Technical & Derivatives Report

May 11, 2016

Sensex (25773) / Nifty (7888)

Exhibit 1: Nifty Daily Chart

Monday’s strong closing beyond the 7850 mark was followed by

an obvious gap up opening. Subsequently, the index remained

within a narrow range amid some intraday volatility. However, the

overall bias remained positive to end the range bound session

almost at the highest point of the day.

Yesterday’s session was just a continuation of Monday’s optimistic

move. During the session, the Nifty managed to surpass the

hourly hurdle of 7890.25 by a small margin. At this juncture, we

do not see any weakness on the chart; but, considering the recent

sideways trend and the incompetence of breaking the stiff barrier

of 8000, we would advise traders to keep booking profits on their

existing longs. The intraday resistance zone is seen around 7920

- 7940 levels; whereas, yesterday’s low of 7837 would now act

as an immediate support for the Nifty.

Key Levels

Support 1 - 7837

Resistance 1 - 7920

Support 2 - 7780

Resistance 2 - 7940

Exhibit 2: Nifty Bank Daily Chart

Nifty Bank Outlook - (16785)

The Nifty Bank index continued its positive momentum and ended

the session with gains of 0.59% over its previous session’s close.

The index moved further higher and seems to be fast

approaching our mentioned target/resistance of 17020 - 17070.

The momentum in Private sector banks, which constitutes majority

of the Nifty Bank index weightage, is indicating positive signs and

hence traders are advised to continue holding long positions in

the index. The intraday support for the index is placed around

16610 and 16500 whereas resistances are seen around 16841

and 17025.

