Technical & Derivatives Report

October 04, 2016

Sensex (28243) / Nifty (8738)

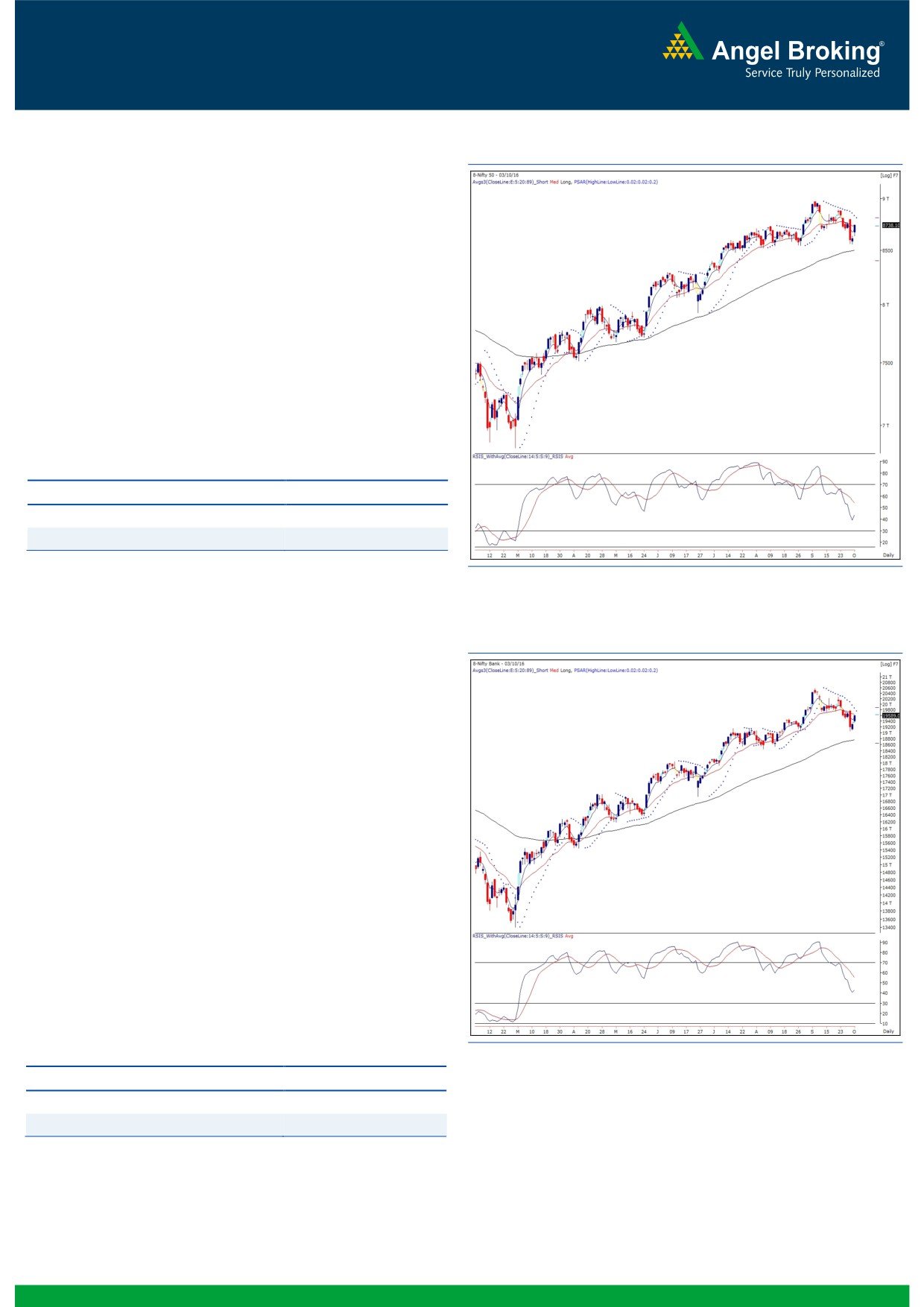

Exhibit 1: Nifty Daily Chart

The Nifty index opened the day on a positive note yesterday and

rallied higher to end the session with gains of 1.47 percent.

