Technical & Derivatives Report

April 07, 2016

Sensex (24901) / Nifty (7614)

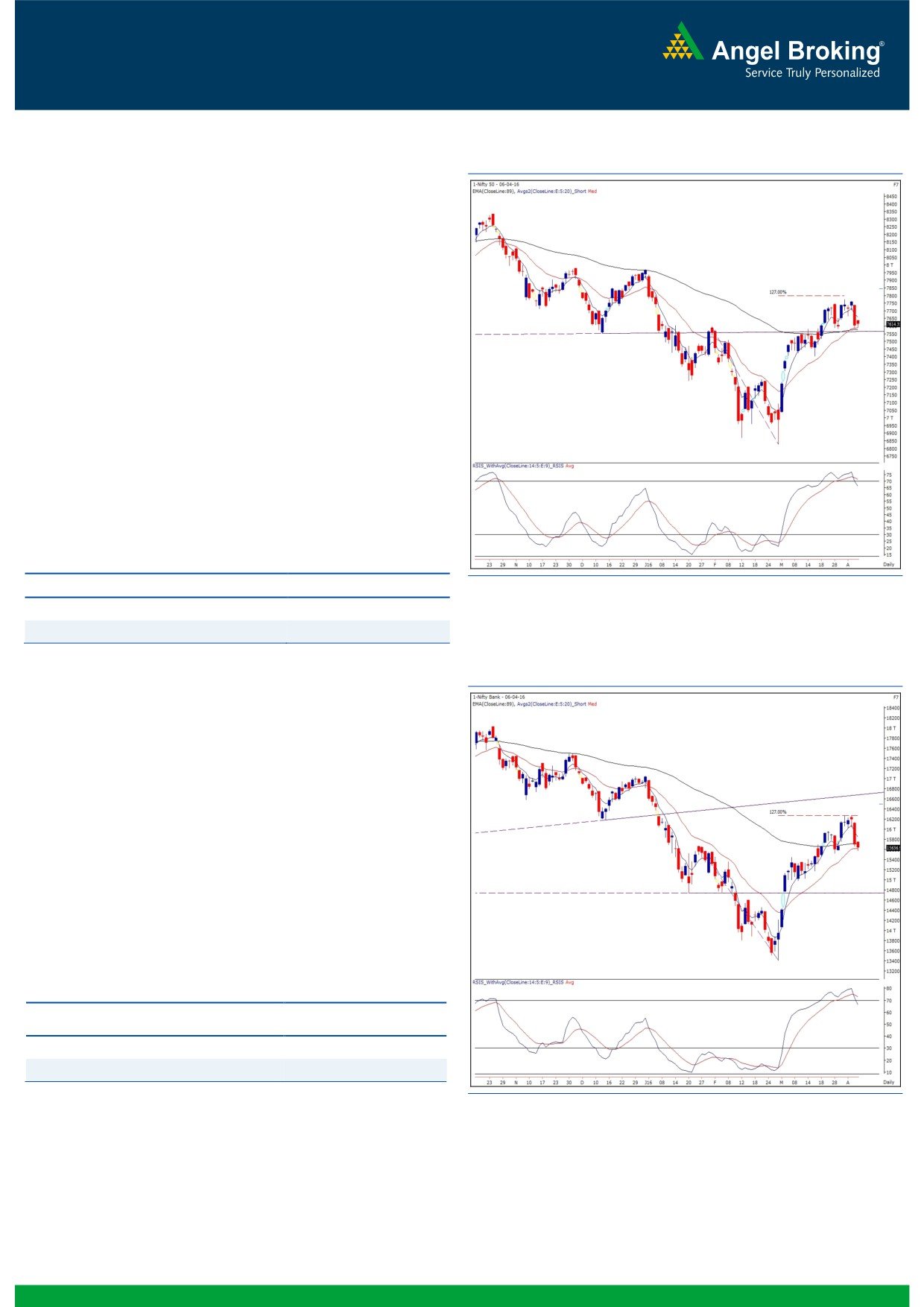

Exhibit 1: Nifty Daily Chart

A decent correction post the RBI Monetary policy was followed by

a flat opening citing to mixed global cues. Subsequently, the Nifty

corrected a bit to test the strong support level of 7580. However,

due to lack of follow through selling we saw index rebounding tad

above the 7600 mark by posting a dull day.

