Technical & Derivatives Report

April 11, 2016

Sensex (24674) / Nifty (7555)

Exhibit 1: Nifty Daily Chart

A colossal rally in the month of March was followed by some

decent profit booking in the inaugural week of the new financial

year. If one refers to our previous weekly report, we had clearly

expressed our negative bias on the market and the week’s

corrective move was no surprise to us. The Nifty precisely lost

steam after entering our mentioned resistance zone of 7750 -

7780 and then kept on correcting throughout the week post the

RBI Monetary Policy. In the process, the index sneaked below the

reliable support level of 7580, which coincided with the daily ’20

EMA’. This is a sign of weakness and thus, considering the

negative placement of the daily ‘RSI-Smoothened’ oscillator, we

expect this corrective move to continue towards 7480 - 7405

levels. On the flipside, 7580 - 7640 is likely to act as a strong

hurdle. Going forward, we expect the range bound action to

continue, but with a negative bias. Meanwhile, the corporate

result season (1QFY2017) will kick-off in the forthcoming week

and thus, we may see a lot of stock specific moves, where traders

can look for potential trades.

Key Levels

Support 1 - 7480

Resistance 1 - 7580

Support 2 - 7450

Resistance 2 - 7640

Exhibit 2: Nifty Bank Daily Chart

Nifty Bank Outlook - (15568)

The Nifty Bank index opened on a flat note on Friday and moved

in narrow range throughout the session. Eventually, the banking

index ended the session with the marginal gains of 0.24 percent

over its previous close.

The banking index has failed to cross its multiple resistance zone

of 16300 - 16400 and corrected in last few sessions to form a

‘Bearish Engulfing’ pattern on weekly chart. Due to formation of

mentioned candlestick pattern, a sustainable move below

previous week’s low of 15458 may drag the index 15180 -

15000 levels. Additionally, the ‘RSI -smoothened’ oscillator on

daily chart also depicts negative picture of the index by giving

negative crossover from oversold territory. On the upside, the

near term resistances are seen around 15760 and 15970.

Traders are advised to continue to trade with a cautious view with

proper risk management strategy.

