Technical & Derivatives Report

May 12, 2016

Sensex (25597) / Nifty (7849)

Exhibit 1: Nifty Daily Chart

Yesterday morning, most of the traders stood shell-shocked after

seeing the SGX Nifty down over 100 points on the back of

Mauritius Treaty announcement. However, we saw a complete

roller coaster ride in the market as the Nifty recovered

immediately from day’s low and then kept on oscillating within a

broad range with a negative bias.

Considering yesterday’s session, the range is set for the upcoming

sessions. 7900 has become an immediate hurdle on the upside;

whereas, the 7810 would be seen as a crucial support. Any

sustainable move on either side beyond these levels would dictate

the direction for the market. Thus, traders need to keep a close

tab on these levels and should ideally avoid aggressive trades in

the market.

Key Levels

Support 1 - 7810

Resistance 1 - 7900

Support 2 - 7780

Resistance 2 - 7940

Exhibit 2: Nifty Bank Daily Chart

Nifty Bank Outlook - (16754)

In yesterday's trading session, the Nifty Bank index traded with

high volatility before ending the session with marginal loss of

0.18%.

Post gap down opening of about 240 points, the index rallied

higher and recovered all the losses during the day. The upmove

was led by the private sector banks, on which we have been

maintaining positive stance on basis of their short term uptrend.

Although the positive momentum continues with formation of

large body bullish candles, the index has crucial resistance

around 17020-17070 range. Yesterday's high coincides with

78.6% retracement resistance of the recent corrective move from

17030 to 16193 and hence a move above yesterday's high will

lead the index higher upto the mentioned resistance zone. At

higher levels, traders are advised to book profits on long positions

and wait for further developments on the charts. The intraday

support for the index is placed around 16655 and 16518 wheres

resistances are seen around 16862 and 17020.

