Technical & Derivatives Report

July 05, 2016

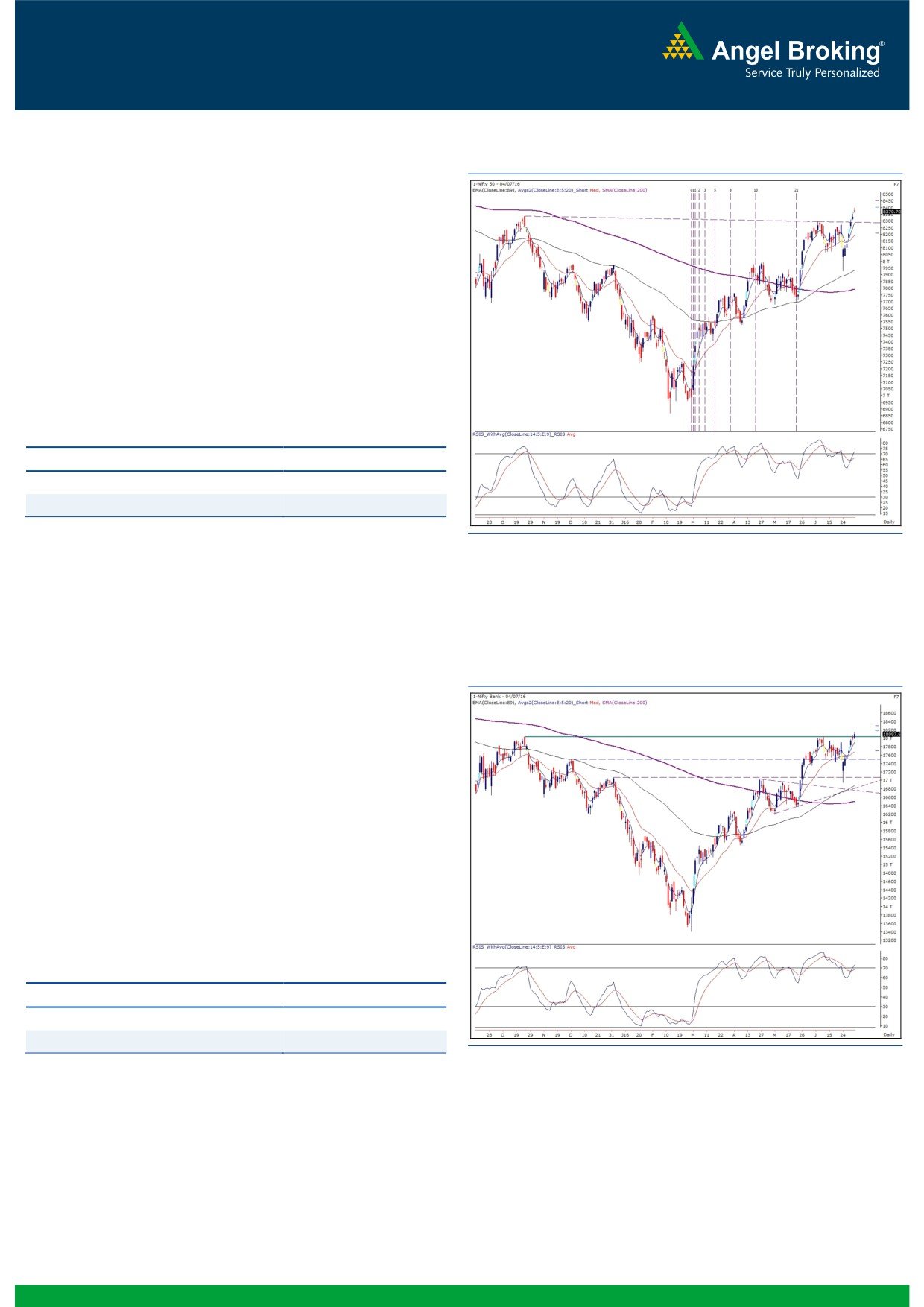

Exhibit 1: Nifty Daily Chart

Sensex (27279) / Nifty (8371)

We have seen a series of gap up opening since last five sessions.

