Technical & Derivatives Report

December 11, 2015

Sensex (25252) / Nifty (7683)

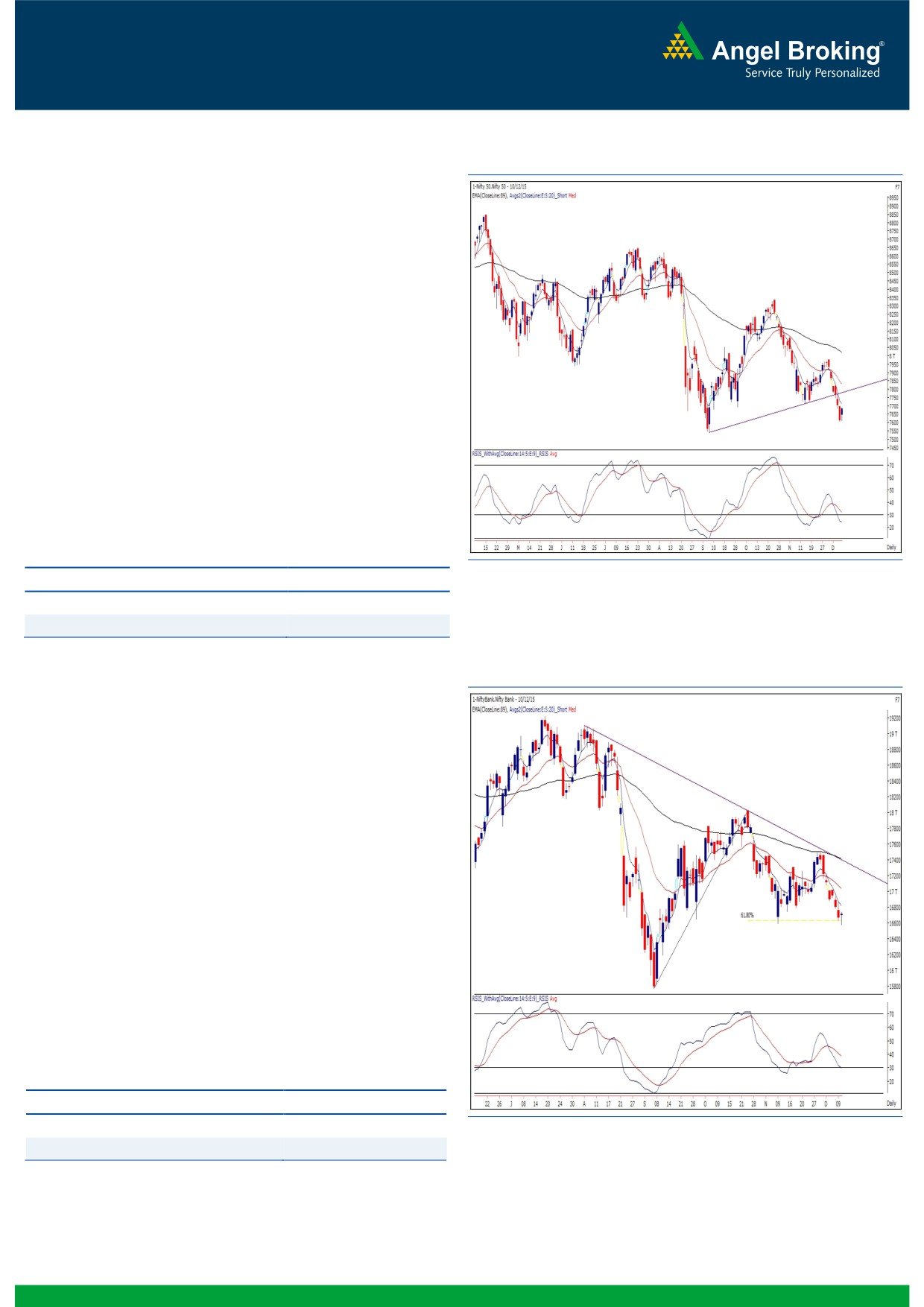

Exhibit 1: Nifty Daily Chart

Yesterday, our market opened slightly higher as indicated by

the SGX Nifty. The bulls then convincingly managed to defend

the 7600 mark throughout the remaining part of the session.

