Technical & Derivatives Report

August 12, 2016

Sensex (27860) / Nifty (8592)

Exhibit 1: Nifty Hourly Chart

Wednesday’s weak session was followed by a flat opening in our

market owing to mixed global cues. Subsequently, the Nifty

extended its previous day’s down move in the initial hour to test

the 8550 mark. However, due to strong buying interest at lower

levels, the Nifty rebounded sharply to reclaim the 8600 mark.

This attempt to move higher somehow exhausted at 8600 as a

strong bout of selling immediately post the midsession dragged

the index lower to test our mentioned support level of hourly ‘200

SMA’ placed around 8535 - 8540.

As expected, this technical tool played a sheet anchor role for the

market and as a result, the rejuvenated bulls managed to push

the index higher for the second time in a single trading day.

However, this time the effort was so strong and looked stable to

end the volatile session tad below the 8600 mark. What we saw

yesterday is a perfect example of a ‘Consolidation Phase’ that we

mentioned in our earlier report. Now on the hourly chart, 8540 -

8518 has earned tremendous importance and thus, looking at

the positive crossover in ‘RSI-Smoothened’, we expect yesterday’s

positive bias to continue towards 8640 - 8690 levels. Due to

yesterday’s move, one thing is clear now, traders holding long

positions should now shift their stop loss below 8518, which could

be now a make or break level in the near term.

Key Levels

Support 1 - 8540

Resistance 1 - 8640

Support 2 - 8518

Resistance 2 - 8690

Nifty Bank Outlook - (18640)

Exhibit 2: Nifty Bank Daily Chart

The Nifty Bank index traded with negative bias yesterday,

however, ended the session almost near its previous day's close.

Post announcement of quarterly results from Bank of Baroda, the

PSU Banking stocks corrected sharply which led to loss of 2.82

percent in Nifty PSU Bank index.

As there was no significant change in the Nifty Bank index

yesterday, we reiterate our previous day's view on the index. The

index is trading close to the lower end of the trading range of

18440 - 19127 and thus, traders should refrain from creating

short positions. On the contrary, with proper risk management,

traders can look enter into long positions with stop loss below

18400. Private sector banks, which constitute majority of the

weightage in the Nifty Bank index, could move higher in near

term. Traders should position their trades accordingly with proper

risk management. The intraday support for the index is placed

around 18540 and 18440; whereas resistances are seen around

18772 and 18833.

