Technical & Derivatives Report

November 08, 2016

Sensex (27459) / Nifty (8497)

Exhibit 1: Nifty Daily Chart

Yesterday, our markets surprised most of the participants with a

huge 100 points gap up opening on Nifty. This was mainly on the

back of positive developments seen in U.S. over the weekend.

Although, this was not what we had expected to see considering

Friday’s close, we still maintained our cautious stance as there

was no follow up buying seen in the market. As a result, the Nifty

corrected a bit from highs to end the session tad below the 8500

mark.

Technically speaking, such gaps if not filled can indicate probable

reversal in the market; but, we saw this gap being filled and

hence, 8550 - 8600 has now become a strong and important

hurdle for the market. In fact, we will not be surprised to see

another leg of downward move in the forthcoming sessions. On

the lower side, 8475 - 8400 would be seen as intraday supports.

We continue to advise caution in the market and thus, traders

should not get carried away by yesterday’s gap up opening. It’s

advisable to stay light and avoid taking undue risks.

Key Levels

Support 1 - 8475

Resistance 1 - 8550

Support 2 - 8400

Resistance 2 - 8600

Exhibit 2: Nifty Bank Daily Chart

Nifty Bank Outlook - (19356)

Citing positive global cues, the Nifty Bank index too opened with

a gap up opening yesterday and ended the session with gains of

1.56 percent over its previous session's close.

The Nifty Bank index has pulled back higher from the '89 DEMA'

support which has now acted as support twice in last one month.

On the flipside, the lower top formation remains intact on the

daily chart. This indicates consolidation phase wherein the bulls

are trying to protect the support zone; whereas the bears are

showing their dominance on pullback rallies. Hence, until the

index either breaches the '89 DEMA' support or forms any bullish

structure; the consolidation is expected to continue. Traders are

thus advised to wait for some definite signs and avoid speculating

on the directional momentum. Traders can follow stock specific

moves and trade with proper risk management. The intraday

supports for the Nifty Bank index are placed around 19165 and

18960 whereas resistances are seen around 19420 and 19592.

