Technical & Derivatives Report

October 13, 2016

Sensex (28082) / Nifty (8709)

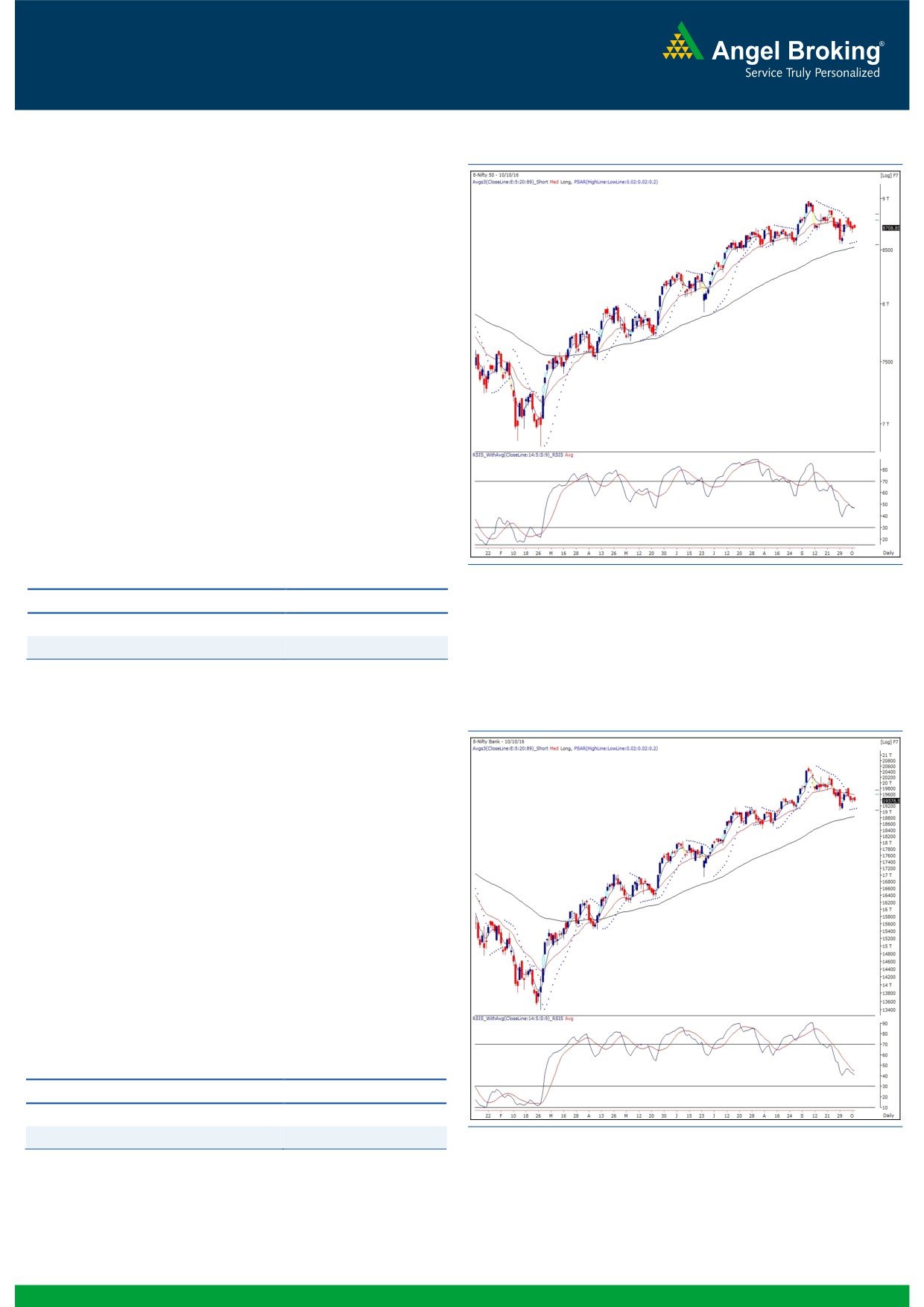

Exhibit 1: Nifty Daily Chart

On Monday, our markets opened marginally higher owing to

positive global cues. However, the lead was very short lived as the

index pared down major portion of gains in the initial trades. This

was followed by a consolidation within a narrow range

throughout the remaining part of the session to conclude tad

above the 8700 mark.

