Technical & Derivatives Report

May 09, 2016

Sensex (25229) / Nifty (7733)

Exhibit 1: Nifty Daily Chart

Post negative opening on Friday, the Nifty index pulled back

higher from its support zone and recovered the losses to end the

session on a flat note.

The index’ behaviour post the breakdown below this support in

the following three sessions suggests exhaustion and lack of

strength in this correction. In addition, a few important technical

evidences such as the ‘Downward Sloping Trend Line’ (at 7700)

and the daily ’89 EMA’ (at 7650) are likely to act as a sheet

anchor for the bulls. Going forward, as long as the Nifty

manages to sustain above the 7650 mark, there is a fair

possibility of a decent bounce back towards 7870 - 7920. We

reiterate our view that traders should refrain from creating fresh

short positions and should ideally keep a close track on the 7780

mark, which may provide a potential trade on the long side.

Meanwhile, lots of individual stocks are likely to perform well in

the forthcoming session. Thus, traders can adopt a stock centric

approach with a proper exit strategy.

Key Levels

Support 1 - 7700

Resistance 1 - 7780

Support 2 - 7650

Resistance 2 - 7890

Exhibit 2: Nifty Bank Daily Chart

Nifty Bank Outlook - (16297)

The Nifty Bank index opened with marginal loss on Friday and

corrected in initial hour of trading. However, the index reversed

piercingly and rallied by around a percent from its intraday lows.

Eventually, the Nifty Bank index ended with negligible gains of

0.10 percent.

On Friday too, the Nifty Bank index traded in a narrow range and

registered low near the support of 16187 which is the 100%

extension level of the previous corrective move seen in the month

of April (16282.75 to 15440.25). This has led to formation of

‘Reciprocal AB=CD’ pattern on daily chart, which is a reversal

pattern. The Nifty Bank index also has an immediate support at

16146 (Super Trend indicator on daily chart) and at 16050

(61.8% retracement of the previous upmove). Since there are

multiple supports in the range of 16050 to 16190, we may see a

pullback rally in the index. Thus, traders are advised to book

profit in short positions and start initiating long on declines with

proper exit strategy. On the flipside, immediate resistance for the

index is seen around 16465 and 16530.

