Technical & Derivatives Report

November 11, 2016

Sensex (27518) / Nifty (8526)

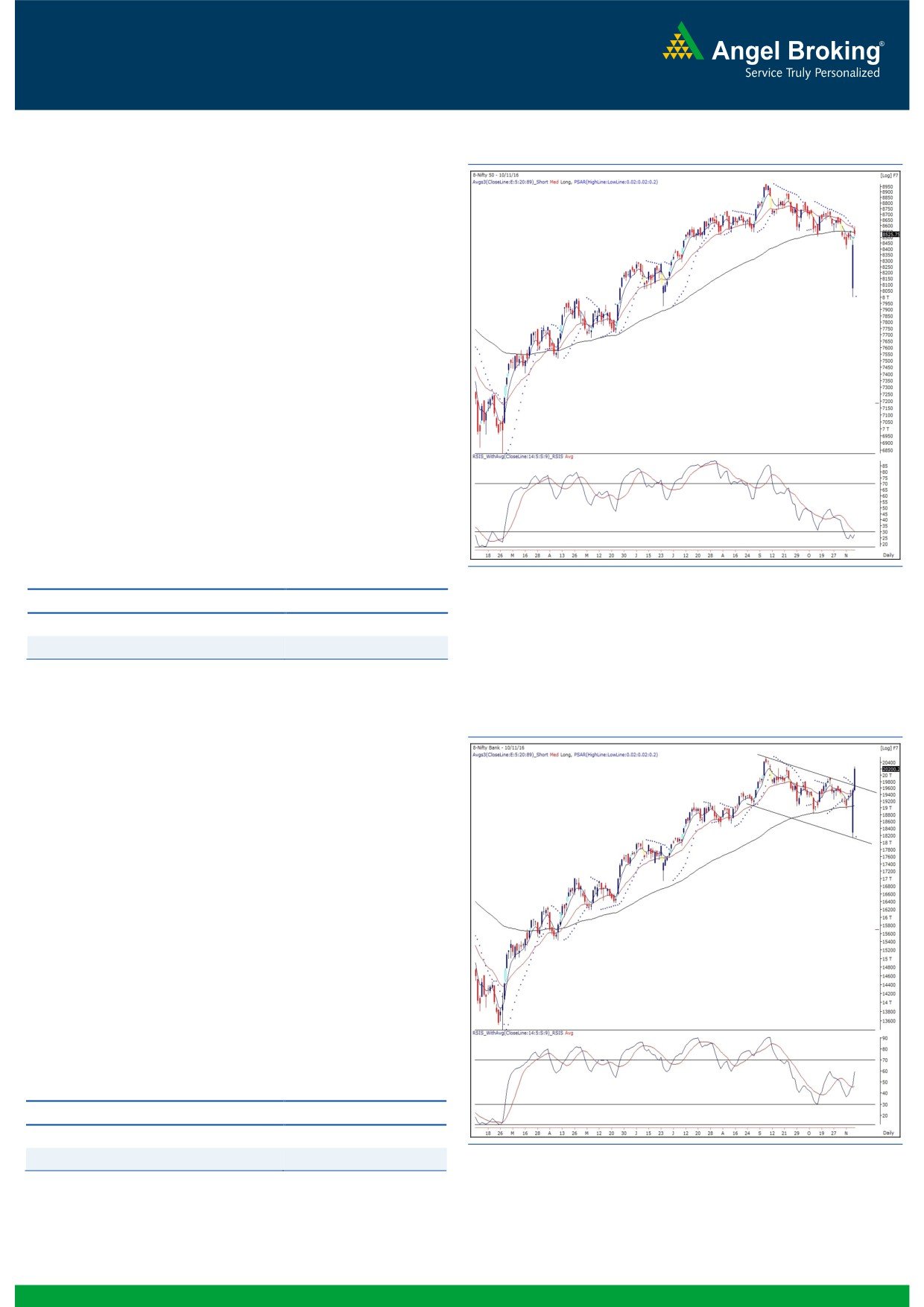

Exhibit 1: Nifty Daily Chart

After an eventful day on Wednesday, we saw our markets

opening with a decent upside gap. In fact, this momentum

accelerated as the day progressed, mainly propelled by banking

conglomerates. However, some of the other heavyweight counters

were not participating in this up move. As a result, we witnessed a

sharp decline towards the fag end to conclude the session well

below the 8550 mark.

