Technical & Derivatives Report

November 09, 2016

Sensex (27591) / Nifty (8544)

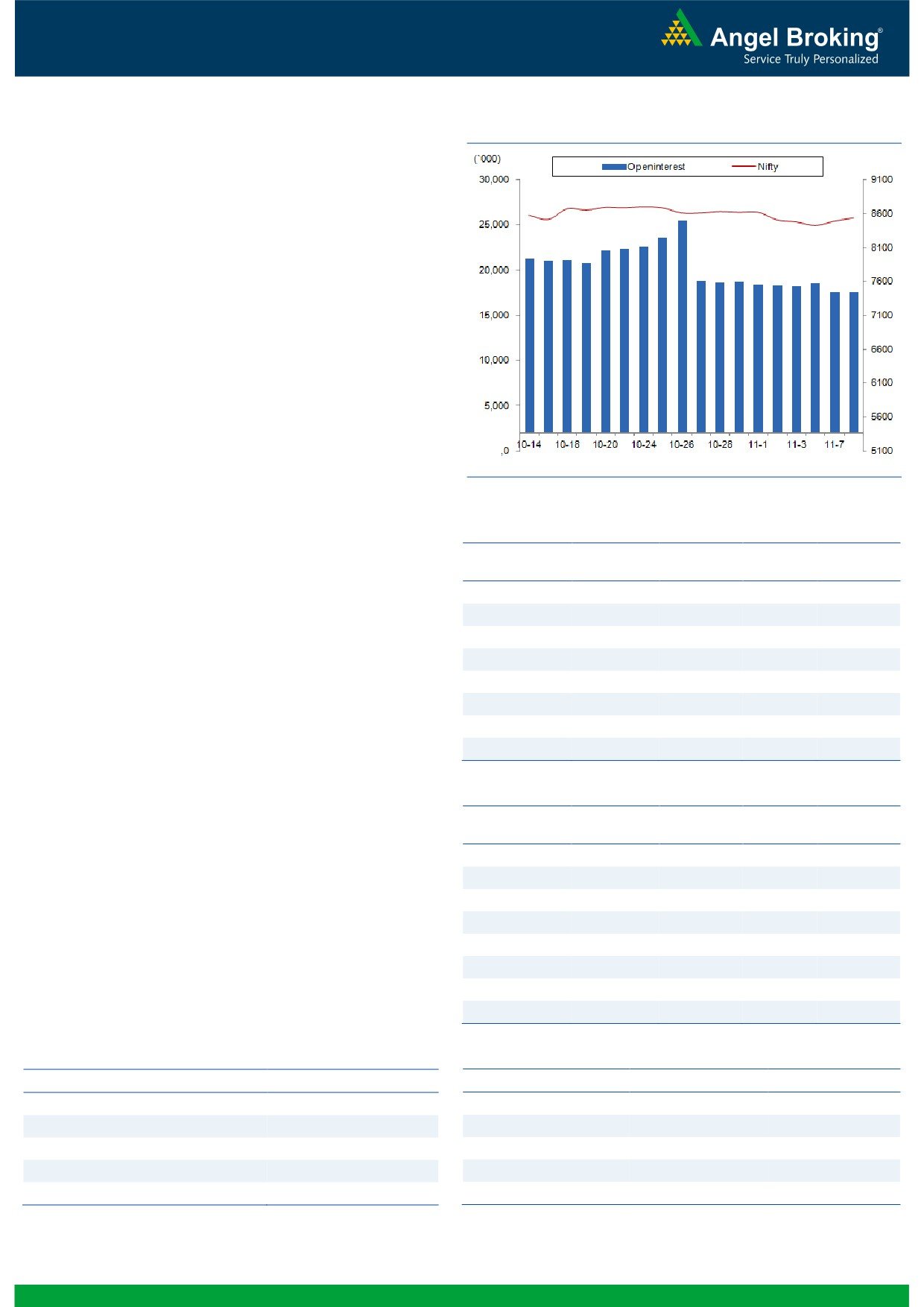

Exhibit 1: Nifty Daily Chart

Yesterday too, our markets opened higher but this time it was with

a very small margin. Subsequently, we witnessed a gradual slide

from morning highs; however, we witnessed a strong surge

during the penultimate hour which lasted till the closing trade of

the session. In the process, the Nifty regained all momentum and

eventually closed around the opening level with decent gains of

0.55%.