Key Levels

Support 1 - 15458

Resistance 1 - 15760

Support 2 - 15180

Resistance 2 - 15970

1

Technical & Derivatives Report

April 11, 2016

Comments

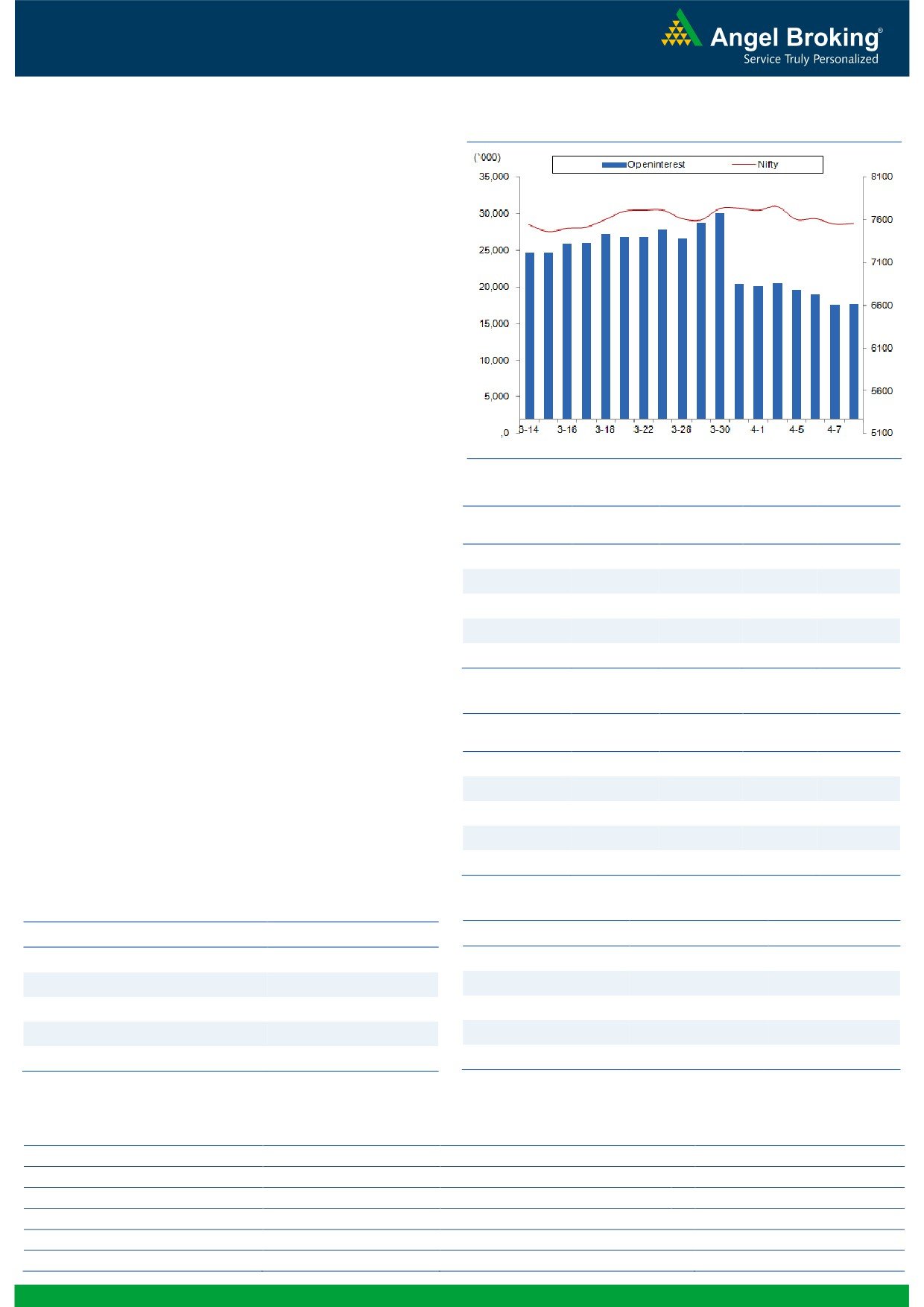

Nifty Vs OI

The Nifty futures open interest has increased by 0.48%

BankNifty futures open interest has increased by 4.08%

as market closed at 7555.20 levels.

The Nifty April future closed at a premium of 22.90

points against a premium of 18.60 points. The May

series closed at a premium of 56.65 points.

The Implied Volatility of at the money options has

decreased from 14.67% to 13.86%.

The total OI of the market is Rs. 1,98,794/- cr. and the

stock futures OI is Rs. 53,000/- cr.

Few of the liquid counters where we have seen high cost

of carry are UNITECH, CESC, FEDERALBNK, JISLJALEQS

and JINDALSTEL.

Views

FIIs were net buyers in cash market segment to the tune

OI Gainers

of Rs. 180 crores. While in Index Futures, they sold of Rs.

OI

PRICE

897 crores with some rise in OI, suggesting blend of

SCRIP

OI

PRICE

CHG. (%)

CHG. (%)

fresh short formation and unwinding of long positions in

AJANTPHARM

439200

24.07

1472.30

4.69

last trading session.

