Technical & Derivatives Report

September 12, 2016

Sensex (28797) / Nifty (8867)

Exhibit 1: Nifty Daily Chart

After witnessing a strong up move from the lows of 8540, the

Nifty continued with its northbound journey targeting the 9000

mark. Despite strong momentum, we emphasized on lightening

up existing longs which we believe was a prudent strategy. The

key observation backing our view was the emergence of the

‘Megaphone’ pattern on the daily chart and the higher end of the

same was seen around 8960 - 8980 levels. Very much on our

expected lines, we saw some profit booking on Friday, which was

relatively more pronounced in banking and IT counters. Now, on

the daily chart, the Nifty has closed a tad below its ‘5 EMA’ while

on the lower degree (hourly) chart, there’s been a formation on

the ‘Lower Top Lower Bottom’ pattern. In addition, the ‘Shooting

Star’ pattern on the weekly chart is clearly visible. All these

evidences justify our cautious stance at higher levels.

Going ahead, we expect further profit booking to pan out,

thereby dragging the Nifty towards 8800 - 8750 levels if not

lower. Nevertheless, 8750 on the Nifty now stands as a strong

support in the upcoming week. Only a sustainable move below

this level could trigger further weakness in the market. On the

flipside, 8939 - 8970 are seen as immediate hurdles for the

index. To summarize, we expect the index to remain in a slightly

broader range of

8970 to

8750 before taking a decisive

direction.

Key Levels

Support 1 - 8800

Resistance 1 - 8939

Support 2 - 8750

Resistance 2 - 8970

Nifty Bank Outlook - (20245)

Exhibit 2: Nifty Bank Daily Chart

The Nifty Bank index opened gap down on Friday and started

correcting from initial trades. The banking index fell sharply in

first half of the session; however, we saw some buying interest

from lower levels in later half. Eventually, the Nifty Bank index

ended the session with loss of 0.84 percent.

The banking index has started correction from higher end of the

‘Rising Channel’ on daily chart. Going forward, ‘Gap area’ of

19911 - 19990 (formed on Sept 06, 2016) would act as strong

support of the Nifty Bank index and a sustainable move below

that may result into a fall towards 19600. On the flipside,

resistance is placed at 20380 and 20500 levels.

