.02)

912703

60778.42

1.48

STOCK

FUTURES

562933

40849.34

-2.90

FUTURES

STOCK

STOCK

5201.25

5233.03

(31.78)

111812

7759.60

1.79

OPTIONS

347686

26112.70

-16.67

OPTIONS

TOTAL

53224.03

54229.80

(1005.78)

2727901

183015.04

1.78

TOTAL

4841482

356276.44

-8.30

Nifty Spot = 8726.60

Lot Size = 75

Bull-Call Spreads

Bear-Put Spreads

Action

Strike

Price

Risk

Reward

BEP

Action

Strike

Price

Risk

Reward

BEP

Buy

8800

77.55

Buy

8700

70.45

38.50

61.50

8838.50

26.45

73.55

8673.55

Sell

8900

39.05

Sell

8600

44.00

Buy

8800

77.55

Buy

8700

70.45

60.55

139.45

8860.55

42.65

157.35

8657.35

Sell

9000

17.00

Sell

8500

27.80

Buy

8900

39.05

Buy

8600

44.00

22.05

77.95

8922.05

16.20

83.80

8583.80

Sell

9000

17.00

Sell

8500

27.80

Note: Above mentioned Bullish or Bearish Spreads in Nifty (September Series) are given as an information and not as a recommendation.

