October 13, 2015

Sensex (26904) / Nifty (8144)

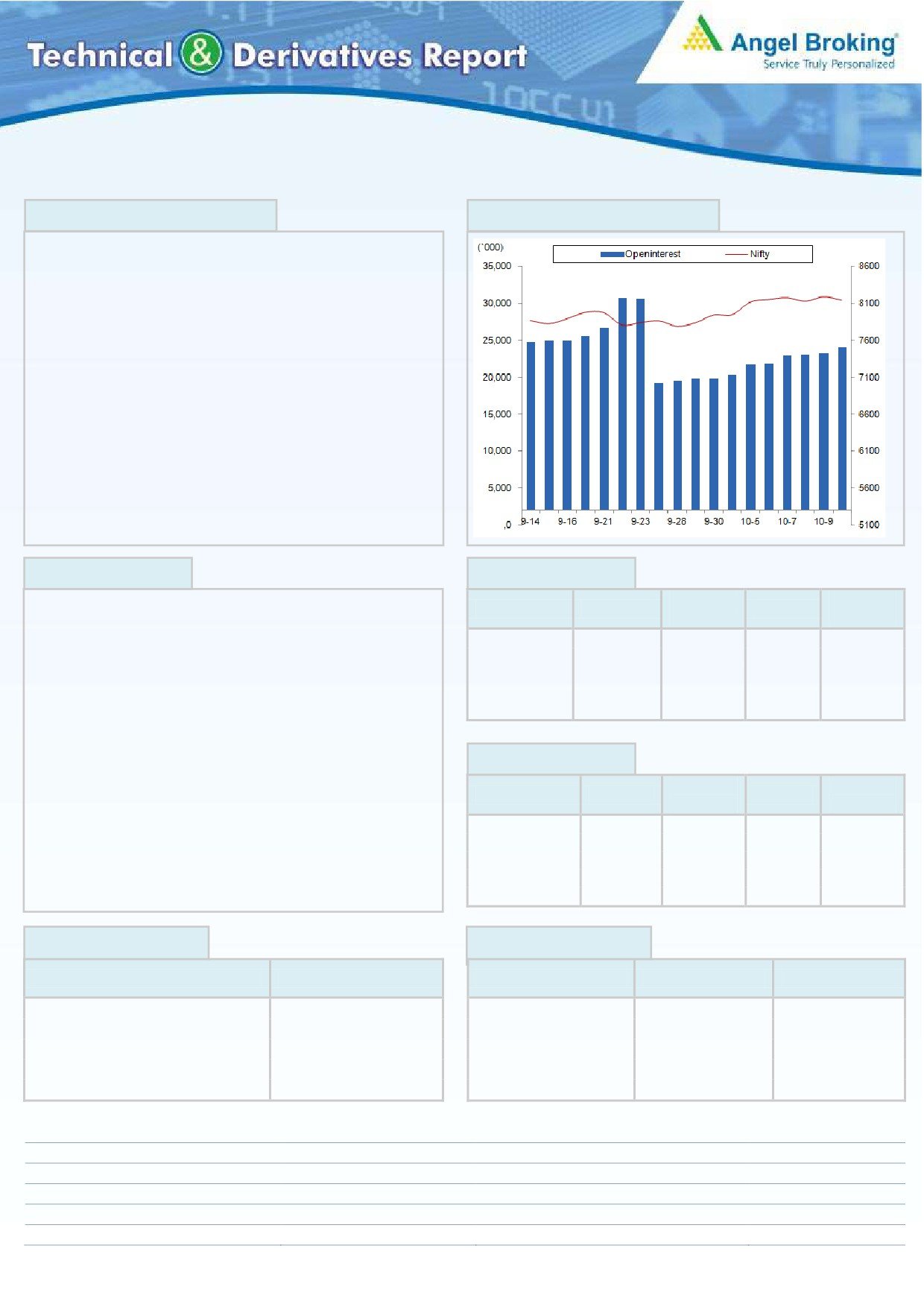

Exhibit 1: Nifty Daily Chart

Trading for the week started with a marginal upside gap owing to

favorable global cues. The index then extended this lead in the

initial trade on the back of IT giant, Infosys, 2QFY2016 numbers.

