Technical & Derivatives Report

June 14, 2016

Sensex (26397) / Nifty (8111)

Exhibit 1: Nifty Daily Chart

Opening session of the week began with nearly a percent cut

mirroring to negative cues from the global bourses. Subsequently,

the index continued this downward bias to sneak convincingly

below the 8100 mark. However, due to a modest recovery in the

latter part Nifty managed to close above 8100 mark.

Yesterday, the Nifty managed to find a strong support around

mentioned technical evidences such as, the Daily ’20 EMA’ and

the ‘Super Trend’ indicator placed around

8080. If we

meticulously observe yesterday’s candle, it resembles a ‘Dragonfly

Doji’. The said pattern has a bullish implication if occurs after a

fall. In this case, it has occurred after a small corrective move and

thus, cannot be termed as a trend reversal; but, certainly indicates

exhaustion or weak move by the bears at a support zone. Going

forward, if the index manages to sustain above yesterday’s high

of 8125 then we may witness an intraday bounce towards 8162 -

8186 levels. On the flipside, yesterday’s low of 8063 would now

be seen as important support during the day.

Key Levels

Support 1 - 8063

Resistance 1 - 8125

Support 2 - 8030

Resistance 2 - 8162

Exhibit 2: Nifty Bank Daily Chart

Nifty Bank Outlook - (17594)

The Nifty Bank index opened on a negative note yesterday on

weak global cues and corrected sharply in first hour of trade.

Thereafter, rest of the session was marred by range bound activity

with the index ending the day with a loss of 1.32% over Friday's

close.

Yesterday's correction in the index was much on our expected

lines as we had mentioned in our previous report about the

bearish implication of the 'Gravestone Doji' pattern around the

resistance zone. Post sell off in first hour of trade, Nifty Bank

consolidated near the support zone hourly ‘89EMA’. However,

analyzing the daily charts, we continue to advise traders to stay

light on positions and wait for fresh developments to re-enter the

markets. Till then, it is wise to trade on stock specific moves with

proper risk management. The intraday support for the index is

placed at 17520 - 17350; whereas, resistances are seen in the

range of 17800 - 17900.