Key Levels

Support 1 - 19165

Resistance 1 - 19420

Support 2 - 18960

Resistance 2 - 19592

1

Technical & Derivatives Report

November 08, 2016

Comments

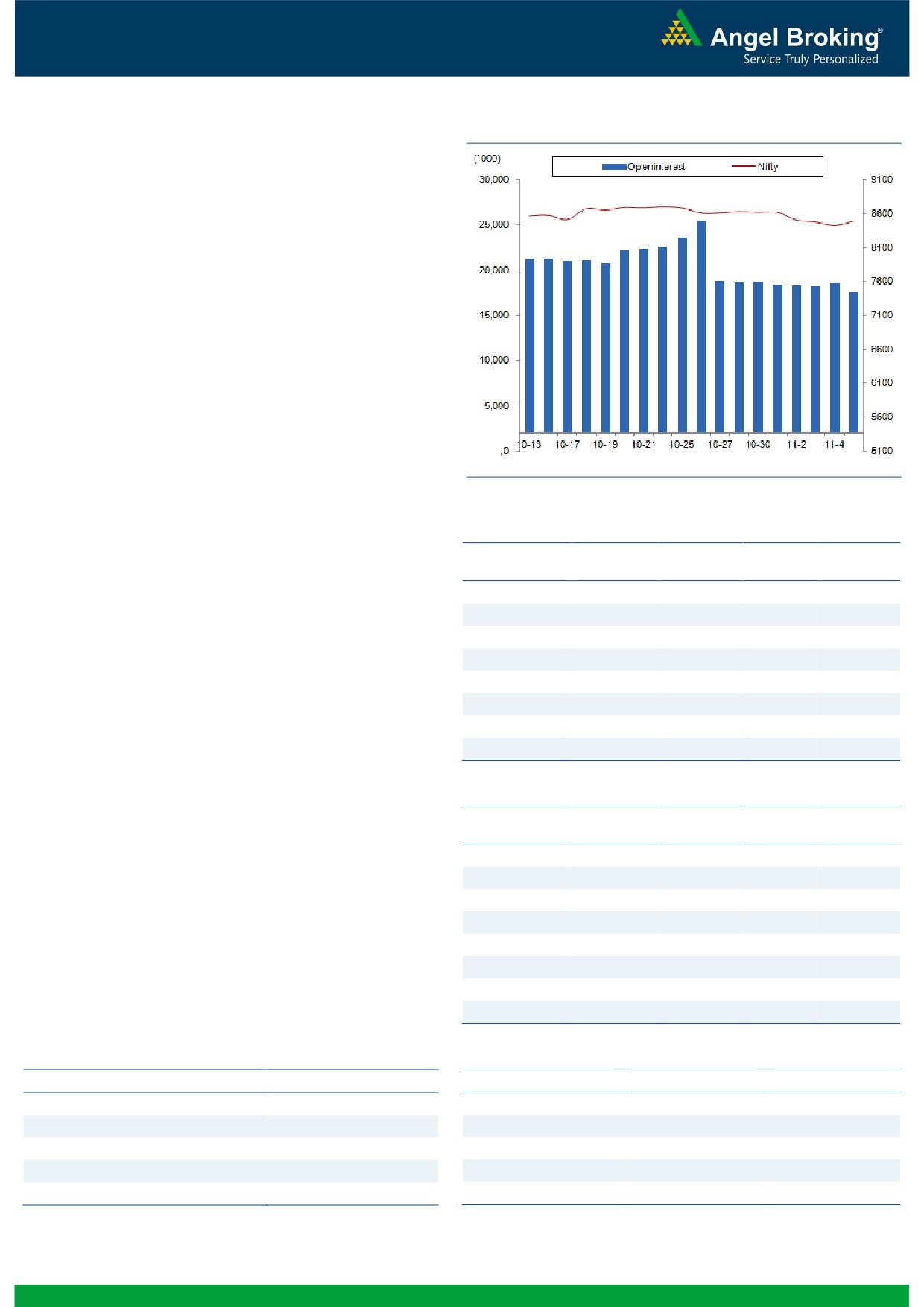

Nifty Vs OI

The Nifty futures open interest has decreased by 5.88%

BankNifty futures open interest has decreased by 7.13%

as market closed at 8497.05 levels.

The Nifty November future closed with a premium of

22.95 against the premium of 24.45 points in last

trading session. The December series closed at a

premium of 69.95 points.

The Implied Volatility of at the money options has

increased from 16.33% to 16.86%. At the same time, the

PCR-OI of Nifty has increased from 0.92 to 0.93 levels.

The total OI of the market is Rs. 2,45,517/- cr. and the

stock futures OI is Rs. 74,924/- cr.

Few of the liquid counters where we have seen high cost

of carry are ADANIPOWER, NIITTECH, GAIL, KTKBANK

and INDIACEM.

Views

OI Gainers

After long time, FIIs were net buyers in equity cash; they

OI

PRICE

SCRIP

OI

PRICE

CHG. (%)

CHG. (%)

bought equities worth Rs. 311 crores. While, in index

CROMPGREAV

10848000

26.61

85.90

12.21

futures, they were net seller to the tune of Rs. 236 crores

DABUR

9900000

13.11

296.45

-0.47

with significant fall in open interest, indicating blend of

NMDC

16158000

11.56

127.50

0.43

long unwinding and covering of short positions formedng.com

VOLTAS

3782000

8.00

360.55

-0.39

earlier.