Key Levels

Support 1 - 16610

Resistance 1 - 16841

Support 2 - 16500

Resistance 2 - 17025

1

Technical & Derivatives Report

May 11, 2016

Comments

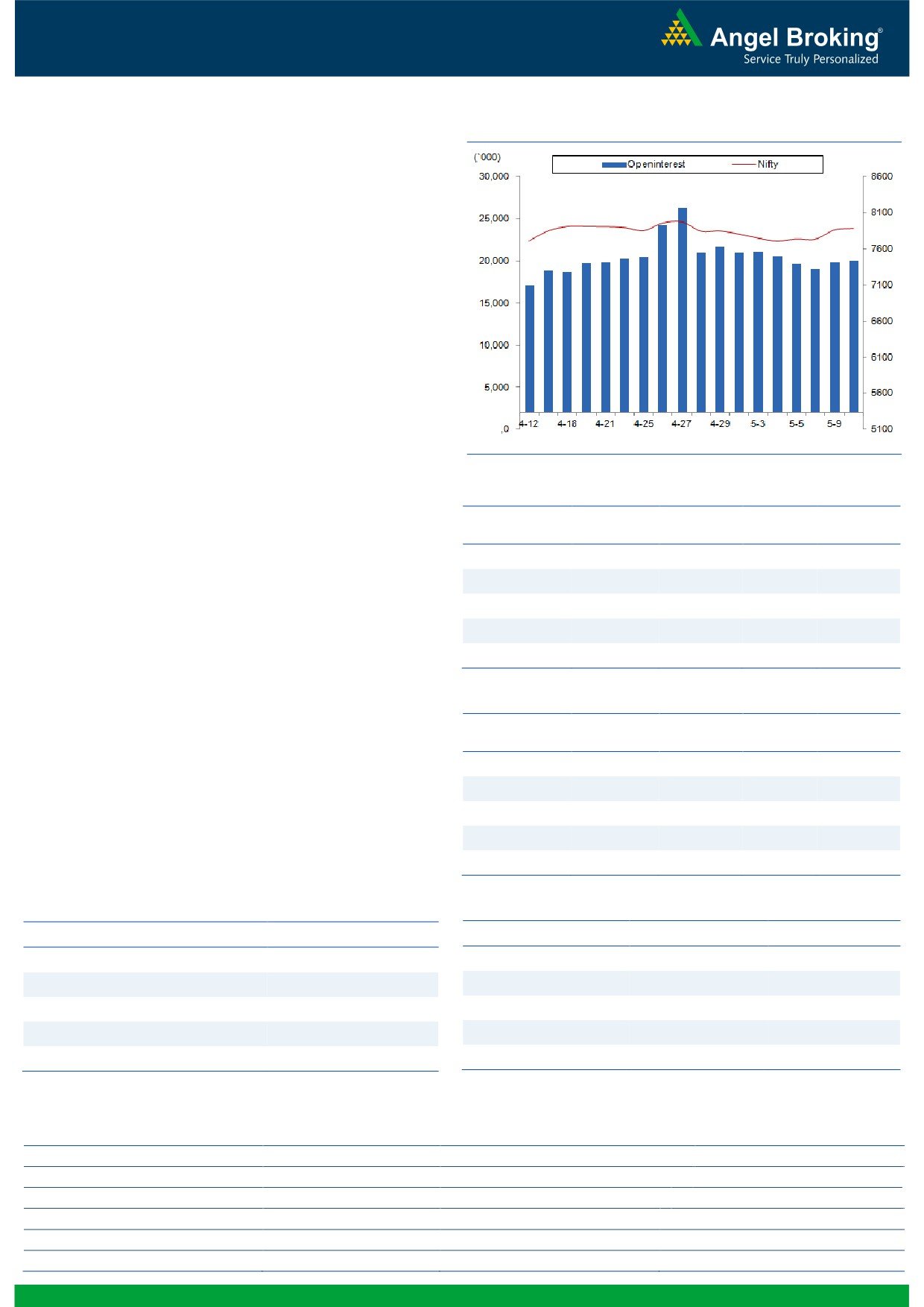

Nifty Vs OI

The Nifty futures open interest has increased by 1.53%

BankNifty futures open interest has increased by 0.11%

as market closed at 7887.80 levels.

The Nifty May future closed at a premium of 31.95

points against a premium of 38.25 points. The June

series closed at a premium of 42.65 points.

The Implied Volatility of at the money options has

decreased from 15.26% to 14.58%.

The total OI of the market is Rs. 2,19,634/- cr. and the

stock futures OI is Rs. 61,022/- cr.

Few of the liquid counters where we have seen high cost

of carry are JPASSOCIAT, UNITECH, ULTRACEMCO,

HDFCBANK and ADANIPOWER.

Views

Yesterday, the FIIs have bought equities worth Rs. 329

OI Gainers

crores. While, they were net seller in Index Futures

OI

PRICE

SCRIP

OI

PRICE

segment to the tune of Rs. 378 crores with marginal rise

CHG. (%)

CHG. (%)

in OI, indicating blend of both short formation and long

CEATLTD

2098600

15.13

1020.20

-1.64

unwinding.