In fact, the momentum accelerated towards the fag end to

close with nearly a percent gains.

The Nifty finally managed to snap the six days losing streak,

which was on cards also after a relentless correction of nearly

350 points from the high. If we combine last two days price

action then we can observe a 'Bullish Harami' pattern which

needs to be confirmed. The said pattern will get activated

above Wednesday's high of 7703. In this scenario, at least a

bounce back towards 7800 - 7820 cannot be ruled out. On

the flipside, a failure to do may result into resumption of the

downward movement towards 7600 - 7540 can not be ruled

out. Traders are advised to stay light on positions as the

market is lacking a clear direction.

Key Levels

Support 1 - 7600

Resistance 1 - 7703

Support 2 - 7540

Resistance 2 - 7760

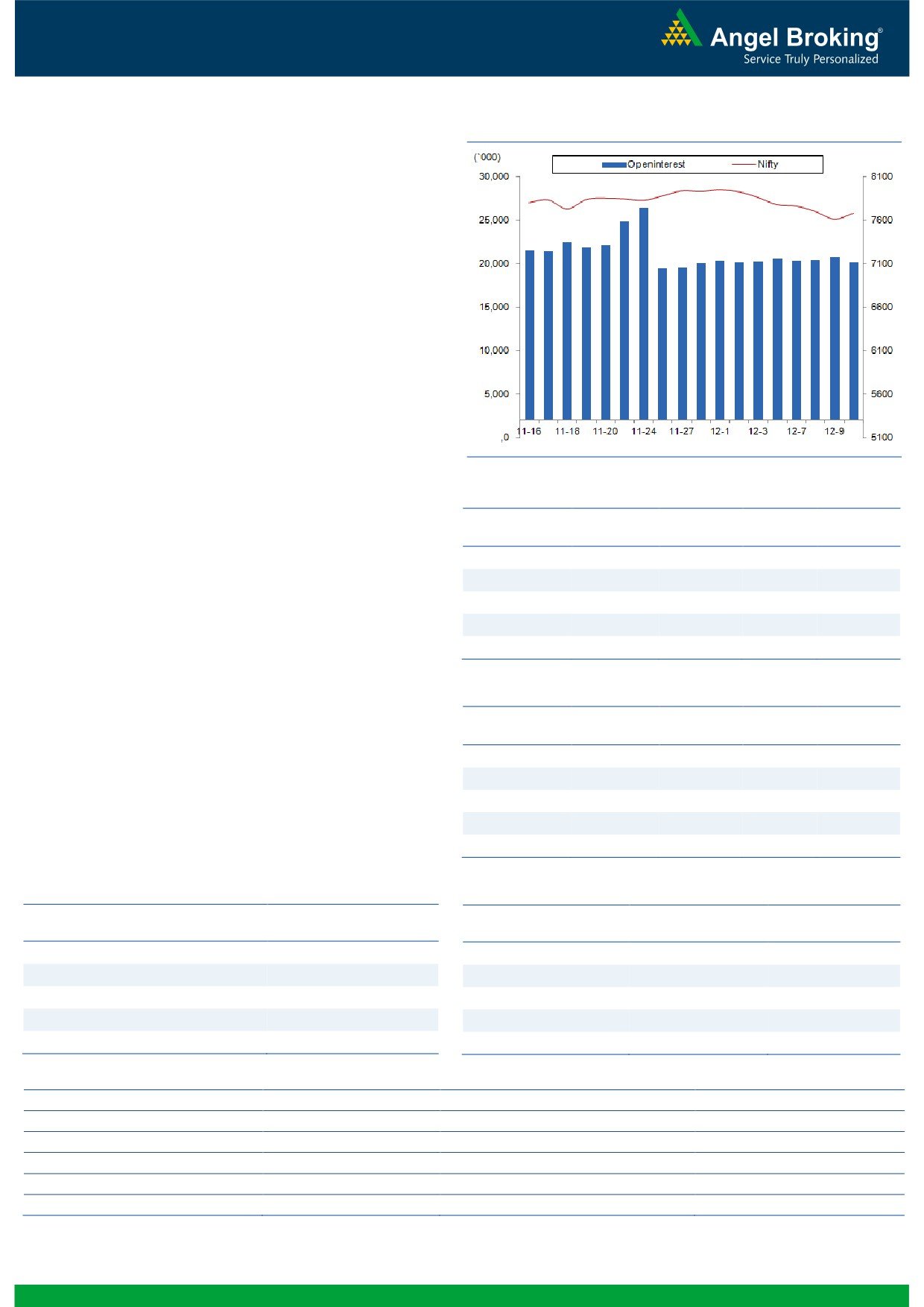

Exhibit 2: Bank Nifty Daily Chart

Bank Nifty Outlook - (16711)

Yesterday, the Bank Nifty opened with marginal gains and

started correcting in the first half of the session. However,

decent buying interest was seen around the pre-mentioned

support zone of 16580 - 16600 in the later half of the session

and as a result, the banking index trimmed all its intraday

losses. Eventually, the Bank Nifty ended the session with

marginal gains of 0.30 percent over its previous close.

After the bearish momentum of last seven trading session, we

witnessed a good traction in the Bank Nifty. Yesterday’s price

action depicts a formation of a ‘Dragonfly Doji’ pattern on the

daily chart. Foration of such pattern around the support zone

can become a reversal trigger on a follow up closing above

yesterdays’ high of 16745.25. Going forward, the intraday

support for the Bank Nifty is placed at 16570 - 16400 levels.

On the flipside, 16780 and 16940 levels may act as intraday

resistances for the index.