Markets remained range bound ahead of the U.S. Presidential

election, which may have an immediate impact across the globe.

Going ahead, an outcome from this event would probably dictate

the near term direction. But, technically speaking, we still do not

see any major sign of reversal. As far as levels are concerned,

8620 - 8682 would be seen as immediate resistance; whereas,

on the other hand, a failure to surpass these levels (post the

election outcome) may result into a continuation of the recent

down move to test lower levels. Now, tracking the SGX Nifty, if the

index stays below 8400 then we may see immediate correction

towards 8287 - 8200, which we have been expecting since last

few weeks.

Key Levels

Support 1 - 8287

Resistance 1 - 8620

Support 2 - 8200

Resistance 2 - 8682

Exhibit 2: Nifty Bank Daily Chart

Nifty Bank Outlook - (19501)

The Nifty Bank index opened yesterday's session with a gap up

opening. However, owing to the volatility, the index filled the gap

during intraday and recovered during the last hour to conclude

the session with formation of a 'Doji' candle.

As we had mentioned in our yesterday's report, the Nifty Bank

index has recently pulled back higher from the '89 DEMA'

support. However, the recent 'Lower Top' formation has also

indicated that bears are showing their dominance on pullback

rallies. Hence, for positional trading, a closing beyond the broad

range of 19000 - 19700 will lead to directional movement.

Although the outcome of the U.S. Presidential Election can lead to

higher volatility in our markets along with the global indices,

traders are advised to keep track of the above-mentioned levels

and trade with proper risk management. The intraday supports

for the Nifty Bank index are placed around 19225 and 19000

whereas resistances are seen around 19700 and 19920.

