Technical & Derivatives Report

August 05, 2016

Sensex (27714) / Nifty (8551)

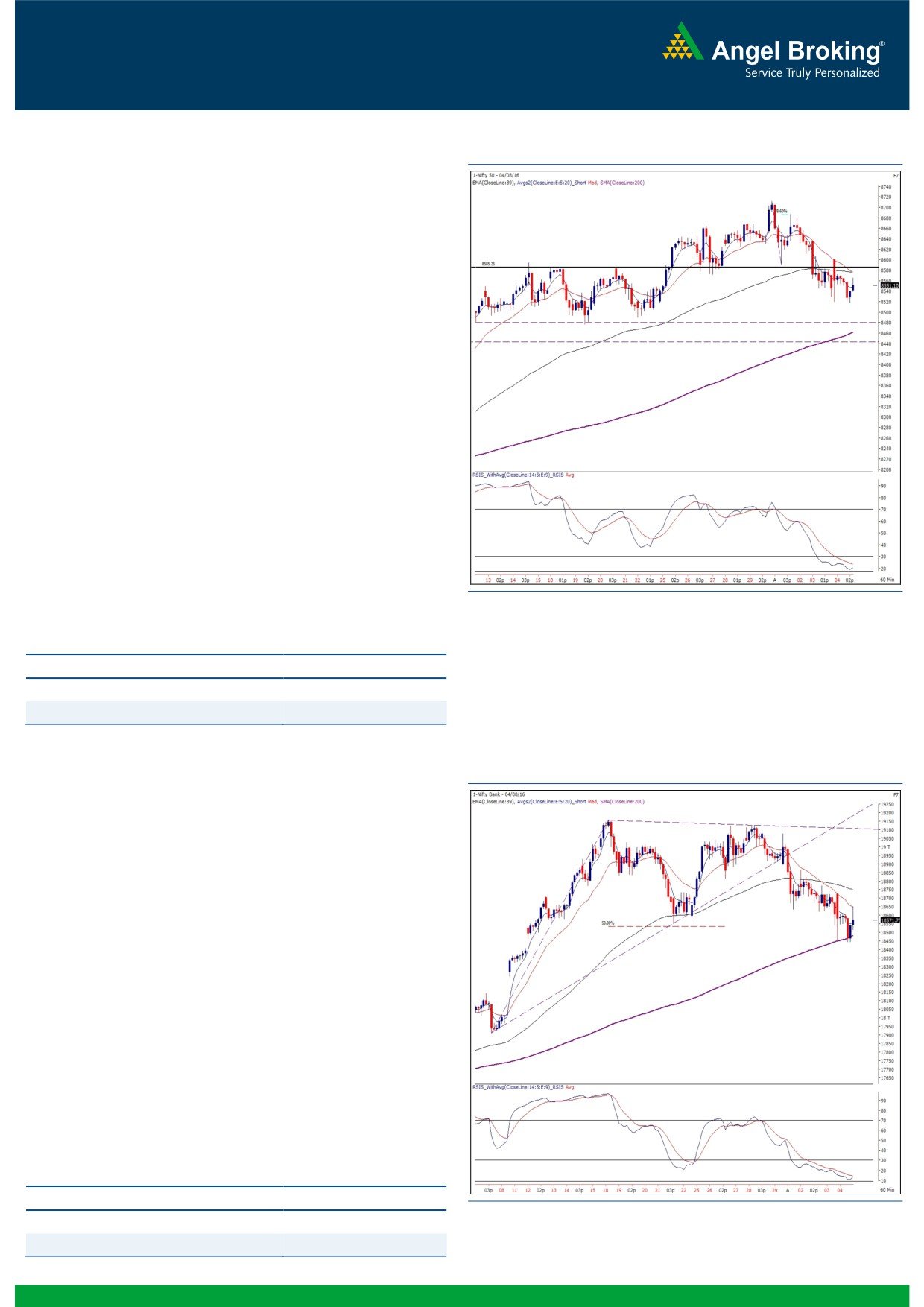

Exhibit 1: Nifty Hourly Chart

Yesterday, our markets opened higher owing to overnight

developments over the GST Constitutional Amendment Bill.