Key Levels

Support 1 - 16570

Resistance 1 - 16780

Support 2 - 16400

Resistance 2 - 16940

1

Technical & Derivatives Report

December 11, 2015

Comments

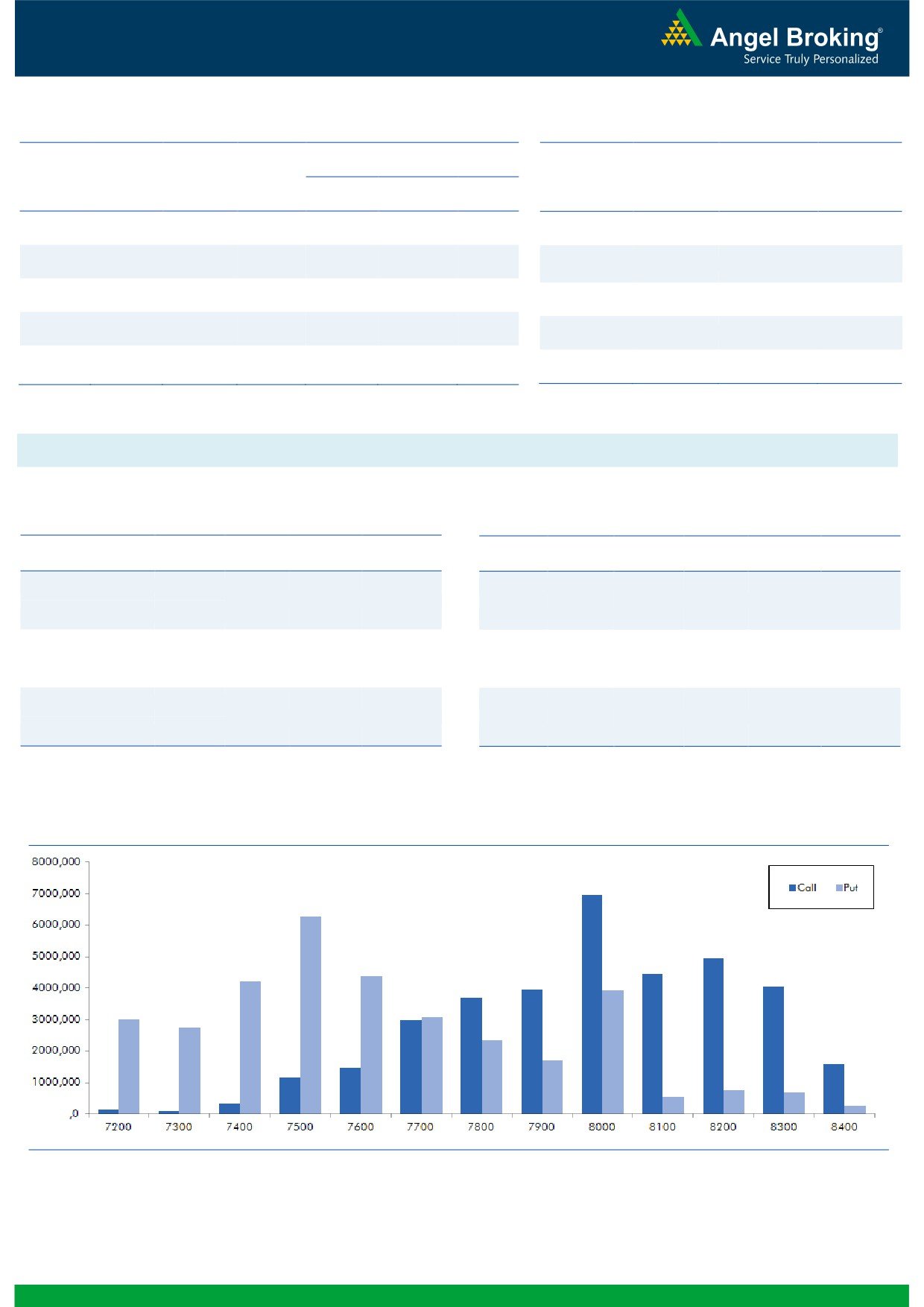

Nifty Vs OI

The Nifty futures open interest has decreased by 2.92%

BankNifty futures open interest has increased by 7.41%

as market closed at 7683.30 levels.

The Nifty December future closed at a premium of 27.45

points against a premium of 31.85 points. The January

series closed at a premium of 64.05 points.

The Implied Volatility of at the money options has

decreased from 15.19% to 14.94%.

The total OI of the market is Rs. 2,22,970/- cr. and the

stock futures OI is Rs. 63,288/- cr.

Few of the liquid counters where we have seen high cost

of carry are UBL, JISLJALEQS, IFCI, UNITECH and

JINDALSTEL.

Views

OI Gainers

FIIs were net sellers in both Equity Cash and Index Future

OI

PRICE

SCRIP

OI

PRICE

segment. In Equity Cash, they were net seller to the tune

CHG. (%)

CHG. (%)

of Rs. 580 crores. While in Index Futures they continue to

MINDTREE

368800

18.97

1482.15

4.21

sell of worth Rs. 120 crores with decent rise in open

APOLLOHOSP

706000

14.61

1401.55

2.76

interest, indicating blend of long and short build-up in

UNIONBANK

15555000

11.43

149.95

-4.58

last trading session.