BEML

922000

16.78

892.55

-3.35

In Index Options front, FIIs were net buyers of Rs. 211

JINDALSTEL

41650000

14.89

67.10

11.28

crores with rise in OI. We hardly saw any meaningful

AMBUJACEM

7362600

11.51

226.90

-0.20

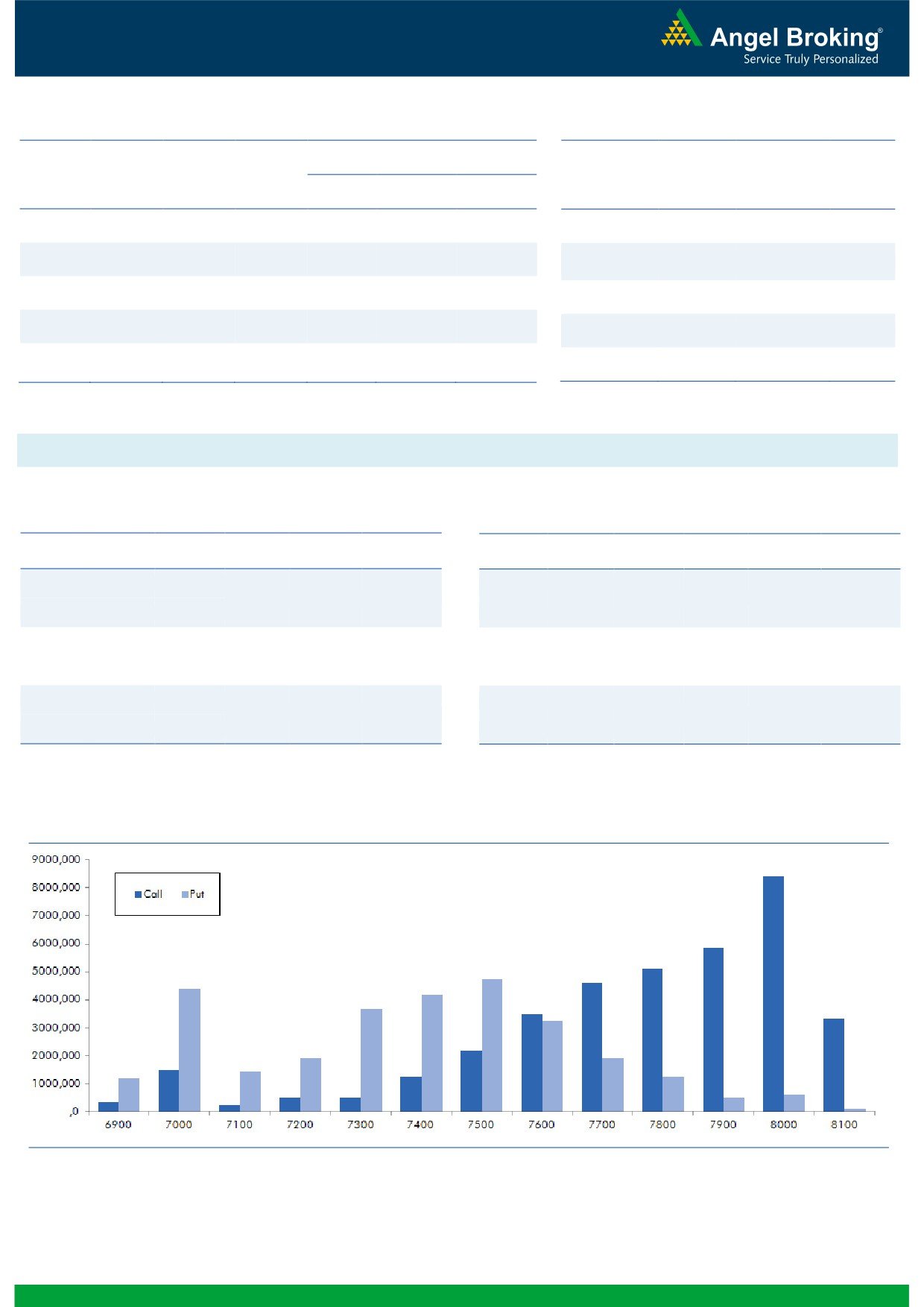

open intrest addition both in call and put options. 7700ng.com

HAVELLS

3700000

9.86

329.65

2.63

call and 7000 put options were comparatively active and

they also added some OI. While, unwinding was visible

OI Losers

in 7500 and 7600 put options, which may be covering

OI

PRICE

by those who were short in these strikes. Maximum OI in

SCRIP

OI

PRICE

CHG. (%)

CHG. (%)

current series is visible in 8000 call and 7500 put

GODREJCP

269600

-11.20

1379.00

1.73

options. Last week, Nifty remained under pressure due to

TATAPOWER

28016000

-9.44

65.90

2.73

good amount of profit booking and some addition of

NTPC

15716000

-7.42

131.75

3.86

shorts. Looking at overall F&O data, we would suggest

HCLTECH

5660400

-4.59

830.15

0.55

traders to avoid forming fresh long till we see any

UCOBANK

9240000

-4.55

38.15

1.46

positive development.