However, as expected, this eventually turned out to be a non-

event as we saw a sharp decline immediately post the opening

tick. The index remained under pressure for quite some time as a

result, the volatile day eventually ended around the 8550 mark.

We had mentioned in our earlier report about few technical

evidences indicating weakness or consolidation in the near term.

Firstly, the lower top lower bottom in hourly chart along with a

negative crossover in 'RSI- Smoothened' on daily chart. Last two

day’s movement with a negative bias was clearly an impact of

these mentioned observations. However, having said that, we do

not expect a substantial downside form current level as the

directional view with a target of 8800 remains intact. We rather

expect a consolidation within a small range of 8480 - 8460 to

8610 - 8680 for next few sessions. Thus, traders need to be very

selective in their trades and thus, aggressive approach is strictly

not recommended. For the coming session, traders should keep a

close watch on two key levels, 8610 as a resistance and 8518 as

an immediate support.

Key Levels

Support 1 - 8518

Resistance 1 - 8610

Support 2 - 8480

Resistance 2 - 8680

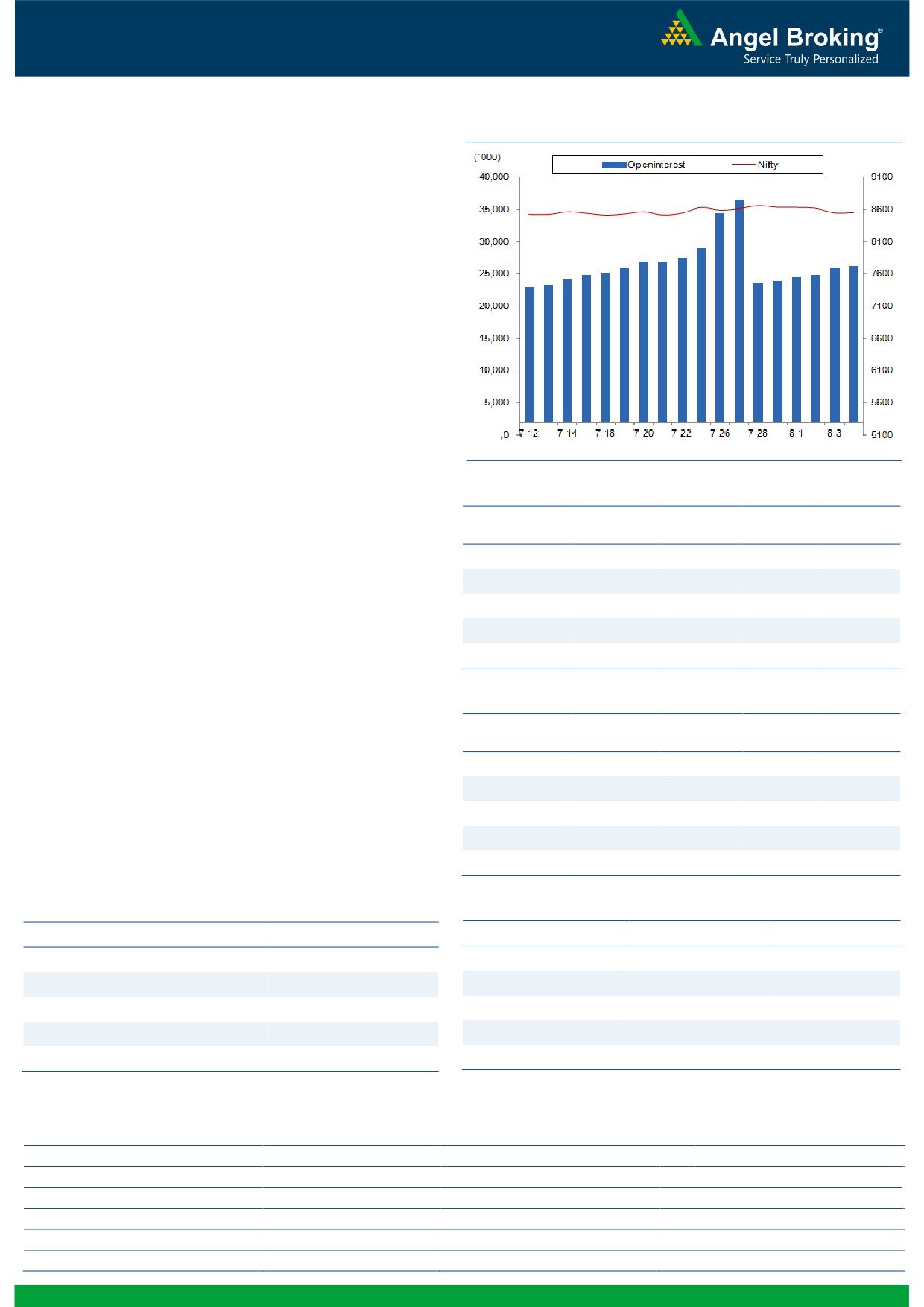

Nifty Bank Outlook - (18572)

Exhibit 2: Nifty Bank Hourly Chart

Amidst volatile trading session, the Nifty bank index ended

yesterday's session with marginal loss of 0.16 percent over its

previous session’s close. The Nifty PSU Bank index outperformed

with gains of 0.70 percent.

Yesterday, the Nifty Bank opened higher tracking SGX Nifty post

the GST development. However, post opening, the index

corrected and tested the support of 18450 (hourly 200SMA)

which we had mentioned in our yesterday's report. The index has

shown minor pullback in last hour from the support zone and

thus, traders are advised to keep a tab on the mentioned support.

Traders are advised not to create short positions as the downside

seems to be limited from current levels. Short term traders should,

infact, look for stock specific opportunities with good risk reward

ratio. The intraday support for the index are placed around

18450 and 18300 whereas resistances are seen around 18750

and 18866.

