Technical & Derivatives Report

November 07, 2016

Sensex (27274) / Nifty (8434)

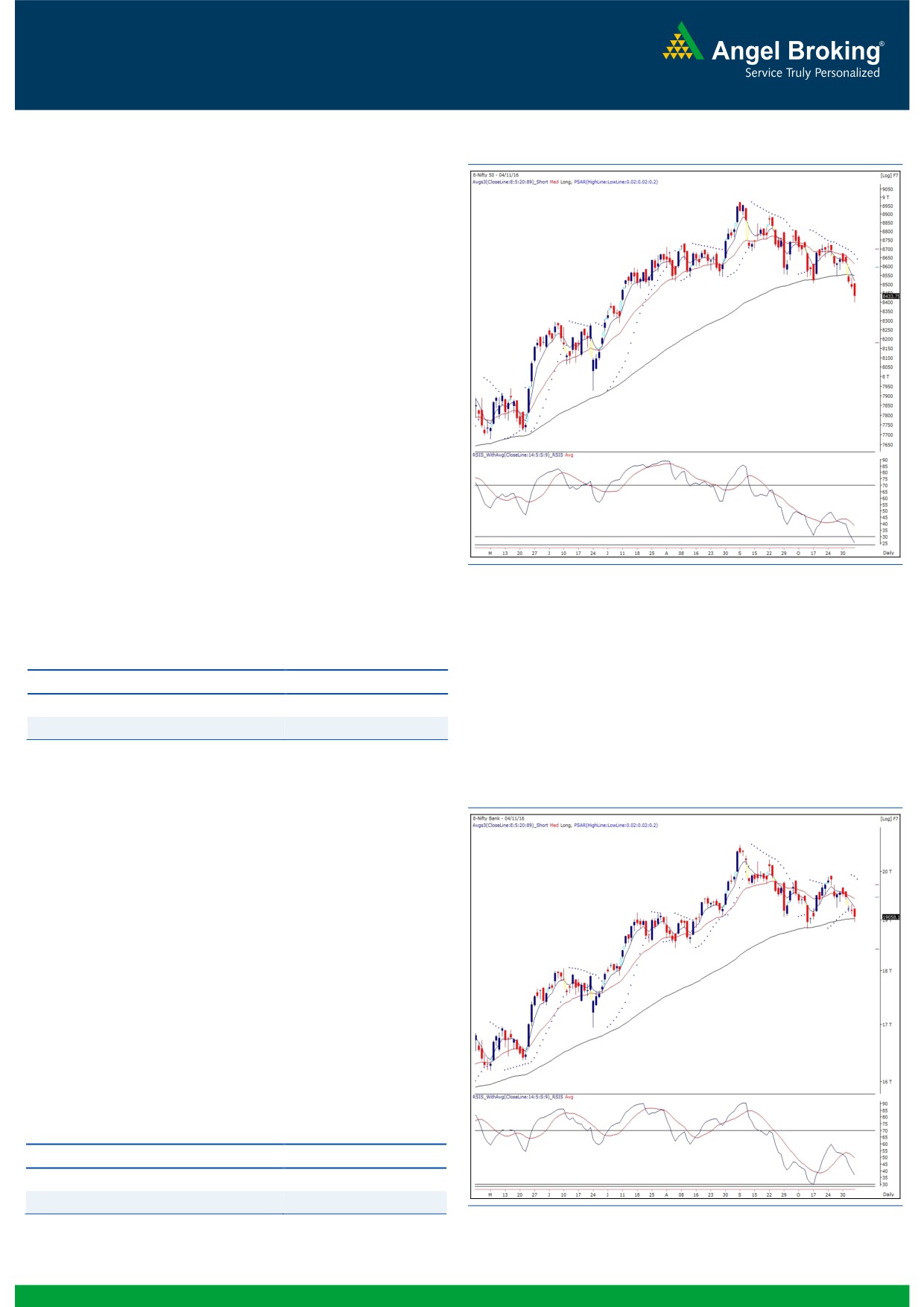

Exhibit 1: Nifty Daily Chart

The Nifty continued the bearish momentum on Friday too and

ended the session with loss of 0.60 percent over its previous

close.