Monday’s lethargic movement was quite obvious taking into a

consideration two-days off for our markets. The volume activity

was lower than average and hence, we witnessed a narrow range

activity throughout the day. Since there was no major price action,

the chart structure remains unchanged so as our view on the

market. On the downside, 8663 - 8635 can be seen as an

immediate support for the market; whereas, the intraday

resistance zone is placed at 8745 - 8781 levels. To summarize,

we expect some consolidation occurrences in the forthcoming

sessions as well. Thus, it is advisable for traders to concentrate on

stock specific moves in order to find potential trades.

Key Levels

Support 1 - 8663

Resistance 1 - 8745

Support 2 - 8635

Resistance 2 - 8781

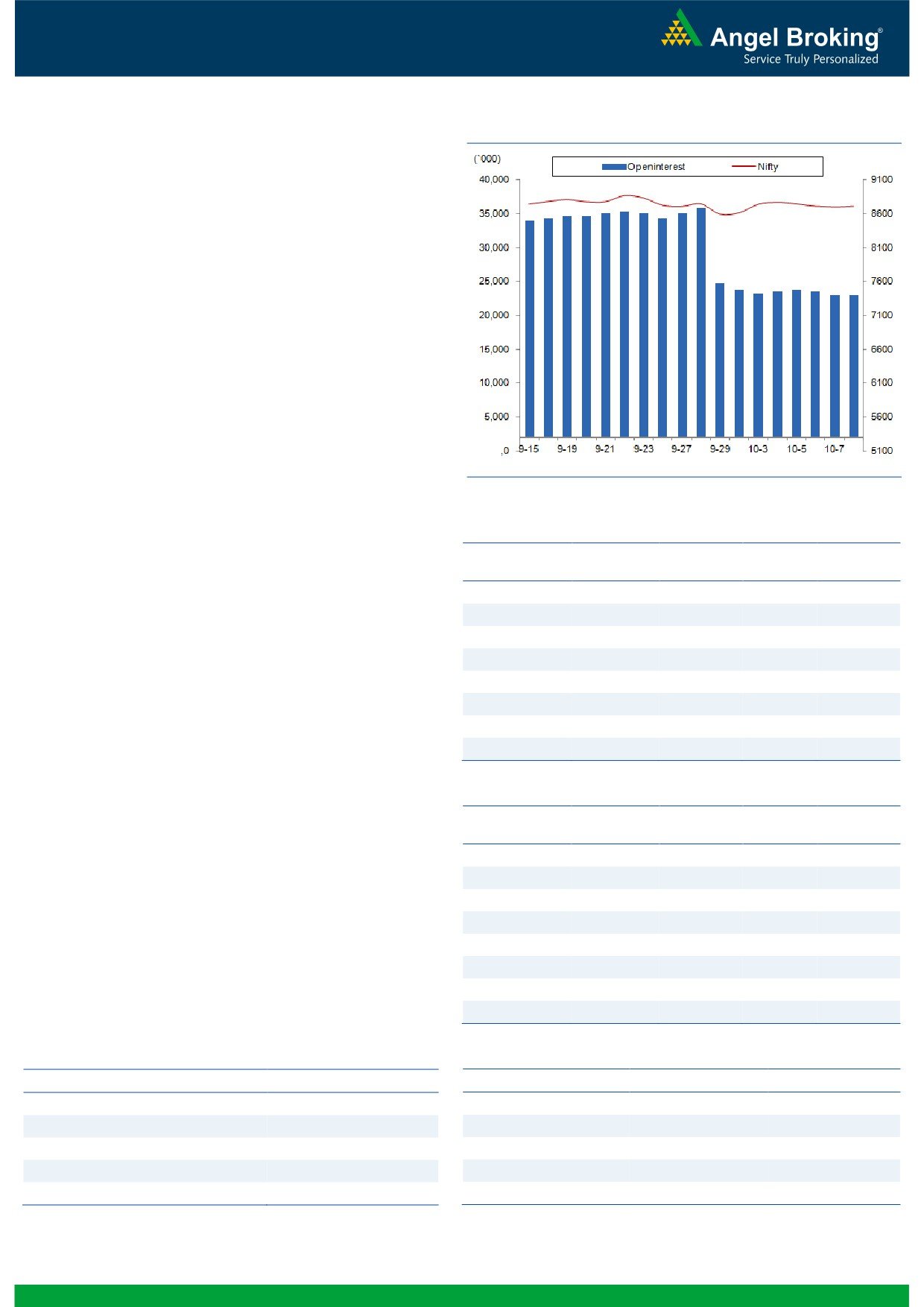

Exhibit 2: Nifty Bank Daily Chart

Nifty Bank Outlook - (19379)

The Nifty Bank index opened with marginal gains on Monday and

consolidated in a narrow range as traders remained cautious of

taking aggressive positions ahead of two days holiday for our

market. Eventually, the banking index ended the session on a flat

note.

Due to the range-bound trading sessions, there has been no

further development on the charts. Hence, we reiterate our view to

remain cautious on the index untill we see the index crossing the

resistance of 19800 or any reversal sign on the charts. Traders

are advised to stay light on positions and trade with proper risk

management. The intraday support for the Nifty Bank index are

placed around 19300 and 19220 whereas resistance is seen in

range of 19525 - 19570.