Yesterday’s session traded within a narrow range and has shown

no clear bias at the close. In last couple of weeks, the Nifty has

taken a support at the 7580 mark on four occasions; indicating

significance of this level. Despite being a strong support, we

expect the Nifty to sneak below this level soon. The important

evidence behind this opinion is the negative placement of the

daily ‘RSI-Smoothened’ oscillator. Going forward, we expect the

Nifty to test 7520 - 7480 levels. Thus, any intraday bounce

towards 7660 - 7700 could be a shorting opportunity for

momentum traders.

Key Levels

Support 1 - 7520

Resistance 1 - 7660

Support 2 - 7480

Resistance 2 - 7700

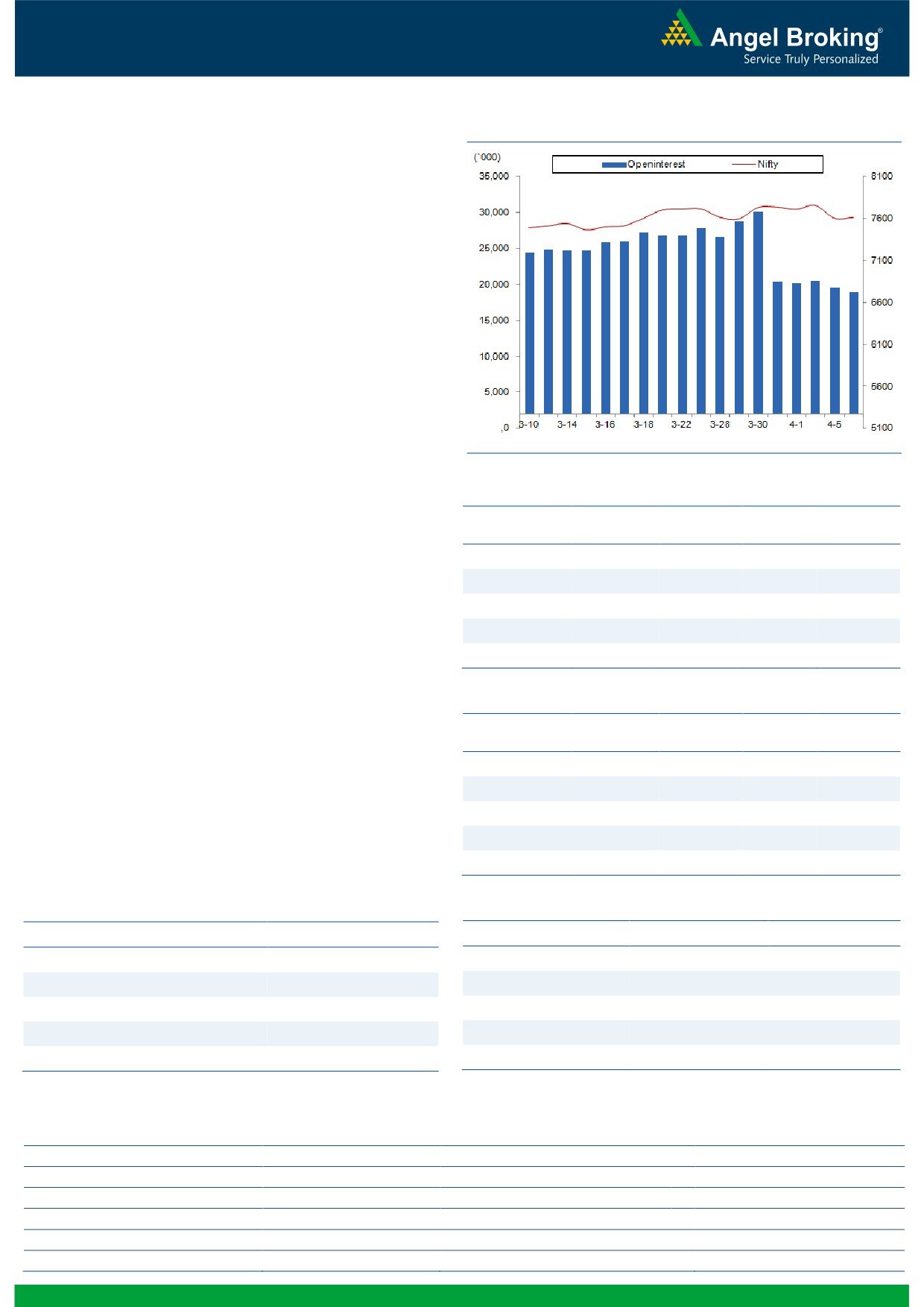

Exhibit 2: Nifty Bank Daily Chart

Nifty Bank Outlook - (15637)

In yesterday's trading session, the Nifty Bank index traded in a

narrow range of 190 points and ended the session with marginal

losses of 0.37%.

The index on Monday had corrected from its resistance zone

which is a bearish indication and the small body candle in

yesterday's session does not indicate any change to the short term

trend. Thus, the index can trade in a range with a negative bias at

least for next couple of days. Traders are hence advised to trade

on stock specific moves with a proper risk management. The

intraday support for the index is placed around 15530 and

15375; whereas, resistances are seen around 15780 and 15970.