Key Levels

Support 1 - 16655

Resistance 1 - 16862

Support 2 - 16518

Resistance 2 - 17020

1

Technical & Derivatives Report

May 12, 2016

Comments

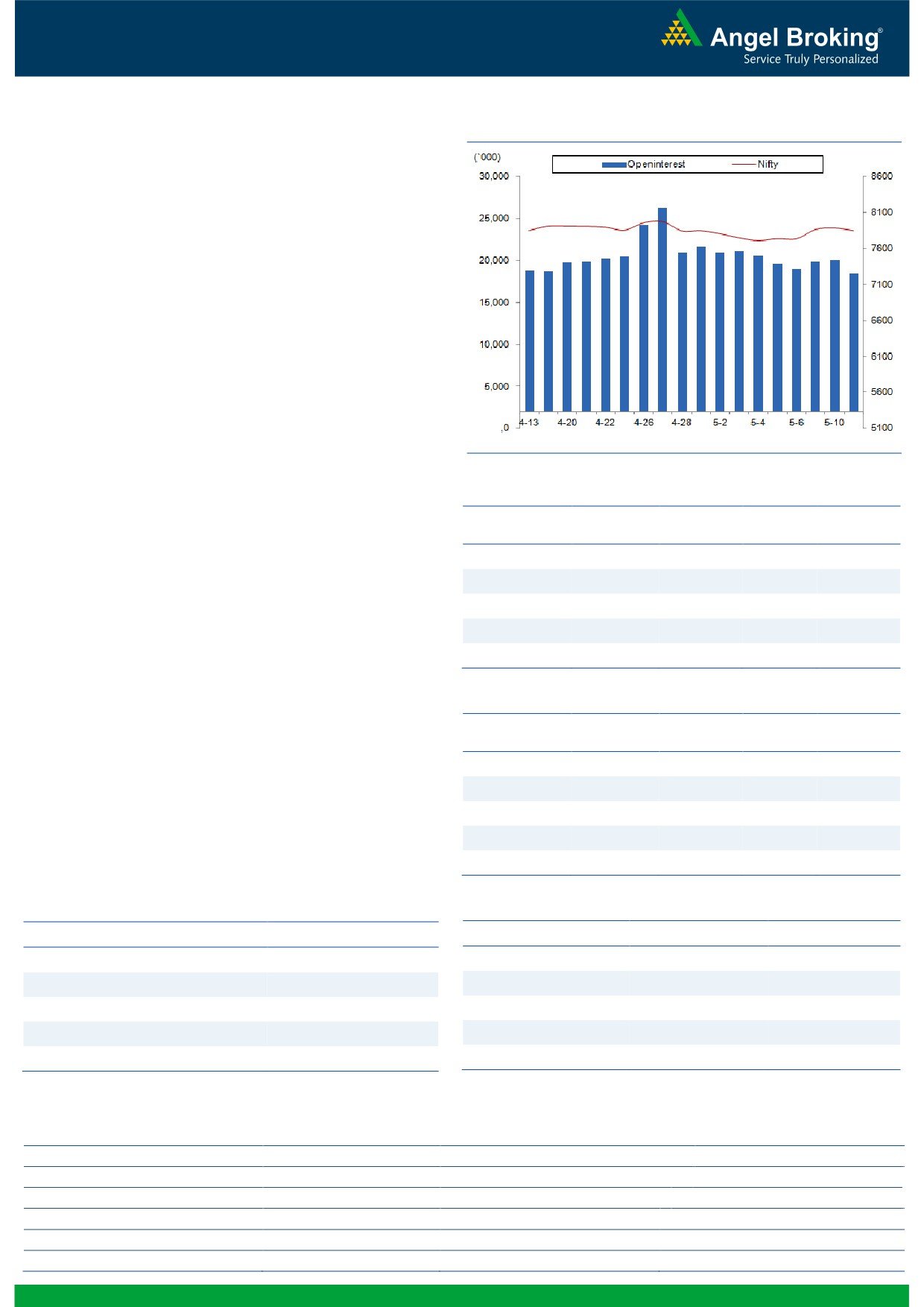

Nifty Vs OI

The Nifty futures open interest has decreased by 8.47%

BankNifty futures open interest has decreased by 1.02%

as market closed at 7848.85 levels.

The Nifty May future closed at a premium of 17.00

points against a premium of 31.95 points. The June

series closed at a premium of 29.60 points.

The Implied Volatility of at the money options has

increased from 14.58% to 15.25%.

The total OI of the market is Rs. 2,20,375/- cr. and the

stock futures OI is Rs. 60,260/- cr.

Few of the liquid counters where we have seen high cost

of carry are UNITECH, JPASSOCIAT, ADANIPOWER,

TATAPOWER and L&TFH.

Views

OI Gainers

Yesterday, the FIIs were net seller in both equity and

OI

PRICE

Index Futures segment. They sold equities worth Rs. 362

SCRIP

OI

PRICE

CHG. (%)

CHG. (%)

crores. While, they sold Index Future to the tune of 962

ZEEL

9938500

17.92

449.50

7.07

crores with fall in OI, indicating long unwinding in

HAVELLS

4020000

16.18

342.05

-1.58

yesterday’s session.

