Technical & Derivatives Report

December 09, 2016

Sensex (26694) / Nifty (8247)

Exhibit 1: Nifty Daily Chart

What we saw yesterday was clearly one of the unique

characteristics of the financial market. The RBI shocked everyone

by maintaining a status-quo on Wednesday. Ideally, this should

have been a disappointing development for our markets. But, we

just witnessed an immediate kneejerk reaction for few minutes

and today surprisingly, a gap up opening with a decent margin.

In fact the momentum accelerated as the day progressed, which

led to a smart intraday rally to add 1.79% gains over its previous

close.

Now, going by the previous article, despite all the negative

development, we continued with our optimistic stance on the

market and the strategy played out well for us. The Nifty has

managed to surpass the recent swing high of 8250.80 on an

intraday basis and has eventually closed tad below it. But now, its

matter of time, the Nifty would overcome this hurdle convincingly

and we would see this rally getting extended towards our

mentioned levels 8320 - 8380. Traders holding long positions

should now trail their stop losses higher at 8055. For the coming

session, 8162 - 8125 would be seen as an immediate support

zone for the index.

Key Levels

Support 1 - 8162

Resistance 1 - 8320

Support 2 - 8125

Resistance 2 - 8380

Nifty Bank Outlook - (18515)

Exhibit 2: Nifty Bank Daily Chart

Along with the Nifty index, the Nifty Bank index too opened

yesterday's session with a gap up opening of over 100 points and

traded with positive bias throughout the session. At close, the

index posted gains of 1.54 percent.

Post last hour of correction on Wednesday, the indices took many

market participants to a surprise with a gap up opening

yesterday. However, as we have been maintaining an optimistic

view since last few days, yesterday's upmove just added to our

conviction on the probability of a pullback rally. The 'RSI

Smoothened' oscillator has given a positive crossover in the

oversold territory, which should further support the pullback

move. Hence, we continue with our advice to avoid creating short

positions and trade with positive bias. The near term supports for

the Nifty Bank index are placed around 18235 and 18100

whereas resistances are seen around 18645 and 18955.