Technically speaking, although, the index managed to hold the

lower end of the ‘Falling Wedge/ Channel’ pattern, we would

give more weightage to the break of 8500. When such an

important level is violated, we rarely see index immediately taking

a u-turn. The daily chart exhibits a breakdown from ‘Head and

Shoulder’ neckline level (8500), which coincides with the daily ’89

EMA’ as well. On one time frame higher degree (weekly) chart,

the Nifty has closed below the ’20 EMA’ along with the ‘RSI-

Smoothened’ slipping below the 70 mark for the first time in last

five months. All these observations provide credence to our

advised cautious stance and hence, we expect the index to remain

under pressure for some more time. On the downside, a

continuation of this move towards 8287 - 8162 cannot be ruled

out. Short term traders are advised not to create positions against

the ongoing momentum as 8550 - 8600 level would now act as

a strong resistance for the index. We reiterate that this corrective

move was essential for the market and can be construed as a

healthy development in order to start fresh the upward leg of the

rally with a long term perspective.

Key Levels

Support 1 - 8380

Resistance 1 - 8490

Support 2 - 8350

Resistance 2 - 8550

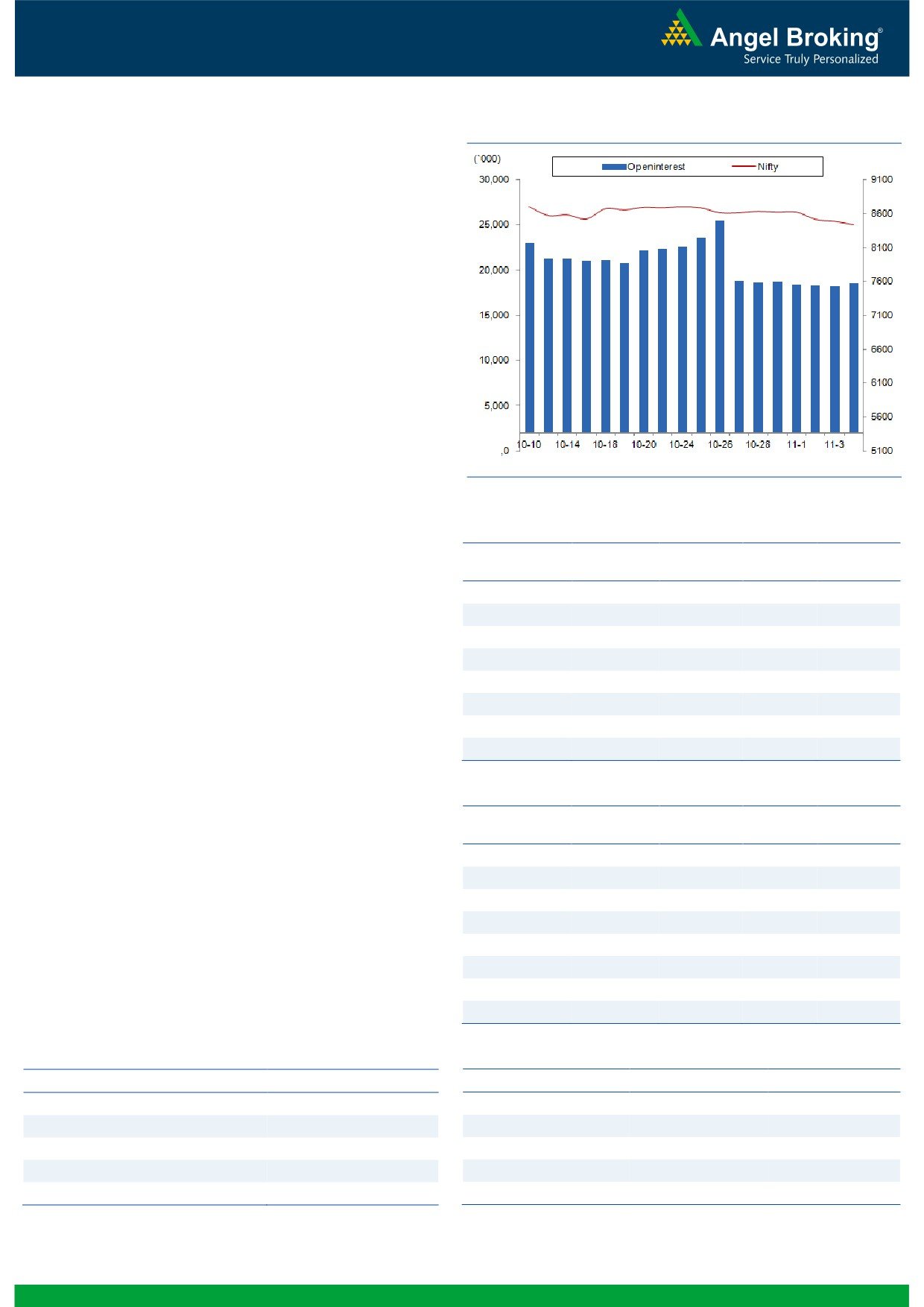

Exhibit 2: Nifty Bank Daily Chart

Nifty Bank Outlook - (19058)

During last week, the Nifty Bank index traded with negative bias

along with the broader market and ended the week with loss of

2.38 percent over its previous week's close.

On Friday, the Nifty Bank index has closed in the vicinity of

support range of 19000-19100 which coincides with the '89

DEMA'. However, there are no signs of reversal on the charts and

the '5 DEMA' has given negative crossover to the '20 DEMA'

during last week. Due to this bearish setup and the corrective

move in seen the broader market, there is higher probability of

the index sneaking below the mentioned support zone. Thus, we

continue to advise traders to remain cautious and avoid bottom

fishing. The near term supports for the Nifty bank index are

placed around 18825 and 18425 whereas resistances are seen

around 19227 and 19400.

