Technical & Derivatives Report

August 04, 2016

Sensex (27698) / Nifty (8545)

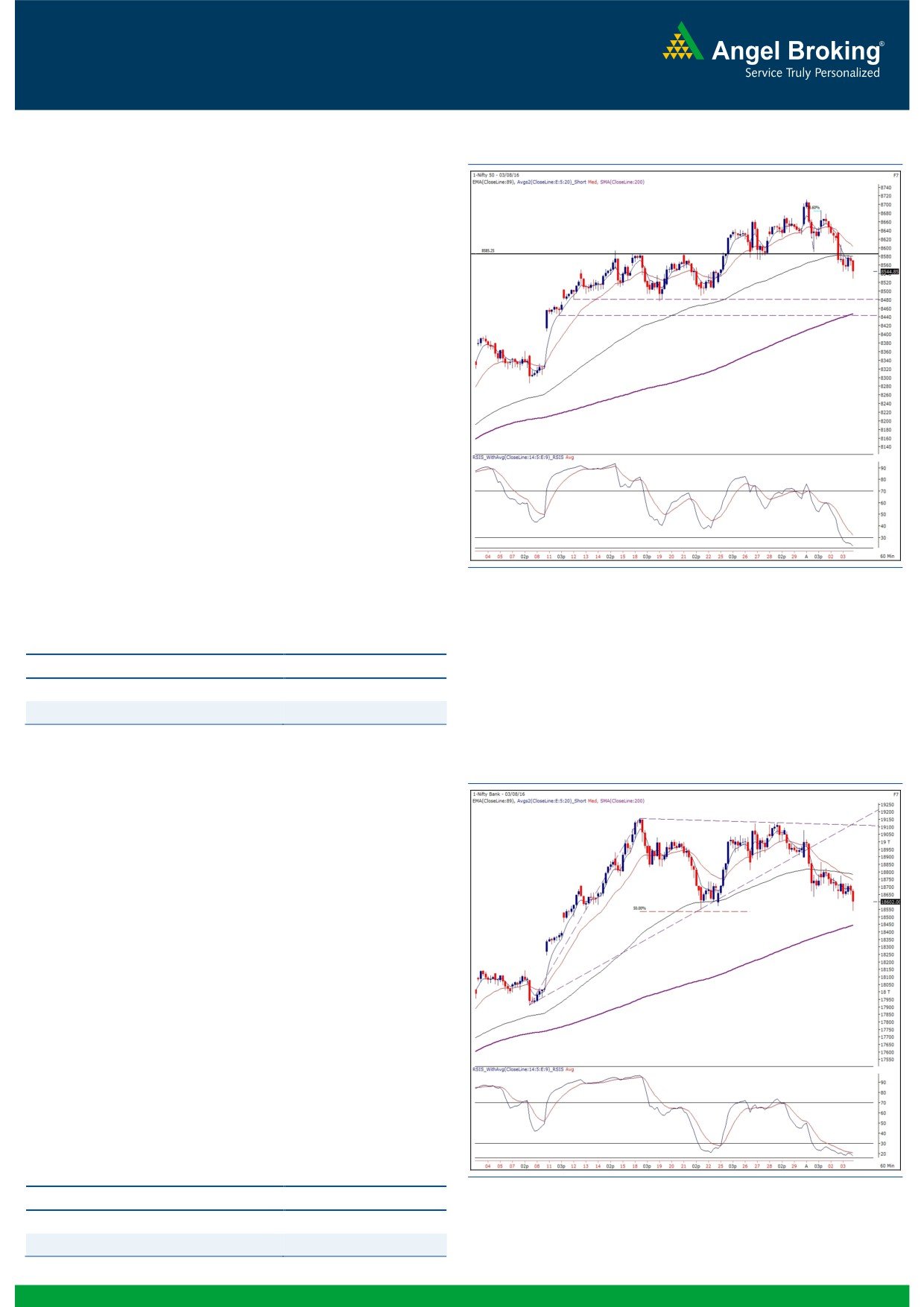

Exhibit 1: Nifty Hourly Chart

Yesterday, our markets opened tad higher; however, this early

morning lead was very short lived as the index posted a open

high and started trading lower. As expected, we saw gradual

decline towards 8572 in initial hours. In fact, due to excessive

selling pressure, the Nifty went on to break this support and

eventually ended the session below the 8550 mark.

