Technical & Derivatives Report

September 09, 2016

Sensex (29045) / Nifty (8953)

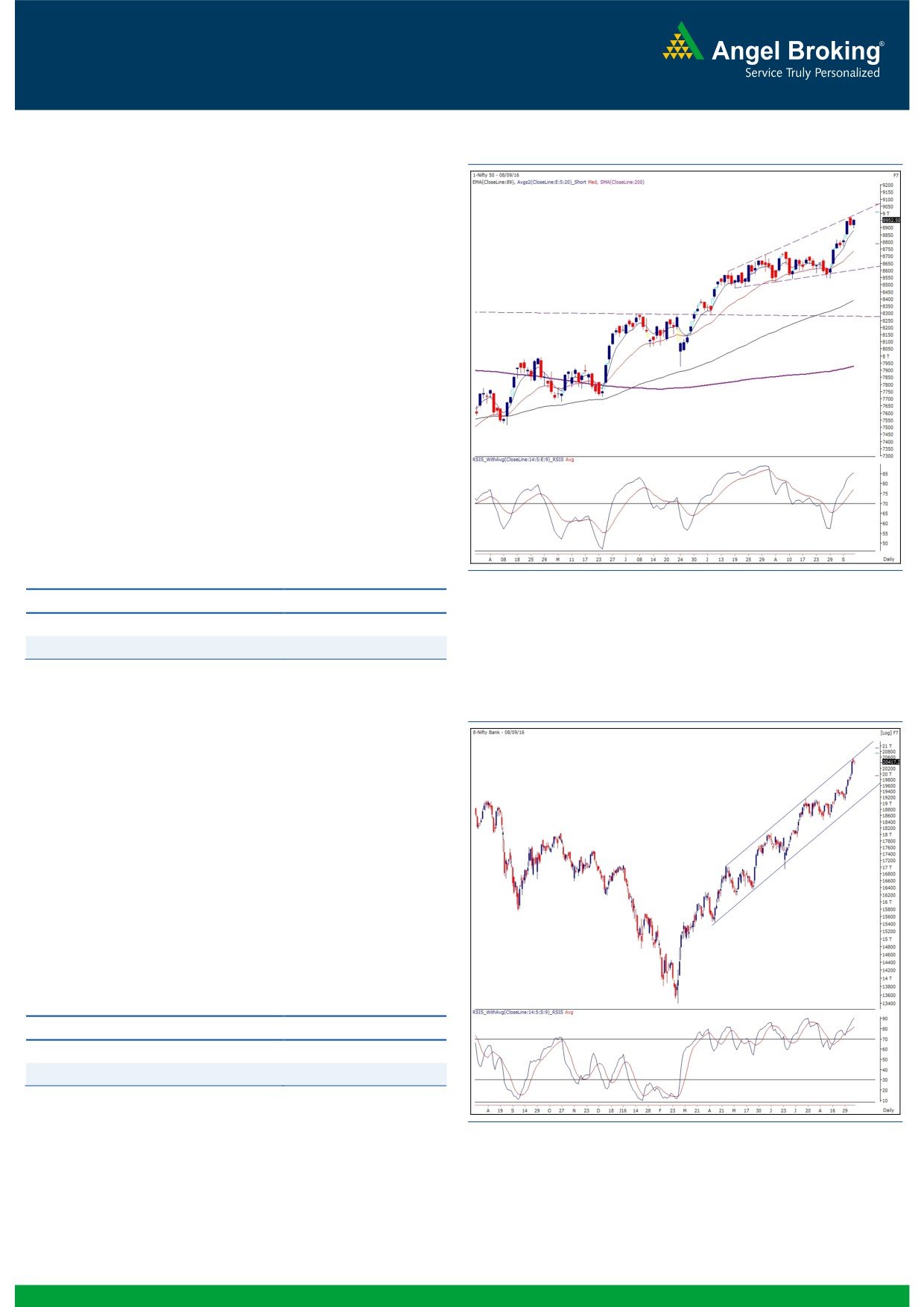

Exhibit 1: Nifty Daily Chart

Yesterday's session opened on a sluggish note considering mixed

cues from global bourses. Subsequently, we witnessed a lethargic

movement with mildly negative bias throughout the first half.