Key Levels

Support 1 - 18235

Resistance 1 - 18645

Support 2 - 18100

Resistance 2 - 18955

1

Technical & Derivatives Report

December 09, 2016

Comments

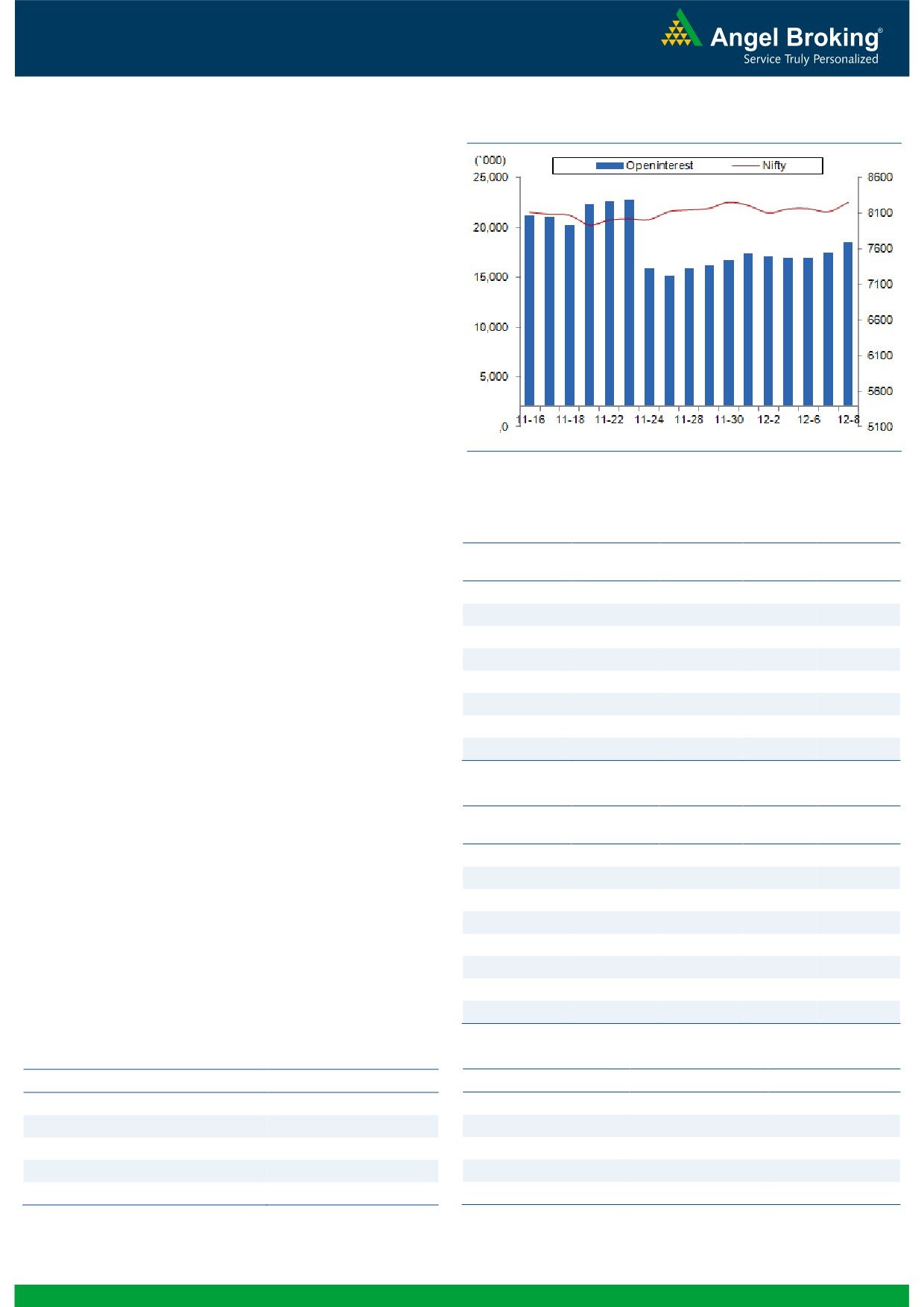

Nifty Vs OI

The Nifty futures open interest has increased by 6.57%

BankNifty futures open interest has decreased by 12.53%

as market closed at 8246.85 levels.

The Nifty December future closed with a premium of

8.80 against the premium of 21.03 points in last trading

session. The January series closed at a premium of

40.65 points.

The Implied Volatility of at the money options has

decreased from 14.78% to 13.08%. At the same time,

the PCR-OI of Nifty has increased from 1.05 to 1.09

levels.

The total OI of the market is Rs. 2,65,132/- cr. and the

stock futures OI is Rs. 68,828/- cr.

Few of the liquid counters where we have seen high cost

of carry are SOUTHBANK, IDBI, ADANIENT,

CROMPGREAV and CONCOR.

Views

OI Gainers

FIIs were net buyers in both cash market segment and

OI

PRICE

SCRIP

OI

PRICE

index futures. They bought equities to the tune of Rs. 699

CHG. (%)

CHG. (%)

crores. While, in index futures they were net buyers worth

CROMPGREAV

22884000

63.55

61.90

-5.54

Rs. 1441 crores with rise in open interest, indicating

OIL

1303900

21.75

440.85

1.34

continuation of long formation in previous trading

TATASTEEL

23870000

20.97

431.30

4.52

www.angelbroking.com

session.