However, we witnessed a complete nosedive from day's high in

the counter post the initial hour. This profit booking had a rub off

effect on the broader market in the second half of the session and

as a result, we witnessed a decent correction to close almost at

the lowest point of the day.

If we look at yesterday's high then it can be concluded that the

Nifty is clearly struggling to cross the mentioned resistance level of

8250. Going forward, we expect this level to act as a major

hurdle for the bulls and thus, we would continue to advise a profit

booking and lighten up existing long positions in the index. On

the flipside, if the index manages to sustain below yesterday's low

then we are likely to see an immediate correction towards 8050 -

8000 levels.

Source: Falcon

Bank Nifty Outlook - (17583)

Exhibit 2: Bank Nifty Daily Chart

Yesterday, the Bank Nifty opened with a marginal upside gap and

started moving higher from the initial trades. After seeing a good

traction in the first half of the session, the Bank Nifty took a bit of

knock along with the broader indices and eventually pared down

all morning gains. As a result, the index concluded the session

with a negligible loss of 0.04 percent over its previous close.

Looking at the daily chart, it can be clearly seen that the Bank

Nifty once again failed to cross the stiff hurdle of the daily ’89

EMA’. Going forward, intraday support levels are placed at

17400 and 17111. On the flipside, the resistance of higher end

of downside gap in weekly chart is still intact at 17842. While, the

61.80% retracement levels of the entire fall from 19229.05 to

15762.20 is also placed at 17905 levels. Thus, we expect the

Bank Nifty to remain within a range of 17100 to 17950 in

forthcoming sessions. At current juncture, we advise traders to

wait for further development to initiate directional trade in the

index.

Source: Falcon

1

October 13, 2015

Comments

Nifty Vs OI

The Nifty futures open interest has increased by 3.78%

BankNifty futures open interest has increased by 3.07%

as market closed at 8143.60 levels.

The Nifty October future closed at a premium of 6.00

points against a premium of

15.65 points. The

November series closed at a premium of 44.30 points.

The Implied Volatility of at the money options has

increased from 16.35% to 16.93%.

The total OI of the market is Rs. 2,20,032/- cr. and the

stock futures OI is Rs. 59,117/- cr.

Few of the liquid counters where we have seen high cost

of carry are JPASSOCIAT, GMRINFRA, UNITECH,

FEDERALBNK and IBREALEST.

Views

OI Gainers

OI

PRICE

Yesterday, FIIs were net buyers in both cash market

SCRIP

OI

PRICE

CHG. (%)

CHG. (%)

segment and in Index Futures. They bought equities to

UCOBANK

11378000

17.18

49.65

2.27

the tune of Rs. 317 crores and Index Futures of Rs. 743

INFRATEL

1920100

9.90

388.10

-4.18

crores with rise in OI, suggesting long formation in last

MINDTREE

382600

9.52

1408.70

-2.37

trading session.