Now, with reference to our previous report, 8560 was seen as an

important resistance level. This hurdle was violated on an intraday

basis but due to late selling, the index eventually closed well

below it. Thus, we would maintain our view that as long as 8560

is not broken on a closing basis, traders shouldn't get too carried

by the momentum. Until then a prudent strategy for momentum

traders would be to take some money off the table from their

existing longs. On the downside, 8450 - 8380 would be seen as

immediate support levels. On the other hand, intraday resistances

are placed at 8560 - 8620 levels.

Key Levels

Support 1 - 8450

Resistance 1 - 8560

Support 2 - 8380

Resistance 2 - 8620

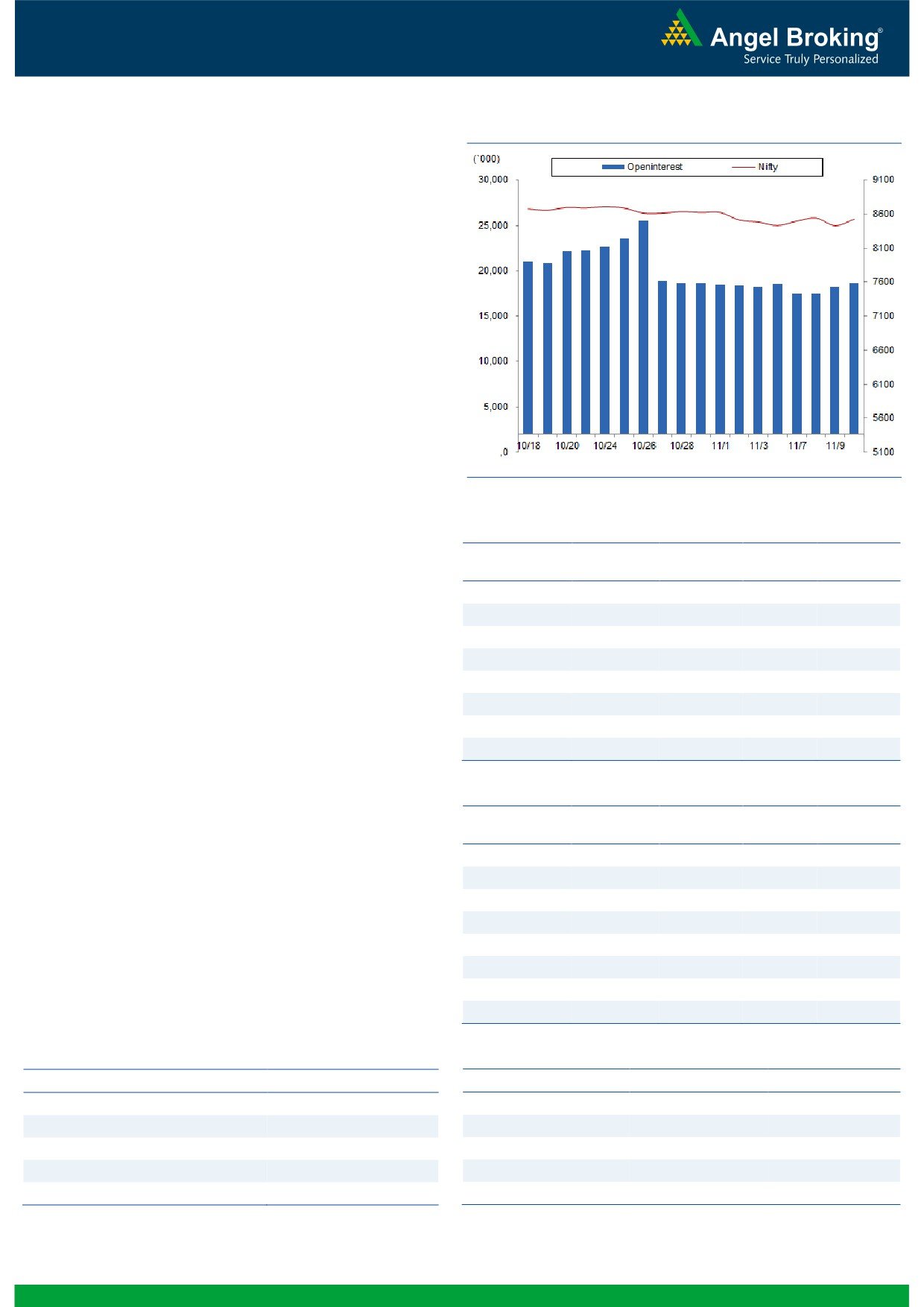

Exhibit 2: Nifty Bank Daily Chart

Nifty Bank Outlook - (20200)

The Nifty Bank index opened yesterday's session with a upside

gap and rallied higher throughout the session. The banking index

has shown tremendous outperformance against the benchmark

indices by posting a gain of 3.49 percent over its previous close.

It was another astonishing day for the banking stocks as the Nifty

Bank index continued its previous day's positive momentum. The

Nifty Bank index gave breakout from the falling trendline

resistance with a gap, which led this firm up move. The stock-

specific move, especially in the PSU Banking space, clearly

indicates resumption of the broader uptrend. Although the

volatility is expected to remain high, traders should trade with

positive bias and look to buy on corrections. The near term

supports for the Nifty Bank index are placed around 19922 and

19787 whereas resistance is seen around 20400 - 20575.