Key Levels

Support 1 - 19300

Resistance 1 - 19525

Support 2 - 19220

Resistance 2 - 19570

1

Technical & Derivatives Report

October 13, 2016

Comments

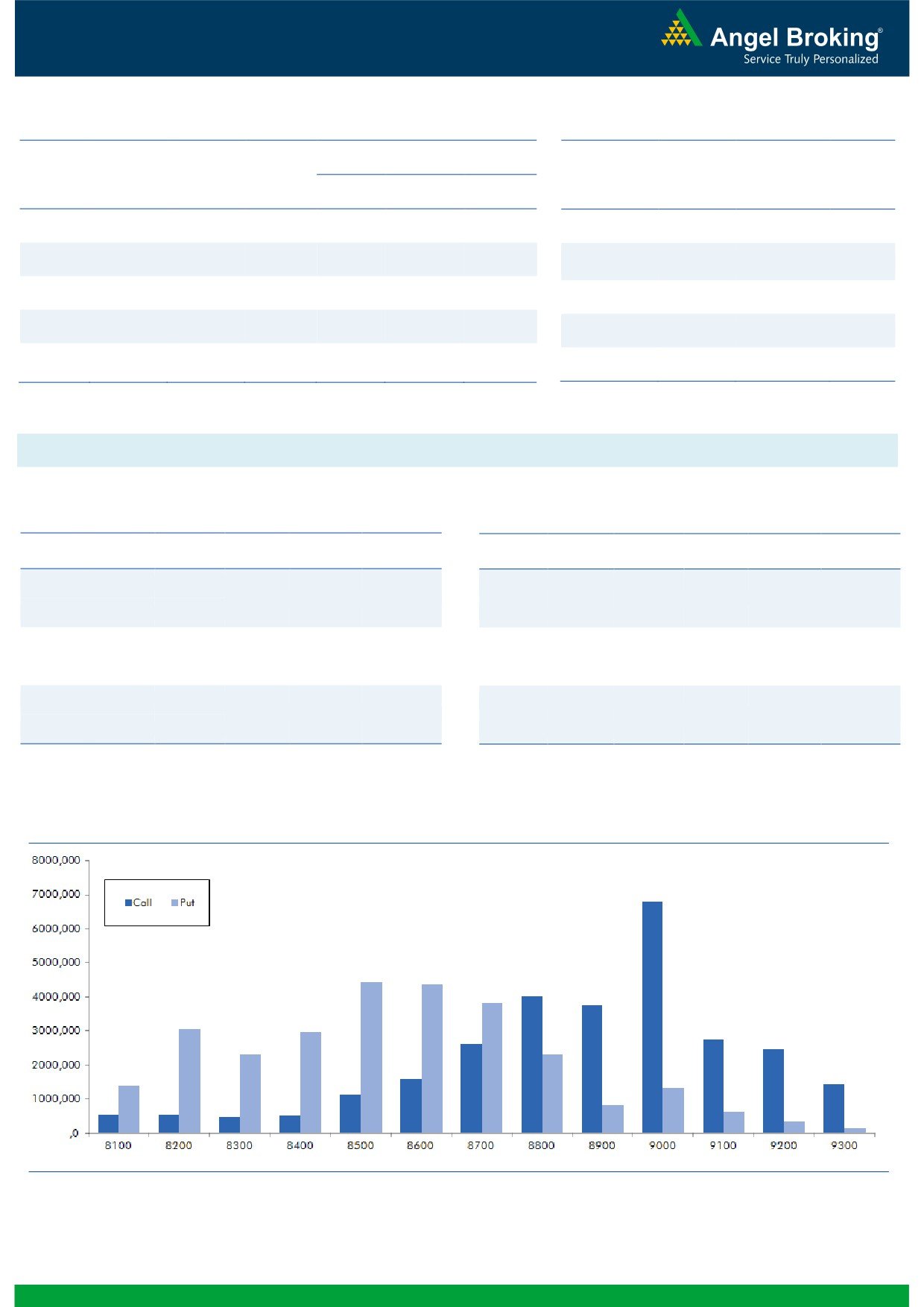

Nifty Vs OI

The Nifty futures open interest has decreased by 0.13%

BankNifty futures open interest has increased by 3.40%

as market closed at 8708.80 levels.

The Nifty October future closed with a premium of 31.15

against the premium of 25.15 points in last trading

session. The November series closed at a premium of

69.70 points.

The Implied Volatility of at the money options has

decreased from 12.55% to 12.35%. At the same time,

the PCR-OI of Nifty has remained unchanged 0.96.

The total OI of the market is Rs. 2,59,320/- cr. and the

stock futures OI is Rs. 79,842/- cr.

Few of the liquid counters where we have seen high cost

of carry are GMRINFRA, CROMPGREAV, MINDTREE,

ALBK and AJANTPHARM.

Views

OI Gainers

FIIs were net sellers in both cash market segment and

OI

PRICE

SCRIP

OI

PRICE

index futures. They sold equities to the tune of Rs. 547

CHG. (%)

CHG. (%)

crores. While, in index future, they were net sellers of

PCJEWELLER

1066500

45.70

522.75

7.35

Rs.152 crores with marginal change in OI, indicating

HINDZINC

6604800

13.34

252.50

-0.24

blend of long unwinding and some fresh short formation

TORNTPOWER

1071000

13.33

180.45

-0.06

www.angelbroking.com

in last trading session.