ANDHRABANK

13576000

8.82

70.45

1.37

TV18BRDCST

11917000

8.18

34.60

0.58

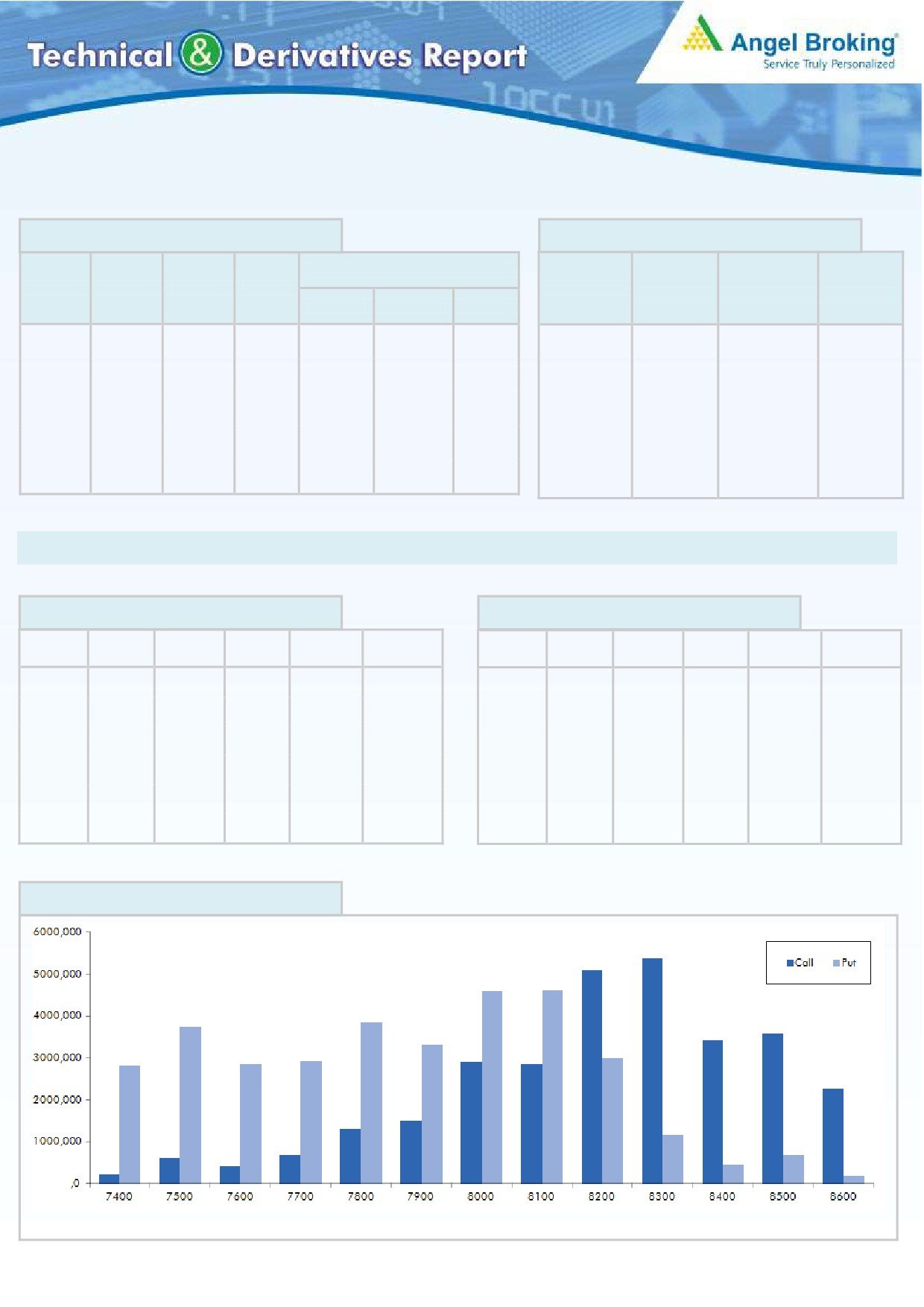

In Index Options front, FIIs sold of Rs. 888 crores with

rise in OI. In call options, we saw good amount of OI

addition in 8200-8300 strikes. While in put options,

OI Losers

decent build-up was visible in 8000 & 8100 strikes,

OI

PRICE

SCRIP

OI

PRICE

followed by unwinding in 7900 put option. Maximum OI

CHG. (%)

CHG. (%)

MOTHERSUMI

10725000

-8.74

254.30

5.04

is seen in 8300 call and 8100 put options. FIIs are

IGL

1136500

-7.03

468.50

-0.10

continuously forming longs in Index Futures but we don’t

PTC

12332000

-6.23

66.50

2.15

see buying interest in heavy weight large cap stocks. We

NMDC

14865000

-5.40

97.60

3.17

will suggest being light in Nifty and trade stock specific.