However, unlike previous sessions, the Nifty remained subdued

throughout the session to close with half a percent gains.

After such a v-shaped recovery, it was quite evident to take a

pause and Nifty has done similar yesterday. We expect this

consolidation to continue and in fact, an intraday dip towards

8340 - 8320 could be a buying opportunity. Hence, traders are

advised not create any short positions for minor correction and

stay with the trend. The next resistance would be seen at 8400 -

8450 and support at 8290 - 8250 levels.

Key Levels

Support 1 - 8340

Resistance 1 - 8400

Support 2 - 8320

Resistance 2 - 8450

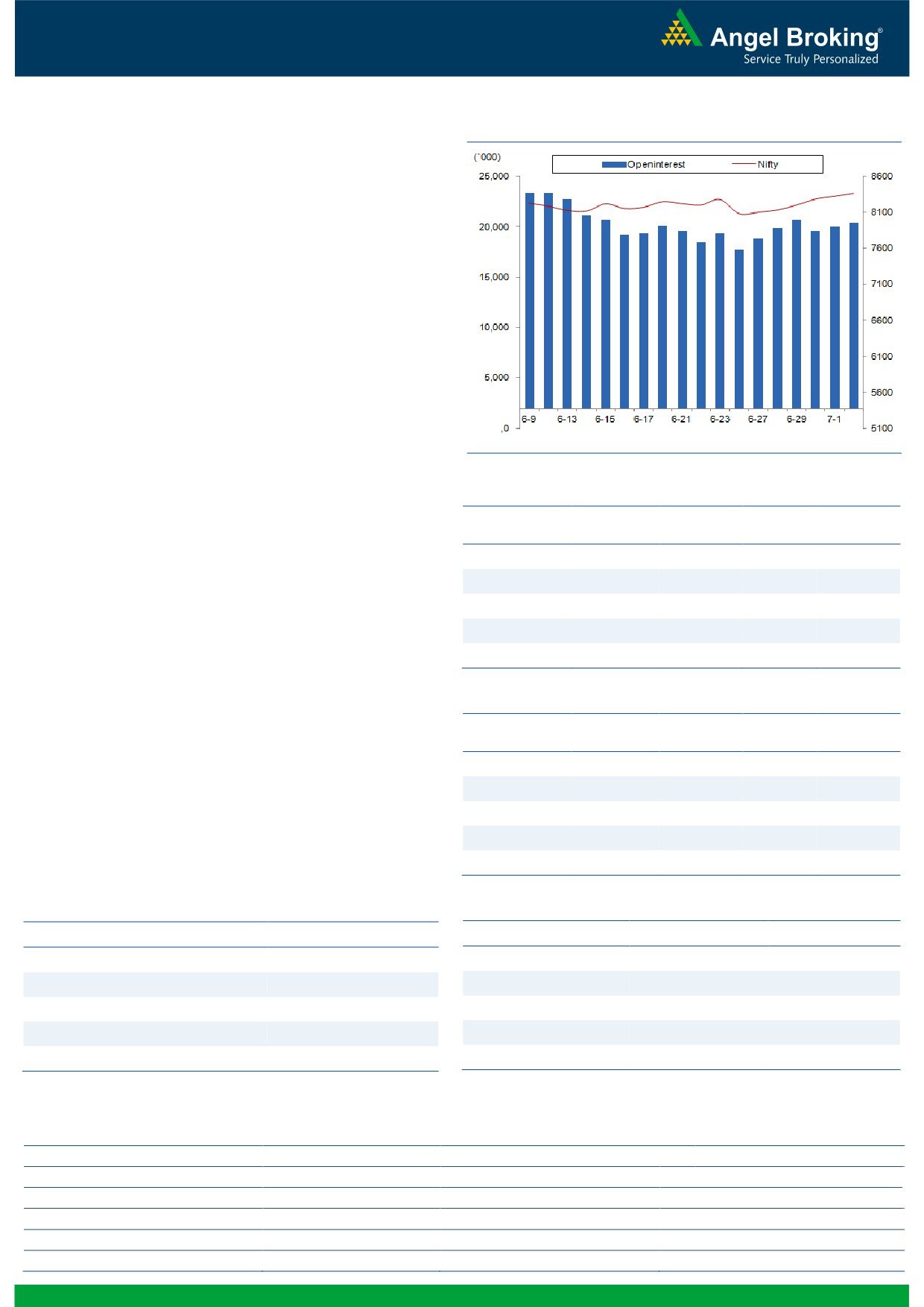

Exhibit 2: Nifty Bank Daily Chart

Nifty Bank Outlook - (18098)

In yesterday's trading session, the Nifty Bank index opened higher

on back of the ongoing positive momentum. However, in the rest

of the session, the index traded range bound and ended the day

with gains of 0.62%.

Although the index traded in a narrow range post gap up

opening, the stock specific moves gave good trading

opportunities to trade with positive bias. With no signs of reversal

on the charts, we continue to advise short term traders to trade

with positive bias. The near term support for the index is placed

around 17940 and 17975 whereas resistances are seen around

18200 and 18350.