UNIONBANK

12668000

12.99

146.45

-2.27

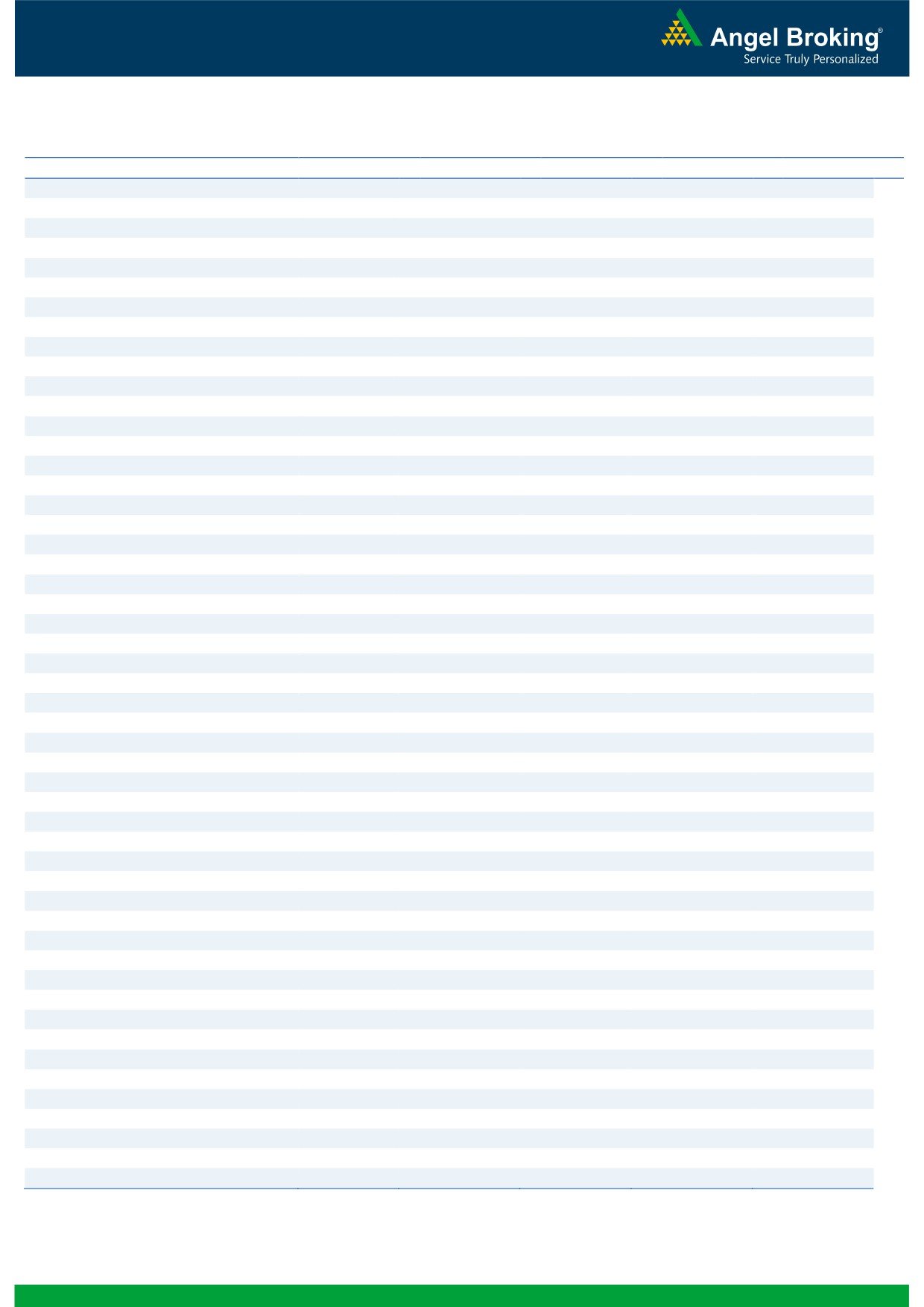

On Index Options front, FIIs sold of worth Rs. 185 crores

DHFL

13506000

12.66

293.10

-0.32

with fall in OI. In call options,

9000-8900 strikes

ULTRACEMCO

875400

12.37

3998.50

1.09

remained active and they also added some positions. On

DISHTV

30156000

11.52

99.00

2.54

the other hand, some build-up was visible in 8500 put

KSCL

2784000

10.67

427.80

2.26

options.Highest OI in October series is placed at 9000

call and of put options has been shifted from 8600 to

OI Losers

8500 strike price.

OI

PRICE

SCRIP

OI

PRICE

From start of October series, we hardly saw any

CHG. (%)

CHG. (%)

meaningful directional build-up in Index Futures by FIIs.

APOLLOHOSP

496400

-5.98

1347.45

1.58

However, good amount of long unwinding with some

SUNTV

8596000

-4.57

558.75

-0.92

fresh shorts are visible since last couple of days. At

DABUR

4912500

-4.10

286.75

0.39

current juncture, 8800-8850 remains a strong hurdle for

SRF

480000

-3.71

1906.70

0.10

Nifty. Looking at the overall data we don’t see Nifty

GRASIM

9849750

-3.03

1019.60

-0.88

breaking this resistance level any time soon. Thus, we

AMBUJACEM

11270000

-2.38

257.70

1.46

suggest trades to avoid any aggressive positions in Index

JINDALSTEL

53001000

-2.19

79.50

-1.00

Futures and opt for stock specific trades.