VOLTAS

5202800

12.06

320.40

3.64

In Index Options front, FIIs bought worth Rs. 1145 crores

UNITECH

206184000

8.44

4.15

-7.78

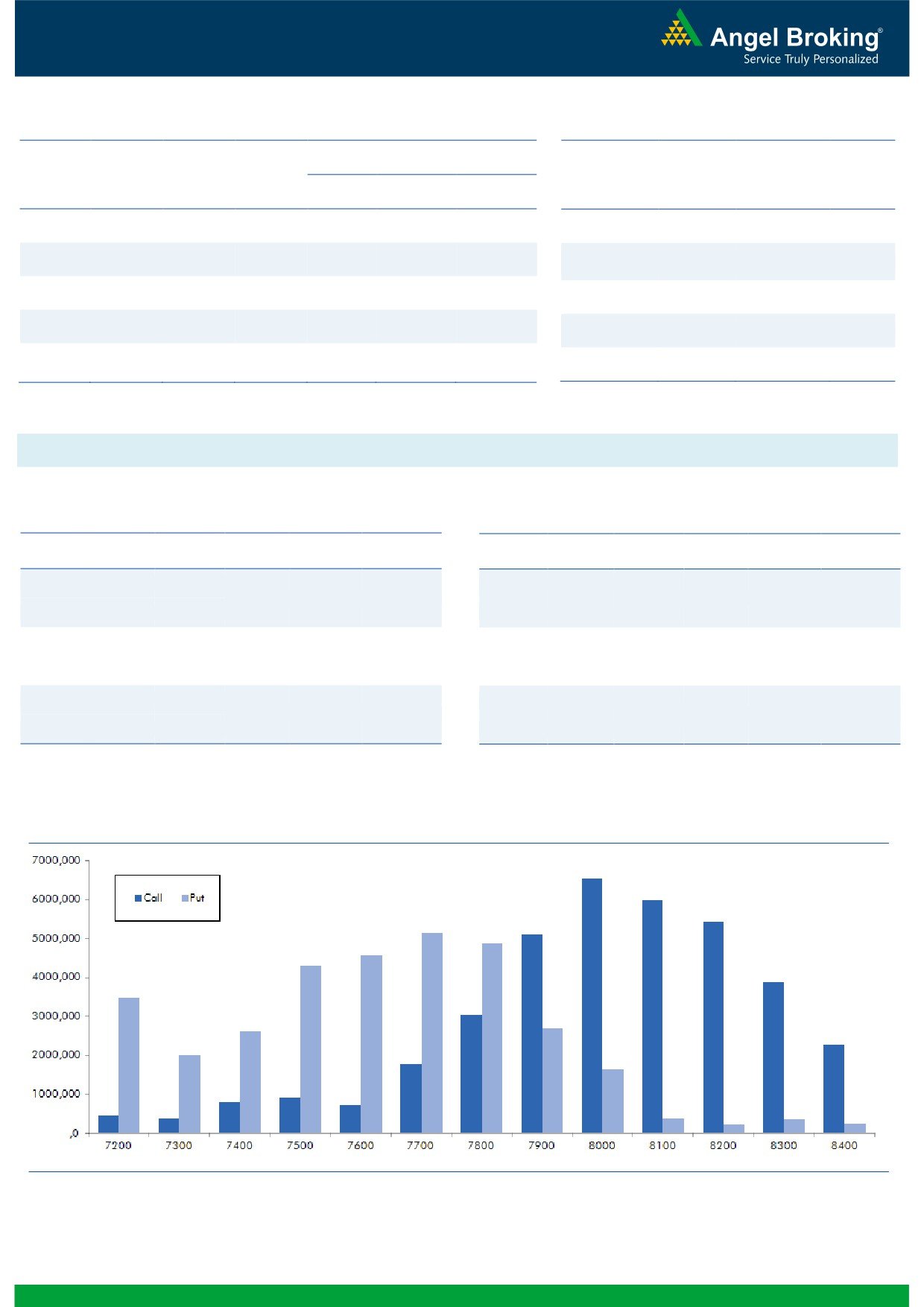

with rise in OI. In call options, 7900 strike has addedng.com

BAJFINANCE

274000

8.03

7486.25

0.86

some amount of fresh positions; while, unwinding was

seen in 7800 call option. Whereas in put options, we

OI Losers

witnessed rise in OI in 7400 strike. Maximum OI in

OI

PRICE

current series is visible at 8000 call and 7700 put

SCRIP

OI

PRICE

CHG. (%)

CHG. (%)

options. In BankNifty; 16500 put options was quite active

KPIT

1624000

-14.88

164.80

0.03

and added fresh positions. Overall derivative data

ENGINERSIN

2453000

-8.98

184.45

1.26

suggests that the Nifty has strong support around 7670 -

M&M

3143600

-6.89

1350.75

-0.31

7700 zone and till the time it holds this support zone,

traders should trade with positive bias.