Key Levels

Support 1 - 17940

Resistance 1 - 18200

Support 2 - 17975

Resistance 2 - 18350

1

Technical & Derivatives Report

July 05, 2016

Comments

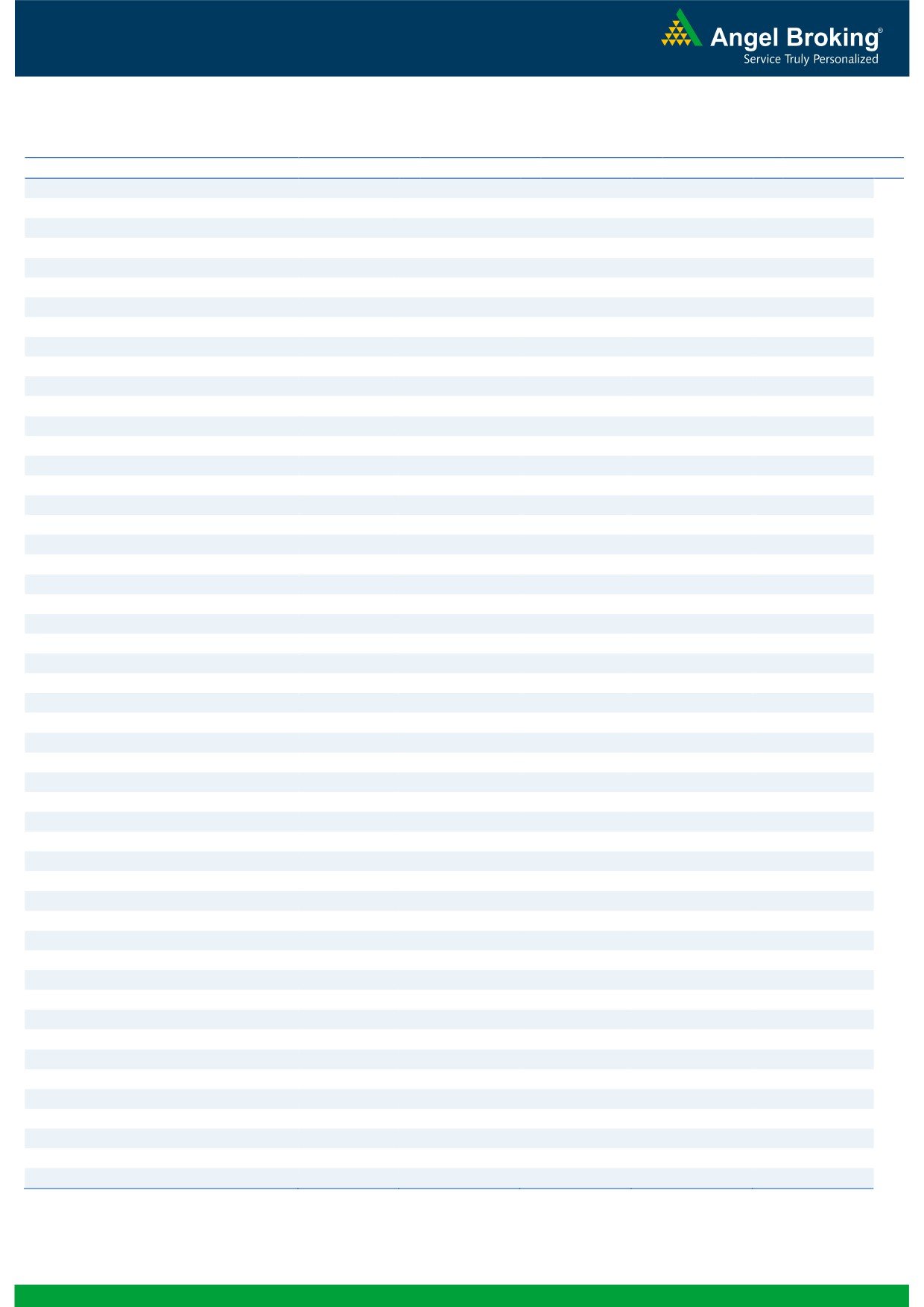

Nifty Vs OI

The Nifty futures open interest has increased by 1.85%

BankNifty futures open interest has increased by 6.05%

as market closed at 8370.70 levels.

The Nifty July future closed with a premium of 16.65

points against a premium of 26.80 points in previous

session. The August series closed at a premium of 49.30

points.

The Implied Volatility of at the money options has

decreased from 14.36% to 14.13%.

The total OI of the market is Rs. 2,04,998/- cr. and the

stock futures OI is Rs. 62,634/- cr.

Few of the liquid counters where we have seen high cost

of carry are UNITECH, JPASSOCIAT, IDFC, SOUTHBANK

and NHPC.

Views

OI Gainers

FIIs were net buyers in both cash market segment and in

OI

PRICE

SCRIP

OI

PRICE

Index Futures. They bought equities to the tune of Rs. 182

CHG. (%)

CHG. (%)

crores. While in Index Futures, they were marginal buyers

HINDZINC

5369600

34.67

186.05

4.35

with good amount of rise in open interest, indicating

SINTEX

7756000

22.57

85.55

1.36

blend of long and short positions in previous trading

NIITTECH

384000

18.89

519.55

1.19

session.

NHPC

24408000

18.32

26.00

3.38