BATAINDIA

4659000

9.49

446.15

-3.01

In Index Options front, FIIs bought of Rs. 220 crores with

IRB

5586000

8.09

237.55

-1.53

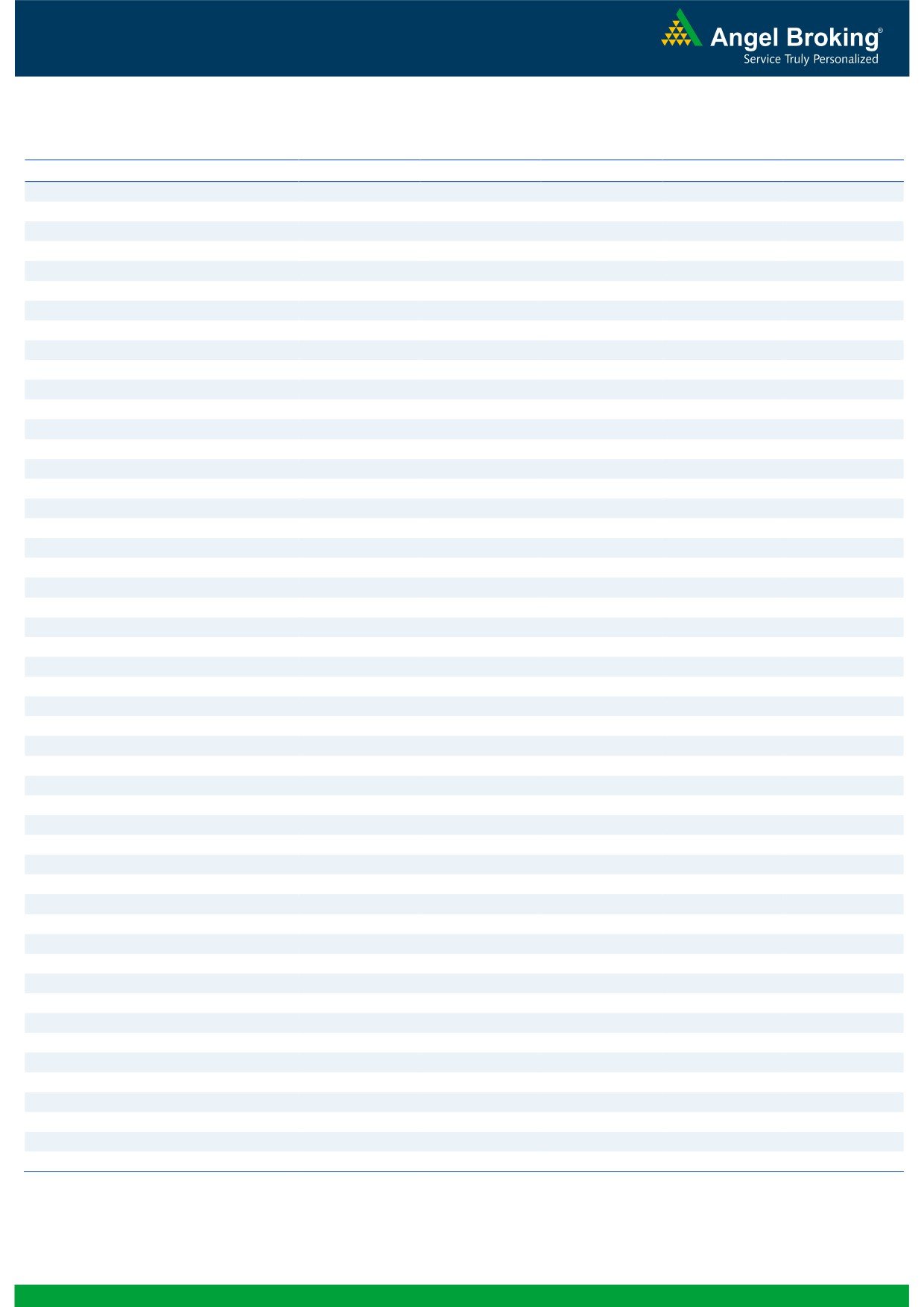

good amount of rise in OI. In both Call and Put options,

we hardly witness any meaningful OI addition. Maximum

OI Losers

OI still remains in 8000 call and 7500 put options. We

OI

PRICE

believe that the Nifty is trading around the lower side of

SCRIP

OI

PRICE

CHG. (%)

CHG. (%)

the range and any positive trigger may pull the index

OFSS

141150

-5.81

3804.00

2.98

back to 7850-7900 mark. Seeing Index Options data we

RELIANCE

25192500

-4.86

952.65

3.39

believe, 7500 is a very strong support for the market.

CEATLTD

2032100

-4.76

1021.80

2.94

Traders are advised to take positions accordingly.