Key Levels

Support 1 - 18825

Resistance 1 - 1927

Support 2 - 18425

Resistance 2 - 19400

1

Technical & Derivatives Report

November 07, 2016

Comments

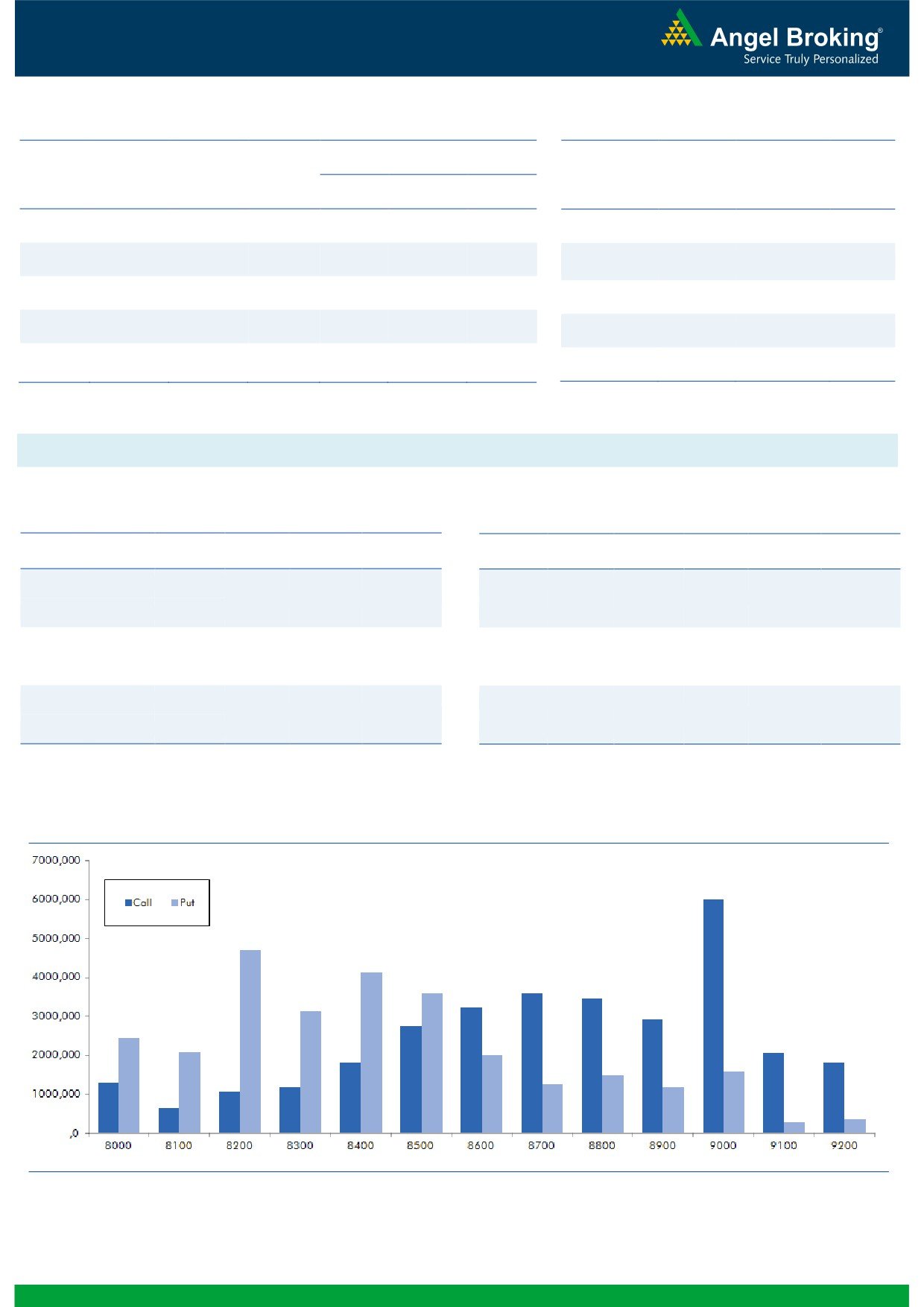

Nifty Vs OI

The Nifty futures open interest has increased by 1.82%

BankNifty futures open interest has increased by 2.35%

as market closed at 8433.75 levels.

The Nifty November future closed with a premium of

24.45 against the premium of 32.95 points in last

trading session. The December series closed at a

premium of 76.15 points.

The Implied Volatility of at the money options has

increased from 15.65% to 16.33%. At the same time, the

PCR-OI of Nifty has decreased from 0.93 to 0.92 levels.

The total OI of the market is Rs. 2,40,907/- cr. and the

stock futures OI is Rs. 74,401/- cr.

Few of the liquid counters where we have seen high cost

of carry are SINTEX, BOSCHLTD, APOLLOTYRE,

ADANIPOWER and IBREALEST.

Views

OI Gainers

On Friday, FIIs were net seller in both equity cash and

OI

PRICE

SCRIP

OI

PRICE

CHG. (%)

CHG. (%)

index future segment. They sold equities worth Rs. 343

AMARAJABAT

638400

16.79

1009.45

-1.39

crores. While, in index futures, they were net seller to the

DRREDDY

1795400

14.52

3082.55

-5.69

tune of Rs. 968 crores with marginal change in open

UNIONBANK

14964000

12.14

133.55

-2.23

interest, indicating blend of long unwindingaand freshng.com

LICHSGFIN

10096900

11.19

535.00

-3.23

short formation in last trading session.

