Technical & Derivatives Report

September 06, 2016

Sensex (28532) / Nifty (8810)

Exhibit 1: Nifty Monthly Chart

Finally, after a time-wise pain of nearly a month, the bulls had

something to cheer about. Due to last week’s spectacular move,

the Nifty managed to close above the psychological level of 8800

as well as at the highest point of the calendar year 2016. Our

contradictory view to go long around 8550 (as per the 5th point

confirmation for ‘Bullish Wolfe wave’) played out well because of

low risk trade with reasonably higher reward. The Nifty met with

the pattern target of 8720 and given the strong momentum, it

even went on to enter our near term target zone of 8800 - 8850.

Now at this juncture, we see resistance points converging around

8850 along with the ‘Super Trend’ on the monthly chart placed at

8831. Thus, to be on the conservative side, we would now advise

traders to start taking some money off the table although we do

not want to sound pessimistic at this point in time since there is no

sign of reversal or weakness. But we would prefer to reassess the

market developments over the next few days and want to wait for

clear signals to emerge for a near term direction. If the Nifty is

able to surpass the 8850 mark, then it may continue to head

higher; whereas, on the flipside, a minor profit booking could

lead to some corrective move towards 8720 - 8670 levels.

Key Levels

Support 1 - 8850

Resistance 1 - 8720

Support 2 - 8900

Resistance 2 - 8670

Nifty Bank Outlook - (19883)

Exhibit 2: Nifty Bank Daily Chart

The Nifty Bank index opened with marginal gains on Friday and

traded in narrow range throughout the session. With some

positive traction, the banking index managed to end the session

with gains of 0.48 percent over its previous close. The Nifty Bank

index posted a strong weekly gain of 3.58 percent and thus

outperformed benchmark indices.

Going forward, the positive momentum in banking

conglomerates should continue in upcoming sessions too as there

is no sign of reversal. We advise traders not to pre-emt any

corrective move as of now and avoid taking short positions at

current juncture. They should follow stock centric approach with

proper risk management. The intraday support for the index are

placed around 19787 and 19700 whereas resistance is seen in

range of 20000 - 20180.