Now, technically speaking, we are seeing some signs of

weakness. Firstly, the lower top lower bottom in hourly chart

along with negative crossover in 'RSI- Smoothened' on daily chart.

Going by these evidences, a possibility of further corrective move

towards the strong support zone of 8480 - 8440 cannot be ruled

out. However, traders should now keep in mind an important

overnight development on the domestic front. The Rajya Sabha

has finally passed much awaited GST Constitutional Amendment

Bill and thus, we may see some volatility in the market. Today,

first hour move would be crucial for the market as failure to

sustain above 8570 - 8610 may lead to some weakness, whereas

on the other hand, if Nifty manages to surpass the

8610

convincingly then we may expect some immediate bounce in the

market.

Key Levels

Support 1 - 8480

Resistance 1 - 8570

Support 2 - 8440

Resistance 2 - 8610

Nifty Bank Outlook - (18602)

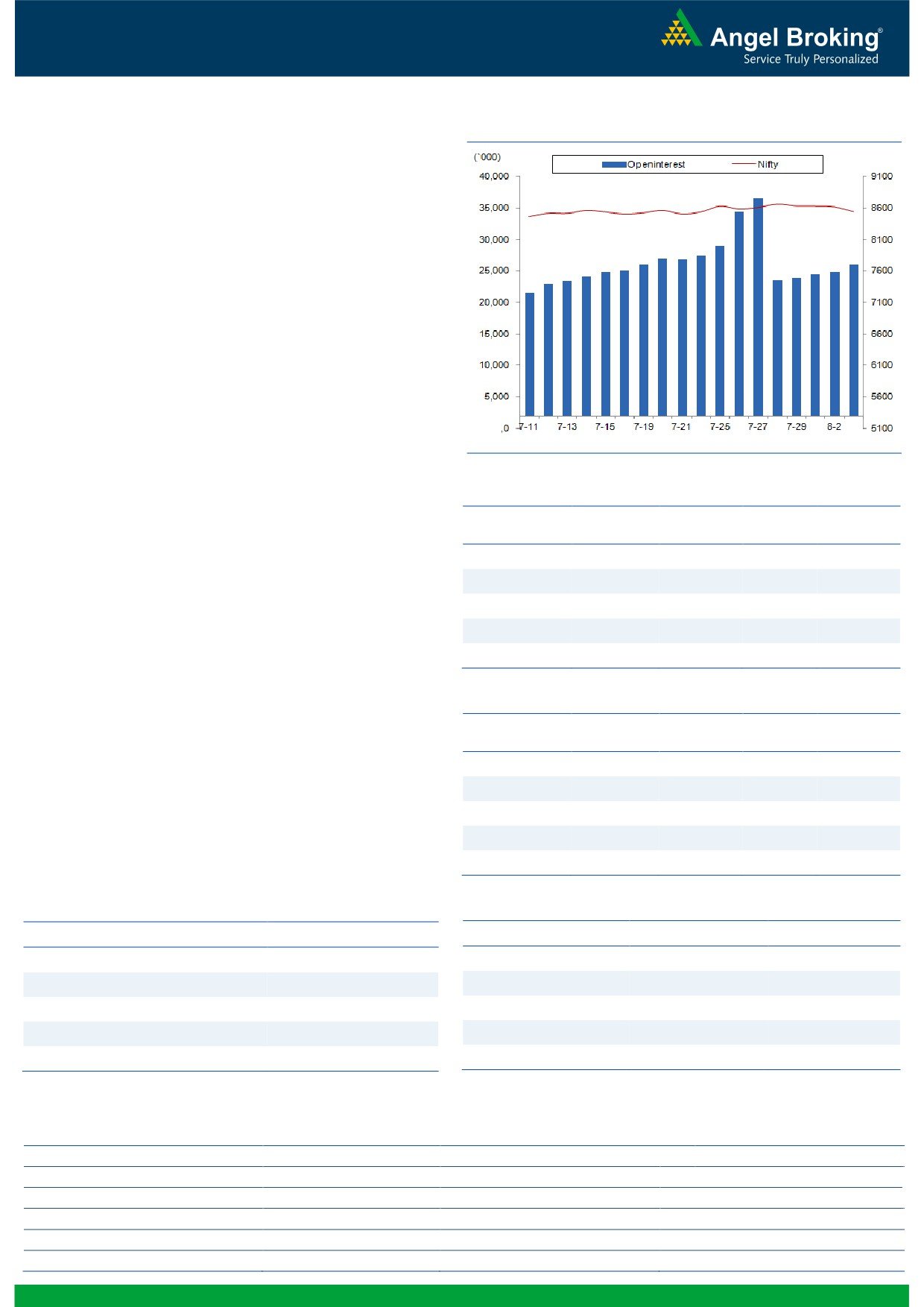

Exhibit 2: Nifty Bank Hourly Chart

Post flat opening, the Nifty Bank index traded in a narrow range

during initial hour yesterday. However, the index gradually

declined during later half and ended the session with loss of 0.57

percent over its previous close.

In last three trading sessions, the Nifty Bank index has shown

some signs of weakness and hence, we have been advising

traders to remain light on positions. Although the SGX Nifty is

indicating positive opening tracking the GST development, it

would be crucial to watch whether the banking index manages to

sustain at higher levels post opening. On hourly chart, the

resistances for the index are seen around 18720 and 18850. If

the index fails to show a sustained up move post initial hour of

trading, then the index could correct and test the support placed

around 18450 (200 SMA on hourly chart). The volatility is

expected to remain high and thus traders are advised to trade

according the moves post initial hour of trading.