Key Levels

Support 1 - 19225

Resistance 1 - 19700

Support 2 - 19000

Resistance 2 - 19920

1

Technical & Derivatives Report

November 09, 2016

Comments

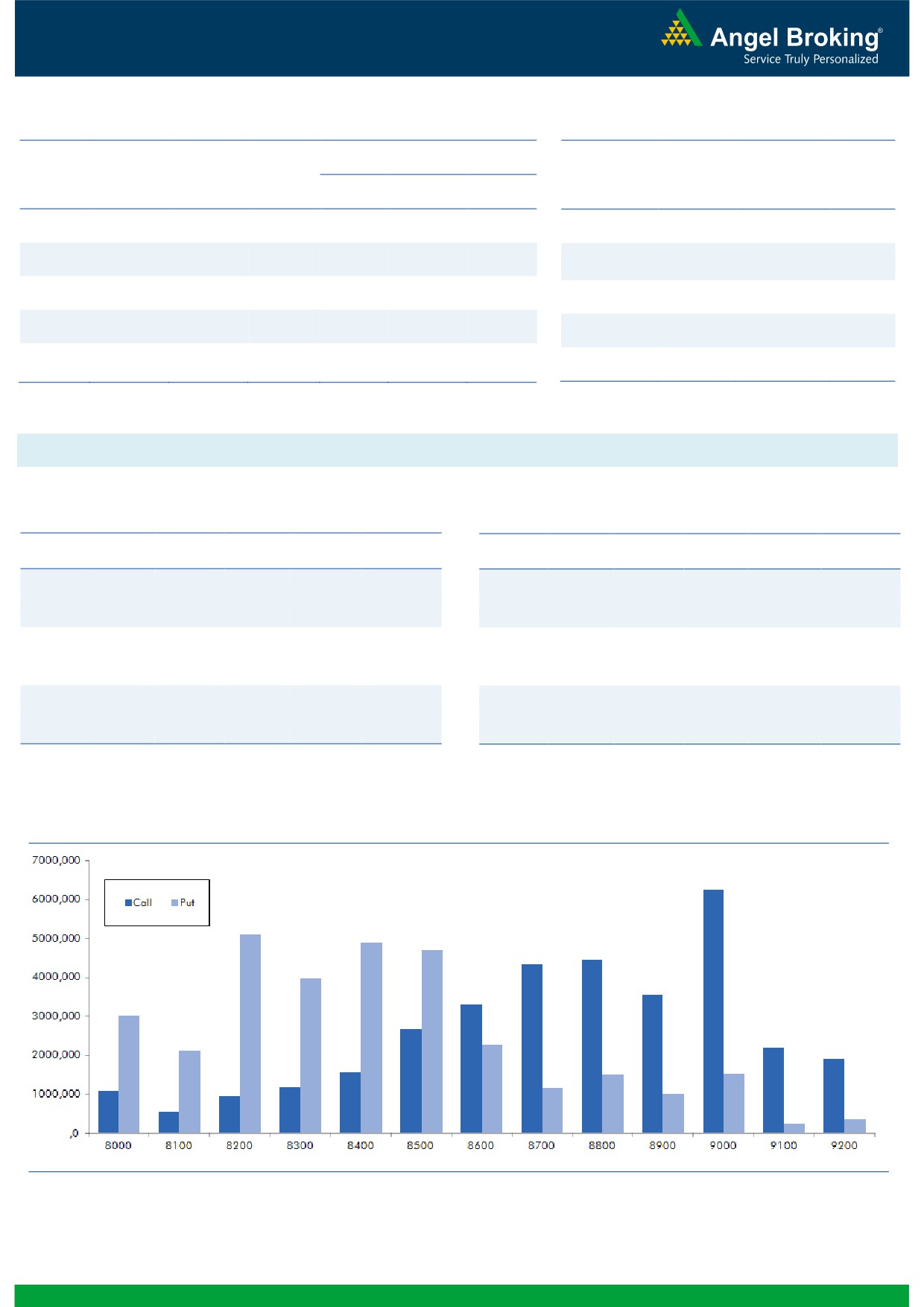

Nifty Vs OI

The Nifty futures open interest has increased by 0.01%

BankNifty futures open interest has decreased by 5.19%

as market closed at 8543.55 levels.

The Nifty November future closed with a premium of

23.00 against the premium of 22.95 points in last

trading session. The December series closed at a

premium of 72.00 points.

The Implied Volatility of at the money options has

increased from 16.86% to 17.73%. At the same time, the

PCR-OI of Nifty has increased from 0.93 to 0.96 levels.

The total OI of the market is Rs. 2,57,464/- cr. and the

stock futures OI is Rs. 74,857/- cr.

Few of the liquid counters where we have seen high cost

of carry are CESC, ADANIPOWER, NHPC, SINTEX and

PTC.

Views

OI Gainers

FIIs activity in cash market segment was subdued. While,

OI

PRICE

SCRIP

OI

PRICE

CHG. (%)

CHG. (%)

in index futures, they were net seller to the tune of Rs.

CEATLTD

1531600

18.66

1311.85

7.11

302 crores with marginal change in open interest,

UNIONBANK

16112000

11.46

130.05

-2.44

indicating blend of long unwinding and fresh short

CROMPGREAV

11892000

9.62

83.40

-2.91

www.angelbroking.com

formation in yesterday’s trading session.

CADILAHC

2931200

5.90

376.25

-2.41

On Index Options front, FIIs sold of worth Rs. 797 crores

HINDZINC

7763200

5.89

260.45

-1.12

with some rise in OI. In call options, 8700 and 8800

DABUR

10472500

5.78

297.00

0.19

strikes added good amount of positions and we believe

SUNPHARMA

33153200

5.55

638.30

-2.97

these are mainly short positions formed by FIIs. While,

MOTHERSUMI

11087500

4.72

312.15

-1.30

8300-8500 put options also added good amount of

positions. Maximum OI in November series is placed at

9000 call and 8200 put options.