Key Levels

Support 1 - 15530

Resistance 1 - 15780

Support 2 - 15375

Resistance 2 - 15970

1

Technical & Derivatives Report

April 07, 2016

Comments

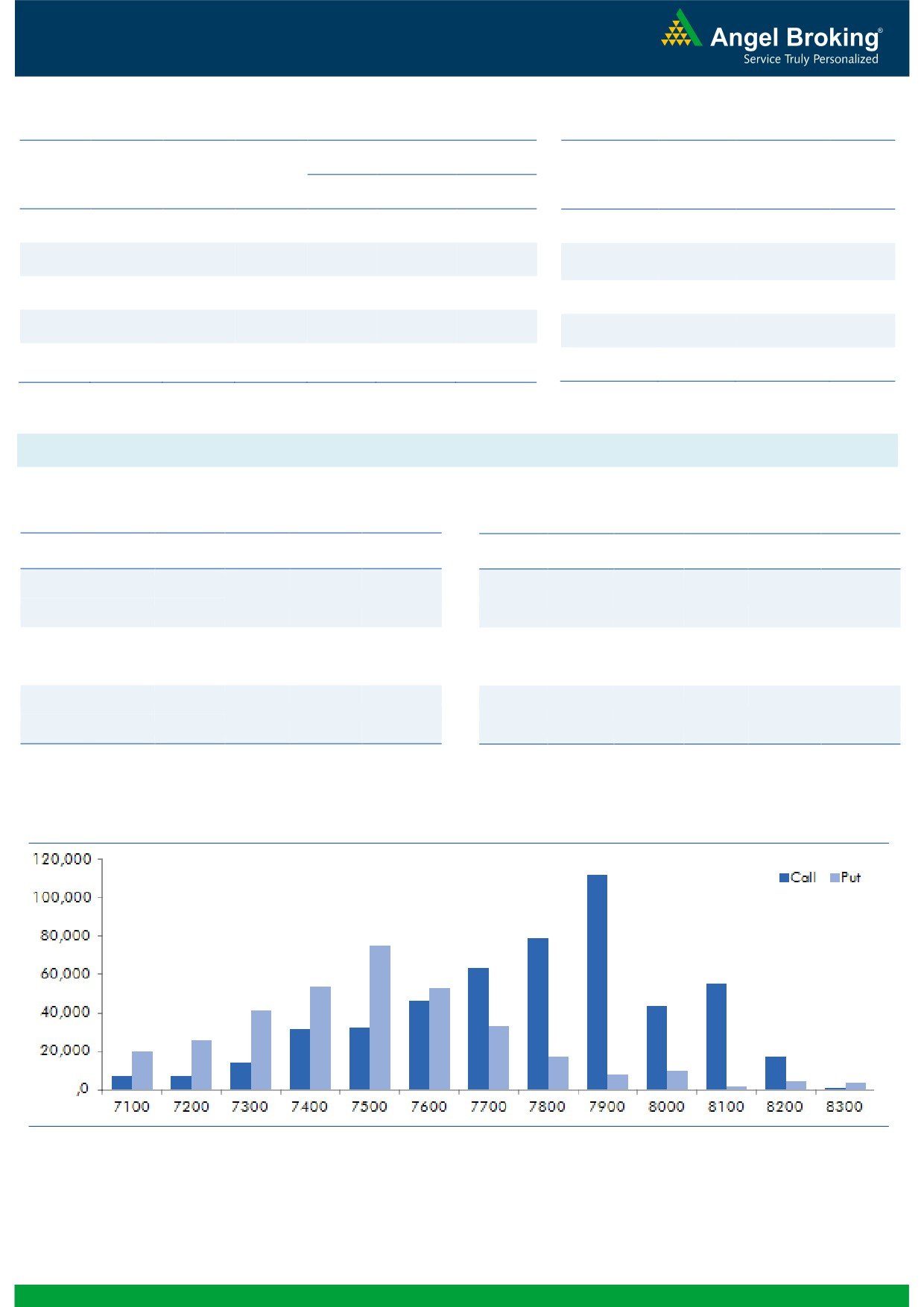

Nifty Vs OI

The Nifty futures open interest has decreased by 3.46%

BankNifty futures open interest has decreased by 0.07%

as market closed at 7614.35 levels.

The Nifty April future closed at a premium of 20.35

points against a premium of 20.30 points. The May

series closed at a premium of 53.40 points.

The Implied Volatility of at the money options has

decreased from 16.46% to 15.50%.

The total OI of the market is Rs. 1,93,697/- cr. and the

stock futures OI is Rs. 52,960/- cr.

Few of the liquid counters where we have seen high cost

of carry are JPASSOCIAT, UNITECH, GMRINFRA,

ADANIPOWER and RCOM.

Views

FIIs continue to sell in both cash market and Index

OI Gainers

Futures. They sold equities to the tune of Rs. 494 crores.

OI

PRICE

While in Index Futures, they were net seller of Rs. 770

SCRIP

OI

PRICE

CHG. (%)

CHG. (%)

crores with some fall in rise in OI, suggesting blend of

HAVELLS

3226000

26.91

327.45