Although the Nifty index showed a pullback move yesterday, the

higher degree charts shows no signs of reversal and hence, there

is higher probability of the ongoing pullback move getting sold

into. The resistance for the Nifty index is seen around

8810,

which is 61.8% retracement of the recent corrective move. Due to

the RBI's Monetary Policy scheduled today, the volatility is

expected to remain higher. Hence, traders are advised to trade

with proper risk management strategy. The intraday support for

the Nifty index is placed around 8690 and 8615 whereas

resistances are seen around 8810 and 8880.

Key Levels

Support 1 - 8690

Resistance 1 - 8810

Support 2 - 8615

Resistance 2 - 8880

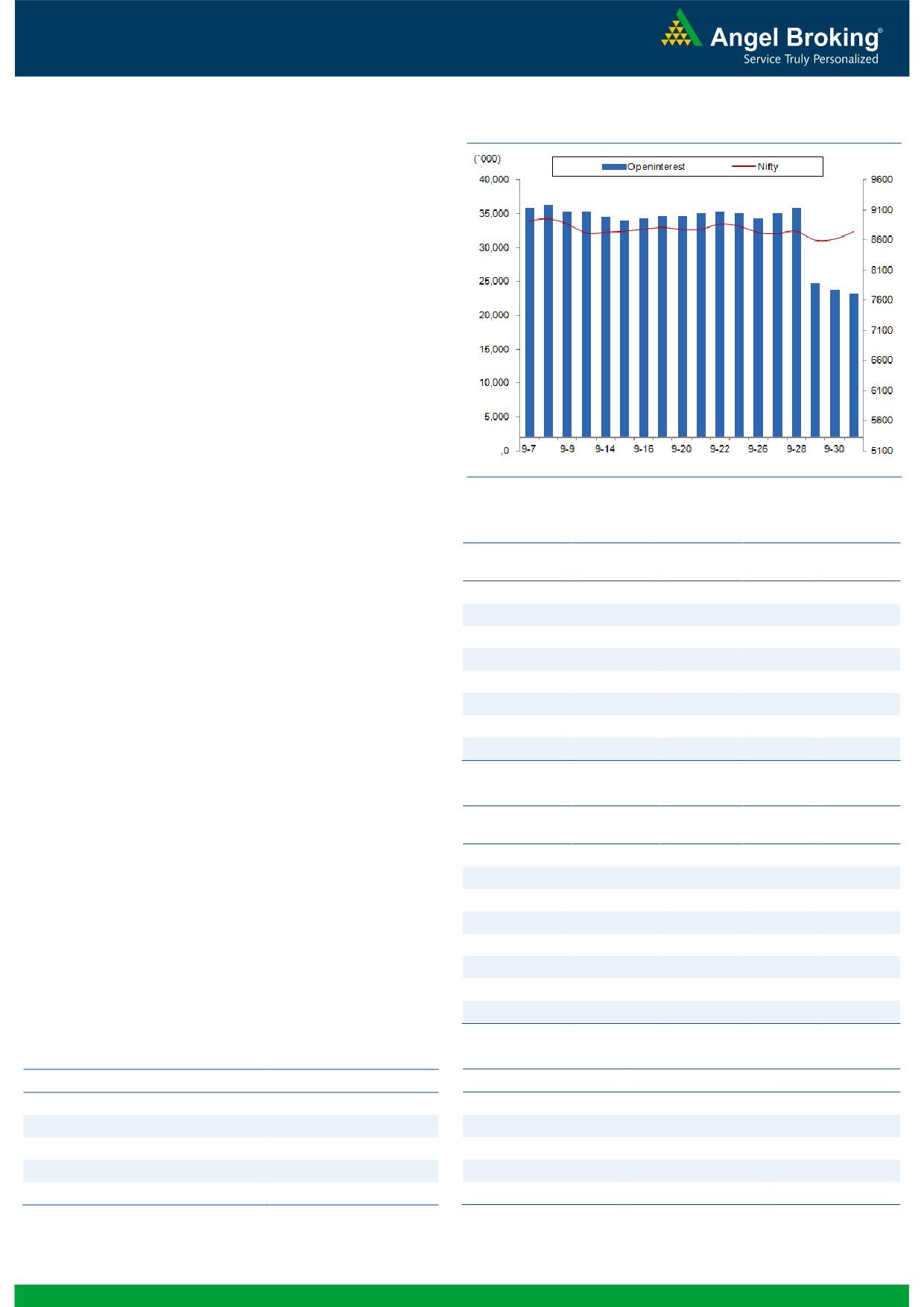

Exhibit 2: Nifty Bank Daily Chart

Nifty Bank Outlook - (19589)

The Nifty Bank index opened gap up yesterday and rallied

throughout the session to end the day with gains of 1.57 percent

over its previous session's close.

The index continued with Friday's positive momentum and rallied

significantly which was unexpected by us, to an extent. However,

on daily charts, the trend following indicators viz. 'SuperTrend'

and the 'Parabolic SAR' have not yet shown any reversal signs.

This coupled with the recent gap down opening which has not

been crossed yet, indicates probability of this upmove being a

pullback move rather than resumption of uptrend. Hence, we

would still wait for further development of the charts and stay

cautious on the market. Owing to the RBI's Monetary Policy

scheduled today, there could be higher volatility and thus, traders

are advised to follow proper risk management. The near term

support for the index is placed in range of 19365-19330;

whereas, resistances are seen around 19760 and 19860.