However, a decent recovery in the latter half pulled the index

above the 8950 mark.

On daily chart, we do not see any major change in the chart

structure and thus, we maintain our view that the index may

consolidate within a narrow range of 8980 - 8840 in the

forthcoming sessions. But, we still believe, lot of individual stocks,

especially mid-caps are likely to give spectacular moves whilst the

index undergoes this consolidation phase. Hence, traders are

advised to concentrate more on individual stocks which are likely

to give higher returns as compared to the benchmark index. Just

to highlight one key point, today's close would be very important

for the market as we need to closely watch whether the Nifty is

able to give a weekly close above 8937 or not, as it would then

confirm highest ever weekly close for the Nifty.

Key Levels

Support 1 - 8880

Resistance 1 - 8960

Support 2 - 8840

Resistance 2 - 8980

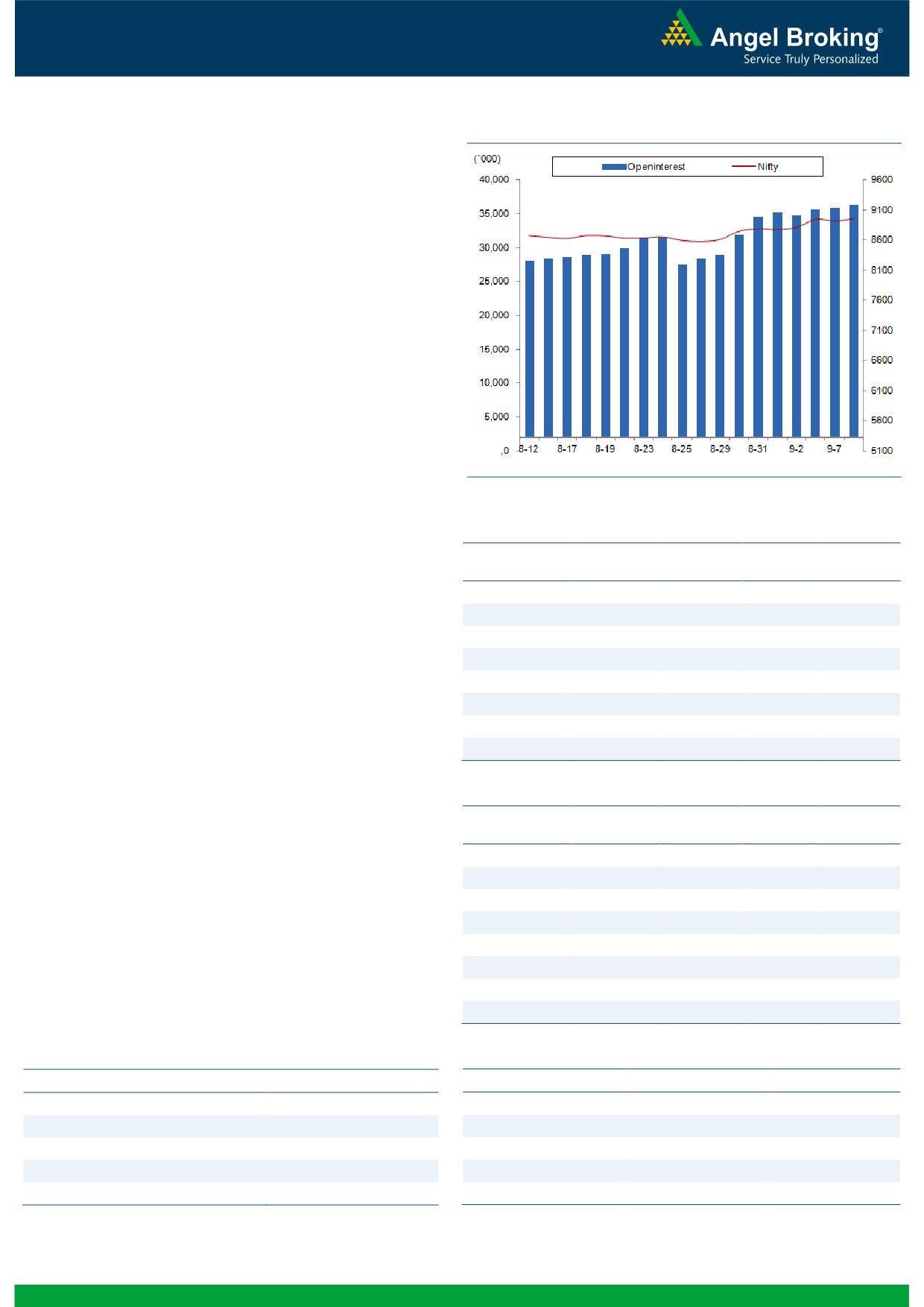

Nifty Bank Outlook - (20417)

Exhibit 2: Nifty Bank Daily Chart

The Nifty Bank index continued with its range bound movement

and ended yesterday's session almost near its previous session's

close.

With narrow range candles in last couple of sessions, there is no

change in the technical structure in the index. Hence, we continue

to reiterate our view that the index can trade range bound in near

term whereas, there could be stock specific momentum from

trading perspective. Hence, traders are advised to continue to

focus on stock specific moves with proper risk management. The

intraday support for the index are placed around 20278 and

20200 whereas resistances are seen around 20575 and 20630.