Key Levels

Support 1 - 18540

Resistance 1 - 18772

Support 2 - 18440

Resistance 2 - 18833

1

Technical & Derivatives Report

August 12, 2016

Comments

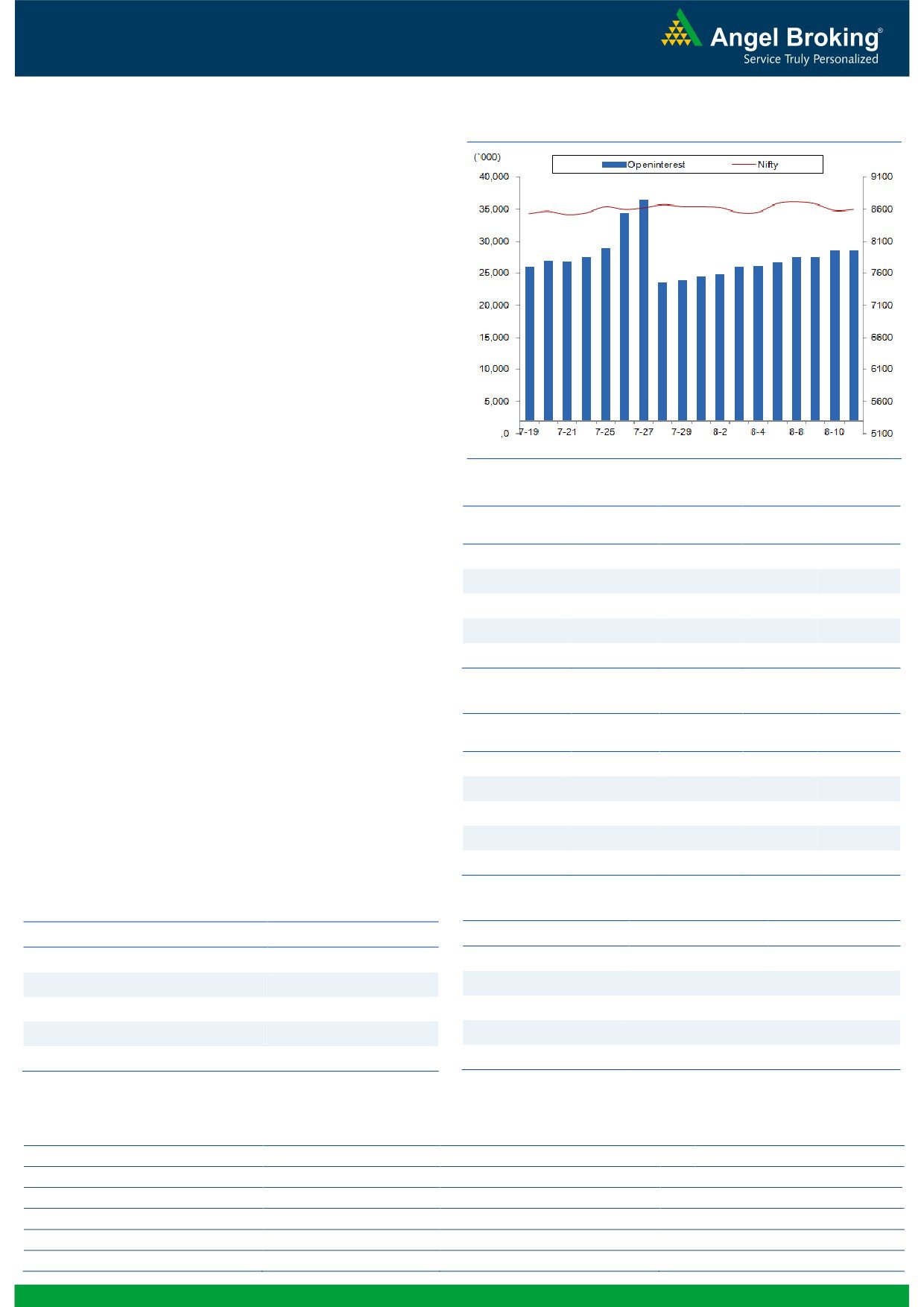

Nifty Vs OI

The Nifty futures open interest has increased by 0.01%

BankNifty futures open interest has decreased by 8.71%

as market closed at 8592.15 levels.

The Nifty August future closed with a premium of 20.30

points against a premium of 22.75 points in previous

session. The September series closed at a premium of

68.75 points.

The Implied Volatility of at the money options has

decreased from 13.17% to 12.66%.

The total OI of the market is Rs. 2,84,871/- cr. and the

stock futures OI is Rs. 77,103/- cr.

Few of the liquid counters where we have seen high cost

of carry are JPASSOCIAT, GMRINFRA, RCOM, PTC and

MCDOWELL-N.

Views

OI Gainers

FIIs continued their buying in cash market segment; they

OI

PRICE

bought equities to the tune of Rs. 608 crores. While, in

SCRIP

OI

PRICE

CHG. (%)

CHG. (%)

Index Futures their activity remained muted in yesterday’s

GRASIM

1240050

22.97

4554.90

-6.31

trading session.

