October 05, 2015

Sensex (26221) / Nifty (7951)

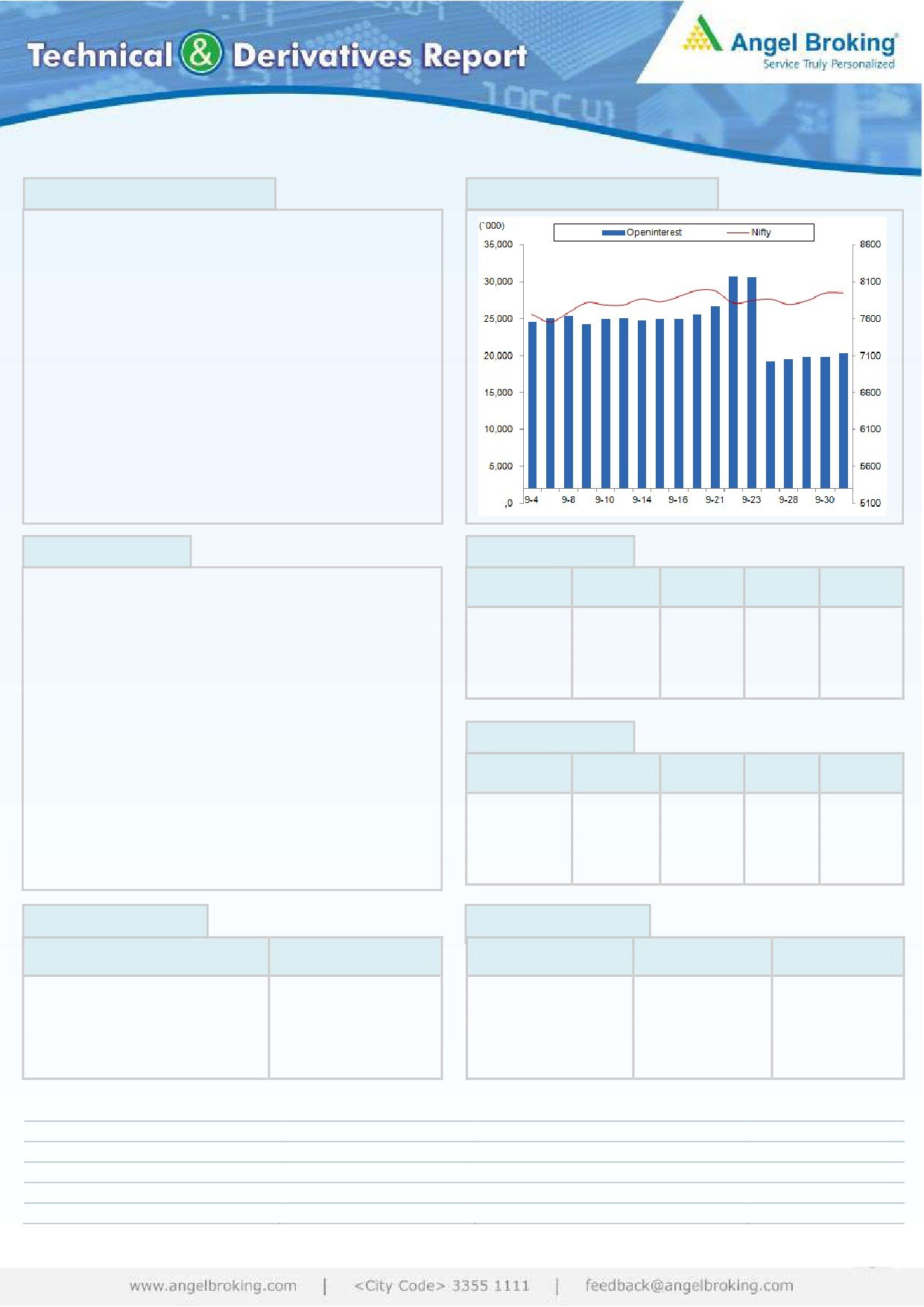

Exhibit 1: Nifty Daily Chart

The concluded week witnessed volatility owing to RBI monetary

policy and ongoing global uncertainty. The price action of last

month has led to the formation of an ‘Inverted Head & Shoulders’