ICIL

886200

10.47

756.30

-0.51

On Index Options front, FIIs sold of worth Rs. 189 crores

COALINDIA

13205600

9.27

317.05

-3.21

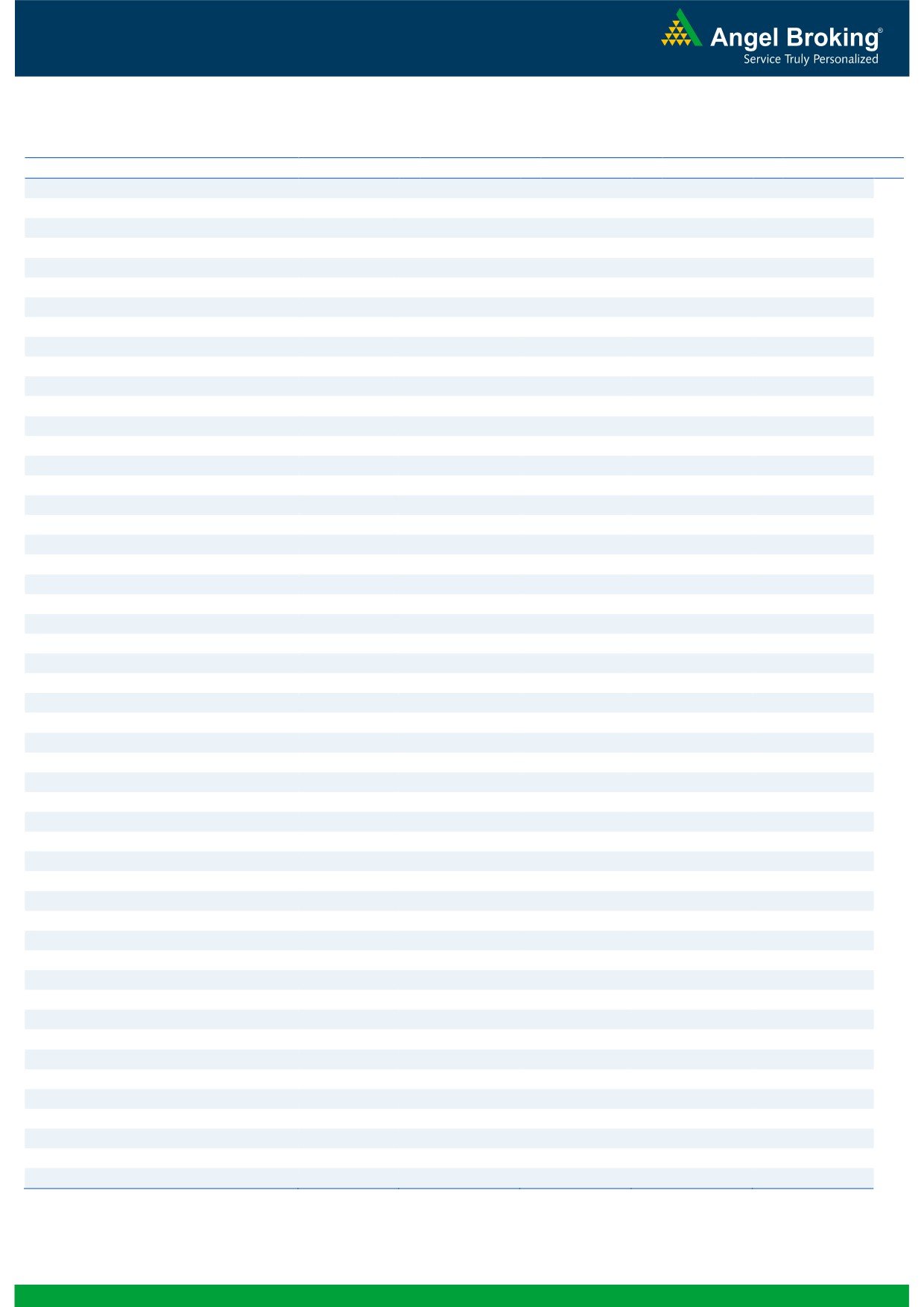

with good amount of rise in OI. In call options, some

SUNPHARMA

31089500

8.21

654.25

-7.43

build-up was seen in 8400-8700 strikes. On the other

PCJEWELLER

792000

5.81

475.55

-2.15

hand, in put options, 8100 and 8200 strikes were active

and they also added good amount of positions.

Maximum OI in November series is placed at 9000 call

OI Losers

and of put options has been shifted to 8200 strike price.

OI

PRICE

SCRIP

OI

PRICE

CHG. (%)

CHG. (%)

Last week, we are witnessing good amount of long

AMBUJACEM

11770000

-11.55

242.10

-0.47

unwinding and fresh short formation in Index Futures by

INFRATEL

3196200

-10.08

364.90

-4.69

stronger hands. They have also been countinously buying

ARVIND

6152000

-9.64

400.65

-1.80

put options and writing out the money call options since

VEDL

46469000

-7.33

212.00

-2.28

past few days. Looking at the above data, we believe

STAR

1789000

-7.31

1066.90

-4.94

market may continue to remain under pressure. Thus,

COLPAL

726600

-7.07

984.30

3.19

traders can buy 8400 put options to trade in Nifty.