JINDALSTEL

32599000

-5.34

73.00

4.66

Historical Volatility

Put-Call Ratio

SCRIP

HV

SCRIP

PCR-OI

PCR-VOL

ADANIPOWER

74.43

NIFTY

1.01

0.89

INFY

39.49

BANKNIFTY

1.05

0.95

FEDERALBNK

37.97

INFY

0.39

0.49

MOTHERSUMI

67.49

TATAMOTORS

1.09

0.76

NHPC

31.25

SBIN

0.46

0.39

Strategy Date

Symbol

Strategy

Status

September 28, 2015

NIFTY

Long Strangle

Active

October 05, 2015

SBIN

Ratio Bear Put Spread

Active

October 12, 2015

LT

Long Put Ladder

Active

2

October 13, 2015

FII Statistics for 12-October 2015

Turnover on 12-October 2015

Open Interest

No. of

Turnover

Change

Detail

Buy

Sell

Net

Instrument

Contracts

( in Cr. )

(%)

Contracts

Value

Change

INDEX

INDEX

1765.07

1022.40

742.67

1023802

23151.61

2.45

544015

14706.46

-17.87

FUTURES

FUTURES

INDEX

INDEX

9469.05

10356.62

(887.57)

2212580

69205.77

2.05

5423645

123085.34

-9.26

OPTIONS

OPTIONS

STOCK

2433.43

2498.91

(65.49)

1797010

47200.06

(0.18)

STOCK

FUTURES

878492

23451.29

-1.42

FUTURES

STOCK

STOCK

2704.49

2864.75

(160.26)

119361

3216.42

4.65

OPTIONS

668957

18474.33

28.10

OPTIONS

TOTAL

16372.04

16742.69

(370.65)

5152753

142773.87

1.40

TOTAL

7515109

179717.42

-6.28

Nifty Spot = 8143.60

Lot Size = 25

Bull-Call Spreads

Bear-Put Spreads

Action

Strike

Price

Risk

Reward

BEP

Action

Strike

Price

Risk

Reward

BEP

Buy

Buy

8100

144.55

8200

140.85

58.15

41.85

8158.15

39.60

60.40

8160.40

Sell

Sell

8200

86.40

8100

101.25

Buy

Buy

8100

144.55

8200

140.85

99.20

100.80

8199.20

68.60

131.40

8131.40

Sell

Sell

8300

45.35

8000

72.25

Buy

Buy

8200

86.40

8100

101.25

41.05

58.95

8241.05

29.00

71.00

8071.00

Sell

Sell

8300

45.35

8000

72.25

Note: Above mentioned Bullish or Bearish Spreads in Nifty (Oct. Series) are given as an information and not as a recommendation.