Key Levels

Support 1 - 18450

Resistance 1 - 18720

Support 2 - 18300

Resistance 2 - 18850

1

Technical & Derivatives Report

August 04, 2016

Comments

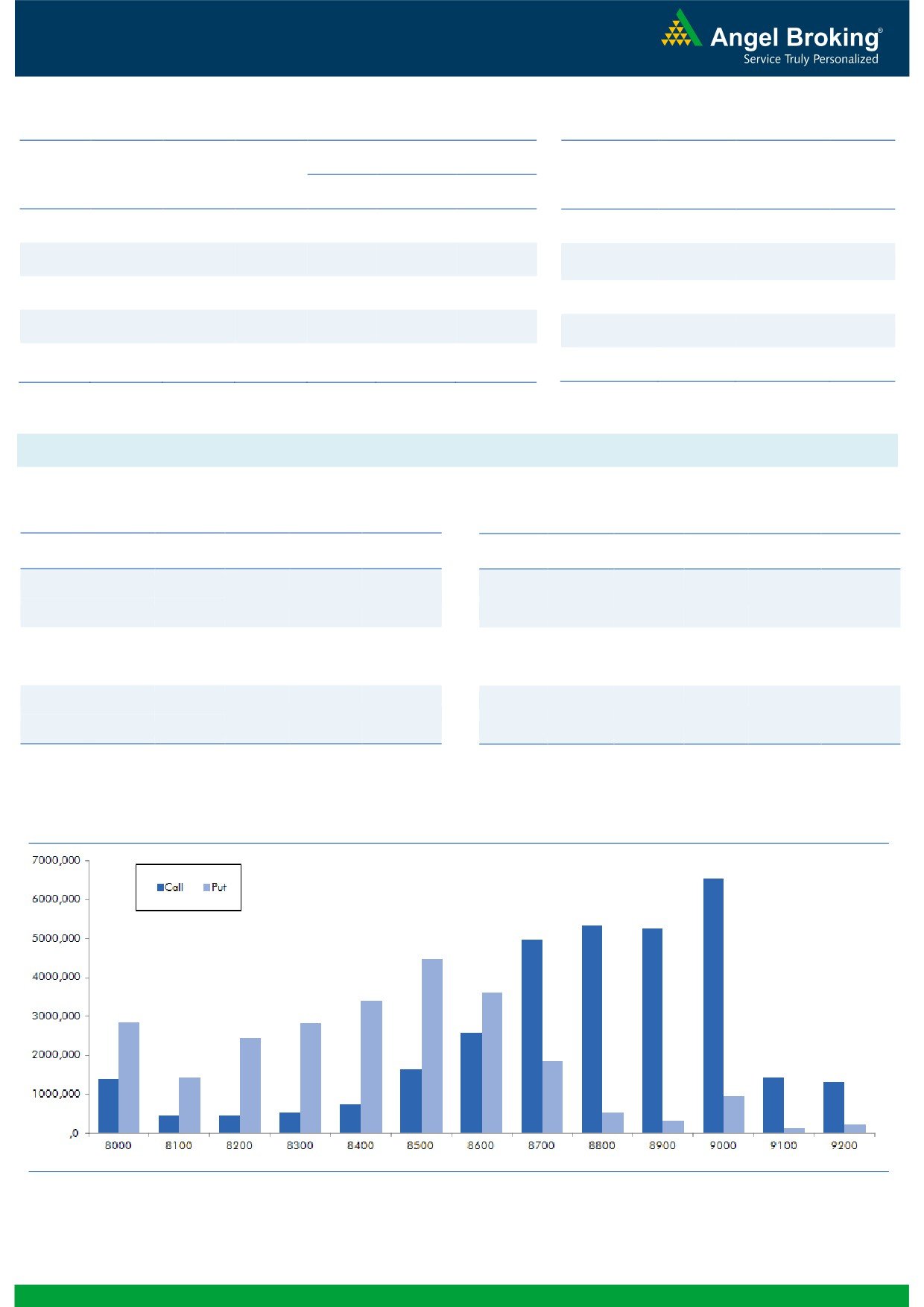

Nifty Vs OI

The Nifty futures open interest has increased by 5.19%

BankNifty futures open interest has increased by 2.50%

as market closed at 8544.85 levels.

The Nifty August future closed with a premium of 37.70

points against a premium of 37.40 points in previous

session. The September series closed at a premium of

86.45 points.

The Implied Volatility of at the money options has

increased from 14.64% to 15.18%.

The total OI of the market is Rs. 2,47,570/- cr. and the

stock futures OI is Rs. 71,326/- cr.

Few of the liquid counters where we have seen high cost

of carry are JPASSOCIAT, GMRINFRA, HDFCBANK,

FEDERALBNK and AMBUJACEM.

Views

OI Gainers

FIIs were net buyer in cash market segment to the tune of

OI

PRICE

Rs.

578 crores. While, in Index Futures they were

SCRIP

OI

PRICE

CHG. (%)

CHG. (%)

marginal sellers with rise in open interest, indicating

GODREJIND

1473000

18.60

411.50

-4.88

blend of both long and short build-up.