Key Levels

Support 1 - 19787

Resistance 1 - 20000

Support 2 - 19700

Resistance 2 - 20180

1

Technical & Derivatives Report

September 06, 2016

Comments

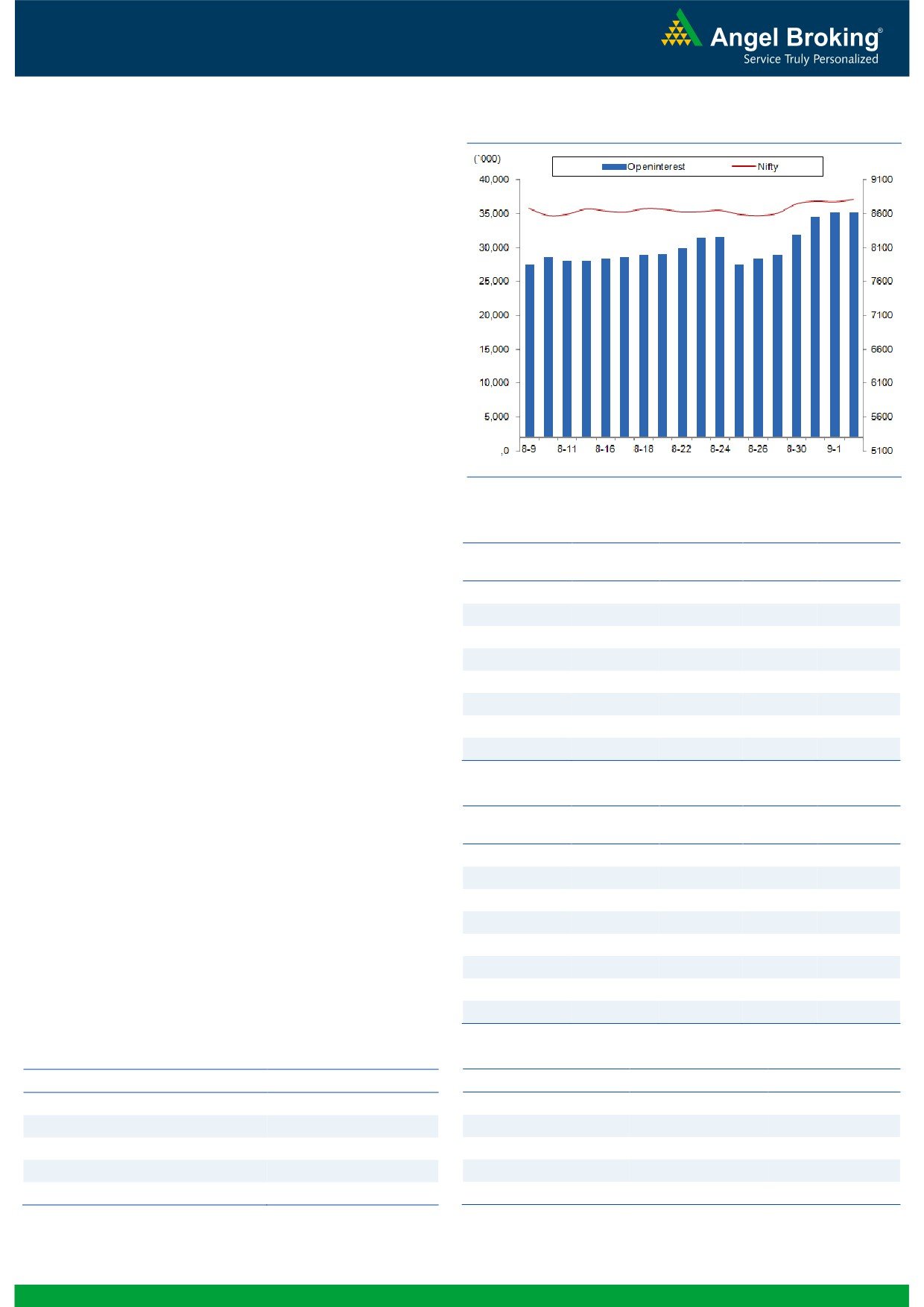

Nifty Vs OI

The Nifty futures open interest has decreased by 1.23%

BankNifty futures open interest has increased by 0.18%

as market closed at 8809.65 levels.

The Nifty September future closed with a premium of

30.50 points against a premium of 33.70 points in

previous session. The October series closed at a

premium of 69.85 points.

The Implied Volatility of at the money options has

decreased from 11.47% to 11.03%. At the same time,

the PCR-OI of Nifty has increased from 1.11 to 1.13.

The total OI of the market is Rs. 2,77,570/- cr. and the

stock futures OI is Rs. 83,092/- cr.

Few of the liquid counters where we have seen high cost

of carry are SOUTHBANK, IBREALEST, GRANULES,

GMRINFRA and ADANIPOWER.

Views

OI Gainers

OI

PRICE

On Friday, FIIs were net buyers in equity cash segment

SCRIP

OI

PRICE

CHG. (%)

CHG. (%)

worth Rs. 231. While, they sold index future worth

APOLLOTYRE

11712000

18.84

195.85

4.87

Rs. 399 crores with marginal fall in OI, indicating blend

PETRONET

3951000

16.96

353.40

1.00

of long unwinding and short build-up in last trading

AMARAJABAT

681600

14.06

993.05

2.48

session.