CUMMINSIND

403200

14.48

883.75

2.33

In Index Options front, FIIs bought worth Rs. 287 crores

KSCL

2156250

11.22

406.60

5.61

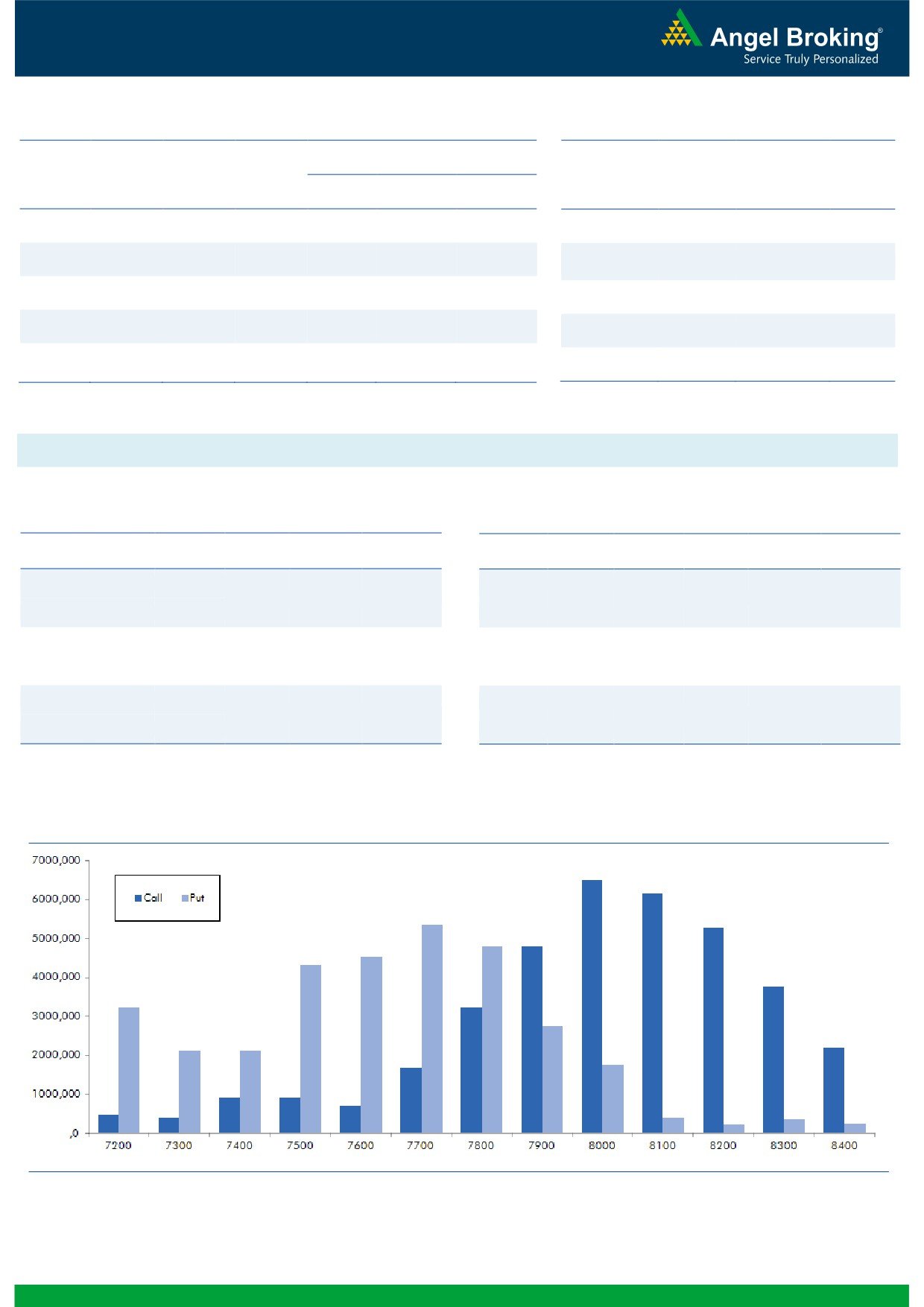

with rise in OI. In call options, 8100 strike has added

HAVELLS

3460000

10.40

347.55

1.59

some amount of fresh positions; while, unwinding wasng.com

APOLLOTYRE

12144000

9.85

153.25

-3.16

seen in 7900 call option. Whereas in put options, 7600

Put option added huge OI, followed by some additions in

OI Losers

7900 and 7800 strikes. Maximum OI in current series is

OI

PRICE

visible at 8000 call and 7700 put options. Considering

SCRIP

OI

PRICE

CHG. (%)

CHG. (%)

the derivative data, 7700 - 7670 levels would act as a

IBREALEST

25470000

-6.75

83.00

4.27

strong support for the index and the gap down opening

CONCOR

398000

-5.60

1305.80

-1.69

(as suggested by SGX Nifty) would provide good risk-

KPIT

1908000

-4.79

164.75

0.46

reward for fresh long positions. Hence, traders are

INDUSINDBK

4707600

-4.09

1059.45

-0.07

advised not to short this market and look for buying

EXIDEIND

7969600

-3.97

148.55

0.64

opportunity on declines.