OI Losers

Since past few trading sessions, we have been

OI

PRICE

SCRIP

OI

PRICE

CHG. (%)

CHG. (%)

continuously witnessing good amount of long unwinding

BEML

822500

-9.57

913.35

2.79

and some fresh short formation in Index Futures by

UPL

5503200

-9.47

685.00

2.49

stronger hands. They also bought good amount of put

PNB

40124000

-7.49

141.15

0.43

options during these period. The above data siuggests

TECHM

9324700

-5.94

454.85

1.96

market has limited upside. While, today’s global market

TVSMOTOR

5400000

-5.82

391.55

0.19

also suggests Nifty to open gap down.Thus, traders who

DCBBANK

1795500

-5.67

129.85

0.62

are short in market should hold on to their positions as

Nifty may test 8200 levels in near term.

COLPAL

679000

-5.55

979.95

0.37

HINDALCO

32788000

-5.53

168.05

0.15

Historical Volatility

Put-Call Ratio

SCRIP

HV

SCRIP

PCR-OI

PCR-VOL

TATAMOTORS

46.92

NIFTY

0.96

0.86

CEATLTD

60.43

BANKNIFTY

1.15

0.78

TATAMTRDVR

46.90

ICICIBANK

0.64

0.67

GAIL

29.77

RELIANCE

0.42

0.44

JSWSTEEL

35.50

SBIN

0.53

0.69

2

Technical & Derivatives Report

November 09, 2016

FII Statistics for November 08, 2016

Turnover on November 08, 2016

Open Interest

No. of

Turnover

Change

Detail

Buy

Sell

Net

Instrument

Value

Change

Contracts

( in Cr. )

(%)

Contracts

(in Cr.)

(%)

INDEX

INDEX

1207.72

1510.20

(302.48)

187033

12478.57

0.47

185903

12779.42

4.88

FUTURES

FUTURES

INDEX

INDEX

29016.76

29813.86

(797.10)

1023642

67162.68

4.55

2729205

189473.42

27.51

OPTIONS

OPTIONS

STOCK

6562.84

6016.49

546.34

877515

55720.38

(0.51)

STOCK

FUTURES

516951

35298.57

14.43

FUTURES

STOCK

STOCK

4985.34

4993.65

(8.32)

93616

6271.37

8.47

OPTIONS

373978

26316.88

17.82

OPTIONS

TOTAL

41772.65

42334.20

(561.54)

2181806

141633.00

2.26

TOTAL

3806037

263868.29

23.33

Nifty Spot = 8543.55

Lot Size = 75

Bull-Call Spreads

Bear-Put Spreads

Action

Strike

Price

Risk

Reward

BEP

Action

Strike

Price

Risk

Reward

BEP

Buy

8600

100.95

Buy

8500

95.65

41.65

58.35

8641.65

29.95

70.05

8470.05

Sell

8700

59.30

Sell

8400

65.70

Buy

8600

100.95

Buy

8500

95.65

69.85

130.15

8669.85

50.35

149.65

8449.65

Sell

8800

31.10

Sell

8300

45.30

Buy

8700

59.30

Buy

8400

65.70

28.20

71.80

8728.20

20.40

79.60

8379.60

Sell

8800

31.10

Sell

8300

45.30

Note: Above mentioned Bullish or Bearish Spreads in Nifty (November Series) are given as an information and not as a recommendation.