Nifty Put-Call Analysis

3

Technical & Derivatives Report

September 15, 2016

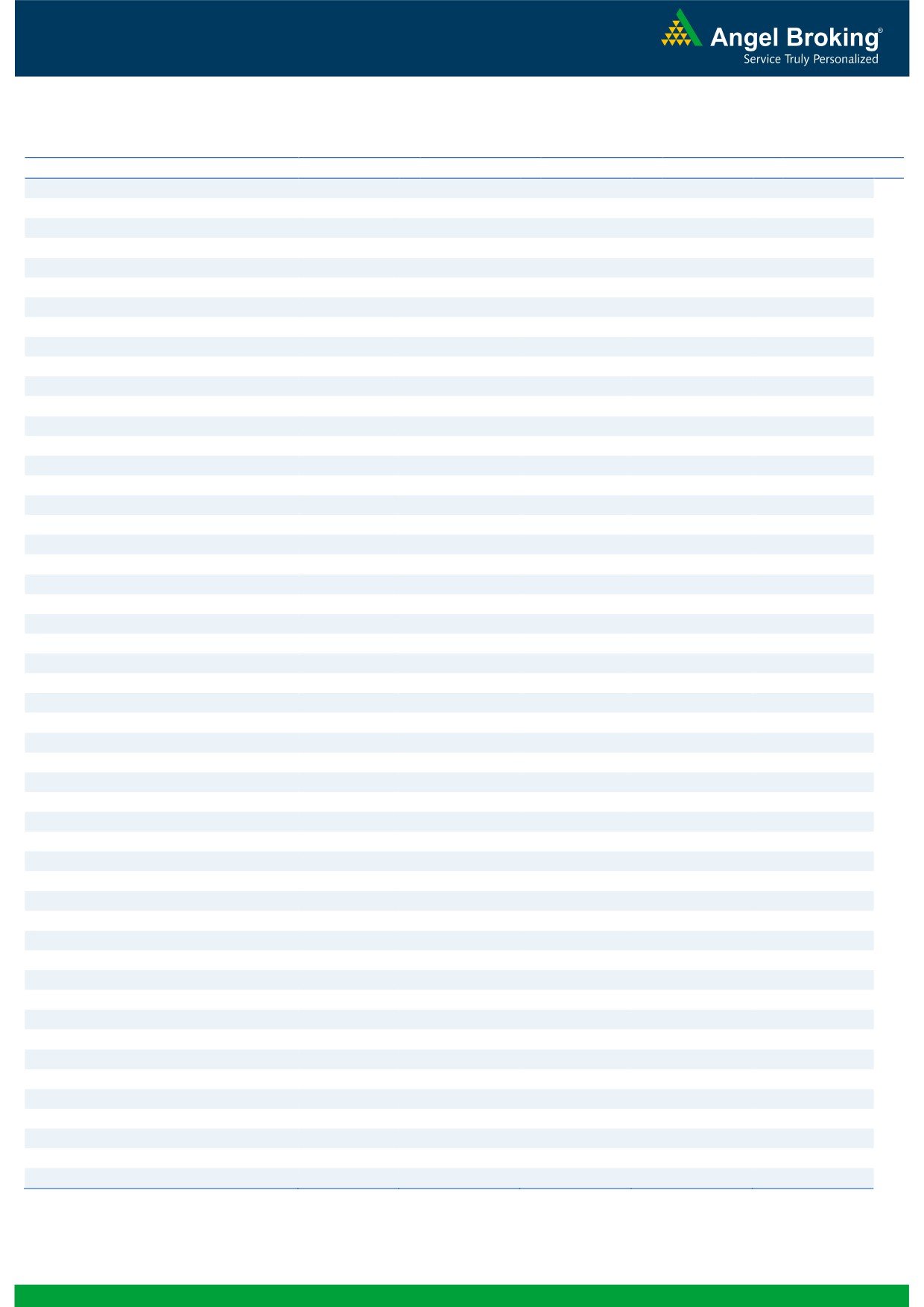

Daily Pivot Levels for Nifty Constituents

Scrips

S2

S1

PIVOT

R1

R2

ACC

1,566

1,593

1,610

1,637

1,654

ADANIPORTS

252

258

263

270

274

AMBUJACEM

257

261

263

267

269

ASIANPAINT

1,135

1,149

1,164

1,178

1,193

AUROPHARMA

770

777

783

790

797

AXISBANK

585

593

599

607

613

BAJAJ-AUTO

2,914

2,943

2,969

2,997

3,023

BANKBARODA

159

164

166

171

173

BHEL

142

144

147

149

152

BPCL

561

568

573

580

586

BHARTIARTL

314

317

320

323

326

INFRATEL

335

339

344

347

352

BOSCH

22,541

22,781

23,190

23,430

23,839

CIPLA

563

570

577

584

591

COALINDIA

318

321

324

327

331

DRREDDY

3,119

3,139

3,154

3,174

3,189

EICHERMOT

22,057

22,327

22,621

22,891

23,185

GAIL

381

384

387

389

392

GRASIM

4,587

4,652

4,695

4,760

4,803

HCLTECH

762

769

782

789

802

HDFCBANK

1,259

1,264

1,271

1,276

1,282

HDFC

1,370

1,381

1,390

1,401

1,409

HEROMOTOCO

3,492

3,541

3,575

3,625

3,659

HINDALCO

137

140

142

145

147

HINDUNILVR

893

901

913

920

932

ICICIBANK

263

267

271

275

278

IDEA

82

83

84

84

85

INDUSINDBK

1,172

1,181

1,191

1,200

1,210

INFY

1,031

1,038

1,048

1,055

1,065

ITC

248

250

252

253

255

KOTAKBANK

793

800

810

816

826

LT

1,445

1,460

1,471

1,486

1,497

LUPIN

1,508

1,520

1,535

1,547

1,561

M&M

1,390

1,401

1,417

1,427

1,443

MARUTI

5,305

5,334

5,360

5,389

5,414

NTPC

150

153

155

158

159

ONGC

241

245

249

252

256

POWERGRID

177

178

180

181

182

RELIANCE

1,030

1,037

1,048

1,056

1,066

SBIN

251

254

256

259

261

SUNPHARMA

762

771

783

793

805

TCS

2,271

2,300

2,339

2,367

2,406

TATAMTRDVR

340

349

356

365

371

TATAMOTORS

535

548

557

569

578

TATAPOWER

72

74

75

77

78

TATASTEEL

357

365

372

380

387

TECHM

459

463

468

472

477

ULTRACEMCO

3,783

3,864

3,914

3,995

4,046

WIPRO

471

474

480

483

489

YESBANK

1,184

1,219

1,238

1,273

1,292

ZEEL

502

510

516

524

529

4

Technical & Derivatives Report

September 15, 2016

Research Team Tel: 022 - 39357800

For Technical Queries

For Derivatives Queries

DISCLAIMER

Angel Broking Private Limited (hereinafter referred to as “Angel”) is a registered Member of National Stock Exchange of India Limited,

Bombay Stock Exchange Limited and Metropolitan Stock Exchange Limited. It is also registered as a Depository Participant with CDSL

and Portfolio Manager with SEBI. It also has registration with AMFI as a Mutual Fund Distributor. Angel Broking Private Limited is a

registered entity with SEBI for Research Analyst in terms of SEBI (Research Analyst) Regulations, 2014 vide registration number

INH000000164. Angel or its associates has not been debarred/ suspended by SEBI or any other regulatory authority for accessing

/dealing in securities Market. Angel or its associates/analyst has not received any compensation / managed or co-managed public

offering of securities of the company covered by Analyst during the past twelve months.

This document is solely for the personal information of the recipient, and must not be singularly used as the basis of any investment

decision. Nothing in this document should be construed as investment or financial advice. Each recipient of this document should

make such investigations as they deem necessary to arrive at an independent evaluation of an investment in the securities of the

companies referred to in this document (including the merits and risks involved), and should consult their own advisors to determine

the merits and risks of such an investment.

Reports based on technical and derivative analysis center on studying charts of a stock's price movement, outstanding positions and

trading volume, as opposed to focusing on a company's fundamentals and, as such, may not match with a report on a company's

fundamentals. Investors are advised to refer the Fundamental and Technical Research Reports available on our website to evaluate the

contrary view, if any.

The information in this document has been printed on the basis of publicly available information, internal data and other reliable

sources believed to be true, but we do not represent that it is accurate or complete and it should not be relied on as such, as this

document is for general guidance only. Angel Broking Pvt. Limited or any of its affiliates/ group companies shall not be in any way

responsible for any loss or damage that may arise to any person from any inadvertent error in the information contained in this report.

Angel Broking Pvt. Limited has not independently verified all the information contained within this document. Accordingly, we cannot

testify, nor make any representation or warranty, express or implied, to the accuracy, contents or data contained within this document.

While Angel Broking Pvt. Limited endeavors to update on a reasonable basis the information discussed in this material, there may be

regulatory, compliance, or other reasons that prevent us from doing so.

This document is being supplied to you solely for your information, and its contents, information or data may not be reproduced,

redistributed or passed on, directly or indirectly.

Neither Angel Broking Pvt. Limited, nor its directors, employees or affiliates shall be liable for any loss or damage that may arise from

or in connection with the use of this information.

5