Key Levels

Support 1 - 19922

Resistance 1 - 20400

Support 2 - 19787

Resistance 2 - 20575

1

Technical & Derivatives Report

November 11, 2016

Comments

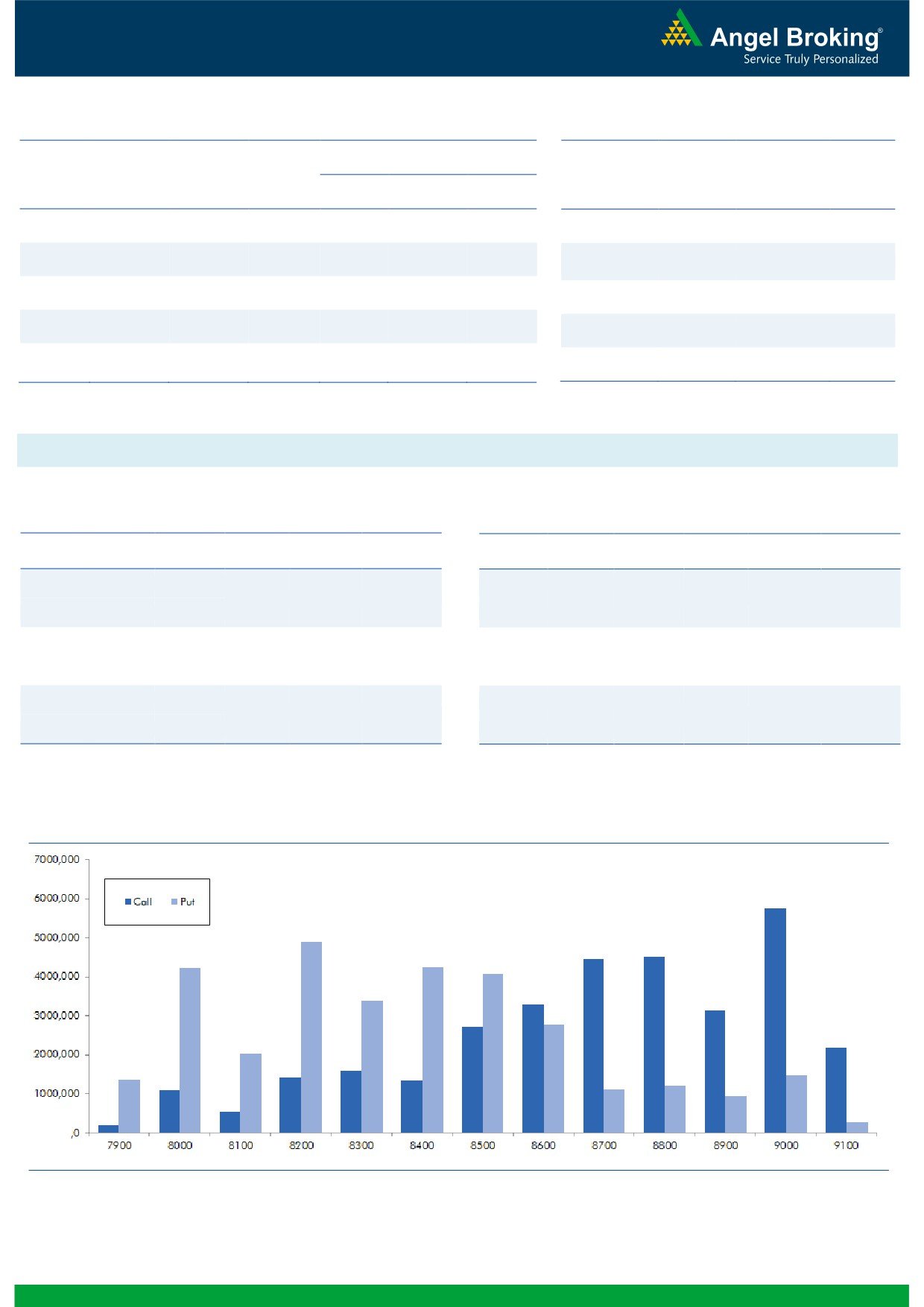

Nifty Vs OI

The Nifty futures open interest has increased by 2.05%

BankNifty futures open interest has increased by 6.63%

as market closed at 8525.75 levels.

The Nifty November future closed with a premium of

27.60 against the premium of 30.70 points in last

trading session. The December series closed at a

premium of 79.20 points.

The Implied Volatility of at the money options has

decreased from 16.20% to 14.21%. At the same time,

the PCR-OI of Nifty has remained unchanged at 0.98

levels.

The total OI of the market is Rs. 2,79,466/- cr. and the

stock futures OI is Rs. 75.187/- cr.

Few of the liquid counters where we have seen high cost

of carry are TATAPOWER, ADANIPOWER, NHPC,

JSWENERGY and JPASSOCIAT.

Views

OI Gainers

Yesterday, FIIs sold in cash market segment; they were

OI

PRICE

SCRIP

OI

PRICE

net sellers of Rs. 733 crores. While, in index futures, they

CHG. (%)

CHG. (%)

were net buyer to the tune of Rs. 205 crores with

IBULHSGFIN

9052000

28.48

702.80

-2.83

marginal change in open interest, indicating blend of

PAGEIND

43300

18.79

15005.65

-6.75

long formation and short covering in yesterday’s trading

TATASTEEL

21982000

18.44

438.55

9.31

www.angelbroking.com

session.

