Technical & Derivatives Report

November 06, 2015

Sensex (26304) / Nifty (7955)

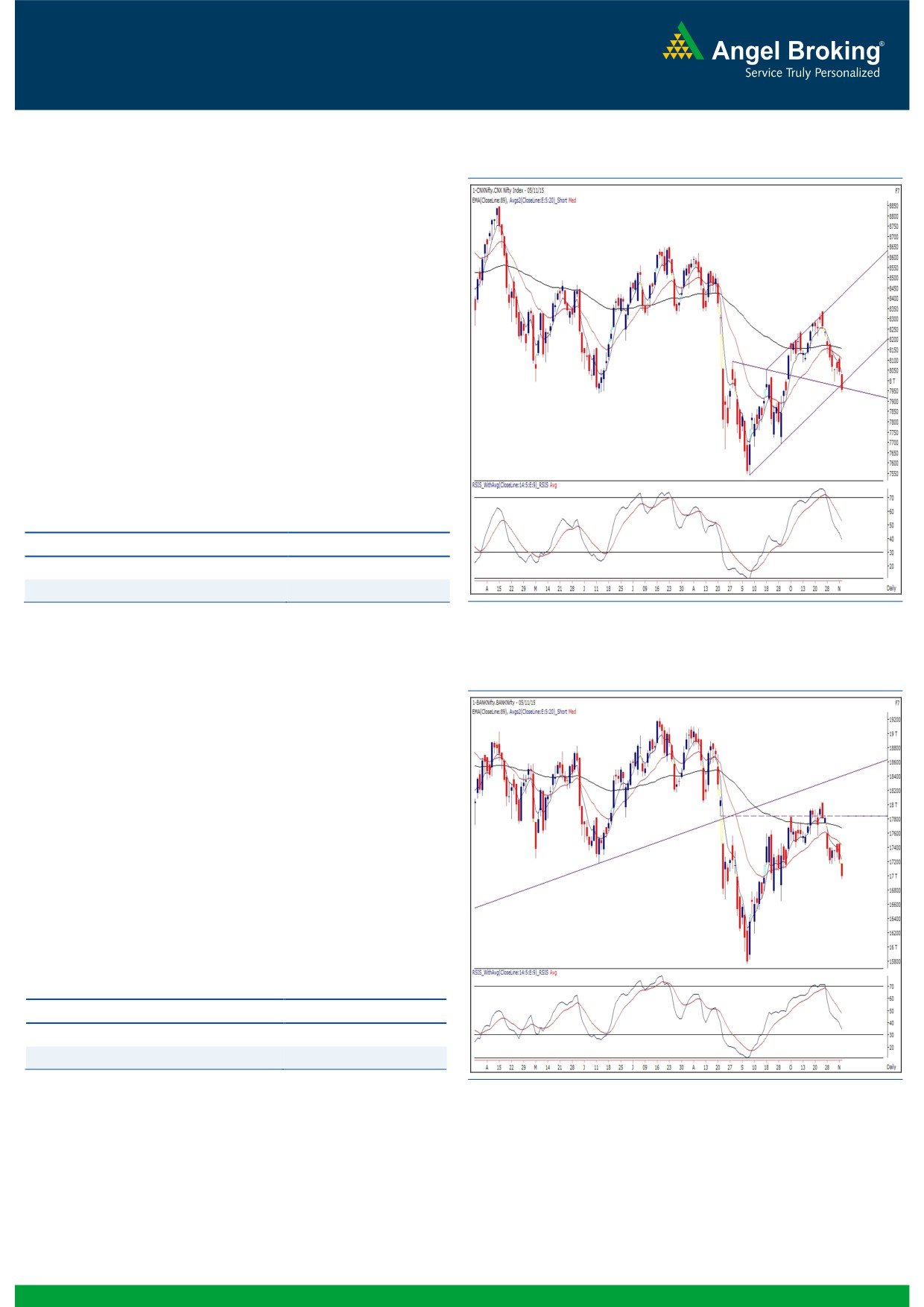

Exhibit 1: Nifty Daily Chart

We had a soft opening yesterday mainly on the back of mixed

global cues. Subsequently, the benchmark index kept on falling

throughout the session to close with a percent cut.