TCS

3689500

-6.76

2523.70

-0.41

ACC

838575

-6.48

1469.65

0.14

Historical Volatility

Put-Call Ratio

SCRIP

HV

SCRIP

PCR-OI

PCR-VOL

ZEEL

48.68

NIFTY

0.92

0.97

ABIRLANUVO

37.62

BANKNIFTY

1.01

0.79

UNITECH

66.80

ICICIBANK

0.40

0.47

DISHTV

46.64

RELIANCE

0.37

0.29

PNB

45.66

SBIN

0.52

0.51

Strategy Date

Symbol

Strategy

Status

02-05-2016

NIFTY

Long Strangle

Active

09-05-2016

RELIANCE

Long Put

Active

2

Technical & Derivatives Report

May 12, 2016

FII Statistics for 11-May 2016

Turnover on 11-May 2016

Open Interest

No. of

Turnover

Change

Detail

Buy

Sell

Net

Instrument

Value

Contracts

( in Cr. )

(%)

Contracts

Change (%)

(in Cr.)

INDEX

INDEX

1185.68

2147.75

(962.07)

232994

13390.26

(3.54)

313630

22128.24

66.29

FUTURES

FUTURES

INDEX

INDEX

40189.83

39044.39

1145.44

1127559

65722.83

3.04

2885567

223556.92

63.92

OPTIONS

OPTIONS

STOCK

4963.08

3891.05

1072.04

1010257

48617.68

(0.31)

STOCK

FUTURES

515157

29583.02

22.98

FUTURES

STOCK

STOCK

2836.70

2879.93

(43.23)

71922

3507.64

7.85

OPTIONS

286718

16725.03

26.05

OPTIONS

TOTAL

49175.29

47963.12

1212.17

2442732

131238.41

1.11

TOTAL

4001072

291993.21

56.13

Nifty Spot = 7848.85

Lot Size = 75

Bull-Call Spreads

Bear-Put Spreads

Action

Strike

Price

Risk

Reward

BEP

Action

Strike

Price

Risk

Reward

BEP

Buy

7900

81.15

Buy

7800

73.00

37.40

62.60

7937.40

28.90

71.10

7771.10

Sell

8000

43.75

Sell

7700

44.10

Buy

7900

81.15

Buy

7800

73.00

59.80

140.20

7959.80

46.70

153.30

7753.30

Sell

8100

21.35

Sell

7600

26.30

Buy

8000

43.75

Buy

7700

44.10

22.40

77.60

8022.40

17.80

82.20

7682.20

Sell

8100

21.35

Sell

7600

26.30

Note: Above mentioned Bullish or Bearish Spreads in Nifty (May Series) are given as an information and not as a recommendation.