4.49

both long unwinding and short formation in last trading

BEML

736000

11.68

941.90

-3.27

session.

TATASTEEL

25534000

11.46

328.55

5.40

In Index Options front, FIIs were net sellers of Rs. 780

GRASIM

903750

9.71

3912.60

2.43

crores with rise in OI. PCR-OI decreased from 0.79 tong.com

AMARAJABAT

583200

8.97

877.70

-1.10

0.78 with fall in IV’s suggesting short formation in call

options. In call options, out of the money strikes 7900,

OI Losers

8000 and 8200 strikes added good amount of build-up.

OI

PRICE

Whereas, in put options, 7500 strike was active and

SCRIP

OI

PRICE

CHG. (%)

CHG. (%)

some fresh OI addition was also visible. Maximum OI in

HINDZINC

7052800

-11.98

162.20

1.18

current series is visible in 8000 call and 7500 put

HEXAWARE

3218000

-7.58

256.10

1.94

options. From past

2-3 trading sessions we are

M&M

3354400

-5.66

1220.35

0.36

witnessing good amount of profit booking and fresh

ONGC

16836000

-4.41

206.10

0.36

short formation by FIIs. We would suggest avoiding fresh

EICHERMOT

166525

-4.32

19179.85

1.99

longs in this market, we may see further pain.