AJANTPHARM

316400

17.36

1895.30

2.92

On Index Options front, FIIs bought worth Rs. 517 crores

HINDPETRO

8400000

14.04

1218.65

-0.98

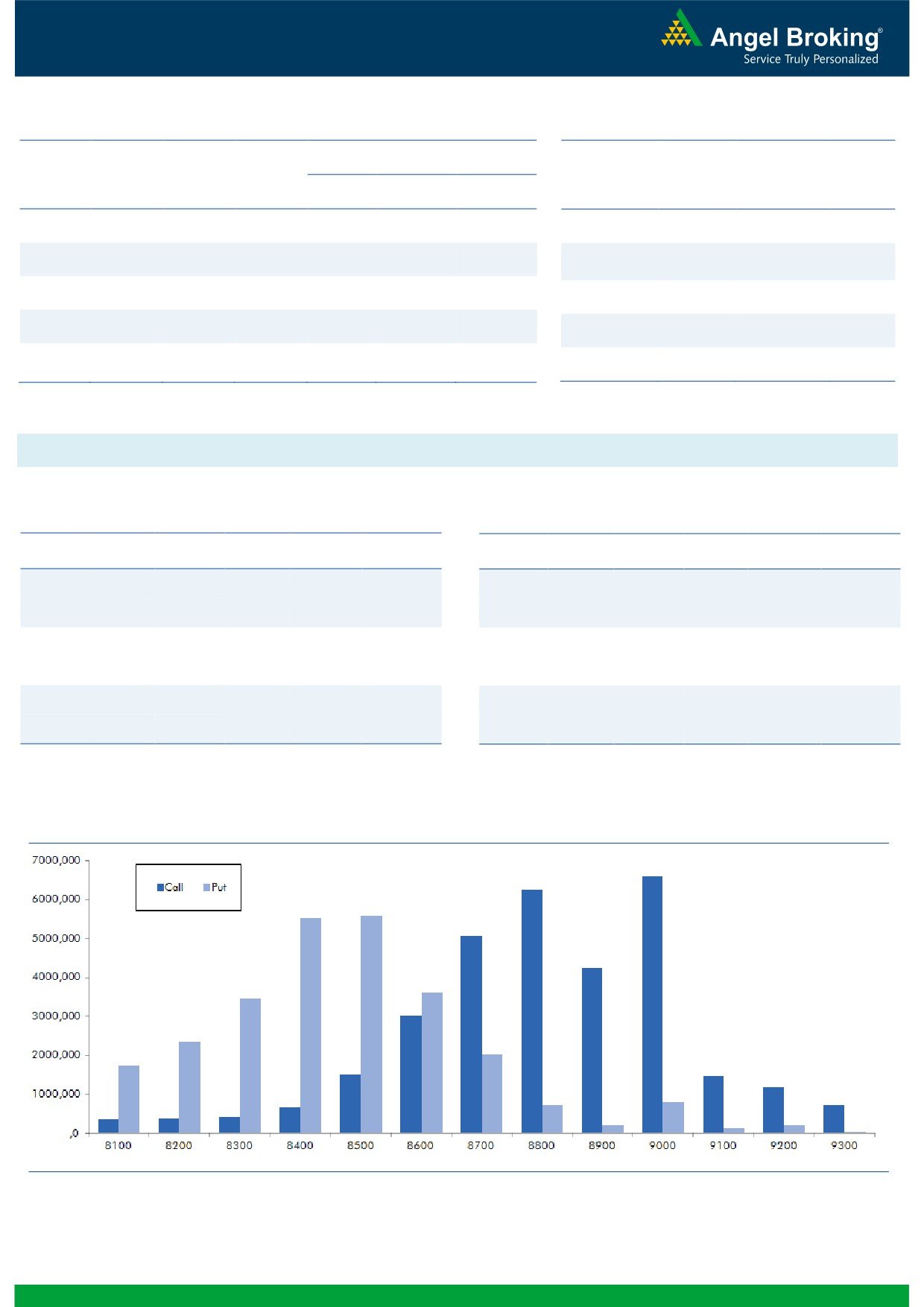

with rise in OI. In call options, we hardly witness any

important activity. While in put options, 8400 strikes

OFSS

279600

11.88

3717.95

-0.30

added good amount of fresh positions; followed by

BANKBARODA

57057000

11.23

146.20

-8.99

unwinding in 8600 strike. We believe, these put buying is

mainly hedge positions formed by FIIs. Highest OI in

OI Losers

August series is visible at 9000 call and 8500 put

OI

PRICE

SCRIP

OI

PRICE

options.

CHG. (%)

CHG. (%)

Despite, market being under pressure Nifty managed to

BRITANNIA

1298000

-6.08

3239.00

3.86

bounce from its support zone yesterday. Till the time, we

SYNDIBANK

14013000

-5.69

71.10

-1.32

don’t see any significant sign of reversal on derivative

CAIRN

10878000

-5.68

190.70

-0.60

data front; we maintain our bullish stance on the index.