pattern on the daily charts. The said pattern is a trend reversal

pattern which possibly implies positive momentum, but that would

be the case only if the Nifty sustains above the neckline resistance

of 8055. However, if we observe the higher degree weekly chart,

the Nifty had earlier formed a broader ‘Head & Shoulders’

pattern from which it had given a breakdown in the last week of

August. The ongoing up move thus seems to be just a pullback

move if traced on the basis of the weekly charts. Also, the recent

up move in the Nifty from the lows of 7539.50 does not show any

‘Impulsive’ characteristics and thus we believe that it is just a

pullback rally within the corrective downtrend. Thus, 8055 seems

to be a trend deciding level for the near term, and until the same

is crossed, traders should trade in line with the broader trend and

should be vigilant to create aggressive long positions. The failure

of the ‘Inverted Head & Shoulders’ pattern and resumption of the

corrective move could be catastrophic and the Nifty could then

move lower towards 7650-7700 levels in the near term. However,

if the Nifty crosses 8055 in the week ahead, then it can possibly

move upto its next resistance zone which is seen around 8157

(89EMA on daily charts) to 8225 (higher end of the gap area of

24 August 2015).

Bank Nifty Outlook - (17150)

Exhibit 2: Bank Nifty Daily Chart

On Thursday, the Bank Nifty started the session with the gains of

more than 140 points in-line with the benchmark indices. But,

once again, the upside gap was not sustainable as the banking

index started falling from the initial trades. The Bank Nifty

continued to make lower lows throughout the sessions and traded

within the range of Wednesday’s trading boundaries. Eventually,

the Bank Nifty ended the concluding session of the week with the

loss of 0.38 percent over its previous close. The lack of positive

momentum post the positive outcome from monetary policy

doesn’t bode well for bulls. Since, the chart structure remains the

same; we continue to maintain our negative stance on the index.

At current juncture, the Bank Nifty is taking support around the

’89 EMA’ in the hourly chart; thus, a minor pull back rally in near

term cannot be ruled out. We advise traders to not get carried

away with the intraday bounces and avoid going aggressive longs

at current levels. Going forward, the Bank Nifty has strong

support at 16960 and 16820 levels; whereas, the immediate

resistance is placed at 17465 and 17655 levels.

1

October 05, 2015

Comments

Nifty Vs OI

The Nifty futures open interest has increased by 2.88%

BankNifty futures open interest has decreased by 1.55%

as market closed at 7950.90 levels.

The Nifty September future closed at a premium of

26.05 points against a premium of 32.55 points. The

October series closed at a premium of 62.50 points.

The Implied Volatility of at the money options has

decreased from 20.40% to 17.60%.

Nifty PCR-OI has decreased from 0.92 to 0.91 levels.

The total OI of the market is Rs. 1,90,872/- cr. and the

stock futures OI is Rs. 55,991/- cr.

Views

OI Gainers

OI

PRICE

Thursday, FIIs were net buyer in both cash market

SCRIP

OI

PRICE

CHG. (%)

CHG. (%)

segment and in Index Futures. They bought equities

INFRATEL

1118000

46.76

399.25

11.63

marginally and Index Futures of Rs. 964 crores with rise

CADILAHC

191700

37.72

2114.15

0.37

in OI, suggesting fresh long formation in last trading

TV18BRDCST

6341000

31.34

35.05

-1.41

session.

MARICO

481000

20.13

402.40

-1.17

BEML

82500

17.86

1249.70

-0.04

In Index Options front, they bought marginally with fall

in OI. In call options, decent OI addition was seen in

OI Losers

8100-8400 strikes and in put options, 7500, 7800 &

OI

PRICE

8000 strike added decent OI. Unwinding in 7600 &

SCRIP

OI

PRICE

CHG. (%)

CHG. (%)

7400 put strikes was also visible. Maximum OI is seen in

ENGINERSIN

1261200

-7.54

192.60

0.05

8300 call and 7500 put options. 8150-8200 is a major

DLF

32987000

-6.95

132.95

-2.49

resistance for market; we don’t expect Nifty to surpass

IRB

4768000

-6.63

237.05

-0.46

this level.