COLPAL

576100

19.80

922.10

0.30

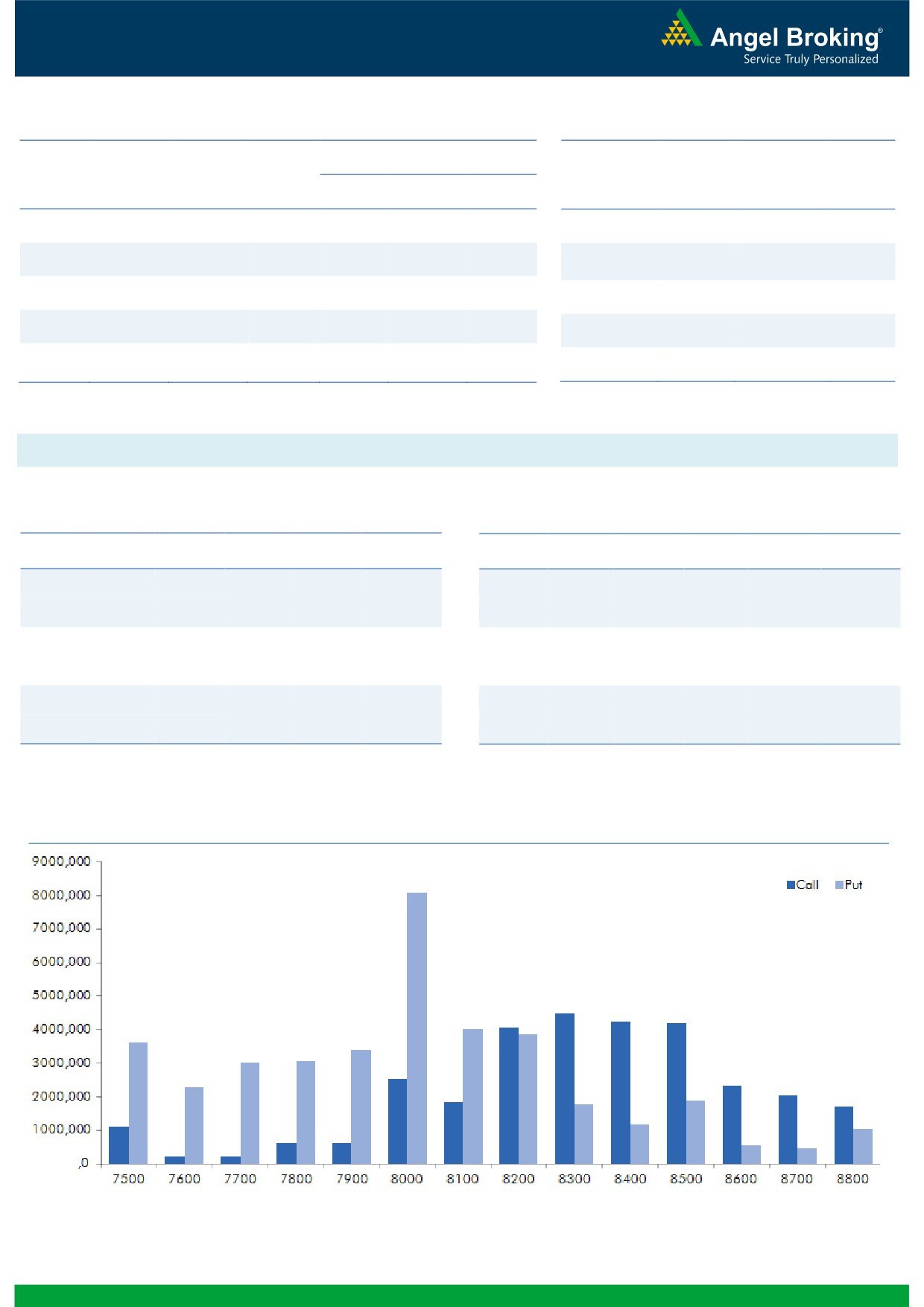

In Index options segment, FIIs were net buyers of Rs. 843

BHARATFORG

4041600

9.49

963.50

5.55

crores with rise in open interest. We hardly saw any

VEDL

53210500

9.01

242.95

4.17

meaningful activity in call option. While on the other

KTKBANK

19093875

8.83

104.50

-1.36

hand, 8100 and 8200 put options were quite active and

JINDALSTEL

55215000

8.74

73.10

2.30

they also added decent amount of open interest. Highest

OI in current series is visible in 8300 call and 8000 put

OI Losers

option.

