Technical & Derivatives Report

September 07, 2016

Sensex (28978) / Nifty (8943)

Exhibit 1: Nifty Daily Chart

Last week, we saw the index posting a new 52-week high tad

above the 8800 mark. This was followed by a gap up opening on

Tuesday in-line with global cues. As a result, the Nifty first met

with our target of 8850 and then continued its strong upward bias

throughout the session to post highest single day gains in last two

months.

What we witnessed yesterday is a perfect example of cheer

optimism in the market. As a result, the index closed well above

the 8900 mark. Now, despite this strong move, we would advise

traders to keep booking profits and follow a stock centric

approach. For the coming session, the immediate resistance is

seen at 8980 - 9000 levels; whereas, 8880 - 8840 would act as

a support zone.

Key Levels

Support 1 - 8880

Resistance 1 - 8980

Support 2 - 8840

Resistance 2 - 9000

Nifty Bank Outlook - (20426)

Exhibit 2: Nifty Bank Daily Chart

The Nifty Bank index started the week with a gap up opening and

continued its positive momentum throughout the session, gaining

another 2.73%.

Yesterday's follow up buying post a gap up opening was clearly a

sign of continuation of the trend. The upmove was quite on

expected lines as the sectoral heavyweights have been showing

continued strength. Although, the pace at which it swiftly move

higher yesterday was remarkable and a bit surprising. Going

ahead, we continue to maintain our positive stance on the index

and we reiterate our advice that unless any reversal signs seen,

traders should focus on stock specific moves and trade in

direction of the broader uptrend. The intraday support for the

index are placed around 20200 and 20089 and the resistances

are seen around 20541 and 20907.