Key Levels

Support 1 - 17520

Resistance 1 - 17800

Support 2 - 17350

Resistance 2 - 17900

1

Technical & Derivatives Report

June 14, 2016

Comments

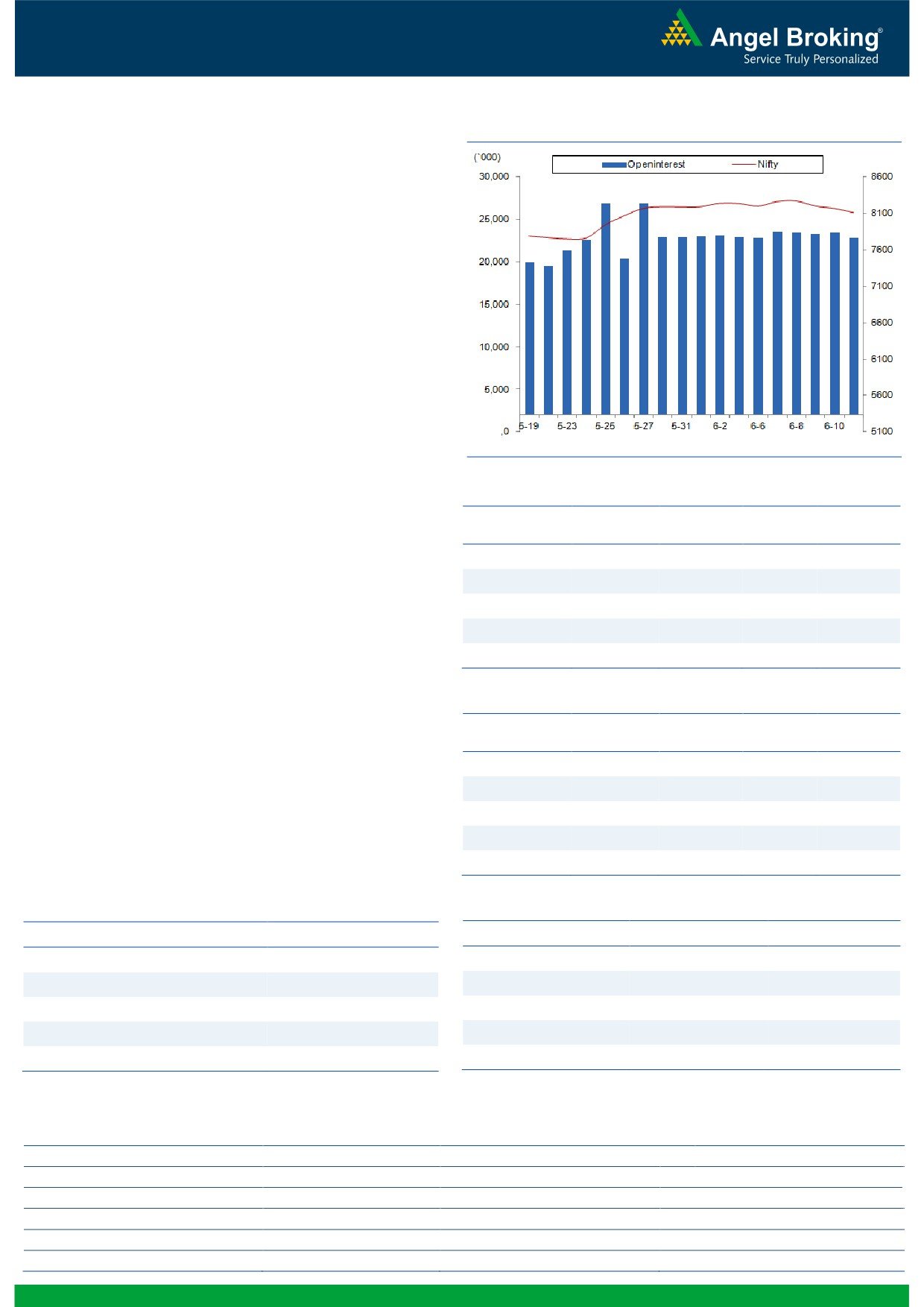

Nifty Vs OI

The Nifty futures open interest has decreased by 2.76%

BankNifty futures open interest has decreased by 8.27%

as market closed at 8110.60 levels.

The Nifty June future closed with a premium of 20.05

points against a premium of 20.35 points in previous

session. The July series closed at a premium of 46.75

points.

The Implied Volatility of at the money options has

increased from 14.64% to 15.59%.

The total OI of the market is Rs. 2,35,653/- cr. and the

stock futures OI is Rs. 66,734/- cr.

Few of the liquid counters where we have seen high cost

of carry are UNITECH, JPASSOCIAT, DISHTV, CESC and

SRTRANSFIN.

Views

Despite a correction in market, yesterday, the FIIs were

OI Gainers

net buyers in equity cash segment worth Rs. 212 crores.

OI

PRICE

SCRIP

OI

PRICE

CHG. (%)

CHG. (%)

While, in Index Futures, they sold worth Rs. 616 crores

MCLEODRUSS

3605200

17.75

198.60

6.37

with fall in open interest, suggesting long unwinding.