Historical Volatility

Put-Call Ratio

SCRIP

HV

SCRIP

PCR-OI

PCR-VOL

CENTURYTEX

59.03

NIFTY

0.78

0.85

BHARATFORG

43.10

BANKNIFTY

0.62

0.81

APOLLOTYRE

45.50

SBIN

0.33

0.42

INDIACEM

58.27

ICICIBANK

0.40

0.59

SRF

43.22

LUPIN

0.53

0.70

Strategy Date

Symbol

Strategy

Status

April 04, 2016

TCS

Ratio Bear Put Spread

Active

2

Technical & Derivatives Report

April 07, 2016

FII Statistics for 05-April 2016

Turnover on 05-April 2016

Open Interest

No. of

Turnover

Change

Detail

Buy

Sell

Net

Instrument

Value

Contracts

( in Cr. )

(%)

Contracts

Change (%)

(in Cr.)

INDEX

INDEX

1015.24

1785.20

(769.95)

238399

13317.54

(1.96)

241736

12822.74

-48.82

FUTURES

FUTURES

INDEX

INDEX

22789.13

23568.88

(779.75)

996662

56316.69

3.34

2300570

130116.17

-39.64

OPTIONS

OPTIONS

STOCK

3854.15

3348.22

505.93

980121

45049.69

0.33

STOCK

FUTURES

498144

24071.99

-15.09

FUTURES

STOCK

STOCK

2163.39

2149.80

13.59

45314

2082.37

15.61

OPTIONS

240797

12023.14

-16.81

OPTIONS

TOTAL

29821.91

30852.09

(1030.17)