CROMPGREAV

8568000

-7.03

76.55

-0.39

INDUSINDBK

3453600

-7.01

1219.70

-1.29

Historical Volatility

Put-Call Ratio

SCRIP

HV

SCRIP

PCR-OI

PCR-VOL

SUNPHARMA

43.80

NIFTY

0.92

1.00

DRREDDY

37.39

BANKNIFTY

1.14

0.93

ITC

26.53

RELIANCE

0.47

0.55

HCLTECH

30.94

SBIN

0.52

0.52

COALINDIA

26.08

AXISBANK

0.44

0.48

2

Technical & Derivatives Report

November 07, 2016

FII Statistics for November 04, 2016

Turnover on November 04, 2016

Open Interest

No. of

Turnover

Change

Detail

Buy

Sell

Net

Instrument

Value

Change

Contracts

( in Cr. )

(%)

Contracts

(in Cr.)

(%)

INDEX

INDEX

2145.14

3113.59

(968.45)

205965

13575.97

0.34

251881

17013.11

24.87

FUTURES

FUTURES

INDEX

INDEX

40237.11

40425.90

(188.79)

970646

62621.62

8.40

2959366

202061.40

-55.08

OPTIONS

OPTIONS

STOCK

7250.11

7850.41

(600.30)

888035

55414.64

1.07

STOCK

FUTURES

645310

42487.13

17.08

FUTURES

STOCK

STOCK

5946.83

5963.06

(16.23)

81865

5387.56

21.65

OPTIONS

400092

27713.64

33.07

OPTIONS

TOTAL

55579.20

57352.97

(1773.77)

2146511

136999.79

4.88

TOTAL

4256649

289275.27

-44.43

Nifty Spot = 8433.75

Lot Size = 75

Bull-Call Spreads

Bear-Put Spreads

Action

Strike

Price

Risk

Reward

BEP

Action

Strike

Price

Risk

Reward

BEP

Buy

8500

105.30

Buy

8400

104.25

41.25

58.75

8541.25

31.25

68.75

8368.75

Sell

8600

64.05

Sell

8300

73.00

Buy

8500

105.30

Buy

8400

104.25

70.05

129.95

8570.05

53.15

146.85

8346.85

Sell

8700

35.25

Sell

8200

51.10

Buy

8600

64.05

Buy

8300

73.00

28.80

71.20

8628.80

21.90

78.10

8278.10

Sell

8700

35.25

Sell

8200

51.10

Note: Above mentioned Bullish or Bearish Spreads in Nifty (November Series) are given as an information and not as a recommendation.