Key Levels

Support 1 - 19911

Resistance 1 - 20380

Support 2 - 19735

Resistance 2 - 20500

1

Technical & Derivatives Report

September 12, 2016

Comments

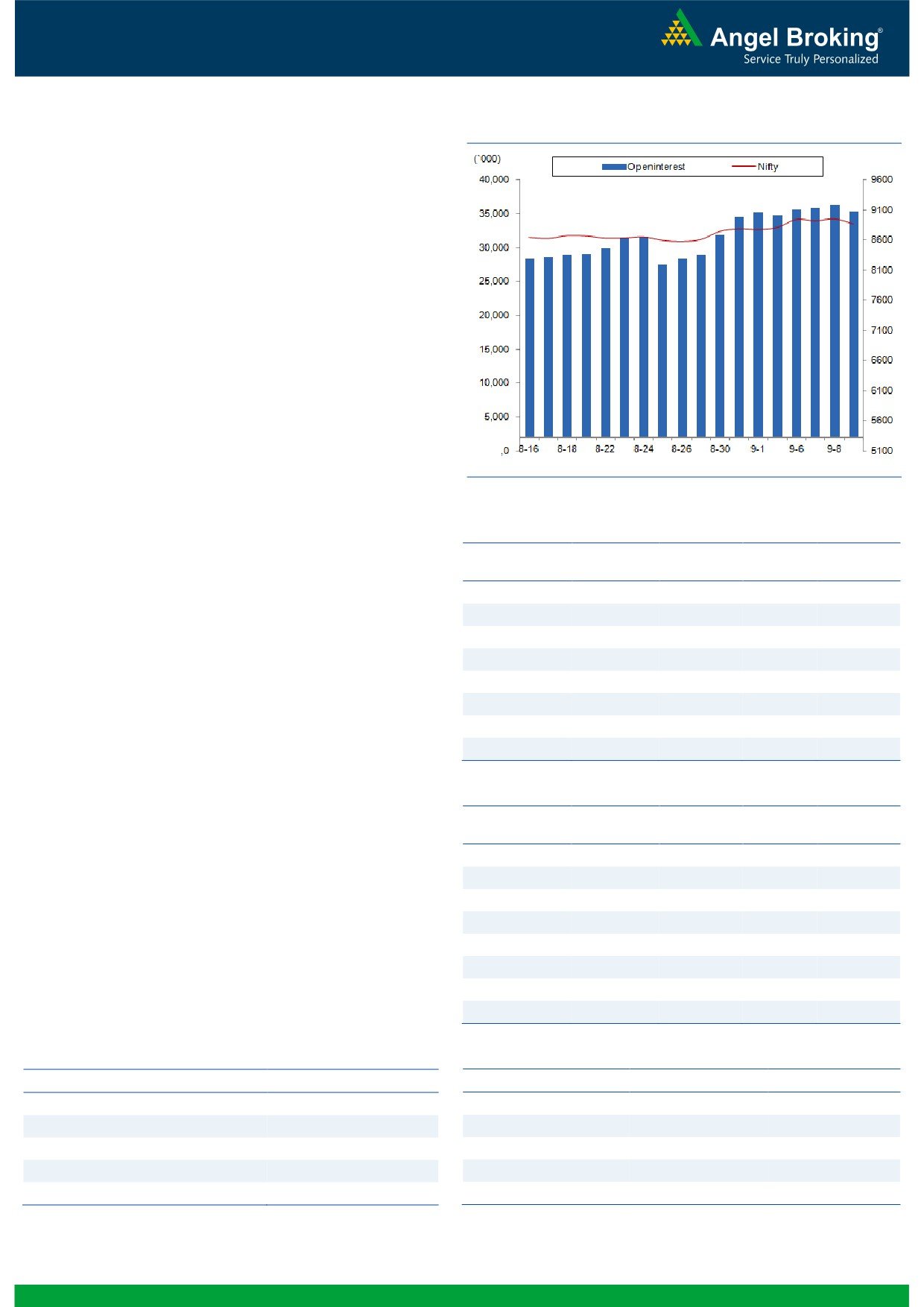

Nifty Vs OI

The Nifty futures open interest has decreased by 2.45%

BankNifty futures open interest has decreased by 5.23%

as market closed at 8866.70 levels.

The Nifty September future closed with a premium of

37.05 points against a premium of 30.05 points in

previous session. The October series closed at a

premium of 76.40 points.

The Implied Volatility of at the money options has

increased from 11.06% to 11.56%. At the same time, the

PCR-OI of Nifty has decreased from 1.23 to 1.18.

The total OI of the market is Rs. 2,96,658/- cr. and the

stock futures OI is Rs. 85,186/- cr.

Few of the liquid counters where we have seen high cost

of carry are JPASSOCIAT, ICIL, IFCI, ADANIPOWER and

GMRINFRA.

Views

OI Gainers

FIIs after long time were net sellers in both cash market

OI

PRICE

segment and Index Futures. On Friday, they sold equities

SCRIP

OI

PRICE

CHG. (%)

CHG. (%)

to the tune of Rs. 315 crores. While, they were net sellers

TORNTPHARM

373600

19.59

1669.20

-1.41

in index future of Rs. 372 crores with fall in OI, indicating

HINDPETRO

9987600

12.85

1247.40

-0.08

some profit booking in last trading session.