DABUR

6555000

-5.34

294.95

2.66

Hence, traders are advised not to go short at current

DHFL

11958000

-5.03

259.30

2.03

juncture.

Historical Volatility

Put-Call Ratio

SCRIP

HV

SCRIP

PCR-OI

PCR-VOL

BANKBARODA

58.62

NIFTY

0.96

1.04

GRASIM

52.92

BANKNIFTY

0.72

0.85

DABUR

24.99

ICICIBANK

0.37

0.26

GRANULES

32.69

INFY

0.30

0.28

ADANIENT

48.95

LT

0.45

0.59

Strategy Date

Symbol

Strategy

Status

01-08-2016

RELIANCE

Ratio Bear Put Spread

Active

08-08-2016

SBIN

Bull Call Spread

Active

2

Technical & Derivatives Report

August 12, 2016

FII Statistics for 11-August 2016

Turnover on 11-August 2016

Open Interest

No. of

Turnover

Change

Detail

Buy

Sell

Net

Instrument

Value

Contracts

( in Cr. )

(%)

Contracts

Change (%)

(in Cr.)

INDEX

INDEX

1780.41

1774.02

6.39

342541

22461.98

0.02

210666

14294.62

-14.54

FUTURES

FUTURES

INDEX

INDEX

48179.52

47662.49

517.04

1033987

67173.67

2.52

5412409

383171.06

36.98

OPTIONS

OPTIONS

STOCK

5881.94

6838.63

(956.69)

895591

57608.57

1.08

STOCK

FUTURES

597375

40097.84

-6.92

FUTURES

STOCK

STOCK

4300.49

4331.10

(30.61)

89064

5814.16

2.75

OPTIONS

366991

24925.63

-14.24

OPTIONS

TOTAL

60142.36

60606.23

(463.87)

2361183

153058.39

1.61

TOTAL

6587441

462489.16

25.47

Nifty Spot = 8592.15

Lot Size = 75

Bull-Call Spreads

Bear-Put Spreads

Action

Strike

Price

Risk

Reward

BEP

Action

Strike

Price

Risk

Reward

BEP

Buy

8600

90.00

Buy

8600

79.35

43.70

56.30

8643.70

35.45

64.55

8564.55

Sell

8700

46.30

Sell

8500

43.90

Buy

8600

90.00

Buy

8600

79.35

69.25

130.75

8669.25

55.50

144.50

8544.50

Sell

8800

20.75

Sell

8400

23.85

Buy

8700

46.30

Buy

8500

43.90

25.55

74.45

8725.55

20.05

79.95

8479.95

Sell

8800

20.75

Sell

8400

23.85

Note: Above mentioned Bullish or Bearish Spreads in Nifty (August Series) are given as an information and not as a recommendation.