TATAMOTORS

26077500

-2.05

564.05

-0.50

Historical Volatility

Put-Call Ratio

SCRIP

HV

SCRIP

PCR-OI

PCR-VOL

PCJEWELLER

56.83

NIFTY

0.96

1.05

ACC

29.96

BANKNIFTY

0.80

0.75

ASIANPAINT

27.94

INFY

0.63

0.69

TATACOMM

63.92

RELIANCE

0.51

0.45

INFY

21.75

AXISBANK

0.37

0.41

2

Technical & Derivatives Report

October 13, 2016

FII Statistics for 10, October 2016

Turnover on 10, October 2016

Open Interest

No. of

Turnover

Change

Detail

Buy

Sell

Net

Instrument

Value

Change

Contracts

( in Cr. )

(%)

Contracts

(in Cr.)

(%)

INDEX

INDEX

759.34

910.96

(151.62)

268853

18029.34

0.15

119994

8416.46

-34.00

FUTURES

FUTURES

INDEX

INDEX

18270.95

18455.56

(184.61)

962731

64172.94

(0.68)

2130287

154833.78

-13.66

OPTIONS

OPTIONS

STOCK

4605.80

4914.53

(308.73)

864748

57723.42

0.38

STOCK

FUTURES

382088

28600.09

-24.71

FUTURES

STOCK

STOCK

2772.15

2829.93

(57.77)

80868

5521.87

5.18

OPTIONS

229025

17049.25

-21.07

OPTIONS

TOTAL

26408.25

27110.98

(702.73)

2177200

145447.56

0.05

TOTAL

2861394

208899.59

-16.99

Nifty Spot = 8708.80

Lot Size = 75

Bull-Call Spreads

Bear-Put Spreads

Action

Strike

Price

Risk

Reward

BEP

Action

Strike

Price

Risk

Reward

BEP

Buy

8700

114.95

Buy

8700

76.60

51.10

48.90

8751.10

29.75

70.25

8670.25

Sell

8800

63.85

Sell

8600

46.85

Buy

8700

114.95

Buy

8700

76.60

84.20

115.80

8784.20

47.75

152.25

8652.25

Sell

8900

30.75

Sell

8500

28.85

Buy

8800

63.85

Buy

8600

46.85

33.10

66.90

8833.10

18.00

82.00

8582.00

Sell

8900

30.75

Sell

8500

28.85

Note: Above mentioned Bullish or Bearish Spreads in Nifty (October Series) are given as an information and not as a recommendation.