2260496

116766.30

1.66

TOTAL

3281247

179034.04

-36.83

Nifty Spot = 7603.20

Lot Size = 75

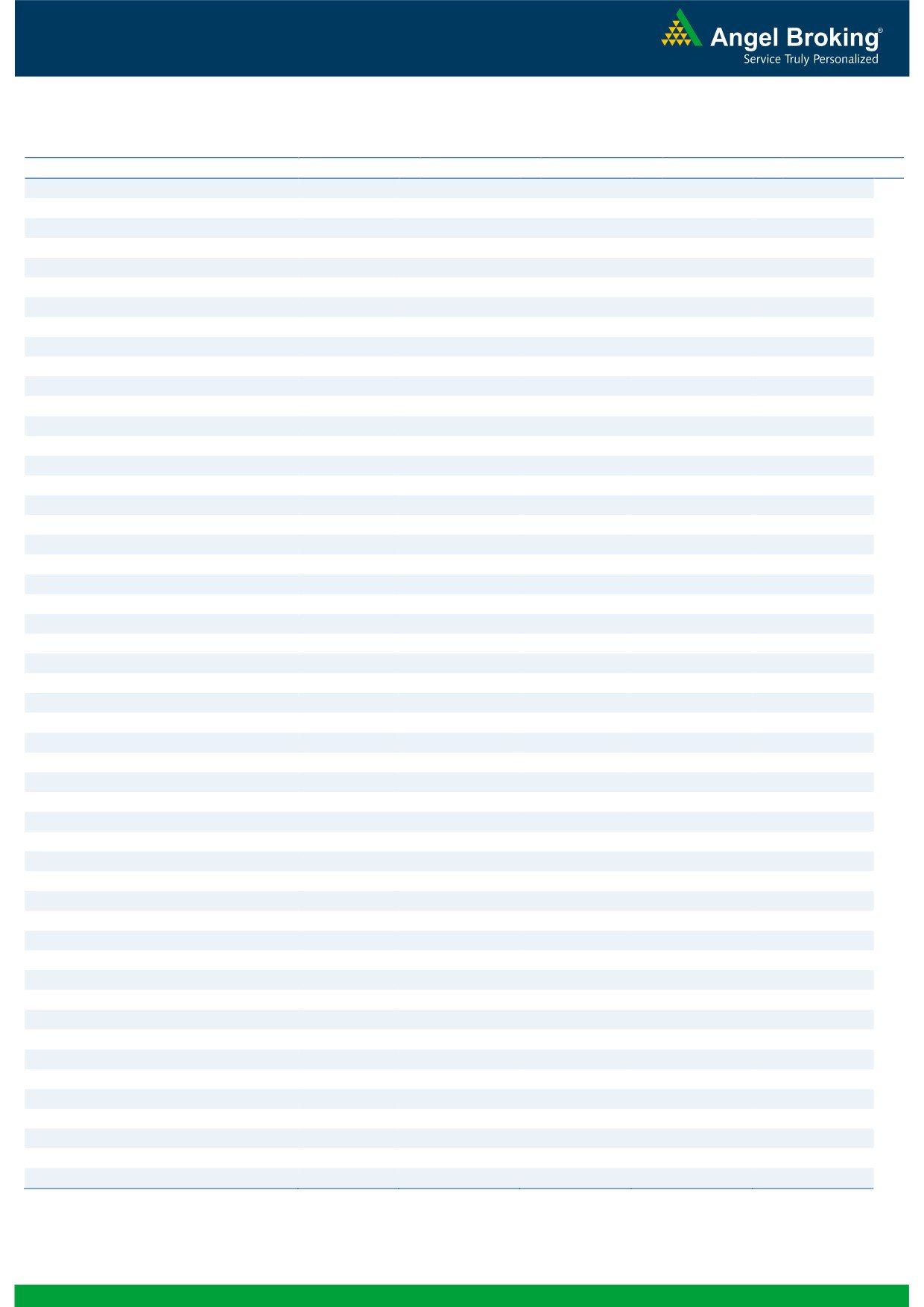

Bull-Call Spreads

Bear-Put Spreads

Action

Strike

Price

Risk

Reward

BEP

Action

Strike

Price

Risk

Reward

BEP

Buy

7600

132.60

Buy

7600

102.70

50.05

49.95

7650.05

33.80

66.20

7566.20

Sell

7700

82.55

Sell

7500

68.90

Buy

7600

132.60

Buy

7600

102.70

85.70

114.30

7685.70

57.15

142.85

7542.85

Sell

7800

46.90

Sell

7400

45.55

Buy

7700

82.55

Buy

7500

68.90

35.65

64.35

7735.65

23.35

76.65

7476.65

Sell

7800

46.90

Sell

7400

45.55

Note: Above mentioned Bullish or Bearish Spreads in Nifty (April Series) are given as an information and not as a recommendation.