AMBUJACEM

10263300

15.24

237.20

0.68

On Index Options front, FIIs were buyer to the tune of

Rs. 649 crores with marginal change in OI. In Call

APOLLOHOSP

747600

10.40

1325.70

-2.74

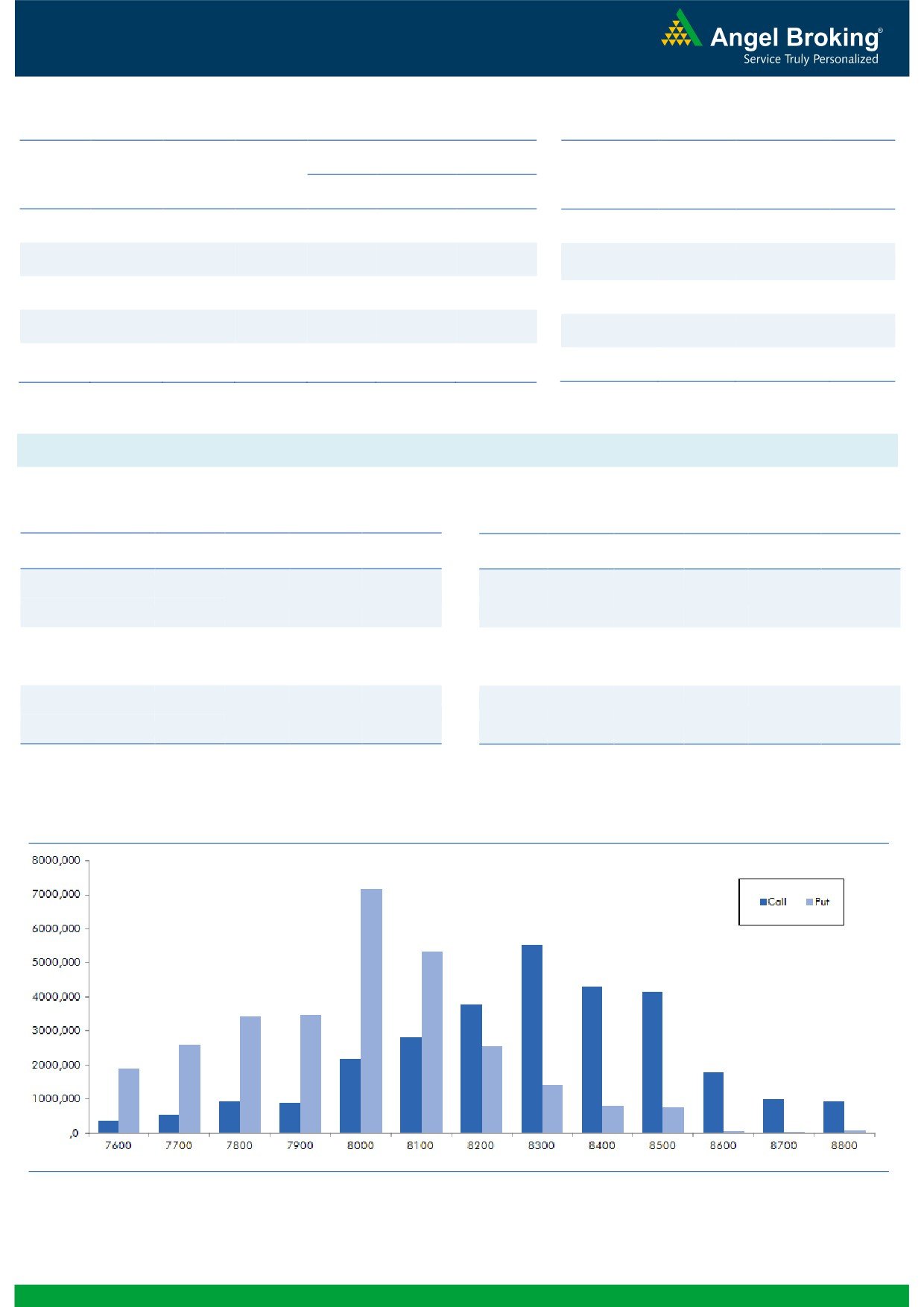

options, good amount of build-up seen in 8100 strike,

KPIT

1508000

9.59

190.00

2.10

followed by unwinding in 8400 - 8500 strikes. While inng.com

HINDUNILVR

5787000

9.49

869.45

-0.08

put option, 7800 strike added some fresh positions;

whereas, huge unwinding was seen in 8100 and 8200

OI Losers

strikes. We believe that put writers are covering their

OI

PRICE

positions. Maximum open interest in current series is

SCRIP

OI

PRICE

CHG. (%)

CHG. (%)

placed at 8300 call and 8000 put option.

HINDALCO

35621000

-5.43

114.90

-0.43

Though FIIs has not formed fresh shorts yet; but, they are

BAJFINANCE

554500

-4.66

7533.15

-1.20

unwinding long and their activity in option segment

IOB

6622000

-4.06

25.90

-2.81

doesn’t bode well for bulls. Hence, we maintain cautious

TVSMOTOR

5964000

-3.40

288.95

0.23

approach and are attentive towards further FIIs activity.

JSWENERGY

13594000

-3.40

79.15

-1.55

Thus, traders are advised to remain light on longs.