Key Levels

Support 1 - 20200

Resistance 1 - 20541

Support 2 - 20089

Resistance 2 - 20907

1

Technical & Derivatives Report

September 07, 2016

Comments

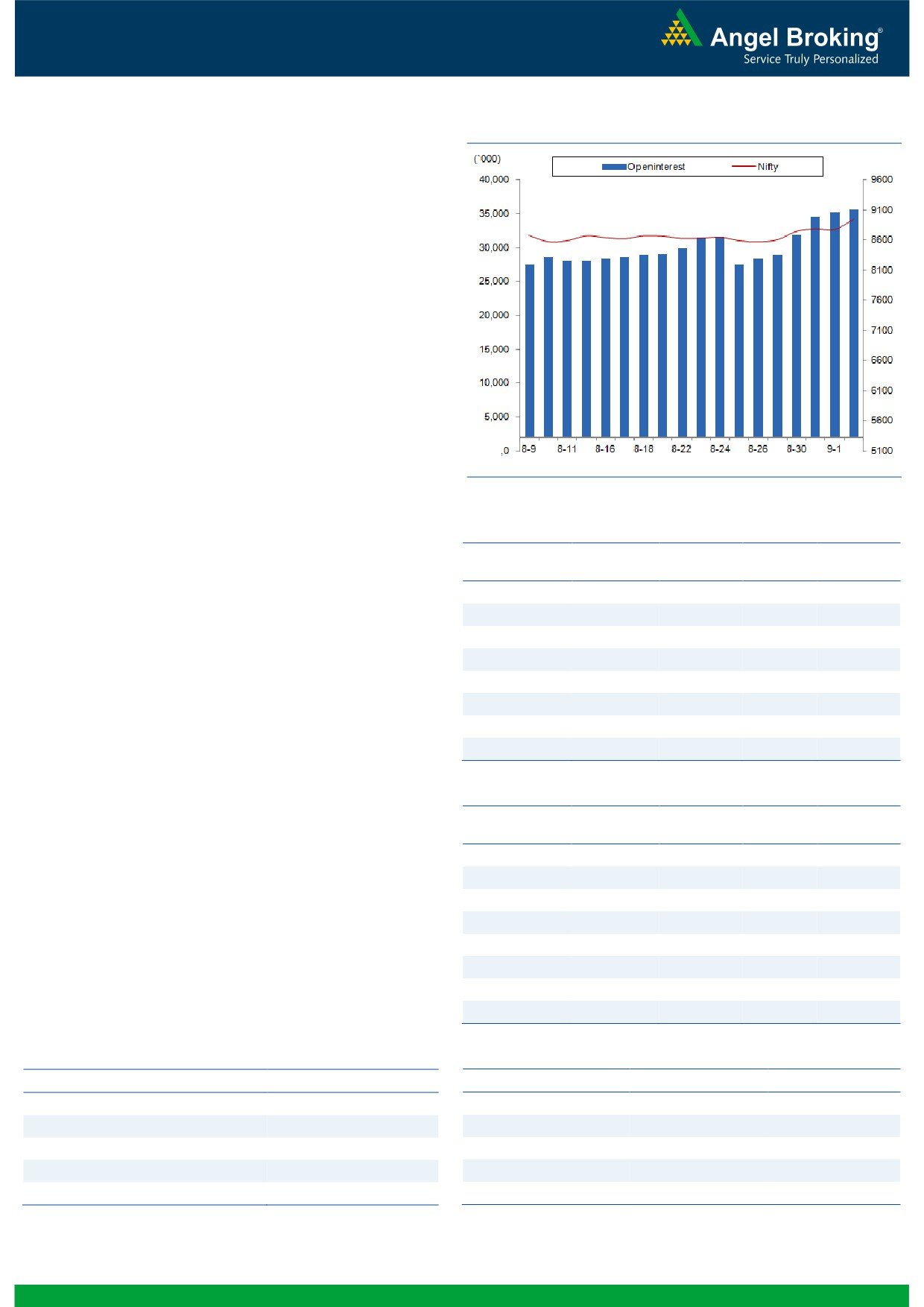

Nifty Vs OI

The Nifty futures open interest has increased by 2.51%

BankNifty futures open interest has increased by 2.32%

as market closed at 8943.00 levels.

The Nifty September future closed with a premium of

18.20 points against a premium of 30.50 points in

previous session. The October series closed at a

premium of 58.25 points.

The Implied Volatility of at the money options has

decreased from 11.03% to 10.89%. At the same time,

the PCR-OI of Nifty has increased from 1.13 to 1.19.

The total OI of the market is Rs. 2,90,418/- cr. and the

stock futures OI is Rs. 83,862/- cr.

Few of the liquid counters where we have seen high cost

of carry are ADANIPOWER, JPASSOCIAT, IBREALEST,

ADANIENT and UBL.

Views

OI Gainers

OI

PRICE

Yesterday, FIIs were net buyers in both equity cash and

SCRIP

OI

PRICE

CHG. (%)

CHG. (%)