www.angelbroking.com

ALBK

15210000

10.30

84.95

3.03

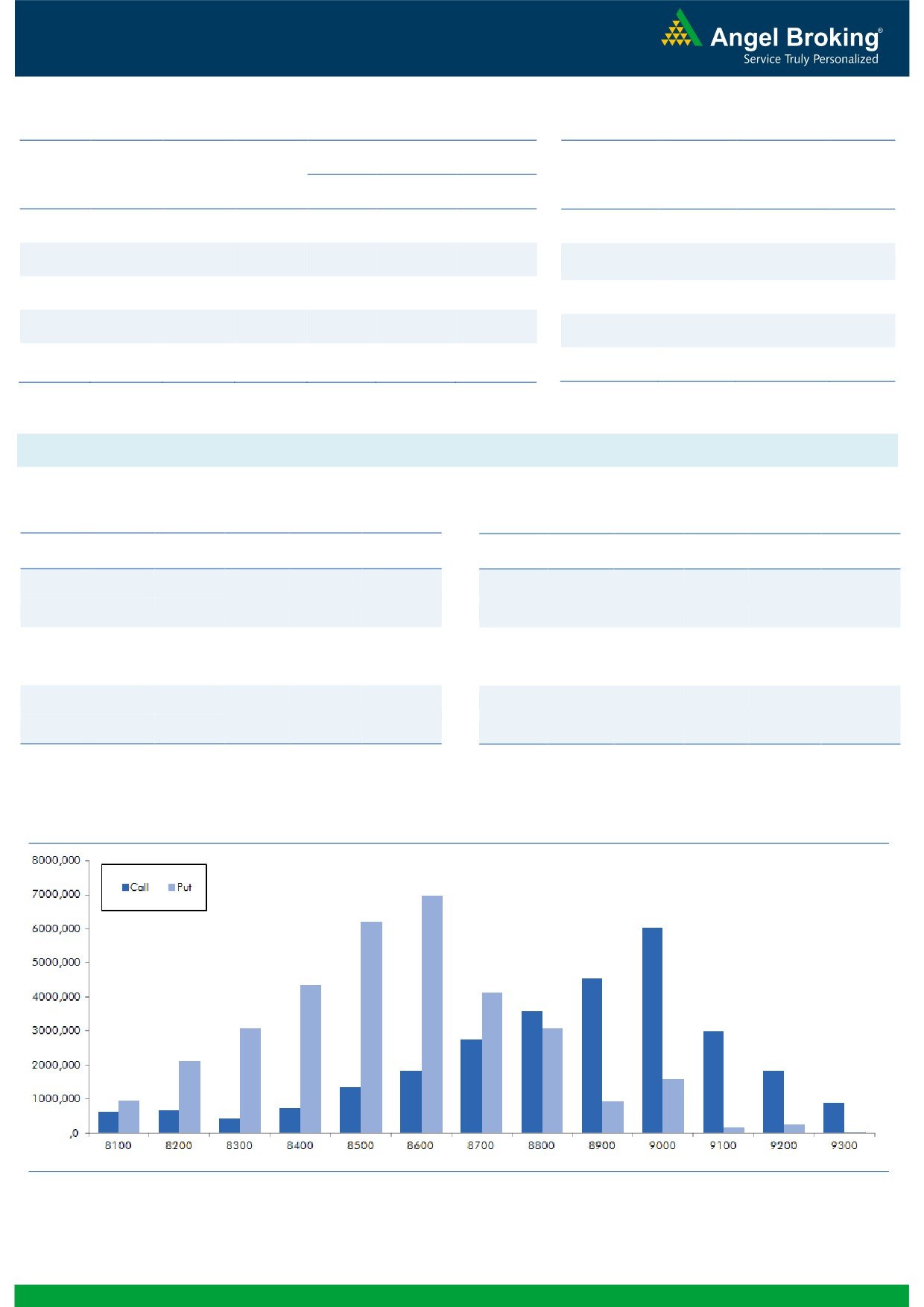

On Index Options front, FIIs were net buyers of Rs. 179

CEATLTD

2954700

8.20

956.15

6.42

crores with rise in OI. In call options, marginal OI build-

ACC

1582400

7.94

1680.40

-1.18

up was seen in 9000 and 8800 strikes; followed by some

DLF

46445000

7.91

151.00

0.87

unwinding in 8700 strike. While in put options, 8600

KSCL

4170000

7.17

329.20

-4.08

strike was active and added good amount of positions;

followed by OI build-up in 8700 and 8800 strikes. We

also witnessed some unwinding in 8500 put option.

OI Losers

OI

PRICE

Highest OI in September series remains intact in 9000

SCRIP

OI

PRICE

CHG. (%)

CHG. (%)

call; while in put option, it got shifted from 8500 to 8600

APOLLOHOSP

445200

-13.45

1377.60

0.89

strike.