Nifty Put-Call Analysis

3

Technical & Derivatives Report

August 12, 2016

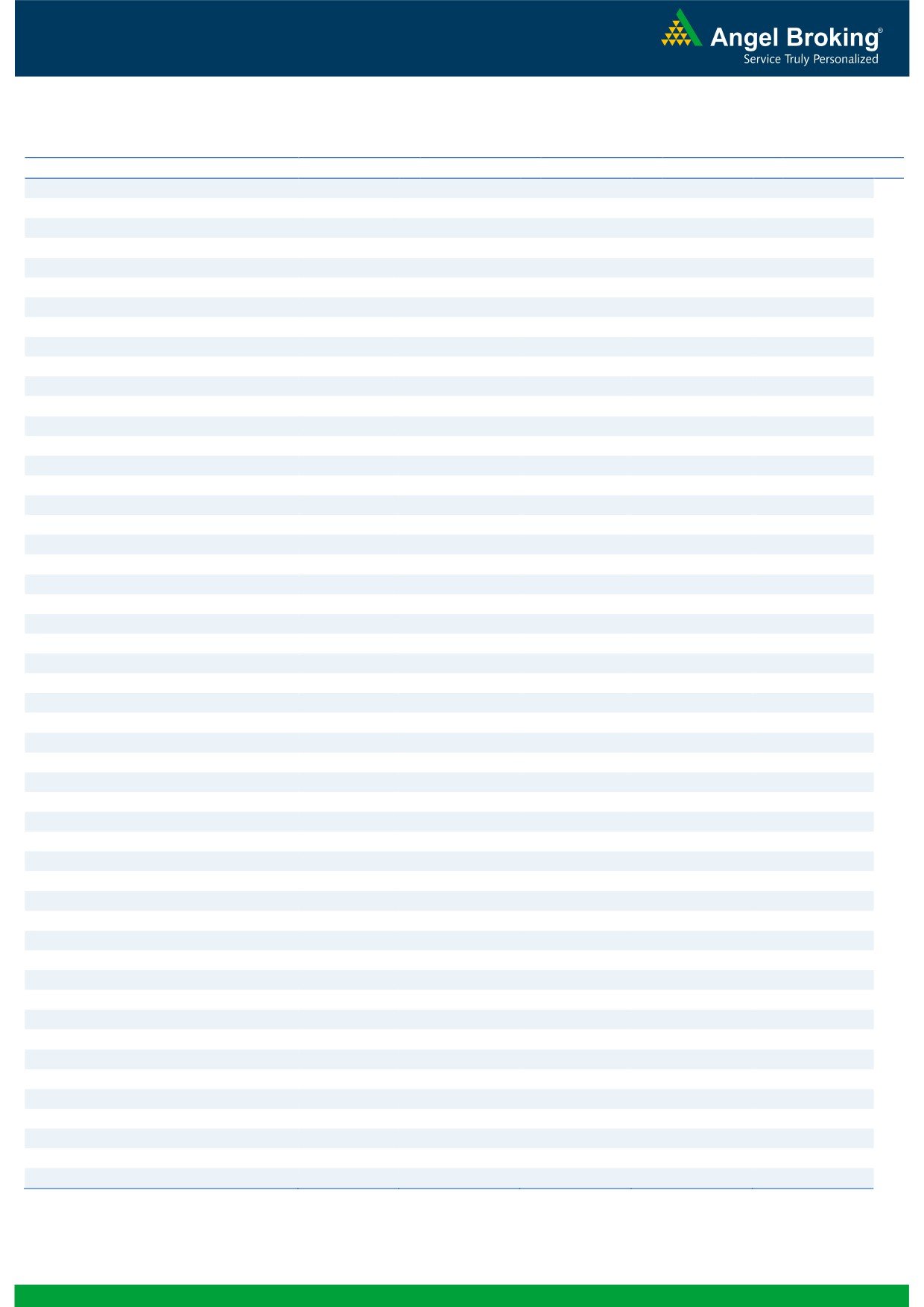

Daily Pivot Levels for Nifty Constituents

Scrips

S2

S1

PIVOT

R1

R2

ACC

1,553

1,586

1,617

1,649

1,680

ADANIPORTS

246

250

255

258

263

AMBUJACEM

252

256

260

264

268

ASIANPAINT

1,108

1,127

1,137

1,156

1,166

AUROPHARMA

728

739

747

758

766

AXISBANK

559

564

570

575

580

BAJAJ-AUTO

2,790

2,818

2,853

2,882

2,917

BANKBARODA

140

143

148

151

156

BHEL

132

134

137

139

141

BPCL

574

585

593

604

612

BHARTIARTL

340

343

345

348

350

INFRATEL

357

363

371

376

384

BOSCH

24,162

24,471

24,861

25,170

25,560

CIPLA

515

519

522

527

530

COALINDIA

331

335

337

340

342

DRREDDY

2,952

2,982

3,003

3,032

3,053

EICHERMOT

21,190

21,729

22,064

22,604

22,939

GAIL

367

369

372

374

377

GRASIM

4,303

4,421

4,634

4,752

4,965

HCLTECH

808

816

822

830

836

HDFCBANK

1,215

1,222

1,228

1,235

1,241

HDFC

1,322

1,335

1,344

1,357

1,366

HEROMOTOCO

3,240

3,272

3,321

3,354

3,402

HINDALCO

135

139

142

146

150

HINDUNILVR

917

926

932

942

948

ICICIBANK

235

239

241

245

247

IDEA

92

94

95

97

98

INDUSINDBK

1,137

1,151

1,159

1,173

1,182

INFY

1,063

1,070

1,083

1,090

1,102

ITC

244

248

250

254

257

KOTAKBANK

754

760

764

769

774

LT

1,456

1,465

1,472

1,482

1,488

LUPIN

1,538

1,559

1,572

1,594

1,607

M&M

1,387

1,404

1,428

1,446

1,470

MARUTI

4,751

4,815

4,869

4,933

4,988

NTPC

156

158

159

161

162

ONGC

226

228

230

233

235

POWERGRID

170

172

174

176

178

RELIANCE

989

1,002

1,012

1,025

1,035

SBIN

223

225

228

230

234

SUNPHARMA

770

789

804

823

838

TCS

2,647

2,679

2,697

2,728

2,746

TATAMTRDVR

321

325

330

334

338

TATAMOTORS

491

497

501

507

511

TATAPOWER

72

73

75

76

77

TATASTEEL

356

362

368

374

380

TECHM

493

496

499

503

506

ULTRACEMCO

3,591

3,649

3,716

3,774

3,841

WIPRO

536

539

544

547

551

YESBANK

1,222

1,237

1,251

1,266

1,280

ZEEL

486

494

505

512

523

4

Technical & Derivatives Report

August 12, 2016

Research Team Tel: 022 - 39357800

For Technical Queries

For Derivatives Queries

DISCLAIMER

Angel Broking Private Limited (hereinafter referred to as “Angel”) is a registered Member of National Stock Exchange of India Limited,

Bombay Stock Exchange Limited and Metropolitan Stock Exchange Limited. It is also registered as a Depository Participant with CDSL

and Portfolio Manager with SEBI. It also has registration with AMFI as a Mutual Fund Distributor. Angel Broking Private Limited is a

registered entity with SEBI for Research Analyst in terms of SEBI (Research Analyst) Regulations, 2014 vide registration number