Historical Volatility

Put-Call Ratio

SCRIP

HV

SCRIP

PCR-OI

PCR-VOL

CADILAHC

31.19

NIFTY

0.92

0.90

KSCL

48.89

BANKNIFTY

1.03

0.83

JSWSTEEL

27.56

ICICIBANK

0.41

0.27

APOLLOHOSP

26.43

RELIANCE

0.38

0.30

DRREDDY

29.79

SBIN

0.53

0.48

Strategy Date

Symbol

Strategy

Status

02-05-2016

NIFTY

Long Strangle

Active

09-05-2016

RELIANCE

Long Put

Active

2

Technical & Derivatives Report

May 11, 2016

FII Statistics for 10-May 2016

Turnover on 10-May 2016

Open Interest

No. of

Turnover

Change

Detail

Buy

Sell

Net

Instrument

Value

Contracts

( in Cr. )

(%)

Contracts

Change (%)

(in Cr.)

INDEX

INDEX

908.76

1286.34

(377.58)

241548

13985.24

0.63

313630

13306.84

-24.35

FUTURES

FUTURES

INDEX

INDEX

19367.21

19079.72

287.49

1094272

64207.27

2.67

2885567

136383.62

-18.72

OPTIONS

OPTIONS

STOCK

3482.68

4214.77

(732.09)

1013401

48982.69

1.41

STOCK

FUTURES

515157

24054.30

-6.44

FUTURES

STOCK

STOCK

2138.04

2113.03

25.01

66689

3256.08

6.95

OPTIONS

286718

13268.57

-7.95

OPTIONS

TOTAL

25896.70

26693.86

(797.16)

2415910

130431.28

2.04

TOTAL

4001072

187013.33

-17.07

Nifty Spot = 7887.80

Lot Size = 75

Bull-Call Spreads

Bear-Put Spreads

Action

Strike

Price

Risk

Reward

BEP

Action

Strike

Price

Risk

Reward

BEP

Buy

7900

106.20

Buy

7900

86.95

45.75

54.25

7945.75

35.40

64.60

7864.60

Sell

8000

60.45

Sell

7800

51.55

Buy

7900

106.20

Buy

7900

86.95

75.05

124.95

7975.05

57.15

142.85

7842.85

Sell

8100

31.15

Sell

7700

29.80

Buy

8000

60.45

Buy

7800

51.55

29.30

70.70

8029.30

21.75

78.25

7778.25

Sell

8100

31.15

Sell

7700

29.80

Note: Above mentioned Bullish or Bearish Spreads in Nifty (May Series) are given as an information and not as a recommendation.