HINDZINC

1944000

-5.45

137.50

-1.47

IOB

9404000

-5.41

36.70

2.37

Historical Volatility

Put-Call Ratio

SCRIP

HV

SCRIP

PCR-OI

PCR-VOL

IDFC

74.71

NIFTY

0.91

0.91

HCLTECH

72.13

BANKNIFTY

0.87

0.64

TCS

21.08

SBIN

0.50

0.41

ULTRACEMCO

39.07

RELIANCE

0.72

0.57

TITAN

34.49

TATAMOTORS

0.64

0.61

Strategy Date

Symbol

Strategy

Status

September 28, 2015

NIFTY

Long Strangle

Active

2

October 05, 2015

FII Statistics for 01-October 2015

Turnover on 01-October 2015

Open Interest

No. of

Turnover

Change

Detail

Buy

Sell

Net

Instrument

Contracts

( in Cr. )

(%)

Contracts

Value

Change

INDEX

INDEX

2163.15

1199.49

963.66

803434

17915.01

2.42

625738

16242.38

-15.63

FUTURES

FUTURES

INDEX

INDEX

9893.77

9870.96

22.81

1922747

60142.46

(3.03)

4986565

109884.87

2.83

OPTIONS

OPTIONS

STOCK

2265.14

2395.71

(130.57)

1783689

44988.15

1.19

STOCK

848187

22431.11

-6.92

FUTURES

FUTURES

STOCK

STOCK

1351.13

1371.19

(20.06)

60218

1566.96

18.09

OPTIONS

377079

9874.68

-23.91

OPTIONS

TOTAL

15673.18

14837.34

835.84

4570088

124612.58

(0.24)