Quite surprisingly to most of the traders (including us), we

witnessed extremely weak session and as a result, the Nifty

eventually slipped below the 8000 mark for the first time in last

four weeks. Cosidering yesterday's session, it seems that the bulls

are opting to stay out of the market just ahead of Bihar election

result. Technically speaking, the Nifty has now broken down

marginally from its lower end of the Channel. Going forward, if

the index manages to stay below 7920 then we may witness an

immediate correction towards 7850 - 7800 levels. On the higher

side, 8020 - 8060 are likely to act as a strong resistance. It's

advisable to stay light on positions as the election outcome on

Monday may bring in higher volatility in our market.

Key Levels

Support 1 - 7920

Resistance 1 - 8020

Support 2 - 7850

Resistance 2 - 8060

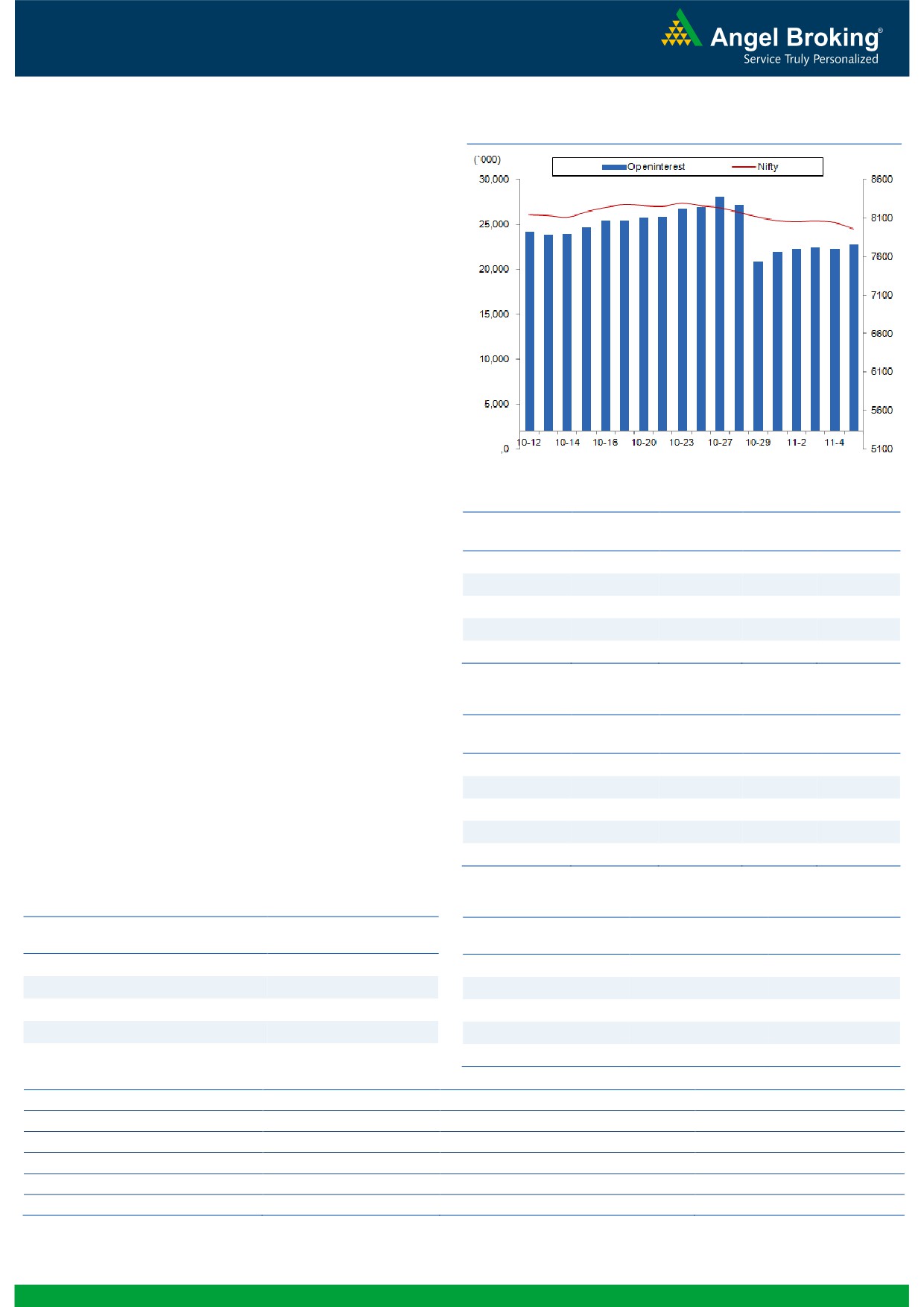

Exhibit 2: Bank Nifty Daily Chart

Bank Nifty Outlook - (16995)

In yesterday's trading session, the Bank Nifty index witnessed

another gap down opening and continued its negative

momentum throughout the session before ending the day with

losses of 1.31%. As we have mentioned in our previous report,

the breach of crucial support levels of 17170 with gaps indicates

resumption of the corrective down move. The index is now

approaching its next support level of 16888 which is

50%

retracement of the previous upmove. The index may give a minor

pullback move from the mentioned support; but, the broader

trend will continue to be negative unless the prices show any

reversal signs. The immediate support for BankNifty index are

placed around 16888 and 16620 whereas resistances are seen

around 17200 and 17475.