Key Levels

Support 1 - 18450

Resistance 1 - 18750

Support 2 - 18300

Resistance 2 - 18866

1

Technical & Derivatives Report

August 05, 2016

Comments

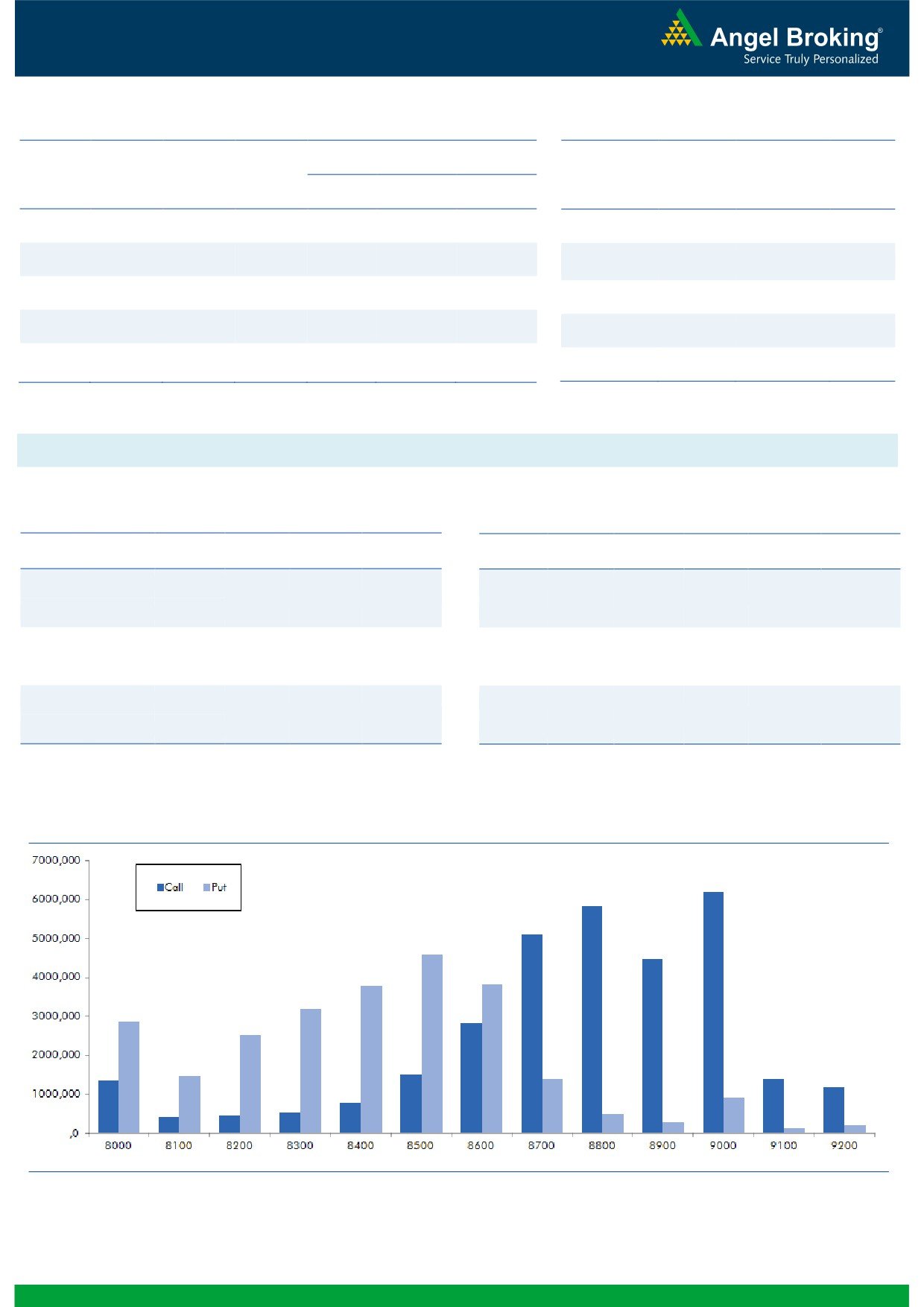

Nifty Vs OI

The Nifty futures open interest has increased by 0.40%

BankNifty futures open interest has decreased by 9.19%

as market closed at 8551.10 levels.

The Nifty August future closed with a premium of 43.30

points against a premium of 37.70 points in previous

session. The September series closed at a premium of

89.75 points.

The Implied Volatility of at the money options has

decreased from 15.18% to 13.97%.

The total OI of the market is Rs. 2,61,192/- cr. and the

stock futures OI is Rs. 72,910/- cr.

Few of the liquid counters where we have seen high cost

of carry are GMRINFRA, ADANIPOWER, ALBK,

BAJFINANCE and JPASSOCIAT.

Views

OI Gainers

FIIs continue to pour in liquidity in both equities and

OI

PRICE

Index Futures. They bought in cash market segment to

SCRIP

OI

PRICE

CHG. (%)

CHG. (%)

the tune of Rs. 559 crores. While, they were net buyers of

AMARAJABAT

910800

35.78

876.50

-4.47

Rs. 711 crores in Index Futures with some rise in OI,

CONCOR

620500

30.91

1433.35

-4.05

indicating fresh long formation near immediate support

zone of 8500-8550.

GODREJIND

1800000

22.20

400.60

-2.65

On Index Options front, FIIs bought significantly of Rs.

BATAINDIA

3187800

14.73

530.70

-4.64

1902 crores with rise in OI. We hardly saw any major OI

ALBK

13160000

14.04

78.50

3.49

additions both in Nifty call and put strikes. 8800 call and

8400 put strikes were comparatively active and they also

OI Losers

added some fresh build-up. Decent amount of

OI

PRICE

SCRIP

OI

PRICE

unwinding was witness in 8900 call options; we believe

CHG. (%)

CHG. (%)

those who were long in 8900 call have squared off their

AJANTPHARM

274800

-5.76

1813.90

-0.49

positions losing hopes on market breaching these higher

CADILAHC

3912000

-5.31

371.20

6.77

levels. Highest OI in August series is placed at 9000 call

BIOCON

3363800

-5.30

827.20

0.75

and 8500 put options. Seeing the above data, we would

PCJEWELLER

498000

-5.14

412.00

2.42

suggest traders to buy on dips and those who are short

VOLTAS

5746000

-5.02

346.65

0.73

should exit at current levels.