TECHM

7599000

-4.02

541.00

2.17

NTPC

20752000

-3.57

133.45

2.14

Historical Volatility

Put-Call Ratio

SCRIP

HV

SCRIP

PCR-OI

PCR-VOL

HAVELLS

56.31

NIFTY

0.79

0.70

MINDTREE

34.47

BANKNIFTY

1.05

0.67

RELIANCE

33.84

SBIN

0.42

0.45

UNIONBANK

46.05

LT

0.54

0.48

NTPC

25.16

DRREDDY

0.46

0.49

Strategy Date

Symbol

Strategy

Status

November 30, 2015

LT

Long Put

Active

December 07, 2015

BANKNIFTY

Raito Bear Put Spread

Active

2

Technical & Derivatives Report

December 11, 2015

FII Statistics for 10-December 2015

Turnover on 10-December 2015

Open Interest

No. of

Turnover

Change

Detail

Buy

Sell

Net

Instrument

Value

Change

Contracts

( in Cr. )

(%)

Contracts

(in Cr.)

(%)

INDEX

INDEX

1345.39

1465.74

(120.35)

269901

15145.12

1.59

219835

12039.82

-16.23

FUTURES

FUTURES

INDEX

INDEX

15038.98

14818.76

220.22

1278639

72974.03

2.86

2083075

120147.42

-21.42

OPTIONS

OPTIONS

STOCK

STOCK

2938.84

3141.74

(202.90)

1012457

49190.70

1.06

FUTURES

447755

22417.75

-2.98

FUTURES

STOCK

1842.84

1856.64

(13.80)

59305

2867.65

6.68

STOCK

OPTIONS

246309

12764.06

-6.19

OPTIONS

TOTAL

21166.05

21282.88

(116.83)

2620302

140177.49

2.11

TOTAL

2996974

167369.06

-17.95

Nifty Spot = 7683.30

Lot Size = 25

Bull-Call Spreads

Bear-Put Spreads

Action

Strike

Price

Risk

Reward

BEP

Action

Strike

Price

Risk

Reward

BEP

Buy

7700

113.75

Buy

7700

104.85

46.90

53.10

7746.90

36.00

64.00

7664.00

Sell

7800

66.85

Sell

7600

68.85

Buy

7700

113.75

Buy

7700

104.85

78.05

121.95

7778.05

60.40

139.60

7639.60

Sell

7900

35.70

Sell

7500

44.45

Buy

7800

66.85

Buy

7600

68.85

31.15

68.85

7831.15

24.40

75.60

7575.60

Sell

7900

35.70

Sell

7500

44.45

Note: Above mentioned Bullish or Bearish Spreads in Nifty (Dec. Series) are given as an information and not as a recommendation.

