Technical & Derivatives Report

July 04, 2016

Sensex (27145) / Nifty (8328)

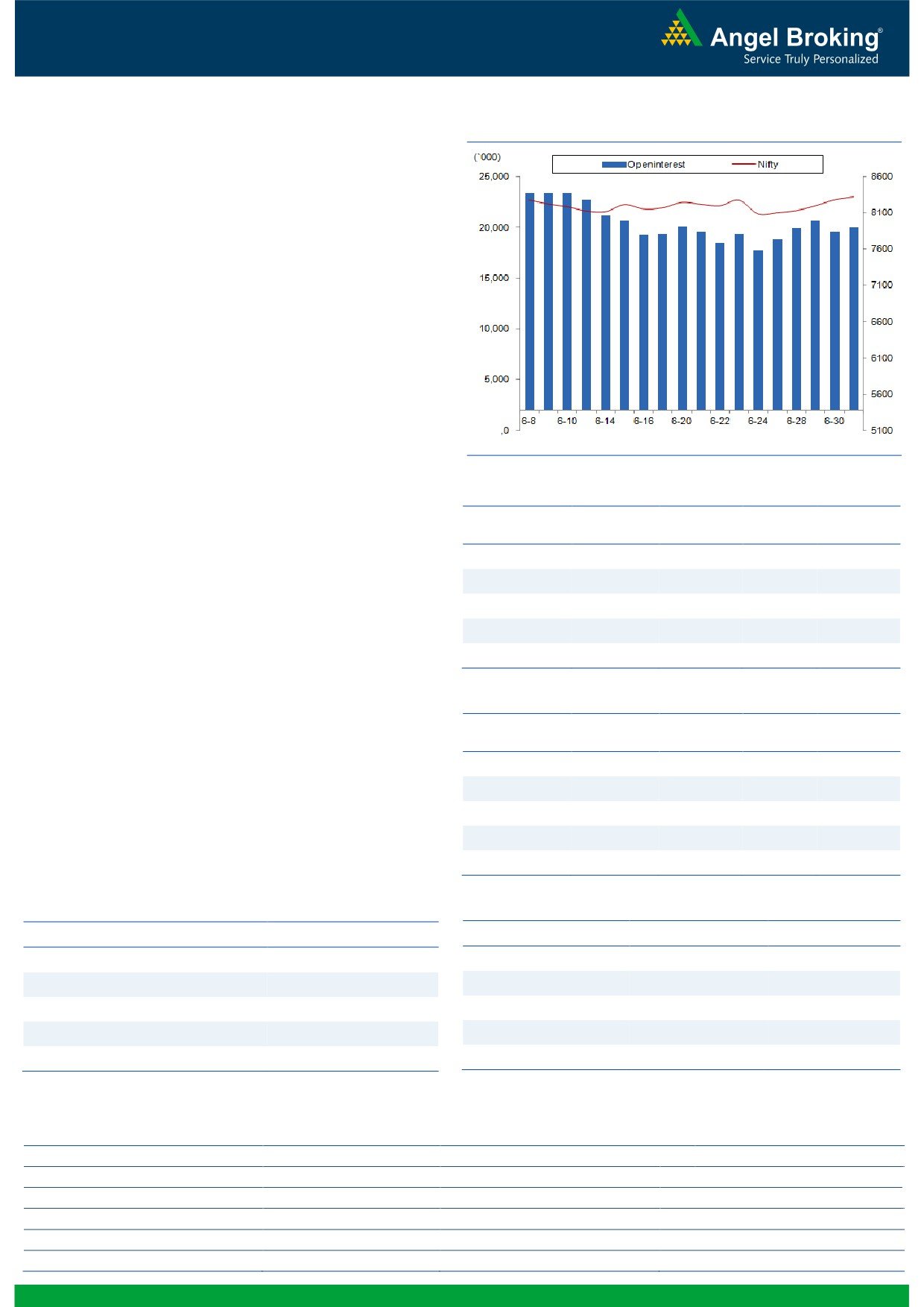

Exhibit 1: Nifty Daily Chart

We saw a clear outperformance by our market in the concluded

week post the unfolding of the BREXIT event. In fact, the strength

in the momentum led the Nifty to breakout beyond the 8300

mark on a closing basis and post its highest closing of the

calendar year 2016.