PCJEWELLER

525000

15.13

402.25

-6.03

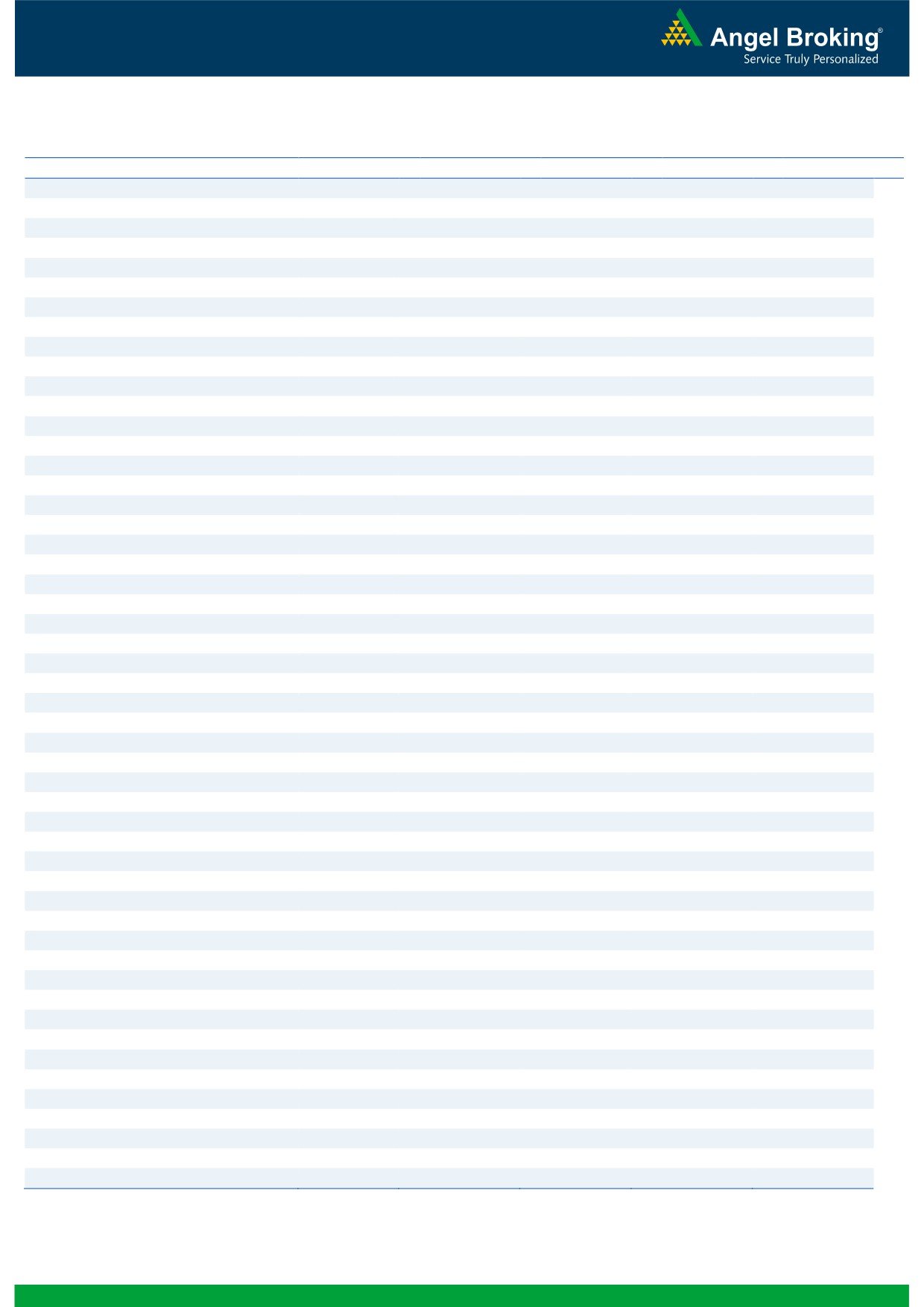

In Index Options segment, FIIs bought worth Rs. 432

crores with rise in OI. In call options, 8600-9000 strikes

ABIRLANUVO

3235500

12.84

1504.10

2.60

added good amount of build-up. We have been

EICHERMOT

207150

12.25

21515.15

-2.14

continuously observing FIIs writing out of the money call

MCDOWELL-N

2637500

10.96

2330.65

-3.09

strikes 8800-9000, indicating wall of resistance near

8800-8850 levels. While, 8300-8400 put strikes were

OI Losers

active and they also added some fresh OI. Highest build-

OI

PRICE

SCRIP

OI

PRICE

up is placed at 9000 call and 8500 put options.

CHG. (%)

CHG. (%)

Since, FIIs are continuously buying in both cash & index

JETAIRWAYS

6209000

-6.52

595.00

2.38

futures and yet there is no sign of reversal seen on

ALBK

11540000

-5.18

75.85

-0.72

derivative data; we advise traders to trade with positive

IDFC

68257200

-5.05

57.05

-1.89

bias and use declines to initiate fresh positions. Support

TVSMOTOR

5858000

-4.90

298.60

-1.04

for Nifty is placed at

8500

-

8550 levels; while,

CROMPGREAV

17268000

-4.89

75.10

-3.03

resistance is at 8800 - 8850.