On Index Options front, FIIs bought worth Rs. 733 crores

GODREJCP

431600

18.31

1642.00

0.82

with rise in open interest. In Call options, some OI

addition was seen in 8600 strike. On the other hand in

Put options,

8100-8400 strikes added huge fresh

OI Losers

positions. Maximum open interest in current series is

OI

PRICE

SCRIP

OI

PRICE

CHG. (%)

CHG. (%)

placed at 8500 call and 8000 put strikes.

OIL

863600

-9.77

374.50

2.06

Since, FIIs are continuously buying in index futures; we

HCLTECH

6846700

-6.36

750.00

2.22

are expecting Nifty to continue its upward momentum in

upcoming sessions too. Hence, traders are advised to

ENGINERSIN

2415000

-5.99

211.30

0.40

trade with positive bias.

BOSCHLTD

81800

-5.60

22299.90

-2.00

INFY

10343000

-4.93

1187.00

0.74

Historical Volatility

Put-Call Ratio

SCRIP

HV

SCRIP

PCR-OI

PCR-VOL

ALBK

63.79

NIFTY

1.04

1.06

PNB

55.50

BANKNIFTY

1.34

1.05

MRF

34.38

SBIN

0.69

0.54

SYNDIBANK

49.53

RELIANCE

0.49

0.30

IDBI

48.18

SUNPHARMA

0.37

0.31

Strategy Date

Symbol

Strategy

Status

04-07-2016

RCOM

Ratio Bull Call Spread

Active

2

Technical & Derivatives Report

July 05, 2016

FII Statistics for 04-July 2016

Turnover on 04-July 2016

Open Interest

No. of

Turnover

Change

Detail

Buy

Sell

Net

Instrument

Value

Contracts

( in Cr. )

(%)

Contracts

Change (%)

(in Cr.)