Historical Volatility

Put-Call Ratio

SCRIP

HV

SCRIP

PCR-OI

PCR-VOL

DHFL

34.15

NIFTY

0.89

0.74

CADILAHC

48.53

BANKNIFTY

0.49

0.70

AMARAJABAT

37.74

ICICIBANK

0.34

0.34

MCDOWELL-N

43.24

LT

0.46

0.41

IGL

24.66

INFY

0.27

0.26

Strategy Date

Symbol

Strategy

Status

01-08-2016

RELIANCE

Ratio Bear Put Spread

Active

2

Technical & Derivatives Report

August 05, 2016

FII Statistics for 04-August 2016

Turnover on 04-August 2016

Open Interest

No. of

Turnover

Change

Detail

Buy

Sell

Net

Instrument

Value

Contracts

( in Cr. )

(%)

Contracts

Change (%)

(in Cr.)

INDEX

INDEX

2706.91

1995.61

711.30

308494

20212.62

1.31

252904

16607.79

-2.92

FUTURES

FUTURES

INDEX

INDEX

53944.74

52042.70

1902.04

908781

58685.60

3.83

3341977

387680.37

65.94

OPTIONS

OPTIONS

STOCK

5582.31

5777.92

(195.61)

841851

54199.42

1.12

STOCK

FUTURES

578456

36183.23

-8.13

FUTURES

STOCK

STOCK

3704.25

3645.71

58.54

61922

4050.11

9.80

OPTIONS

302611

20008.17

-4.70

OPTIONS

TOTAL

65938.21

63461.94

2476.27

2121048

137147.75

2.53

TOTAL

4475948

460479.56

48.01

Nifty Spot = 8551.10

Lot Size = 75

Bull-Call Spreads

Bear-Put Spreads

Action

Strike

Price

Risk

Reward

BEP

Action

Strike

Price

Risk

Reward

BEP

Buy

8600

108.55

Buy

8500

76.30

42.50

57.50

8642.50

28.35

71.65

8471.65

Sell

8700

66.05

Sell

8400

47.95

Buy

8600

108.55

Buy

8500

76.30

72.65

127.35

8672.65

46.70

153.30

8453.30

Sell

8800

35.90

Sell

8300

29.60

Buy

8700

66.05

Buy

8400

47.95

30.15

69.85

8730.15

18.35

81.65

8381.65

Sell

8800

35.90

Sell

8300

29.60

Note: Above mentioned Bullish or Bearish Spreads in Nifty (August Series) are given as an information and not as a recommendation.