Key Levels

Support 1 - 16888

Resistance 1 - 17200

Support 2 - 16620

Resistance 2 - 17475

1

Technical & Derivatives Report

November 06, 2015

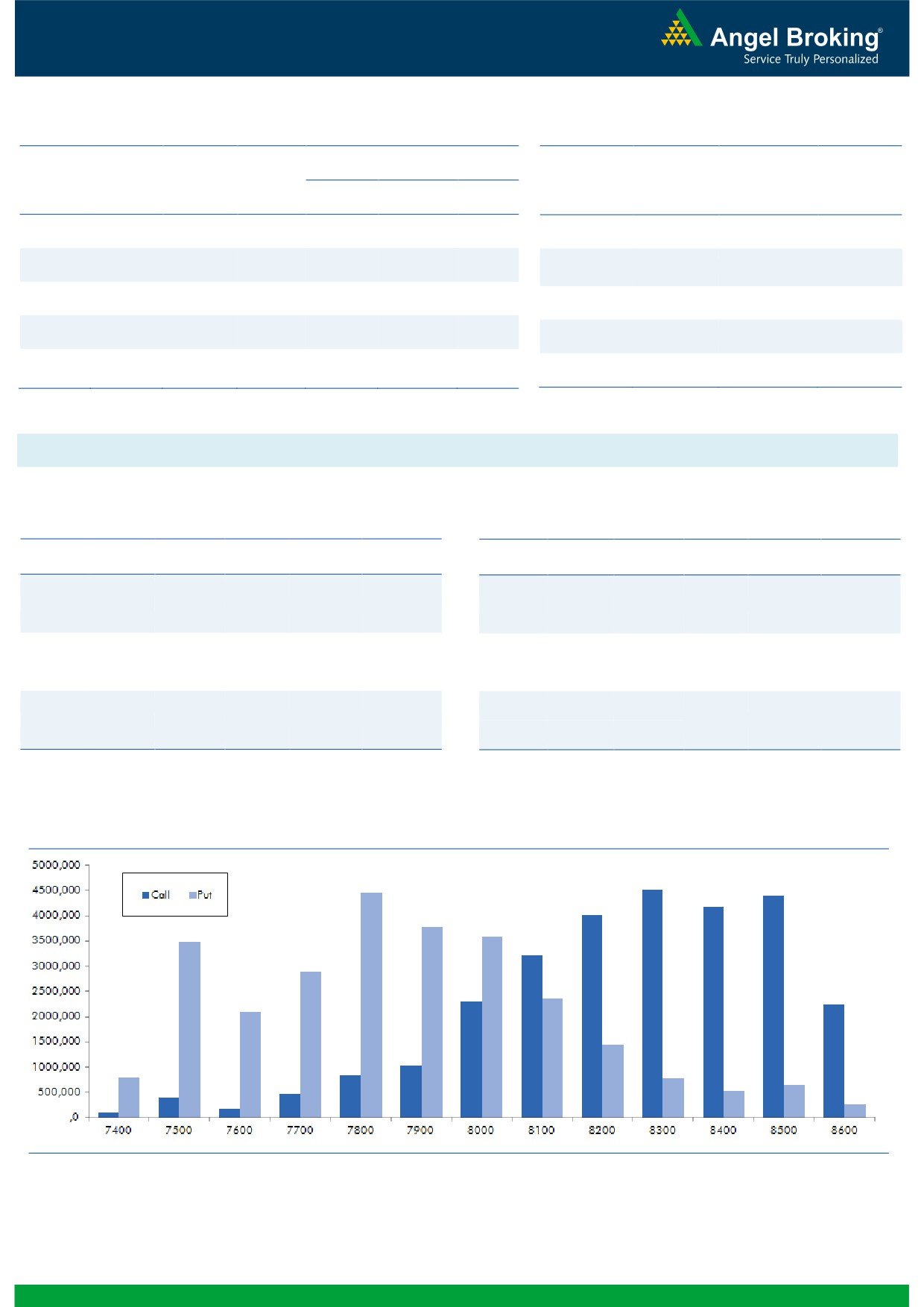

Nifty Vs OI

Comments

The Nifty futures open interest has increased by 2.28%

BankNifty futures open interest has increased by 7.04%

as market closed at 7955.45 levels.

The Nifty November future closed at a premium of 33.95

points against a premium of

29.85 points. The

December series closed at a premium of 78.45 points.

The Implied Volatility of at the money options has

increased from 17.86% to 18.93%.

The total OI of the market is Rs. 2,08,520/- cr. and the

stock futures OI is Rs. 60,098/- cr.

Few of the liquid counters where we have seen high cost

of carry are GMRINFRA, JPASSOCIAT, IDFC, SKSMICRO

and ITC.

OI Gainers

Views

OI

PRICE

SCRIP

OI

PRICE

CHG. (%)

CHG. (%)

Yesterday, FIIs were net seller in both equity cash and

JUBLFOOD

2642700

21.04

1380.30

-5.36

index future segment. They sold worth Rs. 992 crores in

MARICO

2119000

14.55

403.85

1.13

equity cash. While, they were net seller to the tune of Rs

SUNPHARMA

11872800

12.81

820.95

-4.28

858 crores in index future with marginal rise in OI,

ARVIND

4263600

10.14

280.25

4.63

suggesting short built-up in last trading session.

TATASTEEL

33684000

9.12

226.00

-4.24

In Index Options front, they sold of worth Rs. 2182 crores

with decent amount of rise in OI. In call options 800,

8200 and 8300 strikes added decent buildup. While in

OI Losers

put options 7500 strike added some OI. Maximum OI is

OI

PRICE

SCRIP

OI

PRICE

seen in 8300 call and 7800 put options. Seeing the

CHG. (%)

CHG. (%)

APOLLOHOSP

573600

-10.65

1346.65

-1.57

overall data, we believe Nifty may trade in a range of

CADILAHC

1977000

-8.79

430.10

-0.44

7800-7850 on the lower side and 8300-8350 on the

DRREDDY

1176600

-7.79

4265.90

-1.50

higher side. One should trade accordingly.