NCC

34496000

9.41

88.40

-0.95

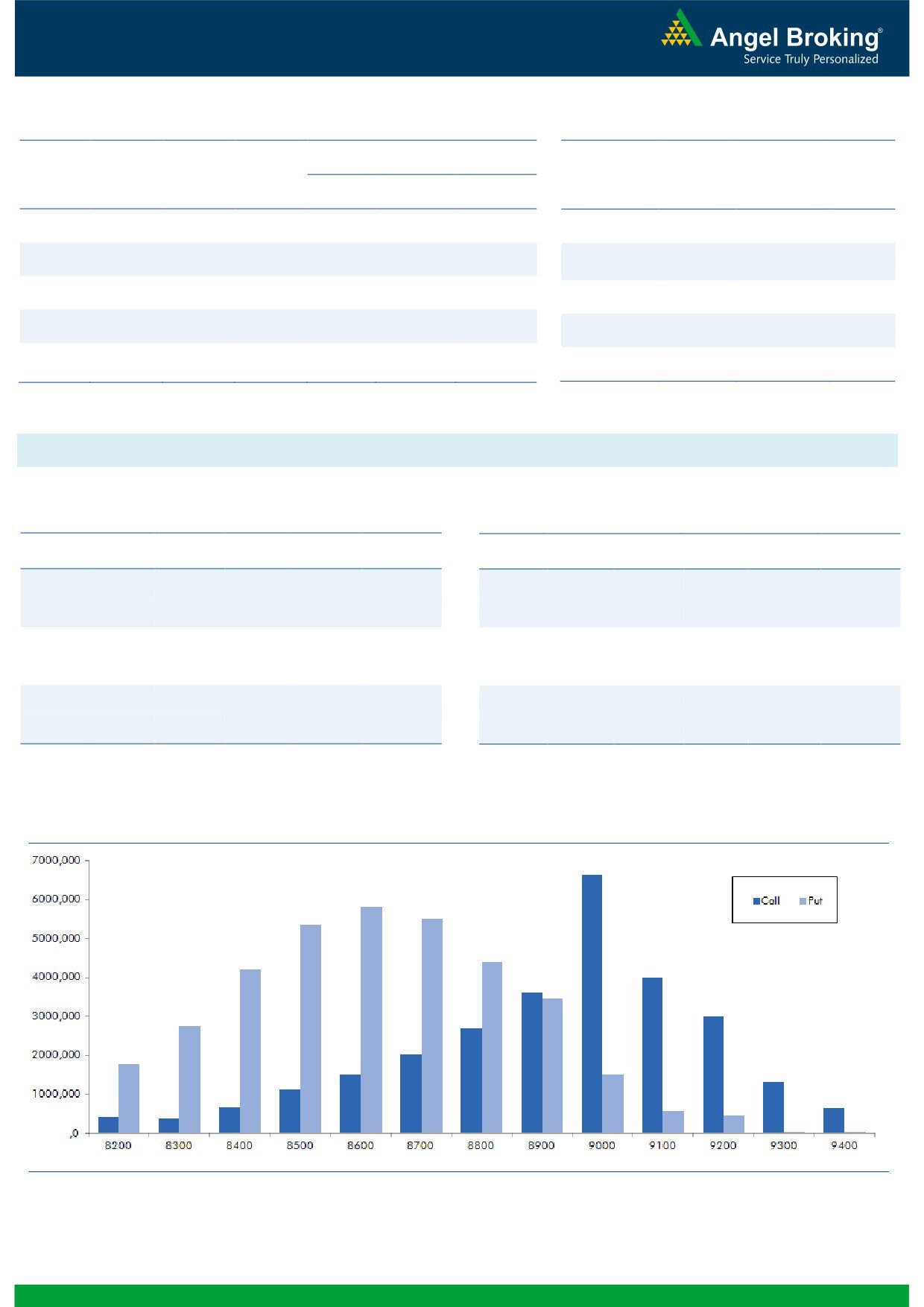

On Index Options front, FIIs were net buyers of Rs. 964ng.com

BIOCON

4341700

8.11

912.75

-2.23

crores with rise in OI. In call options, 9000 and 9100

CADILAHC

3296000

7.80

390.90

-1.05

remained active and they also added good amount of

APOLLOHOSP

568800

7.56

1359.15

-0.89

positions. On the other hand, in put options, we hardly

HINDZINC

5577600

6.28

221.15

-1.60

saw any strikes adding meaningful OI. We witness some

RELCAPITAL

12552000

6.23

556.50

0.42

unwinding in 8800 put options. Highest OI in September

series is placed at 9000 call and 8600 put option.

On Friday, we saw some profit booking; but, the

OI Losers

OI

PRICE

quantum wasn’t significant. At current juncture, Nifty has

SCRIP

OI

PRICE

CHG. (%)

CHG. (%)

immediate support around 8750-8800 levels. Global

OIL

2040000

-12.09

392.15

0.97

clues are suggesting that Nifty may open gap down.