OI

PRICE

SCRIP

OI

PRICE

In past few days, we witnessed decent OI addition in

CHG. (%)

CHG. (%)

Nifty and most of them are longs. Despite market trading

SUNTV

8782000

-5.49

481.20

2.19

in a range, FIIs have been continuously adding good

OFSS

190500

-5.44

3119.75

1.37

amount of long positions in Index futures. In addition, we

COALINDIA

11527700

-4.97

312.10

1.84

are also witnessing buying figures in equities since last

IRB

10842500

-4.60

191.75

3.14

three trading sessions. Considering above data, we

TATACHEM

4458000

-4.31

499.75

1.68

believe Nifty may continue to show strength and can test

RELCAPITAL

11460000

-3.69

436.85

2.88

8300-8350. Thus, we advise traders to trade with

BAJFINANCE

6390000

-3.67

911.55

2.44

positive bias.

AMBUJACEM

11925000

-3.64

213.90

1.83

Historical Volatility

Put-Call Ratio

SCRIP

HV

SCRIP

PCR-OI

PCR-VOL

BEML

50.13

NIFTY

1.09

1.07

BHARATFORG

44.62

BANKNIFTY

1.13

0.90

HAVELLS

53.37

SBIN

0.57

0.50

BAJAJ-AUTO

29.37

INFY

0.54

0.58

MOTHERSUMI

52.31

RELIANCE

0.54

0.47

2

Technical & Derivatives Report

December 09, 2016

FII Statistics for December 08, 2016

Turnover on December 08, 2016

Open Interest

No. of

Turnover

Change

Detail

Buy

Sell

Net

Instrument

Value

Change

Contracts

( in Cr. )

(%)

Contracts

(in Cr.)

(%)

INDEX

INDEX

2680.12

1239.61

1440.51

200963

12759.53

8.50

241865

16027.55

-11.08

FUTURES

FUTURES

INDEX

INDEX

38171.01

37327.80

843.21

1034952

65030.59

2.35

6093589

429105.62

52.21

OPTIONS

OPTIONS

STOCK

5769.77

5558.70

211.07

867364

53790.53

0.99

STOCK

FUTURES

439684

29926.14

3.62

FUTURES

STOCK

STOCK

2954.26

2970.74

(16.48)

71512

4657.94

4.56

OPTIONS

245693

17452.22

2.30

OPTIONS

TOTAL

49575.17

47096.85

2478.32

2174791

136238.60

2.41

TOTAL

7020831

492511.53

42.39

Nifty Spot = 8246.85

Lot Size = 75

Bull-Call Spreads

Bear-Put Spreads

Action

Strike

Price

Risk

Reward

BEP

Action

Strike

Price

Risk

Reward

BEP

Buy

8300

78.90

Buy

8200

84.30

38.10

61.90

8338.10

27.50

72.50

8172.50

Sell

8400

40.80

Sell

8100

56.80

Buy

8300

78.90

Buy

8200

84.30

60.10

139.90

8360.10

45.80

154.20

8154.20

Sell

8500

18.80

Sell

8000

38.50

Buy

8400

40.80

Buy

8100

56.80

22.00

78.00

8422.00

18.30

81.70

8081.70

Sell

8500

18.80

Sell

8000

38.50

Note: Above mentioned Bullish or Bearish Spreads in Nifty (December Series) are given as an information and not as a recommendation.