Key Levels

Support 1 - 16146

Resistance 1 - 16465

Support 2 - 16050

Resistance 2 - 16530

1

Technical & Derivatives Report

May 09, 2016

Comments

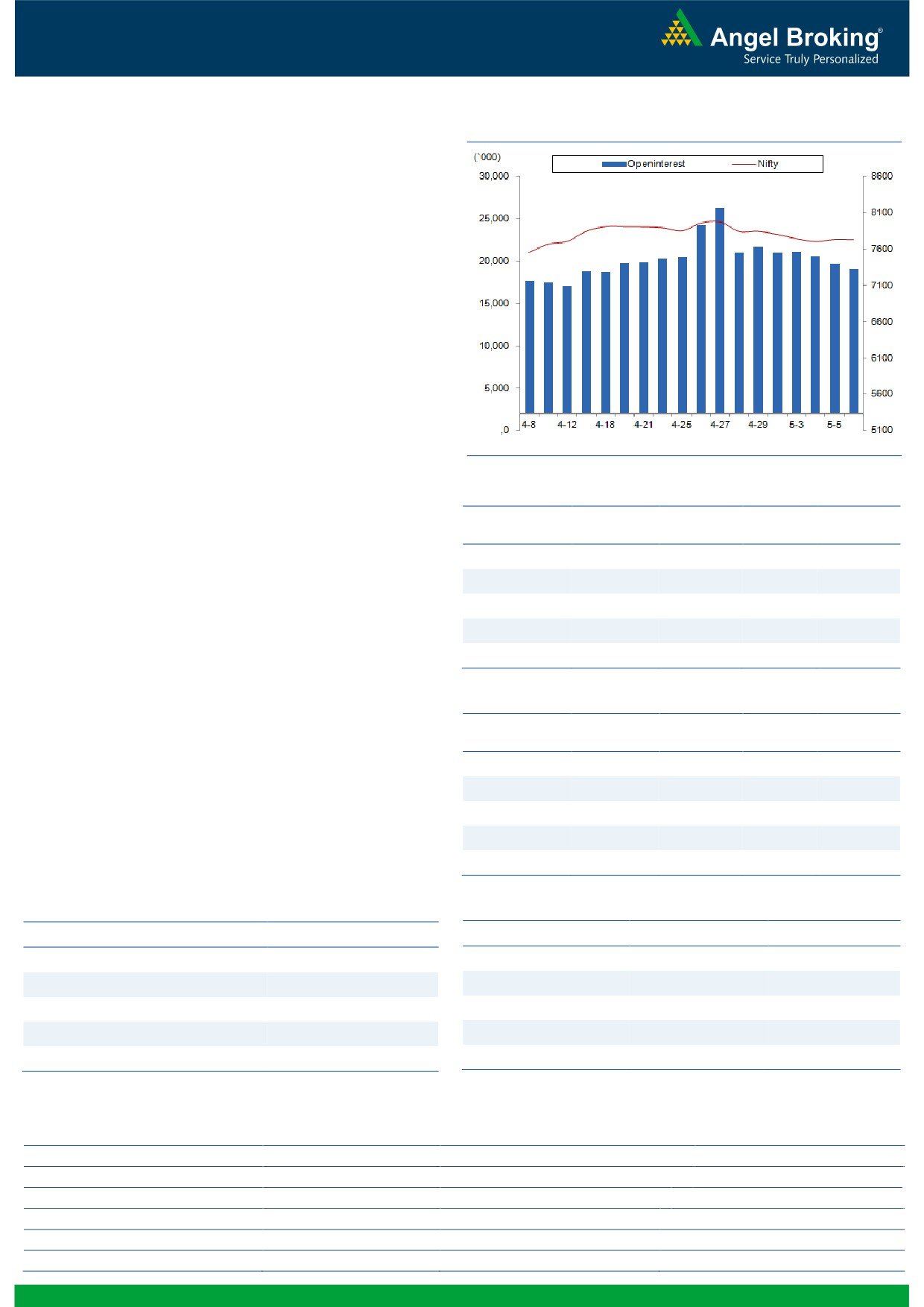

Nifty Vs OI

The Nifty futures open interest has decreased by 3.08%

BankNifty futures open interest has increased by 0.95%

as market closed at 7733.45 levels.

The Nifty May future closed at a premium of 26.80

points against a premium of 37.60 points. The June

series closed at a premium of 38.25 points.

The Implied Volatility of at the money options has

decreased from 15.75% to 15.05%.

The total OI of the market is Rs. 2,06,457/- cr. and the

stock futures OI is Rs. 58,292/- cr.

Few of the liquid counters where we have seen high cost

of carry are JPASSOCIAT, UNITECH, ADANIENT,

ADANIPOWER and SOUTHBANK.

Views

FIIs activity in cash market segment was subdued. While

in Index Futures, they continue selling to the tune of Rs.

OI Gainers

989 crores with fall in OI, indicating long unwinding in

OI

PRICE

SCRIP

OI

PRICE

last trading session.

CHG. (%)

CHG. (%)