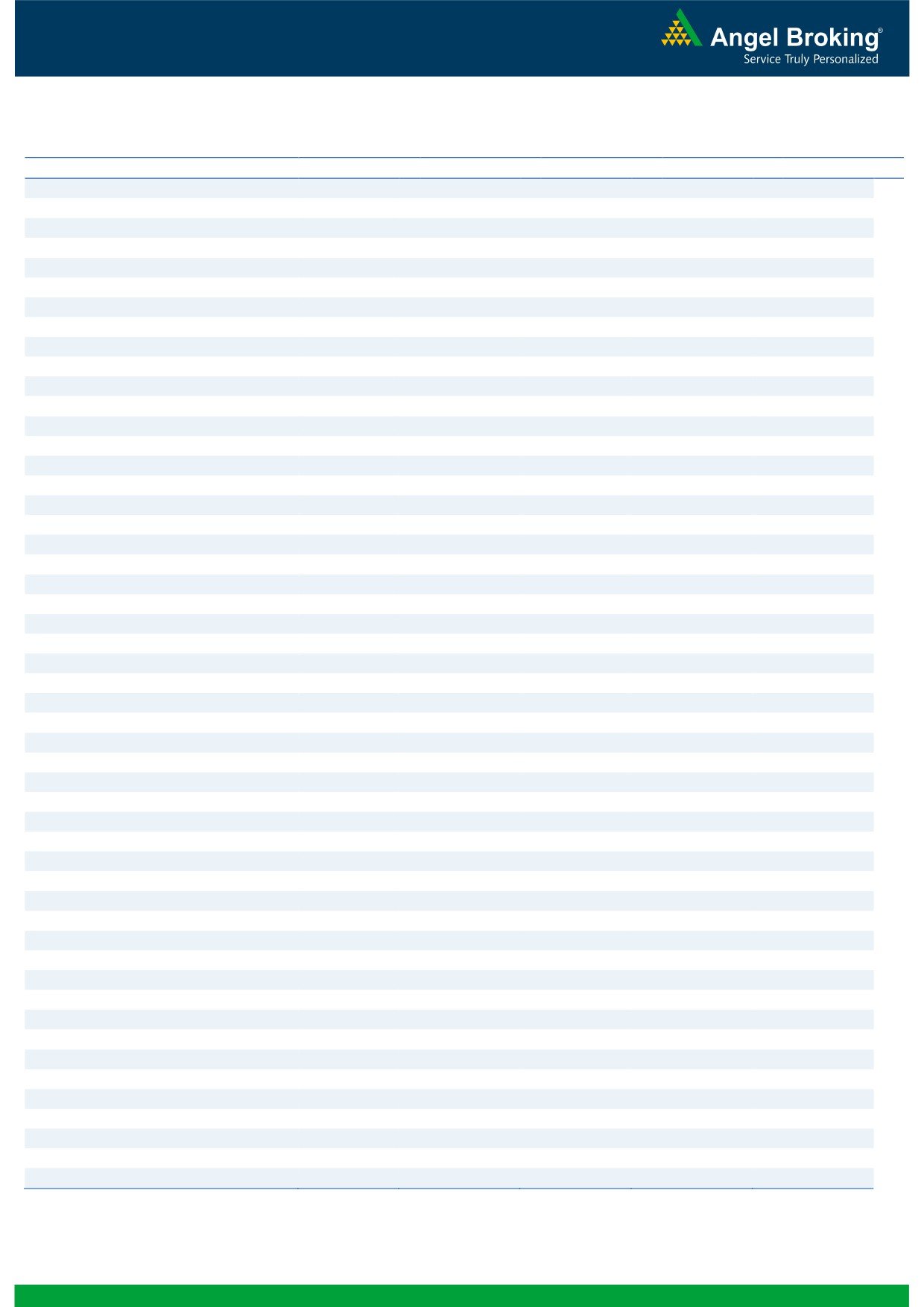

Nifty Put-Call Analysis

3

Technical & Derivatives Report

August 05, 2016

Daily Pivot Levels for Nifty Constituents

Scrips

S2

S1

PIVOT

R1

R2

ACC

1,642

1,654

1,669

1,682

1,697

ADANIPORTS

220

224

227

231

233

AMBUJACEM

260

262

264

266

268

ASIANPAINT

1,095

1,111

1,133

1,149

1,171

AUROPHARMA

737

744

752

759

767

AXISBANK

538

543

549

554

561

BAJAJ-AUTO

2,697

2,720

2,748

2,771

2,799

BANKBARODA

142

149

153

160

164

BHEL

130

132

134

136

138

BPCL

548

559

568

579

589

BHARTIARTL

347

357

363

372

378

INFRATEL

384

388

392

397

401

BOSCH

24,299

24,628

24,829

25,158

25,359

CIPLA

517

522

528

533

539

COALINDIA

316

320

324

328

332

DRREDDY

2,908

2,935

2,958

2,986

3,009

EICHERMOT

20,714

21,059

21,350

21,695

21,987

GAIL

368

371

375

377

381

GRASIM

4,945

4,970

4,994

5,019

5,042

HCLTECH

811

817

827

833

843

HDFCBANK

1,227

1,234

1,240

1,247

1,254

HDFC

1,302

1,311

1,322

1,332

1,343

HEROMOTOCO

3,222

3,249

3,277

3,304

3,332

HINDALCO

134

136

137

138

139

HINDUNILVR

903

911

916

924

930

ICICIBANK

232

236

241

245

249

IDEA

103

104

105

106

107

INDUSINDBK

1,141

1,154

1,170

1,183

1,200

INFY

1,059

1,066

1,076

1,082

1,093

ITC

248

250

252

255

257

KOTAKBANK

746

751

756

761

767

LT

1,440

1,454

1,475

1,490

1,511

LUPIN

1,623

1,640

1,659

1,677

1,696

M&M

1,410

1,423

1,444

1,457

1,478

MARUTI

4,826

4,858

4,901

4,933

4,977

NTPC

156

158

159

160

161

ONGC

216

218

221

223

226

POWERGRID

175

177

178

180

181

RELIANCE

976

984

992

1,001

1,009

SBIN

220

223

226

229

231

SUNPHARMA

833

841

848

856

863

TCS

2,610

2,631

2,657

2,678

2,704

TATAMTRDVR

310

316

320

326

330

TATAMOTORS

484

492

497

505

510

TATAPOWER

70

70

71

72

72

TATASTEEL

351

363

369

380

386

TECHM

490

495

499

505

509

ULTRACEMCO

3,601

3,629

3,664

3,692

3,728

WIPRO

542

545

549

552

555

YESBANK

1,207

1,219

1,232

1,245

1,258

ZEEL

477

482

489

494

501

4

Technical & Derivatives Report

August 05, 2016

Research Team Tel: 022 - 39357800

For Technical Queries

For Derivatives Queries

DISCLAIMER

Angel Broking Private Limited (hereinafter referred to as “Angel”) is a registered Member of National Stock Exchange of India Limited,

Bombay Stock Exchange Limited and Metropolitan Stock Exchange Limited. It is also registered as a Depository Participant with CDSL

and Portfolio Manager with SEBI. It also has registration with AMFI as a Mutual Fund Distributor. Angel Broking Private Limited is a

registered entity with SEBI for Research Analyst in terms of SEBI (Research Analyst) Regulations, 2014 vide registration number