Historical Volatility

Put-Call Ratio

SCRIP

HV

SCRIP

PCR-OI

PCR-VOL

JINDALSTEL

93.14

NIFTY

0.76

0.81

NTPC

33.96

BANKNIFTY

0.59

0.75

AJANTPHARM

41.19

SBIN

0.36

0.29

PAGEIND

63.17

MARUTI

0.34

0.47

INDIACEM

61.04

ICICIBANK

0.38

0.52

Strategy Date

Symbol

Strategy

Status

April 04, 2016

TCS

Ratio Bear Put Spread

Active

2

Technical & Derivatives Report

April 11, 2016

FII Statistics for 08-April 2016

Turnover on 08-April 2016

Open Interest

No. of

Turnover

Change

Detail

Buy

Sell

Net

Instrument

Value

Contracts

( in Cr. )

(%)

Contracts

Change (%)

(in Cr.)

INDEX

INDEX

858.67

1755.95

(897.28)

219735

12097.82

1.32

216016

11402.47

-33.49

FUTURES

FUTURES

INDEX

INDEX

20925.59

20714.38

211.21

1036379

58072.48

1.88

2257878

126389.23

-23.97

OPTIONS

OPTIONS

STOCK

2919.18

3226.84

(307.67)

982351

44989.93

0.15

STOCK

FUTURES

426327

20258.55

-19.64

FUTURES

STOCK

STOCK

2042.74

2080.48

(37.74)

53863

2483.15

9.35

OPTIONS

230789

11182.29

-18.86

OPTIONS

TOTAL

26746.18

27777.65

(1031.47)

2292328

117643.38

1.24

TOTAL

3131010

169232.53

-23.90

Nifty Spot = 7555.20

Lot Size = 75

Bull-Call Spreads

Bear-Put Spreads

Action

Strike

Price

Risk

Reward

BEP

Action

Strike

Price

Risk

Reward

BEP

Buy

7600

87.00

Buy

7500

69.60

39.80

60.20

7639.80

27.00

73.00

7473.00

Sell

7700

47.20

Sell

7400

42.60

Buy

7600

87.00

Buy

7500

69.60

64.60

135.40

7664.60

43.85

156.15

7456.15

Sell

7800

22.40

Sell

7300

25.75

Buy

7700

47.20

Buy

7400

42.60

24.80

75.20

7724.80

16.85

83.15

7383.15

Sell

7800

22.40

Sell

7300

25.75

Note: Above mentioned Bullish or Bearish Spreads in Nifty (April Series) are given as an information and not as a recommendation.