INDEX

INDEX

1309.90

1234.18

75.72

230103

14740.32

3.96

162231

10701.66

-13.29

FUTURES

FUTURES

INDEX

INDEX

16941.29

16207.84

733.44

753058

47431.52

6.64

1819968

119696.72

2.13

OPTIONS

OPTIONS

STOCK

4593.34

4090.16

503.18

768187

48266.22

0.84

STOCK

FUTURES

491361

31951.74

-2.12

FUTURES

STOCK

STOCK

2312.83

2322.65

(9.82)

29814

1916.28

59.60

OPTIONS

231260

15502.41

8.45

OPTIONS

TOTAL

25157.36

23854.83

1302.53

1781162

112354.34

4.29

TOTAL

2704820

177852.53

0.77

Nifty Spot = 8370.70

Lot Size = 75

Bull-Call Spreads

Bear-Put Spreads

Action

Strike

Price

Risk

Reward

BEP

Action

Strike

Price

Risk

Reward

BEP

Buy

8400

113.25

Buy

8300

89.95

46.30

53.70

8446.30

27.90

72.10

8272.10

Sell

8500

66.95

Sell

8200

62.05

Buy

8400

113.25

Buy

8300

89.95

77.15

122.85

8477.15

47.10

152.90

8252.90

Sell

8600

36.10

Sell

8100

42.85

Buy

8500

66.95

Buy

8200

62.05

30.85

69.15

8530.85

19.20

80.80

8180.80

Sell

8600

36.10

Sell

8100

42.85

Note: Above mentioned Bullish or Bearish Spreads in Nifty (July Series) are given as an information and not as a recommendation.