DABUR

5267500

-5.77

297.70

0.98

Although some profit booking was seen by FIIs in index

RCOM

131150000

-5.76

49.40

0.10

future segment, but the quantum was very low. We

TCS

5068500

-5.02

2521.15

-0.12

reiterate our bullish stance on index as there is no sign of

M&M

6382000

-4.93

1477.40

1.16

weakness in market as per derivative data. Thus,

JINDALSTEL

52902000

-4.73

81.85

-3.25

intraday dips are buying opportunities in Nifty as we may

LUPIN

6150900

-4.40

1521.85

0.62

see 8950-9000 in near term.

BIOCON

3572800

-4.33

917.50

0.49

Historical Volatility

Put-Call Ratio

SCRIP

HV

SCRIP

PCR-OI

PCR-VOL

CEATLTD

46.35

NIFTY

1.13

1.16

MRF

33.22

BANKNIFTY

1.17

1.01

RELINFRA

40.74

RELIANCE

0.42

0.49

APOLLOTYRE

48.61

SBIN

0.82

0.66

KSCL

42.81

TATAMOTORS

1.31

0.82

2

Technical & Derivatives Report

September 06, 2016

FII Statistics for 02, September 2016

Turnover on 02, September 2016

Open Interest

No. of

Turnover

Change

Detail

Buy

Sell

Net

Instrument

Value

Contracts

( in Cr. )

(%)

Contracts

Change (%)

(in Cr.)

INDEX

INDEX

1485.52

1884.71

(399.19)

438487

29563.94

(0.70)

157318

11192.32

-19.90

FUTURES

FUTURES

INDEX

INDEX

26409.83

26230.95

178.89

1051203

70826.62

2.86

1979607

142658.67

-64.54

OPTIONS

OPTIONS

STOCK

6581.64

6180.61

401.03

875664

58633.06

0.57

STOCK

FUTURES

524038

35769.94

-14.81

FUTURES

STOCK

STOCK

3929.79

4004.01

(74.22)

81830

5606.74

9.32

OPTIONS

294593

19537.28

-21.60

OPTIONS

TOTAL

38406.78

38300.28

106.50

2447184

164630.36

1.58

TOTAL

2955556

209158.21

-56.71

Nifty Spot = 8809.65

Lot Size = 75

Bull-Call Spreads

Bear-Put Spreads

Action

Strike

Price

Risk

Reward

BEP

Action

Strike

Price

Risk

Reward

BEP

Buy

8900

76.70

Buy

8800

91.65

34.45

65.55

8934.45

31.45

68.55

8768.55

Sell

9000

42.25

Sell

8700

60.20

Buy

8900

76.70

Buy

8800

91.65

55.85

144.15

8955.85

52.00

148.00

8748.00

Sell

9100

20.85

Sell

8600

39.65

Buy

9000

42.25

Buy

8700

60.20

21.40

78.60

9021.40

20.55

79.45

8679.45

Sell

9100

20.85

Sell

8600

39.65

Note: Above mentioned Bullish or Bearish Spreads in Nifty (September Series) are given as an information and not as a recommendation.