INH000000164. Angel or its associates has not been debarred/ suspended by SEBI or any other regulatory authority for accessing

/dealing in securities Market. Angel or its associates/analyst has not received any compensation / managed or co-managed public

offering of securities of the company covered by Analyst during the past twelve months.

This document is solely for the personal information of the recipient, and must not be singularly used as the basis of any investment

decision. Nothing in this document should be construed as investment or financial advice. Each recipient of this document should

make such investigations as they deem necessary to arrive at an independent evaluation of an investment in the securities of the

companies referred to in this document (including the merits and risks involved), and should consult their own advisors to determine

the merits and risks of such an investment.

Reports based on technical and derivative analysis center on studying charts of a stock's price movement, outstanding positions and

trading volume, as opposed to focusing on a company's fundamentals and, as such, may not match with a report on a company's

fundamentals. Investors are advised to refer the Fundamental and Technical Research Reports available on our website to evaluate the

contrary view, if any.

The information in this document has been printed on the basis of publicly available information, internal data and other reliable

sources believed to be true, but we do not represent that it is accurate or complete and it should not be relied on as such, as this

document is for general guidance only. Angel Broking Pvt. Limited or any of its affiliates/ group companies shall not be in any way

responsible for any loss or damage that may arise to any person from any inadvertent error in the information contained in this report.

Angel Broking Pvt. Limited has not independently verified all the information contained within this document. Accordingly, we cannot

testify, nor make any representation or warranty, express or implied, to the accuracy, contents or data contained within this document.

While Angel Broking Pvt. Limited endeavors to update on a reasonable basis the information discussed in this material, there may be

regulatory, compliance, or other reasons that prevent us from doing so.

This document is being supplied to you solely for your information, and its contents, information or data may not be reproduced,

redistributed or passed on, directly or indirectly.

Neither Angel Broking Pvt. Limited, nor its directors, employees or affiliates shall be liable for any loss or damage that may arise from

or in connection with the use of this information.

5