Historical Volatility

Put-Call Ratio

SCRIP

HV

SCRIP

PCR-OI

PCR-VOL

UNITECH

90.39

NIFTY

1.11

1.06

JPASSOCIAT

77.95

BANKNIFTY

0.89

0.83

MCLEODRUSS

44.57

SBIN

0.86

0.74

TATAGLOBAL

30.21

RELIANCE

0.60

0.41

CAIRN

41.58

SUNPHARMA

0.37

0.31

Strategy Date

Symbol

Strategy

Status

May 30, 2016

TCS

Ratio Bull Call Spread

Active

June 06, 2016

NIFTY

Long Call

Exited at Cost

June 13, 2016

ONGC

Ratio Bull Call Spread

Active

2

Technical & Derivatives Report

June 14, 2016

FII Statistics for 13-June 2016

Turnover on 13-June 2016

Open Interest

No. of

Turnover

Change

Detail

Buy

Sell

Net

Instrument

Value

Contracts

( in Cr. )

(%)

Contracts

Change (%)

(in Cr.)

INDEX

INDEX

1506.29

2121.90

(615.61)

282821

16979.91

(4.84)

281982

16377.67

-17.02

FUTURES

FUTURES

INDEX

INDEX

20143.73

19494.61

649.11

1046057

63025.58

(0.10)

2924781

173728.21

-10.96

OPTIONS

OPTIONS

STOCK

4018.41

5405.42

(1387.02)

1064617

52199.57

0.85

STOCK

FUTURES

491511

25245.74

-11.81

FUTURES

STOCK

STOCK

2749.27

2752.95

(3.68)

97188

4973.79

2.22

OPTIONS

293532

15425.71

-6.57

OPTIONS

TOTAL

28417.69

29774.88

(1357.19)

2490683

137178.86

(0.18)

TOTAL

3991806

230777.34

-11.24

Nifty Spot = 8110.60

Lot Size = 75

Bull-Call Spreads

Bear-Put Spreads

Action

Strike

Price

Risk

Reward

BEP

Action

Strike

Price

Risk

Reward

BEP

Buy

8100

124.70

Buy

8100

96.15

50.10

49.90

8150.10

33.45

66.55

8066.55

Sell

8200

74.60

Sell

8000

62.70

Buy

8100

124.70

Buy

8100

96.15

84.40

115.60

8184.40

55.55

144.45

8044.45

Sell

8300

40.30

Sell

7900

40.60

Buy

8200

74.60

Buy

8000

62.70

34.30

65.70

8234.30

22.10

77.90

7977.90

Sell

8300

40.30

Sell

7900

40.60

Note: Above mentioned Bullish or Bearish Spreads in Nifty (June Series) are given as an information and not as a recommendation.