index future segment. They bought equities to the tune of

MINDTREE

2768000

36.22

521.00

-5.69

Rs. 1439 crores. While, they were net buyers in index

PETRONET

4677000

18.38

356.10

0.76

future worth Rs. 331 crores with rise in OI, indicating

CAIRN

11469500

15.59

204.05

0.59

formation of fresh longs in last trading session.ngelbroking.com

JUBLFOOD

2139000

13.44

1074.20

-9.46

On Index Options front, FIIs were net buyers of Rs. 818

AMARAJABAT

760800

11.62

1034.20

4.14

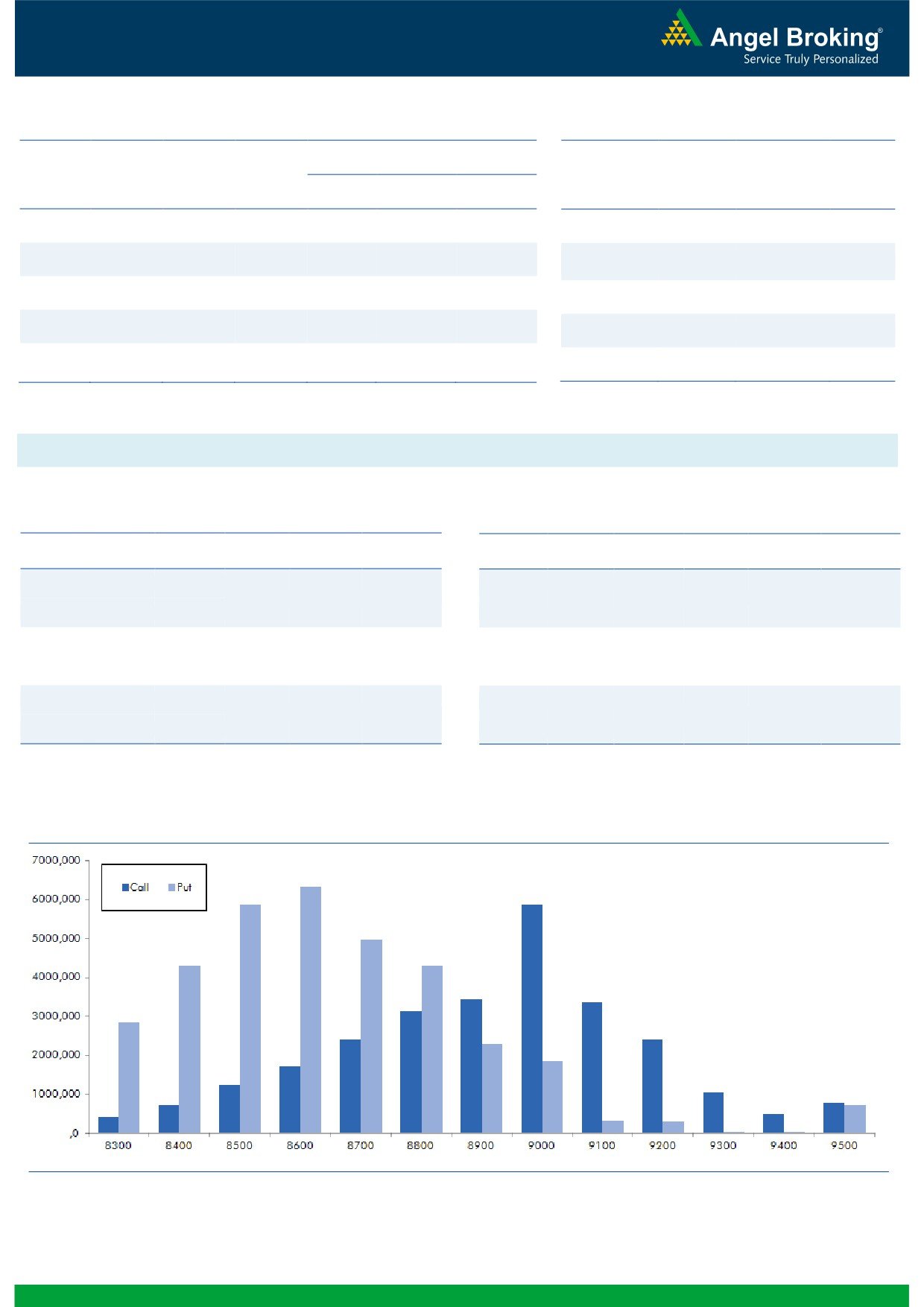

crores with rise in OI. In call options, 9200 and 9100

IBULHSGFIN

6959200

6.42

839.65

0.64

strikes added some fresh positions. While, huge

CENTURYTEX

7439300

5.29

769.05

2.77

unwinding was seen in 8900 strike, followed by some

COALINDIA

12552800

5.14

330.05

-1.00

unwinding in 8800 and 8700 strikes. On the other

hand, in put options, 8900 - 8700 strikes added huge

positions; followed by unwinding in 8600 strike. Highest

OI Losers

OI

PRICE

OI in September series is placed at 9000 call and 8600

SCRIP

OI

PRICE

CHG. (%)

CHG. (%)

put option.

CEATLTD

2082500

-29.52

969.35

1.38

Yesterday, FIIs has bought significantly in cash segment.