Nifty Put-Call Analysis

3

Technical & Derivatives Report

December 11, 2015

Daily Pivot Levels for Nifty 50 Stocks

Scrips

S2

S1

PIVOT

R1

R2

ACC

1,295

1,310

1,320

1,335

1,345

ADANIPORTS

239

243

246

250

253

AMBUJACEM

186

188

190

192

194

ASIANPAINT

835

847

854

866

873

AXISBANK

440

445

450

455

459

BAJAJ-AUTO

2,369

2,406

2,429

2,466

2,489

BANKBARODA

154

156

159

162

165

BHARTIARTL

306

309

312

315

318

BHEL

163

165

168

170

173

BOSCHLTD

18,138

18,366

18,558

18,786

18,978

BPCL

853

878

893

919

933

CAIRN

125

126

127

127

128

CIPLA

614

626

633

644

652

COALINDIA

306

308

310

313

315

DRREDDY

2,929

2,962

3,000

3,033

3,071

GAIL

331

337

342

349

354

GRASIM

3,638

3,675

3,697

3,734

3,756

HCLTECH

831

838

844

851

857

HDFC

1,143

1,163

1,174

1,194

1,205

HDFCBANK

1,034

1,048

1,055

1,068

1,076

HEROMOTOCO

2,518

2,533

2,554

2,569

2,589

HINDALCO

74

75

75

76

77

HINDUNILVR

801

808

820

827

838

ICICIBANK

253

256

259

262

265

IDEA

132

133

135

136

137

INDUSINDBK

914

922

927

935

940

INFY

1,022

1,035

1,043

1,056

1,064

ITC

315

318

320

323

325

KOTAKBANK

659

668

674

684

690

LT

1,293

1,302

1,310

1,319

1,327

LUPIN

1,654

1,694

1,729

1,769

1,804

M&M

1,262

1,277

1,298

1,312

1,334

MARUTI

4,361

4,430

4,475

4,543

4,588

NTPC

129

131

132

135

136

ONGC

212

216

219

222

225

PNB

126

128

130

131

133

POWERGRID

129

130

130

131

132

RELIANCE

908

929

941

963

975

SBIN

227

229

233

236

239

VEDL

80

82

83

84

86

SUNPHARMA

717

737

753

773

790

TATAMOTORS

376

383

392

399

408

TATAPOWER

62

62

63

63

63

TATASTEEL

223

228

231

236

240

TCS

2,337

2,361

2,376

2,400

2,415

TECHM

518

528

534

545

551

ULTRACEMCO

2,709

2,761

2,793

2,846

2,878

WIPRO

555

560

565

570

575

YESBANK

691

699

710

719

730

ZEEL

381

392

398

408

414

4

Technical & Derivatives Report

December 11, 2015

Research Team Tel: 022 - 39357800

For Technical Queries

For Derivatives Queries

DISCLAIMER

Angel Broking Private Limited (hereinafter referred to as “Angel”) is a registered Member of National Stock Exchange of India Limited,

Bombay Stock Exchange Limited and MCX Stock Exchange Limited. It is also registered as a Depository Participant with CDSL and

Portfolio Manager with SEBI. It also has registration with AMFI as a Mutual Fund Distributor. Angel Broking Private Limited is a

registered entity with SEBI for Research Analyst in terms of SEBI (Research Analyst) Regulations, 2014 vide registration number

INH000000164. Angel or its associates has not been debarred/ suspended by SEBI or any other regulatory authority for accessing

/dealing in securities Market. Angel or its associates including its relatives/analyst do not hold any financial interest/beneficial