Historical Volatility

Put-Call Ratio

SCRIP

HV

SCRIP

PCR-OI

PCR-VOL

GODREJIND

38.53

NIFTY

0.87

0.79

VOLTAS

45.04

BANKNIFTY

0.49

0.60

COLPAL

27.19

ICICIBANK

0.36

0.33

BAJFINANCE

73.65

LT

0.49

0.52

PAGEIND

46.20

INFY

0.29

0.34

Strategy Date

Symbol

Strategy

Status

01-08-2016

RELIANCE

Ratio Bear Put Spread

Active

2

Technical & Derivatives Report

August 04, 2016

FII Statistics for 03-August 2016

Turnover on 03-August 2016

Open Interest

No. of

Turnover

Change

Detail

Buy

Sell

Net

Instrument

Value

Contracts

( in Cr. )

(%)

Contracts

Change (%)

(in Cr.)

INDEX

INDEX

2440.74

2473.45

(32.71)

304506

19940.55

1.77

252904

17107.98

36.15

FUTURES

FUTURES

INDEX

INDEX

44614.32

44182.63

431.69

875218

56472.36

5.34

3341977

233629.89

30.39

OPTIONS

OPTIONS

STOCK

5719.11

7027.14

(1308.03)

832516

53274.37

2.15

STOCK

FUTURES

578456

39384.27

-4.11

FUTURES

STOCK

STOCK

3618.39

3686.03

(67.64)

56397

3682.38

17.16

OPTIONS

302611

20994.72

-4.10

OPTIONS

TOTAL

56392.56

57369.25

(976.69)

2068637

133369.66

3.79

TOTAL

4475948

311116.86

22.15

Nifty Spot = 8544.85

Lot Size = 75

Bull-Call Spreads

Bear-Put Spreads

Action

Strike

Price

Risk

Reward

BEP

Action

Strike

Price

Risk

Reward

BEP

Buy

8600

119.75

Buy

8500

93.70

42.90

57.10

8642.90

31.20

68.80

8468.80

Sell

8700

76.85

Sell

8400

62.50

Buy

8600

119.75

Buy

8500

93.70

73.80

126.20

8673.80

52.85

147.15

8447.15

Sell

8800

45.95

Sell

8300

40.85

Buy

8700

76.85

Buy

8400

62.50

30.90

69.10

8730.90

21.65

78.35

8378.35

Sell

8800

45.95

Sell

8300

40.85

Note: Above mentioned Bullish or Bearish Spreads in Nifty (August Series) are given as an information and not as a recommendation.