JUSTDIAL

3742400

-9.85

502.55

5.07

We were quite vocal from last few days that the overall

APOLLOHOSP

402400

-9.61

1408.75

2.26

derivative data is very positive and we may see 8950 -

KSCL

3816000

-8.49

341.75

3.81

9000 levels in near term. Although we reached to the

GODREJCP

423600

-8.47

1626.70

3.33

mentioned zone, we are not seeing any sign of reversal

ACC

1453200

-8.16

1703.10

1.35

as of now. Thus, we advise traders to trade with positive

TORNTPHARM

272800

-7.96

1638.65

1.16

bias and focus more on stock specific moves.

NTPC

23384000

-6.39

162.20

1.98

Historical Volatility

Put-Call Ratio

SCRIP

HV

SCRIP

PCR-OI

PCR-VOL

JUBLFOOD

59.38

NIFTY

1.19

1.24

AXISBANK

35.62

BANKNIFTY

1.54

0.95

JSWSTEEL

31.17

RELIANCE

0.40

0.40

TATAMOTORS

47.40

TATAMOTORS

1.52

0.72

TATAMTRDVR

45.01

SBIN

0.92

0.47

2

Technical & Derivatives Report

September 07, 2016

FII Statistics for 06, September 2016

Turnover on 06, September 2016

Open Interest

No. of

Turnover

Change

Detail

Buy

Sell

Net

Instrument

Value

Contracts

( in Cr. )

(%)

Contracts

Change (%)

(in Cr.)

INDEX

INDEX

2430.66

2099.34

331.33

452263

30977.26

3.14

205774

15069.78

34.64

FUTURES

FUTURES

INDEX

INDEX

36169.27

35351.26

818.00

1096587

75235.22

4.32

3368003

249742.72

75.06

OPTIONS

OPTIONS

STOCK

6941.96

5768.13

1173.83

874284

59522.24

(0.16)

STOCK

FUTURES

546421

39248.97

9.73

FUTURES

STOCK

STOCK

4852.31

4881.01

(28.70)

89199

6355.11

9.01

OPTIONS

318439

23208.56

18.79

OPTIONS

TOTAL

50394.21

48099.75

2294.46

2512333

172089.83

2.66

TOTAL

4438637

327270.04

56.47

Nifty Spot = 8943.00

Lot Size = 75

Bull-Call Spreads

Bear-Put Spreads

Action

Strike

Price

Risk

Reward

BEP

Action

Strike

Price

Risk

Reward

BEP

Buy

9000

78.60

Buy

8900

76.00

37.35

62.65

9037.35

28.70

71.30

8871.30

Sell

9100

41.25

Sell

8800

47.30

Buy

9000

78.60

Buy

8900

76.00

59.40

140.60

9059.40

46.40

153.60

8853.60

Sell

9200

19.20

Sell

8700

29.60

Buy

9100

41.25

Buy

8800

47.30

22.05

77.95

9122.05

17.70

82.30

8782.30

Sell

9200

19.20

Sell

8700

29.60

Note: Above mentioned Bullish or Bearish Spreads in Nifty (September Series) are given as an information and not as a recommendation.