Key Levels

Support 1 - 20278

Resistance 1 - 20575

Support 2 - 20200

Resistance 2 - 20630

1

Technical & Derivatives Report

September 09, 2016

Comments

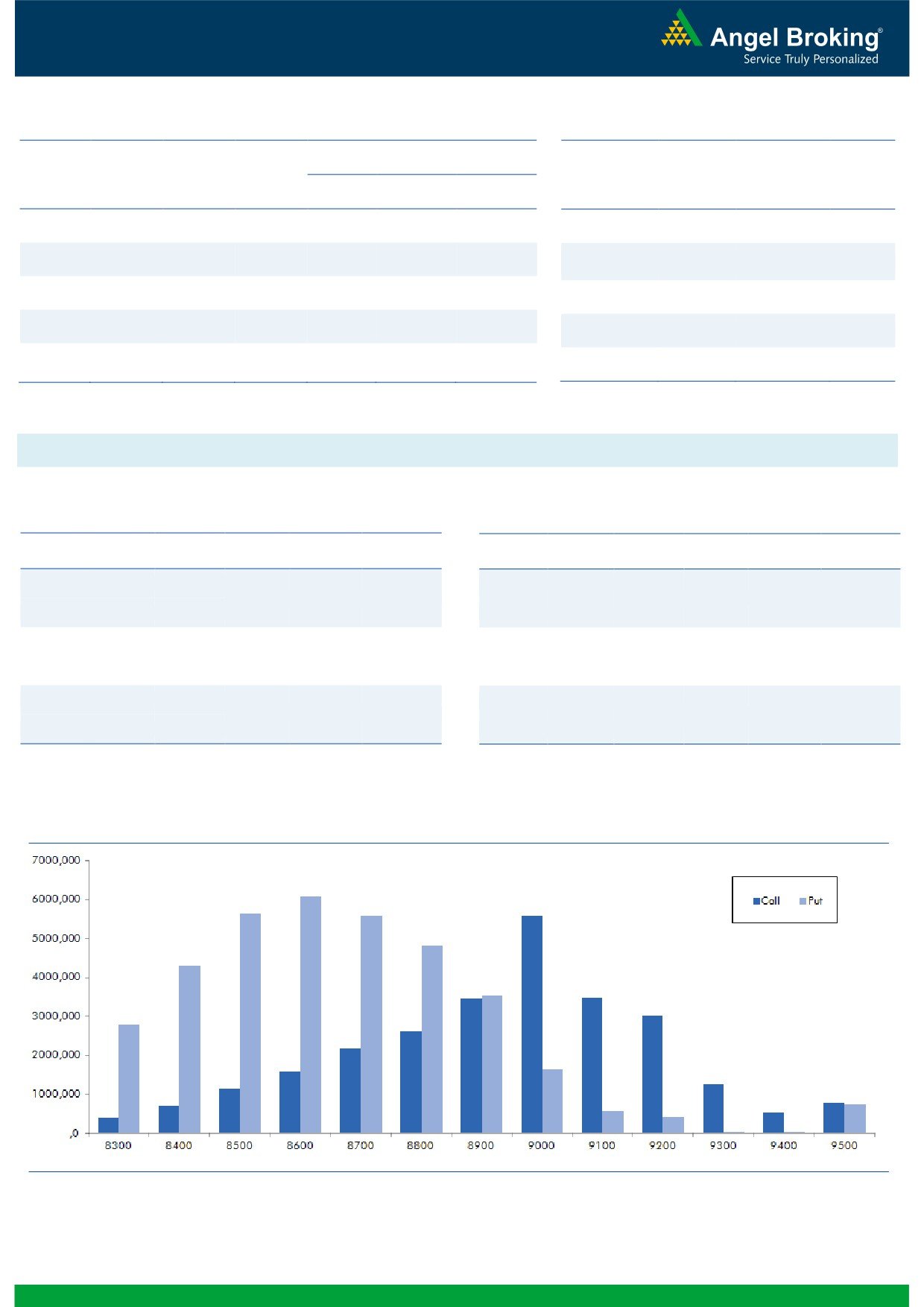

Nifty Vs OI

The Nifty futures open interest has increased by 1.16%

BankNifty futures open interest has decreased by 0.01%

as market closed at 8952.50 levels.

The Nifty September future closed with a premium of

30.05 points against a premium of 34.15 points in

previous session. The October series closed at a

premium of 68.55 points.

The Implied Volatility of at the money options has

decreased from 11.31% to 11.06%. At the same time,

the PCR-OI of Nifty has increased from 1.20 to 1.23.

The total OI of the market is Rs. 3,14,937/- cr. and the

stock futures OI is Rs. 85,969/- cr.

Few of the liquid counters where we have seen high cost

of carry are KSCL, NHPC, CADILAHC, ADANIPOWER

and NCC.

Views

OI Gainers

FIIs continue to pour in liquidity in cash market segment.

OI

PRICE

Yesterday, they bought equities to the tune of Rs. 111

SCRIP

OI

PRICE

CHG. (%)

CHG. (%)

crores. While, they were marginal sellers in index future

CAIRN

15533000

23.86

199.40

-1.21

with rise in OI, indicating blend of both long and short

APOLLOHOSP

528800

15.06

1371.40

-0.95

formation in last trading session.