FEDERALBNK

49181000

7.55

77.50

0.78

On Index Options front, FIIs sold of worth Rs. 344 crores

IDFCBANK

30464000

7.18

72.95

-0.07

with some rise in OI. We hardly saw any meaningful

AMARAJABAT

679200

6.39

1015.00

0.55

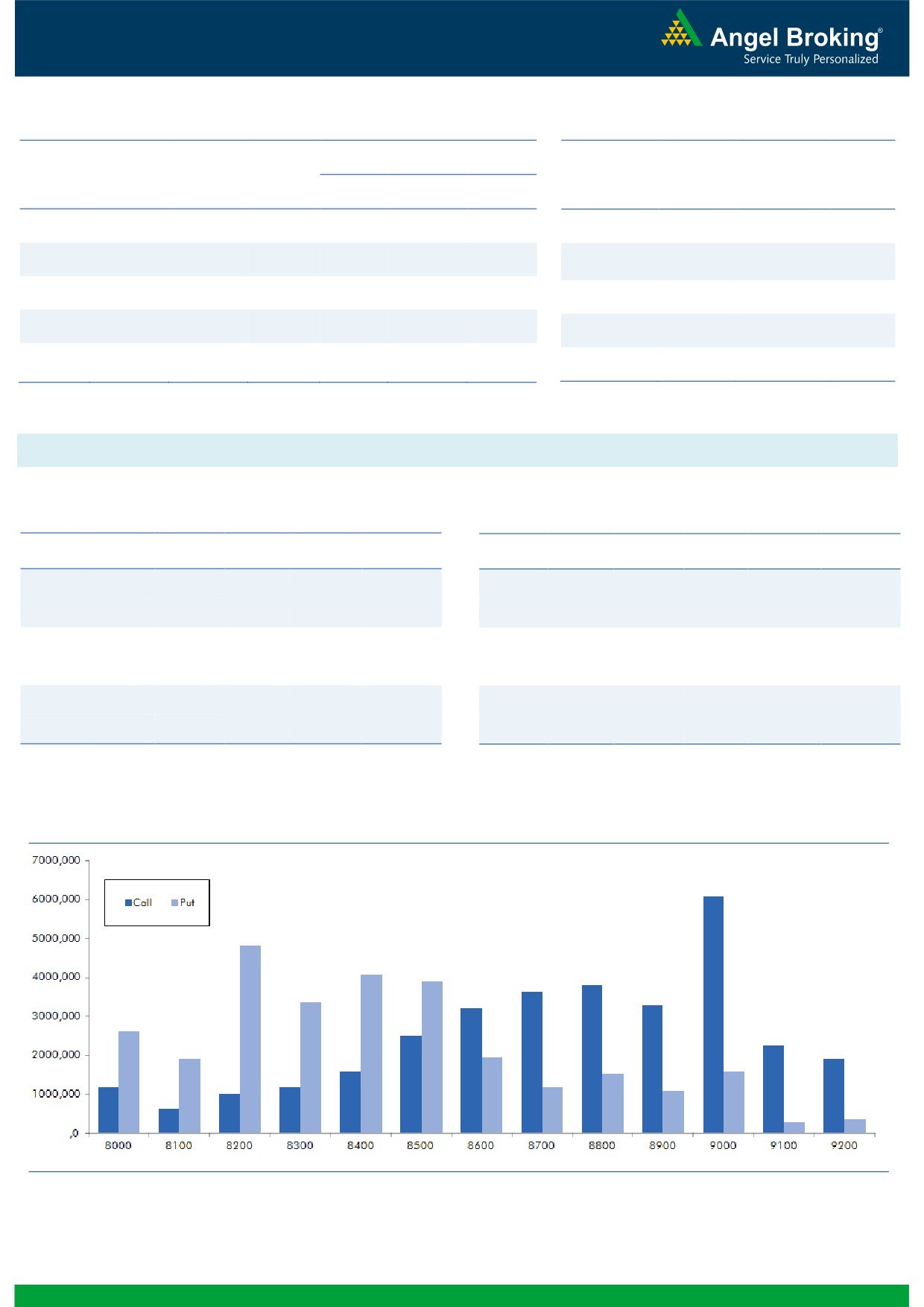

open interest additions in both call and put options of

GAIL

5893500

5.85

428.60

0.63

Nifty. However, 8800 call and 8500 put options were

comparatively active and they also added some fresh

positions. Maximum OI in November series is placed at

OI Losers

9000 call and 8200 put options.