Now if we meticulously observe the daily as well as the weekly

charts, the next major resistance stands as far as 8654.75 (July

2015 high). In addition, one of the noteworthy observations is

that the ‘RSI-Smoothened’ oscillator on the weekly chart has just

crossed the 70 mark, which certainly bodes well for the market in

the near term. Thus, looking at the ongoing strong up trend, we

expect the Nifty to gradually move towards this next hurdle.

Going forward, 8240 - 8200 are now seen as immediate support

levels and resistance would be seen at 8420 - 8510 for the

forthcoming week. Meanwhile, traders can continue to follow a

stock-centric approach to find potential trades.

Key Levels

Support 1 - 8240

Resistance 1 - 8420

Support 2 - 8200

Resistance 2 - 8510

Exhibit 2: Nifty Bank Daily Chart

Nifty Bank Outlook - (17986)

Post the ‘Brexit’ referendum, the Nifty Bank index posted positive

close for five consecutive sessions. In the week gone by, the Nifty

Bank index rallied smartly and gained 3.21% over its last weeks

close.

Since last few day's, banking index has move higher and has

closed near its strong resistance zone of 18050 - 18200. It would

be crucial to watch whether the index continues this trend and if

the index breaches the mentioned resistance on closing basis,

then the rally could continue upto 18600 - 18800 levels in near

term. The individual stock charts are indicating a positive structure

and hence traders should trade with positive bias and avoid

taking any contra position at current juncture. The intraday

support for the index is placed around 17890 and 17730

whereas resistance are seen around 18075 and 18200.

Key Levels

Support 1 - 17890

Resistance 1 - 18075

Support 2 - 17730

Resistance 2 - 18200

1

Technical & Derivatives Report

July 04, 2016

Comments

Nifty Vs OI

The Nifty futures open interest has increased by 2.15%

BankNifty futures open interest has increased by 0.08%

as market closed at 8328.35 levels.

The Nifty July future closed with a premium of 26.80

points against a premium of 33.30 points in previous

session. The August series closed at a premium of 57.95

points.

The Implied Volatility of at the money options has

decreased from 14.76% to 14.36%.

The total OI of the market is Rs. 1,92,806/- cr. and the

stock futures OI is Rs. 61,460/- cr.

Few of the liquid counters where we have seen high cost

of carry are UNITECH, JPASSOCIAT, SOUTHBANK, IDFC

and IFCI.

Views

OI Gainers

Despite the upmove in the Nifty, FIIs were marginal

OI

PRICE

SCRIP

OI

PRICE

sellers in cash market segment on Friday. While in Index

CHG. (%)

CHG. (%)

Futures, they were net buyers worth Rs. 254 crores with

KPIT

4188000

103.30

158.40

-14.77

rise in open interest, indicating formation of long

ITC

36626400

40.08

254.15

-31.49

positions in previous trading session.

MCLEODRUSS

3207000

37.23

211.35

9.42

On Index Options front, FIIs bought worth Rs. 901 crores

HINDZINC

3987200

22.04

178.30

-1.49

with significant rise in open interest.