JSWENERGY

6702000

-7.61

89.90

-4.36

RELINFRA

5405400

-5.91

398.80

-0.59

Historical Volatility

Put-Call Ratio

SCRIP

HV

SCRIP

PCR-OI

PCR-VOL

JUBLFOOD

40.59

NIFTY

0.86

0.80

DISHTV

42.82

BANKNIFTY

0.70

0.69

ASHOKLEY

45.05

LT

0.44

0.35

SUNPHARMA

36.82

AXISBANK

0.36

0.49

LICHSGFIN

41.71

SBIN

0.48

0.47

Strategy Date

Symbol

Strategy

Status

November 02, 2015

RELIANCE

Short Strangle

Active

2

Technical & Derivatives Report

November 06, 2015

FII Statistics for 05-November 2015

Turnover on 05-November 2015

Open Interest

No. of

Turnover

Change

Detail

Buy

Sell

Net

Instrument

Value

Change

Contracts

( in Cr. )

(%)

Contracts

(in Cr.)

(%)

INDEX

INDEX

1683.68

2542.04

(858.37)

286164

16778.94

1.28

253342

14325.93

19.20

FUTURES

FUTURES

INDEX

INDEX

15210.39

17392.28

(2181.89)

1060268

62646.79

4.46

2057760

123159.61

37.99

OPTIONS

OPTIONS

STOCK

2501.86

3574.33

(1072.47)

928943

45965.13

0.03

STOCK

FUTURES

445912

22784.90

-0.90

FUTURES

STOCK

STOCK

1683.71

1718.37

(34.66)

53633

2645.76

10.72

OPTIONS

236461

12587.43

10.45

OPTIONS

TOTAL

21079.63

25227.02

(4147.39)

2329008

128036.62

2.39

TOTAL

2993475

172857.88

27.42

Nifty Spot = 7955.45

Lot Size = 25

Bull-Call Spreads

Bear-Put Spreads

Action

Strike

Price

Risk

Reward

BEP

Action

Strike

Price

Risk

Reward

BEP

Buy

8000

134.25

Buy

7900

105.35

46.45

53.55

8046.45

30.50

69.50

7869.50

Sell

8100

87.80

Sell

7800

74.85

Buy

8000

134.25

Buy

7900

105.35

80.75

119.25

8080.75

53.65

146.35

7846.35

Sell

8200

53.50

Sell

7700

51.70

Buy

8100

87.80

Buy

7800

74.85

34.30

65.70

8134.30

23.15

76.85

7776.85

Sell

8200

53.50

Sell

7700

51.70

Note: Above mentioned Bullish or Bearish Spreads in Nifty (Nov. Series) are given as an information and not as a recommendation.