Nifty Put-Call Analysis

3

Technical & Derivatives Report

May 12, 2016

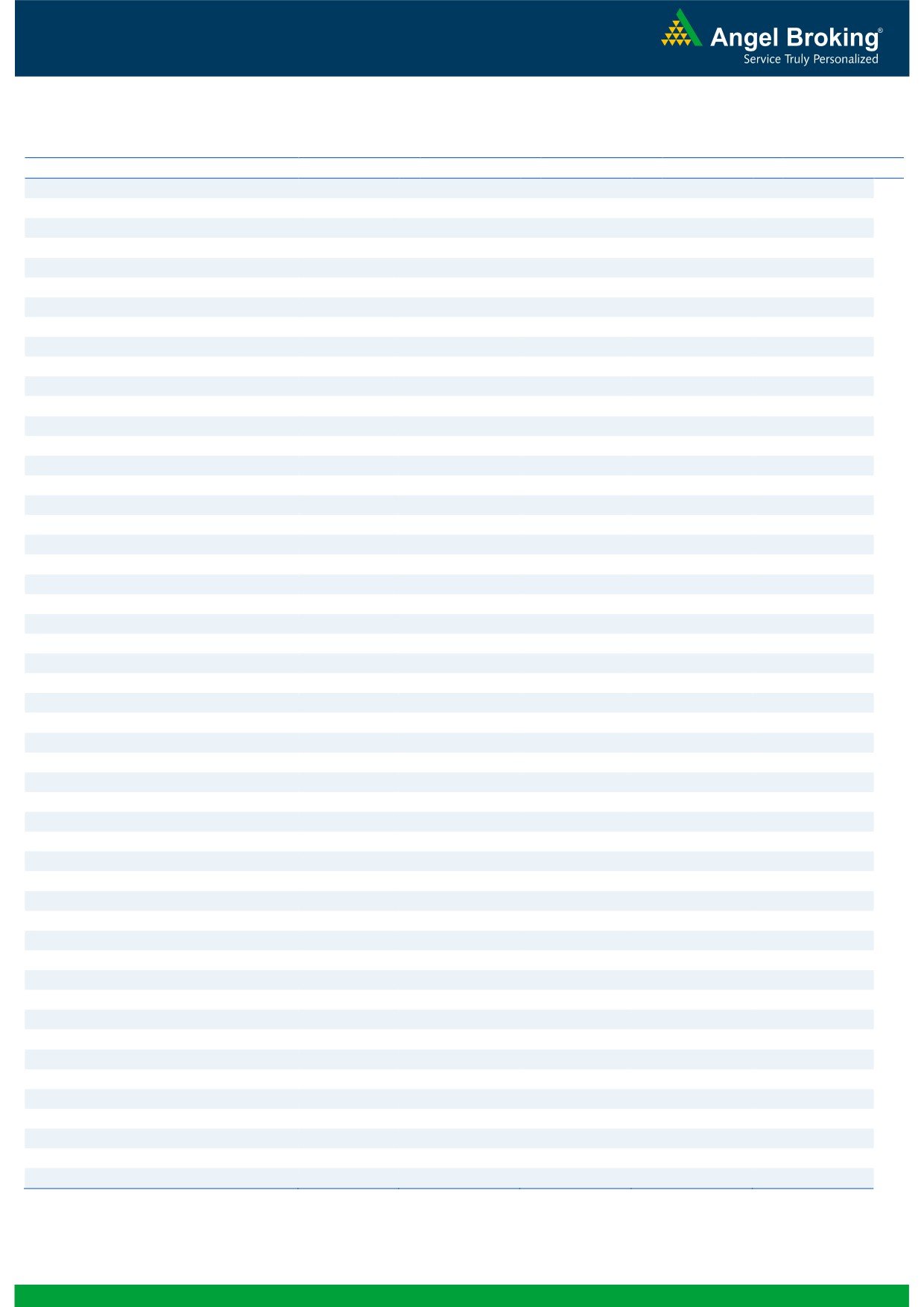

Daily Pivot Levels for Nifty Constituents

Scrips

S2

S1

PIVOT

R1

R2

ACC

1,429

1,448

1,460

1,479

1,491

ADANIPORTS

186

190

193

196

199

AMBUJACEM

215

218

220

223

225

ASIANPAINT

873

891

905

922

936

AUROPHARMA

792

805

813

826

834

AXISBANK

474

486

493

505

512

BAJAJ-AUTO

2,464

2,491

2,523

2,549

2,581

BANKBARODA

151

154

156

159

161

BHEL

123

125

126

128

129

BPCL

899

910

919

929

938

BHARTIARTL

344

351

364

372

385

INFRATEL

364

368

372

375

379

BOSCH

18,983

19,515

19,807

20,339

20,631

CIPLA

527

532

536

540

544

COALINDIA

274

279

282

287

289

DRREDDY

2,821

2,845

2,879

2,903

2,938

EICHERMOT

19,764

19,870

20,015

20,122

20,267

GAIL

380

384

387

390

394

GRASIM

4,140

4,202

4,251

4,313

4,362

HCLTECH

700

705

711

715

721

HDFCBANK

1,123

1,131

1,138

1,146

1,153

HDFC

1,187

1,196

1,209

1,217

1,230

HEROMOTOCO

2,894

2,928

2,954

2,988

3,014

HINDALCO

87

89

91

93

95

HINDUNILVR

844

854

860

869

876

ICICIBANK

215

220

223

227

231

IDEA

105

108

113

116

120

INDUSINDBK

1,026

1,040

1,050

1,064

1,074

INFY

1,181

1,191

1,203

1,214

1,225

ITC

313

315

319

321

324

KOTAKBANK

705

718

728

741

751

LT

1,280

1,304

1,319

1,343

1,358

LUPIN

1,578

1,586

1,599

1,606

1,619

M&M

1,298

1,323

1,337

1,362

1,376

MARUTI

3,751

3,821

3,859

3,929

3,967

NTPC

137

139

142

144

146

ONGC

201

203

205

207

209

POWERGRID

138

140

141

143

144

RELIANCE

965

970

975

981

986

SBIN

181

183

186

188

190

SUNPHARMA

784

790

798

804

812

TCS

2,476

2,497

2,511

2,533

2,547

TATAMTRDVR

265

270

276

280

286

TATAMOTORS

367

373

383

389

398

TATAPOWER

70

70

71

72

73

TATASTEEL

314

322

327

335

340

TECHM

464

469

476

481

488

ULTRACEMCO

3,072

3,136

3,180

3,243

3,287

WIPRO

530

534

537

540

543

YESBANK

915

935

949

970

983

ZEEL

407

427

440

460

473

4

Technical & Derivatives Report

May 12, 2016

Research Team Tel: 022 - 39357800

For Technical Queries

For Derivatives Queries

DISCLAIMER

Angel Broking Private Limited (hereinafter referred to as “Angel”) is a registered Member of National Stock Exchange of India Limited,

Bombay Stock Exchange Limited and MCX Stock Exchange Limited. It is also registered as a Depository Participant with CDSL and

Portfolio Manager with SEBI. It also has registration with AMFI as a Mutual Fund Distributor. Angel Broking Private Limited is a

registered entity with SEBI for Research Analyst in terms of SEBI (Research Analyst) Regulations, 2014 vide registration number

INH000000164. Angel or its associates has not been debarred/ suspended by SEBI or any other regulatory authority for accessing

/dealing in securities Market. Angel or its associates including its relatives/analyst do not hold any financial interest/beneficial