HEROMOTOCO

1489000

17.04

3157.35

-2.68

On Index Options front, FIIs bought of worth Rs. 1261

FEDERALBNK

55869000

14.83

80.65

5.36

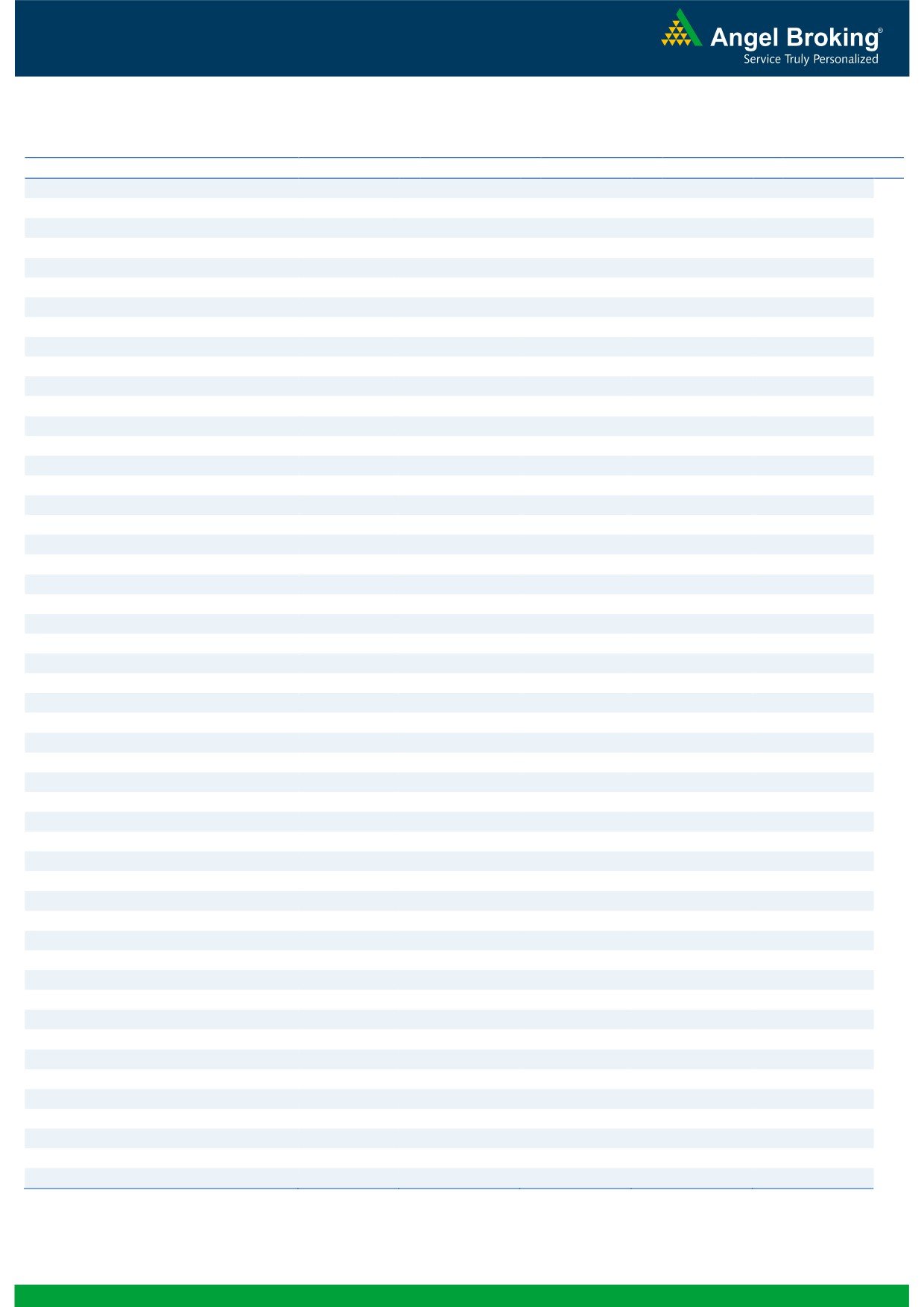

crores with rise in OI. In call options, 8700 and 8800

BHARATFIN

7670000

14.80

742.30

-4.06

strike prices added good amount of positions, followed

IDFCBANK

33984000

14.50

74.70

3.97

by unwinding in 8400 and 8300 strike price. On the

PNB

47901000

14.28

159.90

12.01

other hand in put options, 8500 and 8600 strikes added

huge positions. While, good amount of unwinding was

OI Losers

also visible in 8300 and 8200 put options. Maximum OI

OI

PRICE

in November series is placed at 9000 call and 8200 put

SCRIP

OI

PRICE

CHG. (%)

CHG. (%)

options.

SYNDIBANK

16083000

-11.05

72.95

10.28

In last trading sessions, FIIs were net buyers in Index

UNIONBANK

15072000

-9.92

142.75

10.79

Futures but the quantum remains on the lower side.