Key Levels

Support 1 - 19365

Resistance 1 - 19760

Support 2 - 19330

Resistance 2 - 19860

1

Technical & Derivatives Report

October 04, 2016

Comments

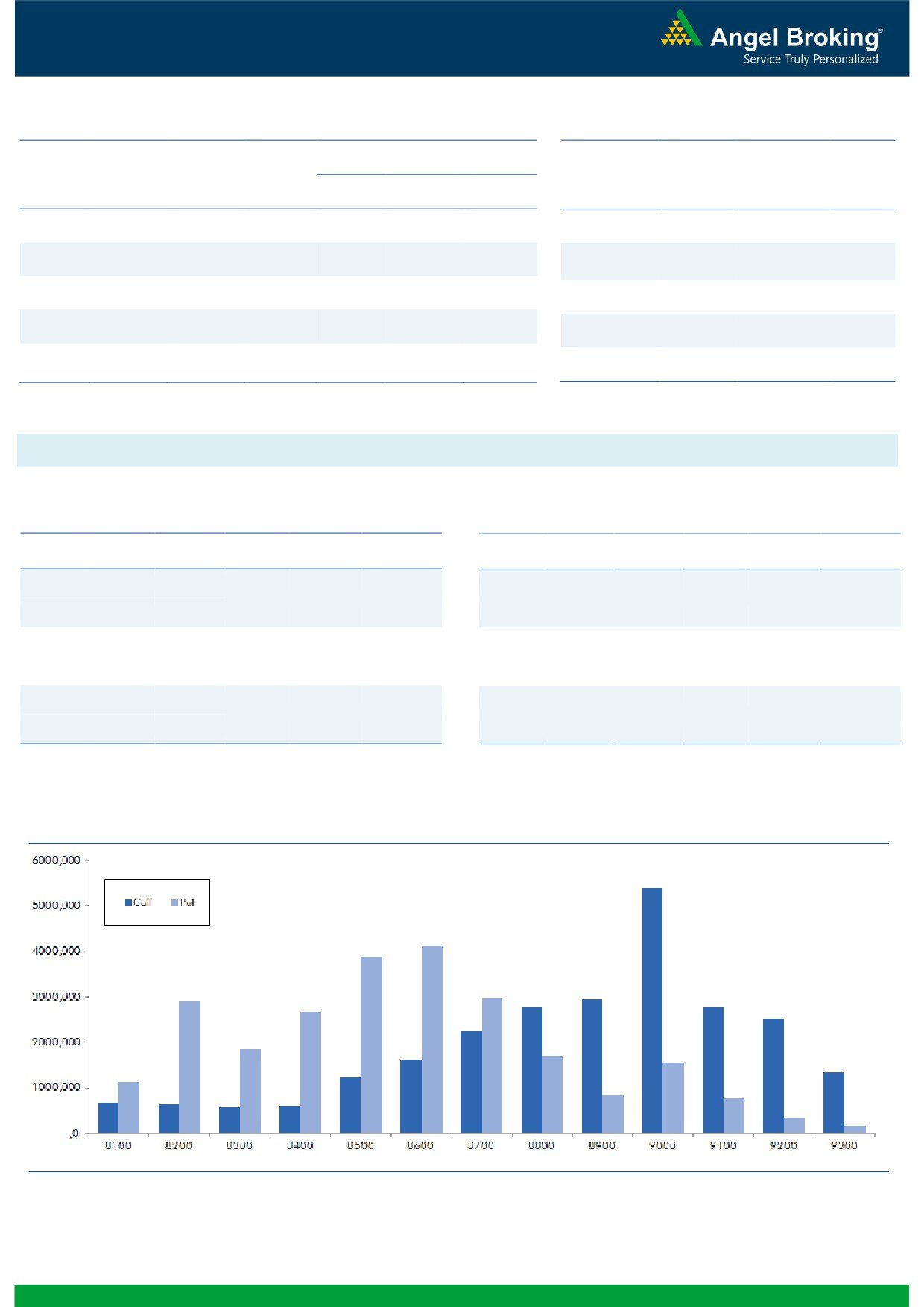

Nifty Vs OI

The Nifty futures open interest has decreased by 2.48%

BankNifty futures open interest has decreased by 1.57%

as market closed at 8738.10 levels.

The Nifty October future closed with a premium of 41.00

against the premium of 29.50 points in last trading

session. The November series closed at a premium of

81.30 points.

The Implied Volatility of at the money options has

decreased from 15.82% to 13.89%. At the same time,

the PCR-OI of Nifty remained unchanged at 0.94.

The total OI of the market is Rs. 2,37,704/- cr. and the

stock futures OI is Rs. 76,751/- cr.

Few of the liquid counters where we have seen high cost

of carry are SOUTHBANK, JPASSOCIAT, HEXAWARE,

DCBBANK and ALBK.

Views

OI Gainers

FIIs activity in cash market segment was subdued. While,

OI

PRICE

SCRIP

OI

PRICE

in index future they were net sellers of worth Rs. 159

CHG. (%)

CHG. (%)

crores with marginal change in OI, indicating some long

DCBBANK

625500

230.95

128.30

1.79