OI

PRICE

SCRIP

OI

PRICE

CHG. (%)

CHG. (%)

Since past few trading sessions, we have been

LUPIN

6471800

-9.89

1520.45

6.90

continuously witnessing good amount of long unwinding

TORNTPHARM

440000

-9.24

1333.10

2.81

and some fresh short formation in Index Futures by

UBL

1550500

-9.00

895.35

1.94

stronger hands. They also bought good amount of put

GLENMARK

2494100

-7.77

896.40

2.93

options during these period. Looking at the above data,

BIOCON

4074000

-6.82

898.70

2.22

we believe market has limited upside. Traders should

SBIN

56646000

-5.90

253.60

3.98

avoid forming long positions in Nifty unless we see any

meaningful change in data.

HEROMOTOCO

1160200

-5.54

3360.70

2.12

CANBK

11082000

-5.35

299.55

3.01

Historical Volatility

Put-Call Ratio

SCRIP

HV

SCRIP

PCR-OI

PCR-VOL

CROMPGREAV

63.17

NIFTY

0.93

0.87

LUPIN

43.43

BANKNIFTY

1.26

0.76

PNB

55.12

RELIANCE

0.44

0.39

SBIN

34.60

SBIN

0.54

0.49

HINDALCO

50.18

AXISBANK

0.44

0.46

2

Technical & Derivatives Report

November 08, 2016

FII Statistics for November 07, 2016

Turnover on November 07, 2016

Open Interest

No. of

Turnover

Change

Detail

Buy

Sell

Net

Instrument

Value

Change

Contracts

( in Cr. )

(%)

Contracts

(in Cr.)

(%)

INDEX

INDEX

1452.56

1688.34

(235.79)

186160

12397.44

(9.62)

177867

12185.24

-28.38

FUTURES

FUTURES

INDEX

INDEX

21351.64

21695.36

(343.72)

979108

63738.45

0.87

2140663

148592.94

-26.46

OPTIONS

OPTIONS

STOCK

5997.04

5043.76

953.29

881997

55677.16

(0.68)

STOCK

FUTURES

452325

30846.51

-27.40

FUTURES

STOCK

STOCK

4082.91

4115.42

(32.52)

86309

5758.60

5.43

OPTIONS

317896

22336.99

-19.40

OPTIONS

TOTAL

32884.15

32542.88

341.27

2133574

137571.65

(0.60)

TOTAL

3088751

213961.68

-26.04

Nifty Spot = 8497.05

Lot Size = 75

Bull-Call Spreads

Bear-Put Spreads

Action

Strike

Price

Risk

Reward

BEP

Action

Strike

Price

Risk

Reward

BEP

Buy

8600

82.00

Buy

8500

113.45

35.85

64.15

8635.85

34.95

65.05

8465.05

Sell

8700

46.15

Sell

8400

78.50

Buy

8600

82.00

Buy

8500

113.45

58.50

141.50

8658.50

60.15

139.85

8439.85

Sell

8800

23.50

Sell

8300

53.30

Buy

8700

46.15

Buy

8400

78.50

22.65

77.35

8722.65

25.20

74.80

8374.80

Sell

8800

23.50

Sell

8300

53.30

Note: Above mentioned Bullish or Bearish Spreads in Nifty (November Series) are given as an information and not as a recommendation.