Nifty Put-Call Analysis

3

Technical & Derivatives Report

April 11, 2016

Daily Pivot Levels for Nifty Constituents

Scrips

S2

S1

PIVOT

R1

R2

ACC

1,397

1,420

1,434

1,457

1,471

ADANIPORTS

213

216

218

221

223

AMBUJACEM

218

222

227

230

235

ASIANPAINT

842

847

854

859

866

AUROPHARMA

742

750

755

763

769

AXISBANK

416

419

423

426

430

BAJAJ-AUTO

2,327

2,358

2,382

2,413

2,436

BANKBARODA

141

142

143

144

145

BHEL

321

328

333

339

344

BPCL

116

119

121

125

127

BHARTIARTL

18,735

18,864

18,979

19,108

19,223

INFRATEL

872

886

894

907

915

BOSCH

499

502

506

509

513

CIPLA

276

278

280

282

285

COALINDIA

2,994

3,016

3,053

3,076

3,112

DRREDDY

18,607

18,894

19,092

19,380

19,578

EICHERMOT

332

340

345

352

357

GAIL

3,833

3,908

3,950

4,025

4,067

GRASIM

821

827

832

838

842

HCLTECH

1,062

1,071

1,077

1,086

1,092

HDFCBANK

1,050

1,055

1,059

1,064

1,068

HDFC

2,836

2,876

2,921

2,961

3,007

HEROMOTOCO

84

86

88

89

91

HINDALCO

836

843

853

860

870

HINDUNILVR

217

219

222

224

226

ICICIBANK

106

108

109

110

112

IDEA

928

932

940

944

951

INDUSINDBK

364

367

369

372

375

INFY

1,153

1,159

1,168

1,175

1,184

ITC

317

319

321

323

324

KOTAKBANK

652

659

665

671

677

LT

1,174

1,183

1,190

1,199

1,206

LUPIN

1,477

1,508

1,532

1,563

1,586

M&M

1,197

1,214

1,227

1,244

1,256

MARUTI

3,386

3,408

3,441

3,464

3,497

NTPC

124

128

130

134

136

ONGC

203

205

207

209

211

POWERGRID

140

140

141

141

142

RELIANCE

1,017

1,027

1,041

1,050

1,064

SBIN

179

181

182

185

186

SUNPHARMA

802

807

812

817

822

TCS

364

368

374

378

384

TATAMTRDVR

273

275

278

280

283

TATAMOTORS

63

65

65

67

67

TATAPOWER

316

319

322

325

328

TATASTEEL

2,398

2,415

2,444

2,462

2,491

TECHM

439

447

453

461

466

ULTRACEMCO

3,093

3,126

3,163

3,196

3,233

WIPRO

544

547

549

552

554

YESBANK

825

837

845

858

866

ZEEL

379

384

388

393

396

4

Technical & Derivatives Report

April 11, 2016

Research Team Tel: 022 - 39357800

For Technical Queries

For Derivatives Queries

DISCLAIMER

Angel Broking Private Limited (hereinafter referred to as “Angel”) is a registered Member of National Stock Exchange of India Limited,

Bombay Stock Exchange Limited and MCX Stock Exchange Limited. It is also registered as a Depository Participant with CDSL and

Portfolio Manager with SEBI. It also has registration with AMFI as a Mutual Fund Distributor. Angel Broking Private Limited is a

registered entity with SEBI for Research Analyst in terms of SEBI (Research Analyst) Regulations, 2014 vide registration number

INH000000164. Angel or its associates has not been debarred/ suspended by SEBI or any other regulatory authority for accessing

/dealing in securities Market. Angel or its associates including its relatives/analyst do not hold any financial interest/beneficial

ownership of more than 1% in the company covered by Analyst. Angel or its associates/analyst has not received any compensation /

managed or co-managed public offering of securities of the company covered by Analyst during the past twelve months. Angel/analyst

has not served as an officer, director or employee of company covered by Analyst and has not been engaged in market making activity

of the company covered by Analyst.

This document is solely for the personal information of the recipient, and must not be singularly used as the basis of any investment

decision. Nothing in this document should be construed as investment or financial advice. Each recipient of this document should

make such investigations as they deem necessary to arrive at an independent evaluation of an investment in the securities of the

companies referred to in this document (including the merits and risks involved), and should consult their own advisors to determine

the merits and risks of such an investment.

Reports based on technical and derivative analysis center on studying charts of a stock's price movement, outstanding positions and

trading volume, as opposed to focusing on a company's fundamentals and, as such, may not match with a report on a company's

fundamentals.

The information in this document has been printed on the basis of publicly available information, internal data and other reliable

sources believed to be true, but we do not represent that it is accurate or complete and it should not be relied on as such, as this

document is for general guidance only. Angel Broking Pvt. Limited or any of its affiliates/ group companies shall not be in any way

responsible for any loss or damage that may arise to any person from any inadvertent error in the information contained in this report.

Angel Broking Pvt. Limited has not independently verified all the information contained within this document. Accordingly, we cannot

testify, nor make any representation or warranty, express or implied, to the accuracy, contents or data contained within this document.

While Angel Broking Pvt. Limited endeavors to update on a reasonable basis the information discussed in this material, there may be

regulatory, compliance, or other reasons that prevent us from doing so.

This document is being supplied to you solely for your information, and its contents, information or data may not be reproduced,

redistributed or passed on, directly or indirectly.

Neither Angel Broking Pvt. Limited, nor its directors, employees or affiliates shall be liable for any loss or damage that may arise from

or in connection with the use of this information.

Note: Please refer to the important ‘Stock Holding Disclosure' report on the Angel website (Research Section). Also, please refer to the

latest update on respective stocks for the disclosure status in respect of those stocks. Angel Broking Pvt. Limited and its affiliates may

have investment positions in the stocks recommended in this report.

5