Nifty Put-Call Analysis

3

Technical & Derivatives Report

December 09, 2016

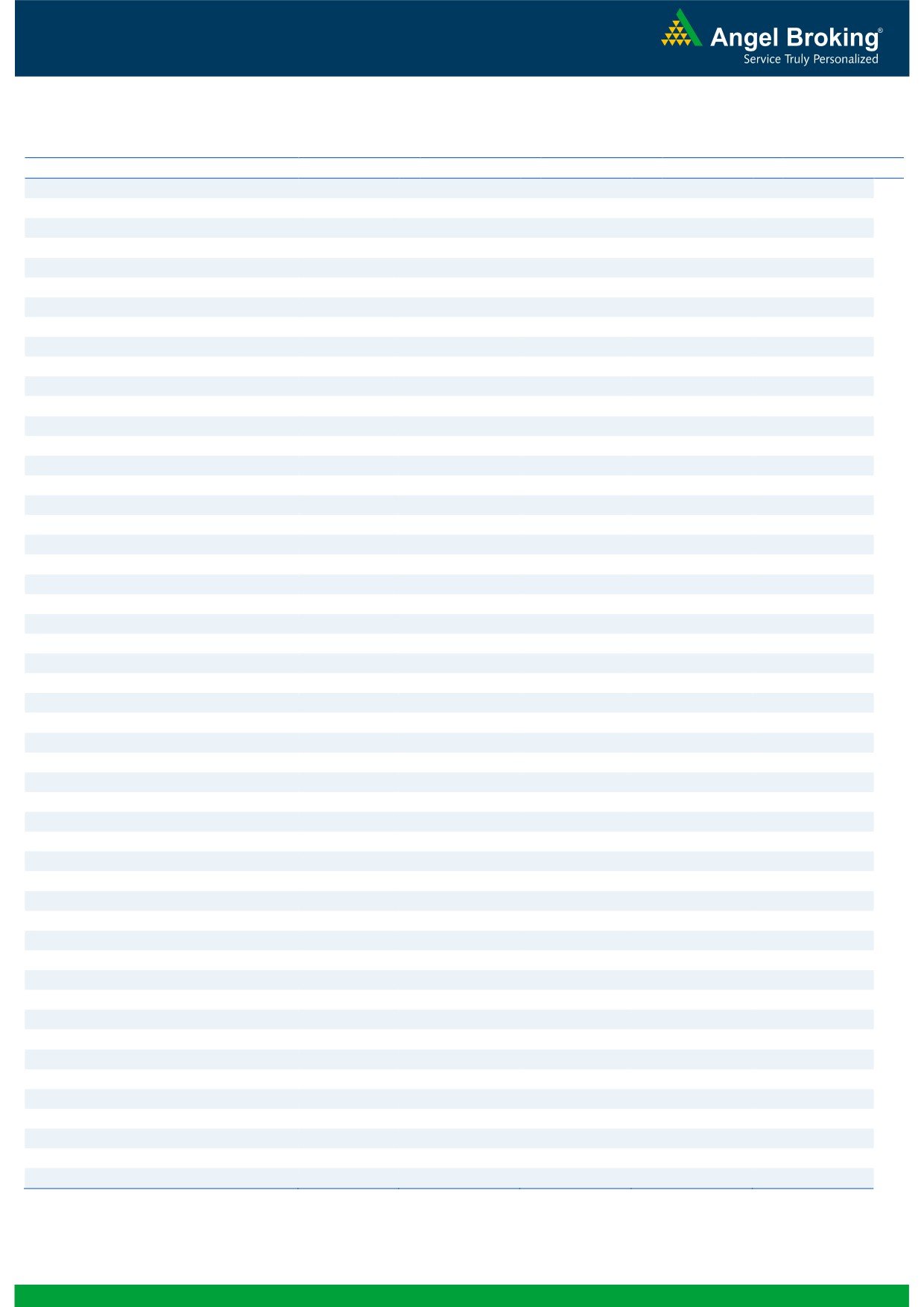

Daily Pivot Levels for Nifty Constituents

Scrips

S2

S1

PIVOT

R1

R2

ACC

1,340

1,349

1,360

1,370

1,381

ADANIPORTS

277

282

285

291

294

AMBUJACEM

207

211

214

217

220

ASIANPAINT

920

928

938

946

956

AUROPHARMA

709

715

721

727

734

AXISBANK

444

447

450

452

455

BAJAJ-AUTO

2,687

2,733

2,761

2,807

2,835

BANKBARODA

156

157

158

160

161

BHEL

127

128

129

130

131

BPCL

628

633

637

643

647

BHARTIARTL

326

329

332

335

337

INFRATEL

360

365

374

379

388

BOSCH

19,975

20,449

20,874

21,348

21,774

CIPLA

565

574

579

587

592

COALINDIA

303

307

311

315

318

DRREDDY

3,100

3,156

3,199

3,255

3,297

EICHERMOT

22,691

22,971

23,335

23,615

23,979

GAIL

424

427

432

435

440

GRASIM

871

883

891

902

911

HCLTECH

778

786

792

800

806

HDFCBANK

1,179

1,189

1,197

1,208

1,216

HDFC

1,261

1,275

1,285

1,300

1,310

HEROMOTOCO

3,218

3,272

3,299

3,353

3,381

HINDALCO

174

177

179

182

184

HINDUNILVR

831

837

842

848

853

ICICIBANK

256

260

261

265

266

IDEA

75

76

77

77

78

INDUSINDBK

1,070

1,084

1,095

1,110

1,121

INFY

964

974

980

990

996

ITC

225

229

232

236

239

KOTAKBANK

730

739

745

755

761

LT

1,354

1,361

1,368

1,375

1,382

LUPIN

1,496

1,510

1,519

1,533

1,542

M&M

1,175

1,189

1,202

1,217

1,229

MARUTI

5,125

5,180

5,225

5,280

5,325

NTPC

159

161

163

165

167

ONGC

296

300

302

306

308

POWERGRID

180

183

184

187

189

RELIANCE

998

1,009

1,015

1,026

1,033

SBIN

257

258

259

261

262

SUNPHARMA

650

663

671

684

692

TCS

2,146

2,171

2,185

2,210

2,224

TATAMTRDVR

290

297

301

309

313

TATAMOTORS

446

453

459

467

472

TATAPOWER

74

75

75

76

76

TATASTEEL

412

422

427

438

443

TECHM

454

459

462

467

471

ULTRACEMCO

3,545

3,569

3,600

3,624

3,655

WIPRO

452

456

457

461

463

YESBANK

1,184

1,200

1,209

1,225

1,235

ZEEL

439

446

450

457

462

4

Technical & Derivatives Report

December 09, 2016

Research Team Tel: 022 - 39357800

For Technical Queries

For Derivatives Queries

DISCLAIMER

Angel Broking Private Limited (hereinafter referred to as “Angel”) is a registered Member of National Stock Exchange of India Limited,

Bombay Stock Exchange Limited and Metropolitan Stock Exchange Limited. It is also registered as a Depository Participant with CDSL

and Portfolio Manager with SEBI. It also has registration with AMFI as a Mutual Fund Distributor. Angel Broking Private Limited is a

registered entity with SEBI for Research Analyst in terms of SEBI (Research Analyst) Regulations, 2014 vide registration number