Nifty Put-Call Analysis

3

October 13, 2015

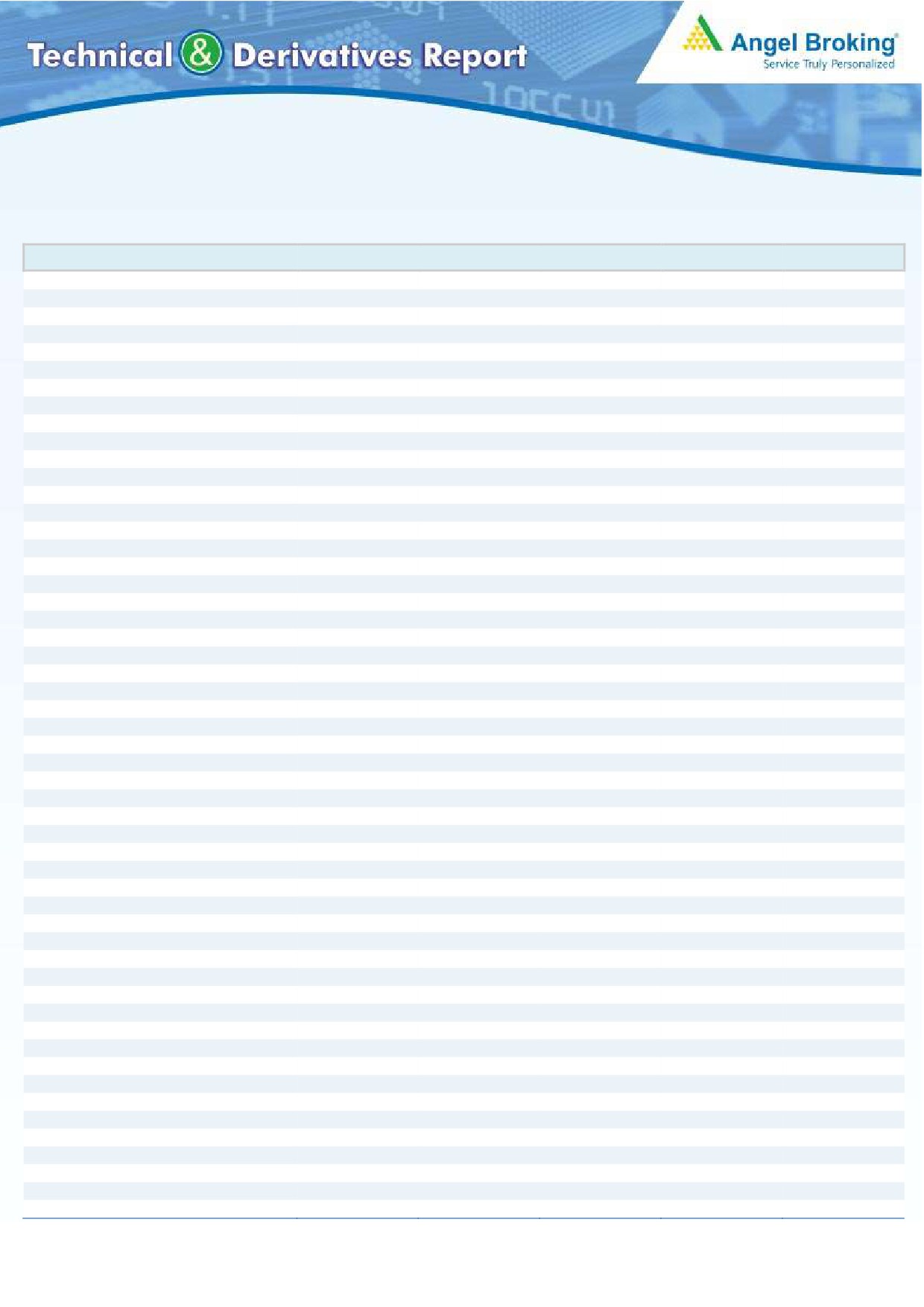

Daily Pivot Levels for Nifty 50 Stocks

Scrips

S2

S1

PIVOT

R1

R2

SENSEX

26,572

26,738

27,022

27,188

27,471

NIFTY

8,056

8,100

8,172

8,216

8,288

BANKNIFTY

17,417

17,500

17,630

17,713

17,843

ACC

1,330

1,339

1,349

1,358

1,369

AMBUJACEM

207

209

210

211

212

ASIANPAINT

836

845

855

864

874

AXISBANK

477

482

490

495

503

BAJAJ-AUTO

2,385

2,417

2,438

2,470

2,491

BANKBARODA

165

171

175

181

186

BHARTIARTL

345

346

349

351

354

BHEL

198

202

205

209

212

BOSCHLTD

20,898

21,085

21,217

21,404

21,537

BPCL

833

841

847

855

861

CAIRN

163

166

169

172

175

CIPLA

664

670

681

688

699

COALINDIA

327

331

335

339

343

DRREDDY

4,105

4,181

4,232

4,309

4,360

GAIL

302

307

313

318

325

GRASIM

3,569

3,596

3,642

3,669

3,715

HCLTECH

817

836

849

867

880

HDFC

1,250

1,271

1,283

1,304

1,316

HDFCBANK

1,067

1,074

1,085

1,091

1,102

HEROMOTOCO

2,512

2,532

2,564

2,585

2,617

HINDALCO

81

85

89

93

96

HINDUNILVR

800

807

815

822

830

ICICIBANK

282

285

288

291

294

IDEA

155

156

158

159

161

INDUSINDBK

930

937

948

955

966

INFY

1,040

1,081

1,151

1,192

1,261

ITC

333

337

343

346

352

KOTAKBANK

649

656

663

669

676

LT

1,540

1,547

1,557

1,564

1,573

LUPIN

1,973

2,014

2,043

2,085

2,113

M&M

1,250

1,262

1,272

1,285

1,295

MARUTI

4,151

4,191

4,257

4,298

4,363

NMDC

95

97

99

101

103

NTPC

124

126

127

129

131

ONGC

259

261

264

267

270

PNB

134

136

138

140

142

POWERGRID

131

132

133

134

135

RELIANCE

880

886

894

900

907

SBIN

239

242

244

246

248

VEDL

101

106

112

118

124

SUNPHARMA

865

878

897

910

928

TATAMOTORS

351

357

362

367

373

TATAPOWER

69

69

70

71

72

TATASTEEL

242

246

254

259

266

TCS

2,552

2,591

2,626

2,664

2,699

TECHM

552

557

564

569

576

ULTRACEMCO

2,784

2,815

2,842

2,872

2,900

WIPRO

573

583

591

601

609

YESBANK

711

717

727

733

743

ZEEL

394

398

402

405

409

4

October 13, 2015

Research Team Tel: 022 - 39357800

For Technical Queries

For Derivatives Queries

DISCLAIMER

Angel Broking Private Limited (hereinafter referred to as “Angel”) is a registered Member of National Stock Exchange of India Limited,

Bombay Stock Exchange Limited and MCX Stock Exchange Limited. It is also registered as a Depository Participant with CDSL and

Portfolio Manager with SEBI. It also has registration with AMFI as a Mutual Fund Distributor. Angel Broking Private Limited is a

registered entity with SEBI for Research Analyst in terms of SEBI (Research Analyst) Regulations, 2014 vide registration number

INH000000164. Angel or its associates has not been debarred/ suspended by SEBI or any other regulatory authority for accessing

/dealing in securities Market. Angel or its associates including its relatives/analyst do not hold any financial interest/beneficial