Nifty Put-Call Analysis

3

Technical & Derivatives Report

June 14, 2016

Daily Pivot Levels for Nifty Constituents

Scrips

S2

S1

PIVOT

R1

R2

ACC

1,530

1,539

1,545

1,553

1,560

ADANIPORTS

195

199

201

205

207

AMBUJACEM

229

233

236

240

243

ASIANPAINT

981

988

992

999

1,004

AUROPHARMA

723

736

744

757

766

AXISBANK

519

525

530

536

541

BAJAJ-AUTO

2,537

2,560

2,577

2,601

2,618

BANKBARODA

140

143

145

148

151

BHEL

118

119

121

122

124

BPCL

968

988

1,001

1,021

1,033

BHARTIARTL

336

339

345

348

354

INFRATEL

369

374

377

382

385

BOSCH

21,001

21,299

21,500

21,798

21,998

CIPLA

457

463

471

477

486

COALINDIA

302

305

308

311

314

DRREDDY

3,052

3,070

3,086

3,104

3,120

EICHERMOT

18,151

18,299

18,426

18,574

18,701

GAIL

358

365

371

377

383

GRASIM

4,256

4,284

4,309

4,337

4,362

HCLTECH

736

745

750

759

765

HDFCBANK

1,142

1,148

1,156

1,162

1,170

HDFC

1,187

1,196

1,211

1,220

1,234

HEROMOTOCO

2,995

3,016

3,037

3,058

3,079

HINDALCO

110

112

114

116

118

HINDUNILVR

861

867

874

881

888

ICICIBANK

239

241

245

247

251

IDEA

97

99

101

102

104

INDUSINDBK

1,090

1,099

1,109

1,119

1,129

INFY

1,158

1,170

1,177

1,189

1,196

ITC

342

346

350

354

358

KOTAKBANK

740

748

753

761

765

LT

1,447

1,456

1,465

1,475

1,484

LUPIN

1,415

1,434

1,449

1,467

1,482

M&M

1,315

1,336

1,356

1,377

1,398

MARUTI

4,028

4,081

4,116

4,169

4,204

NTPC

147

148

149

150

152

ONGC

210

212

214

216

218

POWERGRID

150

151

152

153

155

RELIANCE

955

968

976

989

996

SBIN

199

200

202

203

204

SUNPHARMA

728

737

743

752

757

TCS

2,504

2,526

2,539

2,561

2,575

TATAMTRDVR

291

297

303

308

314

TATAMOTORS

429

437

444

452

459

TATAPOWER

74

75

76

77

78

TATASTEEL

316

319

325

328

334

TECHM

525

530

533

537

541

ULTRACEMCO

3,300

3,349

3,377

3,426

3,455

WIPRO

536

538

542

544

547

YESBANK

1,044

1,054

1,063

1,074

1,082

ZEEL

446

455

460

469

474

4

Technical & Derivatives Report

June 14, 2016

Research Team Tel: 022 - 39357800

For Technical Queries

For Derivatives Queries

DISCLAIMER

Angel Broking Private Limited (hereinafter referred to as “Angel”) is a registered Member of National Stock Exchange of India Limited,

Bombay Stock Exchange Limited and MCX Stock Exchange Limited. It is also registered as a Depository Participant with CDSL and

Portfolio Manager with SEBI. It also has registration with AMFI as a Mutual Fund Distributor. Angel Broking Private Limited is a

registered entity with SEBI for Research Analyst in terms of SEBI (Research Analyst) Regulations, 2014 vide registration number

INH000000164. Angel or its associates has not been debarred/ suspended by SEBI or any other regulatory authority for accessing

/dealing in securities Market. Angel or its associates including its relatives/analyst do not hold any financial interest/beneficial

ownership of more than 1% in the company covered by Analyst. Angel or its associates/analyst has not received any compensation /

managed or co-managed public offering of securities of the company covered by Analyst during the past twelve months. Angel/analyst

has not served as an officer, director or employee of company covered by Analyst and has not been engaged in market making activity

of the company covered by Analyst.

This document is solely for the personal information of the recipient, and must not be singularly used as the basis of any investment

decision. Nothing in this document should be construed as investment or financial advice. Each recipient of this document should

make such investigations as they deem necessary to arrive at an independent evaluation of an investment in the securities of the

companies referred to in this document (including the merits and risks involved), and should consult their own advisors to determine

the merits and risks of such an investment.

Reports based on technical and derivative analysis center on studying charts of a stock's price movement, outstanding positions and

trading volume, as opposed to focusing on a company's fundamentals and, as such, may not match with a report on a company's

fundamentals.

The information in this document has been printed on the basis of publicly available information, internal data and other reliable

sources believed to be true, but we do not represent that it is accurate or complete and it should not be relied on as such, as this

document is for general guidance only. Angel Broking Pvt. Limited or any of its affiliates/ group companies shall not be in any way

responsible for any loss or damage that may arise to any person from any inadvertent error in the information contained in this report.

Angel Broking Pvt. Limited has not independently verified all the information contained within this document. Accordingly, we cannot

testify, nor make any representation or warranty, express or implied, to the accuracy, contents or data contained within this document.

While Angel Broking Pvt. Limited endeavors to update on a reasonable basis the information discussed in this material, there may be

regulatory, compliance, or other reasons that prevent us from doing so.

This document is being supplied to you solely for your information, and its contents, information or data may not be reproduced,

redistributed or passed on, directly or indirectly.

Neither Angel Broking Pvt. Limited, nor its directors, employees or affiliates shall be liable for any loss or damage that may arise from

or in connection with the use of this information.

Note: Please refer to the important ‘Stock Holding Disclosure' report on the Angel website (Research Section). Also, please refer to the

latest update on respective stocks for the disclosure status in respect of those stocks. Angel Broking Pvt. Limited and its affiliates may

have investment positions in the stocks recommended in this report.

5