TOTAL

6837569

158433.04

-2.91

Nifty Spot = 7950.90

Lot Size = 25

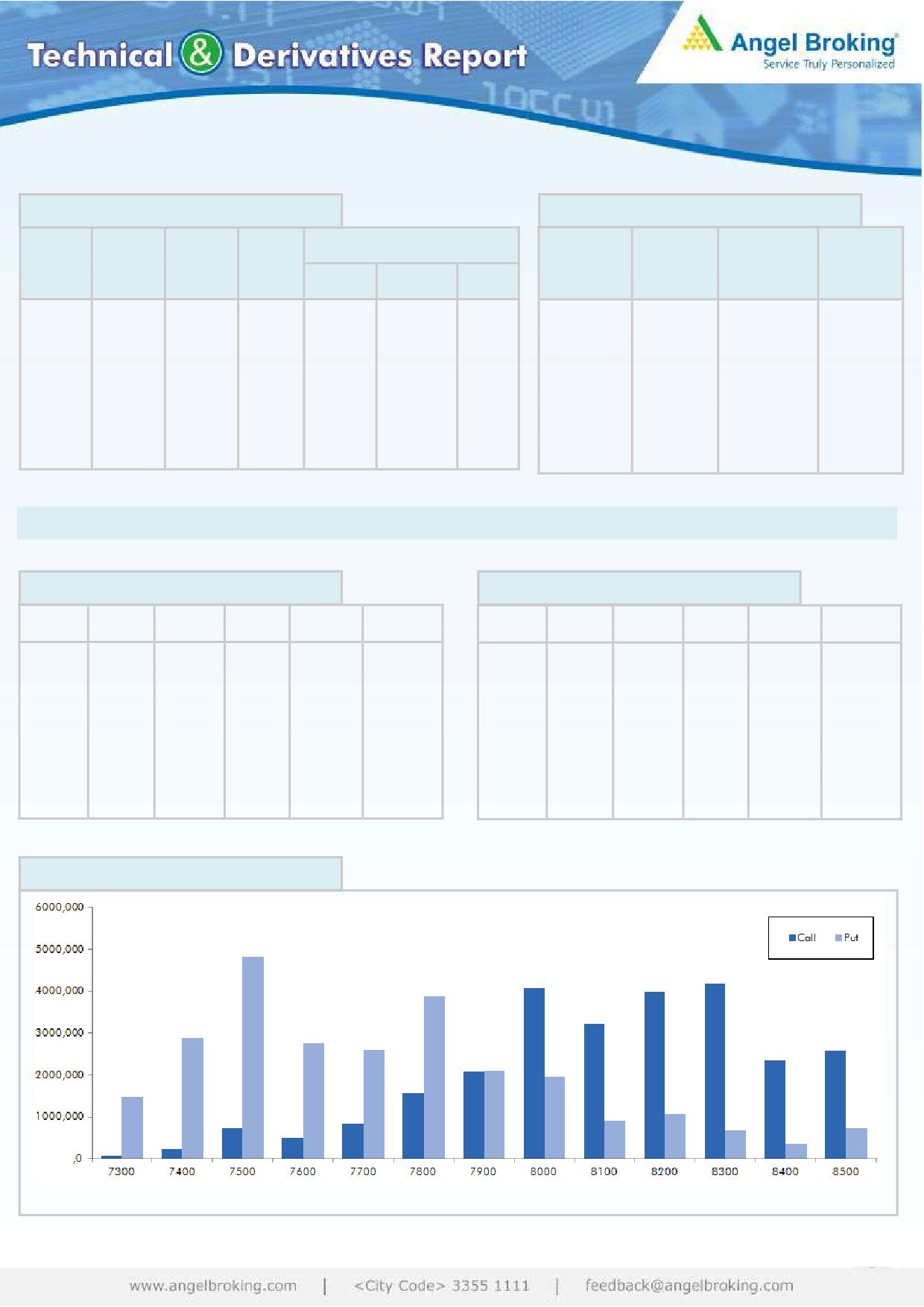

Bull-Call Spreads

Bear-Put Spreads

Action

Strike

Price

Risk

Reward

BEP

Action

Strike

Price

Risk

Reward

BEP

Buy

Buy

8000

141.35

7900

126.70

50.10

49.90

8050.10

30.65

69.35

7869.35

Sell

Sell

8100

91.25

7800

96.05

Buy

Buy

8000

141.35

7900

126.70

85.70

114.30

8085.70

54.60

145.40

7845.40

Sell

Sell

8200

55.65

7700

72.10

Buy

Buy

8100

91.25

7800

96.05

35.60

64.40

8135.60

23.95

76.05

7776.05

Sell

Sell

8200

55.65

7700

72.10

Note: Above mentioned Bullish or Bearish Spreads in Nifty (Oct. Series) are given as an information and not as a recommendation.