Nifty Put-Call Analysis

3

Technical & Derivatives Report

October 13, 2016

Daily Pivot Levels for Nifty Constituents

Scrips

S2

S1

PIVOT

R1

R2

ACC

1,605

1,637

1,655

1,687

1,706

ADANIPORTS

260

262

265

268

271

AMBUJACEM

252

254

256

259

261

ASIANPAINT

1,177

1,195

1,207

1,225

1,237

AUROPHARMA

842

849

857

864

871

AXISBANK

525

528

534

537

542

BAJAJ-AUTO

2,829

2,853

2,880

2,903

2,930

BANKBARODA

159

161

163

164

167

BHEL

133

134

135

136

138

BPCL

646

652

659

665

673

BHARTIARTL

312

314

317

319

322

INFRATEL

366

372

375

381

385

BOSCH

22,927

23,014

23,117

23,205

23,308

CIPLA

564

572

578

587

593

COALINDIA

316

317

320

321

323

DRREDDY

3,012

3,046

3,072

3,105

3,132

EICHERMOT

25,563

25,684

25,883

26,004

26,203

GAIL

407

413

419

425

430

GRASIM

995

1,005

1,021

1,031

1,047

HCLTECH

796

805

810

819

824

HDFCBANK

1,275

1,279

1,284

1,289

1,293

HDFC

1,371

1,381

1,397

1,407

1,422

HEROMOTOCO

3,457

3,473

3,491

3,507

3,526

HINDALCO

157

159

161

163

165

HINDUNILVR

868

872

879

883

890

ICICIBANK

247

248

251

252

255

IDEA

79

79

80

81

81

INDUSINDBK

1,207

1,214

1,223

1,230

1,239

INFY

1,002

1,016

1,024

1,038

1,046

ITC

238

239

241

242

244

KOTAKBANK

775

778

782

784

788

LT

1,436

1,443

1,454

1,461

1,473

LUPIN

1,490

1,505

1,515

1,530

1,540

M&M

1,367

1,372

1,380

1,385

1,393

MARUTI

5,676

5,694

5,714

5,733

5,753

NTPC

144

145

147

149

151

ONGC

260

264

267

270

273

POWERGRID

176

177

178

179

180

RELIANCE

1,076

1,086

1,104

1,114

1,132

SBIN

253

255

258

259

262

SUNPHARMA

746

751

754

759

762

TCS

2,342

2,361

2,374

2,393

2,406

TATAMTRDVR

360

363

368

370

375

TATAMOTORS

554

558

565

568

575

TATAPOWER

80

80

81

82

82

TATASTEEL

404

411

416

423

428

TECHM

413

418

421

425

429

ULTRACEMCO

3,909

3,943

3,969

4,003

4,029

WIPRO

474

475

478

479

481

YESBANK

1,268

1,274

1,282

1,288

1,296

ZEEL

556

562

569

575

581

4

Technical & Derivatives Report

October 13, 2016

Research Team Tel: 022 - 39357800

For Technical Queries

For Derivatives Queries

DISCLAIMER

Angel Broking Private Limited (hereinafter referred to as “Angel”) is a registered Member of National Stock Exchange of India Limited,

Bombay Stock Exchange Limited and Metropolitan Stock Exchange Limited. It is also registered as a Depository Participant with CDSL

and Portfolio Manager with SEBI. It also has registration with AMFI as a Mutual Fund Distributor. Angel Broking Private Limited is a

registered entity with SEBI for Research Analyst in terms of SEBI (Research Analyst) Regulations, 2014 vide registration number