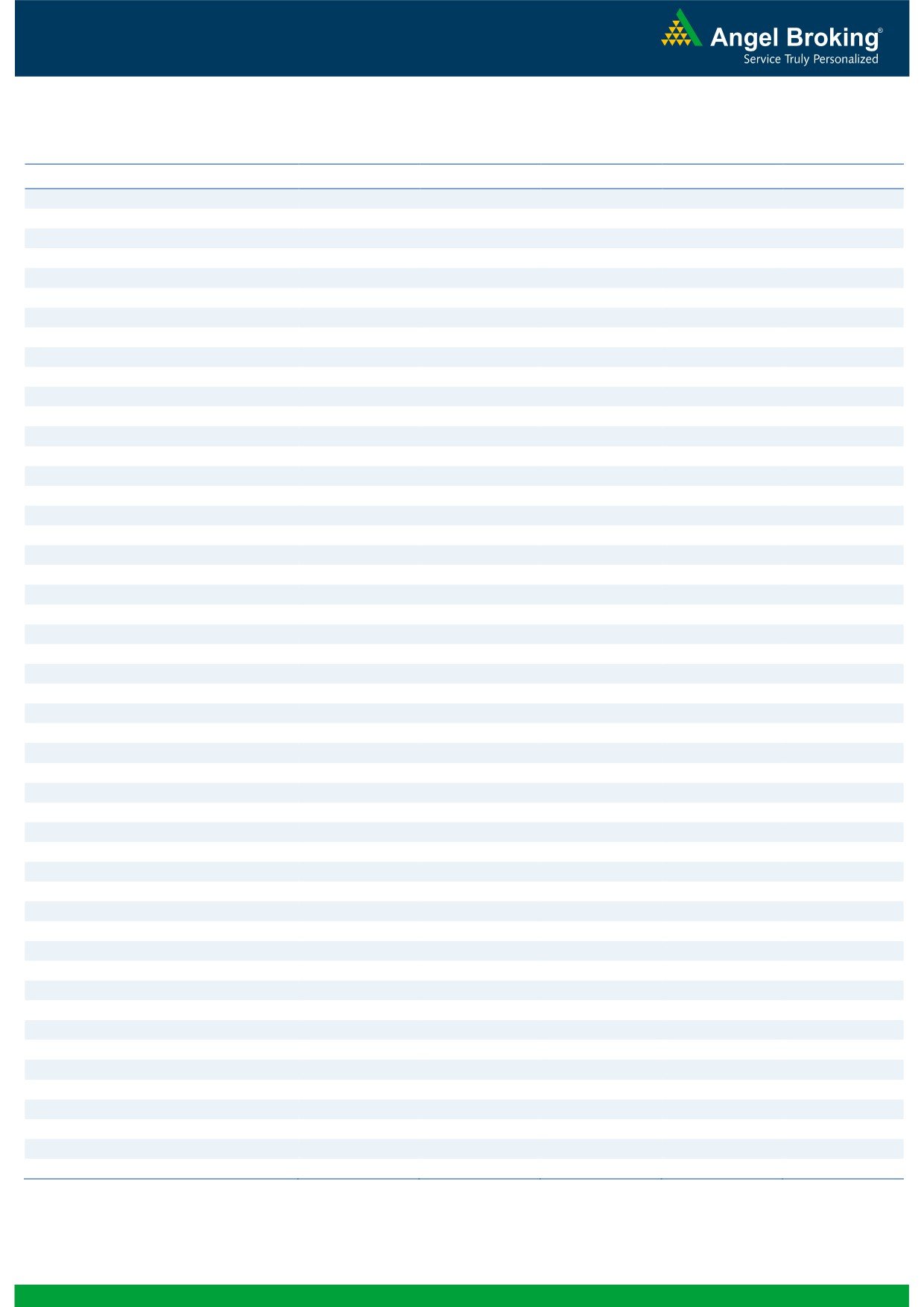

Nifty Put-Call Analysis

3

Technical & Derivatives Report

November 06, 2015

Daily Pivot Levels for Nifty 50 Stocks

Scrips

S2

S1

PIVOT

R1

R2

ACC

1,365

1,377

1,393

1,405

1,422

ADANIPORTS

277

280

287

290

297

AMBUJACEM

205

207

208

210

211

ASIANPAINT

790

798

805

813

819

AXISBANK

456

460

466

470

476

BAJAJ-AUTO

2,366

2,390

2,429

2,453

2,492

BANKBARODA

156

157

160

162

165

BHARTIARTL

327

332

339

344

351

BHEL

187

191

196

200

205

BOSCHLTD

19,527

19,710

20,023

20,206

20,520

BPCL

875

882

888

896

902

CAIRN

147

149

151

153

156

CIPLA

643

650

663

671

683

COALINDIA

324

330

335

342

346

DRREDDY

4,180

4,215

4,272

4,306

4,363

GAIL

286

290

297

302

309

GRASIM

3,645

3,671

3,689

3,714

3,732

HCLTECH

869

873

878

883

888

HDFC

1,186

1,196

1,210

1,220

1,235

HDFCBANK

1,064

1,072

1,077

1,085

1,091

HEROMOTOCO

2,582

2,610

2,634

2,663

2,687

HINDALCO

80

80

81

82

83

HINDUNILVR

790

796

804

810

818

ICICIBANK

266

268

271

273

276

IDEA

136

138

139

141

142

INDUSINDBK

896

902

907

913

919

INFY

1,104

1,113

1,129

1,139

1,155

ITC

331

334

337

340

342

KOTAKBANK

633

642

657

666

681

LT

1,355

1,362

1,371

1,378

1,386

LUPIN

1,820

1,829

1,843

1,852

1,866

M&M

1,234

1,247

1,258

1,271

1,283

MARUTI

4,467

4,497

4,526

4,556

4,585

NTPC

134

135

136

137

138

ONGC

247

249

251

253

256

PNB

128

129

130

131

133

POWERGRID

129

130

131

132

133

RELIANCE

922

929

940

947

958

SBIN

229

232

235

238

241

SUNPHARMA

90

92

96

97

101

TATAMOTORS

784

800

825

841

866

TATAPOWER

395

399

406

411

417

TATASTEEL

67

68

69

69

70

TCS

217

221

229

233

240

TECHM

2,444

2,463

2,499

2,518

2,554

ULTRACEMCO

524

530

538

544

552

VEDL

2,776

2,805

2,856

2,885

2,935

WIPRO

566

569

572

574

577

YESBANK

746

754

767

775

789

ZEEL

397

402

408

413

419

4

Technical & Derivatives Report

November 06, 2015

Research Team Tel: 022 - 39357800

For Technical Queries

For Derivatives Queries

DISCLAIMER

Angel Broking Private Limited (hereinafter referred to as “Angel”) is a registered Member of National Stock Exchange of India Limited,

Bombay Stock Exchange Limited and MCX Stock Exchange Limited. It is also registered as a Depository Participant with CDSL and

Portfolio Manager with SEBI. It also has registration with AMFI as a Mutual Fund Distributor. Angel Broking Private Limited is a

registered entity with SEBI for Research Analyst in terms of SEBI (Research Analyst) Regulations, 2014 vide registration number

INH000000164. Angel or its associates has not been debarred/ suspended by SEBI or any other regulatory authority for accessing

/dealing in securities Market. Angel or its associates including its relatives/analyst do not hold any financial interest/beneficial