CENTURYTEX

7814400

-11.71

834.60

2.59

Traders should avoid taking positions aggressively in this

PCJEWELLER

493500

-11.56

484.65

-0.09

move as derivatives data is not showing any signs of

JSWENERGY

20064000

-11.16

82.35

3.00

reversal yet.

CESC

1331000

-8.95

643.30

-4.36

MRF

56385

-7.73

40250.50

0.27

AMBUJACEM

9747500

-7.03

273.75

-1.32

STAR

2701500

-6.25

984.20

0.71

Historical Volatility

Put-Call Ratio

SCRIP

HV

SCRIP

PCR-OI

PCR-VOL

CESC

29.02

NIFTY

1.18

1.08

ADANIPOWER

33.63

BANKNIFTY

1.09

0.83

ULTRACEMCO

34.27

RELIANCE

0.46

0.56

ONGC

28.78

YESBANK

0.54

0.53

SAIL

51.56

ICICIBANK

0.60

0.53

2

Technical & Derivatives Report

September 12, 2016

FII Statistics for 09, September 2016

Turnover on 09, September 2016

Open Interest

No. of

Turnover

Change

Detail

Buy

Sell

Net

Instrument

Value

Contracts

( in Cr. )

(%)

Contracts

Change (%)

(in Cr.)

INDEX

INDEX

2034.07

2406.22

(372.15)

456248

31091.54

(1.47)

232928

16783.25

41.46

FUTURES

FUTURES

INDEX

INDEX

43293.72

42329.74

963.98

1192999

81599.21

3.10

3291871

241212.85

-36.43

OPTIONS

OPTIONS

STOCK

7397.32

9040.56

(1643.25)

891513

60498.46

0.46

STOCK

FUTURES

661255

48463.46

4.66

FUTURES

STOCK

STOCK

6550.60

6555.21

(4.61)

108323

7664.75

5.50

OPTIONS

418912

31105.64

2.91

OPTIONS

TOTAL

59275.71

60331.73

(1056.02)

2649083

180853.96

1.49

TOTAL

4604966

337565.19

-27.84

Nifty Spot = 8866.70

Lot Size = 75

Bull-Call Spreads

Bear-Put Spreads

Action

Strike

Price

Risk

Reward

BEP

Action

Strike

Price

Risk

Reward

BEP

Buy

8900

97.15

Buy

8900

93.55

44.85

55.15

8944.85

36.75

63.25

8863.25

Sell

9000

52.30

Sell

8800

56.80

Buy

8900

97.15

Buy

8900

93.55

73.30

126.70

8973.30

59.80

140.20

8840.20

Sell

9100

23.85

Sell

8700

33.75

Buy

9000

52.30

Buy

8800

56.80

28.45

71.55

9028.45

23.05

76.95

8776.95

Sell

9100

23.85

Sell

8700

33.75

Note: Above mentioned Bullish or Bearish Spreads in Nifty (September Series) are given as an information and not as a recommendation.