VOLTAS

4798000

9.60

306.55

5.18

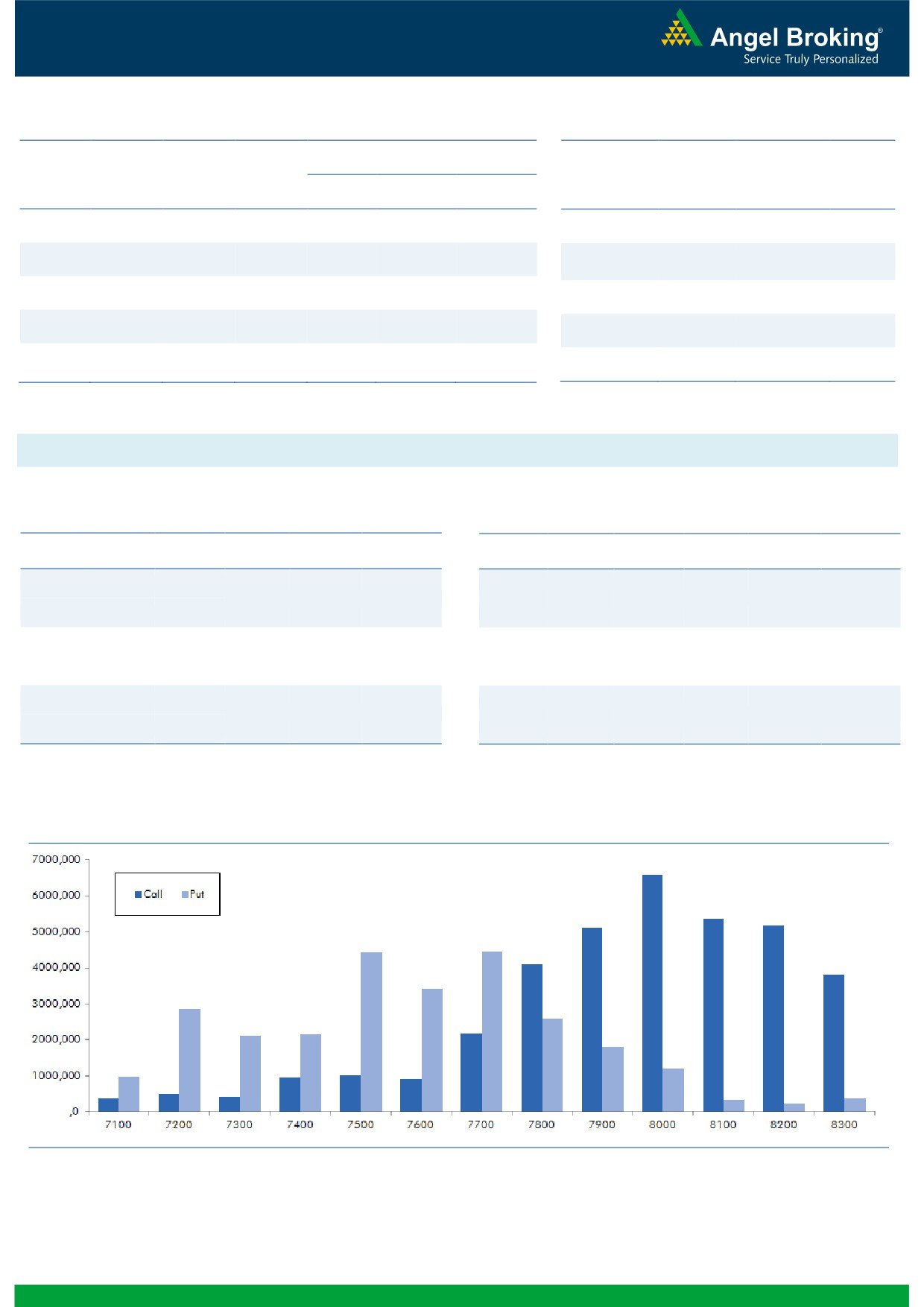

In Index Options front, FIIs sold worth Rs. 113 crores with

TITAN

6862500

9.37

364.90

1.66

good amount of rise in OI. In call options, 7900 and

IDFC

63554700

8.69

47.10

11.61

8000 strikes were quite active and they also added some

fresh positions. While in put options, we hardly saw any

WOCKPHARMA

2414625

8.42

942.15

-3.53

meaningful OI addition, decent amount of unwinding

GAIL

7149800

8.41

384.10

4.63

was visible in 7400 put options. Maximum OI in call

options has shifted from 8000 to 8100 strike; whereas in

OI Losers

put options, it remained intact at 7700 strike. Nifty

OI

PRICE

SCRIP

OI

PRICE

remained under pressure but this move was only because

CHG. (%)

CHG. (%)

of long unwinding, we didn’t witness any short

INDUSINDBK

4912800

-5.37

1042.40

-0.21

formation. Since, the Nifty is trading near around its

TATAMOTORS

24498000

-4.46

391.60

2.30

crucial support of 7650 - 7700 zone, shorting at current

COALINDIA

20506800

-3.42

282.60

0.71

levels won’t be a prudent strategy. Thus, we advise

WIPRO

8263000

-3.41

545.85

0.67

traders to remain light in this market till we see any

TVSMOTOR

5786000

-3.31

295.10

1.92

meaningful fresh positions in either direction.