APOLLOTYRE

9171000

-9.90

196.10

-0.20

Looking at the past two days data, we don’t see any clear

TITAN

10953000

-9.42

348.85

0.19

indication. Thus, we would like to wait for any relevant

CEATLTD

1287300

-7.87

1331.10

-0.40

follow up action by FIIs. At current juncture, we would

ALBK

16610000

-7.47

74.50

8.52

suggest traders to be light in Index and trade stock

ORIENTBANK

13536000

-7.27

126.90

9.78

specific.

CANBK

10593000

-7.13

322.15

6.97

Historical Volatility

Put-Call Ratio

SCRIP

HV

SCRIP

PCR-OI

PCR-VOL

BANKINDIA

73.47

NIFTY

0.98

1.05

PAGEIND

45.13

BANKNIFTY

1.67

0.91

CIPLA

42.23

RELIANCE

0.43

0.43

TATASTEEL

56.20

ICICIBANK

0.56

0.43

UNIONBANK

65.77

SBIN

0.80

0.42

2

Technical & Derivatives Report

November 11, 2016

FII Statistics for November 10, 2016

Turnover on November 10, 2016

Open Interest

No. of

Turnover

Change

Detail

Buy

Sell

Net

Instrument

Value

Change

Contracts

( in Cr. )

(%)

Contracts

(in Cr.)

(%)

INDEX

INDEX

3452.24

3247.69

204.55

193721

13020.16

(0.39)

345025

24585.14

-46.35

FUTURES

FUTURES

INDEX

INDEX

85471.08

84210.41

1260.67

1114968

73243.17

3.33

8553607

638251.38

0.12

OPTIONS

OPTIONS

STOCK

10056.70

9498.62

558.08

882160

56471.12

0.39

STOCK

FUTURES

714767

50992.32

-10.08

FUTURES

STOCK

STOCK

8289.62

8336.44

(46.82)

107240

7261.82

6.02

OPTIONS

575307

42319.63

-0.85

OPTIONS

TOTAL

107269.63

105293.16

1976.48

2298089

149996.26

1.98

TOTAL

10188706

756148.46

-3.39

Nifty Spot = 8525.75

Lot Size = 75

Bull-Call Spreads

Bear-Put Spreads

Action

Strike

Price

Risk

Reward

BEP

Action

Strike

Price

Risk

Reward

BEP

Buy

8600

71.30

Buy

8500

71.55

34.95

65.05

8634.95

28.55

71.45

8471.45

Sell

8700

36.35

Sell

8400

43.00

Buy

8600

71.30

Buy

8500

71.55

54.45

145.55

8654.45

45.65

154.35

8454.35

Sell

8800

16.85

Sell

8300

25.90

Buy

8700

36.35

Buy

8400

43.00

19.50

80.50

8719.50

17.10

82.90

8382.90

Sell

8800

16.85

Sell

8300

25.90

Note: Above mentioned Bullish or Bearish Spreads in Nifty (November Series) are given as an information and not as a recommendation.