JUSTDIAL

4413600

14.48

501.60

-1.83

On Index Options front, FIIs were net sellers of Rs. 17ng.com

TORNTPHARM

312400

14.35

1693.05

4.22

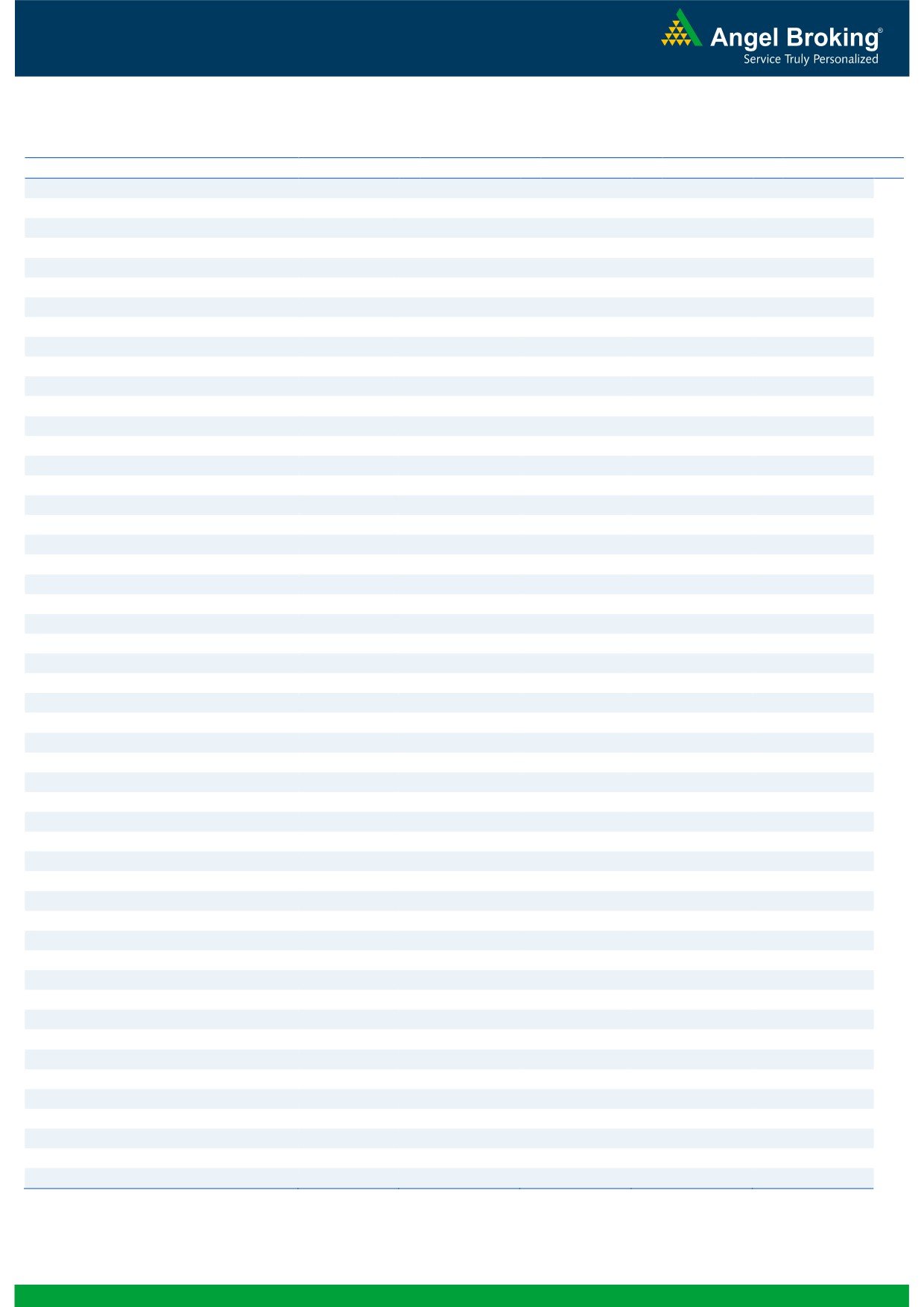

crores with rise in OI. In call options, 9200 strikes added

WOCKPHARMA

3652800

13.69

881.40

5.61

some fresh positions. On the other hand, in put options,

MOTHERSUMI

11977500

13.00

328.60

-2.82

8900 and 8700 strikes added decent positions, which

IRB

14260000

12.88

253.40

9.27

are mostly shorts as implied volatility of put options

PETRONET

7323000

12.70

350.50

1.71

decreased yesterday. Highest OI in September series is

placed at 9000 call and 8600 put option.

Since last 3-4 trading sessions, FIIs continue buying in

OI Losers

OI

PRICE

cash segment, at the same time mixed activity was visible

SCRIP

OI

PRICE

CHG. (%)

CHG. (%)

in Index Futures. Longs formed in Index Futures are still

SAIL

78900000

-11.26

53.80

3.16

intact and we are not seeing any sign of profit booking

IBREALEST

39500000

-8.05

86.50

4.85

as of now. Thus, we advise traders to trade with positive

UNIONBANK

13540000

-5.71

152.40

0.56

bias and focus more on stock specific move.

CEATLTD

2079700

-4.44

1033.10

1.40

Large cap counters that added longs are GRASIM,

LUPIN

5550900

-4.34

1583.80

2.43

HINDUNILVR and CIPLA. While, stock like YESBANK,

OIL

2320500

-4.08

388.40

-0.08

TECHM and TCS added fresh short position in yesterdays

JISLJALEQS

48960000

-3.67

94.50

-1.82

trading session.