Historical Volatility

Put-Call Ratio

SCRIP

HV

SCRIP

PCR-OI

PCR-VOL

IDFC

67.27

NIFTY

0.79

0.78

KTKBANK

42.28

BANKNIFTY

0.77

0.67

GAIL

41.06

ICICIBANK

0.37

0.26

VOLTAS

43.65

RELIANCE

0.38

0.32

HEXAWARE

39.68

SBIN

0.54

0.40

Strategy Date

Symbol

Strategy

Status

02-05-2016

NIFTY

Long Strangle

Active

2

Technical & Derivatives Report

May 09, 2016

FII Statistics for 06-May 2016

Turnover on 06-May 2016

Open Interest

No. of

Turnover

Change

Detail

Buy

Sell

Net

Instrument

Value

Contracts

( in Cr. )

(%)

Contracts

Change (%)

(in Cr.)

INDEX

INDEX

776.25

1765.32

(989.07)

236196

13391.94

(2.03)

228642

12573.15

-23.40

FUTURES

FUTURES

INDEX

INDEX

20291.18

20404.25

(113.07)

1018091

58571.63

4.19

2332850

134951.18

-2.56

OPTIONS

OPTIONS

STOCK

3716.86

3632.12

84.73

991668

47145.43

0.91

STOCK

FUTURES

457961

21989.93

-20.25

FUTURES

STOCK

STOCK

1868.74

1908.84

(40.10)

58322

2793.52

10.53

OPTIONS

248050

11956.22

-19.89

OPTIONS

TOTAL

26653.02

27710.53

(1057.51)

2304277

121902.52

2.24

TOTAL

3267503

181470.48

-8.07

Nifty Spot = 7733.45

Lot Size = 75

Bull-Call Spreads

Bear-Put Spreads

Action

Strike

Price

Risk

Reward

BEP

Action

Strike

Price

Risk

Reward

BEP

Buy

7800

89.00

Buy

7700

85.60

38.15

61.85

7838.15

30.30

69.70

7669.70

Sell

7900

50.85

Sell

7600

55.30

Buy

7800

89.00

Buy

7700

85.60

61.20

138.80

7861.20

50.40

149.60

7649.60

Sell

8000

27.80

Sell

7500

35.20

Buy

7900

50.85

Buy

7600

55.30

23.05

76.95

7923.05

20.10

79.90

7579.90

Sell

8000

27.80

Sell

7500

35.20

Note: Above mentioned Bullish or Bearish Spreads in Nifty (May Series) are given as an information and not as a recommendation.