Nifty Put-Call Analysis

3

Technical & Derivatives Report

November 09, 2016

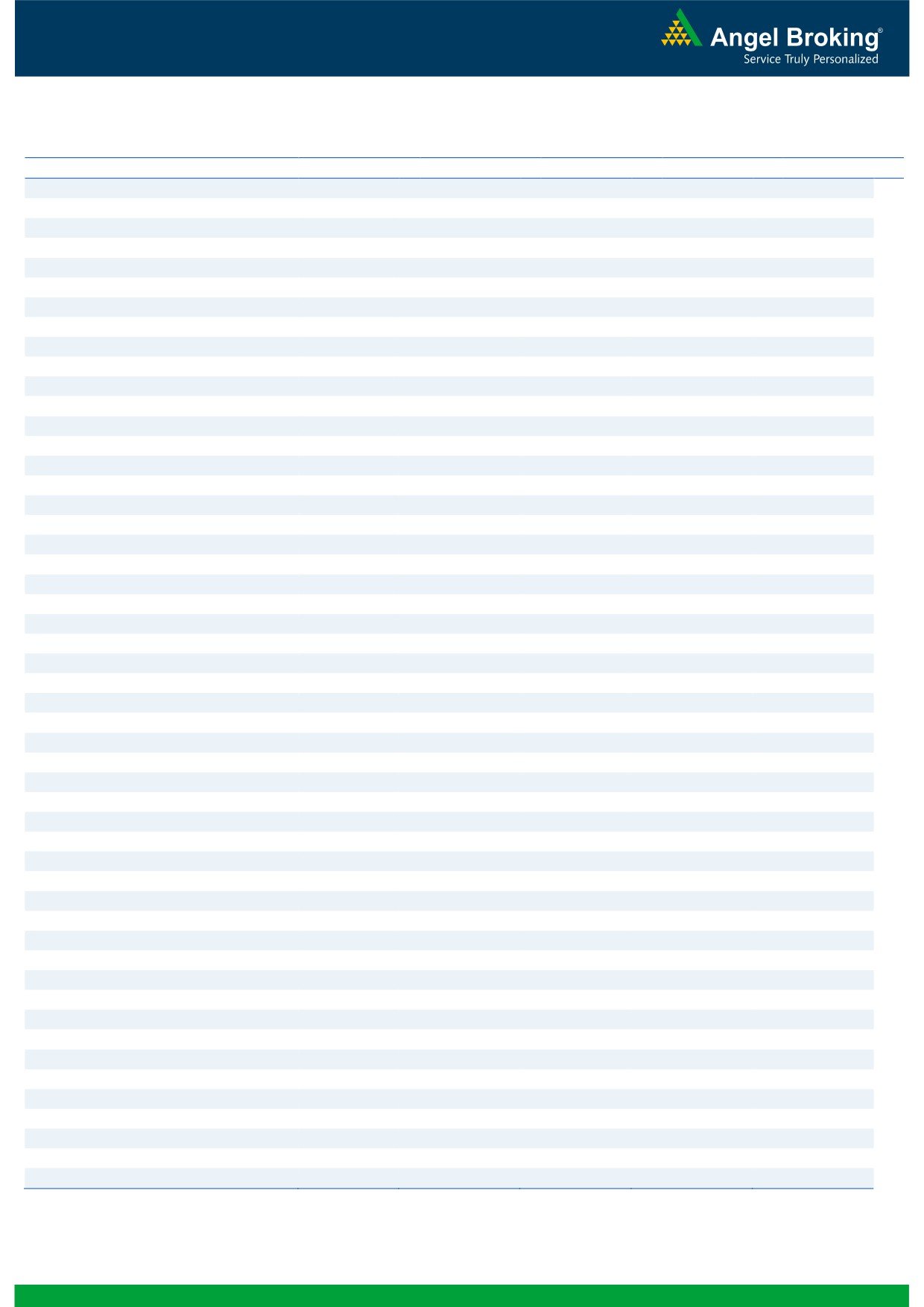

Daily Pivot Levels for Nifty Constituents

Scrips

S2

S1

PIVOT

R1

R2

ACC

1,481

1,494

1,503

1,517

1,526

ADANIPORTS

281

286

291

295

300

AMBUJACEM

240

243

244

246

247

ASIANPAINT

1,031

1,043

1,051

1,063

1,071

AUROPHARMA

735

745

760

770

784

AXISBANK

480

486

489

495

498

BAJAJ-AUTO

2,797

2,831

2,853

2,887

2,909

BANKBARODA

145

147

148

150

152

BHEL

137

140

144

146

150

BPCL

647

654

661

668

674

BHARTIARTL

298

301

304

307

310

INFRATEL

349

355

360

366

371

BOSCH

21,202

21,391

21,596

21,785

21,990

CIPLA

518

527

539

547

560

COALINDIA

312

314

318

321

325

DRREDDY

3,074

3,096

3,122

3,144

3,170

EICHERMOT

23,636

23,984

24,235

24,583

24,834

GAIL

418

428

435

446

452

GRASIM

891

902

914

925

938

HCLTECH

781

795

805

820

830

HDFCBANK

1,233

1,244

1,251

1,262

1,269

HDFC

1,356

1,373

1,384

1,402

1,413

HEROMOTOCO

3,299

3,336

3,361

3,398

3,423

HINDALCO

162

165

169

171

175

HINDUNILVR

832

838

842

849

853

ICICIBANK

274

279

283

288

292

IDEA

71

72

73

74

75

INDUSINDBK

1,197

1,206

1,212

1,221

1,227

INFY

963

973

980

990

997

ITC

250

253

255

258

260

KOTAKBANK

786

799

807

820

828

LT

1,374

1,385

1,396

1,407

1,418

LUPIN

1,464

1,486

1,517

1,538

1,569

M&M

1,359

1,372

1,380

1,393

1,402

MARUTI

5,511

5,590

5,661

5,740

5,810

NTPC

152

153

155

156

158

ONGC

263

266

269

273

275

POWERGRID

172

175

176

178

180

RELIANCE

995

999

1,003

1,007

1,010

SBIN

246

250

252

255

257

SUNPHARMA

613

624

644

655

674

TCS

2,239

2,264

2,286

2,311

2,333

TATAMTRDVR

326

336

341

351

357

TATAMOTORS

507

523

533

549

559

TATAPOWER

72

73

75

76

78

TATASTEEL

400

404

410

414

420

TECHM

441

448

452

458

462

ULTRACEMCO

3,875

3,917

3,943

3,985

4,011

WIPRO

442

447

451

456

461

YESBANK

1,180

1,203

1,220

1,243

1,259

ZEEL

493

499

507

513

521

4

Technical & Derivatives Report

November 09, 2016

Research Team Tel: 022 - 39357800

For Technical Queries

For Derivatives Queries

DISCLAIMER

Angel Broking Private Limited (hereinafter referred to as “Angel”) is a registered Member of National Stock Exchange of India Limited,

Bombay Stock Exchange Limited and Metropolitan Stock Exchange Limited. It is also registered as a Depository Participant with CDSL

and Portfolio Manager with SEBI. It also has registration with AMFI as a Mutual Fund Distributor. Angel Broking Private Limited is a

registered entity with SEBI for Research Analyst in terms of SEBI (Research Analyst) Regulations, 2014 vide registration number