Nifty Put-Call Analysis

3

Technical & Derivatives Report

August 04, 2016

Daily Pivot Levels for Nifty Constituents

Scrips

S2

S1

PIVOT

R1

R2

ACC

1,648

1,658

1,672

1,682

1,695

ADANIPORTS

217

220

224

227

231

AMBUJACEM

256

259

263

266

270

ASIANPAINT

1,115

1,129

1,138

1,152

1,161

AUROPHARMA

711

729

758

776

805

AXISBANK

536

542

548

555

560

BAJAJ-AUTO

2,673

2,694

2,726

2,747

2,780

BANKBARODA

144

146

151

153

157

BHEL

129

131

135

137

141

BPCL

559

566

575

581

590

BHARTIARTL

350

355

358

362

365

INFRATEL

383

390

394

401

405

BOSCH

24,084

24,419

24,659

24,994

25,234

CIPLA

507

518

527

538

546

COALINDIA

319

323

326

329

332

DRREDDY

2,902

2,920

2,949

2,967

2,996

EICHERMOT

20,669

21,019

21,590

21,939

22,511

GAIL

366

369

374

377

381

GRASIM

4,887

4,928

4,969

5,009

5,051

HCLTECH

792

809

834

851

876

HDFCBANK

1,222

1,231

1,240

1,250

1,259

HDFC

1,302

1,314

1,328

1,340

1,354

HEROMOTOCO

3,165

3,198

3,253

3,287

3,342

HINDALCO

132

134

136

137

139

HINDUNILVR

899

907

917

924

934

ICICIBANK

237

239

243

246

250

IDEA

102

103

105

106

107

INDUSINDBK

1,163

1,171

1,182

1,190

1,201

INFY

1,064

1,075

1,081

1,091

1,097

ITC

246

249

255

258

263

KOTAKBANK

749

753

758

762

768

LT

1,442

1,460

1,489

1,507

1,535

LUPIN

1,646

1,663

1,691

1,708

1,735

M&M

1,423

1,435

1,452

1,464

1,482

MARUTI

4,749

4,811

4,916

4,978

5,083

NTPC

155

156

158

159

161

ONGC

215

217

220

222

225

POWERGRID

171

173

176

179

182

RELIANCE

977

986

1,000

1,008

1,023

SBIN

223

225

228

230

232

SUNPHARMA

810

825

836

851

862

TCS

2,618

2,637

2,668

2,687

2,718

TATAMTRDVR

302

308

318

323

333

TATAMOTORS

460

469

484

493

508

TATAPOWER

70

71

72

72

73

TATASTEEL

348

353

360

365

371

TECHM

487

492

498

503

509

ULTRACEMCO

3,623

3,645

3,673

3,695

3,722

WIPRO

542

545

550

553

558

YESBANK

1,205

1,221

1,233

1,248

1,260

ZEEL

483

488

494

498

504

4

Technical & Derivatives Report

August 04, 2016

Research Team Tel: 022 - 39357800

For Technical Queries

For Derivatives Queries

DISCLAIMER

Angel Broking Private Limited (hereinafter referred to as “Angel”) is a registered Member of National Stock Exchange of India Limited,

Bombay Stock Exchange Limited and Metropolitan Stock Exchange Limited. It is also registered as a Depository Participant with CDSL

and Portfolio Manager with SEBI. It also has registration with AMFI as a Mutual Fund Distributor. Angel Broking Private Limited is a

registered entity with SEBI for Research Analyst in terms of SEBI (Research Analyst) Regulations, 2014 vide registration number

INH000000164. Angel or its associates has not been debarred/ suspended by SEBI or any other regulatory authority for accessing

/dealing in securities Market. Angel or its associates/analyst has not received any compensation / managed or co-managed public

offering of securities of the company covered by Analyst during the past twelve months.

This document is solely for the personal information of the recipient, and must not be singularly used as the basis of any investment

decision. Nothing in this document should be construed as investment or financial advice. Each recipient of this document should

make such investigations as they deem necessary to arrive at an independent evaluation of an investment in the securities of the

companies referred to in this document (including the merits and risks involved), and should consult their own advisors to determine

the merits and risks of such an investment.

Reports based on technical and derivative analysis center on studying charts of a stock's price movement, outstanding positions and

trading volume, as opposed to focusing on a company's fundamentals and, as such, may not match with a report on a company's

fundamentals. Investors are advised to refer the Fundamental and Technical Research Reports available on our website to evaluate the

contrary view, if any.

The information in this document has been printed on the basis of publicly available information, internal data and other reliable

sources believed to be true, but we do not represent that it is accurate or complete and it should not be relied on as such, as this

document is for general guidance only. Angel Broking Pvt. Limited or any of its affiliates/ group companies shall not be in any way

responsible for any loss or damage that may arise to any person from any inadvertent error in the information contained in this report.

Angel Broking Pvt. Limited has not independently verified all the information contained within this document. Accordingly, we cannot

testify, nor make any representation or warranty, express or implied, to the accuracy, contents or data contained within this document.

While Angel Broking Pvt. Limited endeavors to update on a reasonable basis the information discussed in this material, there may be

regulatory, compliance, or other reasons that prevent us from doing so.

This document is being supplied to you solely for your information, and its contents, information or data may not be reproduced,

redistributed or passed on, directly or indirectly.

Neither Angel Broking Pvt. Limited, nor its directors, employees or affiliates shall be liable for any loss or damage that may arise from

or in connection with the use of this information.

5