Nifty Put-Call Analysis

3

Technical & Derivatives Report

May 09, 2016

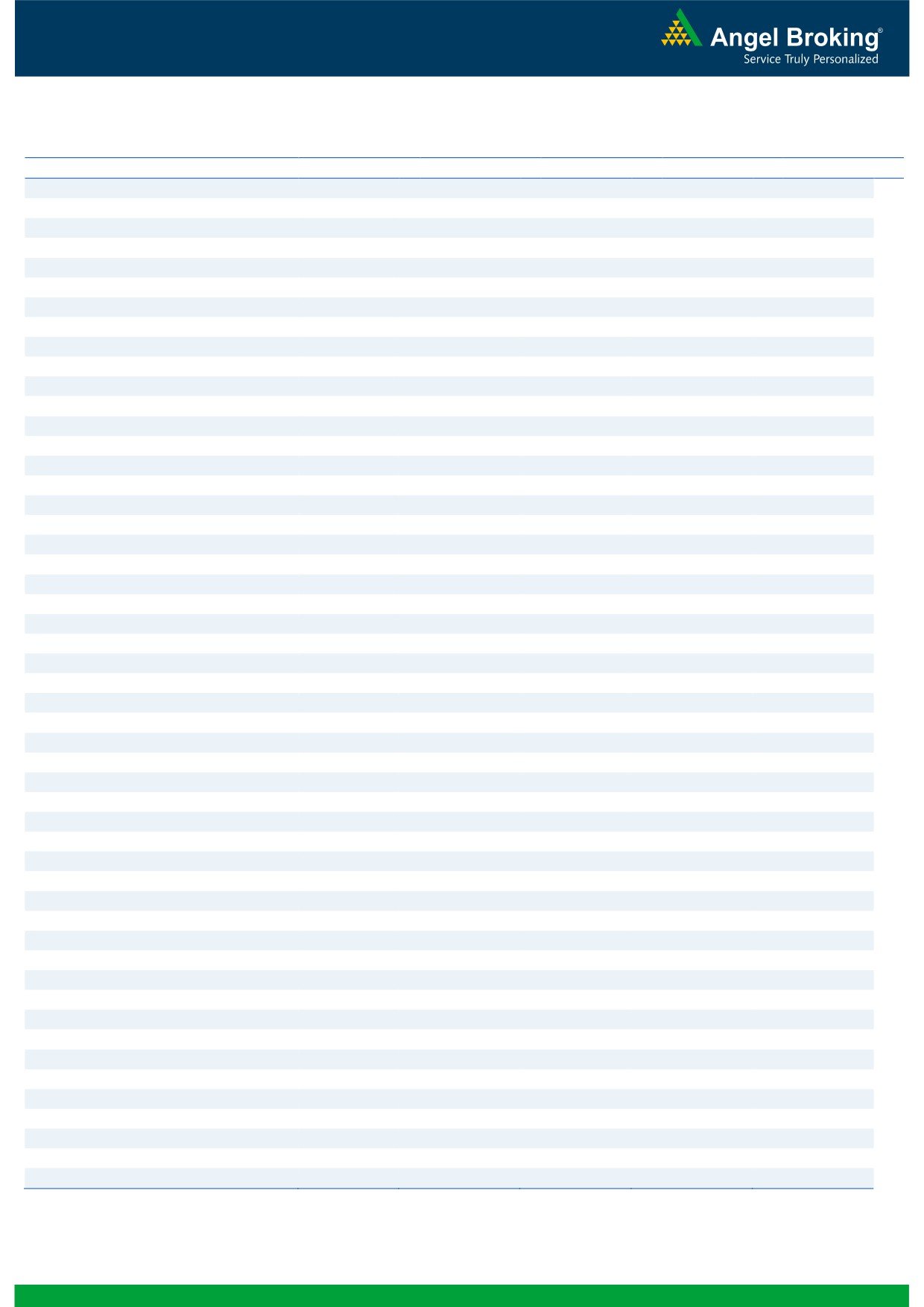

Daily Pivot Levels for Nifty Constituents

Scrips

S2

S1

PIVOT

R1

R2

ACC

1,363

1,394

1,420

1,451

1,476

ADANIPORTS

186

190

195

199

204

AMBUJACEM

213

217

219

222

224

ASIANPAINT

852

870

880

899

909

AUROPHARMA

788

794

801

807

813

AXISBANK

456

459

462

464

467

BAJAJ-AUTO

2,416

2,426

2,440

2,449

2,463

BANKBARODA

147

149

151

153

155

BHEL

118

122

125

129

132

BPCL

920

930

937

947

955

BHARTIARTL

349

354

359

364

369

INFRATEL

364

367

371

374

378

BOSCH

18,812

18,970

19,122

19,280

19,432

CIPLA

531

534

538

542

546

COALINDIA

276

279

281

284

286

DRREDDY

2,822

2,844

2,882

2,904

2,942

EICHERMOT

19,333

19,774

20,062

20,503

20,791

GAIL

353

368

378

393

402

GRASIM

4,059

4,086

4,108

4,134

4,156

HCLTECH

714

718

726

730

737

HDFCBANK

1,108

1,114

1,123

1,129

1,138

HDFC

1,139

1,153

1,164

1,178

1,188

HEROMOTOCO

2,787

2,839

2,872

2,923

2,957

HINDALCO

88

90

91

93

94

HINDUNILVR

842

848

852

858

862

ICICIBANK

210

214

217

222

224

IDEA

111

113

114

115

116

INDUSINDBK

1,018

1,030

1,037

1,049

1,056

INFY

1,170

1,176

1,183

1,189

1,196

ITC

301

309

314

323

328

KOTAKBANK

689

696

703

710

717

LT

1,244

1,252

1,262

1,271

1,281

LUPIN

1,561

1,574

1,592

1,605

1,622

M&M

1,296

1,314

1,324

1,341

1,351

MARUTI

3,786

3,802

3,819

3,835

3,852

NTPC

137

138

139

141

142

ONGC

205

207

209

210

212

POWERGRID

139

141

142

144

145

RELIANCE

961

965

971

975

981

SBIN

178

181

183

186

188

SUNPHARMA

794

799

807

812

820

TCS

2,410

2,442

2,463

2,495

2,516

TATAMTRDVR

275

281

284

290

294

TATAMOTORS

378

389

395

405

411

TATAPOWER

69

71

72

73

74

TATASTEEL

322

326

329

332

335

TECHM

466

469

474

478

483

ULTRACEMCO

3,028

3,064

3,098

3,134

3,168

WIPRO

522

528

537

543

552

YESBANK

898

904

912

918

926

ZEEL

395

399

402

406

410

4

Technical & Derivatives Report

May 09, 2016

Research Team Tel: 022 - 39357800

For Technical Queries

For Derivatives Queries

DISCLAIMER

Angel Broking Private Limited (hereinafter referred to as “Angel”) is a registered Member of National Stock Exchange of India Limited,

Bombay Stock Exchange Limited and MCX Stock Exchange Limited. It is also registered as a Depository Participant with CDSL and

Portfolio Manager with SEBI. It also has registration with AMFI as a Mutual Fund Distributor. Angel Broking Private Limited is a

registered entity with SEBI for Research Analyst in terms of SEBI (Research Analyst) Regulations, 2014 vide registration number

INH000000164. Angel or its associates has not been debarred/ suspended by SEBI or any other regulatory authority for accessing

/dealing in securities Market. Angel or its associates including its relatives/analyst do not hold any financial interest/beneficial