ownership of more than 1% in the company covered by Analyst. Angel or its associates/analyst has not received any compensation /

managed or co-managed public offering of securities of the company covered by Analyst during the past twelve months. Angel/analyst

has not served as an officer, director or employee of company covered by Analyst and has not been engaged in market making activity

of the company covered by Analyst.

This document is solely for the personal information of the recipient, and must not be singularly used as the basis of any investment

decision. Nothing in this document should be construed as investment or financial advice. Each recipient of this document should

make such investigations as they deem necessary to arrive at an independent evaluation of an investment in the securities of the

companies referred to in this document (including the merits and risks involved), and should consult their own advisors to determine

the merits and risks of such an investment.

Reports based on technical and derivative analysis center on studying charts of a stock's price movement, outstanding positions and

trading volume, as opposed to focusing on a company's fundamentals and, as such, may not match with a report on a company's

fundamentals.

The information in this document has been printed on the basis of publicly available information, internal data and other reliable

sources believed to be true, but we do not represent that it is accurate or complete and it should not be relied on as such, as this

document is for general guidance only. Angel Broking Pvt. Limited or any of its affiliates/ group companies shall not be in any way

responsible for any loss or damage that may arise to any person from any inadvertent error in the information contained in this report.

Angel Broking Pvt. Limited has not independently verified all the information contained within this document. Accordingly, we cannot

testify, nor make any representation or warranty, express or implied, to the accuracy, contents or data contained within this document.

While Angel Broking Pvt. Limited endeavors to update on a reasonable basis the information discussed in this material, there may be

regulatory, compliance, or other reasons that prevent us from doing so.

This document is being supplied to you solely for your information, and its contents, information or data may not be reproduced,

redistributed or passed on, directly or indirectly.

Neither Angel Broking Pvt. Limited, nor its directors, employees or affiliates shall be liable for any loss or damage that may arise from

or in connection with the use of this information.

Note: Please refer to the important ‘Stock Holding Disclosure' report on the Angel website (Research Section). Also, please refer to the

latest update on respective stocks for the disclosure status in respect of those stocks. Angel Broking Pvt. Limited and its affiliates may

5