Nifty Put-Call Analysis

3

Technical & Derivatives Report

November 08, 2016

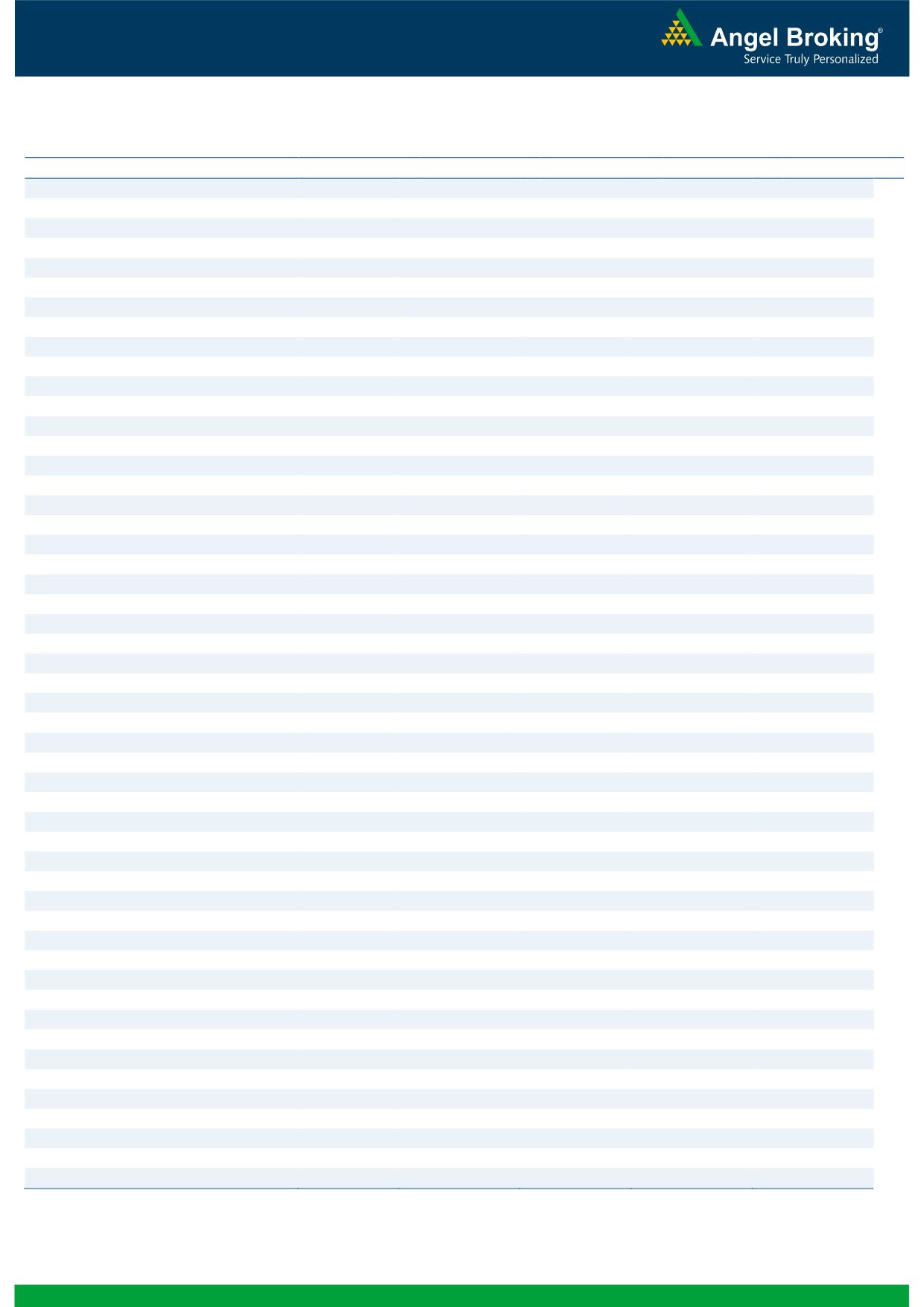

Daily Pivot Levels for Nifty Constituents

Scrips

S2

S1

PIVOT

R1

R2

ACC

1,462

1,475

1,496

1,509

1,530

ADANIPORTS

287

290

294

298

302

AMBUJACEM

237

239

243

246

250

ASIANPAINT

1,010

1,024

1,042

1,055

1,073

AUROPHARMA

739

753

765

779

791

AXISBANK

478

482

486

489

493

BAJAJ-AUTO

2,749

2,787

2,818

2,856

2,887

BANKBARODA

142

145

147

150

152

BHEL

134

137

139

141

143

BPCL

638

649

658

669

678

BHARTIARTL

299

302

307

310

315

INFRATEL

343

349

359

366

376

BOSCH

20,727

21,075

21,648

21,996

22,569

CIPLA

537

541

549

553

560

COALINDIA

314

316

319

322

325

DRREDDY

3,040

3,073

3,114

3,147

3,188

EICHERMOT

23,557

23,789

24,187

24,419

24,817

GAIL

418

422

426

430

434

GRASIM

898

908

919

929

939

HCLTECH

781

799

813

832

846

HDFCBANK

1,233

1,241

1,248

1,256

1,263

HDFC

1,357

1,369

1,386

1,398

1,414

HEROMOTOCO

3,218

3,288

3,335

3,406

3,453

HINDALCO

159

163

166

170

173

HINDUNILVR

824

831

841

848

859

ICICIBANK

269

274

277

282

286

IDEA

72

72

73

74

75

INDUSINDBK

1,199

1,207

1,218

1,227

1,237

INFY

969

973

980

984

991

ITC

242

249

254

262

267

KOTAKBANK

795

799

803

807

811

LT

1,368

1,383

1,407

1,422

1,447

LUPIN

1,468

1,493

1,514

1,539

1,560

M&M

1,358

1,368

1,381

1,391

1,403

MARUTI

5,659

5,688

5,736

5,765

5,813

NTPC

152

153

155

157

159

ONGC

262

264

269

272

277

POWERGRID

173

174

174

175

175

RELIANCE

988

995

1,006

1,012

1,023

SBIN

242

248

251

256

259

SUNPHARMA

638

646

662

670

686

TCS

2,209

2,243

2,294

2,328

2,379

TATAMTRDVR

317

322

332

337

347

TATAMOTORS

495

501

511

517

527

TATAPOWER

74

75

76

76

77

TATASTEEL

402

407

411

417

420

TECHM

423

434

442

453

461

ULTRACEMCO

3,833

3,871

3,908

3,946

3,983

WIPRO

444

447

451

454

458

YESBANK

1,187

1,197

1,214

1,225

1,242

ZEEL

496

502

509

515

522

4

Technical & Derivatives Report

November 08, 2016

Research Team Tel: 022 - 39357800

For Technical Queries

For Derivatives Queries

DISCLAIMER

Angel Broking Private Limited (hereinafter referred to as “Angel”) is a registered Member of National Stock Exchange of India Limited,

Bombay Stock Exchange Limited and Metropolitan Stock Exchange Limited. It is also registered as a Depository Participant with CDSL

and Portfolio Manager with SEBI. It also has registration with AMFI as a Mutual Fund Distributor. Angel Broking Private Limited is a

registered entity with SEBI for Research Analyst in terms of SEBI (Research Analyst) Regulations, 2014 vide registration number