Nifty Put-Call Analysis

3

Technical & Derivatives Report

September 07, 2016

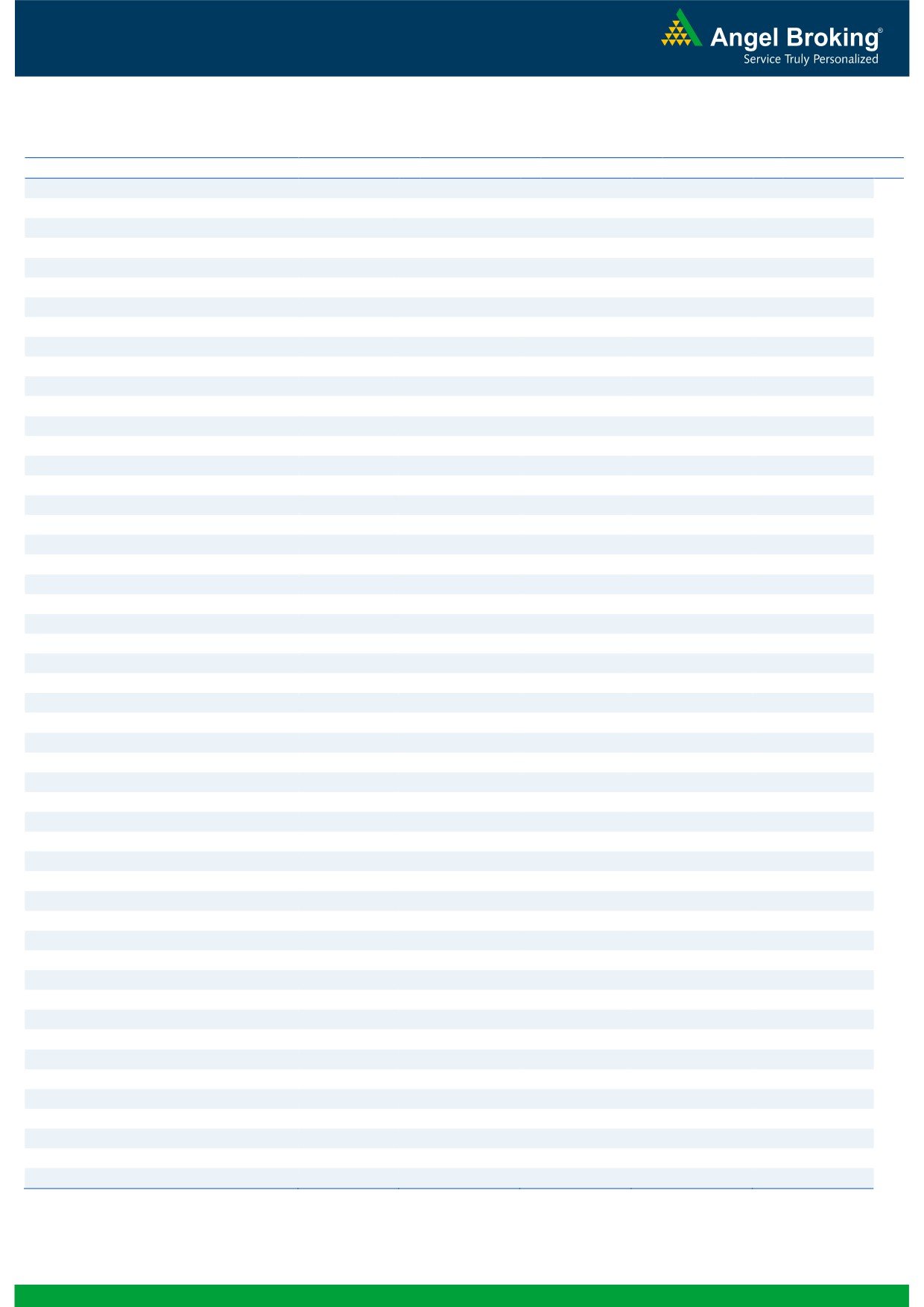

Daily Pivot Levels for Nifty Constituents

Scrips

S2

S1

PIVOT

R1

R2

ACC

1,659

1,679

1,694

1,714

1,728

ADANIPORTS

266

268

270

272

274

AMBUJACEM

274

276

277

279

281

ASIANPAINT

1,153

1,179

1,196

1,222

1,240

AUROPHARMA

766

772

779

785

793

AXISBANK

590

613

625

648

661

BAJAJ-AUTO

2,965

2,985

3,010

3,030

3,056

BANKBARODA

166

168

169

171

173

BHEL

136

137

138

139

140

BPCL

585

592

596

603

607

BHARTIARTL

309

315

319

325

329

INFRATEL

335

341

345

351

355

BOSCH

23,888

24,174

24,337

24,623

24,786

CIPLA

570

574

580

585

591

COALINDIA

321

325

329

333

338

DRREDDY

3,102

3,117

3,131

3,147

3,161

EICHERMOT

22,722

22,835

22,940

23,053

23,158

GAIL

389

396

401

408

413

GRASIM

4,576

4,639

4,694

4,757

4,813

HCLTECH

769

777

783

791

796

HDFCBANK

1,284

1,292

1,298

1,306

1,312

HDFC

1,434

1,446

1,454

1,466

1,474

HEROMOTOCO

3,558

3,587

3,618

3,646

3,678

HINDALCO

156

157

158

160

161

HINDUNILVR

916

927

933

944

951

ICICIBANK

259

266

270

277

281

IDEA

81

83

84

86

87

INDUSINDBK

1,182

1,205

1,219

1,241

1,255

INFY

1,030

1,037

1,043

1,051

1,056

ITC

258

261

263

265

268

KOTAKBANK

811

815

818

822

825

LT

1,494

1,505

1,515

1,526

1,536

LUPIN

1,506

1,521

1,530

1,545

1,554

M&M

1,472

1,481

1,488

1,497

1,504

MARUTI

5,151

5,235

5,285

5,369

5,419

NTPC

159

161

163

165

166

ONGC

236

237

239

241

243

POWERGRID

182

184

186

188

190

RELIANCE

1,010

1,015

1,020

1,025

1,030

SBIN

254

257

259

262

265

SUNPHARMA

773

778

783

788

794

TCS

2,455

2,469

2,495

2,509

2,535

TATAMTRDVR

346

360

368

382

390

TATAMOTORS

543

566

579

603

616

TATAPOWER

77

78

79

79

80

TATASTEEL

370

378

382

390

395

TECHM

462

471

476

485

490

ULTRACEMCO

4,027

4,051

4,078

4,102

4,129

WIPRO

477

480

483

486

488

YESBANK

1,368

1,404

1,427

1,463

1,486

ZEEL

528

533

536

541

544

4

Technical & Derivatives Report

September 07, 2016

Research Team Tel: 022 - 39357800

For Technical Queries

For Derivatives Queries

DISCLAIMER

Angel Broking Private Limited (hereinafter referred to as “Angel”) is a registered Member of National Stock Exchange of India Limited,

Bombay Stock Exchange Limited and Metropolitan Stock Exchange Limited. It is also registered as a Depository Participant with CDSL

and Portfolio Manager with SEBI. It also has registration with AMFI as a Mutual Fund Distributor. Angel Broking Private Limited is a

registered entity with SEBI for Research Analyst in terms of SEBI (Research Analyst) Regulations, 2014 vide registration number