ownership of more than 1% in the company covered by Analyst. Angel or its associates/analyst has not received any compensation /

managed or co-managed public offering of securities of the company covered by Analyst during the past twelve months. Angel/analyst

has not served as an officer, director or employee of company covered by Analyst and has not been engaged in market making activity

of the company covered by Analyst.

This document is solely for the personal information of the recipient, and must not be singularly used as the basis of any investment

decision. Nothing in this document should be construed as investment or financial advice. Each recipient of this document should

make such investigations as they deem necessary to arrive at an independent evaluation of an investment in the securities of the

companies referred to in this document (including the merits and risks involved), and should consult their own advisors to determine

the merits and risks of such an investment.

Reports based on technical and derivative analysis center on studying charts of a stock's price movement, outstanding positions and

trading volume, as opposed to focusing on a company's fundamentals and, as such, may not match with a report on a company's

fundamentals.

The information in this document has been printed on the basis of publicly available information, internal data and other reliable

sources believed to be true, but we do not represent that it is accurate or complete and it should not be relied on as such, as this

document is for general guidance only. Angel Broking Pvt. Limited or any of its affiliates/ group companies shall not be in any way

responsible for any loss or damage that may arise to any person from any inadvertent error in the information contained in this report.

Angel Broking Pvt. Limited has not independently verified all the information contained within this document. Accordingly, we cannot

testify, nor make any representation or warranty, express or implied, to the accuracy, contents or data contained within this document.

While Angel Broking Pvt. Limited endeavors to update on a reasonable basis the information discussed in this material, there may be

regulatory, compliance, or other reasons that prevent us from doing so.

This document is being supplied to you solely for your information, and its contents, information or data may not be reproduced,

redistributed or passed on, directly or indirectly.

Neither Angel Broking Pvt. Limited, nor its directors, employees or affiliates shall be liable for any loss or damage that may arise from

or in connection with the use of this information.

Note: Please refer to the important ‘Stock Holding Disclosure' report on the Angel website (Research Section). Also, please refer to the

latest update on respective stocks for the disclosure status in respect of those stocks. Angel Broking Pvt. Limited and its affiliates may

have investment positions in the stocks recommended in this report.

5