unwinding in last trading session.

TORNTPOWER

462000

123.19

181.55

-0.11

On Index Options front, FIIs sold to the tune of Rs. 293

IDFCBANK

9792000

67.44

79.25

-1.31

www.angelbroking.com

crores with decent amount of rise in OI. In call options,

HINDZINC

5184000

41.73

255.85

9.08

9000 strike was active and also added some buildup.

SRF

458500

38.52

1918.60

7.43

On the other hand in put options, we saw good amount

ARVIND

4950000

22.77

356.25

5.03

of open interest adittion in 8600 and 8700 strikes. We

GODREJIND

1483500

17.74

448.25

3.52

believe, these are long formation in the hopes of market

OIL

936700

16.99

417.85

3.70

correcting to 8600 level. Highest OI in October series is

placed at 9000 call and 8600 put option.

OI Losers

We witnessed continuation of long unwinding in October

OI

PRICE

SCRIP

OI

PRICE

series too. In Index Options as well FIIs are forming fresh

CHG. (%)

CHG. (%)

longs in out of the money put options. Hence, the above

PIDILITIND

2479000

-8.73

726.70

6.02

data suggests, market may remain under pressure and

ASHOKLEY

82117000

-6.47

83.35

4.38

may test its support zone of 8550-8600 in near term.