ownership of more than 1% in the company covered by Analyst. Angel or its associates/analyst has not received any compensation /

managed or co-managed public offering of securities of the company covered by Analyst during the past twelve months. Angel/analyst

has not served as an officer, director or employee of company covered by Analyst and has not been engaged in market making activity

of the company covered by Analyst.

This document is solely for the personal information of the recipient, and must not be singularly used as the basis of any investment

decision. Nothing in this document should be construed as investment or financial advice. Each recipient of this document should

make such investigations as they deem necessary to arrive at an independent evaluation of an investment in the securities of the

companies referred to in this document (including the merits and risks involved), and should consult their own advisors to determine

the merits and risks of such an investment.

Reports based on technical and derivative analysis center on studying charts of a stock's price movement, outstanding positions and

trading volume, as opposed to focusing on a company's fundamentals and, as such, may not match with a report on a company's

fundamentals.

The information in this document has been printed on the basis of publicly available information, internal data and other reliable

sources believed to be true, but we do not represent that it is accurate or complete and it should not be relied on as such, as this

document is for general guidance only. Angel Broking Pvt. Limited or any of its affiliates/ group companies shall not be in any way

responsible for any loss or damage that may arise to any person from any inadvertent error in the information contained in this report.

Angel Broking Pvt. Limited has not independently verified all the information contained within this document. Accordingly, we cannot

testify, nor make any representation or warranty, express or implied, to the accuracy, contents or data contained within this document.

While Angel Broking Pvt. Limited endeavors to update on a reasonable basis the information discussed in this material, there may be

regulatory, compliance, or other reasons that prevent us from doing so.

This document is being supplied to you solely for your information, and its contents, information or data may not be reproduced,

redistributed or passed on, directly or indirectly.

Neither Angel Broking Pvt. Limited, nor its directors, employees or affiliates shall be liable for any loss or damage that may arise from

or in connection with the use of this information.

Note: Please refer to the important ‘Stock Holding Disclosure' report on the Angel website (Research Section). Also, please refer to the

latest update on respective stocks for the disclosure status in respect of those stocks. Angel Broking Pvt. Limited and its affiliates may

have investment positions in the stocks recommended in this report.

5