ownership of more than 1% in the company covered by Analyst. Angel or its associates/analyst has not received any compensation /

managed or co-managed public offering of securities of the company covered by Analyst during the past twelve months. Angel/analyst

has not served as an officer, director or employee of company covered by Analyst and has not been engaged in market making activity

of the company covered by Analyst.

This document is solely for the personal information of the recipient, and must not be singularly used as the basis of any investment

decision. Nothing in this document should be construed as investment or financial advice. Each recipient of this document should

make such investigations as they deem necessary to arrive at an independent evaluation of an investment in the securities of the

companies referred to in this document (including the merits and risks involved), and should consult their own advisors to determine

the merits and risks of such an investment.

Reports based on technical and derivative analysis center on studying charts of a stock's price movement, outstanding positions and

trading volume, as opposed to focusing on a company's fundamentals and, as such, may not match with a report on a company's

fundamentals.

The information in this document has been printed on the basis of publicly available information, internal data and other reliable

sources believed to be true, but we do not represent that it is accurate or complete and it should not be relied on as such, as this

document is for general guidance only. Angel Broking Pvt. Limited or any of its affiliates/ group companies shall not be in any way

responsible for any loss or damage that may arise to any person from any inadvertent error in the information contained in this report.

Angel Broking Pvt. Limited has not independently verified all the information contained within this document. Accordingly, we cannot

testify, nor make any representation or warranty, express or implied, to the accuracy, contents or data contained within this document.

While Angel Broking Pvt. Limited endeavors to update on a reasonable basis the information discussed in this material, there may be

regulatory, compliance, or other reasons that prevent us from doing so.

This document is being supplied to you solely for your information, and its contents, information or data may not be reproduced,

redistributed or passed on, directly or indirectly.

Neither Angel Broking Pvt. Limited, nor its directors, employees or affiliates shall be liable for any loss or damage that may arise from

or in connection with the use of this information.

Note: Please refer to the important ‘Stock Holding Disclosure' report on the Angel website (Research Section). Also, please refer to the

latest update on respective stocks for the disclosure status in respect of those stocks. Angel Broking Pvt. Limited and its affiliates may

have investment positions in the stocks recommended in this report.

5