Nifty Put-Call Analysis

3

Technical & Derivatives Report

September 06, 2016

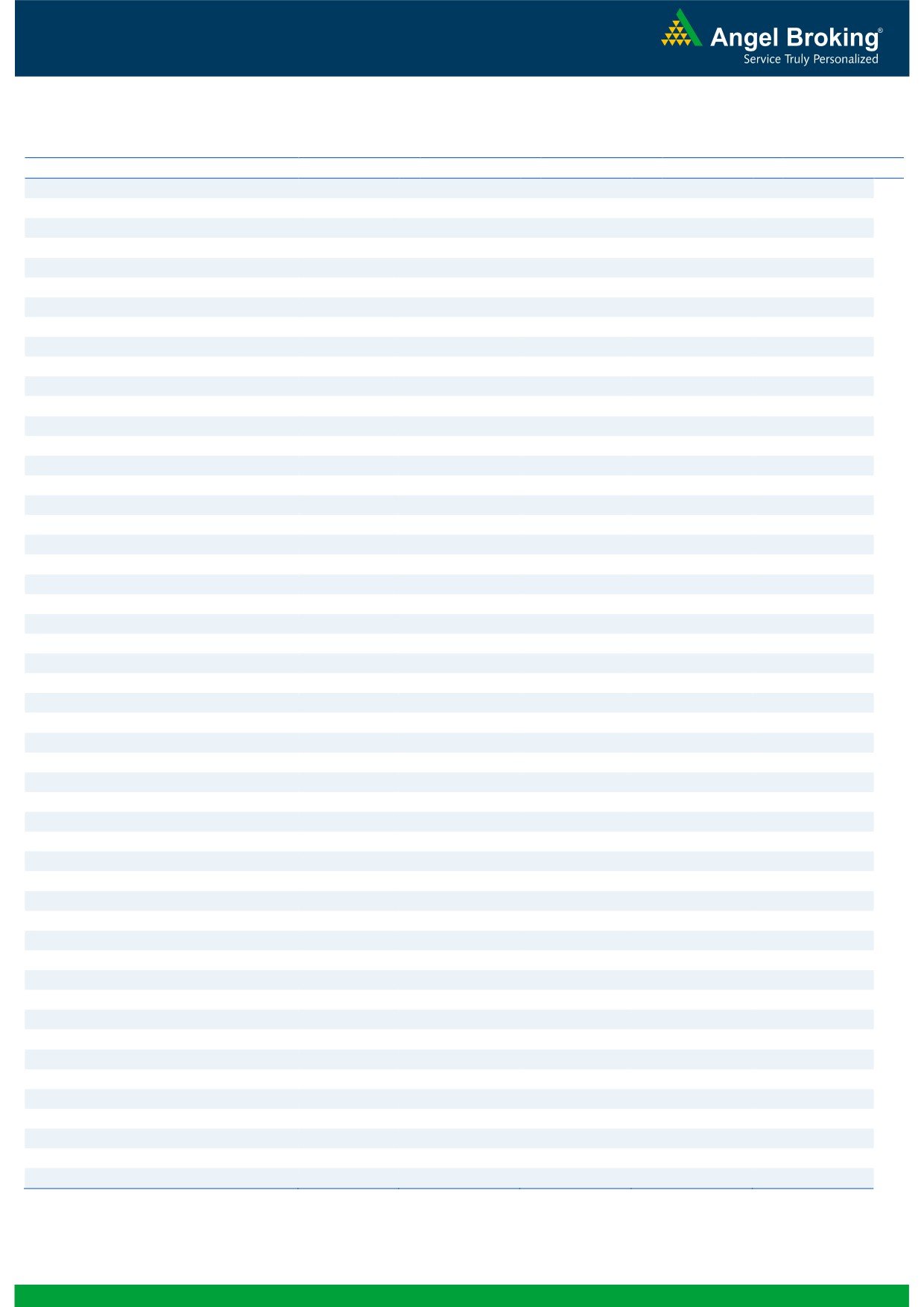

Daily Pivot Levels for Nifty Constituents

Scrips

S2

S1

PIVOT

R1

R2

ACC

1,646

1,658

1,677

1,689

1,708

ADANIPORTS

252

260

265

273

277

AMBUJACEM

271

274

276

279

282

ASIANPAINT

1,143

1,155

1,164

1,176

1,184

AUROPHARMA

758

769

777

788

796

AXISBANK

591

595

598

603

606

BAJAJ-AUTO

2,888

2,943

2,979

3,034

3,070

BANKBARODA

159

163

165

168

171

BHEL

133

135

136

137

138

BPCL

577

582

586

591

596

BHARTIARTL

301

310

315

324

330

INFRATEL

334

339

345

350

356

BOSCH

23,580

23,795

24,118

24,333

24,655

CIPLA

567

573

577

582

586

COALINDIA

328

330

334

336

339

DRREDDY

3,058

3,090

3,115

3,147

3,172

EICHERMOT

22,596

22,707

22,865

22,976

23,135

GAIL

386

391

394

399

402

GRASIM

4,494

4,553

4,597

4,656

4,700

HCLTECH

775

780

784

788

792

HDFCBANK

1,277

1,281

1,285

1,289

1,293

HDFC

1,413

1,426

1,434

1,447

1,455

HEROMOTOCO

3,519

3,548

3,581

3,611

3,643

HINDALCO

152

155

157

159

161

HINDUNILVR

913

917

922

926

931

ICICIBANK

258

260

262

264

266

IDEA

79

82

83

86

88

INDUSINDBK

1,176

1,184

1,189

1,197

1,202

INFY

1,019

1,025

1,033

1,039

1,046

ITC

259

261

262

264

266

KOTAKBANK

805

809

813

817

820

LT

1,476

1,490

1,501

1,516

1,527

LUPIN

1,495

1,507

1,516

1,527

1,536

M&M

1,421

1,447

1,462

1,488

1,502

MARUTI

5,028

5,094

5,141

5,208

5,255

NTPC

156

158

160

161

163

ONGC

233

236

238

241

243

POWERGRID

181

182

184

185

186

RELIANCE

986

1,000

1,016

1,030

1,046

SBIN

250

252

254

256

257

SUNPHARMA

762

772

778

788

795

TCS

2,487

2,501

2,510

2,524

2,533

TATAMTRDVR

345

348

351

354

356

TATAMOTORS

545

547

552

554

558

TATAPOWER

77

78

79

80

81

TATASTEEL

368

371

374

377

379

TECHM

462

467

471

475

479

ULTRACEMCO

4,016

4,051

4,073

4,108

4,130

WIPRO

477

480

483

486

489

YESBANK

1,350

1,369

1,382

1,401

1,414

ZEEL

525

529

535

539

544

4

Technical & Derivatives Report

September 06, 2016

Research Team Tel: 022 - 39357800

For Technical Queries

For Derivatives Queries

DISCLAIMER

Angel Broking Private Limited (hereinafter referred to as “Angel”) is a registered Member of National Stock Exchange of India Limited,

Bombay Stock Exchange Limited and Metropolitan Stock Exchange Limited. It is also registered as a Depository Participant with CDSL

and Portfolio Manager with SEBI. It also has registration with AMFI as a Mutual Fund Distributor. Angel Broking Private Limited is a

registered entity with SEBI for Research Analyst in terms of SEBI (Research Analyst) Regulations, 2014 vide registration number