Nifty Put-Call Analysis

3

October 05, 2015

Daily Pivot Levels for Nifty 50 Stocks

Scrips

S2

S1

PIVOT

R1

R2

SENSEX

26,011

26,116

26,274

26,379

26,537

NIFTY

7,886

7,918

7,963

7,996

8,041

BANKNIFTY

16,939

17,044

17,217

17,323

17,496

ACC

1,340

1,352

1,363

1,375

1,386

AMBUJACEM

205

208

209

212

213

ASIANPAINT

829

834

842

847

854

AXISBANK

484

490

497

503

509

BAJAJ-AUTO

2,266

2,290

2,309

2,334

2,352

BANKBARODA

177

179

182

184

188

BHARTIARTL

334

337

339

341

343

BHEL

193

196

202

205

211

BOSCHLTD

18,952

19,129

19,389

19,566

19,826

BPCL

835

845

855

865

874

CAIRN

150

152

154

155

157

CIPLA

620

627

638

645

656

COALINDIA

322

325

328

331

334

DRREDDY

4,164

4,199

4,224

4,259

4,284

GAIL

281

287

298

304

315

GRASIM

3,465

3,497

3,534

3,566

3,602

HCLTECH

789

823

869

903

949

HDFC

1,166

1,182

1,207

1,222

1,248

HDFCBANK

1,050

1,059

1,068

1,077

1,086

HEROMOTOCO

2,356

2,384

2,428

2,457

2,501

HINDALCO

69

70

71

72

73

HINDUNILVR

802

809

818

825

834

ICICIBANK

261

264

269

272

276

IDEA

144

147

150

153

157

INDUSINDBK

933

945

954

967

976

INFY

1,139

1,156

1,177

1,194

1,215

ITC

323

326

330

333

337

KOTAKBANK

628

634

644

651

661

LT

1,450

1,470

1,482

1,502

1,515

LUPIN

1,996

2,053

2,090

2,147

2,184

M&M

1,222

1,236

1,257

1,271

1,292

MARUTI

4,472

4,526

4,624

4,678

4,776

NMDC

92

93

94

95

95

NTPC

121

122

124

125

127

ONGC

225

229

231

235

237

PNB

130

131

133

134

136

POWERGRID

128

129

132

133

135

RELIANCE

850

858

866

873

881

SBIN

230

232

237

240

245

VEDL

80

82

84

86

88

SUNPHARMA

865

878

886

900

908

TATAMOTORS

287

292

297

302

307

TATAPOWER

65

65

66

67

67

TATASTEEL

207

210

213

215

218

TCS

2,571

2,608

2,629

2,666

2,687

TECHM

526

545

556

574

585

ULTRACEMCO

2,630

2,702

2,741

2,812

2,851

WIPRO

588

594

603

610

619

YESBANK

703

716

728

740

752

ZEEL

384

388

392

396

400

4

October 05, 2015

Research Team Tel: 022 - 39357800

DISCLAIMER

Angel Broking Private Limited (hereinafter referred to as “Angel”) is a registered Member of National Stock Exchange of India Limited,

Bombay Stock Exchange Limited and MCX Stock Exchange Limited. It is also registered as a Depository Participant with CDSL and

Portfolio Manager with SEBI. It also has registration with AMFI as a Mutual Fund Distributor. Angel Broking Private Limited is a

registered entity with SEBI for Research Analyst in terms of SEBI (Research Analyst) Regulations, 2014 vide registration number

INH000000164. Angel or its associates has not been debarred/ suspended by SEBI or any other regulatory authority for accessing

/dealing in securities Market. Angel or its associates including its relatives/analyst do not hold any financial interest/beneficial

ownership of more than 1% in the company covered by Analyst. Angel or its associates/analyst has not received any compensation /

managed or co-managed public offering of securities of the company covered by Analyst during the past twelve months. Angel/analyst

has not served as an officer, director or employee of company covered by Analyst and has not been engaged in market making activity

of the company covered by Analyst.

This document is solely for the personal information of the recipient, and must not be singularly used as the basis of any investment

decision. Nothing in this document should be construed as investment or financial advice. Each recipient of this document should

make such investigations as they deem necessary to arrive at an independent evaluation of an investment in the securities of the

companies referred to in this document (including the merits and risks involved), and should consult their own advisors to determine

the merits and risks of such an investment.

Reports based on technical and derivative analysis center on studying charts of a stock's price movement, outstanding positions and

trading volume, as opposed to focusing on a company's fundamentals and, as such, may not match with a report on a company's

fundamentals.

The information in this document has been printed on the basis of publicly available information, internal data and other reliable

sources believed to be true, but we do not represent that it is accurate or complete and it should not be relied on as such, as this

document is for general guidance only. Angel Broking Pvt. Limited or any of its affiliates/ group companies shall not be in any way

responsible for any loss or damage that may arise to any person from any inadvertent error in the information contained in this report.

Angel Broking Pvt. Limited has not independently verified all the information contained within this document. Accordingly, we cannot

testify, nor make any representation or warranty, express or implied, to the accuracy, contents or data contained within this document.

While Angel Broking Pvt. Limited endeavors to update on a reasonable basis the information discussed in this material, there may be

regulatory, compliance, or other reasons that prevent us from doing so.

This document is being supplied to you solely for your information, and its contents, information or data may not be reproduced,

redistributed or passed on, directly or indirectly.

Neither Angel Broking Pvt. Limited, nor its directors, employees or affiliates shall be liable for any loss or damage that may arise from

or in connection with the use of this information.

Note: Please refer to the important ‘Stock Holding Disclosure' report on the Angel website (Research Section). Also, please refer to the

latest update on respective stocks for the disclosure status in respect of those stocks. Angel Broking Pvt. Limited and its affiliates may

have investment positions in the stocks recommended in this report.

5