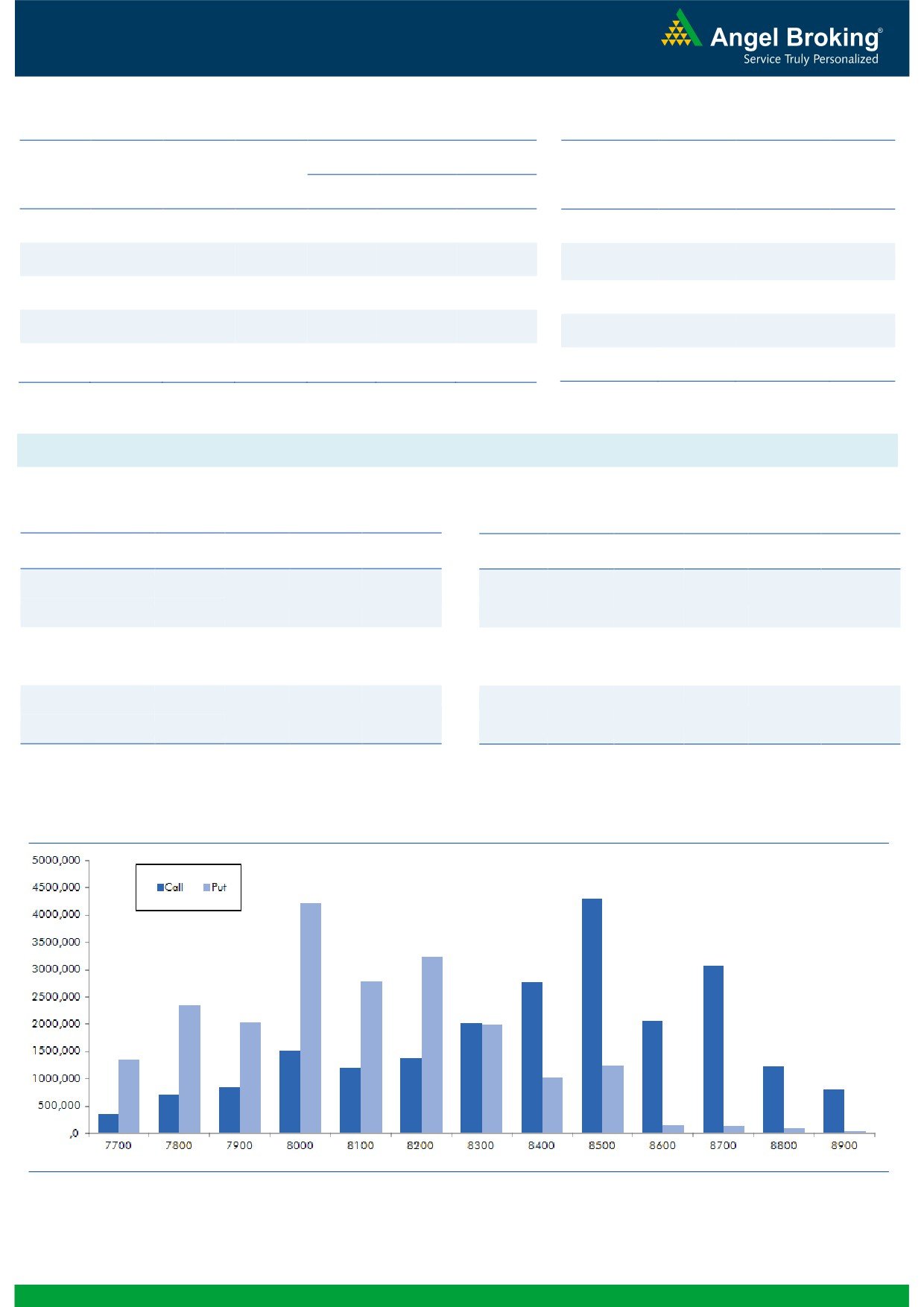

In Call options,

VOLTAS

3900000

21.34

319.90

-1.17

good amount of OI addition was seen in 8500 - 8600

strikes, followed by some build-up in 8700 and 8900

strikes. On the other hand in Put options, 8200 and

OI Losers

8300 strikes added huge fresh positions. Maximum open

OI

PRICE

SCRIP

OI

PRICE

CHG. (%)

CHG. (%)

interest in current series is placed at 8500 call and 8000

TORNTPHARM

172800

-8.28

1399.25

1.17

put.

BOSCHLTD

86650

-5.82

22754.55

-0.14

Since, FIIs are continuously buying in index futures; we

are expecting Nifty to continue its upward momentum in

CAIRN

13013000

-3.60

142.25

2.74

upcoming sessions too. Hence, traders are advised to

GRASIM

913200

-3.40

4651.85

-0.45

trade with positive bias.