Nifty Put-Call Analysis

3

Technical & Derivatives Report

November 11, 2016

Daily Pivot Levels for Nifty Constituents

Scrips

S2

S1

PIVOT

R1

R2

ACC

1 421

1 439

1 468

1 486

1 515

ADANIPORTS

281

288

293

299

304

AMBUJACEM

226

229

232

235

238

ASIANPAINT

974

993

1 026

1 045

1 078

AUROPHARMA

757

775

790

807

822

AXISBANK

485

496

505

516

524

BAJAJ-AUTO

2 625

2 676

2 761

2 812

2 898

BANKBARODA

151

158

162

169

173

BHEL

136

139

141

143

146

BPCL

651

658

665

672

680

BHARTIARTL

298

303

309

314

320

INFRATEL

353

370

382

399

411

BOSCH

19 722

20 294

21 247

21 819

22 772

CIPLA

536

550

559

573

582

COALINDIA

313

323

330

340

347

DRREDDY

3 224

3 251

3 292

3 319

3 361

EICHERMOT

22 211

22 638

23 319

23 747

24 427

GAIL

440

445

450

455

461

GRASIM

889

904

916

932

943

HCLTECH

761

775

790

805

820

HDFCBANK

1 243

1 261

1 272

1 290

1 301

HDFC

1 280

1 302

1 333

1 356

1 387

HEROMOTOCO

3 020

3 083

3 197

3 260

3 374

HINDALCO

163

169

173

180

184

HINDUNILVR

797

808

825

836

853

ICICIBANK

281

287

293

298

304

IDEA

72

72

73

74

75

INDUSINDBK

1 190

1 202

1 215

1 228

1 241

INFY

918

929

946

956

973

ITC

242

247

250

254

257

KOTAKBANK

802

810

822

831

842

LT

1 387

1 399

1 413

1 426

1 440

LUPIN

1 451

1 473

1 511

1 533

1 571

M&M

1 268

1 295

1 337

1 363

1 405

MARUTI

5 171

5 250

5 384

5 462

5 596

NTPC

153

154

155

156

157

ONGC

267

272

276

280

284

POWERGRID

178

183

187

192

195

RELIANCE

994

1 002

1 015

1 024

1 037

SBIN

258

270

277

289

296

SUNPHARMA

645

656

675

685

704

TCS

2 095

2 125

2 171

2 202

2 248

TATAMTRDVR

334

338

346

351

359

TATAMOTORS

520

527

538

545

556

TATAPOWER

71

73

74

76

77

TATASTEEL

397

417

428

448

459

TECHM

428

435

442

449

456

ULTRACEMCO

3 748

3 795

3 862

3 909

3 977

WIPRO

434

440

445

451

457

YESBANK

1 195

1 243

1 278

1 325

1 361

ZEEL

491

499

510

518

529

4

Technical & Derivatives Report

November 11, 2016

Research Team Tel: 022 - 39357800

For Technical Queries

For Derivatives Queries

DISCLAIMER

Angel Broking Private Limited (hereinafter referred to as “Angel”) is a registered Member of National Stock Exchange of India Limited,

Bombay Stock Exchange Limited and Metropolitan Stock Exchange Limited. It is also registered as a Depository Participant with CDSL

and Portfolio Manager with SEBI. It also has registration with AMFI as a Mutual Fund Distributor. Angel Broking Private Limited is a

registered entity with SEBI for Research Analyst in terms of SEBI (Research Analyst) Regulations, 2014 vide registration number

INH000000164. Angel or its associates has not been debarred/ suspended by SEBI or any other regulatory authority for accessing

/dealing in securities Market. Angel or its associates/analyst has not received any compensation / managed or co-managed public

offering of securities of the company covered by Analyst during the past twelve months.

This document is solely for the personal information of the recipient, and must not be singularly used as the basis of any investment

decision. Nothing in this document should be construed as investment or financial advice. Each recipient of this document should

make such investigations as they deem necessary to arrive at an independent evaluation of an investment in the securities of the

companies referred to in this document (including the merits and risks involved), and should consult their own advisors to determine

the merits and risks of such an investment.

Reports based on technical and derivative analysis center on studying charts of a stock's price movement, outstanding positions and

trading volume, as opposed to focusing on a company's fundamentals and, as such, may not match with a report on a company's

fundamentals. Investors are advised to refer the Fundamental and Technical Research Reports available on our website to evaluate the

contrary view, if any.

The information in this document has been printed on the basis of publicly available information, internal data and other reliable

sources believed to be true, but we do not represent that it is accurate or complete and it should not be relied on as such, as this

document is for general guidance only. Angel Broking Pvt. Limited or any of its affiliates/ group companies shall not be in any way

responsible for any loss or damage that may arise to any person from any inadvertent error in the information contained in this report.

Angel Broking Pvt. Limited has not independently verified all the information contained within this document. Accordingly, we cannot

testify, nor make any representation or warranty, express or implied, to the accuracy, contents or data contained within this document.

While Angel Broking Pvt. Limited endeavors to update on a reasonable basis the information discussed in this material, there may be

regulatory, compliance, or other reasons that prevent us from doing so.

This document is being supplied to you solely for your information, and its contents, information or data may not be reproduced,

redistributed or passed on, directly or indirectly.

Neither Angel Broking Pvt. Limited, nor its directors, employees or affiliates shall be liable for any loss or damage that may arise from

or in connection with the use of this information.

5