INH000000164. Angel or its associates has not been debarred/ suspended by SEBI or any other regulatory authority for accessing

/dealing in securities Market. Angel or its associates/analyst has not received any compensation / managed or co-managed public

offering of securities of the company covered by Analyst during the past twelve months.

This document is solely for the personal information of the recipient, and must not be singularly used as the basis of any investment

decision. Nothing in this document should be construed as investment or financial advice. Each recipient of this document should

make such investigations as they deem necessary to arrive at an independent evaluation of an investment in the securities of the

companies referred to in this document (including the merits and risks involved), and should consult their own advisors to determine

the merits and risks of such an investment.

Reports based on technical and derivative analysis center on studying charts of a stock's price movement, outstanding positions and

trading volume, as opposed to focusing on a company's fundamentals and, as such, may not match with a report on a company's

fundamentals. Investors are advised to refer the Fundamental and Technical Research Reports available on our website to evaluate the

contrary view, if any.

The information in this document has been printed on the basis of publicly available information, internal data and other reliable

sources believed to be true, but we do not represent that it is accurate or complete and it should not be relied on as such, as this

document is for general guidance only. Angel Broking Pvt. Limited or any of its affiliates/ group companies shall not be in any way

responsible for any loss or damage that may arise to any person from any inadvertent error in the information contained in this report.

Angel Broking Pvt. Limited has not independently verified all the information contained within this document. Accordingly, we cannot

testify, nor make any representation or warranty, express or implied, to the accuracy, contents or data contained within this document.

While Angel Broking Pvt. Limited endeavors to update on a reasonable basis the information discussed in this material, there may be

regulatory, compliance, or other reasons that prevent us from doing so.

This document is being supplied to you solely for your information, and its contents, information or data may not be reproduced,

redistributed or passed on, directly or indirectly.

Neither Angel Broking Pvt. Limited, nor its directors, employees or affiliates shall be liable for any loss or damage that may arise from

or in connection with the use of this information.

5