SYNDIBANK

13140000

-3.63

80.45

1.19

Historical Volatility

Put-Call Ratio

SCRIP

HV

SCRIP

PCR-OI

PCR-VOL

IRB

51.87

NIFTY

1.23

1.22

HDIL

49.79

BANKNIFTY

1.33

0.95

TCS

34.19

RELIANCE

0.42

0.36

GMRINFRA

52.38

TATAMOTORS

1.23

0.78

YESBANK

38.19

SBIN

0.88

0.68

2

Technical & Derivatives Report

September 09, 2016

FII Statistics for 08, September 2016

Turnover on 08, September 2016

Open Interest

No. of

Turnover

Change

Detail

Buy

Sell

Net

Instrument

Value

Contracts

( in Cr. )

(%)

Contracts

Change (%)

(in Cr.)

INDEX

INDEX

2003.47

2059.27

(55.80)

463058

31823.44

1.12

162520

11864.70

-18.12

FUTURES

FUTURES

INDEX

INDEX

36213.68

36230.46

(16.79)

1157085

79707.64

1.87

4852253

379428.58

15.92

OPTIONS

OPTIONS

STOCK

6897.36

7848.42

(951.06)

887401

60840.68

1.08

STOCK

FUTURES

641941

46306.10

-10.70

FUTURES

STOCK

STOCK

6424.85

6459.35

(34.50)

102680

7359.74

6.37

OPTIONS

408736

30225.94

-5.06

OPTIONS

TOTAL

51539.35

52597.51

(1058.15)

2610224

179731.50

1.64

TOTAL

6065450

467825.33

9.95

Nifty Spot = 8952.50

Lot Size = 75

Bull-Call Spreads

Bear-Put Spreads

Action

Strike

Price

Risk

Reward

BEP

Action

Strike

Price

Risk

Reward

BEP

Buy

9000

83.95

Buy

8900

65.55

40.70

59.30

9040.70

25.80

74.20

8874.20

Sell

9100

43.25

Sell

8800

39.75

Buy

9000

83.95

Buy

8900

65.55

64.95

135.05

9064.95

41.25

158.75

8858.75

Sell

9200

19.00

Sell

8700

24.30

Buy

9100

43.25

Buy

8800

39.75

24.25

75.75

9124.25

15.45

84.55

8784.55

Sell

9200

19.00

Sell

8700

24.30

Note: Above mentioned Bullish or Bearish Spreads in Nifty (September Series) are given as an information and not as a recommendation.