GAIL

7995000

-6.44

386.65

2.90

Thus, traders are suggested to avoid bottom fishing in

UNIONBANK

12804000

-4.90

143.75

4.09

this market. We would also recommend buying 8700 put

UBL

987000

-4.67

910.85

0.21

options of October series to trade for short term

PAGEIND

37700

-3.33

15563.20

2.31

correction.

LT

7708000

-3.32

1475.15

2.54

SYNDIBANK

15813000

-3.20

75.85

2.92

Historical Volatility

Put-Call Ratio

SCRIP

HV

SCRIP

PCR-OI

PCR-VOL

HINDZINC

52.25

NIFTY

0.94

1.00

PIDILITIND

38.53

BANKNIFTY

0.98

0.90

ZEEL

38.42

RELIANCE

0.55

0.52

OIL

26.12

ICICIBANK

0.43

0.42

M&MFIN

48.38

INFY

0.60

0.50

2

Technical & Derivatives Report

October 04, 2016

FII Statistics for 03, October 2016

Turnover on 03, October 2016

Open Interest

No. of

Turnover

Change

Detail

Buy

Sell

Net

Instrument

Value

Change

Contracts

( in Cr. )

(%)

Contracts

(in Cr.)

(%)

INDEX

INDEX

2160.00

2319.12

(159.13)

257268

17298.55

(0.31)

245710

17076.04

-12.00

FUTURES

FUTURES

INDEX

INDEX

33970.47

34263.68

(293.20)

893753

59526.89

3.05

2837510

200465.61

-0.91

OPTIONS

OPTIONS

STOCK

7715.10

7052.24

662.86

847813

56617.90

0.68

STOCK

FUTURES

573646

41855.34

2.27

FUTURES

STOCK

STOCK

3517.95

3432.11

85.84

43531

2992.23

27.74

OPTIONS

281053

20630.68

0.98

OPTIONS

TOTAL

47363.51

47067.15

296.36

2042365

136435.57

2.04

TOTAL

3937919

280027.67

-1.07

Nifty Spot = 8738.10

Lot Size = 75

Bull-Call Spreads

Bear-Put Spreads

Action

Strike

Price

Risk

Reward

BEP

Action

Strike

Price

Risk

Reward

BEP

Buy

8800

113.20

Buy

8700

96.60

44.90

55.10

8844.90

27.95

72.05

8672.05

Sell

8900

68.30

Sell

8600

68.65

Buy

8800

113.20

Buy

8700

96.60

75.10

124.90

8875.10

48.45

151.55

8651.55

Sell

9000

38.10

Sell

8500

48.15

Buy

8900

68.30

Buy

8600

68.65

30.20

69.80

8930.20

20.50

79.50

8579.50

Sell

9000

38.10

Sell

8500

48.15

Note: Above mentioned Bullish or Bearish Spreads in Nifty (October Series) are given as an information and not as a recommendation.