INH000000164. Angel or its associates has not been debarred/ suspended by SEBI or any other regulatory authority for accessing

/dealing in securities Market. Angel or its associates/analyst has not received any compensation / managed or co-managed public

offering of securities of the company covered by Analyst during the past twelve months.

This document is solely for the personal information of the recipient, and must not be singularly used as the basis of any investment

decision. Nothing in this document should be construed as investment or financial advice. Each recipient of this document should

make such investigations as they deem necessary to arrive at an independent evaluation of an investment in the securities of the

companies referred to in this document (including the merits and risks involved), and should consult their own advisors to determine

the merits and risks of such an investment.

Reports based on technical and derivative analysis center on studying charts of a stock's price movement, outstanding positions and

trading volume, as opposed to focusing on a company's fundamentals and, as such, may not match with a report on a company's

fundamentals. Investors are advised to refer the Fundamental and Technical Research Reports available on our website to evaluate the

contrary view, if any.

The information in this document has been printed on the basis of publicly available information, internal data and other reliable

sources believed to be true, but we do not represent that it is accurate or complete and it should not be relied on as such, as this

document is for general guidance only. Angel Broking Pvt. Limited or any of its affiliates/ group companies shall not be in any way

responsible for any loss or damage that may arise to any person from any inadvertent error in the information contained in this report.

Angel Broking Pvt. Limited has not independently verified all the information contained within this document. Accordingly, we cannot

testify, nor make any representation or warranty, express or implied, to the accuracy, contents or data contained within this document.

While Angel Broking Pvt. Limited endeavors to update on a reasonable basis the information discussed in this material, there may be

regulatory, compliance, or other reasons that prevent us from doing so.

This document is being supplied to you solely for your information, and its contents, information or data may not be reproduced,

redistributed or passed on, directly or indirectly.

Neither Angel Broking Pvt. Limited, nor its directors, employees or affiliates shall be liable for any loss or damage that may arise from

or in connection with the use of this information.

5