Nifty Put-Call Analysis

3

Technical & Derivatives Report

September 09, 2016

Daily Pivot Levels for Nifty Constituents

Scrips

S2

S1

PIVOT

R1

R2

ACC

1,666

1,679

1,697

1,711

1,729

ADANIPORTS

270

273

275

277

279

AMBUJACEM

272

274

276

278

280

ASIANPAINT

1,162

1,172

1,181

1,191

1,200

AUROPHARMA

765

786

798

819

831

AXISBANK

613

621

628

636

642

BAJAJ-AUTO

2,923

3,006

3,063

3,146

3,203

BANKBARODA

171

173

175

177

179

BHEL

148

153

158

162

167

BPCL

580

583

588

592

597

BHARTIARTL

315

320

324

328

332

INFRATEL

344

351

356

363

368

BOSCH

24,155

24,302

24,438

24,584

24,721

CIPLA

574

585

592

602

609

COALINDIA

327

330

331

334

336

DRREDDY

3,120

3,154

3,176

3,210

3,232

EICHERMOT

22,618

23,018

23,259

23,659

23,900

GAIL

374

382

394

402

414

GRASIM

4,583

4,679

4,750

4,846

4,917

HCLTECH

737

756

769

787

800

HDFCBANK

1,278

1,284

1,289

1,295

1,301

HDFC

1,422

1,430

1,436

1,444

1,451

HEROMOTOCO

3,543

3,623

3,682

3,762

3,820

HINDALCO

158

160

162

164

165

HINDUNILVR

923

938

946

960

968

ICICIBANK

272

274

278

280

283

IDEA

83

84

84

85

86

INDUSINDBK

1,191

1,205

1,215

1,229

1,239

INFY

1,015

1,026

1,036

1,047

1,057

ITC

262

263

264

266

267

KOTAKBANK

792

806

814

828

836

LT

1,511

1,525

1,536

1,550

1,560

LUPIN

1,519

1,551

1,570

1,601

1,620

M&M

1,474

1,483

1,492

1,501

1,509

MARUTI

5,256

5,373

5,436

5,553

5,616

NTPC

157

159

160

161

163

ONGC

238

242

248

253

259

POWERGRID

179

183

185

189

191

RELIANCE

1,014

1,024

1,030

1,040

1,046

SBIN

264

266

269

271

274

SUNPHARMA

766

787

798

819

831

TCS

2,247

2,285

2,322

2,360

2,398

TATAMTRDVR

359

365

371

376

382

TATAMOTORS

571

577

585

591

599

TATAPOWER

76

77

77

78

78

TATASTEEL

382

393

401

411

419

TECHM

448

454

460

466

472

ULTRACEMCO

4,037

4,076

4,103

4,142

4,169

WIPRO

465

470

475

479

484

YESBANK

1,278

1,303

1,347

1,372

1,415

ZEEL

529

534

538

543

547

4

Technical & Derivatives Report

September 09, 2016

Research Team Tel: 022 - 39357800

For Technical Queries

For Derivatives Queries

DISCLAIMER

Angel Broking Private Limited (hereinafter referred to as “Angel”) is a registered Member of National Stock Exchange of India Limited,

Bombay Stock Exchange Limited and Metropolitan Stock Exchange Limited. It is also registered as a Depository Participant with CDSL

and Portfolio Manager with SEBI. It also has registration with AMFI as a Mutual Fund Distributor. Angel Broking Private Limited is a

registered entity with SEBI for Research Analyst in terms of SEBI (Research Analyst) Regulations, 2014 vide registration number

INH000000164. Angel or its associates has not been debarred/ suspended by SEBI or any other regulatory authority for accessing

/dealing in securities Market. Angel or its associates/analyst has not received any compensation / managed or co-managed public

offering of securities of the company covered by Analyst during the past twelve months.

This document is solely for the personal information of the recipient, and must not be singularly used as the basis of any investment

decision. Nothing in this document should be construed as investment or financial advice. Each recipient of this document should

make such investigations as they deem necessary to arrive at an independent evaluation of an investment in the securities of the

companies referred to in this document (including the merits and risks involved), and should consult their own advisors to determine

the merits and risks of such an investment.

Reports based on technical and derivative analysis center on studying charts of a stock's price movement, outstanding positions and

trading volume, as opposed to focusing on a company's fundamentals and, as such, may not match with a report on a company's

fundamentals. Investors are advised to refer the Fundamental and Technical Research Reports available on our website to evaluate the

contrary view, if any.

The information in this document has been printed on the basis of publicly available information, internal data and other reliable

sources believed to be true, but we do not represent that it is accurate or complete and it should not be relied on as such, as this

document is for general guidance only. Angel Broking Pvt. Limited or any of its affiliates/ group companies shall not be in any way

responsible for any loss or damage that may arise to any person from any inadvertent error in the information contained in this report.

Angel Broking Pvt. Limited has not independently verified all the information contained within this document. Accordingly, we cannot

testify, nor make any representation or warranty, express or implied, to the accuracy, contents or data contained within this document.

While Angel Broking Pvt. Limited endeavors to update on a reasonable basis the information discussed in this material, there may be

regulatory, compliance, or other reasons that prevent us from doing so.

This document is being supplied to you solely for your information, and its contents, information or data may not be reproduced,

redistributed or passed on, directly or indirectly.

Neither Angel Broking Pvt. Limited, nor its directors, employees or affiliates shall be liable for any loss or damage that may arise from

or in connection with the use of this information.

5