INH000000164. Angel or its associates has not been debarred/ suspended by SEBI or any other regulatory authority for accessing

/dealing in securities Market. Angel or its associates/analyst has not received any compensation / managed or co-managed public

offering of securities of the company covered by Analyst during the past twelve months.

This document is solely for the personal information of the recipient, and must not be singularly used as the basis of any investment

decision. Nothing in this document should be construed as investment or financial advice. Each recipient of this document should

make such investigations as they deem necessary to arrive at an independent evaluation of an investment in the securities of the

companies referred to in this document (including the merits and risks involved), and should consult their own advisors to determine

the merits and risks of such an investment.

Reports based on technical and derivative analysis center on studying charts of a stock's price movement, outstanding positions and

trading volume, as opposed to focusing on a company's fundamentals and, as such, may not match with a report on a company's

fundamentals. Investors are advised to refer the Fundamental and Technical Research Reports available on our website to evaluate the

contrary view, if any.

The information in this document has been printed on the basis of publicly available information, internal data and other reliable

sources believed to be true, but we do not represent that it is accurate or complete and it should not be relied on as such, as this

document is for general guidance only. Angel Broking Pvt. Limited or any of its affiliates/ group companies shall not be in any way

responsible for any loss or damage that may arise to any person from any inadvertent error in the information contained in this report.

Angel Broking Pvt. Limited has not independently verified all the information contained within this document. Accordingly, we cannot

testify, nor make any representation or warranty, express or implied, to the accuracy, contents or data contained within this document.

While Angel Broking Pvt. Limited endeavors to update on a reasonable basis the information discussed in this material, there may be

regulatory, compliance, or other reasons that prevent us from doing so.

This document is being supplied to you solely for your information, and its contents, information or data may not be reproduced,

redistributed or passed on, directly or indirectly.

Neither Angel Broking Pvt. Limited, nor its directors, employees or affiliates shall be liable for any loss or damage that may arise from

or in connection with the use of this information.

5