INH000000164. Angel or its associates has not been debarred/ suspended by SEBI or any other regulatory authority for accessing

/dealing in securities Market. Angel or its associates/analyst has not received any compensation / managed or co-managed public

offering of securities of the company covered by Analyst during the past twelve months.

This document is solely for the personal information of the recipient, and must not be singularly used as the basis of any investment

decision. Nothing in this document should be construed as investment or financial advice. Each recipient of this document should

make such investigations as they deem necessary to arrive at an independent evaluation of an investment in the securities of the

companies referred to in this document (including the merits and risks involved), and should consult their own advisors to determine

the merits and risks of such an investment.

Reports based on technical and derivative analysis center on studying charts of a stock's price movement, outstanding positions and

trading volume, as opposed to focusing on a company's fundamentals and, as such, may not match with a report on a company's

fundamentals. Investors are advised to refer the Fundamental and Technical Research Reports available on our website to evaluate the

contrary view, if any.

The information in this document has been printed on the basis of publicly available information, internal data and other reliable

sources believed to be true, but we do not represent that it is accurate or complete and it should not be relied on as such, as this

document is for general guidance only. Angel Broking Pvt. Limited or any of its affiliates/ group companies shall not be in any way

responsible for any loss or damage that may arise to any person from any inadvertent error in the information contained in this report.

Angel Broking Pvt. Limited has not independently verified all the information contained within this document. Accordingly, we cannot

testify, nor make any representation or warranty, express or implied, to the accuracy, contents or data contained within this document.

While Angel Broking Pvt. Limited endeavors to update on a reasonable basis the information discussed in this material, there may be

regulatory, compliance, or other reasons that prevent us from doing so.

This document is being supplied to you solely for your information, and its contents, information or data may not be reproduced,

redistributed or passed on, directly or indirectly.

Neither Angel Broking Pvt. Limited, nor its directors, employees or affiliates shall be liable for any loss or damage that may arise from

or in connection with the use of this information.

5