Nifty Put-Call Analysis

3

Technical & Derivatives Report

July 05, 2016

Daily Pivot Levels for Nifty Constituents

Scrips

S2

S1

PIVOT

R1

R2

ACC

1,585

1,595

1,611

1,621

1,636

ADANIPORTS

202

208

211

216

219

AMBUJACEM

250

252

254

255

257

ASIANPAINT

986

993

1,005

1,012

1,024

AUROPHARMA

744

751

757

763

769

AXISBANK

536

540

543

547

551

BAJAJ-AUTO

2,618

2,635

2,663

2,680

2,708

BANKBARODA

155

158

160

162

164

BHEL

131

135

137

140

142

BPCL

1,089

1,097

1,104

1,112

1,119

BHARTIARTL

366

370

373

377

380

INFRATEL

348

351

355

359

363

BOSCH

22,000

22,124

22,250

22,374

22,500

CIPLA

505

508

511

513

516

COALINDIA

309

313

316

321

324

DRREDDY

3,330

3,383

3,471

3,523

3,611

EICHERMOT

19,071

19,281

19,461

19,671

19,851

GAIL

387

391

397

401

407

GRASIM

4,506

4,543

4,606

4,644

4,707

HCLTECH

728

738

744

754

760

HDFCBANK

1,166

1,170

1,175

1,178

1,183

HDFC

1,237

1,247

1,256

1,266

1,276

HEROMOTOCO

3,118

3,139

3,164

3,185

3,211

HINDALCO

125

125

126

127

127

HINDUNILVR

880

886

895

901

909

ICICIBANK

239

244

246

251

253

IDEA

104

105

107

108

109

INDUSINDBK

1,091

1,099

1,113

1,121

1,134

INFY

1,167

1,176

1,185

1,194

1,204

ITC

238

241

248

251

258

KOTAKBANK

732

738

747

753

762

LT

1,536

1,552

1,564

1,581

1,593

LUPIN

1,546

1,558

1,566

1,578

1,586

M&M

1,440

1,453

1,465

1,478

1,490

MARUTI

4,139

4,156

4,173

4,191

4,208

NTPC

152

154

156

158

160

ONGC

226

229

232

235

238

POWERGRID

163

164

166

167

168

RELIANCE

967

977

985

995

1,003

SBIN

221

222

223

224

225

SUNPHARMA

762

766

771

775

779

TCS

2,457

2,476

2,501

2,519

2,545

TATAMTRDVR

292

298

301

307

310

TATAMOTORS

463

466

470

474

478

TATAPOWER

74

74

75

75

76

TATASTEEL

325

328

331

334

337

TECHM

504

512

518

525

531

ULTRACEMCO

3,356

3,383

3,429

3,455

3,502

WIPRO

557

559

562

564

567

YESBANK

1,099

1,108

1,124

1,133

1,149

ZEEL

448

455

459

466

471

4

Technical & Derivatives Report

July 05, 2016

Research Team Tel: 022 - 39357800

For Technical Queries

For Derivatives Queries

DISCLAIMER

Angel Broking Private Limited (hereinafter referred to as “Angel”) is a registered Member of National Stock Exchange of India Limited,

Bombay Stock Exchange Limited and MCX Stock Exchange Limited. It is also registered as a Depository Participant with CDSL and

Portfolio Manager with SEBI. It also has registration with AMFI as a Mutual Fund Distributor. Angel Broking Private Limited is a

registered entity with SEBI for Research Analyst in terms of SEBI (Research Analyst) Regulations, 2014 vide registration number

INH000000164. Angel or its associates has not been debarred/ suspended by SEBI or any other regulatory authority for accessing

/dealing in securities Market. Angel or its associates including its relatives/analyst do not hold any financial interest/beneficial

ownership of more than 1% in the company covered by Analyst. Angel or its associates/analyst has not received any compensation /

managed or co-managed public offering of securities of the company covered by Analyst during the past twelve months. Angel/analyst

has not served as an officer, director or employee of company covered by Analyst and has not been engaged in market making activity

of the company covered by Analyst.

This document is solely for the personal information of the recipient, and must not be singularly used as the basis of any investment

decision. Nothing in this document should be construed as investment or financial advice. Each recipient of this document should

make such investigations as they deem necessary to arrive at an independent evaluation of an investment in the securities of the

companies referred to in this document (including the merits and risks involved), and should consult their own advisors to determine

the merits and risks of such an investment.

Reports based on technical and derivative analysis center on studying charts of a stock's price movement, outstanding positions and

trading volume, as opposed to focusing on a company's fundamentals and, as such, may not match with a report on a company's

fundamentals.

The information in this document has been printed on the basis of publicly available information, internal data and other reliable

sources believed to be true, but we do not represent that it is accurate or complete and it should not be relied on as such, as this

document is for general guidance only. Angel Broking Pvt. Limited or any of its affiliates/ group companies shall not be in any way

responsible for any loss or damage that may arise to any person from any inadvertent error in the information contained in this report.

Angel Broking Pvt. Limited has not independently verified all the information contained within this document. Accordingly, we cannot

testify, nor make any representation or warranty, express or implied, to the accuracy, contents or data contained within this document.

While Angel Broking Pvt. Limited endeavors to update on a reasonable basis the information discussed in this material, there may be

regulatory, compliance, or other reasons that prevent us from doing so.

This document is being supplied to you solely for your information, and its contents, information or data may not be reproduced,

redistributed or passed on, directly or indirectly.

Neither Angel Broking Pvt. Limited, nor its directors, employees or affiliates shall be liable for any loss or damage that may arise from

or in connection with the use of this information.

Note: Please refer to the important ‘Stock Holding Disclosure' report on the Angel website (Research Section). Also, please refer to the

latest update on respective stocks for the disclosure status in respect of those stocks. Angel Broking Pvt. Limited and its affiliates may

have investment positions in the stocks recommended in this report.

5