INH000000164. Angel or its associates has not been debarred/ suspended by SEBI or any other regulatory authority for accessing

/dealing in securities Market. Angel or its associates/analyst has not received any compensation / managed or co-managed public

offering of securities of the company covered by Analyst during the past twelve months.

This document is solely for the personal information of the recipient, and must not be singularly used as the basis of any investment

decision. Nothing in this document should be construed as investment or financial advice. Each recipient of this document should

make such investigations as they deem necessary to arrive at an independent evaluation of an investment in the securities of the

companies referred to in this document (including the merits and risks involved), and should consult their own advisors to determine

the merits and risks of such an investment.

Reports based on technical and derivative analysis center on studying charts of a stock's price movement, outstanding positions and

trading volume, as opposed to focusing on a company's fundamentals and, as such, may not match with a report on a company's

fundamentals. Investors are advised to refer the Fundamental and Technical Research Reports available on our website to evaluate the

contrary view, if any.

The information in this document has been printed on the basis of publicly available information, internal data and other reliable

sources believed to be true, but we do not represent that it is accurate or complete and it should not be relied on as such, as this

document is for general guidance only. Angel Broking Pvt. Limited or any of its affiliates/ group companies shall not be in any way

responsible for any loss or damage that may arise to any person from any inadvertent error in the information contained in this report.

Angel Broking Pvt. Limited has not independently verified all the information contained within this document. Accordingly, we cannot

testify, nor make any representation or warranty, express or implied, to the accuracy, contents or data contained within this document.

While Angel Broking Pvt. Limited endeavors to update on a reasonable basis the information discussed in this material, there may be

regulatory, compliance, or other reasons that prevent us from doing so.

This document is being supplied to you solely for your information, and its contents, information or data may not be reproduced,

redistributed or passed on, directly or indirectly.

Neither Angel Broking Pvt. Limited, nor its directors, employees or affiliates shall be liable for any loss or damage that may arise from

or in connection with the use of this information.

5