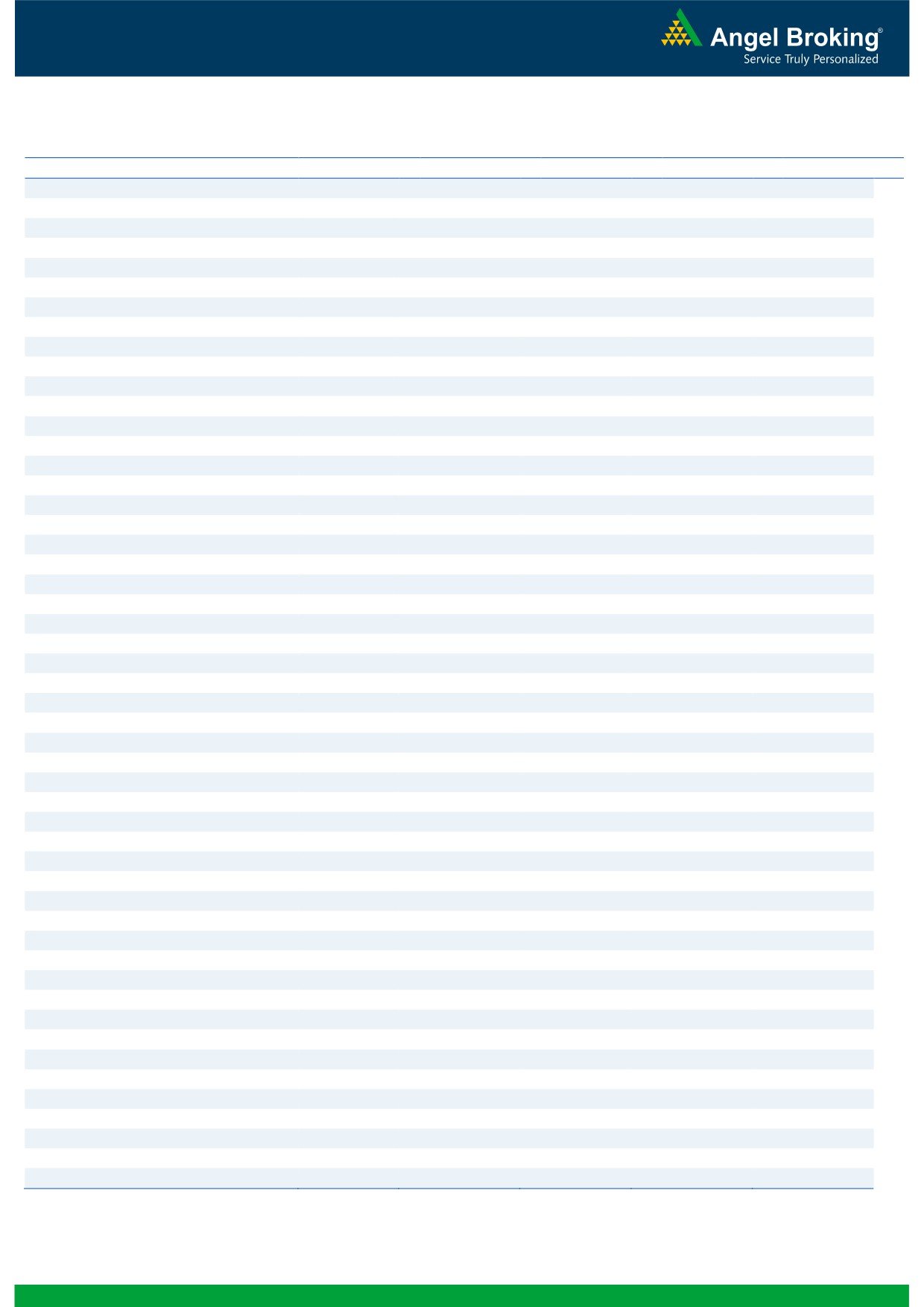

Nifty Put-Call Analysis

3

Technical & Derivatives Report

October 04, 2016

Daily Pivot Levels for Nifty Constituents

Scrips

S2

S1

PIVOT

R1

R2

ACC

1,591

1,612

1,625

1,646

1,659

ADANIPORTS

256

260

264

268

272

AMBUJACEM

251

255

257

261

264

ASIANPAINT

1,152

1,173

1,186

1,206

1,219

AUROPHARMA

854

862

868

876

882

AXISBANK

539

545

549

555

558

BAJAJ-AUTO

2,795

2,838

2,873

2,916

2,951

BANKBARODA

166

168

169

170

172

BHEL

134

136

137

138

139

BPCL

609

618

624

634

640

BHARTIARTL

312

315

318

321

324

INFRATEL

351

357

363

369

375

BOSCH

22,427

22,590

22,859

23,021

23,290

CIPLA

578

583

588

593

597

COALINDIA

319

323

326

331

333

DRREDDY

3,083

3,122

3,153

3,192

3,224

EICHERMOT

24,811

25,304

25,636

26,129

26,462

GAIL

366

376

382

392

398

GRASIM

4,820

4,860

4,896

4,936

4,971

HCLTECH

787

798

805

816

823

HDFCBANK

1,271

1,279

1,285

1,293

1,298

HDFC

1,370

1,398

1,414

1,442

1,458

HEROMOTOCO

3,395

3,458

3,499

3,562

3,603

HINDALCO

151

153

154

155

157

HINDUNILVR

851

860

869

878

887

ICICIBANK

248

252

254

259

261

IDEA

78

80

81

82

83

INDUSINDBK

1,176

1,205

1,222

1,251

1,268

INFY

1,021

1,029

1,035

1,043

1,049

ITC

240

241

243

244

245

KOTAKBANK

778

783

788

793

798

LT

1,421

1,446

1,460

1,485

1,500

LUPIN

1,473

1,483

1,495

1,505

1,517

M&M

1,380

1,412

1,432

1,464

1,484

MARUTI

5,589

5,635

5,678

5,723

5,766

NTPC

147

149

150

152

153

ONGC

249

254

258

264

268

POWERGRID

173

177

180

184

187

RELIANCE

1,060

1,075

1,092

1,107

1,123

SBIN

251

253

255

257

259

SUNPHARMA

745

751

756

762

767

TCS

2,367

2,389

2,423

2,446

2,480

TATAMTRDVR

340

343

346

349

352

TATAMOTORS

535

538

542

545

549

TATAPOWER

75

76

76

77

78

TATASTEEL

373

378

381

386

390

TECHM

415

418

421

424

428

ULTRACEMCO

3,824

3,876

3,906

3,958

3,987

WIPRO

472

475

478

481

484

YESBANK

1,252

1,261

1,272

1,281

1,292

ZEEL

531

555

573

596

614

4

Technical & Derivatives Report

October 04, 2016

Research Team Tel: 022 - 39357800

For Technical Queries

For Derivatives Queries

DISCLAIMER

Angel Broking Private Limited (hereinafter referred to as “Angel”) is a registered Member of National Stock Exchange of India Limited,

Bombay Stock Exchange Limited and Metropolitan Stock Exchange Limited. It is also registered as a Depository Participant with CDSL

and Portfolio Manager with SEBI. It also has registration with AMFI as a Mutual Fund Distributor. Angel Broking Private Limited is a

registered entity with SEBI for Research Analyst in terms of SEBI (Research Analyst) Regulations, 2014 vide registration number