Nifty Put-Call Analysis

3

Technical & Derivatives Report

September 12, 2016

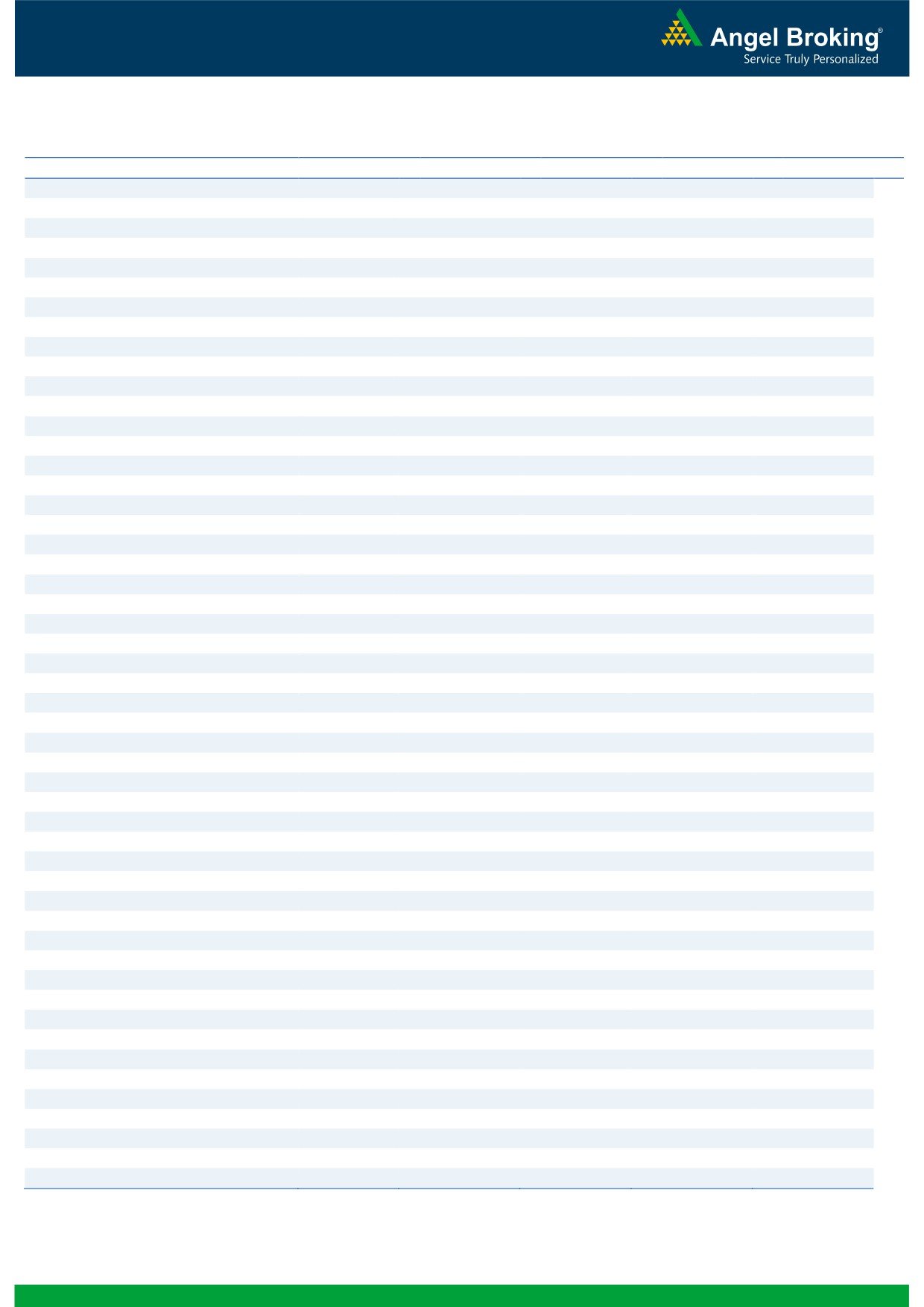

Daily Pivot Levels for Nifty Constituents

Scrips

S2

S1

PIVOT

R1

R2

ACC

1,624

1,639

1,666

1,681

1,708

ADANIPORTS

267

270

273

275

278

AMBUJACEM

269

271

273

275

278

ASIANPAINT

1,160

1,166

1,174

1,180

1,188

AUROPHARMA

788

795

807

814

826

AXISBANK

604

608

617

621

630

BAJAJ-AUTO

2,964

3,000

3,054

3,090

3,144

BANKBARODA

169

171

173

174

176

BHEL

151

152

155

156

159

BPCL

580

584

590

594

599

BHARTIARTL

314

318

322

326

331

INFRATEL

340

346

355

361

370

BOSCH

23,848

24,006

24,228

24,386

24,608

CIPLA

567

574

585

591

602

COALINDIA

329

331

332

333

334

DRREDDY

3,142

3,168

3,196

3,222

3,251

EICHERMOT

22,408

22,666

23,120

23,378

23,832

GAIL

383

389

394

400

405

GRASIM

4,638

4,672

4,726

4,760

4,813

HCLTECH

765

773

781

789

798

HDFCBANK

1,272

1,281

1,288

1,297

1,304

HDFC

1,371

1,391

1,416

1,436

1,462

HEROMOTOCO

3,493

3,557

3,631

3,695

3,769

HINDALCO

148

152

157

160

166

HINDUNILVR

911

920

937

947

964

ICICIBANK

268

271

273

277

279

IDEA

82

83

84

85

86

INDUSINDBK

1,190

1,204

1,214

1,228

1,238

INFY

1,020

1,028

1,034

1,042

1,049

ITC

253

255

260

263

267

KOTAKBANK

801

810

818

827

834

LT

1,492

1,505

1,523

1,536

1,554

LUPIN

1,550

1,560

1,574

1,584

1,598

M&M

1,441

1,457

1,477

1,493

1,513

MARUTI

5,310

5,357

5,423

5,470

5,536

NTPC

157

158

159

160

162

ONGC

243

249

253

259

264

POWERGRID

181

183

185

186

188

RELIANCE

1,022

1,033

1,041

1,053

1,061

SBIN

260

262

265

267

270

SUNPHARMA

779

788

803

813

828

TCS

2,300

2,326

2,346

2,373

2,393

TATAMTRDVR

357

360

365

368

372

TATAMOTORS

565

569

576

580

587

TATAPOWER

76

77

78

78

79

TATASTEEL

385

390

398

403

412

TECHM

444

451

458

465

473

ULTRACEMCO

3,816

3,885

4,002

4,071

4,188

WIPRO

471

476

479

484

488

YESBANK

1,211

1,244

1,279

1,312

1,347

ZEEL

527

530

535

538

543

4

Technical & Derivatives Report

September 12, 2016

Research Team Tel: 022 - 39357800

For Technical Queries

For Derivatives Queries

DISCLAIMER

Angel Broking Private Limited (hereinafter referred to as “Angel”) is a registered Member of National Stock Exchange of India Limited,

Bombay Stock Exchange Limited and Metropolitan Stock Exchange Limited. It is also registered as a Depository Participant with CDSL

and Portfolio Manager with SEBI. It also has registration with AMFI as a Mutual Fund Distributor. Angel Broking Private Limited is a

registered entity with SEBI for Research Analyst in terms of SEBI (Research Analyst) Regulations, 2014 vide registration number