UPL

8928000

-3.31

562.35

1.45

Historical Volatility

Put-Call Ratio

SCRIP

HV

SCRIP

PCR-OI

PCR-VOL

IOC

43.21

NIFTY

0.98

0.97

MCLEODRUSS

56.50

BANKNIFTY

1.20

0.98

TATACHEM

26.11

SBIN

0.67

0.64

CASTROLIND

28.68

RELIANCE

0.56

0.34

PFC

37.23

SUNPHARMA

0.38

0.33

Strategy Date

Symbol

Strategy

Status

2

Technical & Derivatives Report

July 04, 2016

FII Statistics for 01-July 2016

Turnover on 01-July 2016

Open Interest

No. of

Turnover

Change

Detail

Buy

Sell

Net

Instrument

Value

Contracts

( in Cr. )

(%)

Contracts

Change (%)

(in Cr.)

INDEX

INDEX

1188.85

934.54

254.32

221329

14117.61

2.97

187758

12341.28

-64.29

FUTURES

FUTURES

INDEX

INDEX

17792.86

16891.37

901.49

706172

44213.29

5.54

1797763

117203.87

-81.11

OPTIONS

OPTIONS

STOCK

5099.21

5080.41

18.80

761764

47378.28

1.39

STOCK

FUTURES

505787

32644.59

-59.44

FUTURES

STOCK

STOCK

1789.94

1675.13

114.81

18680

1175.98

1280.64

OPTIONS

214572

14295.13

-49.96

OPTIONS

TOTAL

25870.87

24581.46

1289.41

1707945

106885.16

4.35

TOTAL

2705880

176484.88

-76.90

Nifty Spot = 8328.35

Lot Size = 75

Bull-Call Spreads

Bear-Put Spreads

Action

Strike

Price

Risk

Reward

BEP

Action

Strike

Price

Risk

Reward

BEP

Buy

8400

105.25

Buy

8300

107.70

40.80

59.20

8440.80

31.85

68.15

8268.15

Sell

8500

64.45

Sell

8200

75.85

Buy

8400

105.25

Buy

8300

107.70

68.60

131.40

8468.60

55.05

144.95

8244.95

Sell

8600

36.65

Sell

8100

52.65

Buy

8500

64.45

Buy

8200

75.85

27.80

72.20

8527.80

23.20

76.80

8176.80

Sell

8600

36.65

Sell

8100

52.65

Note: Above mentioned Bullish or Bearish Spreads in Nifty (July Series) are given as an information and not as a recommendation.