ownership of more than 1% in the company covered by Analyst. Angel or its associates/analyst has not received any compensation /

managed or co-managed public offering of securities of the company covered by Analyst during the past twelve months. Angel/analyst

has not served as an officer, director or employee of company covered by Analyst and has not been engaged in market making activity

of the company covered by Analyst.

This document is solely for the personal information of the recipient, and must not be singularly used as the basis of any investment

decision. Nothing in this document should be construed as investment or financial advice. Each recipient of this document should

make such investigations as they deem necessary to arrive at an independent evaluation of an investment in the securities of the

companies referred to in this document (including the merits and risks involved), and should consult their own advisors to determine

the merits and risks of such an investment.

Reports based on technical and derivative analysis center on studying charts of a stock's price movement, outstanding positions and

trading volume, as opposed to focusing on a company's fundamentals and, as such, may not match with a report on a company's

fundamentals.

The information in this document has been printed on the basis of publicly available information, internal data and other reliable

sources believed to be true, but we do not represent that it is accurate or complete and it should not be relied on as such, as this

document is for general guidance only. Angel Broking Pvt. Limited or any of its affiliates/ group companies shall not be in any way

responsible for any loss or damage that may arise to any person from any inadvertent error in the information contained in this report.

Angel Broking Pvt. Limited has not independently verified all the information contained within this document. Accordingly, we cannot

testify, nor make any representation or warranty, express or implied, to the accuracy, contents or data contained within this document.

While Angel Broking Pvt. Limited endeavors to update on a reasonable basis the information discussed in this material, there may be

regulatory, compliance, or other reasons that prevent us from doing so.

This document is being supplied to you solely for your information, and its contents, information or data may not be reproduced,

redistributed or passed on, directly or indirectly.

Neither Angel Broking Pvt. Limited, nor its directors, employees or affiliates shall be liable for any loss or damage that may arise from

or in connection with the use of this information.

Note: Please refer to the important ‘Stock Holding Disclosure' report on the Angel website (Research Section). Also, please refer to the

latest update on respective stocks for the disclosure status in respect of those stocks. Angel Broking Pvt. Limited and its affiliates may

have investment positions in the stocks recommended in this report.

5