Nifty Put-Call Analysis

3

Technical & Derivatives Report

May 11, 2016

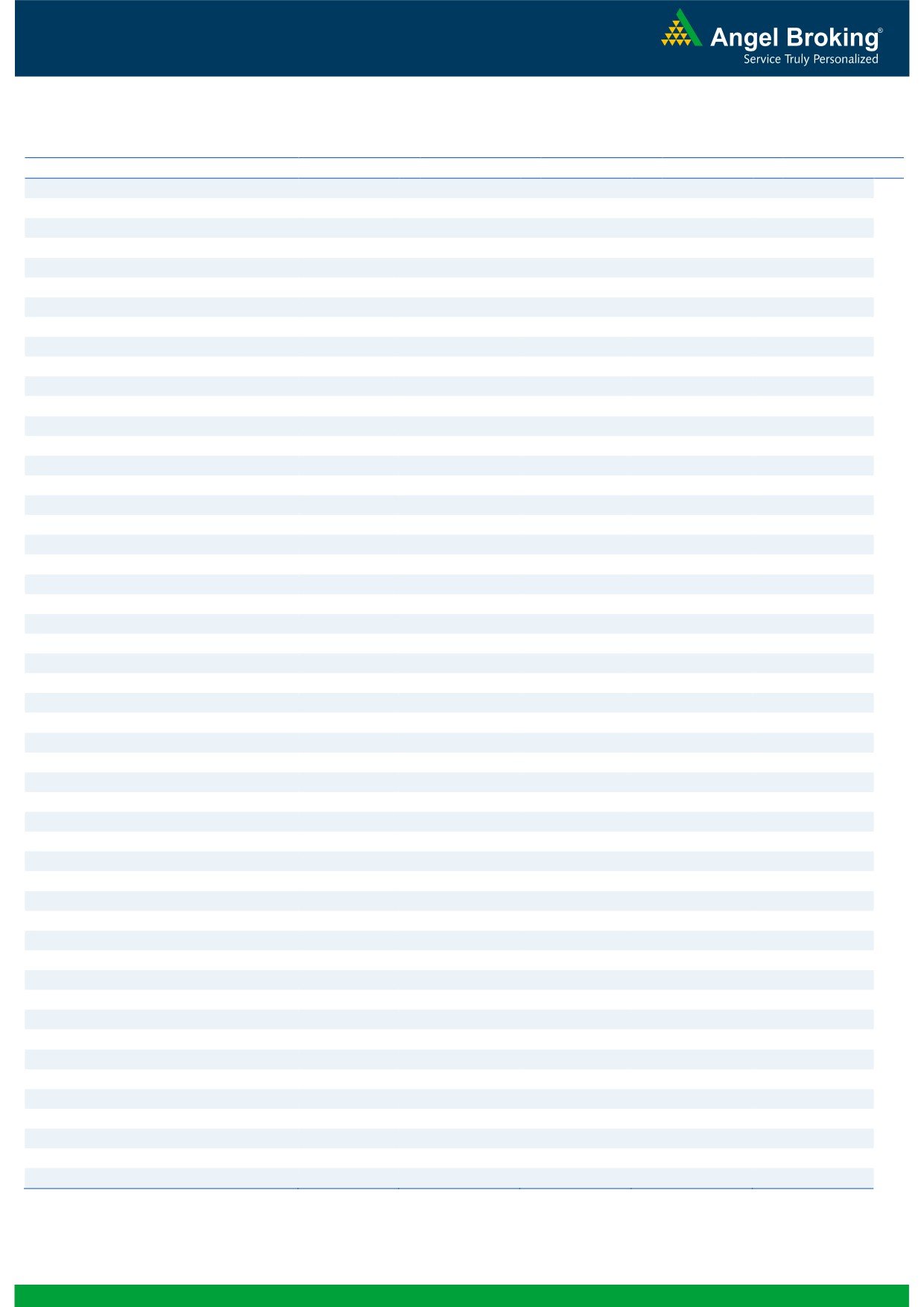

Daily Pivot Levels for Nifty Constituents

Scrips

S2

S1

PIVOT

R1

R2

ACC

1,411

1,437

1,452

1,478

1,492

ADANIPORTS

191

193

196

198

201

AMBUJACEM

215

218

220

223

225

ASIANPAINT

885

892

900

907

915

AUROPHARMA

803

809

816

821

828

AXISBANK

474

481

485

492

496

BAJAJ-AUTO

2,483

2,507

2,523

2,547

2,563

BANKBARODA

150

154

156

160

162

BHEL

124

126

128

131

133

BPCL

914

921

932

938

950

BHARTIARTL

357

363

366

372

375

INFRATEL

370

374

377

382

385

BOSCH

19,426

19,561

19,806

19,941

20,186

CIPLA

530

533

536

540

543

COALINDIA

281

283

285

287

289

DRREDDY

2,800

2,862

2,912

2,974

3,024

EICHERMOT

19,853

20,046

20,272

20,466

20,692

GAIL

375

383

389

397

403

GRASIM

4,019

4,117

4,199

4,297

4,379

HCLTECH

712

715

720

723

728

HDFCBANK

1,131

1,138

1,143

1,150

1,154

HDFC

1,189

1,204

1,212

1,227

1,235

HEROMOTOCO

2,915

2,936

2,953

2,974

2,991

HINDALCO

88

89

90

91

92

HINDUNILVR

836

849

859

872

881

ICICIBANK

220

223

225

228

230

IDEA

111

112

113

114

115

INDUSINDBK

1,045

1,050

1,052

1,057

1,060

INFY

1,189

1,201

1,209

1,221

1,229

ITC

319

321

324

326

328

KOTAKBANK

703

713

721

731

740

LT

1,276

1,298

1,310

1,333

1,345

LUPIN

1,589

1,602

1,611

1,624

1,633

M&M

1,323

1,336

1,346

1,359

1,369

MARUTI

3,797

3,821

3,859

3,883

3,921

NTPC

138

139

141

143

145

ONGC

203

205

209

211

214

POWERGRID

139

141

142

143

145

RELIANCE

975

979

982

986

988

SBIN

185

187

189

191

192

SUNPHARMA

794

798

804

809

815

TCS

2,480

2,501

2,518

2,539

2,556

TATAMTRDVR

273

277

284

288

295

TATAMOTORS

379

384

392

397

406

TATAPOWER

71

72

73

73

74

TATASTEEL

318

323

330

335

342

TECHM

471

477

481

487

491

ULTRACEMCO

3,113

3,139

3,163

3,190

3,214

WIPRO

531

535

538

542

546

YESBANK

932

941

947

956

962

ZEEL

411

414

418

422

426

4

Technical & Derivatives Report

May 11, 2016

Research Team Tel: 022 - 39357800

For Technical Queries

For Derivatives Queries

DISCLAIMER

Angel Broking Private Limited (hereinafter referred to as “Angel”) is a registered Member of National Stock Exchange of India Limited,

Bombay Stock Exchange Limited and MCX Stock Exchange Limited. It is also registered as a Depository Participant with CDSL and

Portfolio Manager with SEBI. It also has registration with AMFI as a Mutual Fund Distributor. Angel Broking Private Limited is a

registered entity with SEBI for Research Analyst in terms of SEBI (Research Analyst) Regulations, 2014 vide registration number

INH000000164. Angel or its associates has not been debarred/ suspended by SEBI or any other regulatory authority for accessing

/dealing in securities Market. Angel or its associates including its relatives/analyst do not hold any financial interest/beneficial