Nifty Put-Call Analysis

3

Technical & Derivatives Report

April 07, 2016

Daily Pivot Levels for Nifty Constituents

Scrips

S2

S1

PIVOT

R1

R2

ACC

1,370

1,380

1,398

1,408

1,426

ADANIPORTS

212

219

231

238

249

AMBUJACEM

222

224

227

230

233

ASIANPAINT

849

859

872

883

896

AUROPHARMA

728

740

753

765

778

AXISBANK

419

426

438

444

456

BAJAJ-AUTO

2,333

2,364

2,417

2,448

2,501

BANKBARODA

138

141

147

150

155

BHEL

109

111

114

116

120

BPCL

869

880

895

906

921

BHARTIARTL

318

324

335

342

353

INFRATEL

365

370

376

381

388

BOSCH

19,433

19,623

19,894

20,085

20,356

CIPLA

492

498

507

512

521

COALINDIA

267

271

278

282

289

DRREDDY

2,963

2,981

3,011

3,029

3,059

EICHERMOT

18,135

18,435

18,942

19,242

19,749

GAIL

332

336

342

346

352

GRASIM

3,785

3,810

3,848

3,874

3,912

HCLTECH

825

834

842

851

858

HDFCBANK

1,042

1,050

1,063

1,071

1,085

HDFC

1,074

1,089

1,100

1,114

1,125

HEROMOTOCO

2,912

2,938

2,975

3,001

3,038

HINDALCO

81

83

86

88

91

HINDUNILVR

851

860

871

880

892

ICICIBANK

217

221

229

234

242

IDEA

106

108

111

112

115

INDUSINDBK

936

944

954

961

972

INFY

1,197

1,208

1,225

1,237

1,254

ITC

321

324

327

330

333

KOTAKBANK

653

661

673

681

693

LT

1,162

1,179

1,207

1,223

1,251

LUPIN

1,430

1,447

1,463

1,480

1,496

M&M

1,192

1,204

1,226

1,238

1,259

MARUTI

3,436

3,495

3,596

3,656

3,756

NTPC

123

125

128

130

134

ONGC

202

204

206

208

210

POWERGRID

137

138

140

140

142

RELIANCE

1,010

1,019

1,031

1,039

1,051

SBIN

176

180

187

192

199

SUNPHARMA

789

795

806

812

823

TCS

2,420

2,442

2,463

2,484

2,506

TATAMTRDVR

261

266

275

280

289

TATAMOTORS

358

364

375

381

392

TATAPOWER

66

66

67

68

69

TATASTEEL

302

307

313

318

324

TECHM

452

457

465

470

478

ULTRACEMCO

3,046

3,073

3,124

3,151

3,202

WIPRO

552

555

561

565

570

YESBANK

802

815

840

854

879

ZEEL

376

380

387

391

398

4

Technical & Derivatives Report

April 07, 2016

Research Team Tel: 022 - 39357800

For Technical Queries

For Derivatives Queries

DISCLAIMER

Angel Broking Private Limited (hereinafter referred to as “Angel”) is a registered Member of National Stock Exchange of India Limited,

Bombay Stock Exchange Limited and MCX Stock Exchange Limited. It is also registered as a Depository Participant with CDSL and

Portfolio Manager with SEBI. It also has registration with AMFI as a Mutual Fund Distributor. Angel Broking Private Limited is a

registered entity with SEBI for Research Analyst in terms of SEBI (Research Analyst) Regulations, 2014 vide registration number

INH000000164. Angel or its associates has not been debarred/ suspended by SEBI or any other regulatory authority for accessing

/dealing in securities Market. Angel or its associates including its relatives/analyst do not hold any financial interest/beneficial

ownership of more than 1% in the company covered by Analyst. Angel or its associates/analyst has not received any compensation /

managed or co-managed public offering of securities of the company covered by Analyst during the past twelve months. Angel/analyst

has not served as an officer, director or employee of company covered by Analyst and has not been engaged in market making activity

of the company covered by Analyst.

This document is solely for the personal information of the recipient, and must not be singularly used as the basis of any investment

decision. Nothing in this document should be construed as investment or financial advice. Each recipient of this document should

make such investigations as they deem necessary to arrive at an independent evaluation of an investment in the securities of the

companies referred to in this document (including the merits and risks involved), and should consult their own advisors to determine

the merits and risks of such an investment.

Reports based on technical and derivative analysis center on studying charts of a stock's price movement, outstanding positions and

trading volume, as opposed to focusing on a company's fundamentals and, as such, may not match with a report on a company's

fundamentals.

The information in this document has been printed on the basis of publicly available information, internal data and other reliable

sources believed to be true, but we do not represent that it is accurate or complete and it should not be relied on as such, as this

document is for general guidance only. Angel Broking Pvt. Limited or any of its affiliates/ group companies shall not be in any way

responsible for any loss or damage that may arise to any person from any inadvertent error in the information contained in this report.

Angel Broking Pvt. Limited has not independently verified all the information contained within this document. Accordingly, we cannot

testify, nor make any representation or warranty, express or implied, to the accuracy, contents or data contained within this document.

While Angel Broking Pvt. Limited endeavors to update on a reasonable basis the information discussed in this material, there may be

regulatory, compliance, or other reasons that prevent us from doing so.

This document is being supplied to you solely for your information, and its contents, information or data may not be reproduced,

redistributed or passed on, directly or indirectly.

Neither Angel Broking Pvt. Limited, nor its directors, employees or affiliates shall be liable for any loss or damage that may arise from

or in connection with the use of this information.

Note: Please refer to the important ‘Stock Holding Disclosure' report on the Angel website (Research Section). Also, please refer to the

latest update on respective stocks for the disclosure status in respect of those stocks. Angel Broking Pvt. Limited and its affiliates may

have investment positions in the stocks recommended in this report.

5