Nifty Put-Call Analysis

3

Technical & Derivatives Report

November 07, 2016

Daily Pivot Levels for Nifty Constituents

Scrips

S2

S1

PIVOT

R1

R2

ACC

1,445

1,467

1,497

1,520

1,549

ADANIPORTS

280

284

288

292

296

AMBUJACEM

234

237

242

245

249

ASIANPAINT

1,025

1,034

1,044

1,054

1,064

AUROPHARMA

673

701

735

762

796

AXISBANK

468

473

480

485

491

BAJAJ-AUTO

2,779

2,797

2,823

2,841

2,868

BANKBARODA

136

140

144

147

152

BHEL

131

133

136

138

141

BPCL

624

634

642

651

659

BHARTIARTL

301

304

307

310

314

INFRATEL

345

355

368

378

392

BOSCH

20,566

21,038

21,394

21,867

22,223

CIPLA

522

533

549

561

577

COALINDIA

304

310

318

325

333

DRREDDY

3,004

3,042

3,105

3,143

3,206

EICHERMOT

23,180

23,555

24,150

24,525

25,120

GAIL

415

419

426

431

437

GRASIM

863

882

904

923

945

HCLTECH

750

772

786

808

822

HDFCBANK

1,235

1,239

1,246

1,250

1,257

HDFC

1,360

1,373

1,391

1,404

1,421

HEROMOTOCO

3,178

3,233

3,306

3,361

3,434

HINDALCO

149

154

160

164

170

HINDUNILVR

828

838

852

862

876

ICICIBANK

262

266

269

273

276

IDEA

70

71

73

74

76

INDUSINDBK

1,193

1,206

1,220

1,233

1,247

INFY

952

962

970

980

989

ITC

241

245

251

255

260

KOTAKBANK

779

789

801

811

822

LT

1,380

1,400

1,417

1,437

1,455

LUPIN

1,350

1,385

1,429

1,464

1,508

M&M

1,324

1,348

1,370

1,394

1,416

MARUTI

5,599

5,652

5,720

5,773

5,842

NTPC

151

152

154

155

157

ONGC

262

266

269

273

276

POWERGRID

169

171

174

176

178

RELIANCE

984

995

1,011

1,022

1,038

SBIN

236

240

244

247

251

SUNPHARMA

627

639

660

672

692

TCS

2,278

2,304

2,320

2,346

2,362

TATAMTRDVR

319

327

333

341

347

TATAMOTORS

495

504

510

519

525

TATAPOWER

72

73

75

77

79

TATASTEEL

394

398

403

408

412

TECHM

406

418

427

438

447

ULTRACEMCO

3,757

3,806

3,867

3,916

3,978

WIPRO

441

447

450

456

460

YESBANK

1,152

1,174

1,195

1,217

1,238

ZEEL

495

501

505

511

515

4

Technical & Derivatives Report

November 07, 2016

Research Team Tel: 022 - 39357800

For Technical Queries

For Derivatives Queries

DISCLAIMER

Angel Broking Private Limited (hereinafter referred to as “Angel”) is a registered Member of National Stock Exchange of India Limited,

Bombay Stock Exchange Limited and Metropolitan Stock Exchange Limited. It is also registered as a Depository Participant with CDSL

and Portfolio Manager with SEBI. It also has registration with AMFI as a Mutual Fund Distributor. Angel Broking Private Limited is a

registered entity with SEBI for Research Analyst in terms of SEBI (Research Analyst) Regulations, 2014 vide registration number

INH000000164. Angel or its associates has not been debarred/ suspended by SEBI or any other regulatory authority for accessing

/dealing in securities Market. Angel or its associates/analyst has not received any compensation / managed or co-managed public

offering of securities of the company covered by Analyst during the past twelve months.

This document is solely for the personal information of the recipient, and must not be singularly used as the basis of any investment

decision. Nothing in this document should be construed as investment or financial advice. Each recipient of this document should

make such investigations as they deem necessary to arrive at an independent evaluation of an investment in the securities of the

companies referred to in this document (including the merits and risks involved), and should consult their own advisors to determine

the merits and risks of such an investment.

Reports based on technical and derivative analysis center on studying charts of a stock's price movement, outstanding positions and

trading volume, as opposed to focusing on a company's fundamentals and, as such, may not match with a report on a company's

fundamentals. Investors are advised to refer the Fundamental and Technical Research Reports available on our website to evaluate the

contrary view, if any.

The information in this document has been printed on the basis of publicly available information, internal data and other reliable

sources believed to be true, but we do not represent that it is accurate or complete and it should not be relied on as such, as this

document is for general guidance only. Angel Broking Pvt. Limited or any of its affiliates/ group companies shall not be in any way

responsible for any loss or damage that may arise to any person from any inadvertent error in the information contained in this report.

Angel Broking Pvt. Limited has not independently verified all the information contained within this document. Accordingly, we cannot

testify, nor make any representation or warranty, express or implied, to the accuracy, contents or data contained within this document.

While Angel Broking Pvt. Limited endeavors to update on a reasonable basis the information discussed in this material, there may be

regulatory, compliance, or other reasons that prevent us from doing so.

This document is being supplied to you solely for your information, and its contents, information or data may not be reproduced,

redistributed or passed on, directly or indirectly.

Neither Angel Broking Pvt. Limited, nor its directors, employees or affiliates shall be liable for any loss or damage that may arise from

or in connection with the use of this information.

5