ownership of more than 1% in the company covered by Analyst. Angel or its associates/analyst has not received any compensation /

managed or co-managed public offering of securities of the company covered by Analyst during the past twelve months. Angel/analyst

has not served as an officer, director or employee of company covered by Analyst and has not been engaged in market making activity

of the company covered by Analyst.

This document is solely for the personal information of the recipient, and must not be singularly used as the basis of any investment

decision. Nothing in this document should be construed as investment or financial advice. Each recipient of this document should

make such investigations as they deem necessary to arrive at an independent evaluation of an investment in the securities of the

companies referred to in this document (including the merits and risks involved), and should consult their own advisors to determine

the merits and risks of such an investment.

Reports based on technical and derivative analysis center on studying charts of a stock's price movement, outstanding positions and

trading volume, as opposed to focusing on a company's fundamentals and, as such, may not match with a report on a company's

fundamentals.

The information in this document has been printed on the basis of publicly available information, internal data and other reliable

sources believed to be true, but we do not represent that it is accurate or complete and it should not be relied on as such, as this

document is for general guidance only. Angel Broking Pvt. Limited or any of its affiliates/ group companies shall not be in any way

responsible for any loss or damage that may arise to any person from any inadvertent error in the information contained in this report.

Angel Broking Pvt. Limited has not independently verified all the information contained within this document. Accordingly, we cannot

testify, nor make any representation or warranty, express or implied, to the accuracy, contents or data contained within this document.

While Angel Broking Pvt. Limited endeavors to update on a reasonable basis the information discussed in this material, there may be

regulatory, compliance, or other reasons that prevent us from doing so.

This document is being supplied to you solely for your information, and its contents, information or data may not be reproduced,

redistributed or passed on, directly or indirectly.

Neither Angel Broking Pvt. Limited, nor its directors, employees or affiliates shall be liable for any loss or damage that may arise from

or in connection with the use of this information.

Note: Please refer to the important ‘Stock Holding Disclosure' report on the Angel website (Research Section). Also, please refer to the

latest update on respective stocks for the disclosure status in respect of those stocks. Angel Broking Pvt. Limited and its affiliates may

have investment positions in the stocks recommended in this report.

5