Nifty Put-Call Analysis

3

Technical & Derivatives Report

July 04, 2016

Daily Pivot Levels for Nifty Constituents

Scrips

S2

S1

PIVOT

R1

R2

ACC

1,604

1,611

1,618

1,625

1,633

ADANIPORTS

201

203

205

207

209

AMBUJACEM

249

251

254

256

259

ASIANPAINT

987

995

1,003

1,011

1,019

AUROPHARMA

737

742

747

752

757

AXISBANK

531

537

541

547

552

BAJAJ-AUTO

2,631

2,651

2,685

2,706

2,740

BANKBARODA

152

154

156

158

160

BHEL

127

130

131

134

135

BPCL

1,052

1,072

1,087

1,107

1,122

BHARTIARTL

358

363

368

373

378

INFRATEL

341

346

350

354

358

BOSCH

22,309

22,497

22,698

22,886

23,087

CIPLA

496

502

506

512

516

COALINDIA

307

308

311

313

316

DRREDDY

3,398

3,441

3,473

3,517

3,549

EICHERMOT

18,819

18,987

19,218

19,387

19,618

GAIL

382

389

393

399

404

GRASIM

4,601

4,622

4,649

4,670

4,696

HCLTECH

726

729

733

736

740

HDFCBANK

1,164

1,169

1,177

1,182

1,190

HDFC

1,223

1,232

1,248

1,258

1,273

HEROMOTOCO

3,143

3,165

3,181

3,203

3,219

HINDALCO

122

123

124

126

127

HINDUNILVR

878

888

896

906

915

ICICIBANK

238

239

241

242

244

IDEA

105

105

106

107

108

INDUSINDBK

1,113

1,118

1,123

1,129

1,134

INFY

1,164

1,168

1,174

1,178

1,184

ITC

234

243

252

261

269

KOTAKBANK

742

748

757

763

772

LT

1,485

1,514

1,529

1,558

1,574

LUPIN

1,534

1,544

1,551

1,561

1,568

M&M

1,414

1,439

1,457

1,481

1,499

MARUTI

4,088

4,127

4,171

4,209

4,253

NTPC

154

155

156

158

159

ONGC

210

218

224

231

237

POWERGRID

161

163

165

167

168

RELIANCE

967

970

973

977

980

SBIN

218

219

220

221

222

SUNPHARMA

758

760

765

768

772

TCS

2,450

2,475

2,520

2,546

2,590

TATAMTRDVR

286

289

293

296

300

TATAMOTORS

449

453

459

464

469

TATAPOWER

73

74

74

75

75

TATASTEEL

324

326

328

331

333

TECHM

501

506

511

517

522

ULTRACEMCO

3,335

3,375

3,425

3,465

3,515

WIPRO

552

556

560

564

568

YESBANK

1,096

1,113

1,123

1,140

1,151

ZEEL

445

449

454

458

464

4

Technical & Derivatives Report

July 04, 2016

Research Team Tel: 022 - 39357800

For Technical Queries

For Derivatives Queries

DISCLAIMER

Angel Broking Private Limited (hereinafter referred to as “Angel”) is a registered Member of National Stock Exchange of India Limited,

Bombay Stock Exchange Limited and MCX Stock Exchange Limited. It is also registered as a Depository Participant with CDSL and

Portfolio Manager with SEBI. It also has registration with AMFI as a Mutual Fund Distributor. Angel Broking Private Limited is a

registered entity with SEBI for Research Analyst in terms of SEBI (Research Analyst) Regulations, 2014 vide registration number

INH000000164. Angel or its associates has not been debarred/ suspended by SEBI or any other regulatory authority for accessing

/dealing in securities Market. Angel or its associates including its relatives/analyst do not hold any financial interest/beneficial

ownership of more than 1% in the company covered by Analyst. Angel or its associates/analyst has not received any compensation /

managed or co-managed public offering of securities of the company covered by Analyst during the past twelve months. Angel/analyst

has not served as an officer, director or employee of company covered by Analyst and has not been engaged in market making activity

of the company covered by Analyst.

This document is solely for the personal information of the recipient, and must not be singularly used as the basis of any investment

decision. Nothing in this document should be construed as investment or financial advice. Each recipient of this document should

make such investigations as they deem necessary to arrive at an independent evaluation of an investment in the securities of the

companies referred to in this document (including the merits and risks involved), and should consult their own advisors to determine

the merits and risks of such an investment.

Reports based on technical and derivative analysis center on studying charts of a stock's price movement, outstanding positions and

trading volume, as opposed to focusing on a company's fundamentals and, as such, may not match with a report on a company's

fundamentals.

The information in this document has been printed on the basis of publicly available information, internal data and other reliable

sources believed to be true, but we do not represent that it is accurate or complete and it should not be relied on as such, as this

document is for general guidance only. Angel Broking Pvt. Limited or any of its affiliates/ group companies shall not be in any way

responsible for any loss or damage that may arise to any person from any inadvertent error in the information contained in this report.

Angel Broking Pvt. Limited has not independently verified all the information contained within this document. Accordingly, we cannot

testify, nor make any representation or warranty, express or implied, to the accuracy, contents or data contained within this document.

While Angel Broking Pvt. Limited endeavors to update on a reasonable basis the information discussed in this material, there may be

regulatory, compliance, or other reasons that prevent us from doing so.

This document is being supplied to you solely for your information, and its contents, information or data may not be reproduced,

redistributed or passed on, directly or indirectly.

Neither Angel Broking Pvt. Limited, nor its directors, employees or affiliates shall be liable for any loss or damage that may arise from

or in connection with the use of this information.

Note: Please refer to the important ‘Stock Holding Disclosure' report on the Angel website (Research Section). Also, please refer to the

latest update on respective stocks for the disclosure status in respect of those stocks. Angel Broking Pvt. Limited and its affiliates may

have investment positions in the stocks recommended in this report.

5