INH000000164. Angel or its associates has not been debarred/ suspended by SEBI or any other regulatory authority for accessing

/dealing in securities Market. Angel or its associates/analyst has not received any compensation / managed or co-managed public

offering of securities of the company covered by Analyst during the past twelve months.

This document is solely for the personal information of the recipient, and must not be singularly used as the basis of any investment

decision. Nothing in this document should be construed as investment or financial advice. Each recipient of this document should

make such investigations as they deem necessary to arrive at an independent evaluation of an investment in the securities of the

companies referred to in this document (including the merits and risks involved), and should consult their own advisors to determine

the merits and risks of such an investment.

Reports based on technical and derivative analysis center on studying charts of a stock's price movement, outstanding positions and

trading volume, as opposed to focusing on a company's fundamentals and, as such, may not match with a report on a company's

fundamentals. Investors are advised to refer the Fundamental and Technical Research Reports available on our website to evaluate the

contrary view, if any.

The information in this document has been printed on the basis of publicly available information, internal data and other reliable

sources believed to be true, but we do not represent that it is accurate or complete and it should not be relied on as such, as this

document is for general guidance only. Angel Broking Pvt. Limited or any of its affiliates/ group companies shall not be in any way

responsible for any loss or damage that may arise to any person from any inadvertent error in the information contained in this report.

Angel Broking Pvt. Limited has not independently verified all the information contained within this document. Accordingly, we cannot

testify, nor make any representation or warranty, express or implied, to the accuracy, contents or data contained within this document.

While Angel Broking Pvt. Limited endeavors to update on a reasonable basis the information discussed in this material, there may be

regulatory, compliance, or other reasons that prevent us from doing so.

This document is being supplied to you solely for your information, and its contents, information or data may not be reproduced,

redistributed or passed on, directly or indirectly.

Neither Angel Broking Pvt. Limited, nor its directors, employees or affiliates shall be liable for any loss or damage that may arise from

or in connection with the use of this information.

5