INH000000164. Angel or its associates has not been debarred/ suspended by SEBI or any other regulatory authority for accessing

/dealing in securities Market. Angel or its associates/analyst has not received any compensation / managed or co-managed public

offering of securities of the company covered by Analyst during the past twelve months.

This document is solely for the personal information of the recipient, and must not be singularly used as the basis of any investment

decision. Nothing in this document should be construed as investment or financial advice. Each recipient of this document should

make such investigations as they deem necessary to arrive at an independent evaluation of an investment in the securities of the

companies referred to in this document (including the merits and risks involved), and should consult their own advisors to determine

the merits and risks of such an investment.

Reports based on technical and derivative analysis center on studying charts of a stock's price movement, outstanding positions and

trading volume, as opposed to focusing on a company's fundamentals and, as such, may not match with a report on a company's

fundamentals. Investors are advised to refer the Fundamental and Technical Research Reports available on our website to evaluate the

contrary view, if any.

The information in this document has been printed on the basis of publicly available information, internal data and other reliable

sources believed to be true, but we do not represent that it is accurate or complete and it should not be relied on as such, as this

document is for general guidance only. Angel Broking Pvt. Limited or any of its affiliates/ group companies shall not be in any way

responsible for any loss or damage that may arise to any person from any inadvertent error in the information contained in this report.

Angel Broking Pvt. Limited has not independently verified all the information contained within this document. Accordingly, we cannot

testify, nor make any representation or warranty, express or implied, to the accuracy, contents or data contained within this document.

While Angel Broking Pvt. Limited endeavors to update on a reasonable basis the information discussed in this material, there may be

regulatory, compliance, or other reasons that prevent us from doing so.

This document is being supplied to you solely for your information, and its contents, information or data may not be reproduced,

redistributed or passed on, directly or indirectly.

Neither Angel Broking Pvt. Limited, nor its directors, employees or affiliates shall be liable for any loss or damage that may arise from

or in connection with the use of this information.

5