INH000000164. Angel or its associates has not been debarred/ suspended by SEBI or any other regulatory authority for accessing

/dealing in securities Market. Angel or its associates/analyst has not received any compensation / managed or co-managed public

offering of securities of the company covered by Analyst during the past twelve months.

This document is solely for the personal information of the recipient, and must not be singularly used as the basis of any investment

decision. Nothing in this document should be construed as investment or financial advice. Each recipient of this document should

make such investigations as they deem necessary to arrive at an independent evaluation of an investment in the securities of the

companies referred to in this document (including the merits and risks involved), and should consult their own advisors to determine

the merits and risks of such an investment.

Reports based on technical and derivative analysis center on studying charts of a stock's price movement, outstanding positions and

trading volume, as opposed to focusing on a company's fundamentals and, as such, may not match with a report on a company's

fundamentals. Investors are advised to refer the Fundamental and Technical Research Reports available on our website to evaluate the

contrary view, if any.

The information in this document has been printed on the basis of publicly available information, internal data and other reliable

sources believed to be true, but we do not represent that it is accurate or complete and it should not be relied on as such, as this

document is for general guidance only. Angel Broking Pvt. Limited or any of its affiliates/ group companies shall not be in any way

responsible for any loss or damage that may arise to any person from any inadvertent error in the information contained in this report.

Angel Broking Pvt. Limited has not independently verified all the information contained within this document. Accordingly, we cannot

testify, nor make any representation or warranty, express or implied, to the accuracy, contents or data contained within this document.

While Angel Broking Pvt. Limited endeavors to update on a reasonable basis the information discussed in this material, there may be

regulatory, compliance, or other reasons that prevent us from doing so.

This document is being supplied to you solely for your information, and its contents, information or data may not be reproduced,

redistributed or passed on, directly or indirectly.

Neither Angel Broking Pvt. Limited, nor its directors, employees or affiliates shall be liable for any loss or damage that may arise from

or in connection with the use of this information.

5