INH000000164. Angel or its associates has not been debarred/ suspended by SEBI or any other regulatory authority for accessing

/dealing in securities Market. Angel or its associates/analyst has not received any compensation / managed or co-managed public

offering of securities of the company covered by Analyst during the past twelve months.

This document is solely for the personal information of the recipient, and must not be singularly used as the basis of any investment

decision. Nothing in this document should be construed as investment or financial advice. Each recipient of this document should

make such investigations as they deem necessary to arrive at an independent evaluation of an investment in the securities of the

companies referred to in this document (including the merits and risks involved), and should consult their own advisors to determine

the merits and risks of such an investment.

Reports based on technical and derivative analysis center on studying charts of a stock's price movement, outstanding positions and

trading volume, as opposed to focusing on a company's fundamentals and, as such, may not match with a report on a company's

fundamentals. Investors are advised to refer the Fundamental and Technical Research Reports available on our website to evaluate the

contrary view, if any.

The information in this document has been printed on the basis of publicly available information, internal data and other reliable

sources believed to be true, but we do not represent that it is accurate or complete and it should not be relied on as such, as this

document is for general guidance only. Angel Broking Pvt. Limited or any of its affiliates/ group companies shall not be in any way

responsible for any loss or damage that may arise to any person from any inadvertent error in the information contained in this report.

Angel Broking Pvt. Limited has not independently verified all the information contained within this document. Accordingly, we cannot

testify, nor make any representation or warranty, express or implied, to the accuracy, contents or data contained within this document.

While Angel Broking Pvt. Limited endeavors to update on a reasonable basis the information discussed in this material, there may be

regulatory, compliance, or other reasons that prevent us from doing so.

This document is being supplied to you solely for your information, and its contents, information or data may not be reproduced,

redistributed or passed on, directly or indirectly.

Neither Angel Broking Pvt. Limited, nor its directors, employees or affiliates shall be liable for any loss or damage that may arise from

or in connection with the use of this information.

5